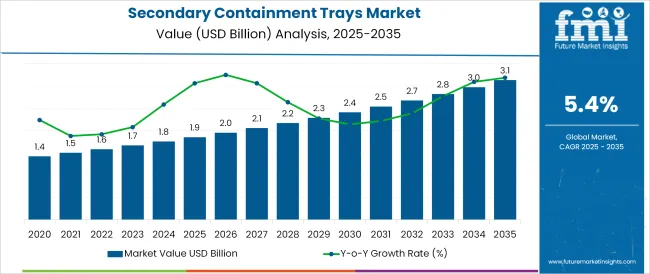

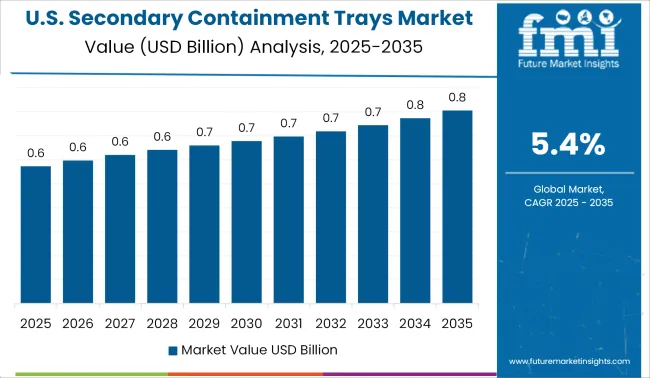

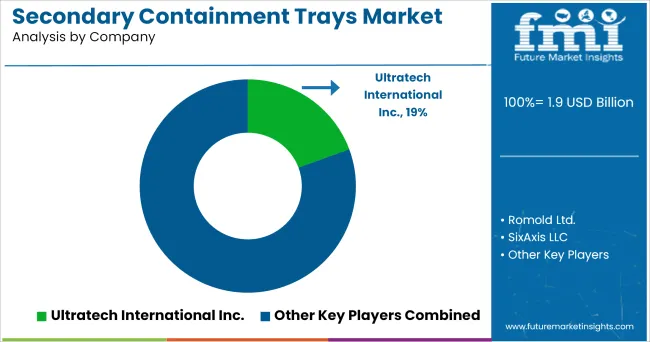

The Secondary Containment Trays Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The secondary containment trays market is experiencing steady expansion, supported by heightened environmental compliance pressures and the need for efficient spill containment solutions in chemical-intensive industries. Growth is being driven by regulatory frameworks mandating safe storage and handling of hazardous liquids, alongside rising awareness of operational risk mitigation and workplace safety

Manufacturers are focusing on durable, chemical-resistant materials that can withstand exposure to aggressive fluids while offering reusability and modular deployment across facilities. The integration of secondary containment into lean facility design, particularly in warehousing, chemical processing, and laboratories, is further strengthening product uptake. Demand is also rising from logistics and transportation stakeholders who prioritize containment trays for compliance during storage and transit.

The market outlook remains favorable due to ongoing industrialization, infrastructure expansion, and the evolution of spill prevention best practices, especially in emerging economies.

The market is segmented by Material, Capacity, and End-use and region. By Material, the market is divided into Polyethylene, LDPE, HDPE, Stainless Steel, and Others. In terms of Capacity, the market is classified into Above 2000 liter, Up to 1000 liter, 1001 to 1500 liter, and 1501 to 2000 liter.

Based on End-use, the market is segmented into Industrial Chemicals, Pharmaceuticals, Petrochemicals and Lubricants, Agrochemicals, and Food and Beverages. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

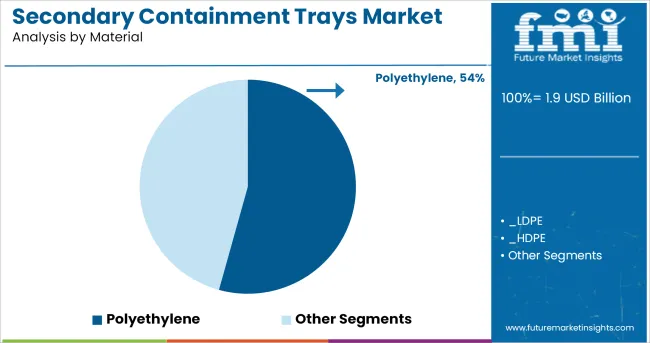

Polyethylene is projected to account for 54.3% of the total revenue share in the secondary containment trays market by 2025, establishing it as the dominant material segment. This leadership is being driven by the material’s high chemical resistance, structural durability, and cost-effectiveness in producing corrosion-resistant trays for industrial environments. Polyethylene offers superior compatibility with a wide range of hazardous and non-hazardous liquids, making it the preferred choice for long-term containment without risk of degradation.

Its lightweight nature supports ease of handling and deployment across varied site conditions, while its moldability allows manufacturers to produce trays in diverse shapes and sizes with integrated safety features.

Additionally, polyethylene trays meet key regulatory guidelines for environmental protection and workplace safety. Their resistance to UV radiation, temperature fluctuations, and impact damage reinforces their use across sectors where consistent performance and extended service life are critical.

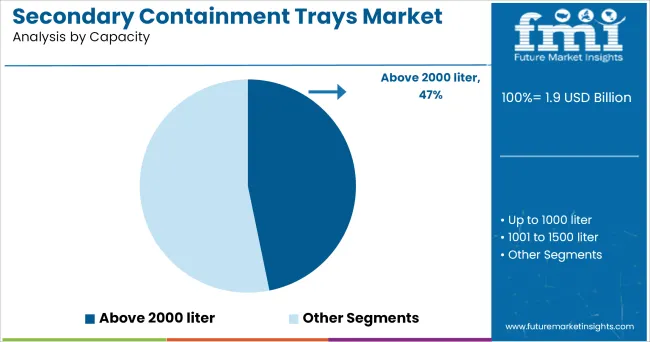

Containment trays with a capacity above 2000 liters are anticipated to hold 46.8% of the total market revenue in 2025, positioning this segment at the forefront of large-scale containment solutions. This dominance is being fueled by increasing deployment in high-volume liquid storage and transfer operations, where large containers such as drums, IBCs, or tanks require dependable spill protection.

The above-2000-liter segment addresses the containment needs of centralized chemical storage zones, bulk handling units, and logistics hubs, supporting regulatory compliance and site safety. The segment’s growth is also linked to the scalability of these trays in modular setups that allow for multiple units to be combined for customized spill control systems.

As industries expand their operations and storage footprints, the requirement for high-capacity, easy-to-clean, and forklift-compatible containment trays is intensifying, making this segment a critical enabler of industrial environmental stewardship.

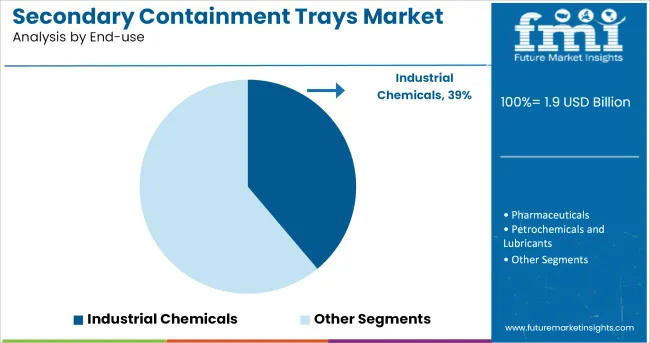

The industrial chemicals segment is forecast to lead the secondary containment trays market with a 38.9% revenue share in 2025, reflecting its intensive demand for safe chemical handling and storage practices. This segment's prominence is underpinned by strict adherence to spill containment regulations governing flammable, corrosive, or reactive substances in production and warehousing facilities.

The use of secondary containment trays in industrial chemical operations is being driven by their role in preventing leaks, minimizing cleanup costs, and safeguarding personnel and infrastructure. These trays are critical for managing accidental spills during filling, decanting, or equipment maintenance processes.

Furthermore, the growing volume of chemical trade and in-plant chemical movement has necessitated robust containment strategies. The shift toward proactive risk management and investments in EH&S (environmental, health, and safety) programs is reinforcing adoption, with end users prioritizing reliable, low-maintenance containment systems that meet evolving audit and inspection requirements.

Transportation of a large quantity of crude oil and bulk petroleum products by these containment trays minimizes the risk of environmental degradation. Low cost and ease of availability of the plastic Secondary tray is another factor that boosting the demand of the market globally.

Besides these factors, the need for proper infrastructure required to cater to the growing needs of the chemical, petrochemical & refining and food & beverage sectors is another factor that is projected to drive demand and new requirements for these trays during the forecast period.

Secondary containment market is primarily driven by the need for a collection of spillage from a leaked international bulk container (IBC). These trays find demand from different end-use industries such as chemical, automobile, pharmaceutical, and others. Based on the end-use, Secondary containment tray market is dominated by industrial chemicals and petrochemicals due to their wide use for secondary spillage containment.

Polyethylene is the most widely used material for the construction of such containment trays as it prevent from UV rays, rust, corrosion, and chemicals and helps in increasing the shelf life of the pallet. On the other hand, containment trays made of stainless steel provide excellent storage safety for highly acidic chemicals, hazardous materials, and flammable liquids. Secondary containment trays can also be used where oil is loaded and unloaded for transportation.

Asia Pacific region is projected to witness sharp growth in the Secondary containment tray market due to rise in demand from petrochemical, lubricants, agrochemical and other industrial chemicals. Asia pacific market is primarily driven by countries such as China, Japan, South Korea, India and ASEAN Countries.

The prospects are particularly lucrative in high potential markets such as India and ASEAN nations. Based on the end-use, the market in Asia is dominated by industrial chemicals and petrochemicals due to their wide use in the various industries. Increasing demand of petrochemicals and oil in India and China will drive the market for secondary containment in Asia pacific region for the transportation and storage of it.

North America is expected to dominate the secondary containment tray market due to significant growth from the chemical and food and beverage industries. With increasing petrochemical industries in the USA, along with food and beverage industry, there will be steady growth in the requirement of the Secondary containment trays which will drive the North American market.

Growing paints, inks and varnish industries in the North America region anticipated to raise demand for such containment trays market it the region.

Some of the leading manufacturers and suppliers of secondary containment trays are

The key manufacturers are focusing on producing HDPE used material for the construction of Secondary containment as it prevent from UV rays, rust, corrosion, and chemicals and helps in increasing the shelf life of the pallet.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global secondary containment trays market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the secondary containment trays market is projected to reach USD 3.1 billion by 2035.

The secondary containment trays market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in secondary containment trays market are polyethylene, ldpe, hdpe, stainless steel and others.

In terms of capacity, above 2000 liter segment to command 46.8% share in the secondary containment trays market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Secondary Alkane Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Secondary Smelting and Alloying of Aluminium Market Size and Share Forecast Outlook 2025 to 2035

Secondary Myelofibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Pharmaceutical Secondary Packaging

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Containment Trays Sector

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Food Trays Sector

CPET Trays Market

Sieve Trays Market Size and Share Forecast Outlook 2025 to 2035

Pharma Trays Market Size, Share & Forecast 2025 to 2035

Correx Trays Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA