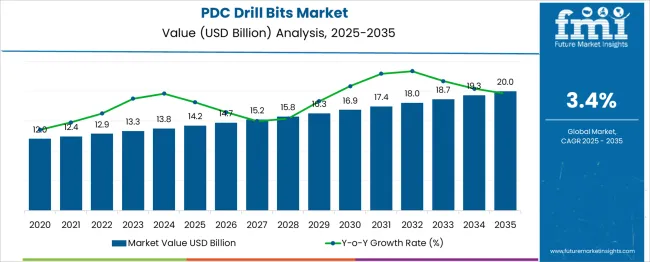

The PDC Drill Bits Market is estimated to be valued at USD 14.2 billion in 2025 and is projected to reach USD 20.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

The market shows a steady and consistent growth trend across the decade, expanding from USD 12.0 billion in 2021 to USD 16.3 billion by 2030, creating an absolute dollar opportunity of USD 4.3 billion during this period. This translates into a CAGR of approximately 3.5%, reflecting sustained demand driven by the global oil and gas sector, increasing drilling activities, and the adoption of high-performance drilling solutions.

Year-wise analysis highlights incremental growth supported by technological enhancements in drilling equipment. The market value moves from USD 12.0 billion in 2021 to USD 12.4 billion in 2022, and USD 12.9 billion in 2023, supported by the recovery in exploration activities and investments in upstream oil projects. By 2024, the market will reach USD 13.3 billion, while 2025 sees the market at USD 13.8 billion, reflecting steady demand for deep-water and unconventional resource drilling.

The latter half of the decade showcases continued expansion as global energy needs drive exploration and production activities. The market climbs to USD 14.2 billion in 2026, USD 14.7 billion in 2027, and USD 15.2 billion by 2028, bolstered by demand for enhanced durability and faster drilling rates in challenging geological formations.

By 2029, the value rises to USD 15.8 billion, ultimately reaching USD 16.3 billion in 2030, supported by technological innovations such as advanced cutter designs and hybrid bit configurations. This stable yet progressive outlook underscores the critical role of PDC drill bits in reducing drilling costs, improving operational efficiency, and ensuring safety in complex well operations.

Companies investing in material innovation, wear-resistant designs, and digital performance monitoring are well-positioned to capture growth opportunities in this evolving market landscape.

| Metric | Value |

|---|---|

| PDC Drill Bits Market Estimated Value in (2025 E) | USD 14.2 billion |

| PDC Drill Bits Market Forecast Value in (2035 F) | USD 20.0 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The PDC drill bits market accounts for a significant yet specialized portion within the broader drill bit and oilfield services ecosystem. In the global drill bits market, which includes roller cone bits, diamond core bits, and carbide tools, PDC drill bits represent an estimated 24% to 26% share, driven by their superior efficiency in hard formations.

Within the oil and gas drill bit segment, their dominance is even higher, capturing approximately 35% to 40%, as these bits are widely used for high-speed drilling and extended durability in exploration and production operations. In the mining and geothermal drilling sectors, PDC bits hold a smaller share, near 10%, since traditional bits still prevail in softer formations and cost-sensitive projects.

While their contribution in the overall industrial tool market is modest, well under 5%,their strategic role in energy and resource extraction is critical for operational efficiency. Market expansion is supported by the increasing complexity of drilling projects, higher energy demand, and technological innovations such as thermally stable polycrystalline diamonds and matrix body designs for challenging well conditions.

With these advancements and the rising shift toward unconventional resources, PDC drill bits are positioned as a core enabler for cost-effective and rapid drilling solutions, reinforcing their long-term importance across global drilling activities.

The PDC drill bits market is exhibiting consistent growth, supported by the rising demand for efficient and cost-effective drilling solutions in both conventional and unconventional oil and gas reservoirs. The growing depth and complexity of drilling operations have led to an increased preference for PDC bits due to their high rate of penetration, extended durability, and minimal maintenance requirements.

Technological advancements in cutter materials, design geometries, and fluid dynamics have further strengthened their value proposition. The shift toward shale and tight formation drilling, especially in North America, has encouraged greater deployment of rotary steerable systems in conjunction with PDC bits, enhancing wellbore precision and reducing downtime.

A resurgence in global oil prices, coupled with increased investments in upstream activities across the Middle East, Asia Pacific, and Latin America, is supporting greater adoption of high-performance drilling tools. The market is also being influenced by operators’ focus on reducing the total cost of ownership and optimizing assets, further promoting innovation in PDC bit design and performance tracking systems.

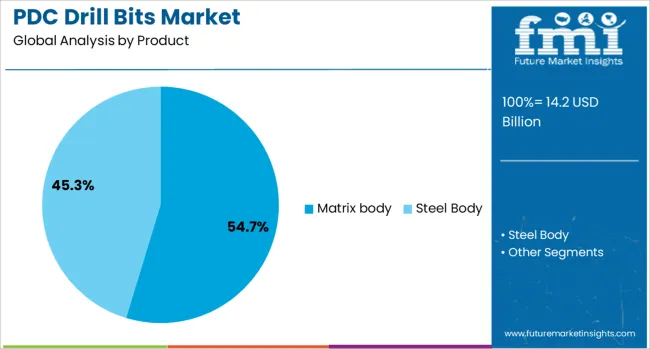

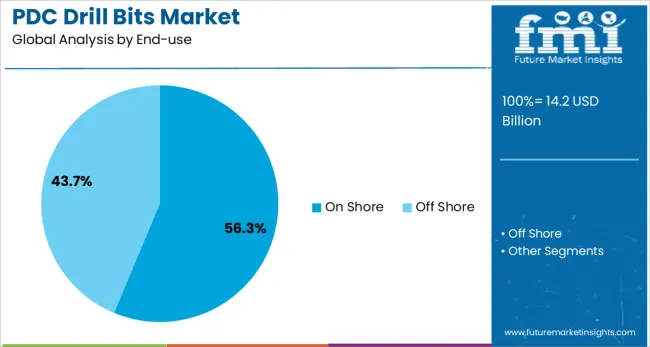

The PDC drill bits market is segmented by product, end-use, and geographic regions. The product of the PDC drill bits market is divided into Matrix body and Steel Body. In terms of end-use, the PDC drill bits market is classified into Onshore and Offshore. Regionally, the PDC drill bits industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Matrix body bits are expected to hold 54.7% of the PDC drill bits market revenue share in 2025, emerging as the leading product category. The preference for matrix body construction is being driven by its superior wear resistance, capability to withstand high-impact formations, and compatibility with complex bottom-hole assemblies. The use of powdered metal composites in matrix bodies enables greater customization of blade geometry and cutter placement, optimizing the bit’s durability in abrasive formations.

These attributes have proven advantageous in environments where formation variability demands robust, longer-lasting drilling solutions. Matrix bits have also demonstrated superior performance in directional drilling applications, contributing to reduced tripping times and improved ROP.

As operators aim to enhance drilling efficiency while maintaining operational safety and cost-effectiveness, matrix body bits continue to offer a compelling solution. The segment’s leadership is further reinforced by the growing adoption of digitally designed bits, supported by real-time performance analytics and design simulation tools tailored for matrix structures.

The on shore segment is projected to contribute 56.3% of the total revenue in the PDC drill bits market in 2025, marking its position as the leading end-use category. This growth is being shaped by the expansion of land-based oil and gas exploration across resource-rich regions such as North America, the Middle East, and China.

On shore operations typically require high-efficiency drilling equipment to lower rig time and maximize productivity, which has favored the deployment of PDC bits due to their proven rate of penetration and durability. Increased investment in tight oil, shale gas, and coal bed methane projects has intensified the need for reliable and long-life drill bits tailored for land-based drilling programs.

Ongoing digital transformation in wellsite operations has allowed better bit selection and real-time optimization, accelerating adoption in on shore fields. The segment’s prominence is also reinforced by lower logistical complexity, better accessibility, and reduced operational costs associated with land-based drilling compared to offshore exploration.

Rising demand for deep and unconventional drilling, coupled with cost optimization needs, is driving the adoption of advanced PDC drill bits for improved efficiency and durability. Competitive strategies focus on customized designs, material innovations, and integration with digital drilling ecosystems to enhance precision and reduce downtime.

The increasing focus on deep and ultra-deep drilling for oil and gas exploration has reinforced market demand. Significant traction is observed in onshore and offshore operations where drilling efficiency is prioritized to reduce operational costs. Advanced cutting structures in PDC bits are being used to extend drilling cycles and minimize tripping frequency. High precision in drilling shale and unconventional formations has strengthened the preference for these bits. Cost optimization strategies in upstream sectors are pushing operators toward tools offering extended durability and a consistent rate of penetration. As energy operators target complex reservoirs, PDC drill bits are being positioned as critical tools that optimize well completion timelines and drilling economics effectively.

Competition within this segment is influenced by manufacturers emphasizing application-specific bit designs. Strategic collaborations between drill bit suppliers and oilfield service companies are enabling customized solutions for high-pressure and high-temperature wells. Performance data analytics and real-time drilling optimization services have become integral to the competitive edge in this industry. Enhanced wear resistance through innovative cutter materials is improving tool longevity, thereby reducing downtime during drilling projects. Companies are expanding product portfolios to cater to varying lithology and operational challenges. Growth in rig automation and digital drilling ecosystems is accelerating the adoption of PDC bits capable of supporting predictive maintenance and higher drilling precision across key global basins.

The PDC drill bits market is gaining momentum with the surge in unconventional resource development, including shale gas and tight oil formations. These drilling environments demand tools capable of high penetration rates and durability under extreme pressure and abrasive rock conditions, where PDC bits outperform conventional roller cone designs. Their ability to reduce trip times and drilling costs makes them an essential component for operators focused on efficiency in deep and horizontal wells. Additionally, the shift toward offshore and ultra-deepwater projects has amplified the requirement for premium drill bits with superior heat resistance and extended operational lifespan, further boosting PDC adoption across global energy markets.

Innovation in cutting structures, thermally stable diamond elements, and matrix body materials has transformed PDC bits into highly reliable tools for complex drilling environments. Manufacturers are incorporating computational design models, 3D printing techniques, and advanced analytics to enhance bit geometry for optimized rock interaction and reduced vibration. Customization for specific well conditions, including abrasive or interbedded formations, is becoming a key differentiator, enabling tailored performance for diverse geological challenges. Integration with real-time drilling data platforms is also emerging, allowing operators to monitor wear patterns and improve drilling strategies dynamically. These advancements not only enhance drilling speed and accuracy but also position PDC drill bits as an indispensable solution in modern oilfield operations.

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 4.0% |

| France | 3.6% |

| UK | 3.3% |

| USA | 2.9% |

| Brazil | 2.6% |

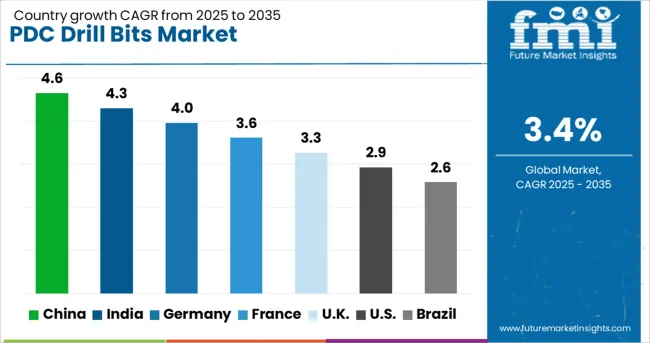

The PDC drill bits industry, projected to expand at a global CAGR of 3.4% between 2025 and 2035, demonstrates notable variations across leading countries. A 4.6% CAGR is being observed in China, a BRICS member, supported by extensive drilling operations for unconventional resources and expanding offshore exploration activities.

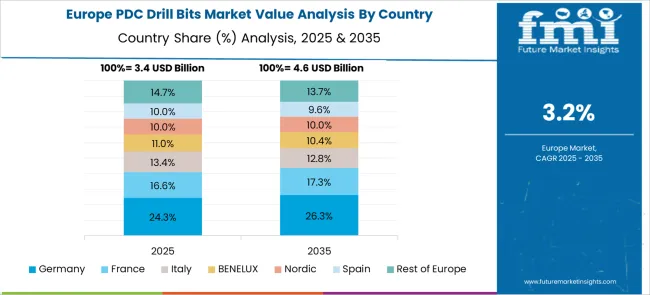

India, also a BRICS member, is recording a 4.3% CAGR as the country strengthens its upstream oil and gas investments, emphasizing cost-effective drilling in complex formations. Germany, an OECD member, exhibits a 4.0% CAGR driven by technological precision in bit manufacturing and growing emphasis on energy security.

Moderate growth of 3.3% is being recorded in the United Kingdom, an OECD member, where market expansion is linked to steady offshore development and advanced drilling solutions. The United States, another OECD member, shows a 2.9% CAGR as shale activity stabilizes and operators focus on optimizing operational expenditure.

While developed countries maintain stable demand through automation and digital drilling integration, stronger growth opportunities are emerging in Asian regions, particularly in China and India, due to increased upstream capital investments. The report includes comprehensive insights into more than 40 countries, with the top five highlighted for reference.

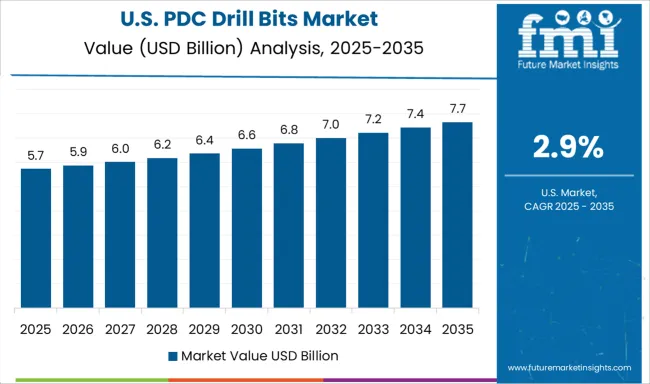

The CAGR of the PDC drill bits market in the United States was estimated at about 2.2% during 2020-2024 and is expected to move to 2.9% for 2025-2035. This increase has been supported by renewed focus on optimizing drilling economics amid stabilization in shale development and deeper offshore programs. Operators have been incorporating advanced PDC bit designs with enhanced wear resistance to extend operational cycles and minimize downtime.

Emphasis on digital drilling and real-time bit performance monitoring has added value to long-term operational strategies. USA manufacturers have diversified portfolios to cater to unconventional formations where drilling efficiency plays a major role. While replacement demand remains steady, technological integration in bit design is strengthening adoption in mature fields.

The CAGR for Germany stood at 3.4% during 2020-2024 and is projected to rise to 4.0% from 2025-2035. The shift has been encouraged by precision-driven upstream activities and localized manufacturing capability that delivers high-quality cutters for European energy operators. Demand in Germany has benefited from complex reservoir development strategies and government-backed energy diversification policies requiring high drilling accuracy.

Suppliers have been innovating to meet drilling requirements in challenging formations across continental basins. Data-driven optimization and integration of wear-resistant materials are viewed as major trends in Germany’s drilling ecosystem, ensuring greater life-cycle value. German companies are leveraging partnerships with oilfield service providers to maintain operational efficiency under stringent cost controls.

The United Kingdom recorded a CAGR of approximately 2.6% from 2020-2024 and is projected to advance to 3.3% in the 2025-2035 period. The upward shift is linked to expansion in offshore drilling programs in the North Sea, where extended well designs demand enhanced bit durability. PDC bits with application-specific configurations have seen growing adoption in HPHT (High Pressure High Temperature) fields.

Market growth in the UK has been encouraged by service providers integrating real-time drilling analytics into offshore rigs, improving operational predictability. Cost optimization pressures have accelerated interest in long-life bits that reduce tripping frequency. Partnerships between bit manufacturers and leading North Sea operators are providing scope for advanced cutter applications.

China posted a CAGR of around 3.8% in the 2020-2024 period and is forecast to increase to 4.6% between 2025 and 2035. This growth acceleration is attributed to extensive onshore and offshore drilling programs targeting unconventional reserves and deep reservoirs. The Chinese market has experienced high investment in advanced drilling technologies, where PDC bits play an essential role in improving penetration rates and reducing operational downtime.

Localization of cutter manufacturing has strengthened China’s cost competitiveness in the global supply chain. Integration of automated drilling systems and predictive analytics tools into exploration projects is reinforcing adoption across major basins such as Sichuan and Tarim. Export-oriented manufacturers are capturing opportunities across Asia-Pacific and Africa due to optimized production strategies.

India registered a CAGR of 3.5% in the 2020-2024 phase, which is expected to climb to 4.3% for the 2025-2035 horizon. This growth progression is supported by upstream exploration campaigns emphasizing efficient drilling practices for unconventional reserves. PDC bits are being preferred due to their ability to optimize drilling speed and lower overall project costs.

Market participants are focusing on durability enhancements and improved cutter technology to address abrasive and challenging formations common in Indian basins. Strategic alliances between local bit manufacturers and global service providers are enabling the integration of digital solutions for performance tracking. Domestic production capabilities are expanding with investment incentives, further reducing dependency on imported drilling tools.

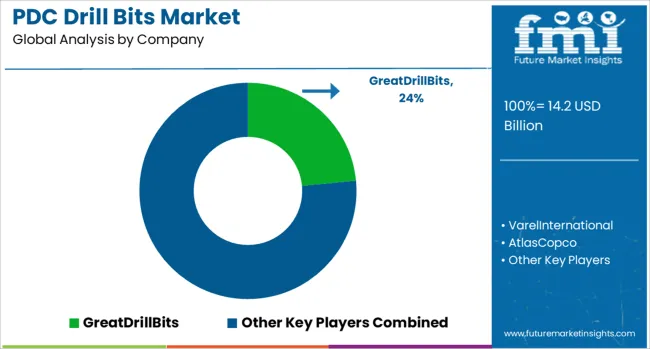

The PDC drill bits market is highly competitive, driven by innovation in cutter technology, material strength, and digital integration to meet the growing complexity of drilling operations. GreatDrillBits, Varel International, and Atlas Copco have established leadership positions by focusing on premium-grade designs with improved cutter durability, optimized blade geometry, and advanced matrix materials that enhance drilling life cycles while minimizing tripping intervals.

Torquato Drilling and Cangzhou are capturing value-driven markets by providing cost-effective yet robust solutions tailored for both onshore and offshore wells, including those with interbedded or abrasive formations. NewTech Drilling and Ulterra Drilling Technologies are leveraging analytics-driven approaches, integrating real-time performance data to enable predictive maintenance and optimize drilling strategies, thereby reducing downtime and increasing operational efficiency.

Oilfield service giants Baker Hughes and Halliburton dominate through comprehensive portfolios featuring PDC drill bits engineered for HPHT (High Pressure High Temperature) and unconventional wells, supported by advanced software platforms for real-time drilling optimization. Both companies are investing in thermally stable polycrystalline diamond technology and hybrid cutting structures to extend bit longevity under extreme conditions.

These players are also forging strategic partnerships with operators for application-specific bit designs, ensuring adaptability to diverse geological environments. Collectively, these strategies highlight a market trend toward combining superior mechanical performance with digital intelligence, positioning PDC drill bits as essential tools for cost-efficient and high-speed drilling in an era of complex energy exploration.

In 2024, strategies in the PDC drill bits market focus on material innovations, such as thermally stable diamond cutters and enhanced matrix body designs, to boost durability in abrasive formations. Companies are prioritizing cost-efficiency through optimized designs and expanding aftermarket support for operators.

In 2025, emphasis will shift toward integrating digital analytics for predictive maintenance and real-time drilling optimization, reducing downtime and enhancing penetration rates. Key drivers include rising global drilling activity, the expansion of unconventional energy exploration, and increasing demand for high-performance bits in HPHT environments, positioning PDC technology as a cornerstone of next-generation drilling solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.2 Billion |

| Product | Matrix body and Steel Body |

| End-use | On Shore and Off Shore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GreatDrillBits, VarelInternational, AtlasCopco, TorquatoDrilling, Cangzhou, NewTechDrilling, UlterraDrillingTechnologies, BakerHughes, and HalliburtonCompany |

| Additional Attributes | Dollar sales, share by region and application, competitive positioning, pricing trends, raw material impact, technology adoption, demand outlook across onshore and offshore drilling, and key growth opportunities in emerging basins. |

The global pdc drill bits market is estimated to be valued at USD 14.2 billion in 2025.

The market size for the pdc drill bits market is projected to reach USD 20.0 billion by 2035.

The pdc drill bits market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in pdc drill bits market are matrix body and steel body.

In terms of end-use, on shore segment to command 56.3% share in the pdc drill bits market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Drill Drivers Market Size and Share Forecast Outlook 2025 to 2035

Drill Shank Adapter Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drill Pipe Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Drill Bit Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Rock Drill Shank Adaptor Market Size and Share Forecast Outlook 2025 to 2035

Core Drill Automatic Feeding Machine Market

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Rapid U-drills Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA