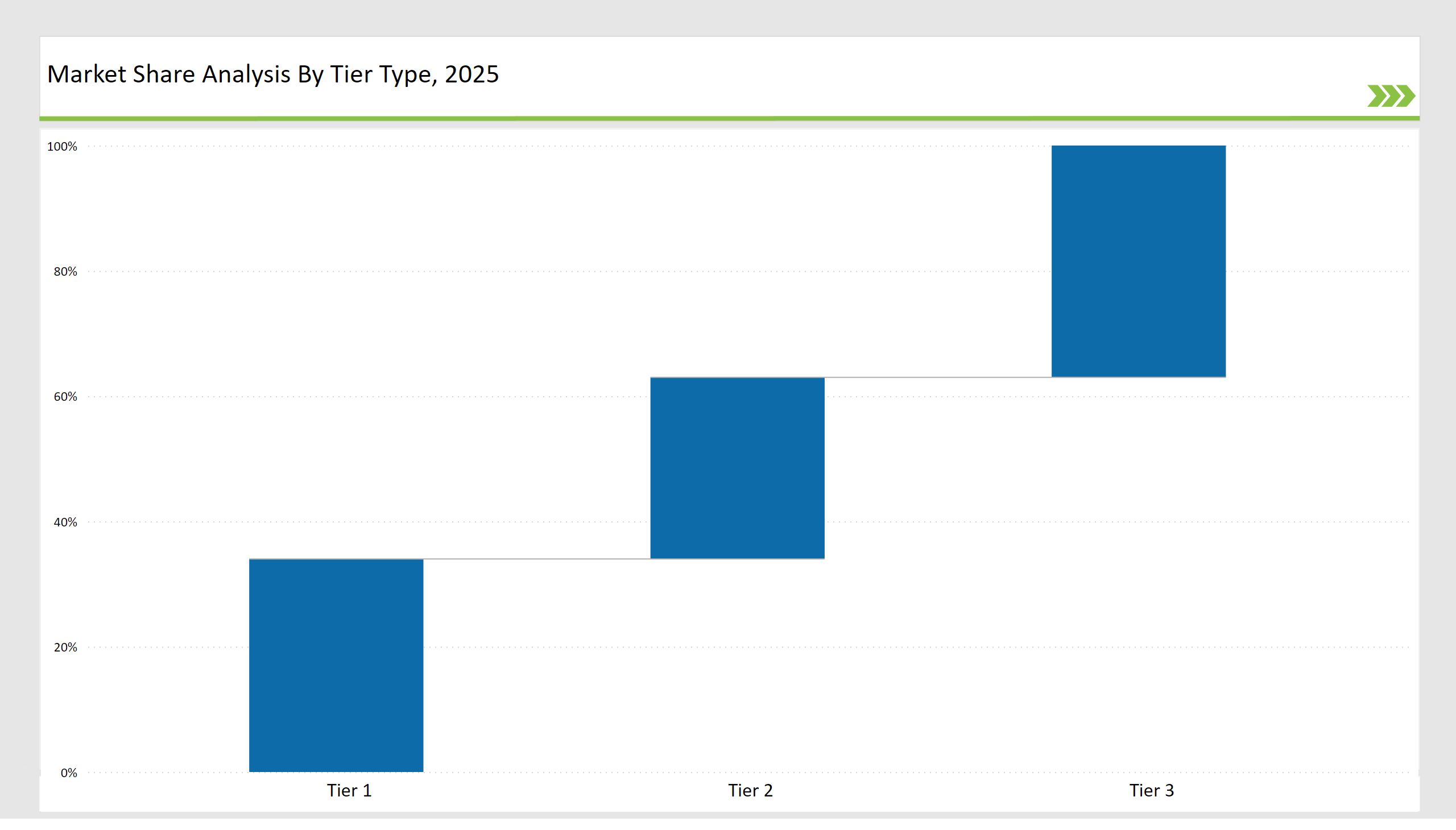

The secondary containment trays market is mildly fragmented and has a competitive arena. Tier 1, Tier 2, and Tier 3 players share the market with themselves. Around 34% of the business is covered under the three giant manufacturers: DENIOS, Eagle Manufacturing, and UltraTech International. These major companies are moving ahead through developed containment solutions, regulatory compliance, and innovative product offerings. More demand for environmentally compliant and hazardous material containment to prevent spills represents a significant key driver for this market.

Tier 2 players, including Justrite Manufacturing, New Pig Corporation, and ENPAC, hold about 29% of the market share. These players focus on cost-effective, high-quality, and customizable containment trays, catering to industrial, pharmaceutical, and laboratory applications.

Tier 3 players represent the remaining 37% of the market, consisting of regional manufacturers and niche players. These companies specialize in customized, low-cost containment trays, meeting specific client needs such as chemical resistance, spill capacity enhancement, and modular configurations.

| Category | Market Share (%) |

|---|---|

| Top 3 (DENIOS, Eagle Manufacturing, UltraTech International) | 17% |

| Rest of Top 5 (Justrite Manufacturing, New Pig Corporation) | 10% |

| Next 5 of Top 10 (ENPAC, Brady Corporation, Black Diamond Eco Solutions, SpillTech, TENAQUIP) | 7% |

| Market Concentration | Criteria | Current Market |

|---|---|---|

| High | Over 60% by leading players | No |

| Medium | 30-60% by top players | Yes |

| Low | Below 30% market share | No |

Companies in the Secondary Containment Trays Market serve the following primary industries

Suppliers offer a variety of product solutions to meet diverse industry needs

Sustainability drives innovation as companies invest in recyclable materials, leak-proof coatings, and improved spill containment technologies.

The companies are investing in eco-friendly materials, automated spill prevention technologies, and AI-driven quality control to sustain their leadership in the market. Companies incorporate automated production, modular tray configurations, and sustainable materials to improve performance, compliance, and spill prevention. Strategic partnerships with oil refineries, chemical plants, and industrial safety organizations are expanding the market’s reach.

Technology suppliers should prioritize

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | DENIOS, Eagle Manufacturing, UltraTech International |

| Tier 2 | Justrite Manufacturing, New Pig Corporation, ENPAC |

| Tier 3 | Brady Corporation, Black Diamond Eco Solutions, SpillTech, TENAQUIP |

| Manufacturer | Latest Developments |

|---|---|

| DENIOS | Developed high-performance, reusable spill containment trays in January 2024. |

| Eagle Manufacturing | Introduced AI-driven, heavy-duty containment solutions in March 2024. |

| UltraTech International | Launched modular, chemical-resistant containment trays in April 2024. |

| Justrite Manufacturing | Expanded spill control solutions for laboratory use in May 2024. |

| New Pig Corporation | Enhanced recyclable and sustainable containment tray options in June 2024. |

| ENPAC | Invested in leak-proof tray designs for industrial applications in July 2024. |

Leading companies in the Secondary Containment Trays Market leverage

The Secondary Containment Trays Market is shifting towards biodegradable materials, smart containment technologies, and AI-driven quality control.Companies are integrating the Internet of Things-enabled monitoring, predictive analytics, and sustainability-centric innovations to safety, compliance, and spill prevention. The sector focuses on greener innovations to meet regulatory as well as customer expectations, considering leak-proof tray designs, lighter materials, and tamper-proof spill containment technologies.

Leading manufacturers include DENIOS, Eagle Manufacturing, UltraTech International, Justrite Manufacturing, and New Pig Corporation.

The top 3 players collectively account for 17% of the global market

The market concentration is medium, with leading players controlling approximately 33% of the industry.

AI-driven automation, smart containment, and increasing demand for environmentally compliant solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Secondary Containment Trays Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

CPET Trays Market

Key Companies & Market Share in the Food Trays Sector

Sieve Trays Market Size and Share Forecast Outlook 2025 to 2035

Pharma Trays Market Size, Share & Forecast 2025 to 2035

Correx Trays Market

Insert Trays Market

Syringe Trays Market

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Assembly Trays Market Size and Share Forecast Outlook 2025 to 2035

Bakeable Trays Market

Market Share Breakdown of Assembly Trays Manufacturers

Cardboard Trays Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA