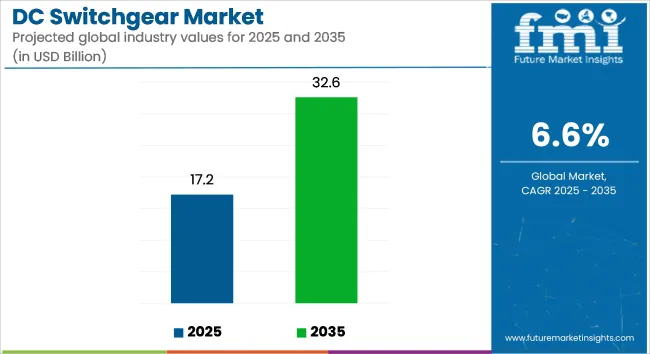

The global DC switchgear market is projected to grow from USD 17.2 billion in 2025 to USD 32.6 billion by 2035, at a CAGR of 6.6%. Growth is driven by rising investments in renewable energy, smart grid infrastructure, and urbanization. Air-insulated switchgear leads the market, favored for reliability and cost-efficiency.

Asia-Pacific is the fastest-growing region due to expanding power infrastructure and industrialization. Power distributor switch breakers are gaining traction market share by 2025. Key players include Siemens AG, ABB Ltd., and Schneider Electric SE, focusing on technological innovation and modular designs for improved safety and efficiency.

Technological advancements are significantly driving the growth of the DC switchgear market by improving operational reliability, compactness, and fault isolation capabilities. Innovations in arc-quenching mechanisms, solid-state components, and insulation materials enhance system performance while reducing maintenance needs.

The push for smarter energy systems and rising urban infrastructure projects are accelerating the adoption of advanced DC switchgear solutions across both developed and emerging economies. The advancements in arc-quenching, solid-state components, and insulation are boosting DC switchgear performance and reducing maintenance. These innovations improve reliability, compactness, and fault isolation. Growing adoption is driven by smart energy systems and expanding urban infrastructure in both developed and emerging markets.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 17.2 billion |

| Industry Value (2035F) | USD 32.6 billion |

| CAGR (2025 to 2035) | 6.6% |

Stringent government regulations are a key market driver. Regulatory bodies like the U.S. Department of Energy and the IEC mandate high safety, efficiency, and fault tolerance in power systems. This compels manufacturers to invest in R&D for more robust, compact, and energy-efficient switchgear.

Advancements in digital monitoring, modular designs, and smart protection systems are reshaping the competitive landscape, fostering innovation and reinforcing the shift toward resilient, future-ready DC infrastructure. Increased compliance requirements across utilities and transportation sectors are accelerating product upgrades. Supportive policies and incentives for clean energy deployment further boost adoption of advanced DC switchgear solutions.

The DC switchgear market segments include component types such as power distributor switch breaker, switch disconnector, mccb, mcb, hrc fuse, and earth fuse; voltage ranges including Up to 750V, 750V to 1800V, 1800V to 3000V, 3000V to 10,000V, and Above 10kV; insulation types comprising air insulated, gas insulated, oil insulated, vacuum insulated, and solid insulated; deployment types including fixed mounting, plug-in, and withdrawable; applications such as railways, solar farms, battery storage, ev charging infrastructure, marine, power generation and distribution, and others (data centers, defense and military installations, underground metro and tunnel systems, telecommunications infrastructure, industrial automation, and offshore oil and gas platforms); and Regions covering North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The power distributor switch breaker segment is poised to be the most lucrative component type in the DC switchgear market, growing at a CAGR of 7.8%. This growth is underpinned by rising integration of renewable energy systems, smart grids, and distributed energy storage requiring compact, modular, and high-endurance switchgear solutions.

The increasing electrification of transportation and industrial DC networks further cements its dominance, as these applications demand fast fault isolation, minimal downtime, and high switching frequency with strengths aligned with power distributor switch breakers.

Additionally, advancements in arc-quenching technology and compatibility with solid-state protection systems enhance the reliability and safety of power distributor switch breakers, driving broader adoption. Their modular design and lower maintenance requirements make them ideal for space-constrained environments, supporting long-term operational efficiency. Other components such as MCBs and MCCBs will continue to see steady deployment in commercial and residential segments, driven by cost-effectiveness and ease of installation.

HRC fuses and earth fuses, while declining in relative share, will maintain relevance in specific backup protection applications. Among insulation types, air-insulated and vacuum-insulated systems will dominate due to their balance of performance and safety. Deployment types like fixed mounting remain standard in legacy systems, but withdrawable units will gain share in high-maintenance industrial and transport sectors.

| Component Type Segment | CAGR (2025 to 2035) |

|---|---|

| Power Distributor Switch Breaker | 7.8% |

The 1800V to 3000V voltage range is set to become the most lucrative segment in the DC switchgear market, with an estimated CAGR of 7.9% from 2025 to 2035. This segment’s strong growth is primarily fueled by increasing demand in utility-scale solar photovoltaic (PV) plants, large electric vehicle (EV) charging hubs, and grid-level battery energy storage systems (BESS). These applications require robust insulation performance and reliable fault isolation to ensure operational safety and efficiency under variable load conditions.

The 1800V-3000V band offers a strategic advantage by delivering higher power throughput compared to lower voltage ranges such as sub-750V and 750-1800V, while maintaining better cost-effectiveness and compactness relative to ultra-high voltage systems above 10kV. This balance makes it highly attractive for expanding smart city infrastructure, electrified transportation corridors, and distributed energy networks globally.

Its compatibility with advanced arc-quenching technologies and solid-state protective components further enhances system reliability and longevity. Other voltage ranges will continue to serve niche markets and specialized industrial uses; however, none are positioned to match the combined scale, flexibility, and economic appeal of the 1800V to 3000V range. As capital investments increasingly focus on scalable, efficient power solutions, this segment is primed to capture the majority of growth and innovation in the DC switchgear space.

| Voltage Range Segment | CAGR (2025 to 2035) |

|---|---|

| 1800V to 3000V | 7.9% |

The air insulated segment stands out as the most lucrative insulation type, with expanding at a CAGR of 7.5%. Air insulated DC switchgear offers a compelling value proposition lower initial cost, environmental safety, and minimal maintenance complexity making it particularly attractive for utilities, transport electrification, and large infrastructure installations.

Governments and private operators scale up investment in sustainable urban development and smart grids, air-insulated systems provide a modular and easily serviceable alternative to gas and oil-based systems, particularly in regions with regulatory restrictions on greenhouse gas usage (e.g., SF₆).

Moreover, with increased focus on decentralization and compact substations, air-insulated units are preferred for low to medium voltage applications where footprint and total cost of ownership matter. In contrast, while vacuum and solid insulated systems will gain traction in high-performance industrial zones, their adoption will remain limited by higher capital expenditure.

Gas and oil insulated types, though efficient, face increasing scrutiny due to environmental and safety considerations. Advancements in air insulation technology, including improved dielectric materials and innovative design architectures, are further enhancing performance and reliability, expanding their applicability across diverse environments. As regulatory pressures tighten on environmentally harmful gases, the demand for air insulated systems is expected to accelerate, solidifying their dominance in the insulation segment throughout the forecast period.

| Insulation Type Segment | CAGR (2025 to 2035) |

|---|---|

| Air Insulated | 7.5% |

The withdrawable deployment segment is projected to be the most lucrative, growing at a CAGR of 7.7%, driven by its high adaptability in critical infrastructure, reduced downtime, and maintenance efficiency. Withdrawable DC switchgear enables safe and rapid disconnection and reintegration of circuits, making it indispensable in mission-critical applications such as railways, battery energy storage systems, EV charging stations, and industrial automation. The ability to conduct maintenance without full system shutdown significantly enhances operational continuity, a key KPI for transport, utility, and defense sectors.

Additionally, as modular and digital-ready systems become industry standard, withdrawable solutions align well with smart grid expansion strategies and flexible energy distribution models. Compatibility with advanced fault detection and remote monitoring technologies further strengthens its appeal, enabling proactive maintenance and reducing unexpected outages.

As infrastructure demands grow, the withdrawable deployment segment will continue to lead market adoption due to its superior operational flexibility and reliability. Fixed mounting systems will maintain dominance in legacy and cost-sensitive installations, and plug-in types will support compact environments, neither match the lifecycle value or application breadth of withdrawable units. OEMs are also prioritizing innovation in this space, integrating real-time diagnostics and IoT interfaces, further increasing adoption.

| Deployment Type Segment | CAGR (2025 to 2035) |

|---|---|

| Withdrawable | 7.7% |

The EV charging infrastructure segment emerges as the most lucrative application vertical, reflecting a CAGR of 7.8%, outperforming all other categories. The rapid electrification of the transport sector driven by regulatory mandates, EV adoption targets, and large-scale rollouts of charging corridors is fueling exponential demand for high-performance, compact, and digitally monitored DC switchgear. This segment requires switchgear capable of fast fault isolation, high switching endurance, and seamless integration with renewable energy sources, making advanced DC switchgear indispensable.

The expansion of fast and ultra-fast charging stations, operating within mid-to-high voltage ranges, further boosts demand for reliable and scalable switchgear solutions. EV charging networks require rapid fault isolation, consistent load handling, and modular scalability, all of which are intrinsic to DC switchgear systems designed for this domain. Additionally, the deployment of fast-charging and ultra-fast-charging stations (ranging between 400V and 1000V) calls for robust switchgear with minimal switching lag and high thermal endurance.

The integration of renewable energy into EV charging hubs further necessitates dynamic grid management strengthening demand for intelligent DC infrastructure. Other application areas such as railways, solar farms, and battery storage will continue to drive volume, while marine, power generation/distribution, and others (including defense systems, data centers, and underground metro networks) will offer specialized growth paths without matching EV infrastructure’s velocity.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| EV Charging Infrastructure | 7.8% |

The DC switchgear market segments include component types such as power distributor switch breaker, switch disconnector, mccb, mcb, hrc fuse, and earth fuse; voltage ranges including Up to 750V, 750V to 1800V, 1800V to 3000V, 3000V to 10,000V, and Above 10kV; insulation types comprising air insulated, gas insulated, oil insulated, vacuum insulated, and solid insulated; deployment types including fixed mounting, plug-in, and withdrawable; applications such as railways, solar farms, battery storage, ev charging infrastructure, marine, power generation and distribution, and others (data centers, defense and military installations, underground metro and tunnel systems, telecommunications infrastructure, industrial automation, and offshore oil and gas platforms); and Regions covering North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Challenge: High Initial Costs and Retrofitting Complexities

High installation cost of intelligent switchgear systems is a major obstacle to the growth of the DC switchgear market, particularly in large-scale grid modernization projects. Existing AC-based electrical infrastructure requires expensive compatibility solutions with complex installations and substantial training of personnel for retrofitting with DC switchgear. Tackling these issues will need innovative and cost-effective modular switchgear solutions as well as increased funding to upgrade infrastructure.

Opportunity: Expansion of Smart Grid and Digitalized DC Switchgear Solutions

This combination of factors is expected to generate huge opportunities in the DC switchgear market due to the early adoption of smart grid technologies and digital monitoring capabilities across the global landscape. Switchgear efficiency and reliability are revolutionized through AI-powered condition monitoring, remote diagnostics and predictive maintenance solutions.

Moreover, increasing emphasis on sustainable and SF6-free switchgear technologies is expected to open new possibilities for the market growth. The growing investment into electrification and energy efficiency across region including utilities, industrial, and transport, is expected to continue to drive demand for next-generation DC switchgear solutions for the foreseeable future, with significant growth anticipated over the coming decade.

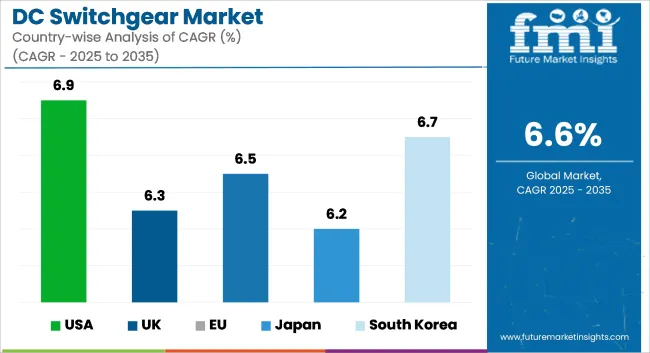

The demand for DC switchgear is strong in the United States, which continues to be a key market due to rising investments in renewable energy systems, enhanced in-charging station infrastructure for electric vehicles (EV), and driving technological advancements in smart grids.

Additionally, the well-established presence of key manufacturers of electrical components and the modernization of the electric grid in many regions are also expected to contribute to market growth. The acceleration in adoption of state-of-the-art DC switchgear solutions is also due to government polices supporting energy efficient systems along with the shift towards high-voltage DC (HVDC) transmission systems.

Data centers that continue to expand and higher Fibre Rich (HR) data generation continue to integrate into the national grid, but in particular solar and wind power that will pay in a general way.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

The United Kingdom DC Switchgear market is expected to grow at a robust rate during the forecast period. This is due to a growing investment in offshore wind farm projects, increasing deployment of energy storage systems, and expansion of electric rail networks.

The shift to DC power solutions across different industrial and transportation sectors is being spurred on by the government’s goal to reach net-zero emissions. Further technological progress in DC micro grid technology and an increase in demand for small, modular switchgear will shape trends in the market. Demand is also driven by the growing use of battery energy storage systems for commercial and residential applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

In the European Union, Germany, France, and Italy hold prominent positions in the DC switchgear market, with their respective successes being bolstered by a supportive renewable energy regulatory ecosystem, rising investments in electric mobility infrastructure, and growing adoption of energy-efficient electrical components. Growing demand for DC switchgear in HVDC transmission networks and industrial automation is driven by European Commission pledges to minimise carbon emissions.

In addition, technology advancements in switchgear solutions are driven by growing smart city initiatives and the integration of dc based power distribution systems in commercial buildings. In addition, the rising deployment of DC switchgear in high-speed railway networks and offshore wind power investments are also influencing the market expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 6.5% |

Renewed investments in solar energy, the emergence of electric mobility and the growing ability to transmit energy over high voltage DC transmission lines are driving the growth of Japan's DC switchgear market. A shift in the country’s focus on grid resilience and energy storage solutions is pushing demand for small-footprint and high-performance DC switchgear.

In addition, the swift development of data centers and industrial automation is also have an effect by changing the market dynamics. The government push towards smart manufacturing and industrial electrification too aids the adoption of advanced DC switchgear solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

Due to the rapid adoption of renewable energy, a growing emphasis on EV charging infrastructure, and an increase in smart grid investments, South Korea is becoming a critical market for DC switchgear. In addition, the growing semiconductor and electronics manufacturing industry is adding boost to the growth of the market.

Also, the development of AI-powered grid management and real-time monitoring systems are enhancing the efficiency and reliability of the installation of DC switchgear. The ongoing deployment of energy storage solutions and the emergence of distributed power generation are also creating significant demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Several factors contributing to the growing demand of DC Switchgear Market include increasing renewable energy integration, development in power distribution technology and rising electrification of industrial sectors and transportation.

These market is constantly growing as the demand for smart grid solutions and DC power networks continues to rise. Modular switchgear systems, digital monitoring solutions, and high-voltage direct current (HVDC) technology innovations are among the key trends reshaping the industry.

The overall market size for the DC switchgear market was USD 17.2 billion in 2025.

The DC switchgear market is expected to reach USD 32.6 billion in 2035.

The demand for DC switchgear will be driven by the growing adoption of renewable energy sources, rising demand for efficient power distribution in electric vehicles and railways, increasing investments in smart grid infrastructure, and advancements in power electronics technologies.

The top 5 countries driving the development of the DC switchgear market are the USA, China, Germany, Japan, and India.

Power distributor switch breakers segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Voltage Range, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Voltage Range, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Insulation Type, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Insulation Type, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by Deployment Type, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: Global Market Attractiveness by Component Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Voltage Range, 2023 to 2033

Figure 33: Global Market Attractiveness by Insulation Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Deployment Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Application, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 67: North America Market Attractiveness by Component Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Voltage Range, 2023 to 2033

Figure 69: North America Market Attractiveness by Insulation Type, 2023 to 2033

Figure 70: North America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 71: North America Market Attractiveness by Application, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Component Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Voltage Range, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Insulation Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Component Type, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Voltage Range, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Insulation Type, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Component Type, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Voltage Range, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Insulation Type, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Component Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Voltage Range, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Insulation Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Deployment Type, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Component Type, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Voltage Range, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Insulation Type, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Deployment Type, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Voltage Range, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Insulation Type, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Voltage Range, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Voltage Range, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Voltage Range, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Voltage Range, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Insulation Type, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Insulation Type, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Insulation Type, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Insulation Type, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Deployment Type, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Component Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Voltage Range, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Insulation Type, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Deployment Type, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA