From 2025 to 2035, the switchgear market is expected to witness robust growth due to increasing demand for electricity, infrastructure development, and grid modernization efforts across the globe. This equipment is called switchgear (it includes, among others, the following components: circuit breakers, fuses and disconnectors, to name just a few) that is indispensable for efficient, continuous and safe power supply.

This has led to a stronger demand for advanced switchgear solutions that can manage both intermittent power supply and integration into the smart grid, as renewable energy sources like solar and wind power become more prevalent. Urbanization, industrial expansion, and increased allocation towards the development of transmission and distribution networks further supplement the demand for high-voltage and medium-voltage switchgear across the key regions.

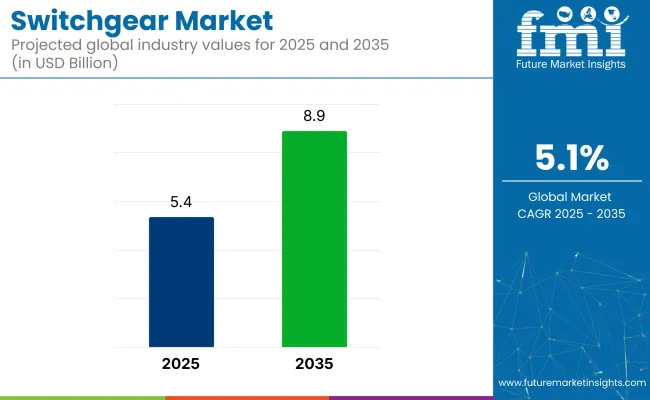

In 2025, the market size was at USD 5.4 Billion and is estimated to reach USD 8.9 Billion in 2035, at CAGR of 5.1% This growth is driven by the growing demand for efficient power infrastructure, government initiatives supporting electrification in emerging economies, as well as a transitioning towards sustainable energy solutions.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 5.4 Billion |

| Market Value (2035F) | USD 8.9 Billion |

| CAGR (2025 to 2035) | 5.1% |

Current Trend of Gas Insulated Switchgear Market Gas-insulated switchgear (GIS) and hybrid switchgear solutions are geared towards reducing maintenance costs, improving reliability, and enhancing safety. The new system technologies such as eco-friendly, SF6-free switchgear are likely to change the market landscape to meet strict environmental regulations. As industries transition to automation and remote operation, the demand for IoT-enabled smart switchgear and digital monitoring systems is expected to rise.

Increasing energy efficiency, investment in smart cities, and industrial automation will further fuel the growth of this market. The need for the expansion of switchgear infrastructure in developed and developing economies is being driven by a global focus of governments and utilities in the overall improvement of power quality and grid resilience.

Because industries and utilities require dependably, high-performance solutions for switching and protection in power distribution networks, industrial machinery, and energy-intensive applications, power distributor switch breakers and switch disconnectors account for a prominent share in the switchgear market. They are manufacturing safety devices that are essential for electrical safety, minimizing downtime, and maximizing energy distribution across various industries.

Power Distributor Switch Breakers Improve Electrical Safety and Grid Performance. The linchpin of electrical safety and fault management for transmission and distribution (T&D) systems, industrial plants and commercial settings, power distributor switch breakers ensure reliable fault isolation and protect end-use loads from damage during fault scenarios. In that regard, these appliances serve to enable automatic interruption of the circuit in the event of abnormal currents, overload, and/or short circuits to maintain uninterrupted functioning and safeguard your equipment.

The growing popularity of smart grid solutions and digital substations has driven increased demand for intelligent switch breakers, capable of real-time monitoring, predictive analytics, and remote control. To support augmented grid resilience and reduced unscheduled outages, utility and industrial operators are integrating automated switch breakers at an accelerating pace.

In renewable energy integration, the power distributor switch breakers are broadly utilized for the protection of solar farms, wind turbines as well as battery energy storage system (BESS) from power spikes or voltage spikes. With the world moving towards clean energy solutions, the demand for adaptive and flexible switchgear components is continuously increasing.

Countries in North America and Europe are witnessing huge investments on modernization of power infrastructure, stimulating the implementation of smart grid applications and also industrial automation in turn fueling the demand for advanced switch breakers. On the other hand, the Asia Pacific region, spearheaded by China and India, is witnessing fast-paced urbanization and electrification, with a resulting increase in demand for energy-efficient power distribution solutions in commercial and residential applications.

Although power distributor switch breakers are widely accepted, their high installation costs and complex maintenance are a challenge for these devices. Still, there are new technologies like solid-state circuit breakers, vacuum switching technology, and insights from AI-based diagnostics that should improve reliability while lowering operations costs over time.

Safety and Operational Efficiency with the Use of Switch Disconnectors in Power Networks During maintenance and emergency operations, a safe isolation technique is highly demanded to prevent electric shock hazards, which has been the key factor to the growth of the market for switch disconnectors in addition to industrial switchgear, power substations and distributed energy systems. The switch disconnectors, unlike traditional breakers, allow for manual or remote disconnection of electrical loads, providing safety to the operator and allowing for convenient servicing of equipment.

Switch disconnectors find increasing applications in oil & gas, manufacturing, data center industries to optimize power control, mitigate arc flash hazards, and ensure operational integrity. The rapid deployment of HVDC (high-voltage direct current) transmission lines and distributed energy resources (DERs) has fueled the need for high-performance switch disconnectors capable of supporting fluctuating power loads.

With regulatory agencies clamping down on electrical safety regulations, many companies are opting to upgrade to enhanced switch disconnectors, including arc-resistant enclosures, motorized switching mechanisms, and fault-detection sensors. In commercial buildings, transportation electrification and railway substations, space optimisation and operational flexibility are paramount, fuelling interest in compact modular switch disconnectors.

While the technology is advancing, it still faces issues like mechanical wear, contact erosion, and inadequate fault interruption capability. But this has led to the development of a new generation switch disconnectors with hybrid switching technologies and vacuum-based insulation to overcome these problems with focus on longevity of the switch disconnector with system efficiency.

The market is broadly classified into medium voltage (1kV to 75kV) and high voltage (75kV to 230kV) switchgear, with increased energy consumption across the globe, growing industrialization, and smart grid initiatives across various regions propelling the demand for advanced electrical infrastructure

Industrial and Utility Distribution Networks Are Supported by Medium Voltage Switchgear Used in industrial, commercial, and municipal substations, medium voltage switchgear is essential to power distribution in these applications. With faster industrialization in developing economies, manufacturers, and energy providers, are investing in medium voltage switchgear for increasing productivity, preventing power fluctuation, and minimizing losses from the energy sector.

Smart automation and digital monitoring systems are integrated into medium voltage switchgear to provide advanced fault detection, load balancing, and energy efficiency optimization. Smart switchgear solutions with IoT sensors, AI-based analytics, and comprehensive cloud-enabled monitoring platforms that enable utilities to preempt outages, reduce downtime, and enhance operational transparency.

The growth of renewable energy has increased the demand for medium voltage switchgear, because solar and wind farms need to be connected to the grid in a stable manner to manage a more variable energy generation. In microgrid deployments, medium voltage switchgear enables grid synchronization, voltage regulation, and coordinated energy transfer between DERs and the grid.

Asia Pacific remains the largest medium voltage switchgear market, supported by rapid urbanization and introduction of infrastructure development along with electrification schemes backed by government in countries like China, India, and Indonesia. In contrast, Europe and North America primarily deem grid modernization projects, renewable integration, and industrial automation as their main drivers, maintaining a steady demand for medium voltage switchgear solutions.

While this brings certain advantages, medium voltage switchgear also suffers from challenges associated with insulation performance, arc flash hazards, and maintenance complexity. But advancements in gas-insulated switchgear (GIS), solid-state switching and eco-conscious SF6-free insulation should improve safety and lower emission levels while increasing product longevity instead.

High Voltage Switchgear Market Will Hit a New High | Expansion Boom in Utility Grids High voltage switchgear is vital for long-distance electrical power transmission, substation automation and industrial electric power distribution, allowing safe and effective handling of high-power loads. High voltage switchgear are used by utilities and grid operators to control, protect and monitor transmission lines and are critical to keep the high demand energy networks stable.

The miniaturization of electrical components and the advent of ultra-mega power projects and intercontinental energy trade have led to a widespread use of high voltage switchgear in higher capacity power corridors, HVDC transmission systems, and offshore wind plants. Demand for advanced high voltage switchgear solutions is driven by investments in transnational power grids and renewable energy exports - and countries like China leveraged the Belt and Road Initiative and Europe has interconnected their electricity markets.

The Investment in high voltage switchgear has been further catalyzed by the growth of electrified transportation, such as high-speed rail, metro networks and EV (electric vehicle) charging infrastructure. Railways and metro operators need strong electrical protection systems to optimise traction power and manage signalling networks, as well as regenerative braking systems.

Although high voltage switchgear meets high market demand, it is constrained by challenges such as system complexity, high initial investment and insulation degradation. Well, next generation hybrid switchgear, digital substations and superconducting circuit breakers are reducing these barriers, providing improved power reliability, efficiency and sustainability.

North America continues to be among the largest and most technologically advanced switchgear markets due to aging grid infrastructure upgrades, growing renewable energy adoption, and rapid industrialization. Canada and the United States are undergoing large-scale grid modernization initiatives, employing smart switchgear solutions with IoT-based monitoring.

As electric vehicle (EV) infrastructure grows, the need for reliable and efficient switchgear in terminals and grid networks is increasing in demand. Utility companies are spending on micro grids and distributed energy systems that demand more sophisticated switchgear with enhanced automation.

In addition, strict environmental standards on SF6 gas emission, a vital insulating material used in conventional switchgear, are further driving manufacturers to adopt SF6-free alternatives. Renewable projects are also driving demand for hybrid switchgear and intelligent grid solutions to manage variable generation and wind and solar energy plants.

Infrastructure development initiatives by the USA government, along with their continuous expansion of transmissions and distribution networks, are anticipated to drive demand for high-voltage switchgear, especially in renewable energy and industrial applications.

Europe is an established, mature switchgear market with strict environmental legislation and ambitious renewable energy goals. Germany, France, and the United Kingdom are spearheading the move toward SF6-free switchgear, supported by moves to reduce carbon footprints and make the grid more efficient.

Rising commitment to achieve net-zero emissions by 2050 targets in European Union leading towards investment in smart grids, advanced electrical infrastructure, high voltage switchgear systems. The growing implementation of renewable energy sources, especially in offshore wind farms, leads to greater demand for substation automation and energy storage systems, which both rely on dependable switchgear technology.

There is an increased demand for medium-voltage and low-voltage switchgear with the electrification of transport systems such as rail networks and electric vehicle (EV) charging stations. Moreover, the increase of smart switchgear, with capabilities such as real-time monitoring and remote diagnostics, and predictive maintenance due to integrating digitalized EU sets the future trend for switchgear.

In Europe, Key switchgear manufacturers are focusing on product innovations, efficiency improvements and sustainable solutions, including vacuum and solid-insulated switchgear that replaces SF6-based products. Retrofitting the old power distribution systems with contemporary, energy-efficient switchgear will continue to remain a key trend affecting the European dynamics.

The Asia-Pacific switchgear market is expected to expand at the highest CAGR owing to rapid urbanization, industrialization, and rising electrification initiatives in developing economies. Countries such as China, India, Japan and South Korea are seeing expanding transmission and distribution networks driven by growing electricity demand, government-led infrastructure investments, and smart city initiatives

As the world's largest energy consumer, China has been undertaking large investments in ultra-high voltage (UHV) power transmission systems, needing field-proven advanced switchgear technology to guarantee stability and efficiency. India, by contrast, is concentrating on rural electrification programs, increasing the demand for low- and medium-voltage switchgear for distribution networks.

With the growing number of installation of renewable energy especially in solar and wind power plants, the market requires more grid integration and smart switchgear solutions to handle the variable nature of energy supply. Likewise, Japan and South Korea are major customers for smart switchgear, supported by energy security efforts and automating industrial applications to enhance demand for intelligent switchgear with self-healing capabilities and real-time monitoring.

Furthermore, the transition to digital and green switchgear solutions is driven by government initiatives that promote smart grid development and clean energy adoption. Key countries are increasing their manufacturing capacities while investing efforts & investments into research & development for complying with changing industry standard & regulations.

Challenges

The high capital cost required by advanced smart switchgear solutions, automation systems, and digitalization represents one of the dominant restraints for the switchgear market. Budget constraints in many developing regions impede the adoption of next-generation switchgear technologies.

Stringent regulatory frameworks with regard to emissions from SF6 gas, predominantly used for insulation of switchgears, is another factor. Governments and environmental agencies have been advocating for SF6-free alternatives, demanding that manufacturers find a way to develop cost-effective, sustainable substitutes that do not sacrifice performance and reliability.

Additionally switchgear production and delivery timelines are susceptible to supply chain disruptions, volatility in raw material prices, and semiconductor shortages, posing increased risk at a critical time. Skilled labour shortages also plague the industry and may push back grid modernization projects and switchgear installations.

Opportunities

Growing adoption of these solutions such as smart grid technology, digital switchgear, and automation solutions for enhancing the grid will create lucrative opportunities for industry participants. AI and IoT integration in the power system transforms the market by providing real-time monitoring, predictive maintenance, and better operational efficiency.

The transition to renewable energy sources globally is likely to create opportunities for switchgear in wind, solar and hydroelectric power plants to deliver efficient transmission and distribution of energy. The growing EV infrastructure also introduces new opportunities for the switchgear industry in charging stations and battery storage solutions.

The growth of these initiatives will drive the demand for innovative and sustainable switchgear solutions. Firms which are investing in next generation switchgear featuring low-carbon footprint materials, modular designs, and digital connectivity are poised to have a first-mover advantage in the tire market landscape.

Growth of the Switchgear Market, Impact of Trends on Switchgear, and Analysis Trends in the Global Switchgear Market and Growth of the Market Between 2020 and 2024 (USD million) The switchgear market has grown significantly between 2020 and 2024 owing to the demand for power distribution, garnering attention towards renewable energy integration, industrial automation, and urban infrastructure expansion.

With the rise in electricity consumption internationally, industries and utilities needed efficient, reliable, and safe switchgear solutions to manage the distribution of power effectively. Governments around the globe poured investment into modernizing outdated electrical grids as well as funding renewable energy initiatives and smart grid technology, increased switchgear demand across both developed and developing markets.

Switchgear adoption was heavily driven by the renewable energy sector, especially in solar, wind and hydroelectric power installations. The demand for advanced switchgear solutions is further propelled by the pace of transition strategies toward decentralized power generation, grid automation, and high-voltage direct current (HVDC) transmission. Manufacturers launched gas-insulated switchgear (GIS), hybrid switchgear, and vacuum switchgear, which provide increased efficiency, safety, and compact designs that cater to modern electrical infrastructures.

Their medium-voltage and low-voltage switchgear solution saw further adoption across industrial and commercial sectors, primarily for use in manufacturing plants, data centers, smart buildings, and transportation networks. The roll out of electric vehicle (EV) charging infrastructure, metro rail projects and industrial automation have triggered the demand for digital switchgear solutions with real-time monitoring and predictive maintenance capabilities. Features such as motor-operated isolators, arc fault detection and remote-control functions helped enhance operational efficiency and system reliability.

The sector has been under pressure with ongoing supply chain disruptions, shifts in raw material prices and regulatory compliance dilemmas weighing on the market. The COVID-19 pandemic did bring initial delays on the manufacturing and projects deployment fronts, however, recovery efforts, digitalization trends, and sustainability initiatives helped the switchgear market reach new heights.SF6-free insulation and switchgear innovations, smart grid integration and energy-efficient designs combined to maintain industry momentum.

The switchgear market is poised to witness transformative advancements from 2025 to 2035, driven by technological innovations, regulatory policies, and the global transition toward clean energy solutions. However, the evolution of the market will be shaped by the increasing adoption of next-generation switchgear technologies, AI-powered automation, and sustainable materials.

The revolution in renewable energy will continue to be a significant driver of growth with investment in offshore wind farms, hydrogen energy systems and distributed generation project increasing. As the smart grid is a pillar of this modern energy infrastructure, demand for DC switchgear, modular substations, and intelligent power distribution systems will be high. Ultra-low loss switchgears, all-in-one high-voltage solutions, and AI-driven fault detection systems will all be focused on to develop solutions that facilitate maximized power distribution and minimize downtime by manufacturers.

Switchgear demand will increase in electric mobility and energy storage solutions - including electric vehicle charging stations, battery storage facilities, and vehicle-to-grid (V2G) networks. Intelligent switchgear will play a critical role in facilitating the new bi-directional flow of energy, as well as enabling the integration of renewable generation, like solid-state transformers, bi-directional charging, and microgrid integration. New self-healing grids, predictive maintenance, and AI-optimized switching mechanisms will improve energy reliability, along with operational efficiencies.

The switchgear industry will keep changing with an emphasis on technological innovation, sustainable innovation, and grid updating. Next generation switchgear technologies, resilient energy distribution models, digital power management (integrated with renewables) and AI-powered automated power systems will become vital drivers of technology change as industries and organizations move towards the integration of renewable energy, digital power management and automation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced grid modernization and energy efficiency policies. |

| Technological Advancements | Companies developed hybrid switchgear, smart monitoring systems, and remote diagnostics. |

| Industry Applications | Switchgear was widely used in utilities, industrial plants, and commercial buildings. |

| Environmental Sustainability | Companies adopted low-loss switchgear and eco-friendly insulation materials. |

| Market Growth Drivers | Demand was fueled by renewable energy integration, urbanization, and industrial expansion. |

| Production & Supply Chain Dynamics | Supply chains faced raw material shortages and logistical challenges. |

| End-User Trends | Consumers preferred digital switchgear with remote operation and real-time analytics. |

| Infrastructure Development | Smart grid deployments and electrification projects drove switchgear demand. |

| Resilience & Cybersecurity | Utilities enhanced grid reliability and power quality through SCADA systems. |

| Investment in R&D | Companies invested in compact, modular switchgear for high-voltage applications. |

| Urbanization & Smart Cities | Increased demand for high-performance switchgear in urban infrastructure. |

| Energy Storage & Microgrids | Microgrids and distributed energy systems adopted medium-voltage switchgear. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental regulations will mandate SF6-free, recyclable, and energy-efficient switchgear solutions. |

| Technological Advancements | Future innovations will focus on AI-driven automation, digital twin modeling, and real-time fault prediction. |

| Industry Applications | Expansion into EV infrastructure, smart cities, energy storage, and autonomous power networks. |

| Environmental Sustainability | Industry-wide adoption of carbon-neutral, circular economy-compatible, and biodegradable switchgear. |

| Market Growth Drivers | Growth will be driven by smart grids, AI-optimized power management, and climate-resilient infrastructure. |

| Production & Supply Chain Dynamics | Companies will invest in localized manufacturing, AI-powered logistics, and sustainable material sourcing. |

| End-User Trends | Future demand will emphasize self-healing networks, AI-enhanced automation, and predictive maintenance technologies. |

| Infrastructure Development | Increased investments in self-repairing grid technology, bidirectional power flow, and decentralized energy distribution. |

| Resilience & Cybersecurity | Future switchgear will integrate AI-driven cybersecurity, blockchain authentication, and real-time threat detection. |

| Investment in R&D | Research will expand into solid-state switchgear, superconducting breakers, and next-gen insulation materials. |

| Urbanization & Smart Cities | Future growth will focus on decentralized energy solutions, intelligent substations, and AI-optimized grid operations. |

| Energy Storage & Microgrids | Next-gen adaptive microgrids, energy-sharing models, and blockchain-based electricity trading will gain traction. |

Growth in the renewable energy sector, investments in smart grid modernization, and new industrial infrastructure development in developing economies are factors driving demand for switchgears.

The customer requirements is shifted towards better distribution & protection systems, which are driven by stringent regulatory measures, energy efficiency, grid reliability & sustainability across power generation, transmission and distribution. The USA government is pumping significant dollars into upgrading the electrical grid to accommodate increasing amounts of solar, wind and energy storage systems.

The Infrastructure Investment and Jobs Act (IIJA) offers billions of dollars including for projects to enhance electrical transmission and distribution networks and will stimulate demand for high-voltage, medium-voltage and low-voltage switchgear. Also, electrification in many of the transportation segments, such as electric vehicle charging systems and high-speed rail systems, is expected to yield high-performance switchgear solutions for safe and efficient power distribution.

The growth in data centers, industrial automation, and smart buildings is driving demand for smart switchgear with IoT-based monitoring, predictive maintenance and remote-control options as well. In fact, between now and the next few years, the trend to gas-insulated and vacuum switchgear will be critical to most functions to improve power reliability with the least environmental impact.

| Country | CAGR (2025 to 2035) |

|---|---|

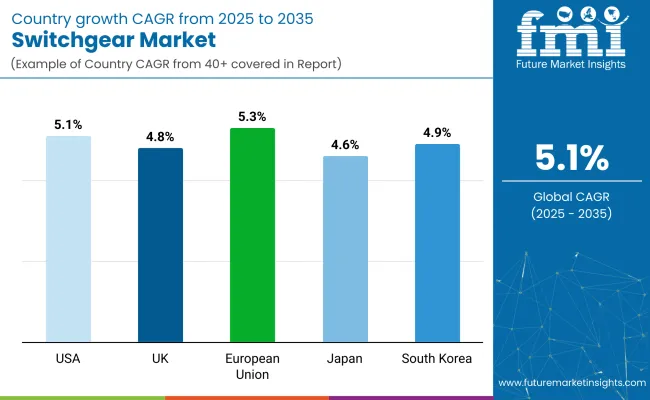

| USA | 5.1% |

The UK switchgear market is growing this is due to renewable energy transition, grid decarbonization efforts and rising adoption of smart power distribution systems. Doing so is in great part being driven by the UK government’s target to achieve net-zero emissions by 2050, which is driving innovations in switchgear and grid modernization projects.

The increase in offshore wind farms and distributed energy resources (DERs) where they fall, grow in significance and increase in energy storage solutions leading to the greater need for flexible and reliable grid in where advanced switchgears are implemented. The proliferation of EV charging stations, electrified rail networks and smart cities is also driving demand for intelligent and remotely controlled switchgear.

Moreover, investments in establishing post-Brexit infrastructure are driving the growth of industrial and commercial projects, which in response is propelling demands for medium and low-voltage switchgear solutions. R&D for low-maintenance, gas-expensive alternatives to SF6 switchgear have greatly been justified due to strict environmental datasets and increasing taxes on SF6 usage.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

Aggressive decarbonization targets, energy efficiency directives, and large investments in renewable energy are driving the European switchgear market. Massive renewable power projects, industrial automation expansion, and regulatory frameworks enabling grid resilience are forging ahead in Germany, France, and Italy.

In a move to make Europe climate-neutral by the year 2050, the European Union (EU) boasts major cornerstones that are paving the road towards a more balanced green environment such as the EU’s Fit for 55 package and Green Deal initiatives, thereby pushing grid modernization efforts and spurring on the demand for next-generation switchgear with minimal environmental impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

The Japanese switchgear market is expected to change as a result of innovations in smart grid technologies, a growing focus on renewable energy and a demand for disaster-resilient power distribution. Japan’s earthquakes-proof energy infrastructure means that there is strong demand for high-durability switchgear able to withstand natural catastrophes and extreme weather conditions.

Thalweiser - More than ever before and with the country’s carbon neutrality goal by 2050, utilities are modernizing aging power infrastructure by deploying high-performance, energy-efficient switchgear solutions. The growing hydrogen economy and the electric vehicle market in Japan also serve as key drivers for medium-voltage and high-voltage switchgear deployments.

Demand for miniaturized, AI-equipped switchgear with remote monitoring capabilities is on the rise due to the increase in industrial automation and data centers. Moreover, Japan's nuclear phase-out has catalyzed investments in solar, wind, and battery systems that are also eyeing switchgear innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The overall market for switchgear in South Korea is growing rapidly on the back of grid modernization efforts, growth in renewable energy, and trends towards smart grid implementations. The Korean New Deal 2.0 is a government initiative that drives investment for carbon-neutral power infrastructure, digitalization of energy management, and therefore stands to affect a significant increase in the demand for advanced switchgear solutions.

The Korean data-center industry and booming semiconductor industry require high-reliability switchgear to keep the power flowing make sure it is uninterrupted. Additionally, the increasing number of green hydrogen projects and offshore wind farms are driving the need for sustainable, smart switchgear with minimal environmental impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The switchgear market is highly competitive, with global leaders and regional manufacturers driving advancements in power distribution, automation, and grid infrastructure. Key players focus on innovative circuit protection, smart grid integration, and energy-efficient solutions, catering to industries such as power utilities, industrial automation, renewable energy, and commercial infrastructure. The market includes established multinational corporations and emerging players, each influencing technological progress, safety enhancements, and market expansion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 12-17% |

| Siemens AG | 10-15% |

| Schneider Electric SE | 9-13% |

| General Electric (GE) | 7-11% |

| Eaton Corporation | 6-10% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | Develops high-voltage, medium-voltage, and low-voltage switchgear for industrial, utility, and renewable energy applications. Focuses on digital switchgear and eco-efficient solutions. |

| Siemens AG | Specializes in air-insulated, gas-insulated, and hybrid switchgear. Emphasizes smart grid integration and automation technologies to improve energy efficiency. |

| Schneider Electric SE | Produces sustainable and intelligent switchgear for power distribution. Leads in IoT-enabled smart switchgear and low-emission solutions. |

| General Electric (GE) | Manufactures industrial and power utility switchgear, with a focus on grid modernization, automation, and SF6-free technology for sustainable operations. |

| Eaton Corporation | Provides compact and modular switchgear for commercial, industrial, and data center applications. Invests in green energy solutions and digitalized control systems. |

Key Company Insights

ABB Ltd. (12-17%)

ABB leads the switchgear market, supplying high-voltage, medium-voltage, and low-voltage solutions for industrial and power grid applications. The company drives sustainability initiatives, investing in SF6-free switchgear and digital solutions. ABB’s global reach and R&D advancements position it as a top supplier for next-generation electrical infrastructure.

Siemens AG (10-15%)

Siemens specializes in air-insulated and gas-insulated switchgear, integrating smart grid automation to enhance power reliability and efficiency. The company’s focus on intelligent monitoring, cybersecurity, and AI-powered diagnostics strengthens its role in power distribution modernization.

Schneider Electric SE (9-13%)

Schneider Electric provides sustainable switchgear solutions, incorporating IoT and automation for optimized energy management. The company actively develops SF6-free technologies and promotes low-carbon infrastructure, aligning with global decarbonization goals.

General Electric (GE) (7-11%)

GE manufactures high-performance industrial and power utility switchgear, emphasizing grid automation and renewable energy integration. The company’s expertise in SF6 alternatives and digital substations supports the shift toward sustainable power networks.

Eaton Corporation (6-10%)

Eaton is a leader in compact and modular switchgear, serving industrial, commercial, and data center applications. The company invests in digitalized switchgear solutions and alternative gas insulation technologies to enhance efficiency and sustainability.

Other Key Players (45-55% Combined)

Several other companies contribute to cost-efficient production, regional expansion, and customized switchgear solutions. These include:

The overall market size for Switchgear market was USD 5.4 Billion in 2025.

The Switchgear market is expected to reach USD 8.9 Billion in 2035.

The demand for switchgear is expected to rise during the forecast period due to the increasing focus on modernizing power transmission and distribution infrastructure. Rapid urbanization, industrial expansion, and the growing integration of renewable energy sources are key factors driving market growth.

The top 5 countries which drives the development of Switchgear market are United States., United Kingdom, Europe Union, Japan and South Korea.

Distributor Switch Breaker is expected to command a significant share in the switchgear market over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

AC Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Paralleling Switchgear Market Growth – Trends & Forecast 2024-2034

Pad Mounted Switchgear Market Growth – Trends & Forecast 2024-2034

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgears (GIS) Market

AC Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA