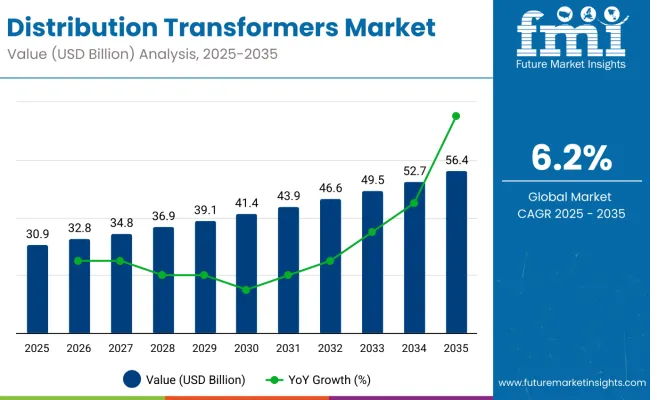

The distribution transformers market is expected to witness strong growth from 2025 to 2035. Market size is estimated at USD 30.9 billion in 2025 and projected to reach USD 56.4 billion by 2035, illustrating a robust CAGR of 6.2%. This expansion is being propelled by accelerating electrification across emerging economies, smart grid modernization programs in developed markets, and the integration of renewable energy sources, all of which demand upgraded and expanded distribution transformer infrastructure.

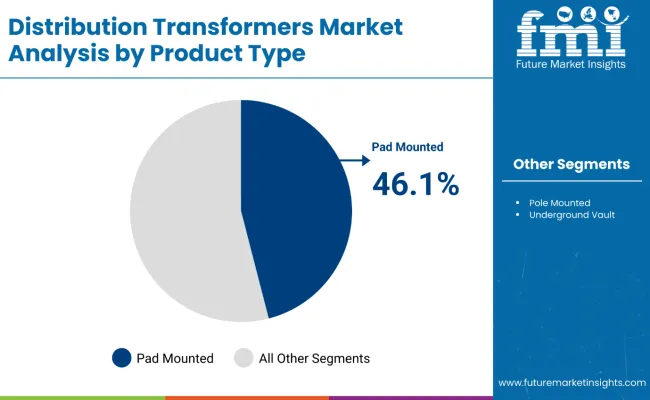

By product type, pad mounted transformers will maintain dominance, expected to account for around 46.1% of the market share in 2025. These units are widely favored for urban and suburban deployment, offering compact design, low maintenance, and fast installation. Their use is especially prominent in residential, commercial, and industrial settings requiring reliable, on-site electricity distribution.

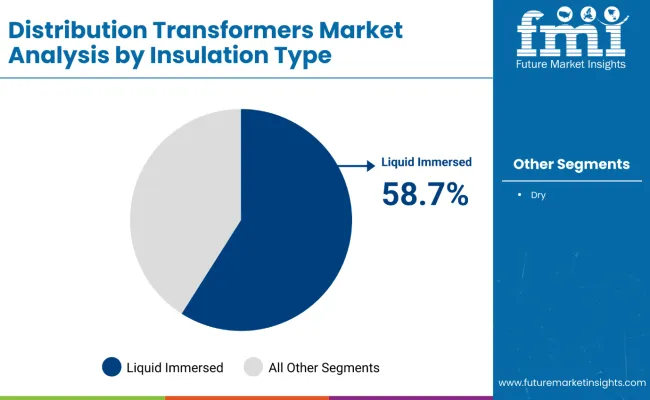

In terms of insulation type, liquid immersed transformers will control approximately 58.7% of the market in 2025. Their popularity stems from efficient thermal management, proven durability, ease of cooling, and overall cost effectiveness. These features make them particularly suitable for heavy-load and continuous-duty applications in utilities and industries.

A key industry insight emerged during a November 3, 2024 interview with Hitachi Energy’s CEO Andreas Schierenbeck in the Financial Times. He emphasized that:

“Ramping up capacity is definitely an issue. It’s not easy and it will probably not ramp up fast enough,” highlighting that the current surge in demand for grid equipment-particularly transformers-could delay essential infrastructure projects and force utilities to extend the operational lifespan of existing transformer assets. This underscores the urgency for manufacturers to increase production capacity and improve supply chain resilience in the short term.

Major manufacturers in the market include ABB Ltd., Siemens Energy, Hitachi Energy, Schneider Electric, Toshiba Energy Systems, and Hyosung Heavy Industries. These companies are prioritizing capacity expansions, digitalization of transformers with monitoring and predictive maintenance features, and development of eco-friendly technologies like bio-based liquid insulation to meet growing demand.

| Metric | Details |

|---|---|

| Market Size (2025) | USD 30.9 billion |

| Market Size (2035) | USD 56.4 billion |

| CAGR (2025 to 2035) | 6.2% |

Distribution transformers are governed by strict regulatory frameworks that ensure safety, performance, energy efficiency, and environmental compliance. These regulations cover product design, testing protocols, hazardous material use, and operational safety across key industries including power distribution and industrial infrastructure.

The global trade of distribution transformers is shaped by expanding energy infrastructure, urbanization, and industrialization. These transformers are essential components in electricity distribution systems and are traded across borders to meet growing demand in both developed and emerging markets. Exporting countries benefit from advanced manufacturing capabilities, while importing countries often focus on infrastructure development and grid modernization.

In 2025, Pad Mounted Transformers will lead the product type segment with a market share of 46.1%, driven by demand for secure, aesthetically pleasing distribution solutions in urban settings. Liquid Immersed Transformers dominate the insulation type segment with a 58.7% share due to their superior cooling efficiency and reliability in handling heavy electrical loads across industrial and commercial zones.

Pad Mounted Transformers are projected to hold the highest share within the product type segment in 2025, accounting for approximately 46.1% of the global distribution transformers market. These transformers are designed for installation in urban and suburban areas where underground cabling is preferred, minimizing visual clutter and ensuring public safety through tamper-resistant, enclosed housings.

Their compact design allows seamless integration into residential, commercial, and public spaces without compromising aesthetics, a key requirement for municipalities and real estate developers. Furthermore, Pad Mounted Transformers offer ease of maintenance and high operational reliability, making them the preferred choice in environments that demand secure, efficient, and low-maintenance power distribution systems.

Major industry players such as ABB Ltd., Siemens AG, and Eaton Corporation are focusing on enhancing the capabilities of pad mounted units by incorporating smart grid features and eco-friendly insulating materials. With increasing urbanization and the expansion of distributed energy resources like rooftop solar, demand for pad mounted transformers will continue to grow, cementing their position as a top investment segment within the distribution transformers market.

Liquid Immersed Transformers are set to dominate the insulation type segment in 2025, capturing an estimated 58.7% market share. These transformers are favored for their excellent thermal management properties, enabling superior heat dissipation even under extreme load conditions. Their capability to handle overloads and maintain performance integrity during peak demand periods makes them indispensable in industrial parks, substations, and large-scale commercial installations.

This segment’s growth is bolstered by the increasing need for efficient and durable power distribution solutions, especially in regions with high ambient temperatures and growing energy consumption. Liquid-immersed transformers offer longer operational lifespans and lower failure rates compared to dry-type alternatives, ensuring reliable service in demanding applications.

Key manufacturers such as Schneider Electric SE, General Electric Company, and Toshiba Corporation are innovating liquid-immersed transformer designs to improve energy efficiency and environmental sustainability by utilizing biodegradable insulating liquids. These developments align with global trends toward greener energy infrastructure, reinforcing the dominance of liquid-immersed units in the distribution transformer landscape. As a result, this insulation type remains a prime focus area for utilities and industrial power system operators worldwide.

High Cost of Advanced Transformer Technologies

A significant challenge for the distribution transformers market is the high initial cost of smart, high-efficiency, eco-friendly transformer technologies. These include improvements to advanced insulation systems, digital monitoring capabilities, and alternative fluid that are more sustainable-all contributing to increased capital expenditures upfront.

Utilities and local distribution companies operating under budget constraints may delay upgrades, particularly in areas where electricity tariffs are regulated or where government subsidies are limited. Outdated logistics and installation challenges in populated or remote locations also contribute to higher project expenses and implementation times.

Growth of Smart Grids and Renewable Integration

Transitioning towards smart grids and distributed energy systems continues to be a major growth inducing factor in the distribution transformer market. As rooftop solar, wind farms, battery storage and electric vehicle charging infrastructure increase, transformers must manage bidirectional power flows and voltage variability.

These capabilities enhance flexibility and are made possible by smart transformers incorporating sensors, real-time diagnostics, and communication features. In addition, global sustainability goals are promoting the uptake of transformers with a lower environmental footprint, fostering opportunities for clean and recyclable transformer products in new markets. This evolution reflects the larger push toward decarbonized and resilient power infrastructure.

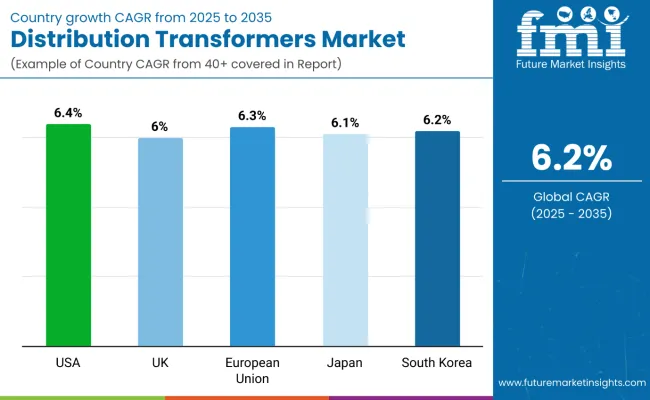

The USA distribution transformers market is being driven by grid modernization activities, declining dependence on fossil fuels and aging infrastructure leading to increasing replacement. This is subject to oversight from the USA Department of Energy and North American Electric Reliability Corporation that require compliance for energy efficiency and safety.

This includes an adoption of smart distribution transformers, installation of dry-type and eco-friendly insulation materials, and a tighter focus on cybersecurity, as well as IoT network-enabled grid infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

The UK distribution transformers market is driven by decarbonisation drives, urbanization, and government initiatives to enhance grid resilience. Transformer deployment and efficiency standards are governed by The Office of Gas and Electricity Markets (Ofgem) and the Department for Energy Security and Net Zero (DESNZ).

Trends influencing the market transformation include the growing demand for compact and modular transformers, a rising move towards using biodegradable oils, along with a higher level of transformer retrofitting in the urban transformer substations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

Evolving European Union directives promoting energy efficiency, extensive renewable integration, and smart grid deployment are steadily driving the growth of the distribution transformers market in the European Union. Safety, environmental impact and design efficiency are regulated by the European Commission and the national energy agencies.

Germany, France, and Italy dominate, spurred by strong utility sector investments, localized energy system rollouts, and compensation of suburban and rural energy distribution systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

Increased demand for earthquake-resistant grid components, integration of renewables such as solar and wind, and a high level of local manufacturers' investment in R&D are driving growth in the Japan distribution transformers market. Transformer Efficiency & Seismic Resilience, The METI and Agency for Natural Resources and Energy regulate transformer efficiency and seismic resilience.

Some key trends include compact, high-efficiency transformer development, increasing utilization of gas-insulated units, and utilization in smart substations for load balancing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korea distribution transformers market is thriving given rapid industrialization, higher energy consumption, and country-level smart grid projects. MOTIE, working in conjunction with the Korea Energy Agency, is responsible for planning the grid infrastructure and enforcing energy efficiency requirements.

Key trends include the urban shift towards dry-type transformers, a continuing increase in the deployment of digitally monitored transformers and increased integration with energy storage systems (ESS).

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

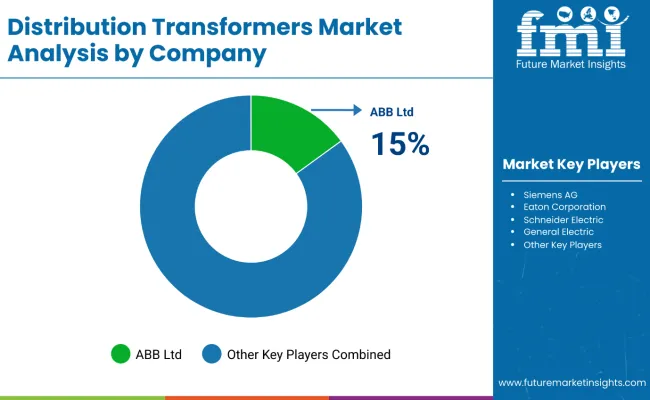

The global distribution transformer market is a rapidly expanding sector within the energy and power industry. Key players dominate the current market with a strong product portfolio and a global presence to support multiple customers.

It provides a competitive landscape covering the strategic initiatives, including mergers and acquisitions, partnerships, and substantial investments in research and development. These are geared towards designing transformers that are energy-efficient and intelligent to cater the next generation power distribution networks and distributed energy resources.

ABB Ltd. (15-18%)

ABB Ltd. is a top player in the transformer market. Their range of transformer products and new energy-saving tech sets them apart. They lead because of their global reach and focus on green initiatives.

Siemens AG (12-15%)

Siemens AG has many types of transformers. They use digital technology to make grids work better and save energy. Siemens' smart grid focus helps them in the changing energy field.

Eaton Corporation (10-13%)

Eaton Corporation designs energy-saving transformers for different users. They care about the environment and offer innovative products, boosting their market power.

Schneider Electric (8-11%)

Schneider Electric makes advanced transformers for smart grids and energy control. Their push for digital change and green tech gives them an edge.

General Electric (7-10%)

General Electric has many transformer options, focusing on reliability and performance. Their worldwide presence and tech progress help their market position.

Other Key Players (Combined Market Share: 33-48%)

Many other firms help a lot in the transformer market:

| Attribute | Details |

|---|---|

| Market Size (2025E) | USD 30.9 Billion |

| Market Size (2035F) | USD 56.4 Billion |

| CAGR (2025 to 2035) | 6.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2018 to 2024 |

| Base Year | 2024 |

| Segment Covered | Product Type, Insulation Type, Phase, Power Rating, End Use, Region |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia, Indonesia, Vietnam, Thailand, Malaysia, GCC Countries, South Africa, Egypt, Turkey |

| By Product Type | Pad Mounted, Pole Mounted, Underground Vault |

| By Insulation Type | Dry, Liquid Immersed |

| By Phase | Single Phase, Three Phase |

| By Power Rating | Up to 500 kVA, 501 kVA to 2500 kVA, 2,501 kVA to 10,000 kVA, Above 10,000 kVA |

| By End Use | Residential, Commercial, Industrial, Power Utilities |

| Key Companies Profiled | Eaton Corporation PLC, General Electric, Brush Electrical Machines Ltd, Kirloskar Electric Company Ltd, Siemens AG, Crompton Greaves Ltd, Mitsubishi Electric Corporation, Fuji Electric Co. Ltd, SPX Transformer Solutions Inc., Bharat Heavy Electricals Ltd. |

| Additional Attributes | What would a manufacturer of Distribution Transformers Market want to know from a market research report? Also use the words dollar sales, share separated by comma and only key pointers in 200-250 characters sentence. Answer: Regional demand outlook, market share by product type, dollar sales forecast for top 5 economies, technology shift towards energy-efficient models, and impact of renewable energy trends on transformer design. |

The overall market size for the distribution transformers market was USD 30.9 billion in 2025.

The distribution transformers market is expected to reach USD 56.4 billion in 2035.

Key drivers include the growing need for replacing aging electrical infrastructure, rising electrification rates in emerging economies, increasing integration of renewable energy into power grids, and expansion of smart grid systems worldwide.

China, the United States, India, Germany, and Japan are the top contributors.

The oil-immersed transformer segment is expected to lead due to its higher efficiency and durability in high-load applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Distribution Board Market Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Lines And Poles Market Size and Share Forecast Outlook 2025 to 2035

Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Distribution Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Unit (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Automation Components Market Analysis by Component, End-Use and Region: Forecast for 2025 to 2035

Hadoop Distribution Market Insights - Trends & Forecast 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Electric Distribution Utility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Distribution Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA