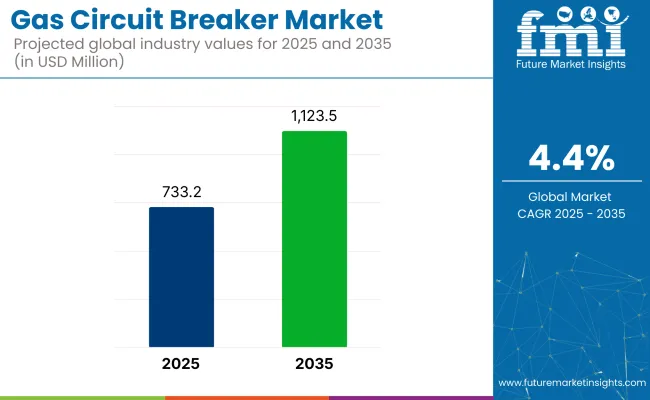

The global gas circuit breaker market is set for steady growth between 2025 and 2035, driven by rising investments in power infrastructure, increasing demand for reliable electricity transmission, and stringent regulations for electrical safety. The market is estimated to reach USD 733.2 million in 2025 and is expected to grow to USD 1,123.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.4% over the forecast period.

Gas circuit breakers (GCBs) are indispensable components in the high voltage power systems which are responsible for fault protection, increasing grid stability, as well as prevention of electrical failures. A major driver of demand for advanced gas circuit breakers includes the surging intake of renewable energy sources, the consequential expansion of power grids, and the increased upgrading of existing transmission networks. Furthermore, the technological progression of industries, the movement of people into cities, and the improved focus on energy efficiency have all led to the positive development of the market.

In the course of the global transition towards smart grids and energy-efficient transmission systems, gas circuit breakers have been increasingly combined with digital monitoring systems, IoT-based fault detection, and remote operation capabilities. The market for the high-performance and eco-friendly gas circuit breakers has the prospect to experience a massive increase in demand because of the government and power utilities' investments in the installation of new technology and the retrofitting of existing outdated electrical infrastructure.

Expansion of the gas circuit breaker market is mainly due to its role in high voltage transmission systems, extension of the smart grid, and the increase in electricity consumption from industrial and commercial sectors. Furthermore, the launch of SF₆ gas alternatives and introduction of ecology-friendly circuit breaker technology are anticipated to be the vigorous forces for long term growth of the market.

Gas circuit breakers have a significant potential for North America since the region is marked with the ongoing energy grid modernization investments, beyond-the-norm safety regulations, and the growth in renewable energy sources. High-voltage circuit breakers are the latest trend in the US and Canada, as the power utilities are focusing on improving the power distribution systems and integrating renewable power sources, including solar and wind. Another aspect that the region is facing is the smart grid transformation, which is the extra need for different types of solutions to build-in real-time monitoring and remote operation capabilities circuit breakers. On top of this, the outdated power structure and the increasing occurrence of power outages have triggered the government-sponsored programs thus enabling the replacement of the old electrical systems with new high-quality gas circuits that also help the grid in maintaining reliability and stability.

The continued growth of gas circuit breakers in Europe owes mainly to rigorous environmental policies, substantiation of offshore wind schemes, together with sustainability power transmission networks' investments. Eco-conscious electrical parts being promoted by countries like Germany, France, and the UK, spurring by higher adoption of SF₆-free circuit breakers in high-voltage applications. Utilities substituting old power protection systems with alternative gas-insulated switchgear and circuit breakers due to Europe emphasizing Decarbonization is another cause of technological improvements. The other issues tackled are: the implementation of advanced industrial infrastructures and the smart city programs that require the new intelligent circuit breaker technologies.

Asia-Pacific is the most rapidly developing area within the gas circuit breaker market, with industrialization, electricity demands, and government-led electrification being the primary driving forces behind this breakthrough. China, India, and Japan are the countries that lead in this power expansion as they are putting up more and more high-voltage transmission networks and grid protection options. China's power production is the biggest in the world and it has been pouring finances into ambitious ultra-high-voltage (UHV) transmission systems installation, which in turn translates into the demand for high-performance gas circuit breakers for grid protection. India's growth in energy projects has been spectacular and it is doing well in the area of rural electrification, smart grid deployment, and renewable energy integration. In parallel, Japan and South Korea are making strides in the advancement of power grid with technology enhancements, therefore, inline, led to higher acceptance of gas-insulated switchgear and circuit breakers.

The MEA region has been boosted by the rapidly growing gas circuit breakers market, driven by industrial expansion, oil and gas projects, as well as major infrastructure projects. The oil-rich Middle East countries, such as Saudi Arabia, UAE, and the African nation of South Africa, show a clear roadmap in the energy sector by the construction of green energy facilities and by the use of modern circuit breakers for high voltage transmission systems. Concurrently, the necessity of the region’s electrical grid protection is the result of propensity on utilizing renewable energy from the sun and wind sources. Electrification is of major attention to the African continent, being the location where many off-grid and mini-grid projects are being undertaken, and one of the results of those are the robust circuit breaker systems that help increase power reliability in distant areas of deployment.

Environmental Concerns Over SF₆ Gas Emissions

The gas circuit breaker market is facing one of the environmental issues associated with the use of sulphur hexafluoride (SF₆) gas, which is preferred for the breaker as it has very good insulation and arc-quenching properties. But SF₆ is a very effective greenhouse gas with a large international warming potential that has resulted in an increase in regulations. The governments and non-governmental groups of environmentalists are exhorting the movement against alternatives to SF₆-filled gas circuit breakers, make manufacturers build insulation material, and gas mixtures all about eco-friendly. Whereas, SF₆-free circuit breakers are coming into the market, they are still more and less used making it difficult for the industries and utilities to set a sustainable circuit breaker technology.

High Initial Costs and Infrastructure Upgrade Challenges

High initial costs and the complexity of integrating them into aging power grids are two main reasons that obstruct the adoption of gas circuit breakers, especially in developing areas. The development of older substations using modern gas-insulated switchgear and circuit breakers is considered typical although necessitates substantial initial capital investment that could prompt the delay of the project in budget-constrained markets. Furthermore, a significant challenge is met due to the unavailability of skilled workforce and the lack of technical expertise in the high-voltage gas circuit breakers, particularly in the rural and underdeveloped areas. Besides, utilities and power companies have a foregone investment in residential training and infrastructural rehabilitation that could be the cause for slow market growth in specific territories.

Advancements in SF₆-Free and Digital Circuit Breaker Technologies

The circuit breakers are moving from a SF₆ gas circuit breaker to a digital, energy-efficient, and fully recyclable product as the market goes through a technological transformation. This trend is influenced both by the demands of electric companies and the requirements from the government in order to decrease the carbon footprints and to make the grid more sustainable. Industry frontrunners are also shifting their focus to alternative gas insulation technologies, like fluoronitrile-based gas mixtures, to bring about circuit breakers that are environmentally-friendly. Besides that, digital monitoring, predictive maintenance, and IoT-enabled integration are altogether the start of a new age of industrial safety and automation across the grid. The advent of ??-based fault detection and composting systems has increased the reliability of the grid, which makes gas breakers economically feasible and effective in longer time periods.

Growing Demand for Smart Grids and High-Voltage Transmission Systems

Gas circuit breakers are witnessing a huge potential for growth in the market with the development and implementation of smart grids and ultra-high-voltage (UHV) transmission systems. The issue has become more pertinent in the context of the increase in electricity consumption as well as the shifts toward the use of renewable energy resources by various governments thereby bringing in the modern transmission infrastructure project plans. The start of the project that was initiated by the local governments in the emerging economies for electrifying the rural areas and also involving the expansion of the local power supply network and further investment in the grid reliability promotion schemes are the new opportunities that create the favourable conditions for gas circuit breaker manufacturers. The necessity of high-performance and cost-effective circuit breakers will also increasingly grow since industries will be implementing the energy-efficient distribution systems.

During the period of 2020 to 2024, the gas circuit breaker market has been demonstrating a good performance and thus, has been continuously thriving with the further development of the power transmission network as well as the increasing use of the renewable energy sources and the growing attention on grid reliability. Gas circuit breakers, or GCBs, are integrated with sulphur hexafluoride (SF₆) or other alternative insulating gases, which are considered indispensable in high-voltage applications in substations, power plants, and industrial grids. The rehabilitation of the old power infrastructure, the promotion of the smart grid, and the regulatory conditions for safety have lessened the excuses of people to ignore the demand for the systems. Fewer challenges like SF₆ gas environmental worries, large upfront investment, and supply chain troubles compromised the market stability.

From the perspective of the period between 2025 to 2035, the scenario in the gas circuit breaker market will be determined by the introduction of SF₆-free insulation technologies, the AI-assisted fault detection systems, and the enhanced hybrid circuit breakers. The attempt to establish carbon-neutral energy grids, the digital substation, and the ultra-high direct current (UHVDC) transmission technology will be the driving factors responsible for ground-breaking changes. Besides, the combination of the solid-state circuit breaker, AI-VV driving grid monitoring, and the use of block chain for energy trading will lead to a re-arranged market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Grid Expansion & High-Voltage Applications | Increasing deployment of gas circuit breakers in high-voltage substations to enhance grid reliability. |

| Transition Toward SF₆-Free Technologies | Growing concerns over SF₆ gas emissions, with regulatory pressure to find alternatives. |

| Smart Grids & Digital Substations | Early adoption of IoT-based monitoring in gas circuit breakers, improving operational efficiency. |

| Integration with Renewable Energy & Energy Storage | Increasing use of gas circuit breakers in wind, solar, and hydropower substations. |

| Advancements in Circuit Breaker Materials & Design | Improvements in high-durability contact materials and compact designs enhanced system efficiency. |

| AI & Automation in Grid Management | Adoption of smart sensors and automated fault detection in high-voltage substations. |

| Market Growth Drivers | Growth fueled by expanding electricity demand, increasing industrial automation, and the need for high-voltage circuit protection. |

| Market Shift | 2025 to 2035 |

|---|---|

| Grid Expansion & High-Voltage Applications | Expansion of ultra-high-voltage (UHV) gas circuit breakers, supporting HVDC and renewable energy grids. |

| Transition Toward SF₆-Free Technologies | Development of eco-friendly gas circuit breakers using fluoronitrile blends, CO₂-based gases, and vacuum switching technology. |

| Smart Grids & Digital Substations | AI-powered self-diagnosing circuit breakers, blockchain-enabled grid fault tracking, and cloud-based predictive maintenance. |

| Integration with Renewable Energy & Energy Storage | Expansion of hybrid circuit breakers with AI-driven response mechanisms for microgrids and energy storage integration. |

| Advancements in Circuit Breaker Materials & Design | Nanotechnology-enhanced insulating materials, graphene-infused contacts, and solid-state hybrid switching solutions improve reliability. |

| AI & Automation in Grid Management | Fully autonomous, AI-integrated grid monitoring with real-time load balancing and demand-response optimization. |

| Market Growth Drivers | Market expansion driven by SF₆-free insulation solutions, AI-powered predictive maintenance, and integration of gas circuit breakers in next-gen digital power grids. |

The USA gas circuit breaker sector is experiencing a continuous surge in its growth, propelled by the rise in funding for power grid upgrades, increased use of renewable energy, and the need for state-of-the-art high-voltage protective devices. The country is actively replacing its obsolete electrical network, a fact which boosts the sales of gas-insulated switchgear (GIS) and high-voltage gas circuit breakers aimed at better grid reliability. With solar and wind energy being incorporated more and more into the national grid, the necessity for fault current interrupting devices has steeped up even further, where gas circuit breakers, as a consequence, can offer better performance due to high arc-quenching capability and long operational life. On the other hand, the stringent environmental regulations on the emission of SF₆ gas entail the manufacturers to mark their products as environmentally friendly by switching to alternatives like fluoronitrile-based circuit breakers, and vacuum-insulated and circuit breakers.

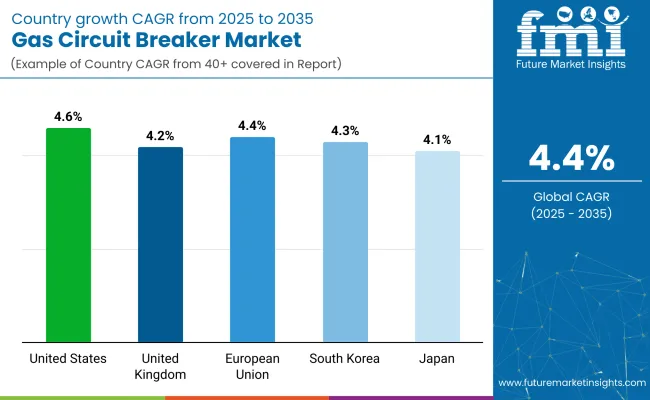

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The United Kingdom gas circuit breaker market is on a steady path of development, mainly because of the problems with the stability of the grid that need solving, as well as the increase in the number of projects which concern the offshore wind energy sector, and the pressure from regulations to make the electrical systems less harmful to the environment. The investments in the renewable energy infrastructure have gone up due to the UK government Net Zero Strategy, which in turn caused the demand for high-voltage gas circuit breakers in offshore wind farms and substations to increase. Following the retirement of the electrical infrastructure in cities like London, Manchester, and Birmingham, it is the right time to deploy the gas-insulated switchgear (GIS) technology, which is compact and efficient, intended for reliable power distribution. Furthermore, the UKs strict environmental policies on SF₆ gas usage are compelling manufacturers to come up with alternative gas circuit breaker technologies that result in less greenhouse gas emissions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The European Union's gas circuit breaker sector is experiencing rapid growth as a result of strict emissions regulations, increased renewable energy integration, and funding in intelligent electricity grids. Germany, France, and the Netherlands are spearheading the shift to environmentally friendly grid systems, supporting SF₆-free and circuit breaker technologies with low emissions.

As the EU Green Deal intends to achieve climate neutrality by 2050, utility companies and grid operators are pouring money into the projects to update transmission infrastructure that would allow them to deal with the rising amount of wind and solar energy. The modernization of cross-border electricity transmission networks has, therefore, been a driving force behind the surge in demand for high-voltage gas circuit breakers featuring exceptional performance on fault-handling.

Deployment of smart grids and automation in power substations are the main factors leading to the need of digital circuit breakers that would monitor conditions from real-time data and also can be controlled remotely.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

The gas circuit breaker market in Japan is steadily growing primarily prompted by the counterbalancing demand for power grid efficiency, smart energy solutions investment, and further development of electric vehicle (EV) carrying networks. The Japanese electrical grid is one of the most advanced in the world and, accordingly, the country sets a strong focus on grid resilience and energy efficiency. The commitment of Japan to Decarbonization shifts considerably the focus toward the eco-friendliness of circuit breakers. Therefore, the requests primarily depend on circuit breakers offering lower losses and the ones that are not filled with SF₆. Moreover, the rising number of urban areas that are electrified in Japan and the move towards underground substations mean that a more compact version of gas-insulated switchgear is required.

The significant number of electric vehicles coming on the road and the deploying of fast-charging networks is another factor that strengthens requests for high-performance gas circuit breakers in the smart charging infrastructure and DC substations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The gas circuit breaker market in South Korea is ballooning as a result of the rapid industrialization, the increase in investments in smart grid projects, and the growing application of renewable energy sources. With the grand plan of the country towards energy transition, the public utilities are cantering their attention on grid automation and efficient power transmission, thereby, increasing the need for digital gas circuit breakers. The burgeoning semiconductor and manufacturing sectors of the country make a demand for uninterrupted power, thus, higher adoption of high-performance gas circuit breakers in industrial substations. In addition to that, the commissioning of offshore wind energy and high-speed rail networks further contribute to the demand for small and easy-to-maintain circuit breakers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Gas circuit breakers are the most selling type of equipment in the range of 145kV to 252kV, thanks to the constant growth of investments in power transmission infrastructure, substation modernization, and grid expansion projects. These circuit breakers are the solution to performing fast arc quenching, good reliability, and very low maintenance, which are the suitable characteristics for medium and high voltage transmission networks. The 145 kV-252 kV gas circuit breaker is the preferred choice of utility firms due to its little space requirement, excellent dielectric strength, and more than double isolating function while used in heavily loaded substations and industrial distribution systems. These breakers interrupt the fault current at a higher level compared to less voltage ratings affected (up to 72.5kV and 72.5-145kV), thereby reassuring grid reliability and stability, and accordingly a continuous power supply. Similarly, as the integration of renewable energy sources increases, the request for dependable, high voltage circuit breakers also grows, particularly in the territories which are concentrating on the smart grid development and interregional transmission networks.

Gas circuit breakers with a voltage rating of more than 800kV are being increasingly used in ultra-high-voltage (UHV) transmission schemes, particularly in the countries which are long-range power transmission and intercontinental grid connections. These circuit breakers are a must-have in UHV transmission lines to withstand overvoltage conditions, short circuits, and grid disturbances. The leading countries for above 800kV transmission projects are China and India, which are deploying gas-insulated circuit breakers of higher capacities to transmit energy in a bulk manner from wind and solar-rich areas to fast-growing urban areas with a lot of demand. Also, Europe and North America are in the process of constructing UHV networks to facilitate the exchange of energy between countries and to strengthen the grid in spite of increased dependence on clean energy sources. In the face of global energy demands, the utility companies are connecting more and more by integrating the high voltage networks, which again put the pressure to develop the over 800618 circuit breakers.

Dead tank gas circuit breakers are trending the most in the market as they are capable of doing this fault interruption to the highest quality. Besides, they have the smallest leakage risk of all types of circuit breakers, and they can be used in extremely harsh environmental conditions. These circuit breakers are made with a metal cover which is completely enclosed as aboveground and are grounded. Not only does that reduce the risk of outside flashovers but they are also the best choice in high-altitude, seismic-prone, and polluted environments. Dead tank breakers are the preferred choice of utility companies due to the fact that they can fully rely on the operational reliability of these types of breakers, particularly in high-voltage substations in transmission, and distribution networks, which need robust insulation and arc extinguishing capabilities. In comparison with live tank circuit breakers, the dead tank versions have a lower maintenance cost and a better dielectric strength, which ensures a longer operational life and a reduced downtime in critical power infrastructure.

The installation of live tank gas circuit breakers on the market is getting more and more buyers, especially in superstations that lack space and in power infrastructure projects that are sensu cost. Somewhat in contrast to dead tank breakers, live tank models put interrupting components in an insulated chamber construction that is located aboveground and this method of construction does not need as much of insulating gas thus resulting in lower overall system costs. Other than the Asia-Pacific region, Africa, Brazil, and other Latin American countries are now increasingly using live tank gas circuit breakers because of their low initial investment, compact layout, and simple installation. These circuit breakers are most frequently used in areas such as rural electrification, industrial power distribution, and renewable energy substations, where the main parameters are space and efficiency costs. In a situation when the need for decentralized energy systems and grid automation becomes more important, live tank breakers are preferred in smart substations and renewable energy integration.

The global gas circuit breaker market is being propelled by parallel developments such as the surge in demand for dependable power transmission and the ever-increasing investments in the electrical infrastructure along with the advancement of the high-voltage switching technology. The gas circuit breaker, which is a crucial element in the efficient operation of the power grid, benefits from its features like high insulation, arc quenching, and the ones making up-base construction including these types of spaces in the power plant, industrial or renewable energy projects. The market is being changed by the new trend of using products that contain no greenhouse gasses (SF₆-free circuit breakers), the increasing emphasis on the smart grid technology, and the rise of the renewable energy vectored. The top players in the sector have a forte in making highly efficient circuit breakers, automating the procedures of fault detection, and utilizing environmentally friendly insulating gas as these are the requirements that have to be completed for the enforcement of strict environmental regulations and the attainment of sustainability goals.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 10-12% |

| Siemens AG | 9-11% |

| Schneider Electric SE | 8-10% |

| Mitsubishi Electric Corporation | 6-8% |

| Hitachi Energy Ltd. | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | A global leader in high-voltage gas circuit breakers, offering SF₆-free insulation technology and smart grid-compatible switching solutions. |

| Siemens AG | Develops intelligent gas-insulated switchgear (GIS) with digital monitoring, ensuring high-performance power transmission reliability. |

| Schneider Electric SE | Specializes in compact and eco-friendly gas circuit breakers, integrating advanced arc quenching and low-maintenance designs. |

| Mitsubishi Electric Corporation | Provides high-voltage SF₆ circuit breakers, focusing on energy-efficient power grid solutions for industrial and utility applications. |

| Hitachi Energy Ltd. | Offers next-generation gas circuit breakers, integrating AI-based fault detection and predictive maintenance systems. |

ABB Ltd.

ABB has taken the position of a significant force in the gas circuit breaker market, offering a comprehensive range of high and extra-high voltage (EHV) gas-insulated switchgear (GIS). The brand has been making strategic moves by investing in a novel technology that eradicates the use of SF₆ gas, manufacturing a gas that is similar to Air Plus, and upholding global sustainability protocols through this initiative. Besides, ABB embeds digital monitoring and automation features in its products, which helps in the continuous fault diagnosis and the construction of the smart grid.

Siemens AG

Simens is a frontrunner in intelligent gas-insulated circuit breakers with built-in real-time performance analytics, AI-driven diagnostics, and modular designs. The grid GIS technology of the company not only stops the gas from using SF₆ but also decreases the carbon footprint, hence the high-voltage transmission is eco-friendly. Siemens is going forward by developing the smart substation solution that is the mainstay for the grid resilience and operational efficiency.

Schneider Electric SE

Compact and eco-friendly gas circuit breakers are one of the most important products of Schneider Electric and they also offer the low-maintenance, high-performance insulation required. The focus of the company is digital automation and remote monitoring has made it possible to reduce or eliminate any possible faults in electrical substations thus, making it predictive fault management. Hybrid switchgear is also in the pipeline at Schneider, which promises to cut down the use of SF₆ gas and at the same time improve the electrical system's reliability.

Mitsubishi Electric Corporation

Mitsubishi Electric is one of the biggest producers of SF6 circuit breakers for high voltage applications used in industrial and utility applications. Energy efficient power switching is the primary focus technology of the company, which applies high-speed arc quenching technology to hardware for dependable circuit protection. The company is actively upgrading its grid automation functions, which will guarantee continuous integration with renewable energy networks.

Hitachi Energy Ltd.

A gas-insulated circuit breakers innovator and Hitachi Energy provides not only advanced fault detection but also AI-driven predictive maintenance. Grid modernization and renewable energy integration, which have been the company's the main focus, the development of next-generation high-voltage switchgear solutions has been the result. In addition, Hitachi Energy SF₆-free circuit breaker technology is being distributed as part of its commitment to sustainable energy distribution solutions.

Up to 72.5 kV, 72.5-145 kV, 145-252 kV, 252-550 kV, 550-800 kV, Above 800kV

Dead Tank, Live Tank

Power Plants, Transmission Grids, Distribution Networks, Heavy Industries, Railway Electrification, Data Centres

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

The global gas circuit breaker market is projected to reach USD 733.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.4% over the forecast period.

By 2035, the gas circuit breaker market is expected to reach USD 1,123.5 million.

It is mainly the enhancement of the demand for the highly efficient and reliable high-voltage circuit breakers in the transmission networks modernization, grid stability, and renewable energy source integration that is the transmission grids segment rising to the top.

Key players in the gas circuit breaker market include ABB Ltd., Siemens AG, Schneider Electric, Mitsubishi Electric Corporation, and Hitachi Energy Ltd.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Circuit Breaker Test Devices Market Size and Share Forecast Outlook 2025 to 2035

Circuit Breaker Based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Air Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Low Voltage Circuit Breakers Market

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA