The Onshore Drilling Waste Management Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. Oil and gas operators are under pressure to adopt safer, cost-efficient, and eco-friendly solutions, which has accelerated investments in advanced waste treatment technologies such as thermal desorption, bioremediation, and solidification.

A growing emphasis on resource recovery from drilling waste, particularly oil-based muds, is reshaping operational strategies across key exploration regions. Service providers are expanding portfolios to include recycling and treatment solutions that lower overall disposal costs while reducing environmental footprint. The rise in drilling activities in North America, the Middle East, and parts of Asia Pacific continues to sustain demand for effective waste management practices. At the same time, advancements in digital monitoring tools for waste streams are improving efficiency, traceability, and compliance in onshore operations.

| Metric | Value |

|---|---|

| Onshore Drilling Waste Management Market Estimated Value in (2025 E) | USD 3.8 billion |

| Onshore Drilling Waste Management Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The onshore drilling waste management market is expanding steadily due to the increasing focus on environmental sustainability and regulatory compliance within the oil and gas sector. As drilling activities intensify, the volume of generated waste requiring proper treatment and disposal has risen significantly.

Industry stakeholders have prioritized adopting efficient waste management solutions that minimize environmental impact and support circular economy principles. Advances in waste treatment technologies have enabled safer processing of drilling cuttings, mud, and other by-products, reducing soil and water contamination risks.

Regulatory frameworks worldwide have become more stringent, compelling operators to invest in compliant disposal methods and on-site treatment facilities. Additionally, community awareness and pressure have driven companies to adopt more responsible waste handling practices. The market’s future growth is expected to be fueled by increasing drilling operations in mature fields and the introduction of innovative waste treatment services. Segmental growth is anticipated to be led by the Treatment & Disposal service segment, reflecting the critical need for comprehensive waste management solutions in onshore drilling.

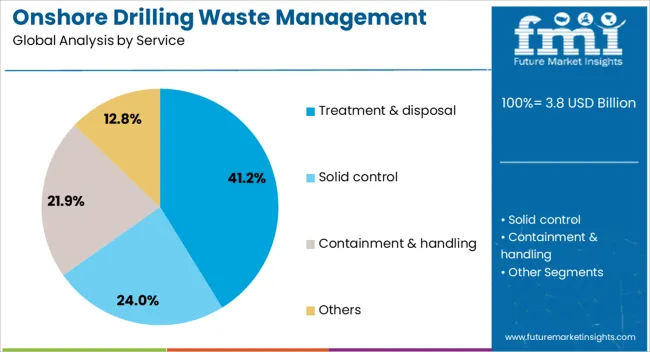

The onshore drilling waste management market is segmented by service and geographic regions. By service, the onshore drilling waste management market is divided into Treatment & disposal, Solid control, Containment & handling, and Others. Regionally, the onshore drilling waste management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Treatment & Disposal segment is projected to hold 41.2% of the onshore drilling waste management market revenue in 2025, maintaining its leadership among service types. This segment’s expansion is driven by the essential requirement to manage hazardous drilling waste safely and effectively to meet environmental regulations.

Treatment processes such as thermal desorption, solidification, and bioremediation have been increasingly adopted to reduce the toxicity and volume of drilling waste before final disposal. Disposal services, including landfill and deep well injection, continue to be necessary for residual materials that cannot be further treated.

Operators have prioritized treatment and disposal services to mitigate operational risks and avoid penalties related to improper waste handling. The increasing complexity of drilling waste composition has further emphasized the need for specialized treatment solutions. As regulatory scrutiny intensifies and drilling operations grow, the Treatment & Disposal segment is expected to maintain a critical role in managing environmental impact.

Onshore drilling waste management is being reshaped by compliance mandates, shale expansion, fluid recovery economics, and remediation services. These dynamics underline its position as both a regulatory necessity and a driver of drilling efficiency.

Onshore drilling waste management has been increasingly shaped by stringent compliance mandates and evolving environmental frameworks. Regulators across North America, Europe, and Asia have introduced tighter standards for cuttings disposal, fluid recovery, and site remediation, forcing operators to adopt structured waste handling solutions. Growing oversight has led to adoption of containment pits, thermal desorption, and secure landfilling methods designed to minimize soil and groundwater impact. Compliance audits are now routine, making adherence to safety and environmental policies a key operational requirement. These shifts are not only redefining operating practices but also creating opportunities for specialized waste management service providers with advanced treatment capabilities.

The expansion of shale and tight oil drilling has significantly driven demand for waste management services in onshore fields. High drilling intensity and extended well counts in regions such as the United States, Argentina, and China have increased cuttings and slurry volumes, requiring consistent treatment and safe disposal. The reliance on horizontal drilling and multi-stage fracking has amplified volumes of spent fluids, demanding reliable recycling and fluid recovery systems. Operators have responded by contracting third-party waste management firms for on-site solutions. This expansion has highlighted the role of waste management not just as a compliance need but as a performance factor influencing drilling efficiency.

Onshore drilling waste management has increasingly emphasized cost reduction through recovery of valuable drilling fluids. Recycling and reuse of drilling muds and fluids not only reduce environmental exposure but also improve operator economics by lowering fresh fluid purchases. Mechanical separation equipment such as centrifuges and dryers play a pivotal role in this recovery cycle, ensuring higher yield and minimizing disposal costs. Service providers offering turnkey recovery systems are gaining traction with operators seeking efficiency in waste-to-value conversion. This shift has altered competitive positioning, with those able to integrate recovery with treatment gaining stronger partnerships across drilling contractors and operators.

Site remediation has grown into a central component of onshore drilling waste management. Once drilling concludes, companies are increasingly obligated to restore land to pre-drilling conditions, covering soil treatment, vegetation reestablishment, and safe closure of pits. This service category has become a differentiator for operators competing for exploration licenses, particularly in regions where public opinion and local government approvals are critical. Innovative soil washing and bioremediation methods are being applied to reduce environmental footprint while meeting local compliance demands. This evolving role demonstrates that waste management now extends beyond active drilling phases, carrying importance throughout the lifecycle of exploration projects.

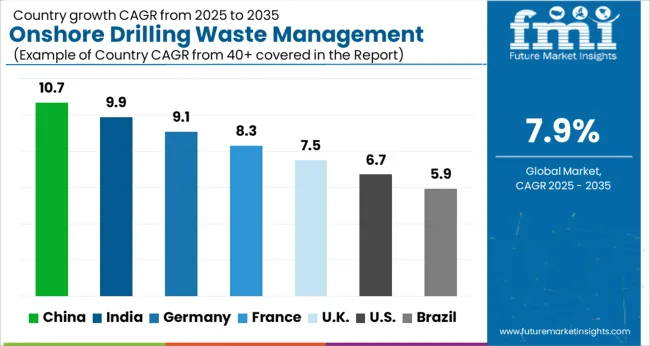

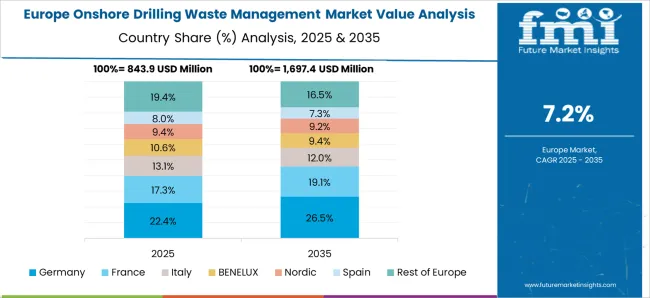

The onshore drilling waste management market is forecast to expand at a global CAGR of 7.9% between 2025 and 2035, supported by stronger regulatory frameworks, shale gas development, and rising demand for fluid recovery systems. China leads with a CAGR of 10.7%, driven by extensive shale operations, stricter compliance mandates, and investments in advanced cuttings treatment technologies. India follows at 9.9%, supported by growing oil and gas exploration projects, expansion of drilling sites, and higher demand for cost-effective slurry management solutions. France posts 8.3%, shaped by regulatory-driven remediation and growing adoption of waste recovery systems.

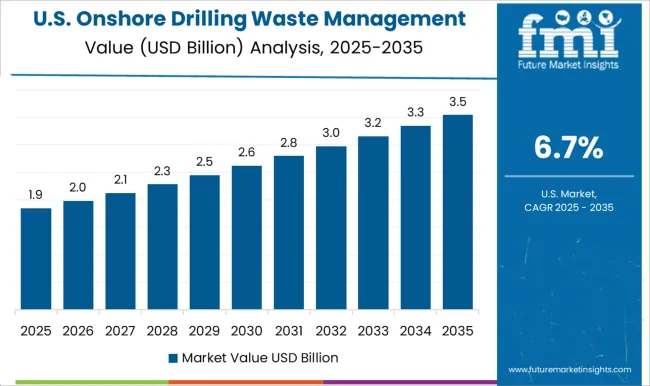

The United Kingdom grows at 7.5%, benefiting from compliance-focused drilling projects, fluid recycling, and remediation contracts. The United States reports 6.7%, reflecting its mature exploration base but steady expansion in shale-focused waste treatment and remediation services. This profile highlights Asia-Pacific as the strongest growth hub, while Europe remains driven by regulatory compliance, and North America continues to expand through shale operations and technology-enabled waste recovery.

China is expected to achieve a CAGR of 10.7% for 2025-2035, well above the global 7.9% average, supported by high-intensity shale exploration, tighter waste disposal standards, and investments in thermal treatment systems. During 2020-2024, CAGR was closer to 8.9%, shaped by rising onshore drilling volumes and growing focus on cuttings management in unconventional wells. The shift upward into 2025-2035 is linked to large-scale adoption of recovery technologies for drilling fluids, alongside the government’s enforcement of stricter remediation requirements. Expansion in shale-rich provinces and partnerships between state-owned enterprises and waste management specialists will reinforce momentum. In my opinion, China’s scale and policy push ensure its leadership.

India is projected to post a CAGR of 9.9% during 2025-2035, above the global benchmark, driven by expanding exploration programs and cost-effective slurry treatment adoption. Between 2020-2024, growth was near 8.1%, influenced by steady exploration activity, limited regional remediation policies, and growing reliance on third-party service providers. The move to a higher trajectory in 2025-2035 stems from rising activity in offshore-to-onshore integrated projects, stronger environmental oversight, and rising demand for pit closure and site restoration services. Infrastructure improvements in energy corridors and the use of regional treatment hubs add stability. My assessment is that India’s fast-growing energy demand and policy focus on compliance underpin long-term growth.

France is forecast to post a CAGR of 8.3% for 2025-2035, supported by a regulatory-driven waste management structure that emphasizes fluid recycling and land remediation. From 2020-2024, CAGR was closer to 6.7%, shaped by moderate drilling activity but strong adoption of soil restoration techniques. The shift upward is explained by evolving EU directives on hazardous waste, which require stricter standards for onshore operations. Adoption of centralized treatment plants for drill cuttings and increased investment in bioremediation will add momentum. In my opinion, France’s growth reflects a compliance-led market where service providers thrive on offering reliable, regulation-ready solutions.

The United Kingdom is expected to achieve a CAGR of 7.5% in 2025-2035, slightly below the global 7.9% level, but higher than its earlier performance. Between 2020-2024, CAGR was closer to 6.2%, limited by delayed drilling approvals, high treatment costs, and constrained infrastructure. The rise to 7.5% reflects policy stabilization, investment in cuttings reinjection methods, and growth in site remediation services linked to mature field decommissioning. With a focus on compliance, operators are increasingly adopting on-site treatment and regional waste hubs. In my opinion, the UK’s recovery stems from combining policy certainty with advanced remediation practices.

The United States is forecast to record a CAGR of 6.7% for 2025-2035, below the global path but significant given its maturity. From 2020-2024, CAGR was closer to 5.5%, shaped by shale activity fluctuations, cost-driven adoption of basic waste management, and selective investment in remediation. The move upward to 6.7% reflects steady shale drilling intensity, growing use of fluid recovery technologies, and incremental adoption of thermal treatment in environmentally sensitive states. In my opinion, the USA growth path shows a mature but evolving market where cost efficiency and compliance continue to drive selective investments in advanced solutions.

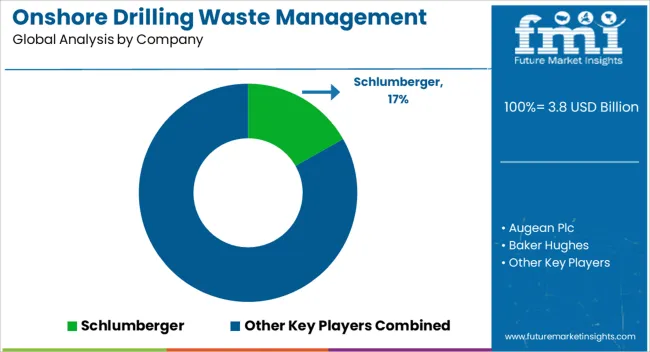

The onshore drilling waste management market is shaped by a combination of global oilfield service leaders, regional specialists, and niche technology providers delivering solutions for solids control, cuttings handling, and site remediation. Schlumberger, Halliburton, and Baker Hughes dominate with integrated drilling waste services, leveraging global networks and advanced treatment systems, from cuttings reinjection to thermal desorption technologies.

Weatherford and NOV Inc. focus on equipment-driven waste solutions, including shakers, centrifuges, and fluid recovery units that optimize efficiency on drilling sites. Clean Harbors, Inc., Secure Energy Services, Inc., and Newpark Resources Inc. emphasize waste treatment, recycling, and disposal services, expanding through regional facilities and partnerships with oil and gas operators. Augean Plc, TWMA, and Ridgeline Canada Inc. have built strong reputations in the UK and North America for hazardous waste handling, onshore waste logistics, and closed-loop treatment systems.

GN Solids Control and Derrick Equipment Company are recognized for their technical specialization in solids control equipment, supporting operators with reliable separation technology. Imdex Limited and SELECT Water Solutions contribute expertise in drilling fluids and water treatment, ensuring efficient fluid recovery and reuse. Soli-Bond, Inc. and Geminor bring regional strengths in soil treatment and remediation, focusing on compliance-driven services. Together, these players differentiate through technological reliability, breadth of services, and strategic regional expansions. Competitive positioning is reinforced by ongoing investment in equipment upgrades, development of cost-efficient treatment methods, and strong operator partnerships to meet tightening regulatory standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Service | Treatment & disposal, Solid control, Containment & handling, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger, Augean Plc, Baker Hughes, CLEAN HARBORS, INC., Derrick Equipment Company, Geminor, GN Solids Control, Halliburton, Imdex Limited, Newpark Resources Inc., NOV Inc., Ridgeline Canada Inc., Secure Energy Services, Inc., SELECT WATER SOLUTIONS., Soli-Bond, Inc., TWMA, and Weatherford |

| Additional Attributes | Dollar sales, share, regulatory impact on services, regional drilling activity trends, competitive landscape, cost of advanced treatment systems, and operator adoption rates. |

The global onshore drilling waste management market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the onshore drilling waste management market is projected to reach USD 8.1 billion by 2035.

The onshore drilling waste management market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in onshore drilling waste management market are treatment & disposal, solid control, containment & handling and others.

In terms of , segment to command 0.0% share in the onshore drilling waste management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Onshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Crawler Drilling Machine Market

Surface Drilling Rigs Market

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Multi Pad Drilling Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Growth – Trends & Forecast 2024-2034

Diamond Core Drilling Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Diamond Core Drilling Market Share

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA