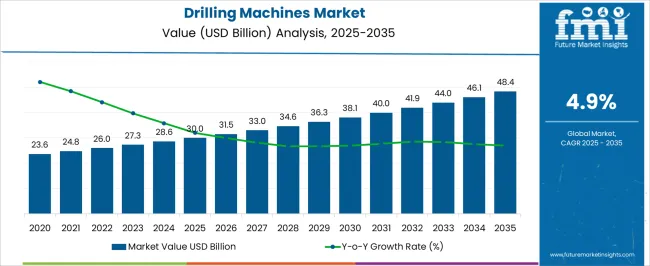

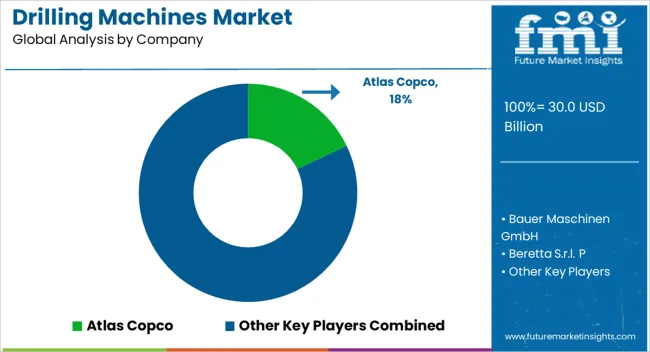

The drilling machines market is valued at USD 30.0 billion in 2025 and expands to USD 48.4 billion by 2035, reflecting a CAGR of 4.9%. Analysis of acceleration and deceleration patterns reveals how growth rates fluctuate over the forecast period, influenced by industrial demand, technological innovation, and regional adoption trends. From 2021 to 2025, the market rises from USD 23.6 billion to USD 30.0 billion, passing through USD 24.8 billion, 26.0 billion, 27.3 billion, and 28.6 billion.

During this early phase, growth accelerates moderately as demand in construction, automotive, and manufacturing sectors strengthens, supported by adoption of advanced CNC drilling machines and automated systems. Incremental gains are driven primarily by volume expansion rather than pricing changes. Between 2026 and 2030, the market continues its upward trajectory from USD 31.5 billion to USD 38.1 billion, with intermediate values of USD 33.0 billion, 34.6 billion, and 36.3 billion. This period reflects a slight deceleration in growth rate compared to the early phase, as market penetration reaches mid-level adoption and replacement cycles in mature regions stabilize.

From 2031 to 2035, the market climbs from USD 40.0 billion to USD 48.4 billion, passing through USD 41.9 billion, 44.0 billion, and 46.1 billion. Growth acceleration picks up slightly due to expansion in emerging markets, increasing demand for energy-efficient and high-precision drilling machines, and ongoing industrial modernization.

| Metric | Value |

|---|---|

| Drilling Machines Market Estimated Value in (2025 E) | USD 30.0 billion |

| Drilling Machines Market Forecast Value in (2035 F) | USD 48.4 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The drilling machines market is strongly influenced by five interconnected parent markets, each contributing to overall demand and technological adoption. The construction and infrastructure market holds the largest share at 35%, as drilling machines are essential for foundations, tunneling, bridge construction, and road development projects worldwide. The mining and quarrying market follows with a 25% share, driven by the need for heavy-duty machines to perform rock drilling, mineral extraction, and blasting operations efficiently and safely.

The oil and gas exploration market accounts for 20%, where specialized drilling rigs and machines enable onshore and offshore exploration, extraction, and well development, ensuring energy security and supply. The manufacturing and metalworking market holds a 12% share, with drilling machines playing a key role in precision component fabrication, industrial machining, and assembly operations. Finally, the geotechnical and environmental survey market represents 8%, supporting soil testing, groundwater exploration, and environmental assessments for sustainable development projects.

The drilling machines market is witnessing robust growth driven by advancements in precision engineering, expanding industrial automation, and demand for efficient hole-making processes across sectors. Rising capital investments in manufacturing, aerospace, and automotive industries have amplified the need for versatile drilling systems with high productivity.

In addition, the transition toward smart factories and the integration of digital monitoring systems have increased the adoption of semi-automated and CNC-based machines. As industries seek to minimize manual labor, reduce cycle times, and enhance machining accuracy, drilling technologies are evolving with capabilities for multi-axis movement, real-time diagnostics, and energy-efficient operation.

Emerging economies are further fueling demand by expanding infrastructure and boosting production capacity in metalworking and fabrication segments.

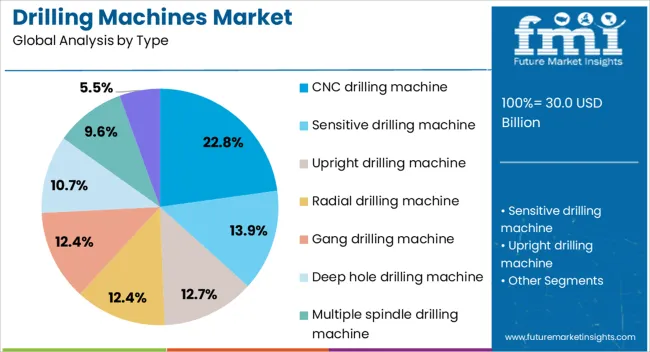

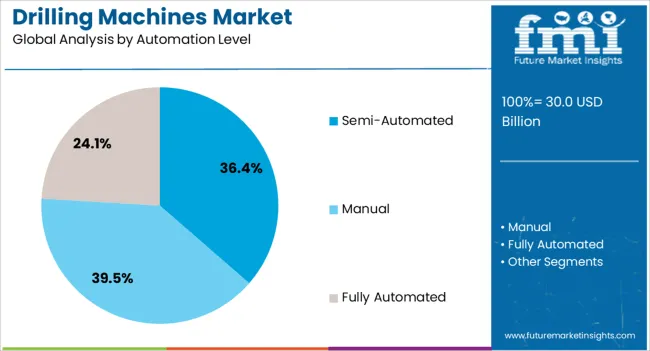

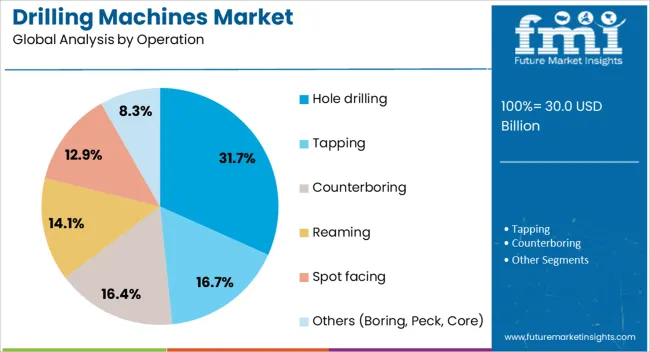

The drilling machines market is segmented by type, automation level, operation, structure, power source, application, end use, and geographic regions. By type, the drilling machines market is divided into CNC drilling machines, Sensitive drilling machines, Upright drilling machines, Radial drilling machines, Gang drilling machines, Deep hole drilling machines, Multiple spindle drilling machines, and Others (magnetic drilling machines).

In terms of automation level, the drilling machines market is classified into Semi-Automated, Manual, and Fully Automated. Based on operation, the drilling machines market is segmented into Hole drilling, Tapping, Counterboring, Reaming, Spot facing, and Others (Boring, Peck, Core). By structure, drilling machines market is segmented into Fixed and Portable. By power source, drilling machines market is segmented into Corded and Battery powered. By application, drilling machines market is segmented into Metal drilling, Wood drilling, Fiber & plastic drilling, Composite material drilling, Glass and ceramic drilling, and Others (Medical implants & Surgical tools, PCB drilling (Micro drilling), etc.). By end use, drilling machines market is segmented into Automotive, Aerospace, Heavy equipment, Energy industry, Military & defense, and Others. Regionally, the drilling machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CNC drilling machine segment is expected to lead the drilling machines market with a 22.80% share in 2025. The need for enhanced accuracy, repeatability, and programmability in complex drilling operations drives its prominence.

CNC models reduce operator intervention while enabling faster cycle times and consistent quality, particularly in high-volume production. Their integration with computer-aided manufacturing (CAM) software and multi-axis capabilities makes them indispensable in aerospace, electronics, and precision tooling applications.

Manufacturers favor CNC drilling machines due to their adaptability for different materials and their ability to incorporate tool libraries, automated measurement, and error reduction systems.

Semi-automated drilling machines are projected to hold 36.40% of the market by 2025, making them the leading automation level segment. Their appeal lies in the balance they strike between cost efficiency and partial automation, especially for small-to-medium enterprises.

These systems allow for enhanced productivity over manual machines while maintaining affordability and operational flexibility. They are widely adopted in industries that require frequent tool changes, varied production runs, or operator involvement in component positioning and inspection.

The growing availability of retrofitting solutions and modular automation kits has further bolstered adoption of semi-automated machines across developing regions.

Hole drilling is expected to account for 31.70% of the total market share in 2025, securing its position as the dominant operation type. This leadership stems from its critical role in manufacturing assemblies across construction, transportation, and industrial machinery sectors.

Demand for precise, clean, and fast hole-making is rising with the production of structural components, enclosures, and fastener systems. Advanced bit technologies, variable feed rates, and coolant delivery enhancements have further improved efficiency in hole drilling tasks.

Given the ubiquity of hole-making in product design and fabrication, this operation remains a fundamental and high-frequency application within drilling processes.

The drilling machines market is growing as industrial, construction, and automotive sectors prioritize precision, efficiency, and productivity. Demand is driven by metalworking, construction, and manufacturing applications requiring versatile drilling solutions for varied materials. Challenges include high capital costs, energy consumption, and maintenance complexity. Opportunities exist in CNC-enabled, automated, and portable drilling systems, as well as IoT-connected equipment. Trends highlight advanced spindle technology, automation, digital monitoring, and multi-functional drilling solutions. Suppliers offering reliable machinery, technical support, and end-to-end integration are best positioned to capture long-term industrial contracts.

Manufacturers and construction firms are increasingly adopting drilling machines to enhance operational efficiency, ensure high precision, and reduce manual labor dependency. The market is driven by demand for metal fabrication, woodworking, and construction applications requiring high-speed and heavy-duty drilling. CNC and automated systems are becoming standard for precision drilling, enabling reduced errors and faster turnaround times. Portable and compact machines are also gaining traction for on-site applications. The increasing complexity of modern components and assemblies necessitates reliable and accurate drilling solutions. As industries adopt smart factory practices, drilling machines integrated with digital monitoring, predictive maintenance, and automation are positioned as essential equipment for operational efficiency and quality assurance.

The drilling machines market faces challenges from fluctuating raw material costs, particularly steel and alloys, which affect production and final pricing. Maintenance requirements, energy consumption, and downtime add to operational costs. Supply chain disruptions for components, spindle units, and electronics can delay deliveries, especially for high-precision machines. Compliance with workplace safety standards, CE certifications, and industry-specific regulations adds complexity. Machine calibration, vibration control, and noise reduction are technical constraints requiring careful design and engineering. Proprietary CNC software and automation technology may limit supplier options. Buyers increasingly prefer manufacturers that provide full technical support, predictable delivery timelines, and training for operators to ensure safety, efficiency, and reliable performance.

Opportunities are growing in CNC drilling, automated production lines, and IoT-enabled machinery. CNC systems allow high-precision, repeatable drilling for automotive, aerospace, and industrial metalworking applications. Portable and compact machines are in demand for construction sites, maintenance operations, and small-scale workshops. IoT-enabled drilling machines provide real-time performance monitoring, predictive maintenance, and integration with smart factory systems. Multi-functional machines combining drilling, tapping, and milling capabilities reduce capital investment and save floor space. Regional industrial expansion in Asia-Pacific, Europe, and North America drives demand for high-end and mid-range equipment. Suppliers offering modular designs, digital monitoring, and turnkey solutions are likely to capture growth opportunities across both established and emerging markets.

CNC-controlled machines with automated tool changers, precision sensors, and AI-driven monitoring improve productivity and reduce operator dependency. Multi-functional drilling machines capable of tapping, reaming, and milling in a single setup are gaining preference. IoT connectivity enables predictive maintenance, remote monitoring, and integration with production management systems. Manufacturers are emphasizing vibration reduction, energy efficiency, and longer tool life to enhance performance. Partnerships between drilling machine producers and software developers are driving innovation in digital interfaces, analytics, and operator training programs. Suppliers that offer high-performance, reliable, and digitally enabled drilling solutions are well positioned to meet evolving industrial needs.

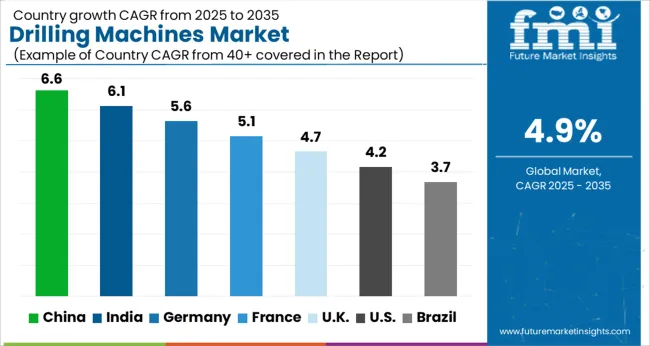

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global drilling machines market is projected to expand at a CAGR of 4.9% from 2025 to 2035. China leads growth at 6.6%, followed by India at 6.1% and Germany at 5.6%, while the UK and the USA grow at 4.7% and 4.2% respectively. BRICS nations, particularly China and India, are driving demand through infrastructure, mining, and manufacturing expansion. OECD countries, including Germany, the UK, and the USA, focus on high-precision, automated, and energy-efficient drilling solutions. Growth is propelled by urbanization, industrial modernization, and adoption of digital monitoring and predictive maintenance systems, creating opportunities across construction, automotive, aerospace, and energy sectors. The analysis includes over 40+ countries, with the leading markets detailed below.

The drilling machines market inn China is projected to grow at a CAGR of 6.6% from 2025 to 2035, fueled by rapid industrialization, urban infrastructure development, and growth in automotive and electronics manufacturing. High-capacity CNC and automated drilling machines are in strong demand to enhance precision and production efficiency. Construction and mining sectors increasingly adopt portable and heavy-duty equipment for urban and resource extraction projects. Collaborations with global suppliers allow technology transfer and integration of advanced digital monitoring systems. Investments in industrial parks, smart factories, and energy sectors provide a supportive environment for drilling technology adoption.

The drilling machines market in India is expected to grow at a CAGR of 6.1%, driven by metro rail projects, highways, mining, and automotive sectors. Industrial and construction-grade drilling machines are increasingly adopted to meet project timelines and operational efficiency requirements. Domestic manufacturers are introducing versatile equipment suitable for heavy-duty and small-scale industrial operations. Automation and digitally monitored drilling systems improve productivity while minimizing errors. Government initiatives to modernize manufacturing hubs, boost local production, and enhance industrial infrastructure further support market expansion.

The drilling machines market in Germany is forecasted to expand at a CAGR of 5.6% from 2025 to 2035, powered by automotive, aerospace, and high-precision manufacturing sectors. Industrial 4.0 programs encourage deployment of smart CNC and automated drilling machines with predictive maintenance and real-time monitoring. Demand exists for energy-efficient and modular equipment adaptable to various production needs. Collaboration between manufacturers, research institutions, and engineering firms fosters innovation and continuous improvement. High-quality standards and regulatory compliance drive adoption of advanced drilling solutions across industrial segments.

The UK drilling machines market is expected to grow at a CAGR of 4.7%, led by industrial, construction, and automotive sectors. Compact and portable drilling machines are increasingly preferred for site flexibility. Advanced automated systems with digital controls enhance productivity and reduce operational errors. Infrastructure development projects, including energy and commercial construction, provide steady demand. Service and maintenance networks from domestic suppliers ensure equipment reliability. Manufacturers focus on modular designs to support diverse industrial applications and quick deployment across projects.

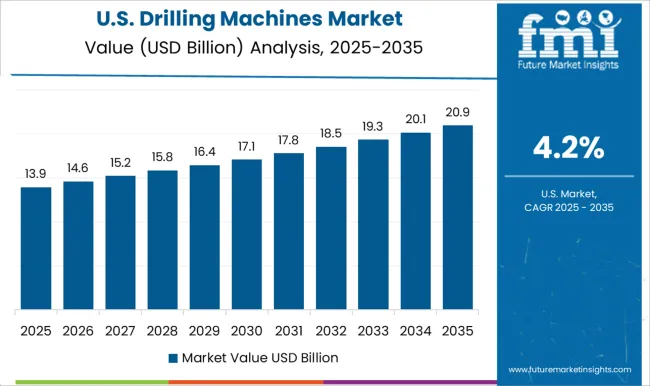

The USA drilling machines market is projected to grow at a CAGR of 4.2%, supported by industrial, aerospace, automotive, and energy sectors. Heavy-duty and precision drilling machines are deployed for manufacturing and infrastructure projects. Adoption of automation, digital monitoring, and predictive maintenance tools improves operational efficiency and reduces downtime. Domestic manufacturers focus on energy-efficient solutions and compliance with safety and quality standards. Oil, gas, and civil construction projects further boost demand for versatile equipment. Collaborations with technology providers allow integration of advanced control systems for high-precision drilling applications.

Competition in the drilling machines market is defined by precision, power output, and adaptability to diverse geological conditions. Atlas Copco and Epiroc AB lead with hydraulic and rotary drilling rigs optimized for mining, construction, and tunneling, emphasizing modular components, automation, and telematics integration. Caterpillar and Hitachi Construction Machinery compete with robust crawler and rotary drilling platforms designed for high productivity in challenging sites. Sandvik AB, Bauer Maschinen GmbH, and Soilmec S.p.A. focus on specialty rigs for foundation drilling, piling, and deep earthworks where precision and reliability are critical. European and Asian players such as Liebherr Group, Mitsubishi Heavy Industries, Ingersoll Rand, Robert Bosch GmbH, KURAKI Co Ltd, and Shenyang Machine Tool Co Ltd emphasize compact rigs, low vibration, and energy efficiency for urban construction and utility projects. Boart Longyear, Beretta S.r.l., and ERLO Group target mining exploration and core drilling with high accuracy and depth penetration.

Smaller manufacturers, including Minitool, Dezhou Hongxin Machine Tool, and Cheto Corporation SA, provide entry-level and mid-capacity units for regional construction markets. Strategies center on automation, IoT-enabled monitoring, and modular rig design. Telemetry-based condition monitoring, predictive maintenance, and remote diagnostics are marketed to reduce downtime and enhance operational efficiency. Hybrid diesel-electric and fuel-efficient hydraulic systems are prioritized for cost-effective operations. Partnerships with construction and mining contractors enable tailored solutions, while retrofit kits allow upgrades without full equipment replacement. Product brochure content highlights rotary, percussion, and core drilling rigs with specifications on drill depth, torque, rotation speed, mast height, and power rating. Accessories such as augers, drill bits, stabilizers, and hydraulic attachments are detailed. Safety systems, vibration control, operator cabins, and mobile platform options are presented, along with maintenance kits, spare parts, and support service packages to ensure reliable deployment in diverse drilling environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.0 Billion |

| Type | CNC drilling machine, Sensitive drilling machine, Upright drilling machine, Radial drilling machine, Gang drilling machine, Deep hole drilling machine, Multiple spindle drilling machine, and Others (magnetic drilling machine) |

| Automation Level | Semi-Automated, Manual, and Fully Automated |

| Operation | Hole drilling, Tapping, Counterboring, Reaming, Spot facing, and Others (Boring, Peck, Core) |

| Structure | Fixed and Portable |

| Power Source | Corded and Battery powered |

| Application | Metal drilling, Wood drilling, Fiber & plastic drilling, Composite material drilling, Glass and ceramic drilling, and Others (Medical implants & Surgical tools, PCB drilling (Micro drilling), etc.) |

| End Use | Automotive, Aerospace, Heavy equipment, Energy industry, Military & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco, Bauer Maschinen GmbH, Beretta S.r.l. P, Boart Longyear, Caterpillar, Cheto Corporation SA, Dezhou Hongxin Machine Tool Co Ltd, Epiroc AB, ERLO Group, Hitachi Construction Machinery Ltd, Ingersoll Rand, KURAKI Co Ltd, Liebherr Group, Minitool, Mitsubishi Heavy Industries Ltd., Robert Bosch GmbH, Sandvik AB, Shenyang Machine Tool Co Ltd, SMTCL, and Soilmec S.p.A. |

| Additional Attributes | Dollar sales by machine type (rotary, percussive, diamond core, auger), power source (electric, diesel, hydraulic), and application (mining, construction, oil & gas, civil engineering). Demand dynamics are driven by infrastructure expansion, resource exploration, and automation adoption in drilling operations. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by large-scale mining projects, urban development, and government investments in energy and infrastructure sectors. |

The global drilling machines market is estimated to be valued at USD 30.0 billion in 2025.

The market size for the drilling machines market is projected to reach USD 48.4 billion by 2035.

The drilling machines market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in drilling machines market are cnc drilling machine, sensitive drilling machine, upright drilling machine, radial drilling machine, gang drilling machine, deep hole drilling machine, multiple spindle drilling machine and others (magnetic drilling machine).

In terms of automation level, semi-automated segment to command 36.4% share in the drilling machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Crawler Drilling Machine Market

Surface Drilling Rigs Market

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Multi Pad Drilling Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Growth – Trends & Forecast 2024-2034

Diamond Core Drilling Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Diamond Core Drilling Market Share

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Lathe Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA