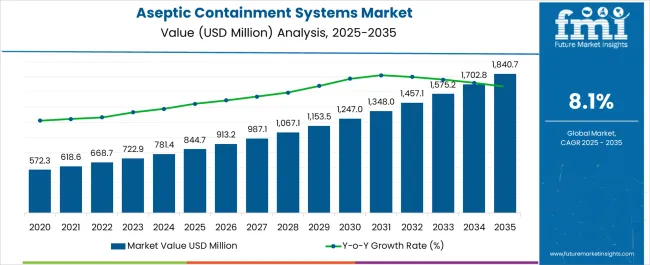

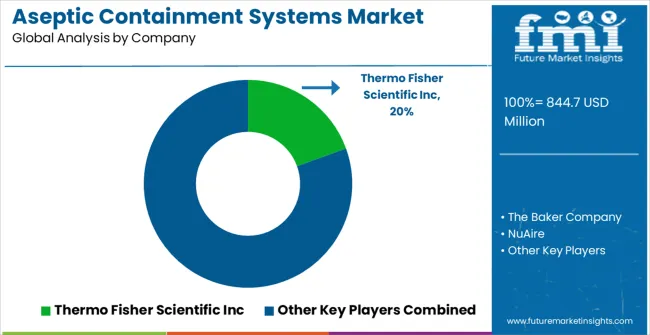

The Aseptic Containment Systems Market is estimated to be valued at USD 844.7 million in 2025 and is projected to reach USD 1840.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Aseptic Containment Systems Market Estimated Value in (2025 E) | USD 844.7 million |

| Aseptic Containment Systems Market Forecast Value in (2035 F) | USD 1840.7 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The Aseptic Containment Systems market is growing steadily, supported by increasing demand for contamination-free environments across industries such as pharmaceuticals, biotechnology, and industrial manufacturing. Rising concerns over worker safety, product sterility, and regulatory compliance are fueling the adoption of advanced containment systems. Innovations in airflow technologies, barrier isolation, and ergonomic designs are enhancing operational safety while reducing risks of cross-contamination.

Global pharmaceutical and biopharmaceutical production expansion is significantly boosting demand, particularly in vaccine manufacturing and sterile drug formulation. In addition, the increasing number of biosafety and research laboratories is supporting sustained adoption. Industrial sectors are also incorporating aseptic containment systems to meet international safety standards and improve quality control processes.

Governments and regulatory authorities are tightening workplace safety guidelines, which is further encouraging investment in advanced containment solutions As industries adopt automation and robotics in cleanroom environments, the need for scalable, software-integrated, and energy-efficient systems is becoming critical This convergence of regulatory, technological, and safety factors is expected to drive long-term growth in the Aseptic Containment Systems market.

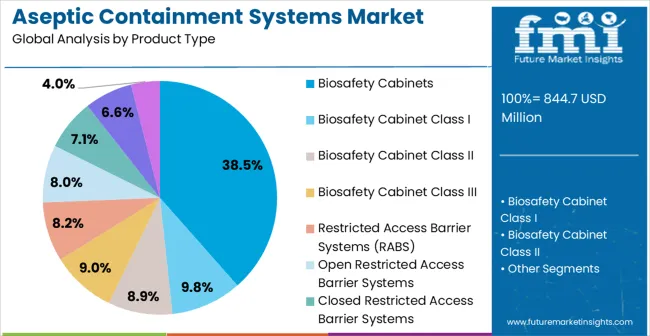

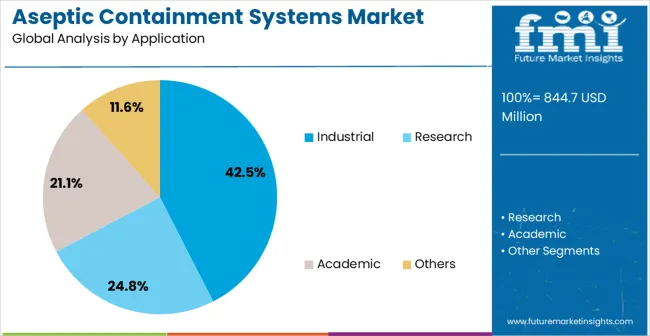

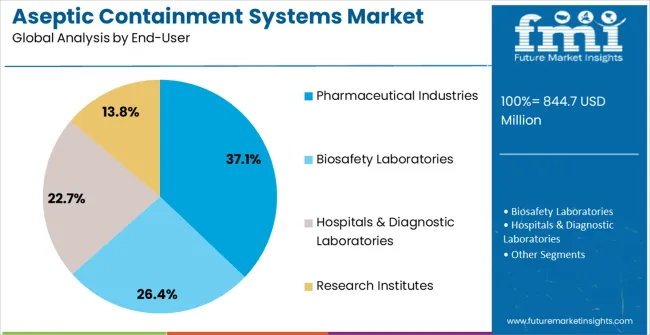

The aseptic containment systems market is segmented by product type, application, end-user, and geographic regions. By product type, aseptic containment systems market is divided into Biosafety Cabinets, Biosafety Cabinet Class I, Biosafety Cabinet Class II, Biosafety Cabinet Class III, Restricted Access Barrier Systems (RABS), Open Restricted Access Barrier Systems, Closed Restricted Access Barrier Systems, Isolators, and Others. In terms of application, aseptic containment systems market is classified into Industrial, Research, Academic, and Others. Based on end-user, aseptic containment systems market is segmented into Pharmaceutical Industries, Biosafety Laboratories, Hospitals & Diagnostic Laboratories, and Research Institutes. Regionally, the aseptic containment systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The biosafety cabinets product type segment is expected to account for 38.5% of the market revenue in 2025, making it the leading product category. Growth in this segment is being driven by its essential role in providing sterile work environments for sensitive processes such as microbiological testing, pharmaceutical production, and research applications.

Biosafety cabinets are widely adopted for their ability to protect both operators and samples from hazardous biological agents, reducing contamination risks and ensuring compliance with stringent safety standards. The integration of advanced HEPA filtration, airflow control, and ergonomic features has further strengthened adoption across research institutes and manufacturing facilities.

The segment’s dominance is also supported by rising investments in laboratory infrastructure and the growth of clinical research organizations worldwide As the global emphasis on biosafety and sterility continues to rise, biosafety cabinets are expected to remain a cornerstone of aseptic containment systems, driven by their reliability, safety, and adaptability across diverse end-use environments.

The industrial application segment is projected to hold 42.5% of the market share in 2025, positioning it as the leading application area. Growth in this segment is attributed to the increasing need for controlled and sterile environments in food processing, chemicals, and biotechnology-related manufacturing. Industrial users are adopting aseptic containment systems to comply with strict quality and safety standards, minimize risks of contamination, and enhance product shelf life.

The rising demand for sterile packaging solutions, particularly in the food and beverage sector, is also strengthening this segment. Technological innovations such as modular containment units and integration with digital monitoring systems are driving efficiency and scalability.

Industrial facilities are leveraging aseptic containment systems not only for compliance but also for process optimization and sustainability goals With global industries increasingly focused on safety and regulatory adherence, the adoption of these systems is expected to accelerate, ensuring that the industrial application segment maintains its leadership in the overall market landscape.

The pharmaceutical industries end-user segment is anticipated to hold 37.1% of the market share in 2025, making it the largest end-use segment. The growing complexity of drug development and the rising prevalence of sterile injectable products are driving the reliance on advanced containment systems. Pharmaceutical manufacturers are adopting these solutions to meet rigorous Good Manufacturing Practices (GMP) and regulatory requirements, ensuring product quality and patient safety.

The expansion of biopharmaceutical production, coupled with increasing investments in vaccine and biologics manufacturing, has further reinforced demand. The ability of containment systems to minimize contamination, protect operators, and improve efficiency is supporting widespread adoption.

Pharmaceutical companies are also investing in flexible and modular containment solutions to adapt to evolving production requirements With the industry’s heightened focus on quality assurance and safety, the pharmaceutical industries segment is expected to sustain its leading position, benefiting from continued innovation in aseptic technologies and global expansion of drug manufacturing facilities.

Aseptic containment is related to laboratory biosafety where the physical containment of the microbial organisms is achieved. Aseptic containment system aids in separating the operator from the clean zone so as to avoid the contamination, interventions in the clean zone.

Various kinds of barrier technologies are said to achieve aseptic containment such as open and closed restricted access barriers, isolators etc. The aseptic zone is maintained through the use of high-efficiency particulate arrestance (HEPA) filters that employs the principle of turbulent air flow.

Biosafety cabinets are also known as one of the aseptic containment system which are equipped with HEPA filters. The aseptic containment system provides personnel protection from the pathogenic organism, avoids the release of organisms into environment, avoids contaminations of the product, and accidental infection to the workers etc.

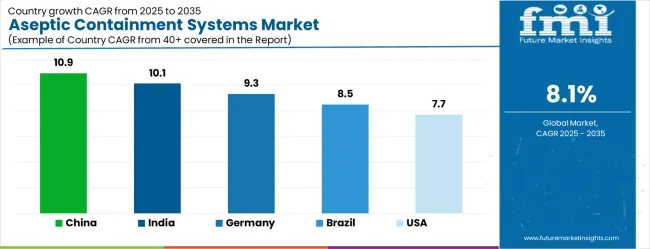

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| Brazil | 8.5% |

| USA | 7.7% |

| UK | 6.9% |

| Japan | 6.1% |

The Aseptic Containment Systems Market is expected to register a CAGR of 8.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.9%, followed by India at 10.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.1%, yet still underscores a broadly positive trajectory for the global Aseptic Containment Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.3%. The USA Aseptic Containment Systems Market is estimated to be valued at USD 301.4 million in 2025 and is anticipated to reach a valuation of USD 301.4 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 40.0 million and USD 22.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 844.7 Million |

| Product Type | Biosafety Cabinets, Biosafety Cabinet Class I, Biosafety Cabinet Class II, Biosafety Cabinet Class III, Restricted Access Barrier Systems (RABS), Open Restricted Access Barrier Systems, Closed Restricted Access Barrier Systems, Isolators, and Others |

| Application | Industrial, Research, Academic, and Others |

| End-User | Pharmaceutical Industries, Biosafety Laboratories, Hospitals & Diagnostic Laboratories, and Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Fisher Scientific Inc, The Baker Company, NuAire, Kewaunee Scientific Corporation, Labconco, IMA Pharma, GERMFREE, Robert Bosch GmbH, and Polypipe |

The global aseptic containment systems market is estimated to be valued at USD 844.7 million in 2025.

The market size for the aseptic containment systems market is projected to reach USD 1,840.7 million by 2035.

The aseptic containment systems market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in aseptic containment systems market are biosafety cabinets, biosafety cabinet class i, biosafety cabinet class ii, biosafety cabinet class iii, restricted access barrier systems (rabs), open restricted access barrier systems, closed restricted access barrier systems, isolators and others.

In terms of application, industrial segment to command 42.5% share in the aseptic containment systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aseptic IBC Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Liquid Packaging Boards Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Equipment Market Trends - Growth & Forecast 2025 to 2035

Aseptic Processing Market Growth - Trends & Forecast 2025 to 2035

Aseptic Fillers Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Containment Trays Sector

Market Share Insights of Leading Aseptic Carton Providers

Aseptic Paper for Packaging Market from 2023 to 2033

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA