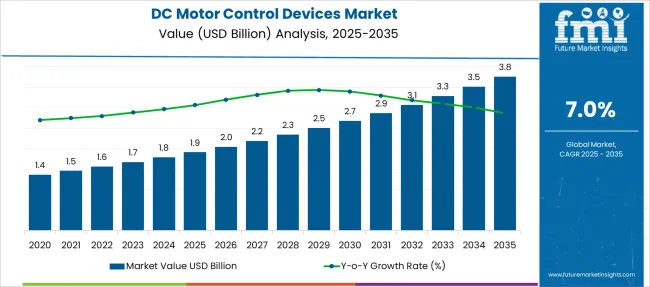

The DC Motor Control Devices Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| DC Motor Control Devices Market Estimated Value in (2025 E) | USD 1.9 billion |

| DC Motor Control Devices Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The DC motor control devices market is experiencing significant momentum, propelled by rising automation across industries, the proliferation of battery-powered systems, and growing demand for energy-efficient motion control. As industries prioritize compact, precise, and responsive motor solutions, DC motor controllers are increasingly integrated into automotive, industrial automation, HVAC, and robotics systems.

The shift toward electric vehicles and renewable energy systems has further fueled demand for intelligent motor control architectures that support performance optimization and energy savings. Emerging advancements in microcontroller integration, real-time feedback systems, and modular design are improving the responsiveness and adaptability of motor control devices.

The market is expected to witness consistent expansion as manufacturers align offerings with trends such as smart manufacturing, electrification, and Industry 4.0, reinforcing the role of advanced motor control in achieving operational agility and sustainability.

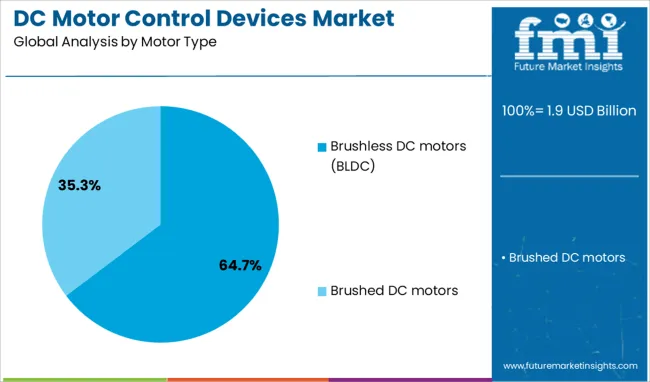

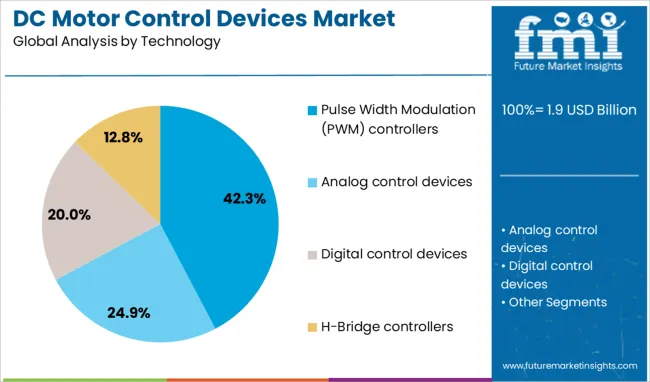

The DC motor control devices market is segmented by motor type, technology, control method, power rating, and end-use industry and geographic regions. The DC motor control devices market is divided by motor type into Brushless DC motors (BLDC) and Brushed DC motors. In terms of technology, the DC motor control devices market is classified into Pulse Width Modulation (PWM) controllers, Analog control devices, Digital control devices, and H-Bridge controllers.

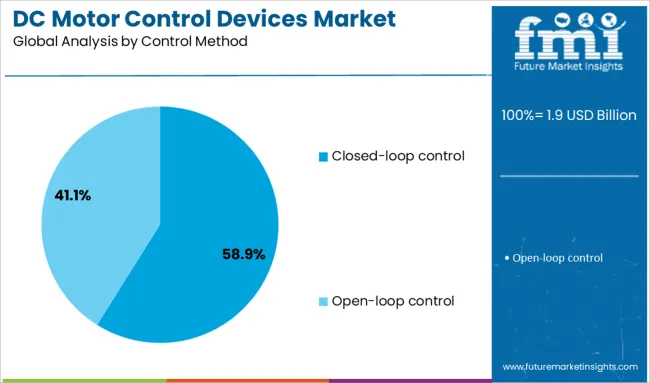

Based on the control method of the DC motor control devices, the market is segmented into Closed-loop control and Open-loop control. By power rating, the DC motor control devices market is segmented into Medium power (100W–500W), Low power (Below 100W), and High power (Above 500W).

The end-use industry of the DC motor control devices market is segmented into Industrial, Aerospace & defense, Automotive & transportation, Consumer electronics, Energy & power, Healthcare, and Others. Regionally, the DC motor control devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Brushless DC motors (BLDC) hold a dominant 64.7% share within the motor type category, reflecting their wide-scale adoption due to higher efficiency, longer service life, and reduced maintenance compared to brushed alternatives. BLDC motors are favored for their precise speed-torque characteristics, low electromagnetic interference, and capability to operate in compact, high-performance environments.

These attributes have accelerated their use in electric vehicles, industrial drives, medical equipment, and consumer electronics. The elimination of brushes minimizes frictional losses and wear, making BLDC motors ideal for continuous and demanding operations.

Manufacturers are also increasingly integrating digital control solutions to exploit the full potential of BLDC configurations. As application areas continue to diversify and demand for compact, high-efficiency systems rises, the BLDC segment is expected to retain its leadership within the motor control ecosystem.

Pulse Width Modulation (PWM) controllers account for 42.3% of the technology segment, owing to their efficiency in regulating motor speed and torque with minimal power loss. PWM control enables precise modulation of voltage and current to the motor, enhancing overall energy efficiency and system responsiveness.

The technology's compatibility with both low- and high-power applications makes it a versatile solution across sectors such as automotive, aerospace, industrial automation, and home appliances. Continuous innovation in digital signal processing and microcontroller integration has elevated the performance capabilities of PWM-based controllers, allowing smoother acceleration, reduced motor heating, and improved system longevity.

As energy efficiency regulations tighten and demand for high-precision control increases, PWM controllers are expected to maintain a pivotal role in the evolution of DC motor control systems.

Closed-loop control dominates the control method category with a 58.9% share, driven by its ability to provide feedback-based, real-time adjustments for optimal motor performance. This method is increasingly favored in applications that require high precision, speed regulation, and load adaptability, such as robotics, CNC machinery, and electric power steering systems.

By constantly monitoring motor output and adjusting input accordingly, closed-loop systems enhance accuracy, reduce energy waste, and extend equipment life. The growing emphasis on predictive maintenance and smart automation has further amplified the adoption of closed-loop systems, particularly in mission-critical and high-precision environments.

Integration with sensors and control algorithms continues to evolve, enabling greater customization and system intelligence. With its superior control dynamics and reliability, the closed-loop segment is set to remain the preferred choice across increasingly complex motor-driven applications.

The DC motor control devices market is expanding steadily due to rising demand across automation, robotics, consumer electronics, automotive systems and renewable energy deployments. These controllers including brushed, brushless and closed‑loop devices enable precise control of motor speed, torque and direction.

Adoption is particularly driven by industrial automation deployment, electric vehicle components and integration within smart devices. Performance expectations now include energy efficiency, connectivity and predictive maintenance capability. As OEMs seek customizable and scalable control modules, providers are introducing modular form factors and digital interfaces to meet evolving application needs.

Manufacturers face increasing challenges due to energy efficiency and safety mandates across key jurisdictions. Requirements for efficient operation push suppliers to develop controllers compatible with high-efficiency motor standards. Certification regimes vary by country and application segment, resulting in multiple design variants for the same platform.

These variations extend product development timelines and raise costs for compliance testing. Legacy adoption of analog controllers also persists among users, requiring suppliers to support both cutting-edge digital and traditional formats.

For global suppliers, maintaining certification and performance compliance across regions adds to the operational burden. Model validation and regional approval add to the time before deployment in industrial and automotive systems, slowing the introduction of next‑generation devices.

Growth in industrial automation, robotics and intelligent manufacturing systems is creating strong demand for high‑precision DC motor control devices. Robotics cells require controllers capable of rapidly adjusting speed, torque and position through closed‑loop feedback. Conveyor systems, automated guided vehicles and assembly lines integrate these devices for repeatable accuracy.

Similarly, in automotive manufacturing and powertrain subsystems, DC motor controllers manage power steering, braking actuators and window systems. Consumer electronics, including appliance motors and smart home actuators, also rely on precision control. Suppliers offering configurable controller platforms with modular form factors, plug‑and‑play firmware, and scalable interfaces are preferred.

Integration with building automation and asset management systems via IoT connectivity adds further value. As automation becomes more pervasive across industries, consistent, reliable, and flexible motor control platforms present a significant business opportunity.

A clear market trend is adoption of smart motor controllers embedded with digital controls, communication interfaces and analytics functionality. Controllers now support IoT integration, enabling remote diagnostics, usage monitoring and predictive maintenance. Incorporation of microcontrollers, DSPs, and PWM modules supports adaptive control algorithms and performance-based tuning. Sensorless techniques reduce hardware cost while delivering speed estimation and closed-loop feedback.

Connectivity options such as wireless or Ethernet allow integration into broader automation or asset management systems. Analytics capture operational data that can inform fault prediction and maintenance scheduling. These smart capabilities reduce downtime and improve energy optimization.

As Industry 4.0 expands into industrial equipment and consumer applications, controllers offering these features become essential for OEMs. Suppliers that deliver analytics-enabled, energy-conscious designs gain a competitive advantage across robotics, smart home, automotive, and industrial ecosystems.

Raw material and component price volatility present a major restraint in the DC motor control market. Drivers rely on electronic components such as semiconductors, rare-earth magnets, copper windings, and power MOSFETs or IGBTs. Fluctuating prices and supply disruptions introduce cost unpredictability. Advanced brushless or closed-loop controller designs often require more premium components.

Sudden input cost increases force suppliers to either absorb margin loss or raise selling prices. In cost-sensitive applications like low-end consumer devices and small OEMs, price increases can dampen adoption. Smaller manufacturers often lack leverage for long-term component contracts or hedging strategies. This makes it difficult to maintain stable pricing or scale profitably. Until raw material supply chains stabilize or alternative lower-cost designs emerge, production cost variability will continue to constrain market expansion in competitive segments and keep pricing pressure on premium controller offerings.

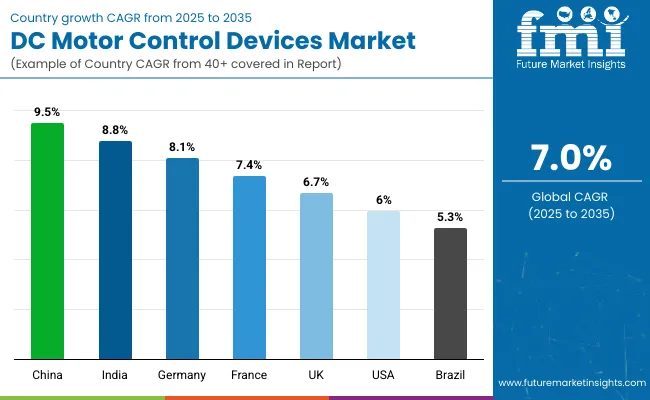

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global DC motor control devices market is projected to grow at a CAGR of 7.0% through 2035, supported by increased deployment in automotive systems, robotics, and precision machinery. Among BRICS nations, China leads with 9.5% growth, driven by high-volume production and extensive integration across motion control platforms. India follows at 8.8%, where demand has been spurred by expanding light electric vehicle manufacturing and factory automation.

In the OECD region, Germany reports 8.1% growth, supported by use in engineered systems requiring fine speed regulation and compact design. The United Kingdom, at 6.7%, shows steady demand in control systems for industrial equipment and mobility aids. The United States, at 6.0%, remains an established market with adoption shaped by application-specific performance criteria and product longevity. Market growth has been shaped by voltage compliance norms, modularity standards, and enclosure classification rules. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth in China has been measured at a 9.5% CAGR, supported by rising integration of DC motor control devices in automated production cells, robotics platforms, and smart mobility applications. Usage has been seen across conveyor systems, adjustable-speed drives, and compact actuator units.

Compact controller modules with thermal overload protection and communication interface compatibility have been widely deployed. Manufacturers have steadily introduced integrated models designed for rapid switching response and improved torque regulation. Strong interest has been reported from the light industrial machinery segment, where load consistency and energy precision remain key. Industrial automation clusters have actively adopted digital DC motor drives with programmable feedback loops.

India has exhibited a CAGR of 8.8%, driven by the expanding use of DC motor controllers in textile units, packaging lines, and compact vehicle powertrains. Adoption has focused on low-voltage controllers with built-in braking and acceleration features, suitable for dynamic applications.

The growing popularity of electric two-wheelers and small-scale automation setups has created sustained pull for DC motor control devices with simple wiring and robust housing. Demand has been reinforced by the surge in localized assembly units and maintenance service hubs, especially in semi-urban belts. Devices designed for ambient heat resistance and cost-effective tuning have been actively procured.

In Germany, DC motor control devices market has progressed at an 8.1% CAGR, with broad deployment observed in assembly lines, CNC equipment, and precision transport modules. Configurable motor drives with fieldbus compatibility and diagnostic feedback loops have been adopted to support Industry 4.0 frameworks. Devices with precise torque management, silent operation, and seamless drive synchronization have gained attention in tier-one component manufacturing. Market interest has shifted toward units offering predictive maintenance integration and modular architecture. Demand has also been noted for controller boards with built-in fault handling systems and compact mounting profiles, tailored for distributed control systems in industrial settings.

The market in the United Kingdom has maintained a 6.7% CAGR, influenced by continued demand from warehousing conveyors, HVAC systems, and compact AGVs. Compact programmable controllers with position feedback and onboard diagnostics have been deployed across both commercial and industrial zones.

Emphasis has been placed on models that offer stable voltage handling and high signal responsiveness for smoother drive cycles. Controllers supporting variable load inputs have become common in logistics setups and specialized machine tools. Growing use of building automation devices and electric mobility testing stations has opened up consistent sales channels.

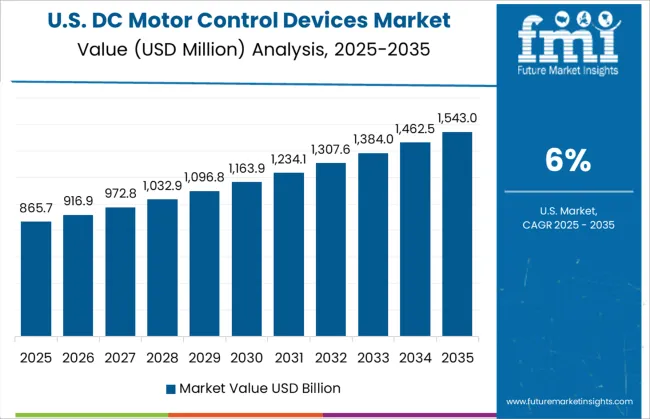

A 6.0% CAGR has been observed in the United States, with increasing utility seen in conveyorized packaging systems, laboratory automation tools, and mobile robotics platforms. DC motor controllers with multi-axis handling capabilities and adjustable speed parameters have been adopted for high-precision setups.

Interest has centered on embedded drive modules that offer overload shielding and continuous monitoring. Integration with motion control software and networked diagnostics has been widely supported in smart plant layouts. Devices offering EMI shielding and modular expansion have received attention, particularly for regulated production zones and research facilities.

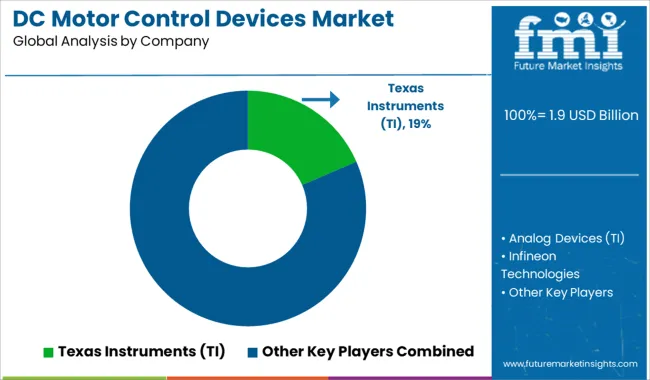

The DC motor control devices market is shaped by semiconductor companies offering integrated circuits and driver solutions for precision control, energy efficiency, and automation. Texas Instruments (TI) holds a dominant position with its broad suite of motor drivers and control ICs tailored for brushed and brushless DC motor applications across industrial automation, automotive, and robotics sectors.

Analog Devices, also under the TI umbrella, provides high-performance signal processing and control components enabling accurate speed, torque, and direction management in demanding environments. Infineon Technologies is a key player known for delivering scalable motor control solutions including gate drivers, microcontrollers, and power modules, often favored in electric mobility and HVAC systems for their thermal efficiency and EMI performance.

STMicroelectronics offers integrated H-Bridge and FOC (field-oriented control) motor drivers that support compact design and precise modulation, used widely in smart appliances and factory automation. Microchip Technology emphasizes ease of integration with its wide microcontroller-based motor control platforms, suited for consumer electronics and low-voltage applications. NXP Semiconductors focuses on real-time motor control and diagnostics, providing embedded control ICs essential in automotive electric motor applications.

ON Semiconductor contributes with intelligent power modules and drivers supporting both low and high-voltage operations. These manufacturers drive innovation and functionality in DC motor control systems, providing developers with configurable, compact, and high-reliability solutions tailored to diverse end-use requirements, from small devices to large-scale automation.

According to ABB, the company unveiled the HES580 mobile inverter, AMXE160 motor, ACS8080 medium-voltage drive, and ACS880 multiaxis drive at bauma 2025 (April 7–13, Munich). These DC motor control devices aim to improve motor efficiency, reduce harmonics, and support electrification in construction and mining machinery.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Motor Type | Brushless DC motors (BLDC) and Brushed DC motors |

| Technology | Pulse Width Modulation (PWM) controllers, Analog control devices, Digital control devices, and H-Bridge controllers |

| Control Method | Closed-loop control and Open-loop control |

| Power Rating | Medium power (100W–500W), Low power (Below 100W), and High power (Above 500W) |

| End-use Industry | Industrial, Aerospace & defense, Automotive & transportation, Consumer electronics, Energy & power, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Texas Instruments (TI), Analog Devices (TI), Infineon Technologies, Microchip Technology, NXP Semiconductors, ON Semiconductor, and STMicroelectronics |

| Additional Attributes | Dollar sales by DC motor control device type including brushed, brushless DC, and stepper motor controllers, by application in industrial automation, automotive & transportation, consumer electronics, and medical devices, and by geographic region including North America, Europe, and Asia‑Pacific; demand driven by rising automation, EV adoption, and energy-efficiency regulations; innovation in sensorless BLDC control, nano-structured controllers, and IoT-enabled predictive systems; costs influenced by rare-earth magnet prices, semiconductor complexity, and integration challenges; and emerging applications in robotics, smart appliances, renewable energy tracking, and precision medical instrumentation |

The global dc motor control devices market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the dc motor control devices market is projected to reach USD 3.8 billion by 2035.

The dc motor control devices market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in dc motor control devices market are brushless dc motors (bldc) and brushed dc motors.

In terms of technology, pulse width modulation (pwm) controllers segment to command 42.3% share in the dc motor control devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA