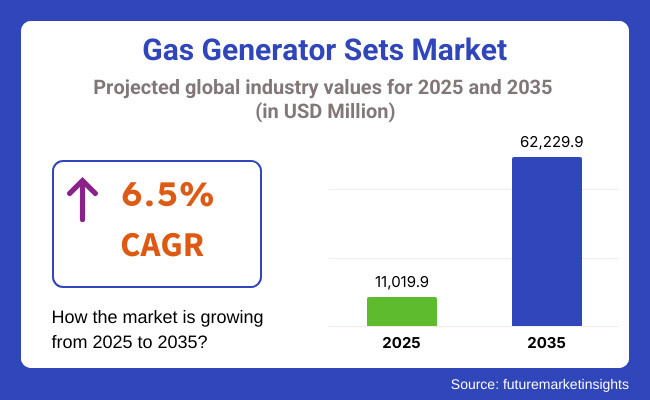

The gas generator sets market is projected to witness steady growth between 2025 and 2035, driven by increasing demand for reliable backup power solutions, growing industrialization, and a shift towards cleaner energy sources. The market is expected to be valued at USD 11,019.9 million in 2025 and is anticipated to reach USD 62,229.9 million by 2035, reflecting a CAGR of 6.5% over the forecast period.

Gas generator sets, powered by natural gas, biogas, or liquefied petroleum gas (LPG), are gaining popularity as eco-friendly alternatives to diesel generators. The increasing adoption of distributed power generation, rising commercial and industrial infrastructure development, and government incentives for cleaner energy adoption are driving market expansion. However, high installation costs, gas supply infrastructure limitations, and competition from renewable energy sources pose challenges to market growth.

The gas generator set market in North America is driven by a diverse energy demand, aging power grid infrastructure, and growing dependence on backup power solutions.

North America has been experiencing an increase in the adoption of natural gas-powered generators in commercial and industrial applications due to stringent emission regulations and availability of large shale gas reserves in the USA and Canada. The broadening adoption of hybrid microgrid solutions and government backing for low-emission standby power are also driving market growth.

Leading drivers of gas generator adoption in Europe are adoption of environmental sustainability policies, diversification of energy mix through renewable energy integration and grid stability concerns. In countries like Germany, the UK, France, and Italy, demand for biogas and LPG-powered generators is increasing as off-grid solutions and standby power across industries require sustainable energy sources. EU carbon neutrality targets and tight diesel generator regulations are driving the movement to cleaner gas-powered alternatives.

The Asia-Pacific is anticipated to be the fastest-growing market, driven by rapid urbanization, industrial development, and increasing electricity demand in China, India, Japan, and South Korea. The growing construction of natural gas infrastructure, especially by China, the global leader in energy consumption, is expanding the adoption rate of gas generator sets in the commercial and utility industries.

The demand for LPG and biogas-powered generators is increasing with India’s plans for smart cities and resilient power backup systems. On the other hand, Japan and South Korea are experiencing the deployment of fuel cell-based generator systems that utilize low-carbon power technologies.

Challenges: High Initial Costs and Infrastructure Limitations

Gas generator sets still have higher initial costs than diesel ones, plus gas supply devices in developing areas. Moreover, the operational costs can be influenced by price volatility in the natural gas markets.

Opportunities: Hybrid Power Solutions and Biogas Integration

New potential for growth comes from hybrid power systems that bring together gas generators with solar, wind, and battery storage. Furthermore, the growing adoption of biogas-powered generators in agricultural, food processing & wastewater treatment industries is augmenting the market for sustainable energy solutions. Hydrogen fuelled generator is further passing experience on next generation emissions free power generation.

There will be a steady growth in the human augmentation technology market between 2020 and 2024 as there is advancement in wearable technology, brain-computer interfaces (BCIs) and artificial intelligence-driven prosthetics. The focus on some of this began to take shape with the move to AI-tethered exoskeletons, AR/VR-utilized cognitive augmentation, and bio-sensing implants for healthcare, defence, industrial applications, and consumer electronics.

This included developments to neural implants, smart prosthetics, and devices for enhancing sensations which allowed for greater accessibility and improved function. But widespread adoption was hampered by challenges including ethical issues, regulatory limitations, cybersecurity risks and expense.

Fast forward to 2025 to 2035, and the marketplace will be populated with AI-enhanced neuro-modulations, bio-engineered muscle extensions and Nano-tech based human-machine interfaces. Self-learning AI-based prosthetics, quantum computing-assisted neural signal processing, and brainwave-controlled external devices will thus allow for ameliorated efficiency and adaptability.

Genetically-based cognitive enhancement, whole-brain-to-cloud computing, and real-time physical optimization through AI-assisted agents will push the boundaries of the industry. As a result, the development of bio-synthetic organs, self-repairing implants, and AI-assisted memory enhancement will push human potential to new frontiers, enabling humans to perform at an unprecedented level, with improved accessibility and ethical implications of these advancements in society.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and bioethics frameworks governing neural implants and wearable augmentations. |

| Technological Innovation | Use of AI-powered prosthetics, AR/VR-assisted cognitive enhancements, and biometric implants. |

| Industry Adoption | Growth in medical rehabilitation, defence, industrial exoskeletons, and immersive gaming applications. |

| Smart & AI-Enabled Solutions | Early adoption of BCIs for communication, smart prosthetics, and AI-assisted physical rehabilitation. |

| Market Competition | Dominated by healthcare firms, neurotech startups, and defence contractors investing in wearable augmentation. |

| Market Growth Drivers | Demand fuelled by aging population rehabilitation needs, performance augmentation in defence, and AR/VR-based cognitive enhancements. |

| Sustainability and Ethical Impact | Early adoption of bio-compatible materials, neuroethics guidelines, and open-source AI-based accessibility solutions. |

| Integration of AI & Digitalization | Limited AI use in basic neuroprosthetics, augmented reality overlays, and real-time sensory augmentation. |

| Advancements in Manufacturing | Use of 3D-printed prosthetics, microchip implants, and traditional biocompatible materials. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance monitoring, global bio-enhancement ethics policies, and blockchain-backed patient data security mandates. |

| Technological Innovation | Adoption of quantum computing for brain-interface optimization, genetic cognitive enhancements, and Nano-bio augmentation. |

| Industry Adoption | Expansion into neural augmentation for intelligence enhancement, AI-driven real-time biological optimization, and brainwave-controlled digital ecosystems. |

| Smart & AI-Enabled Solutions | Large-scale deployment of self-learning AI-powered implants, real-time body enhancement analytics, and blockchain-based augmentation security frameworks. |

| Market Competition | Increased competition from AI-integrated biotechnology firms, brain-cloud computing innovators, and neural interface developers. |

| Market Growth Drivers | Growth driven by brain-to-AI cognitive co-processing, self-healing augmentation implants, and full-scale genetic body enhancements. |

| Sustainability and Ethical Impact | Large-scale transition to AI-driven regulatory compliance, universal augmentation accessibility, and ethical augmentation framework development. |

| Integration of AI & Digitalization | AI-powered real-time neural data processing, blockchain-backed augmented intelligence authentication, and quantum-assisted neuroplasticity modelling. |

| Advancements in Manufacturing | Evolution of bio-synthetic organ production, AI-enhanced material selection for augmentation, and self-replicating nanotechnology for adaptive enhancements. |

The United States is a leading market for gas generator sets, supported with the growing demand for reliable backup power solutions, increasing investments in the industrial and commercial infrastructure, and rising diesel fuelling costs encouraging plant owners to adopt natural gas as a suitable alternative. High-capacity gas generator sets are witnessing high demand owing to the growing demand for data centers, hospitals, and emergency response facilities.

Moreover, technological progression in hybrid generator to drive hybridization of battery storage and integration with smart grid are further improving the market scenario. Rural and off-grid applications for decentralized energy generation and micro grids are also influencing industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The UK market is presiding over a healthy pace of development, driven by growing investments in clean energy substitutes, the growing adoption of gas-powered backup systems in commercial applications, and a strong focus on reducing carbon emissions through stringent regulations. Portable and standby gas generators are widely used in the construction and infrastructure projects, hence the rise in such projects across the globe is propelling the growth of the market.

Also market trends are influenced by the development of the hydrogen powered generator technologies and the hybrid energy solutions. Remote monitoring and IoT-based predictive maintenance systems are helping enhance operational efficiency and reliability even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

German, French, and Italian gas generator sets market players can benefit by emerging investments in sustainable energy infrastructure as well as favourable government policies promoting natural gas as a transition fuel and adoption of cogeneration systems.

The EU’s efforts to reduce dependency on diesel generators and boost grid resilience are driving faster uptake of gas-fuelled solutions. Also, combining heat and power in industrial and residential applications also drives the growth of the market. The increase in biogas and synthetic natural gas (SNG)-powered generators is also supporting industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

The country’s market will also be supported by rising demand for emergency backup power, growing establishment of clean energy backup solutions, and rising investments in hybrid power generation in Japan. Industry leaders in smart grid technology are enabling developments in gas generator efficiency and load-balancing systems across the country.

Emergence of hydrogen fuel cell generator sets and LNG-powered solutions will also shape the trends in this market. Also, at work are market dynamics where continued seismic growth, deployed resilient energy infrastructure and distributed power generation systems are intervolenced in buildings and places on existing faults.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The South Korean market is being driven by rising demand for natural gas-based solutions, as well as increased investments in gas generator sets and power backup systems for industrial development. Its leadership in fuel cell and LNG infrastructure is driving innovation in gas generator efficiency.

Furthermore, the growing data centers and industrial automation is also adding to the demand of high-capacity and remote-monitored generator systems. In addition, the increasing development of hydrogen-based generators and smart energy management solutions is accelerating the industry adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Segmentation Segment-wise, the ≤ 50 kVA and > 750 kVA segments are estimated to hold a major share in the gas generator sets market, as industries and businesses demand cost-effective, fuel-efficient, and eco-friendly power generation solutions. These power ratings are designed to serve specific end-user requirements, Offering scalability, operational efficiency, and grid independence.

≤ 50 kVA Gas Generator Sets Dominate Market as Residential and Small Business Demand Grows

Gas generator sets with a power rating of ≤ 50 kVA have been the front leaders, due to the increasing inclination towards the use of backup power solution for residential and small commercial applications. These models are cost-effective energy options with compact designs and less fuel consumption, contrary to large-scale generators.

Domestic, small business and independent retail outlets have driven adoption of ≤ 50 kVA gas generator sets. The availability of quieter and more portable ≤ 50 kVA gas generators additionally equipped with noise-reduction technology, lightweight designs, and remote monitoring capabilities has strengthened market demand, assuring greater affordability for residential and commercial applications.

Advanced features such as smart load distribution, predictive maintenance alerts, and adaptive power optimization offered by AI-powered fuel efficiency monitoring have also enhanced adoption across the supply chain, enabling longer operating hours and optimizing costs.

Eco-friendly gas generators and their development have helped drive the market due to such things as low-emission engines, biofuel compatibility and hybrid power integration that ensure market growth in accordance with sustainability goals and regulatory compliance.

While the 50<50 kVA gas generator segment offers advantages like low cost, high ease of use and energy efficiency, the segment also has some disadvantages such as limited power supply capacity compared to grid-based power, dependence on fuel availability, and relatively higher maintenance cost.

Despite this, new developments in hydrogen-fuelled small generators, artificial intelligence (AI) to manage power loads, and mobile app-based operations are increasing efficiency, sustainability, and market acceptance that will help maintain the momentum of the global ≤ 50 kVA gas generator sets market.

> 750 kVA Gas Generator Sets Gain Traction as Industrial and Large Commercial Demand Expands

Power ratings exceed 750 kVA, where these gas generator sets are seeing continued market penetration, especially in large industrial, commercial and critical infrastructure sectors. Unlike lower-capacity models however, these high power generators are designed to provide reliable large scale energy solutions suitable for data centres, healthcare facilities, large manufacturing plants and more.

The rise in disposable incomes is now leading to another trend; the increasing adoption of > 750 kVA gas generator sets in industries where continuous and backup power supply is required is also driving the adoption of > 750 kVA gas generator sets. The oil & gas industry, mining, heavy manufacturing, etc. are some of the industries that fall under this study scope where industries here require constant power and begin adopting gas generator sets with > 750 kVA capacity.

The rise of > 750 kVA generator units that are modular, scalable and have parallel operation capabilities with fuel-flexible designs and cloud interfaced energy monitoring systems has reinforced market demand enabling higher adaptability for energy-intensive sectors.

Advanced automated grid synchronization, including real load balance synchronous, fault detection based on AI technology, and dynamic switching of load in the power grid, has also helped the adoption. Moreover, hybrid gas generator sets are then developed with the integration of solar and battery backup systems that are contributing to the betterment of the environment by using high-efficiency gas turbine engines and enabling advanced emission control systems are posing a positive influence on market growth.

While gas generators > 750 kVA can offer stable power supply, scalability, and industrial stability, and they are dominating the generator market, the high capital cost, complex installation, and availability of fuel infrastructure are limiting the growth of this segment.

Nonetheless, new technology solutions around hydrogen-fuelled power generation, AI-based predictive maintenance, and state-supported renewable gas projects are helping overcome cost, reliability, and sustainability barriers that would help drive growth for > 750 kVA gas generator sets worldwide.

End-users favour reliable, sustainable, and cost-effective backup power products to combat grid stability, energy shortages, and increased power demands with respect to the Gas Generator Sets Market which is why the Residential and Industrial segments account for a sizable portion of this review.

Residential Sector Gains Momentum as Consumers Seek Affordable Backup Power Options

The residential sector has become one of the fastest growing end-users of gas generator sets, underlining the need for the integration of small-capacity generators to ensure continuity of power, emergency preparedness, and off-grid energy solutions.

This adoption has been fuelled by increasing demand for residential gas generators, such as standby home generators, portable emergency power units, and smart hybrid systems. Availability of these generators synchronized with smart home technology, including Wi-Fi-integrated remote operation, real-time energy tracking, and AI assisted fuel efficiency optimization, has further cemented market demand as they provide added convenience and energy savings for the homeowner.

For urban and suburban consumers, the use of low-noise residential gas generators with soundproof enclosures, vibration-reducing engine mounts, and adaptive speed control has further improved adoption. The introduction of carbon-neutral gas generator models which can utilize biogas and hydrogen fuel, include smart emissions monitoring and environmentally friendly exhaust treatment represents an important stimulus to market development, including better observance of sustainable household energy solutions.

While it has its benefits including home energy security, cost efficiency and smart integration fuel storage limitations, regulatory restrictions on emissions, and competition from solar-powered backup systems hinder demand for residential gas generators in the upcoming years.

However, upcoming innovations building on next-gen fuel cells, AI-inspired smart grid integration, and advanced lithium-ion cells for compact solutions continue to enhance efficiency, affordability, and sustainability, allowing further growth for residential gas generator sets around the globe.

Industrial End-Users Expand as High-Power Demand Necessitates Reliable Backup Solutions

The gas generator set market has also seen a significant increase in demand from the industrial sector, with companies striving to maintain uninterrupted power supply in large-scale operations, data centers, and manufacturing facilities.

The growing adoption of gas generator sets in industrial applications such as mining operations, oil & gas refineries, large-scale production plants, and chemical processing units has been responsible for the growth of the target market.

This not only enhances reliability and cost savings for high-energy-demanding sectors, but the rise of industrial-grade gas generators with multi-fuel optionality, modular scalability, and AI-assisted predictive maintenance has solidified demand in the market as an essential energy source.

Experiencing a surge in adoption are remote monitoring solutions incorporating IoT-based diagnostics, AI-powered load forecasting, and real-time performance tracking, allowing for optimized power management and reduced operational downtime.

Proliferation of alternative energy sources such as hydrogen and biofuels benefits such technologies as well, thereby enhancing the prospects of industrial gas generator set market, as these comply with environmental sustainability regulations in addition to being more viable than fossil fuels.

Industrial gas generators offer multiple advantages in terms of scalability, operational stability, and long-term energy costs however, similar to every sector, this segment faces high initial costs, threats based on fuel dependency, and growing competition against renewable energy-based alternatives.

Nevertheless, new developments in hybrid gas-diesel systems, AI-fuelled fuel optimization, and energy storage technology integration are enhancing efficiency, sustainability, and cost-effectiveness around the globe, allowing for continued growth of industrial gas generator sets worldwide.

The gas generator sets market is driven by increasing demand for reliable backup power solutions, rising adoption of natural gas-powered generators, and advancements in energy-efficient and low-emission technologies. With expanding applications in commercial, industrial, and residential sectors, the market is experiencing steady growth. Key trends shaping the industry include hybrid generator systems, smart monitoring integration, and increasing use of biogas and renewable fuel sources.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Caterpillar Inc. | 12-16% |

| Cummins Inc. | 10-14% |

| Generac Holdings Inc. | 8-12% |

| Kohler Co. | 6-10% |

| MTU Onsite Energy (Rolls-Royce) | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Caterpillar Inc. | Develops high-capacity gas generator sets for industrial, commercial, and utility applications. |

| Cummins Inc. | Specializes in energy-efficient gas generators with low emissions and smart monitoring systems. |

| Generac Holdings Inc. | Offers a range of standby and portable gas generator sets for residential and commercial use. |

| Kohler Co. | Focuses on natural gas and biogas-powered generators with advanced load management features. |

| MTU Onsite Energy (Rolls-Royce) | Provides scalable gas generator solutions for large-scale industrial and power plant applications. |

Key Company Insights

Other Key Players (45-55% Combined)

Several power generation equipment manufacturers contribute to the expanding Gas Generator Sets Market. These include:

The overall market size for the gas generator sets market was USD 11,019.9 million in 2025.

The gas generator sets market is expected to reach USD 62,229.9 million in 2035.

The demand for gas generator sets will be driven by increasing reliance on backup power solutions, rising demand for cleaner energy alternatives, growing adoption in industrial and commercial sectors, and advancements in fuel efficiency and emission control technologies.

The top 5 countries driving the development of the gas generator sets market are the USA, China, Germany, India, and Japan.

The Industrial End-User’s Generator Sets segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Power Rating, 2023 to 2033

Figure 22: Global Market Attractiveness by End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Power Rating, 2023 to 2033

Figure 46: North America Market Attractiveness by End User, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Power Rating, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Power Rating, 2023 to 2033

Figure 94: Europe Market Attractiveness by End User, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Power Rating, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Power Rating, 2023 to 2033

Figure 142: MEA Market Attractiveness by End User, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gasoline Generator Market - Growth & Demand 2025 to 2035

Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA