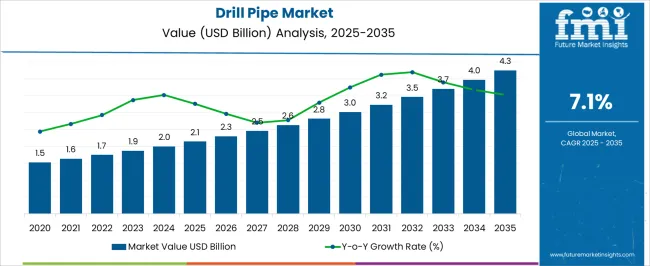

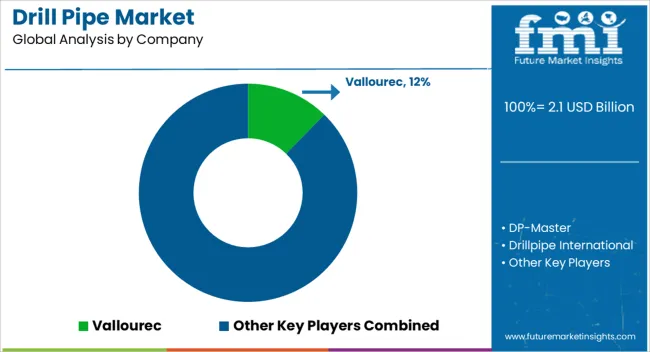

The drill pipe market is anticipated to expand from USD 2.1 billion in 2025 to USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1%. Market growth is being propelled as the demand for efficient drilling operations is recognized across oilfield and gasfield activities. Product adoption is being influenced by factors such as enhanced tensile strength, fatigue resistance, and corrosion protection, while manufacturers are being encouraged to optimize material selection and design standards.

Supply chains are being strengthened to ensure the timely delivery of high-quality drill pipes, which are essential for deep and extended drilling operations. Over the 2025–2035 period, growth in the drill pipe market is being shaped by the need for reliable drilling performance and operational continuity. End-users are being driven by considerations of safety, durability, and reduced maintenance requirements, leading to increasing deployment of advanced drill pipe solutions.

The market is being defined as a critical enabler for exploration efficiency, with manufacturers emphasizing quality control, inspection protocols, and component standardization. The rise in unconventional and offshore drilling activities is being leveraged to drive long-term adoption and support sustained market expansion.

| Metric | Value |

|---|---|

| Drill Pipe Market Estimated Value in (2025 E) | USD 2.1 billion |

| Drill Pipe Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The drill pipe market has established a strong presence across its parent industries, driven by its essential function in transmitting drilling fluid and torque from surface rigs to downhole drilling assemblies. Within the oilfield equipment market, drill pipes account for approximately 20–22% share, as they are indispensable for maintaining operational efficiency and ensuring wellbore stability in oil and gas extraction.

In the drilling and exploration equipment market, the segment contributes around 18–20% share, reflecting the demand for high-performance pipes that can withstand extreme pressure, temperature, and mechanical stresses during exploratory operations. Within the oil and gas downstream services market, drill pipes represent roughly 10–12% share, as they support well maintenance, workovers, and the execution of complex intervention activities. In the subsea and offshore drilling market, drill pipes hold a significant share of about 25–28%, due to the critical requirement for robust and corrosion-resistant components in deepwater and shallow offshore installations. Within the broader energy infrastructure market, drill pipes account for approximately a 12–14% share, demonstrating their strategic role in enabling energy production projects and supporting global oil and gas supply chains.

While alternative materials and advanced drilling technologies are emerging, the reliance on high-quality drill pipes remains central to drilling efficiency and safety. From my perspective, the drill pipe market is a foundational element of the oil and gas value chain, shaping operational reliability and influencing cost-effectiveness across upstream and offshore drilling projects.

The drill pipe market is experiencing stable expansion, supported by a revival in oil and gas exploration projects and the modernization of drilling infrastructure. Energy sector updates and company investment reports have shown renewed capital allocation toward upstream activities, with both national and independent operators increasing rig counts.

Technological improvements in metallurgy and pipe design have enhanced product lifespan and performance in high-pressure, high-temperature drilling environments. Additionally, demand has been reinforced by the expansion of unconventional resource extraction, which requires durable and high-specification drill pipes.

Supply chain developments, including streamlined manufacturing and localized production facilities, have improved availability in key oil-producing regions. Looking ahead, the market’s growth trajectory is expected to be driven by deeper drilling programs, increased offshore activity, and continued investments in high-strength, corrosion-resistant materials. Segmental performance is anticipated to be led by API grade drill pipes and onshore drilling applications, reflecting widespread industry adoption and operational practicality.

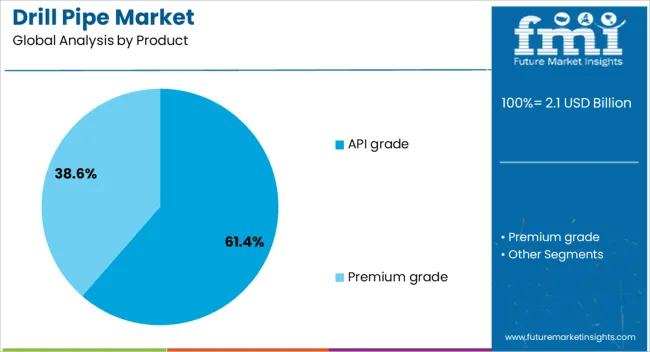

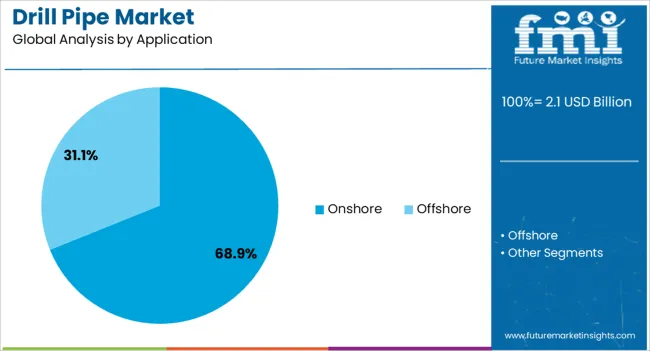

The drill pipe market is segmented by product, application, and geographic regions. By product, drill pipe market is divided into API grade and Premium grade. In terms of application, drill pipe market is classified into Onshore and Offshore. Regionally, the drill pipe industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The API grade segment is projected to hold 61.4% of the drill pipe market revenue in 2025, maintaining its lead among product categories. This dominance is attributed to the segment’s compliance with standardized manufacturing and performance criteria set by the American Petroleum Institute, ensuring reliability in diverse drilling environments.

Oilfield operators have consistently favored API grade drill pipes for their proven durability, cost-effectiveness, and ease of sourcing across global supply chains. Manufacturers have optimized production processes to meet API specifications, enabling consistent quality and interchangeability across different drilling rigs.

Additionally, the availability of API grade pipes in a wide range of sizes and grades has supported their applicability in both shallow and deep drilling operations. The balance between performance and affordability has positioned API grade drill pipes as the industry standard, with demand expected to remain strong in both mature and emerging oil and gas markets.

The onshore segment is projected to account for 68.9% of the drill pipe market revenue in 2025, reflecting its dominant role in global drilling activity. Growth in this segment has been driven by the lower operational costs, faster project timelines, and logistical advantages associated with onshore drilling compared to offshore operations.

National oil companies and private operators have prioritized onshore resource development due to easier infrastructure access and reduced regulatory complexities. Additionally, advancements in horizontal drilling and hydraulic fracturing have boosted demand for high-performance drill pipes tailored to extended-reach onshore wells.

Oilfield service providers have also increased inventories of drill pipes for onshore projects, ensuring rapid mobilization and minimizing downtime. With the ongoing development of shale plays, tight oil formations, and other unconventional reserves, the onshore segment is expected to sustain its leadership position, supported by continuous drilling program expansions and field redevelopment initiatives.

The drill pipe market is growing due to rising oil and gas exploration and production activities. Opportunities exist in premium, high-performance, and specialized pipe segments, while trends emphasize lightweight, corrosion-resistant, and digitally monitored materials. Challenges include raw material price volatility, regulatory compliance, and operational risks. Overall, the market outlook remains positive as manufacturers focus on supplying durable, high-performance, and application-specific drill pipes to support efficient and safe hydrocarbon extraction globally.

The drill pipe market is witnessing increasing demand due to ongoing oil and gas exploration and production activities worldwide. Rising investments in upstream operations, deepwater drilling, and shale gas projects require high-strength, durable, and reliable drill pipes. These pipes ensure operational efficiency, withstand high pressure, and maintain structural integrity in challenging drilling environments. Enhanced focus on energy security and expanding exploration in emerging markets further fuels adoption. Manufacturers are supplying customized, high-performance drill pipes to meet the evolving requirements of conventional, unconventional, and offshore drilling operations.

Significant opportunities exist in high-performance and premium-grade drill pipe segments, including those designed for deepwater, extended-reach, and high-temperature high-pressure (HTHP) wells. Technological advancements in alloy composition, threading, and surface coatings improve strength, wear resistance, and longevity. Emerging exploration zones and unconventional drilling projects create demand for specialty pipes tailored to unique well conditions. Collaborations with drilling contractors and oilfield service providers facilitate market penetration, enabling manufacturers to capitalize on the need for reliability, reduced operational downtime, and optimized drilling performance in complex hydrocarbon recovery projects.

A notable trend in the drill pipe market is the adoption of lightweight, high-strength, and corrosion-resistant materials to enhance drilling efficiency. Innovations in carbon steel alloys, premium connections, and protective coatings reduce operational strain, improve torque handling, and extend service life. Additionally, digital monitoring and predictive maintenance technologies are being integrated to track pipe performance and prevent failures. These trends reflect the industry’s focus on cost efficiency, operational safety, and performance optimization, driving broader adoption of advanced drill pipes in challenging environments such as deepwater and ultra-deep reservoirs.

The drill pipe market faces challenges from fluctuating raw material costs, primarily steel and alloy prices, which affect manufacturing expenses and pricing strategies. Compliance with strict industry standards, including ISO and API specifications, adds complexity to production and certification processes. Operational risks such as pipe fatigue, failure, or corrosion in extreme drilling conditions can further constrain adoption. Additionally, competition from alternative drilling technologies and international manufacturers intensifies market pressure. Companies must invest in quality assurance, R&D, and process optimization to ensure reliable, compliant, and high-performance drill pipe supply across diverse oilfield operations.

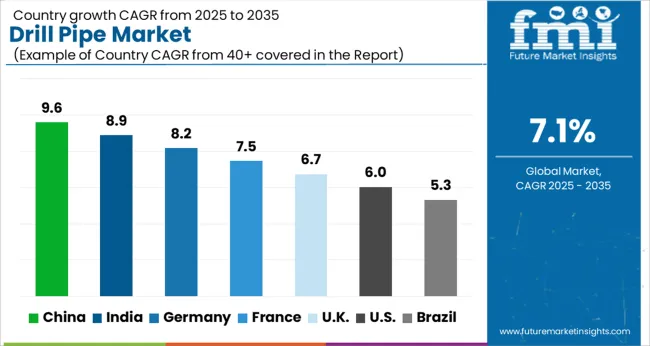

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

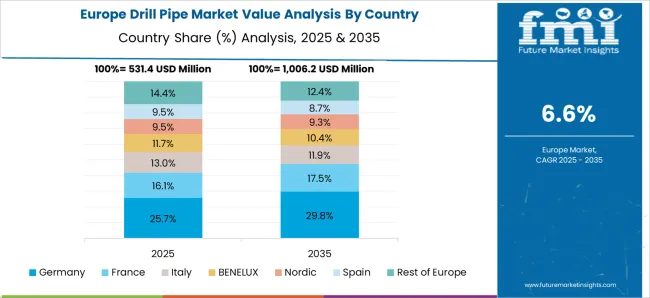

The global drill pipe market is projected to grow at a CAGR of 7.1% from 2025 to 2035. China leads with a growth rate of 9.6%, followed by India at 8.9% and Germany at 8.2%. The United Kingdom records a growth rate of 6.7%, while the United States shows the slowest growth at 6%. Market expansion is fueled by increasing exploration and production activities in the oil and gas sector, rising offshore and onshore drilling projects, and growing demand for high-performance and durable drill pipes. Emerging markets such as China and India experience higher growth due to infrastructure expansion, industrialization, and government support for energy exploration, while developed markets like the USA, UK, and Germany focus on technological reliability, safety compliance, and maintenance efficiency in oilfield operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The drill pipe market in China is projected to grow at a CAGR of 9.6%. Growth is driven by increasing onshore and offshore drilling projects, expansion in the oil and gas sector, and rising exploration activities. Demand for high-strength, corrosion-resistant, and lightweight drill pipes is growing. Local manufacturers are investing in advanced production technologies to meet rising industrial requirements. Government initiatives supporting energy exploration and industrial development further accelerate market adoption. Strategic partnerships with international suppliers help enhance quality standards and broaden application in challenging drilling environments.

The drill pipe market in India is expected to grow at a CAGR of 8.9%. Growth is fueled by increasing oil and gas exploration activities, expanding offshore drilling, and the development of shale and unconventional resources. Demand for durable and high-performance drill pipes is rising. Manufacturers focus on meeting international quality standards and supplying cost-effective solutions to domestic and export markets. Government policies promoting energy independence and industrial growth also support market adoption. Infrastructure expansion in energy sectors contributes to steady market growth.

The drill pipe market in Germany is projected to grow at a CAGR of 8.2%. Growth is driven by industrial oilfield operations, offshore drilling, and stringent safety standards requiring reliable and high-quality drill pipes. Manufacturers emphasize high-performance materials, corrosion resistance, and adherence to international specifications. Investment in research and development enhances product reliability and efficiency in drilling applications. The market is supported by ongoing infrastructure projects and demand from European oil and gas operators.

The drill pipe market in the United Kingdom is expected to grow at a CAGR of 6.7%. Growth is supported by offshore oil and gas exploration in the North Sea and increasing onshore drilling operations. Demand for durable, lightweight, and high-quality drill pipes is rising. Manufacturers focus on meeting safety and quality standards while improving operational efficiency. Adoption is further driven by exploration in unconventional oil and gas resources. Market expansion is strengthened by collaborations with service providers and energy operators to meet evolving drilling requirements.

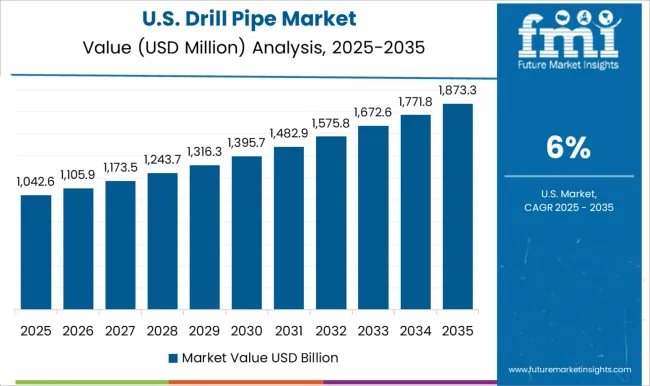

The drill pipe market in the United States is projected to grow at a CAGR of 6%. Demand is fueled by increasing drilling activities in shale formations, offshore oilfields, and unconventional energy resources. Adoption of high-strength, corrosion-resistant drill pipes ensures operational reliability and efficiency. Manufacturers emphasize quality compliance and cost-effective solutions to meet energy sector requirements. Growth is also supported by advancements in drilling technologies and expansion in oilfield infrastructure. Market adoption is further strengthened by partnerships between suppliers and service providers in the energy sector.

The drill pipe market is led by tubular manufacturers and oilfield service suppliers competing on material strength, fatigue resistance, and seamless integration with drilling operations. Vallourec, NOV, and Oil Country Tubular dominate with brochures highlighting high-grade steel, premium connections, and endurance under high-pressure, high-temperature (HPHT) conditions.

Marketing materials emphasize torsional strength, corrosion resistance, and compatibility with directional and deepwater drilling applications. DP-Master, Drillpipe International, and Drilling Tools International differentiate through custom designs, lightweight alloys, and enhanced thread profiles, showcased in brochures targeting offshore and unconventional drilling operators. Mid-sized suppliers such as Hilong, Holly Pipe, and Jiangyin Long Bright focus on regional demand, emphasizing cost-effective solutions and quality compliance. Brochures serve as essential tools to communicate mechanical performance, certification adherence, and operational reliability, influencing procurement and engineering decisions. Other players, including Taizhou Elite, Tejas Tubular, Texas Steel Conversion, TMK, Tube Technologies, Weatherock, and Wuxi Beilai, leverage manufacturing expertise and local distribution networks to capture niche applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Product | API grade and Premium grade |

| Application | Onshore and Offshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Vallourec, DP-Master, Drillpipe International, Drilling Tools International, Hilong, Holly Pipe, Jiangyin Long Bright, NOV, Oil Country Tubular, Taizhou Elite, Tejas Tubular, Texas Steel Conversion, TMK, Tube Technologies, Weatherock, and Wuxi Beilai |

| Additional Attributes | Dollar sales by pipe type (plain end, threaded, upset) and material grade (steel, alloy, premium) are key metrics. Trends include rising demand for high-strength, corrosion-resistant pipes, growth in onshore and offshore drilling activities, and adoption in deepwater and unconventional drilling operations. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global drill pipe market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the drill pipe market is projected to reach USD 4.3 billion by 2035.

The drill pipe market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in drill pipe market are api grade and premium grade.

In terms of application, onshore segment to command 68.9% share in the drill pipe market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Drill Drivers Market Size and Share Forecast Outlook 2025 to 2035

Drill Shank Adapter Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Drill Bit Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

Rock Drill Shank Adaptor Market Size and Share Forecast Outlook 2025 to 2035

Core Drill Automatic Feeding Machine Market

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Crawler Drilling Machine Market

Surface Drilling Rigs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA