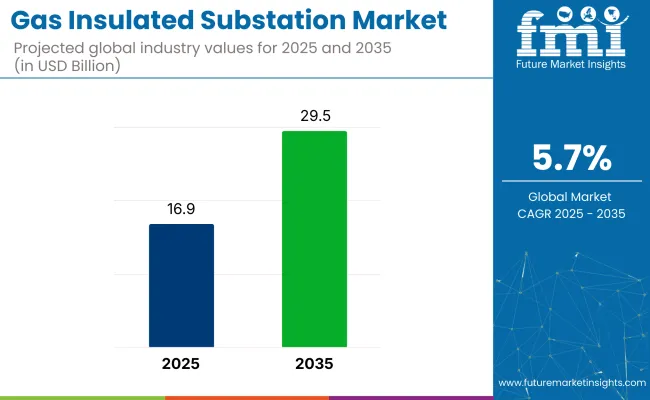

The global gas insulated substation market is slated to be worth USD 16.9 billion in 2025. It is poised to witness 5.7% CAGR during the forecast period, reaching USD 29.5 billion by 2035. Growth is driven by rising demand for compact and high-capacity power infrastructure, especially in urban and space-constrained areas, alongside increasing electricity demand, rapid industrialization, and grid modernization globally.

Additionally, the growing integration of renewable energy sources and the need for reliable, low-maintenance substation solutions further propel market expansion. The Asia-Pacific region leads growth, backed by infrastructure investments and energy sector reforms.

The market is undergoing rapid transformation driven by digital integration, advanced monitoring technologies, and localization of manufacturing and service operations. The rise of smart grid projects, remote monitoring capabilities, and predictive maintenance solutions is making substations more intelligent and responsive.

These advancements are transforming the GIS market into a more data-driven, standardized, and highly efficient sector, improving network stability, transparency, and long-term asset performance. As infrastructure investments increase across developing and developed regions, the market is witnessing resilient, automated, and future-proof power transmission systems.

Technological advancements play a crucial role in driving the growth of the market by enhancing operational reliability, safety, and spatial efficiency. Innovations in high-voltage insulation and digital control systems are improving performance while addressing environmental concerns. The integration of GIS with smart grid platforms, remote diagnostics, and real-time monitoring further boosts asset optimization and reduces system downtime.

Additionally, increasing urban density and land constraints are pushing utilities and infrastructure developers toward compact GIS solutions over conventional air-insulated substations. Global regulatory frameworks are increasingly emphasizing grid reliability, environmental safety, and emissions control.

Regulatory bodies such as the International Electrotechnical Commission (IEC), European Union Commission, and regional energy regulators are implementing stringent guidelines on substation safety, SF₆ gas handling, and energy efficiency.

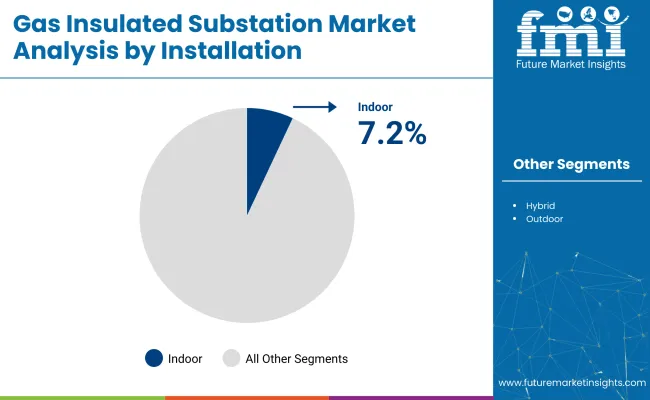

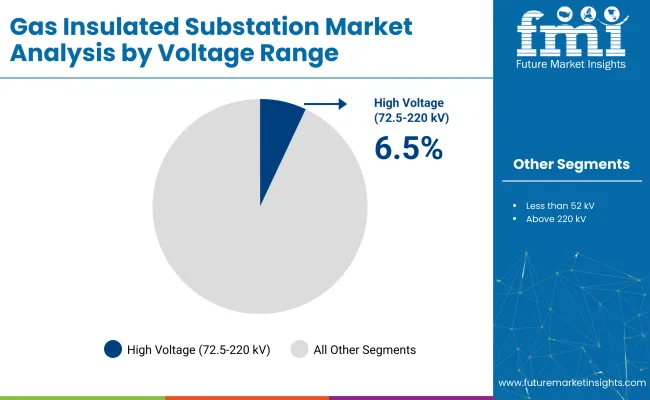

The global gas insulated substation market is segmented on the basis of installation into indoor and outdoor; by voltage rating into medium voltage (up to 72.5 kV), high voltage (72.5 kV - 220 kV), and ultra-high voltage (220 kV - 765 kV); by end user into power transmission & distribution and manufacturing & processing; and by region into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

| Basis of Installation | CAGR (2025 to 2035) |

|---|---|

| Indoor | 7.2% |

The indoor segment is projected to be the most lucrative between 2025 and 2035, projected to grow at a CAGR of 7.2%, driven by increasing urbanization, space constraints, and stringent regulatory requirements for safety and environmental impact.

The indoor GIS segment’s market value is estimated to reach USD 18.5 billion by 2035, up from approximately USD 9.5 billion in 2025, reflecting its rapid adoption in urban infrastructure projects and renewable energy integration. This elevated growth trajectory can be attributed to the expanding demand for compact, enclosed substations in densely populated metropolitan regions, where land availability is limited and safety concerns are paramount.

Furthermore, advancements in modular design and ease of installation are accelerating adoption in new infrastructure projects. Growing investments in renewable energy integration and smart grid technologies also favor indoor GIS solutions due to their flexibility and enhanced monitoring capabilities.

The outdoor segment, while substantial in market size, is forecasted to experience moderate growth due to its application in less space-constrained environments and older power transmission systems. It remains critical for rural and industrial zones but faces increasing competition from indoor solutions, especially where modernization and land optimization are prioritized.

| Voltage Rating | CAGR (2025 to 2035) |

|---|---|

| High Voltage (72.5-220 kV) | 6.5% |

The high voltage segment (72.5 kV - 220 kV) is projected to be the most lucrative in the gas insulated substation market between 2025 and 2035, expanding at a CAGR of 6.5%. The segment is reflecting strong investments in grid modernization and replacement of aging infrastructure with estimated value increase from around USD 7.8 billion in 2025 to USD 15.2 billion by 2035, capturing a significant share of the GIS market due to its balanced application in both urban and industrial environments. This voltage range supports critical infrastructure for regional transmission and urban distribution, positioning it as a growth engine.

Moreover, increasing demand for reliable power supply in rapidly developing economies is accelerating adoption. The technological advancements in insulation and switching further enhance its efficiency and operational lifespan, solidifying its market dominance. The medium voltage segment (up to 72.5 kV) caters mainly to localized distribution and smaller industrial clients, showing steady but slower expansion.

Ultra-high voltage GIS (220 kV - 765 kV), while vital for long-distance transmission and grid interconnections, represents a more niche segment with comparatively slower growth due to high capital costs and longer project timelines.

| End User | CAGR (2025 to 2035) |

|---|---|

| Power Transmission & Distribution | 6.3% |

The power transmission & distribution (T&D) segment is projected to be the most lucrative, estimated to grow at an accelerated CAGR of 6.3% over the forecast period. The segment’s market value is expected to rise from USD 12.4 billion in 2025 to USD 23.5 billion by 2035, accounting for a dominant share of the GIS market. This is driven by the escalating need to upgrade aging power grids, increase transmission capacity, and integrate renewable energy sources globally.

The rising electrification initiatives, grid modernization projects, and expansion of smart grid infrastructure underscore the quantitative growth in this segment. Additionally, increasing government investments and regulatory support for reliable power supply in emerging economies further fuel demand.

The segment also benefits from technological innovations that improve system efficiency and reduce downtime, making GIS a preferred choice for utilities worldwide. The manufacturing & processing segment, while important, represents a smaller portion of the overall GIS market.

The segment growth is stable but limited by industry-specific capital expenditure cycles and the scale of in-plant power infrastructure needs. Although this segment contributes to the GIS market, the power transmission & distribution segment’s broader scale and consistent investment flows position it as the principal revenue driver.

Challenges

Environmental Concerns Over SF₆ Gas Usage

The most significant concern in the GIS industry is the detrimental effect of sulfur hexafluoride (SF₆) gas, which is predominantly utilized as an insulating medium in the GIS circuit. SF₆ is primarily a greenhouse gas with a high global warming potential (GWP), making it subject to international environmental regulatory laws. To this end, bodies like the EU’s F-Gas regulations are advocating for less emission of industrial SF6 gases, which is the main driving force behind the invention of SF6-free GIS technologies. While other gases like fluoronitriles, and CO₂ are being focused on as options, their production, and durability challenges remain.

High Installation and Maintenance Costs

Gas insulated substations require more capital investment than air-insulated substations (AIS), thus making cost a big factor for acceptance, especially in developing countries. The difficulty of installation, specialized maintenance procedures, and the need for trained personnel increase the total expenses of GIS further. Moreover, the price of transforming existing substations into GIS technology is also high, needing the utility companies to think very well about profits in a long run and compare them with upfront costs. Nonetheless, a rise in automation and decrease in production price are the main reasons that push GIS technology costs down in forthcoming years.

Opportunities

Advancements in SF₆-Free and Digital GIS Technology

The development of SF₆-free GIS solutions presents a major opportunity for market growth, as utilities and governments focus on reducing carbon footprints and enhancing environmental sustainability. Companies are investing in fluoronitrile-based, vacuum-insulated, and hybrid GIS solutions to comply with emission reduction regulations while maintaining high-performance standards.

Additionally, the integration of AI-driven monitoring systems, predictive maintenance tools, and IoT-enabled GIS components is enhancing grid reliability and operational efficiency. The shift towards fully digital substations is expected to accelerate the adoption of next-generation GIS technology.

Expansion of Smart Grid Infrastructure and Renewable Energy Projects

The worldwide movement towards smart grid renovation and higher integration of renewable energy resources is providing the space for GIS implementation. The growing number of solar and wind power plants makes it necessary to build substations with high-voltage GIS that will be connected to these renewable sources to the national grids.

Meanwhile, both public authorities and enterprises are financing in high-performance and space-efficient GIS technologies with a primary target of strengthening the efficiency of the grid, decreasing electrical losses, and catering to the requirements of the prevailing electricity demand. The establishment of microgrid networks, EV charging points, and mixed power systems will additionally influence the rise of GIS in the next years to come.

The USA gas insulated substation (GIS) sector is steadily increasing as a consequence of the progressive trend of modernization of the power transmission network along with the widespread adoption of renewable energy and the urban need for space-efficient substations.

The power grid in the USA is currently under renovation to a great extent to enhance the system's reliability and to accommodate renewable power sources effectively which causes an increase in the quality of the services such as high-voltage GIS. Digital substations and smart grids are becoming prevalent through the use of advanced GIS technologies endowed with real-time monitoring and automation capabilities that go beyond the solution of simple issues.

Together with that, Compact, low-maintenance substations as a measure proposed by the USA Department of Energy (DOE) and Federal Energy Regulatory Commission (FERC) to mitigate the effects of extreme weather and at the same time improve grid efficiency are also being promoted. The rising awareness of SF₆ gas emissions, a greenhouse gas that is widely used in GIS, is prompting utility companies to consider the use of alternate eco-friendly insulating gases and hybrid GIS solution.

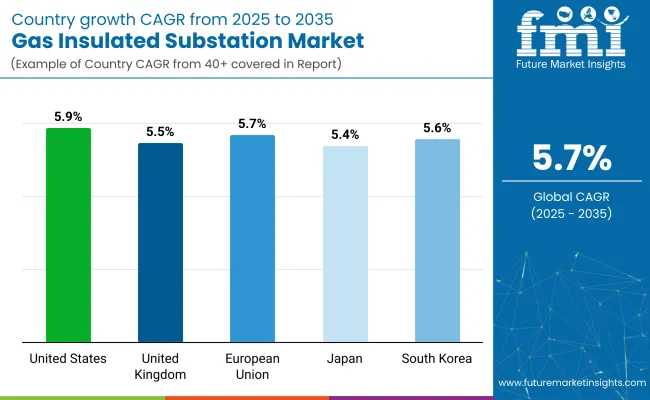

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

The UK gas insulated substation sector has shown a slight growth track which is mainly attributed to the constant influx of investments to the offshore wind power, grid resilience projects, and the essentiality of space-efficient substations. Under the guidance of the UK’s Net Zero 2050 Strategy, the electrification of the country has been put on the top priority list which in turn has resulted in a hike in the GIS installations that are meant for renewable energy projects.

The National Grid ESO (Electricity System Operator) is putting money into the existing high-voltage GIS substations which will improve the stability of the grid network and will also result in lower transmission losses. Furthermore, the swift growth of offshore wind farms in the North Sea is giving rise to the need for compact and high-capacity GIS solutions which are necessary for delivering the power to the city centers in a more efficient manner.

With the age-old electrical infrastructure prevalent in key locations like London, Manchester, and Birmingham, the GIS installations are the first choice for retrofit projects as they take a small amount of land and are easy to handle maintenance wise.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

The European Union gas insulated substation market is expanding significantly due to stringent emissions regulations, rapid renewable energy integration, and increasing investments in grid reliability. Leading nations such as Germany, France, and the Netherlands are at the forefront of GIS adoption, driven by EU Green Deal policies promoting low-carbon and energy-efficient grid solutions.

With the EU aiming for carbon neutrality by 2050, power utilities are rapidly replacing traditional air-insulated substations (AIS) with GIS, as they offer superior space efficiency, lower maintenance, and better operational reliability.

Additionally, the expansion of high-voltage direct current (HVDC) transmission systems across Europe is increasing demand for GIS to facilitate long-distance power transfers with minimal losses. European manufacturers are also pioneering SF₆-free GIS technologies, developing eco-friendly alternatives such as fluoronitrile-based insulation to meet strict environmental regulations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

The steady growth of the Japan gas insulated substation market is due to the efforts on grid modernization, the expansion of renewable energy, and the implementation of the smart grid technologies. The high population density and space constraints in Japan make compact GIS solutions very beneficial for the urban areas.

The country is pushing harder on renewable energy technologies thus, GIS is instrumental in the transmission of offshore wind, solar, and geothermal power efficiently through the grid. Furthermore, the government is funding the earthquake-resistant power infrastructure which is causing the demand for GIS that has better reliability and stability in the seismic areas.

The development of technologies such as remote-controlled GIS and AI-integrated GIS are now also achieving a great deal of success, making utilities more efficient with predictive maintenance and automated monitoring systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The South Korea gas insulated substation market is expanding due to rapid industrialization, growing electricity demand, and increasing adoption of smart energy solutions. With South Korea’s ambitious renewable energy goals, GIS is being increasingly deployed in solar and wind energy transmission networks.

The South Korean government’s investment in digital substations and smart grids has also led to the integration of IoT-enabled GIS with real-time diagnostics and automated fault detection. Additionally, the expansion of high-speed rail and metro infrastructure has created demand for compact GIS installations in transportation hubs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The worldwide GIS for gas insulated substation market is extensively expanding as a result of the continuous increase in electricity demand, the rise in the adoption of smart grid technologies, and the improvement of high-voltage electrical infrastructure. GIS technology has been the first choice for beyond traditional air-insulated substations because of its compact design, higher reliability, and super insulation characteristics that are particularly suitable for urban, industrial, and offshore applications.

The market is driven by factors such as the rise in investments in renewable energy projects, the increasing need for grid modernization, and the issue of environmental concerns with SF₆ gas emissions that led to the creation of SF₆-free GIS solutions. Major suppliers are inclined to energy-efficient GIS designs, intelligent automation, and alternative development for environmental sustainability to meet global energy transition goals.

Less than 52 kV, 72.5 to 245 kV, Above 245 kV

Indoor, Outdoor, Hybrid

Transmission & Distribution, Industrial, Renewable Energy, Offshore

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The global gas insulated substation market is projected to reach USD 16.9 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.7% over the forecast period.

By 2035, the gas insulated substation market is expected to reach USD 29.5 billion.

The 72.5 to 245 kV segment is expected to dominate due to increasing demand for efficient and space-saving substations in urban areas and industrial zones, along with the growing need for reliable power transmission.

Key players in the gas insulated substation market include ABB Ltd., Siemens AG, General Electric, Hitachi Energy, and Toshiba Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA