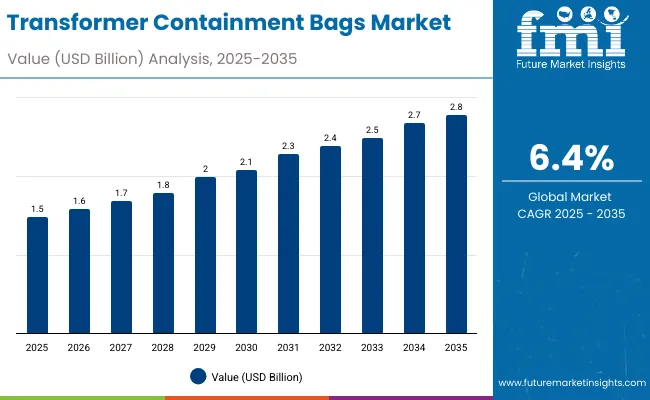

The transformer containment bags market will grow from USD 1.5 billion in 2025 to USD 2.8 billion by 2035, reflecting a CAGR of 6.4%. Demand is driven by rising safety standards in oil containment, spill prevention, and transformer maintenance. PVC-based bags dominate due to strength, flexibility, and dielectric stability.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 2.8 billion |

| CAGR (2025 to 2035) | 6.4% |

Between 2025 and 2030, market value will rise by USD 0.6 billion, led by grid modernization and oil containment upgrades. From 2030 to 2035, global sustainability and leakage prevention programs will contribute another USD 0.7 billion. Asia-Pacific will lead expansion due to expanding power utility infrastructure.

From 2020 to 2024, the market expanded due to stricter environmental containment mandates and investments in electrical safety. Transformer maintenance projects and industrial upgrades enhanced the use of oil-resistant and heavy-duty containment systems.

By 2035, market value will reach USD 2.8 billion, supported by grid digitalization and increased renewable integration. Power utilities’ focus on sustainability and zero-spill operations will drive material innovations.

Growth is driven by infrastructure modernization and global safety compliance requirements for oil spill prevention. Transformer containment bags ensure efficient handling of transformer oil leaks during maintenance and transport.

Rising grid investments in Asia and power restoration efforts across aging Western networks are boosting demand. Additionally, use in emergency containment and chemical industries adds a new application layer.

The market is segmented by material, bag type, capacity, application, end-use industry, and region. Materials include PVC, PE, PP, TPU, reinforced nylon, and multi-layer composites. Bag types include standard, heavy-duty reinforced, UV-resistant, chemical-resistant, and fire-retardant containment bags. Applications include transformer oil containment, spill control, and hazardous waste handling.

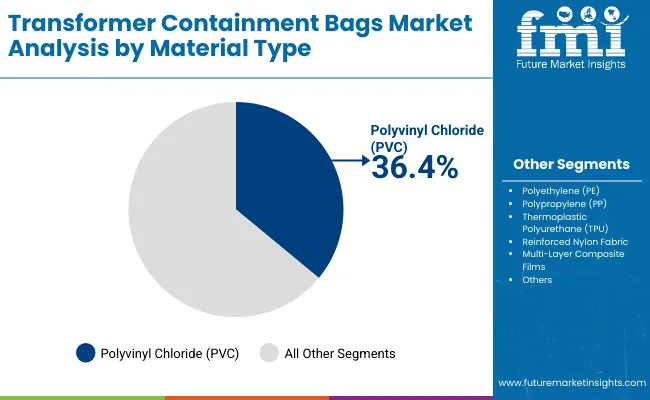

PVC will hold a 36.4% share in 2025, favored for chemical resistance, tensile strength, and cost efficiency. It’s used across transformer oil containment and emergency spill bags.

Future innovation will enhance recyclability and resistance to dielectric fluid degradation, reinforcing PVC’s leadership through 2035.

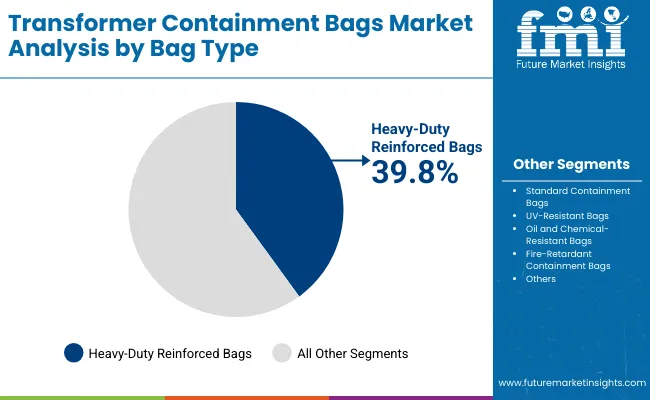

Heavy-duty reinforced bags will account for 39.8% share in 2025 due to structural durability and reusability. Their multi-layer laminations and UV protection enable extended outdoor service life.

By 2035, smart sensor-integrated containment designs will drive industrial adoption, improving spill detection and environmental monitoring.

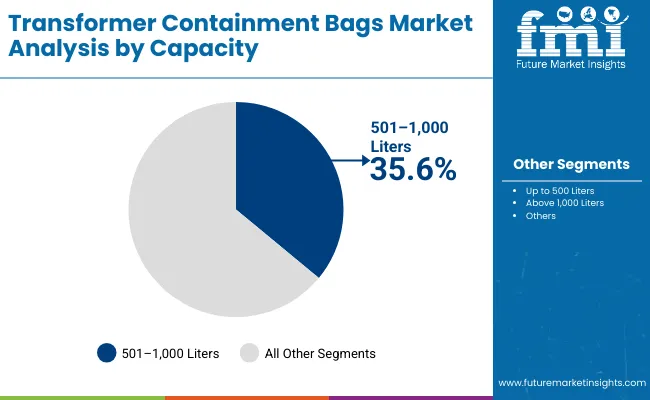

The 501-1,000-liter capacity range will hold a 35.6% share in 2025, supporting medium-scale transformers and maintenance operations. These liners balance portability with sufficient oil containment.

Advanced flexible polymer composites and modular sizes will boost their future market appeal.

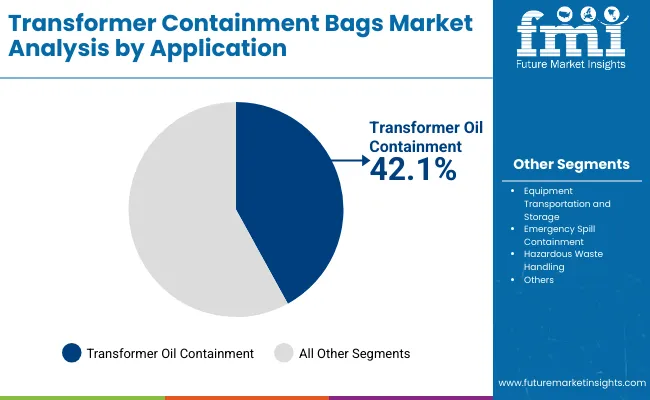

Transformer oil containment will represent 42.1% share in 2025, driven by power utility requirements for maintenance and oil filtration processes.

Smart monitoring features and compatibility with biodegradable fluids will further expand their application by 2035.

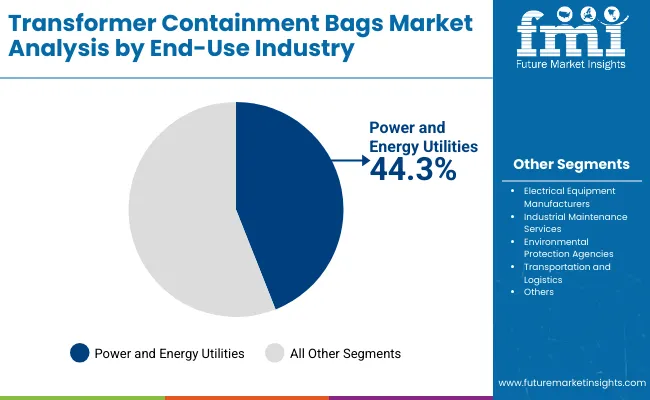

Power and energy utilities will account for 44.3% share in 2025, reflecting heavy investment in grid reliability and safety compliance.

By 2035, green energy expansion and decentralized grid systems will amplify containment system demand across all voltage categories.

Rising transformer maintenance activities, spill-prevention laws, and environmental safety policies drive growth. High-voltage grid expansions globally support consistent containment system demand.

High costs of advanced multi-layer composites and limited awareness among smaller maintenance providers restrict growth in emerging economies.

New opportunities arise from smart grid modernization, biodegradable containment solutions, and hybrid material development.

Key trends include UV-resistant laminates, RFID-enabled monitoring, and quick-deploy containment bags. Industrial digitization and green compliance continue shaping demand.

The global transformer containment bags market is expanding as utilities modernize power infrastructure and align with stricter environmental and safety standards. Asia-Pacific leads innovation, driven by industrialization and renewable energy integration, while North America focuses on environmental protection and compliance. Europe emphasizes grid safety and spill prevention through advanced materials and automation. Growing investments in smart grids, renewable integration, and substation upgrades are fuelling global demand for reliable containment solutions.

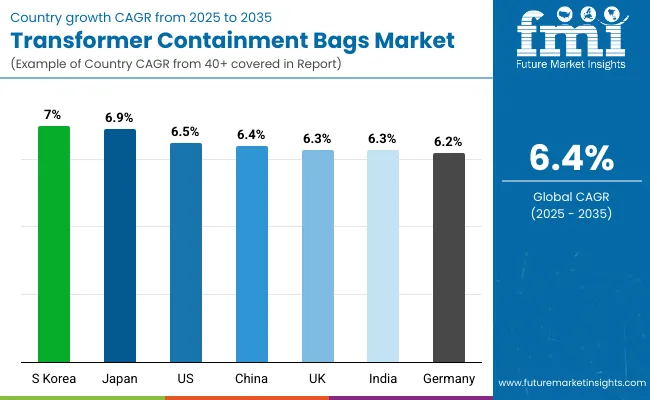

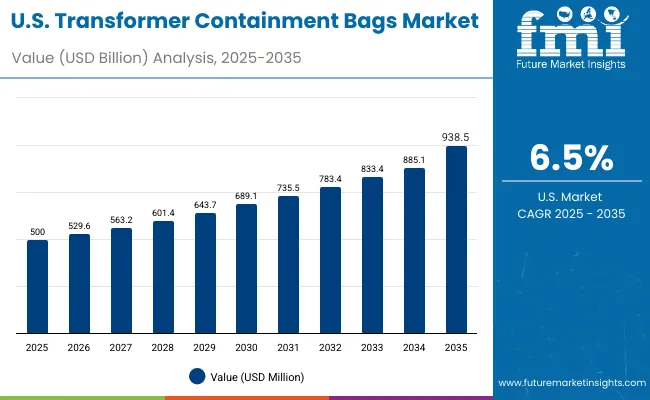

The USA market will grow at a CAGR of 6.5% from 2025 to 2035, supported by large-scale grid modernization and renewable energy integration. The Environmental Protection Agency (EPA) is enforcing stringent containment and spill control regulations. Utilities are investing in transformer containment systems to prevent oil leaks and environmental contamination. Increased grid resilience projects and infrastructure renewal initiatives are further reinforcing market expansion across USA power networks.

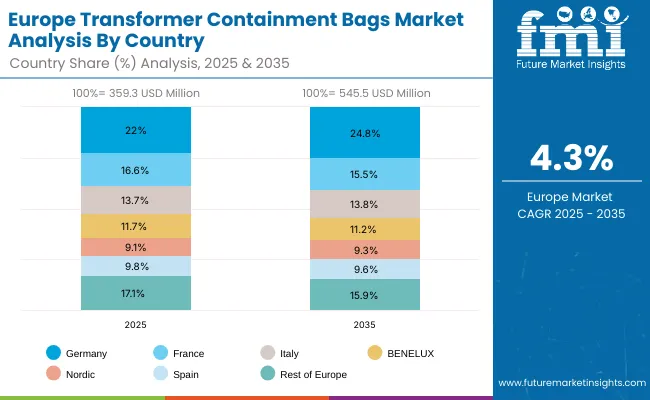

Germany will expand at a CAGR of 6.2%, driven by strict EU safety and environmental standards. Utilities and industrial facilities are adopting advanced containment solutions to prevent transformer oil leaks. The transition toward renewable energy systems is prompting investments in substation modernization. German engineering firms are developing fire-resistant, recyclable containment bags to ensure safety, durability, and sustainability in high-voltage operations.

The UK market will grow at a CAGR of 6.3%, supported by infrastructure upgrades and environmental safety initiatives. Utilities are expanding smart maintenance networks to prevent transformer oil spills. Regulations on waste management and contamination control are reinforcing containment system adoption. Integration of smart sensor-equipped containment bags is also improving real-time monitoring of oil leaks in transformer systems.

China will grow at a CAGR of 6.4%, propelled by industrialization, urbanization, and large-scale power grid reforms. The government’s investment in modern grid infrastructure and renewable energy expansion is driving adoption of containment solutions. Local manufacturers are developing cost-effective, UV-resistant containment bags to meet growing domestic and export demand. Increasing focus on oil containment during transformer transportation is further boosting growth.

India will grow at a CAGR of 6.3%, supported by capacity expansion and rural electrification under national power initiatives. Utilities are modernizing aging equipment and adopting containment systems to minimize environmental risks. Smart grid and renewable projects are driving sustainable containment solutions. With increased focus on safety and regulatory compliance, demand for oil-retention systems is growing across India’s expanding transmission and distribution network.

Japan will grow at a CAGR of 6.9%, driven by industrial automation, safety innovation, and renewable integration. Advanced robotics are optimizing transformer maintenance processes. UV-resistant and fire-retardant containment bags are being increasingly adopted to protect aging grid assets. Rising investments in smart substation infrastructure and replacement of legacy transformers are supporting long-term growth in the containment solutions market.

South Korea will lead with a CAGR of 7.0%, supported by integration of smart power systems and renewable energy projects. High-voltage transmission and offshore wind grid expansion are major drivers. Local manufacturers are investing in automation and biodegradable material innovation for containment solutions. Industrial safety standards and export-oriented containment technologies are further strengthening South Korea’s position as a leader in eco-efficient grid safety products.

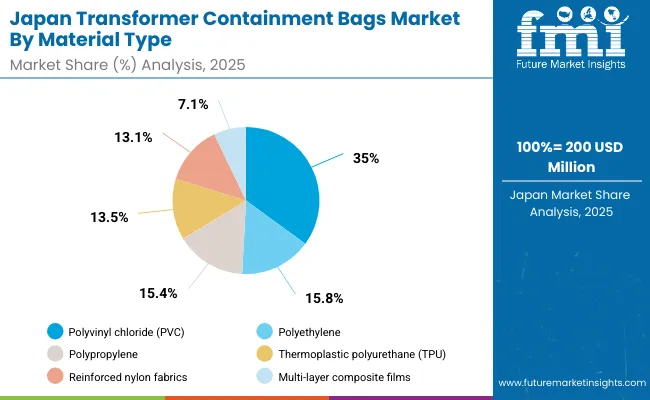

Japan’s transformer containment bags market, valued at USD 200 million in 2025, is dominated by polyvinyl chloride (PVC) with a 35.0% share due to its exceptional durability and chemical resistance. Polyethylene holds 15.8%, favoured for flexibility and cost efficiency, while polypropylene contributes 15.4% for its heat tolerance. Thermoplastic polyurethane (TPU) and reinforced nylon fabrics account for 13.5% and 13.1%, respectively, ensuring resilience in extreme environments. Multi-layer composite films represent 7.1%, catering to high-performance applications. Demand is supported by Japan’s stringent safety standards and grid modernization projects emphasizing environmental protection, fire safety, and reliable oil containment in utility and industrial settings.

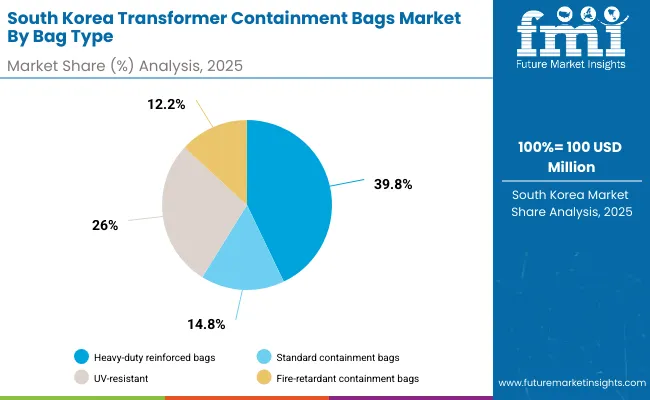

South Korea’s transformer containment bags market, estimated at USD 100 million in 2025, is led by heavy-duty reinforced bags capturing 39.8% share, driven by industrial-scale containment needs in transformer maintenance. Standard containment bags represent 14.8%, preferred for routine substation operations. UV-resistant and oil-chemical-resistant bags collectively contribute over 26%, addressing outdoor and hazardous site conditions. Fire-retardant containment bags account for 12.2%, aligning with national electrical safety mandates. Growth is propelled by the expansion of renewable grids, aging transformer infrastructure upgrades, and rising emphasis on spill prevention, sustainable materials, and emergency-ready containment systems across South Korea’s power utilities.

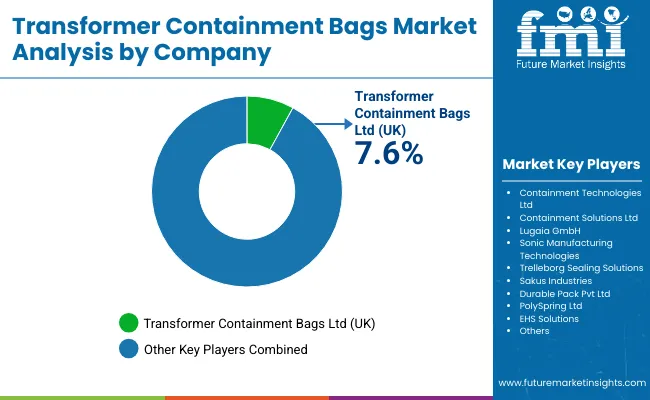

The market is moderately fragmented with key players Transformer Containment Systems, Containment Technologies Group, Containment Solutions Inc., Lugiaa GmbH, Sonic Manufacturing, Trelleborg Sealing Solutions, Sakus Industries, Durable Pack Pvt Ltd, PolySpring Ltd, and EHS Solutions.

Transformer Containment Systems leads in utility-grade containment, while Trelleborg focuses on polymer innovation. Durable Pack Pvt Ltd and PolySpring Ltd specialize in customized industrial-grade solutions. Sustainability-focused manufacturing defines competition through 2035.

Key Developments of Transformer Containment Bags Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Material | PVC, PE, PP, TPU, Nylon, Composite Films |

| By Bag Type | Standard, Heavy-Duty, UV-Resistant, Chemical-Resistant, Fire-Retardant |

| By Capacity | Up to 500L, 501-1,000L, Above 1,000L |

| By Application | Transformer Oil, Equipment Storage, Emergency Spills, Hazardous Waste |

| By End-Use Industry | Power & Energy, Equipment Manufacturing, Industrial Maintenance, Environmental, Logistics |

| Key Companies Profiled | Transformer Containment Systems, Containment Technologies Group, Containment Solutions Inc., Lugiaa GmbH, Sonic Manufacturing, Trelleborg Sealing Solutions, Sakus Industries, Durable Pack Pvt Ltd, PolySpring Ltd, EHS Solutions |

| Additional Attributes | Growth driven by grid safety upgrades, containment innovation, and regulatory compliance adoption. |

The market will be valued at USD 1.5 billion in 2025.

The market will reach USD 2.8 billion by 2035.

The market will grow at a CAGR of 6.4% during 2025-2035.

Polyvinyl chloride will dominate with a 36.4% share in 2025.

Heavy-duty reinforced bags will lead with a 39.8% share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA