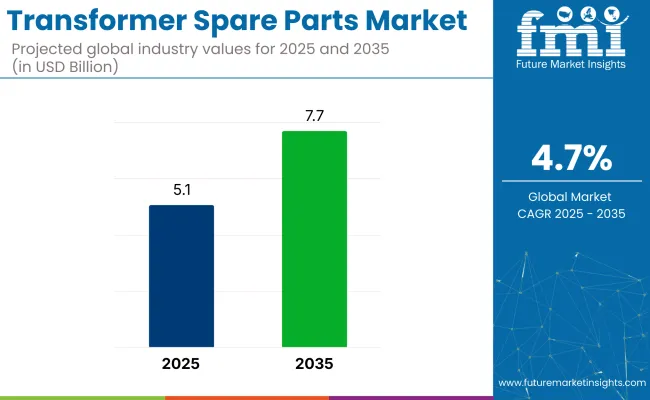

The transformer spare parts market is projected to increase from USD 5.1 billion in 2025 to USD 7.7 billion by 2035, registering a CAGR of 4.7% through the forecast period. This growth is being fueled by the aging global power grid infrastructure and the persistent need for maintenance, refurbishment, and reliability enhancement in energy transmission and distribution systems.

As of 2025, the transformer spare parts market holds a specialized but vital share within several broader industrial segments. In the global transformer market, it contributes approximately 6-8%, driven by ongoing replacement needs for bushings, tap changers, gaskets, and cooling components. Within the power transmission and distribution equipment market, its share stands at 3-4%, supported by aging grid infrastructure and routine utility maintenance.

In the electrical components market, it represents about 2-3%, due to its focus on high-voltage applications. Within the energy infrastructure maintenance market, the contribution is higher at 5-6%, reflecting its role in asset reliability. In the utility equipment aftermarket, transformer spare parts account for 4-5%, as public and private utilities invest in extending equipment lifespan.

The transformer spare parts market operates through a multi-tiered supply chain involving OEMs, niche component suppliers, regional refurbishers, and utility-based service providers. From 2020 to 2024, aging grid infrastructure in countries such as Brazil, India, and Poland increased demand for high-wear components like bushings, gaskets, tap changers, and winding insulation kits. Manufacturers responded by establishing regional depots to ensure faster part availability for critical power nodes.

Several European countries are witnessing strong momentum in both greenfield and brownfield investments aimed at developing sustainable packaging systems for the food and beverage industry. The region has demonstrated a high level of acceptance for metal beverage cans, particularly aluminum, driven by growing environmental concerns and regulatory support.

In the aluminum beverage cans market, countries such as Germany, France, Italy, Spain, the UK, and Russia have embraced aluminum due to its favorable recyclability characteristics. Key industry players are heavily investing in advanced interior coatings that minimize chemical usage, aiming to strengthen their position amid increasing scrutiny from regulatory and environmental committees.

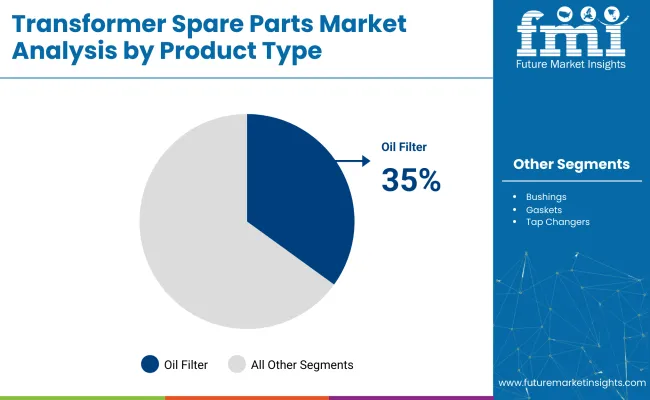

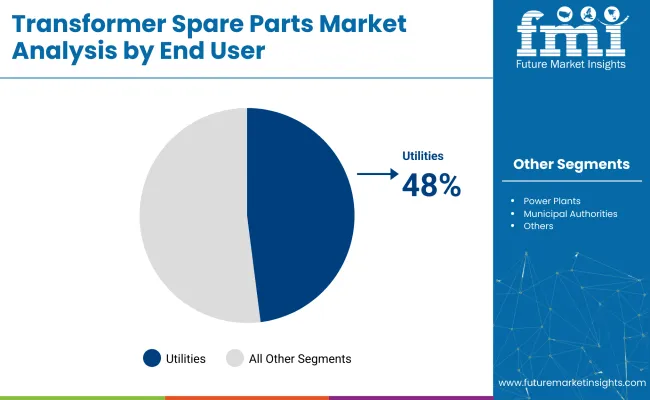

Oil filters are anticipated to lead the product type segment with a 35% market share by 2025, while power transformers will dominate the transformer type segment with 60%. Oil-immersed transformers are expected to capture a 70% share of the transformer category, and utilities will emerge as the key end user with 48% share.

Oil filters are projected to secure 35% of the product type segment by 2025, supported by their vital role in transformer longevity and efficiency.

Power transformers are forecast to command 60% of the transformer type segment in 2025, driven by their widespread use in high-voltage transmission networks.

Oil-immersed transformers are expected to account for 70% of the transformer category segment by 2025 due to their durability and superior insulation.

Utilities are anticipated to lead the end user segment with a 48% market share in 2025, reflecting their central role in maintaining national power networks.

The market is expanding steadily due to increasing demand for grid reliability, asset maintenance, and extended transformer lifespans. Utilities and industrial facilities are investing in timely replacements of key components to minimize downtime and avoid costly outages.

High Demand from Utilities and Power Distribution Networks

Utilities rely on critical transformer components such as bushings, tap changers, gaskets, cooling fans, and winding kits to ensure continuous power delivery. Regular maintenance and predictive failure analysis drive consistent replacement of these parts. Spare part availability supports fast repair, reducing the risk of blackouts and equipment failure.

Rising Aftermarket Demand from Industrial and Renewable Sectors

Industrial users and renewable energy operators are investing in transformer spares to reduce equipment downtime and support load fluctuations. Wind farms and solar power plants rely on timely part replacement to maintain stable energy output. Aftermarket services offer compatibility with both OEM and legacy systems.

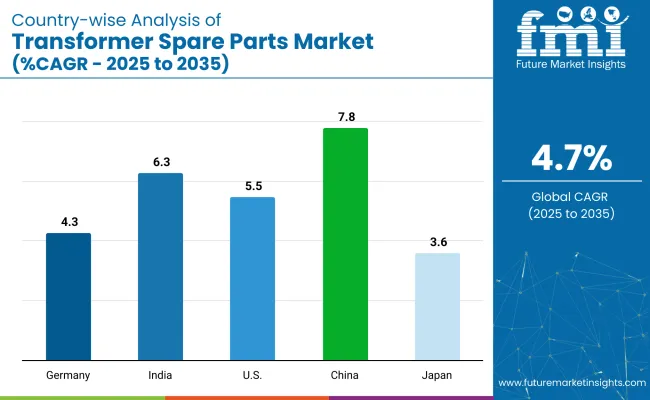

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

| India | 6.3% |

| USA | 5.5% |

| Germany | 4.3% |

| Japan | 3.6% |

China’s momentum is being driven by grid modernization, renewable integration, and large-scale industrial expansion. India is advancing its transformer spare parts sector through public electrification schemes and growth in smart substations. In contrast, developed economies such as the United States (5.5%), Germany (4.3%), and Japan (3.6%) are expanding at 0.75-0.92x of the global rate.

The USA focuses on retrofit kits and high-voltage spare part stocking. Germany emphasizes compact parts for wind energy and smart grid upgrades. Japan prioritizes space-saving components and long-life insulation materials. As the global transformer fleet ages, both replacement-led and expansion-led countries are shaping aftermarket and OEM supply strategies.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s market is projected to grow at a CAGR of 7.8% through 2035. Rapid transmission infrastructure expansion, particularly in rural and interior regions, is driving demand for core, coil, bushing, and tap changer replacements. Utilities are overhauling transformers for solar and wind integration. Local suppliers are manufacturing high-voltage bushings, radiators, and on-load tap changers at scale. State Grid projects across Central and Western China are requiring fast-moving spares.

Indian is forecast to grow at a CAGR of 6.3% between 2025 and 2035. Public-sector utilities are modernizing substation networks under programs like RDSS and Saubhagya. Demand is rising for windings, insulating oils, and arc suppressors in rural networks. Local manufacturers are scaling production of standard parts for 11 kV to 66 kV class units. Solar parks in Rajasthan and Gujarat are generating demand for on-site replacement of cooling fins and tap switches.

The USA market is expected to grow at a CAGR of 5.5% through 2035. Spare demand is rising in response to transformer aging, grid stress, and wildfire-prone utility zones. Power companies are stocking critical spares for sub-100 MVA units used in residential and industrial applications. OEM-certified bushings, fans, and terminal connectors are being used in preventive maintenance cycles. Federal funding for grid resilience is supporting proactive parts procurement.

Germany is projected to grow at a CAGR of 4.3% during the forecast period. Energy transition programs and offshore wind grid upgrades are driving the need for advanced cooling components and protection relays. High-efficiency distribution transformers require compact bushing and winding designs with long service life. Domestic engineering firms are offering plug-and-play spares tailored to modular substation formats.

Japan’s market is forecast to grow at a CAGR of 3.6% through 2035. Compact urban substations and grid efficiency upgrades are supporting demand for sealed bushings, tap diverters, and long-life insulation. Earthquake-resistant transformer designs are generating demand for rugged spare components. Utilities are focusing on condition-based monitoring to optimize replacement schedules. Japanese firms are investing in high-durability insulating paper and ceramic-coated spare parts for high-heat tolerance.

The market is moderately consolidated, with key players such as Hitachi Energy, Maschinenfabrik Reinhausen GmbH, and The H-J Family of Companies dominating global supply chains. These companies offer a wide range of components, from bushings and tap changers to gaskets and insulation parts, catering to power utilities and OEMs. Hitachi Energy focuses on high-voltage replacement parts and digitalized service kits.

Maschinenfabrik Reinhausen specializes in on-load tap changers and control accessories, known for precision and reliability. Regional suppliers like Asian Electrotech Industries LLP and Nanjing Electric International Co., Ltd. serve localized markets in Asia with cost-effective alternatives. Stephens Gaskets Ltd. and RAM Gaskets supply vital sealing components, reinforcing the aftermarket ecosystem.

Recent Transformer Spare Parts Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.1 billion |

| Projected Market Size (2035) | USD 7.7 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | Bushings, Relays, Gaskets, Busbars, Tap Changers, Oil Filters, Flow Switches |

| Transformer Types Analyzed (Segment 2) | Power Transformers, Distribution Transformers |

| Transformer Categories Analyzed (Segment 3) | Dry Type, Oil Immersed |

| End Users Analyzed (Segment 4) | Power Plants, Utilities, Municipal Authorities, Industrial Facilities, Non-Industrial Sectors |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Hitachi Energy, Asian Electrotech Industries LLP, Nanjing Electric International Co., Ltd., The H-J Family of Companies, Maschinenfabrik Reinhausen GmbH, RAM Gaskets, BaronUSA, LLC, Stephens Gaskets Ltd. |

| Additional Attributes | Dollar sales by product and transformer type, rising demand for aging grid refurbishments, consistent utility sector investments, and expansion of aftermarket services for long-life transformer operation. |

The market is segmented by product type into bushings, relays, gaskets, busbars, tap changers, oil filters, and flow switches.

Based on transformer type, the market includes power transformers and distribution transformers.

By category, transformers are classified into dry type and oil immersed units.

Key end users include power plants, utilities, municipal authorities, industrial facilities, and non-industrial sectors.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 5.1 billion in 2025 and is projected to reach USD 7.7 billion by 2035.

The market is projected to expand at a CAGR of 4.7% between 2025 and 2035.

Oil filters are the leading product type, accounting for 35% of the global market share in 2025.

Utilities dominate the end-user segment with a 48% share in 2025, driven by ongoing grid upgrades and transformer maintenance needs.

China is forecast to register the highest CAGR at 7.8% from 2025 to 2035, driven by grid modernization and renewable energy expansion.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA