The Gastroesophageal Junction Adenocarcinoma (GEJAC) Therapeutics Market is valued at USD 9.12 Billion in 2025. As per FMI's analysis, the Gastroesophageal Junction Adenocarcinoma Therapeutics industry will grow at a CAGR of 18% and reach USD 47.73 Billion by 2035.

In 2024, the industry experienced notable growth, primarily driven by the increasing prevalence of gastroesophageal junction adenocarcinoma (GEJAC) cases, particularly in regions with high consumption of processed foods and tobacco products.

Advances in diagnostic technologies, including liquid biopsies and next-generation sequencing, enabled early-stage detection, leading to a higher number of patients undergoing targeted therapies. Additionally, pharmaceutical companies intensified their research and development efforts, resulting in the launch of novel therapeutics like immune checkpoint inhibitors and monoclonal antibodies.

The Asia-Pacific region saw significant industry expansion, attributed to the growing awareness of GEJAC symptoms, improved healthcare infrastructure, and government-backed cancer screening programs. Meanwhile, North America retained its dominance due to established healthcare systems and a surge in clinical trials evaluating combination therapies.

Looking ahead to 2025 and beyond, the industry is expected to witness accelerated growth as personalized medicine and precision oncology become mainstream. Collaborations between biotech firms and research institutions will likely lead to the discovery of innovative treatments.

Additionally, increasing investments in oncology research and favourable regulatory pathways are anticipated to support faster drug approvals, further propelling industry expansion. Technological advancements in AI-driven diagnostics and real-world data analytics will also contribute to more effective treatment strategies and improved patient outcomes.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.12 Billion |

| Industry Value (2035F) | USD 47.73 Billion |

| CAGR (2025 to 2035) | 18% |

The Gastroesophageal Junction Adenocarcinoma Therapeutics Industry is poised for robust growth, driven by the rising incidence of gastroesophageal cancers and advancements in targeted therapies. Pharmaceutical companies and biotechnology firms stand to benefit from increasing investments in oncology research and accelerated drug approvals. However, healthcare providers in regions with limited access to innovative treatments may face challenges in delivering optimal patient care.

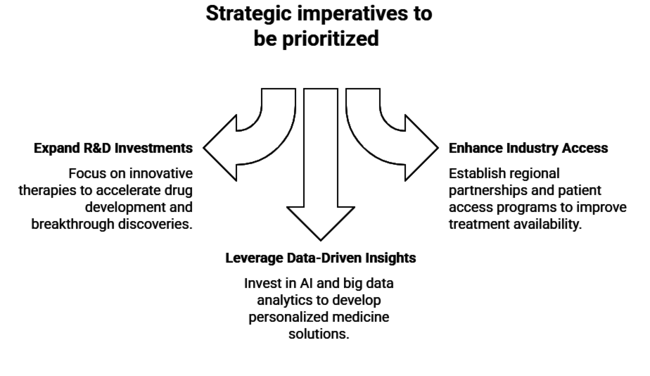

Expand R&D Investments in Targeted Therapies

Executives should prioritize increasing investments in research and development to advance innovative targeted therapies, including immune checkpoint inhibitors and monoclonal antibodies. Collaborations with academic institutions and biotech firms can accelerate breakthrough discoveries and shorten drug development timelines.

Enhance Industry Access and Regional Expansion

To align with the rising incidence of gastroesophageal junction adenocarcinoma, companies should expand their presence in emerging industry’s by establishing regional partnerships. Implementing patient access programs and working with local governments to ensure affordable treatment options can boost industry penetration.

Leverage Data-Driven Insights for Personalized Medicine

Executives should invest in artificial intelligence and big data analytics to enhance precision oncology solutions. Developing personalized treatment plans using predictive analytics can improve patient outcomes and optimize therapy selection, positioning companies as leaders in personalized cancer care.

| Risk | Probability and Impact |

|---|---|

| Regulatory Delays in Drug Approvals | Medium Probability, High Impact |

| Competition from Biosimilars and Generics | High Probability, Medium Impact |

| Limited Access to Advanced Therapies in Emerging Industry’s | High Probability, High Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Accelerate Targeted Therapy Approvals | Collaborate with regulatory bodies to fast-track drug approvals through priority review programs. |

| Expand Emerging Industry Presence | Partner with local healthcare providers and distributors to increase accessibility in underserved regions. |

| Enhance Clinical Trial Data Utilization | Implement AI-driven analytics to gain real-time insights and optimize trial outcomes. |

To stay ahead, companies must prioritize accelerating the development and approval of targeted therapies through regulatory partnerships and expedited review programs. Expanding industry presence in emerging regions by forming local alliances and ensuring affordability will unlock significant growth.

Additionally, leveraging AI-powered analytics to optimize clinical trial design and real-world data utilization will enhance treatment efficacy and industry differentiation. A proactive focus on personalized medicine, strategic investments in R&D, and innovative patient access programs will position companies as leaders in the Gastroesophageal Junction Adenocarcinoma Therapeutics Industry.

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across pharmaceutical companies, healthcare providers, regulators, and payers in North America, Europe, Asia-Pacific, and Latin America

Regional Variance

Convergent and Divergent Perspectives on ROI

74% of North American stakeholders reported AI investments as yielding measurable diagnostic improvements, compared to 40% in Latin America.

Targeted Therapies: Preferred by 70% globally, particularly in regions with established precision oncology infrastructure.

Regional Variance

85% of stakeholders cited high treatment costs as a significant barrier to patient access.

Regional Differences

Pharmaceutical Companies

Healthcare Providers

78% of global pharmaceutical companies plan to expand their targeted therapy portfolios.

Regional Focus

High Consensus: Accelerating targeted therapy development, improving patient access, and reducing cost barriers remain shared priorities.

Key Variances

Strategic Insight: Industry players must tailor their strategies by aligning with regional needs, whether through regulatory partnerships in Europe, technology adoption in North America, or affordability-focused models in Latin America and Asia-Pacific.

| Country | Policies and Regulations |

|---|---|

| The USA | FDA approval through New Drug Application (NDA) and Biologics License Application (BLA); CMS reimbursement policies. |

| UK | NICE guidelines for cost-effectiveness; MHRA regulatory approvals. |

| France | ANSM approval for therapeutics; reimbursement through the French National Health Insurance. |

| Germany | BfArM and PEI approvals; AMNOG pricing negotiations. |

| Italy | AIFA marketing authorization; regional reimbursement policies. |

| South Korea | MFDS approval; Health Insurance Review and Assessment Service (HIRA) reimbursement. |

| Japan | PMDA and MHLW approvals; strict post- industry surveillance; national insurance reimbursement. |

| China | NMPA approval; National Reimbursement Drug List (NRDL) inclusion critical for industry access. |

| Australia-NZ | TGA and Medsafe approvals; Pharmaceutical Benefits Scheme (PBS) coverage in Australia. |

The drugs segment is anticipated to be a primary driver of industry growth, with a projected CAGR of 20.5% during the forecast period. This robust expansion is largely driven by the increasing adoption of targeted therapies, such as trastuzumab and ramucirumab, which have demonstrated significant efficacy in treating gastroesophageal junction adenocarcinoma (GEJAC).

These therapies are improving patient outcomes by targeting specific molecular pathways involved in cancer progression. Additionally, the development of novel immunotherapies, including immune checkpoint inhibitors and CAR T-cell therapies, is enhancing the therapeutic landscape, providing patients with promising treatment alternatives that offer better survival rates and fewer side effects compared to traditional chemotherapy.

Advancements in diagnostic technologies are expected to propel the diagnosis segment, which is projected to grow at a CAGR of 18.8%. Techniques like endoscopy, CT scans, and PET scans are becoming more prevalent, facilitating early detection and improving patient outcomes. The integration of AI and machine learning in imaging technologies is enhancing the accuracy of diagnoses, allowing for better tumor localization and staging.

Additionally, liquid biopsy techniques, which detect cancer-related biomarkers in blood samples, are emerging as non-invasive alternatives, further advancing early detection. The emphasis on early diagnosis is crucial in managing GEJAC effectively, enabling timely interventions and personalized treatment, thereby driving the demand for advanced diagnostic tools.

Treatment modalities, including surgical procedures like esophagectomy, are projected to grow at a CAGR of 16.7%. Esophagectomy surgery, in particular, is expected to hold a significant industry share, accounting for 40% in 2023. This procedure is critical in cases where tumors are localized, offering the best chance for long-term survival. However, advancements in multimodal therapy are transforming GEJAC treatment.

The integration of chemotherapy, immunotherapy, and targeted therapies, such as trastuzumab and ramucirumab, is enhancing overall treatment efficacy. These therapies are improving survival rates by addressing tumor heterogeneity and preventing recurrence. The combination of surgery with these therapies is significantly boosting patient outcomes and driving demand in the treatment segment.

The distribution channels segment, encompassing hospital, retail, and online pharmacies, is anticipated to grow at a CAGR of 19.3%. Hospital pharmacies are likely to dominate due to the complex nature of GEJAC treatments, which often require specialized handling, administration, and patient monitoring. These treatments, such as chemotherapy and immunotherapies, are typically provided in hospital settings where patients can receive comprehensive care.

However, the rise of online pharmacies is contributing significantly to increased accessibility and convenience, especially for patients in remote areas or those requiring maintenance medications for chronic conditions. Online platforms are also facilitating faster prescription refills, enhancing patient adherence to treatment plans and improving overall convenience in accessing medications.

The USA is expected to grow at a CAGR of 16.5%, driven by advancements in targeted therapies, increased funding in cancer research, and early adoption of innovative treatments. The presence of leading pharmaceutical companies and robust clinical trial activity further enhances industry growth.

Government initiatives supporting cancer research, along with rising incidence rates of gastroesophageal junction adenocarcinoma, are contributing to the industry's expansion. Additionally, public awareness campaigns and access to advanced diagnostic tools promote early detection, leading to improved treatment outcomes. Strong collaborations between biotech firms and academic institutions further support the development of novel therapeutics.

The industry in the UK is anticipated to register a CAGR of 14.2%, owing to the presence of robust healthcare infrastructure and government-funded cancer research programs. Collaboration between academic institutions and pharmaceutical companies driving innovation. Increased usage of personalized medicine and national screening programs to facilitate early diagnosis are also driving growth in the industry.

Broad access to innovative therapies via the National Health Service (NHS) coupled with supportive regulation for expedited drug approvals will continue to expand the industry. In addition, partnerships between the public and individual institutions, in combination with specific cancer research centres, contribute to the advancement in therapeutics.

Theindustryin France is expected to grow at a CAGR of 13.8%, owing to the development of immunotherapy and precision medicine. The industry is driven by strong government support for cancer research and a high prevalence of gastroesophageal cancers. The existence of adequately regulated settings for clinical trials further accelerates industry growth.

France’s investment in biotech, both start-ups and cancer specific initiatives, fuels innovation. Additionally, comprehensive patient access to state-of-the-art treatments and initiatives to reduce cancer mortality rates contribute to industry growth. Increased collaboration between European research institutions helps cross-border innovation.

Germany is expected to witness a CAGR of 15.3% due to large investment in oncology research and large pharma presence. The presence of advanced medical facilities and the acceptance of emerging therapies drives the growth of the industry. Germany also creates good chances for growth through its participation in large, EU-wide cancer research initiatives.

The country’s focus on precision medicine and biomarker-based therapies boosts its industry potential. Broad insurance coverage and significant government incentives to support clinical research increase access to novel treatments. In addition, Germany has a strong pharmaceutical manufacturing sector that enables the efficient production of therapeutics.

Italy is expected to grow at a CAGR of 12.7%, as the country is witnessing an increasing aging population and a rising incidence of cancer. The industry's growth is driven by increasing government funding for oncology research. New partnerships and collaborations with other global pharmaceutical firms further drive the expansion. Regional cancer networks help drive the industry forward by expanding access to innovative therapies.

Italy's national healthcare system guarantees affordable treatment, and government-directed programs focusing on early cancer diagnosis improve patient prognosis. Moreover, collaborations of any Italian biotech companies with international pharma leaders promote the growth of novel medications, while industry extension strengthens.

The South Korean industry is expected to grow at a CAGR of 14.9%, driven by rising healthcare expenditure and government initiatives supporting cancer therapy innovation. Moreover, the growing emphasis on precision medicine and advancements in molecular diagnostics are paving the way for industry growth in the country. Collaborations between academic institutions and biotech companies speed up the creation of new therapies.

Government incentives for biotech start-ups and international partnerships offer further impetus. In addition, the adoption of telehealth services and AI-based diagnostics facilitates early diagnosis and treatment strategies, driving the industry positively. South Korea’s participation in global clinical trials also enhances access to novel therapeutics.

Japan is expected to grow at a CAGR of 14.5%, backed by an established pharmaceutical industry with heavy investments directed towards oncology studies. Expansion of the industry is due to early diagnosis with national cancer screening programs, an increase in the adoption of advanced treatment technologies. Local partnerships with multinationals add even more muscle to Japan’s industry share.

Japan’s regulatory agency (PMDA) also has a system in place for accelerated drug approval for breakthrough therapies which, when granted, allows patients to get breakthrough therapy substantially faster than in similar jurisdictions. Japan ranks high in the oncology industry, with investment in AI-driven healthcare solutions and advancements in genomic understandings enabling it to drive personalized treatment options.

China's industry is expected to grow at a CAGR of 19.3%, dominating revenue growth due to the rapid development of biotechnology and increasing healthcare investments. The industry is driven by the increasing prevalence of cancer, the initiatives taken by the government for research of cancer, and the increase in the availability of targeted therapies.

Moreover, China’s emphasis on domestic pharmaceutical innovation, backed by government funding and regulatory changes, speeds up the development and commercialization of advanced therapeutics. Industry prospects are also enhanced through collaborations with international biotech firms and participation in global clinical trials.

The Australian and New Zealand industries should be poised with 13.1% (CAGR) due to their well-established healthcare systems and government-funded cancer research programs. The industry growth is attributed to early adoption of advanced therapies and active participation in international clinical trials.

Growing awareness about cancer among the population and better access to patients for treatment also contribute positively to industry outlook. The region’s emphasis on personalized medicine and genomic research drives the development of novel therapist. Moreover, the presence of a favourable regulatory framework and government funding for cancer treatment programs ensures good access to novel therapies, thereby supporting overall industry growth.

In 2024, the Gastroesophageal Junction Adenocarcinoma (GEJAC) therapeutics industry witnessed significant advancements, with notable regulatory approvals and clinical trial successes. Astellas Pharma received FDA approval for Vyloy (zolbetuximab) for the treatment of specific gastric cancers, supported by Roche’s companion diagnostic test to identify eligible patients.

Merck reported promising results from its Phase 3 trial of Keytruda in combination with trastuzumab and chemotherapy, further expanding treatment options. Additionally, Daiichi Sankyo and Astra Zeneca’s Enhertu secured approval in China for HER2-positive cases, strengthening their presence in the region. Roche also achieved a milestone with the approval of its VENTANA CLDN18 assay as a companion diagnostic, enhancing precision in therapy selection for GEJAC patients.

Market Share Analysis

Bristol-Myers Squibb (BMS)

Merck & Co. (MSD)

Roche/Genentech

AstraZeneca

Eli Lilly

Daiichi Sankyo

Taiho Pharmaceutical

The industry is bifurcated into trastuzumab andramucirumab.

The industry is divided into endoscopy, X-ray, CT Scan, and PET Scan.

The industry is segmented into esophagectomy surgery, esophageal dilation, chemotherapy, and targeted therapy.

The industry is divided into hospital pharmacy, retail pharmacy, and online pharmacy.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

The expected size of the landscape is USD 47.73 Billion by 2035.

Regions like North America, Europe, and Asia-Pacific are experiencing significant growth due to improved healthcare infrastructure and rising cancer cases.

The drugs segment is expected to grow at a CAGR of 20.5%, making it the fastest-growing.

Advancements in targeted therapies, rising cancer cases, and improved diagnostic tools are key growth drivers.

The major manufacturers in the industry include Astellas Pharma, Merck & Co., Roche, Daiichi Sankyo, AstraZeneca, Bristol Myers Squibb, Eli Lilly and Company, Pfizer, Amgen, Novartis, Bayer, Beigene, Elevar Therapeutics, FivePrime Therapeutics, Incyte, Macrogenics, Ono Pharmaceuticals, Taiho Pharmaceuticals, Zai Labs, ZymeWorks.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Drug, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug, 2023 to 2033

Figure 22: Global Market Attractiveness by Diagnosis, 2023 to 2033

Figure 23: Global Market Attractiveness by Treatment , 2023 to 2033

Figure 24: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Drug, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Drug, 2023 to 2033

Figure 47: North America Market Attractiveness by Diagnosis, 2023 to 2033

Figure 48: North America Market Attractiveness by Treatment , 2023 to 2033

Figure 49: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Drug, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Drug, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Diagnosis, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Treatment , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Drug, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Drug, 2023 to 2033

Figure 97: Europe Market Attractiveness by Diagnosis, 2023 to 2033

Figure 98: Europe Market Attractiveness by Treatment , 2023 to 2033

Figure 99: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Drug, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Drug, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Diagnosis, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Treatment , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Drug, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Drug, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Diagnosis, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Treatment , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Drug, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Drug, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Diagnosis, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Treatment , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Drug, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Drug, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Drug, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Drug, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 196: MEA Market Attractiveness by Drug, 2023 to 2033

Figure 197: MEA Market Attractiveness by Diagnosis, 2023 to 2033

Figure 198: MEA Market Attractiveness by Treatment , 2023 to 2033

Figure 199: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease Therapeutics Market Analysis - Innovations & Forecast 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Super Junction MOSFET Market

Automotive Junction Box Market Size and Share Forecast Outlook 2025 to 2035

Polycarbonate Junction Box Market Forecast and Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA