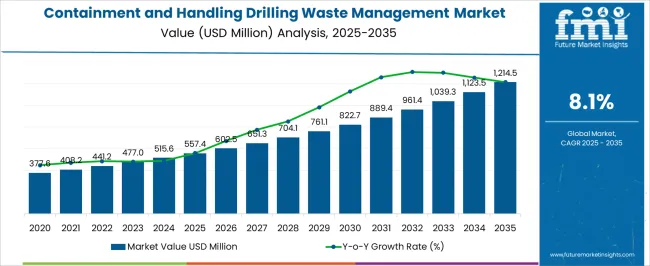

The containment and handling drilling waste management market is estimated to be valued at USD 557.4 million in 2025 and is projected to reach USD 1214.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. The growth curve of the containment and handling drilling waste management market is expected to follow a consistent upward trajectory. The market is anticipated to grow steadily year on year, moving from USD 557.4 million in 2025 to USD 602.5 million in 2026, reaching USD 704.1 million by 2028. This trajectory reflects the increasing emphasis on efficient handling and containment solutions in drilling operations, where regulatory pressures and operational safety considerations drive demand for reliable waste management solutions.

By 2035, the market is projected to more than double, reaching USD 1,214.5 million, driven by rising activity in oil and gas exploration and production across major regions. The consistent growth pattern highlights that containment and handling systems are being increasingly integrated into operational workflows to reduce risks, maintain compliance, and improve efficiency. As drilling projects become more complex and expansive, the need for advanced waste management solutions is expected to intensify, positioning this market as a critical element in the overall operational strategy. The projected expansion signals strong opportunities for providers of specialized containment and handling technologies, as well as for service companies aiming to support safer and more effective drilling operations.

| Metric | Value |

|---|---|

| Containment and Handling Drilling Waste Management Market Estimated Value in (2025 E) | USD 557.4 million |

| Containment and Handling Drilling Waste Management Market Forecast Value in (2035 F) | USD 1214.5 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The containment and handling drilling waste management market is a specialized segment within the oil and gas drilling market, where it currently accounts for around 5-6% share, reflecting its critical role in managing drilling cuttings, mud, and other hazardous by-products generated during extraction. In the environmental services market, the share is approximately 3-4%, as this sector encompasses a wide range of waste treatment and disposal solutions, with drilling waste management representing a highly regulated and technically demanding subset. Within the industrial waste management market, the segment captures roughly 2-3% share, highlighting its importance in reducing environmental impact and ensuring compliance with local and international regulations.

The energy infrastructure market contributes about 4-5% share, as proper handling of drilling waste is essential for maintaining sustainable operations in both upstream and midstream energy projects. Meanwhile, in the onshore and offshore drilling equipment market, the share of containment and handling drilling waste management is around 3-4%, driven by the need for specialized equipment and systems to store, transport, and treat drilling by-products safely. Collectively, these parent markets underscore the growing significance of drilling waste management as operators and governments increasingly prioritize environmental protection, regulatory compliance, and operational safety. With stricter regulations and rising focus on sustainable practices in oil and gas extraction, the market is expected to expand steadily, strengthening its share across these key parent industries over the coming decade.

The containment and handling drilling waste management market is expanding steadily, driven by increasingly stringent environmental regulations and a rising focus on safe disposal and recycling of drilling by-products. Operators are investing in mobile and modular containment solutions to reduce on-site spillage and enable streamlined transportation of hazardous waste.

Innovations in solids control and closed-loop systems are also enhancing compliance and reducing contamination risks. Growing energy demand, especially in emerging economies, is further prompting drilling activities, thereby amplifying the demand for effective waste containment infrastructure. Regulatory incentives and penalties around ecological protection continue to accelerate technology adoption and services in this space.

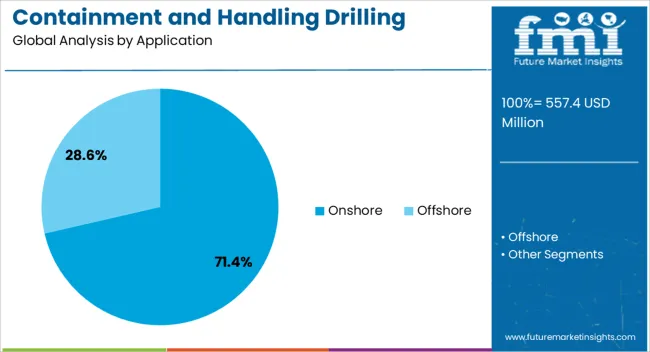

The containment and handling drilling waste management market is segmented by application and geographic regions. By application, containment and handling drilling waste management market is divided into Onshore and Offshore. Regionally, the containment and handling drilling waste management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The onshore segment is expected to dominate with 71.40% share of the containment and handling drilling waste management market by 2025. This leadership is attributed to the widespread presence of onshore drilling sites across regions like North America, Asia Pacific, and the Middle East.

Lower operational costs, logistical simplicity, and easier regulatory coordination in onshore environments have contributed to higher drilling activity and, consequently, more substantial waste generation. Onshore sites benefit from improved access to containment infrastructure, waste transportation networks, and land treatment options.

Government regulations aimed at minimizing groundwater contamination and soil degradation are compelling companies to adopt advanced on-site waste handling systems, further solidifying this segment's dominance.

The containment and handling drilling waste management market is growing alongside rising oil and gas exploration. Opportunities exist in environmentally compliant treatment solutions and turnkey service offerings. Trends include automation, IoT monitoring, and predictive analytics for safer and more efficient operations. However, high costs and stringent regulatory compliance remain challenges. Market growth will depend on adopting scalable, cost-effective solutions and innovative technologies that improve safety, environmental performance, and operational efficiency across drilling projects worldwide.

The containment and handling drilling waste management market is growing due to increasing oil and gas exploration activities globally. With deepwater drilling, shale exploration, and onshore projects expanding, the volume of drilling waste generated has surged, creating a strong need for safe and efficient waste management solutions. Proper containment and treatment of drilling mud, cuttings, and other by-products are essential for operational safety and environmental compliance. Stringent regulations in regions like North America and Europe further drive demand for advanced waste handling technologies and services.

Significant opportunities are emerging in environmentally compliant and sustainable drilling waste management solutions. Companies providing advanced treatment technologies, such as solidification, stabilization, and recycling of drilling fluids, are gaining traction. Emerging markets with expanding oilfields present prospects for service providers who can offer turnkey solutions to manage waste efficiently while adhering to local regulations. Partnerships with drilling operators for integrated waste management programs also enhance business potential. Growing awareness of environmental responsibility among oil and gas companies reinforces the adoption of innovative containment and handling technologies.

A key trend in the market is the adoption of automation and real-time monitoring systems to manage drilling waste more efficiently. Sensors and IoT-enabled equipment allow continuous tracking of waste volumes, treatment efficacy, and regulatory compliance. Automation reduces human exposure to hazardous materials and improves operational safety. Companies increasingly prefer modular and scalable systems that can be deployed across multiple drilling sites. The integration of predictive analytics helps optimize processes, reduce downtime, and cut disposal costs, making these technological trends critical for competitive positioning in the market.

The market faces challenges due to stringent environmental regulations and the high cost of advanced waste management systems. Compliance with local and international standards can be complex, requiring continuous monitoring, reporting, and certification. Smaller operators may struggle with capital-intensive equipment and operational costs, limiting market penetration. In addition, variations in drilling practices, waste types, and site conditions complicate standardized solutions.

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

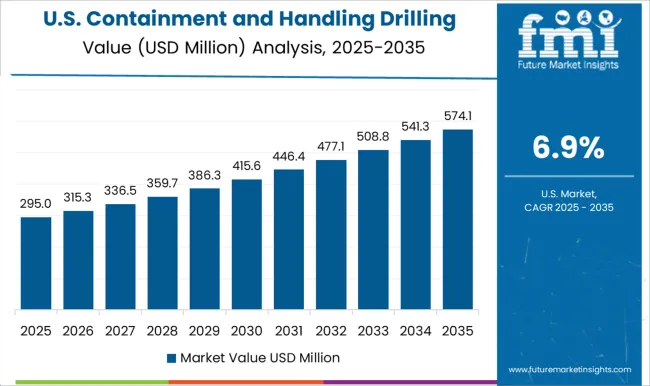

| USA | 6.9% |

| Brazil | 6.1% |

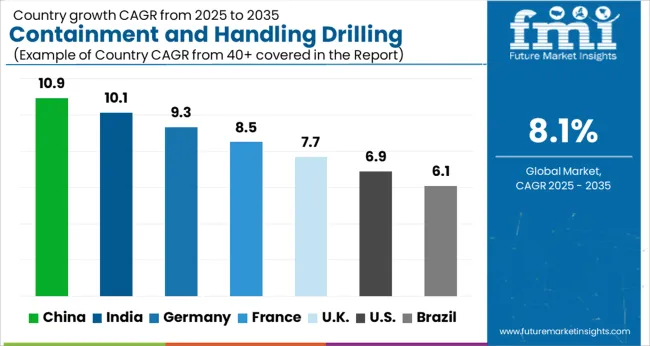

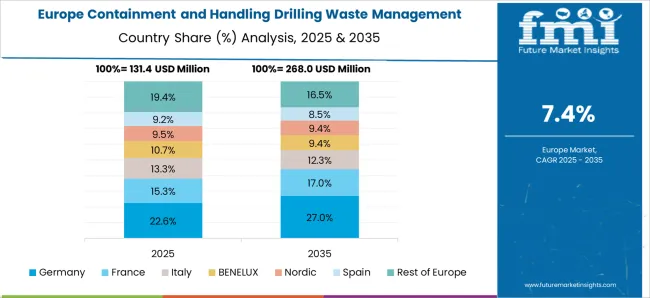

The global containment and handling drilling waste management market is projected to grow at a CAGR of 8.1% from 2025 to 2035. China leads with a growth rate of 10.9%, followed by India at 10.1% and Germany at 9.3%. The United Kingdom records a growth rate of 7.7%, while the United States shows the slowest growth at 6.9%. Expansion is supported by increasing drilling activities, stricter environmental regulations, and growing adoption of waste containment technologies. Emerging economies like China and India benefit from rising oil and gas exploration, while developed nations such as the USA, UK, and Germany are focusing on advanced waste treatment, compliance, and efficiency. This report includes insights on 40+ countries; the top markets are shown here for reference.

The containment and handling of drilling waste management market in China is growing at a 10.9% CAGR, the highest among leading nations. Rapid oil and gas exploration, especially offshore and shale projects, drives significant demand for advanced containment and treatment systems. Companies are implementing cutting-edge waste separation, recycling, and storage technologies to comply with environmental standards. Domestic and international players are collaborating to strengthen infrastructure and operational safety. The rise in drilling volumes and government initiatives to manage hazardous byproducts further boost market adoption.

The containment and handling of drilling waste management market in India is advancing at a 10.1% CAGR, fueled by growth in onshore and offshore drilling operations. Rising petroleum and natural gas production necessitates proper treatment of drilling byproducts and hazardous waste. Companies are increasingly adopting waste recycling and containment technologies to meet stricter environmental and safety standards. Government initiatives promoting cleaner energy and safe disposal practices encourage the deployment of advanced solutions. Collaborations with international technology providers support knowledge transfer and enhance operational efficiency in drilling waste management.

The containment and handling of drilling waste management market in Germany is projected to grow at a 9.3% CAGR. Strict regulatory frameworks on drilling waste and the focus on sustainable disposal methods primarily drive growth. Germany’s mature oil and gas sector requires advanced treatment technologies, including solid-liquid separation, filtration, and neutralization systems. Energy companies and service providers are increasingly investing in automated and monitoring-enabled waste management solutions to ensure compliance and safety. The market benefits from both replacement and new installations of containment systems across drilling sites.

The containment and handling of drilling waste management market in the United Kingdom is expanding at a 7.7% CAGR, influenced by offshore oil and gas exploration. Operators are increasingly adopting containment and treatment technologies to manage drilling byproducts safely. Stringent environmental standards and EU-aligned regulations support steady market demand. Advanced separation, storage, and recycling technologies are being integrated to reduce operational risks. Partnerships between service providers and oil companies are enhancing deployment efficiency. The UK market remains growth-oriented, driven by offshore energy production and compliance initiatives.

The containment and handling of drilling waste management market in the United States is growing at a 6.9% CAGR. Growth is driven by shale gas, tight oil production, and increasing environmental compliance requirements. Service providers are deploying advanced containment, separation, and recycling systems to meet federal and state regulations. Mature onshore and offshore drilling operations require continuous upgrades of waste handling technologies. Partnerships with technology leaders support operational efficiency and the adoption of safe disposal methods. The USA market is stable, with steady demand from conventional and unconventional drilling operations.

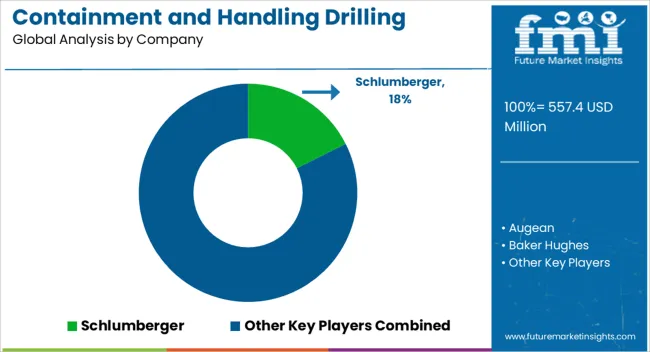

Leading companies in the containment and handling drilling waste management market, such as Schlumberger, Baker Hughes, and Halliburton, are competing by offering integrated solutions that ensure safe, efficient, and regulatory-compliant disposal of drilling byproducts. Schlumberger emphasizes its waste containment systems and treatment technologies, presenting brochures that highlight environmental compliance and operational efficiency.

Baker Hughes and Halliburton focus on modular waste management units and automated monitoring, reducing handling risks while improving turnaround times. GN Solids Control and Derrick Equipment Company offer specialized solids control and separation equipment, marketing reliability and precision in managing drilling fluids. Clean Harbors and Augean target regional and onshore operations, emphasizing compliance with local regulations and rapid response capabilities. Other key players, including NOV, Imdex, and Newpark Resources, position their solutions around high-capacity handling systems and flexible deployment for offshore and remote sites. Ridgeline Canada, Secure Energy Services, and Select Water Solutions emphasize sustainable treatment options, highlighting cost-effectiveness and reduced environmental impact in their product brochures.

TWMA and Soli-Bond focus on engineered containment solutions for hazardous drilling wastes, while Weatherford markets integrated management systems that combine collection, storage, and disposal. Strategies center on providing turnkey solutions, operational reliability, and regulatory compliance. Brochures consistently highlight efficiency, safety, and environmental protection, framing these companies as essential partners in maintaining responsible and productive drilling operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 557.4 Million |

| Application | Onshore and Offshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger, Augean, Baker Hughes, Clean Harbors, Derrick Equipment Company, Geminor, GN Solids Control, Halliburton, Imdex, Newpark Resources, NOV, Ridgeline Canada, Secure Energy Services, Select Water Solutions, Soli-Bond, TWMA, and Weatherford |

| Additional Attributes | Dollar sales by equipment type (containment tanks, mud recycling units, filtration systems) and service type (collection, treatment, disposal) are key metrics. Trends include increasing demand for environmentally compliant waste management, adoption of advanced drilling technologies, and focus on operational efficiency. Regional adoption, regulatory standards, and technological innovations are driving market growth. |

The global containment and handling drilling waste management market is estimated to be valued at USD 557.4 million in 2025.

The market size for the containment and handling drilling waste management market is projected to reach USD 1,214.5 million by 2035.

The containment and handling drilling waste management market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in containment and handling drilling waste management market are onshore and offshore.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Containment Trays Sector

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Secondary Containment Trays Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA