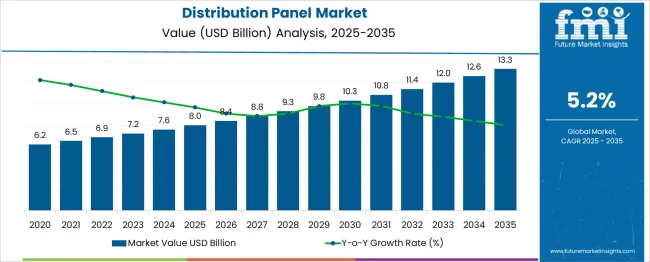

The Distribution Panel Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. The market is projected to demonstrate a consistent and gradual upward trajectory. However, mapping key inflection points reveals deeper insights into shifts in growth momentum. The market enters a stable acceleration phase between 2025 and 2029, growing from USD 8.0 billion to USD 9.3 billion. This phase is primarily driven by rising investments in smart grid infrastructure, increasing electrification in emerging markets, and heightened industrial demand for reliable power distribution.

The first notable inflection point appears between 2029 and 2031, where growth shifts from linear to slightly exponential, from USD 9.3 billion to USD 10.8 billion. This is likely due to regulatory pushes for sustainable energy systems and the integration of IoT-enabled distribution solutions. A second inflection zone is visible post-2032 as demand is further boosted by the retrofitting of aging power infrastructure across developed economies, pushing the market from USD 11.4 billion in 2032 to USD 13.3 billion by 2035. The market’s inflection points reflect a compound response to technological integration, policy interventions, and infrastructure modernization indicating that innovation and regulatory alignment are central to future growth acceleration.

| Metric | Value |

|---|---|

| Distribution Panel Market Estimated Value in (2025 E) | USD 8.0 billion |

| Distribution Panel Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The distribution panel market is witnessing steady growth, driven by the global expansion of commercial infrastructure, modernization of grid systems, and the integration of renewable energy sources. As buildings and industries transition toward smart power management, demand for reliable and efficient electrical distribution solutions is increasing.

Emphasis on energy efficiency, compliance with IEC standards, and adoption of automation in energy systems are reshaping product design and procurement priorities. Government-led electrification programs, along with rising investments in infrastructure upgrades across emerging economies, are contributing to heightened panel installations.

Technological improvements in switchgear components and the shift toward low-maintenance, compact panel designs are favoring both new construction and retrofit markets. Looking ahead, digital integration, including IoT-based monitoring and fault detection systems, is expected to further elevate the role of distribution panels in sustainable energy architecture.

The distribution panel market is segmented by voltage, mounting end use, and geographic regions. By voltage, the distribution panel market is divided into Low voltage and medium voltage. In terms of mounting, the distribution panel market is classified into Surface mounting and Flush mounting. Based on end use, the distribution panel market is segmented into Commercial, Industrial, Utility, and Residential. Regionally, the distribution panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

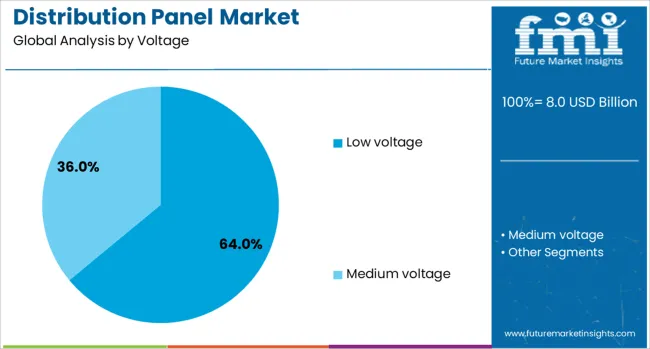

Low voltage panels are expected to command 64.00% of the revenue share in 2025, establishing them as the leading voltage category. This is being driven by their extensive applicability in residential, commercial, and light industrial facilities where operating voltage requirements are typically under 1,000V.

Increased deployment of low-voltage distribution systems is being supported by urbanization, smart building developments, and the rise of distributed energy generation. Their cost-effectiveness, compact size, and ease of installation make them a preferred choice for end-users with moderate load demands.

Furthermore, rising adoption of electric vehicle charging infrastructure, HVAC systems, and intelligent lighting solutions is boosting demand for low-voltage panels due to compatibility and safety advantages in decentralized energy applications.

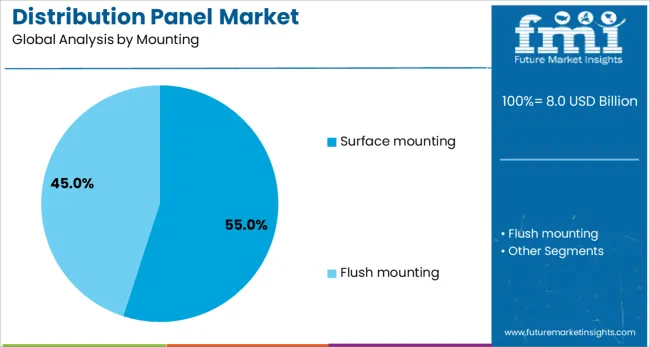

Surface mounting panels are projected to hold 55.00% of the market share in 2025, making them the most widely adopted mounting configuration. Their dominance is being supported by simplified installation procedures, reduced structural alterations, and lower associated labor costs.

Surface-mounted panels are commonly used in retrofit projects and modular buildings where internal wall spaces are limited or access flexibility is essential. These panels allow quick maintenance access and are better suited for temporary setups or frequently modified environments, making them popular in commercial, institutional, and industrial renovations.

Enhanced design aesthetics and corrosion-resistant enclosures are also contributing to their increased application in visible installations.

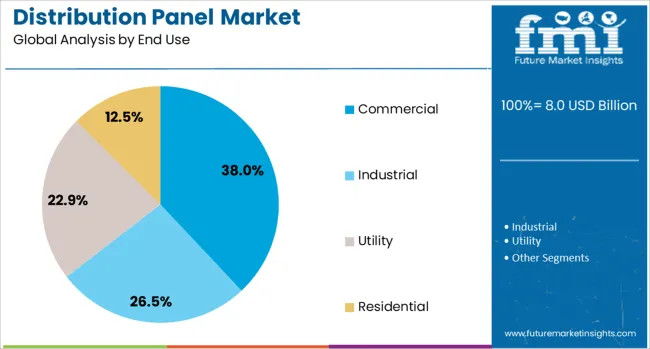

Commercial usage is expected to account for 38.00% of total market revenue in 2025, positioning it as the dominant end-use segment. This lead is being influenced by rapid expansion in retail outlets, business parks, hospitals, and hospitality infrastructure globally.

Rising demand for energy-efficient and resilient power distribution systems within commercial facilities has led to significant upgrades in panel specifications and functionalities. Increasing reliance on electronic systems, data centers, and HVAC systems in commercial buildings necessitates highly reliable and easy-to-integrate distribution panels.

Energy compliance mandates and sustainability certifications in the commercial sector are further accelerating the adoption of advanced panel systems that support metering, fault diagnostics, and load balancing.

The distribution panel market is steadily expanding due to the growing demand for reliable power management in commercial, industrial, and residential sectors. These panels serve as key components in electrical distribution systems, enabling controlled delivery of electricity across facilities. As infrastructure upgrades and electrification projects continue globally, demand for robust, compact, and safety-certified panels is increasing. Product customization, ease of installation, and space-saving designs are becoming important differentiators. Rising construction activity and grid modernization further contribute to the market's ongoing development.

Distribution panels are essential in managing and segmenting power flow in a wide range of infrastructure settings. As construction of commercial buildings, industrial units, and public facilities expands, the need for organized and efficient electrical systems grows. Distribution panels ensure protection from overcurrent and short circuits, while enabling ease of maintenance and expansion. This functional importance makes them a standard component in new installations as well as retrofit applications. In many regions, efforts to improve electrical reliability are driving replacement of outdated panels with modern versions that offer better control, modularity, and durability. Users seek products that integrate smoothly into existing setups, which supports demand for configurable and compact panel options. With a global focus on uninterrupted power delivery in both developed and emerging markets, distribution panels remain indispensable. These systems are being integrated not just in buildings, but also in utilities, transport systems, and temporary power setups.

Despite growing demand, the market faces challenges due to inconsistent design specifications and regional installation codes. Distribution panels must often be customized to fit specific voltage classes, breaker arrangements, and load requirements. This creates complexity for manufacturers attempting to standardize production across multiple regions or sectors. Additionally, installation of these panels requires coordination with electrical layout plans, making last-minute changes difficult and costly. In many retrofit projects, space limitations and legacy wiring configurations introduce further complications. Maintenance teams may also face difficulties in managing panels that lack clear labeling or modular features. For manufacturers, producing a diverse range of designs while ensuring safety compliance adds to operational burdens. Electrical consultants and contractors must invest additional time in project planning, especially when integrating panels into complex facilities. These factors can delay procurement decisions and slow project timelines, particularly in cost-sensitive or regulation-heavy markets where adherence to local codes is mandatory.

There is growing interest in modular and pre-wired distribution panels, particularly among commercial builders and industrial users seeking faster deployment and reduced on-site labor. These systems come partially or fully assembled, often with standardized cable entries, labeled circuits, and integrated accessories. This simplifies the installation process, reduces errors, and minimizes downtime during panel upgrades or expansions. For contractors and facility managers, pre-configured panels reduce the need for skilled labor during final connections. Manufacturers offering these value-added solutions are becoming preferred suppliers for time-sensitive or large-scale projects. Additionally, modularity allows end users to scale their power distribution setup as operational needs change, without requiring complete system overhauls. This flexibility is attractive to sectors like manufacturing, data centers, and temporary infrastructure installations. As project planners and engineers prioritize ease of integration, customizable and expandable panel systems are gaining traction. This shift opens up new product development and market positioning opportunities for panel manufacturers.

Regulatory compliance remains a significant restraint in the distribution panel market. Electrical panels must meet a range of local and international safety standards that cover insulation, fire resistance, short-circuit tolerance, and enclosure ratings. These requirements differ across jurisdictions, and delays in obtaining product certifications can affect time-to-market. Frequent updates to electrical safety codes also force manufacturers to redesign or recertify existing models, increasing time and cost pressures. Additionally, in regions with strict energy use regulations, distribution panels must accommodate monitoring devices and power meters, adding to design complexity. Delays in inspection and approval processes at the project level can also stall installation and usage. For smaller suppliers, navigating these standards can be resource-intensive, limiting their ability to compete with established brands. Until regulatory alignment improves and certification processes become more predictable, these compliance-related constraints will continue to influence product development cycles, market entry timelines, and pricing structures.

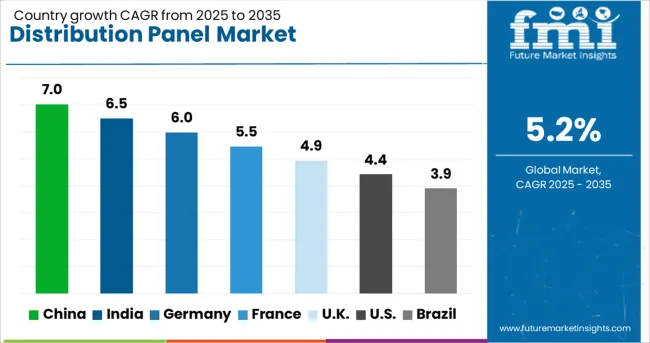

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global distribution panel market is growing at a CAGR of 5.2%, driven by expanding power infrastructure, rapid urbanization, and increasing adoption of smart grid technologies. China leads with 7.0% growth, backed by large-scale industrial development and government investments in electrical infrastructure. India follows at 6.5%, fueled by rising electrification in rural areas and upgrades in commercial and residential power distribution. Germany records 6.0% growth, reflecting advanced automation in electrical systems and stringent safety standards. The United Kingdom shows consistent growth at 4.9%, focusing on energy-efficient panel designs and retrofitting of aging infrastructure. The United States, with 4.4% growth, remains a mature market shaped by regulatory compliance, smart home integration, and renewable energy adoption. Market trends are influenced by modular design, safety protocols, and digital monitoring capabilities. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the distribution panel market with a 7.0% CAGR, driven by rapid urbanization, industrial automation, and renewable energy integration. Smart city developments and large-scale infrastructure projects are accelerating the demand for advanced low- and medium-voltage distribution panels. Local manufacturers are investing in digital monitoring features, IoT integration, and modular panel designs to meet modern energy management standards. The growing solar and wind sectors require specialized panels with real-time load balancing and safety features. Policy incentives for energy efficiency and electrification in transportation are creating new application areas. Export-oriented manufacturers are producing globally certified panels to serve overseas markets. High-rise construction and commercial real estate developments are also contributing to increased installations.

India is seeing a 6.5% CAGR in the distribution panel market, supported by growth in power infrastructure, commercial construction, and industrial electrification. The government's focus on power distribution reform and smart metering is driving investment in modern panels with remote monitoring and fault detection. Demand is strong across commercial complexes, manufacturing units, and residential developments. Indian OEMs are producing cost-effective and durable panel solutions suited for local conditions, including high-temperature and dust-prone environments. Initiatives like Smart Cities Mission and EV charging infrastructure are creating new use cases. Collaborations with global technology providers are introducing advanced protection and automation systems. Public sector tenders and utility-scale electrification projects are also contributing to steady market expansion.

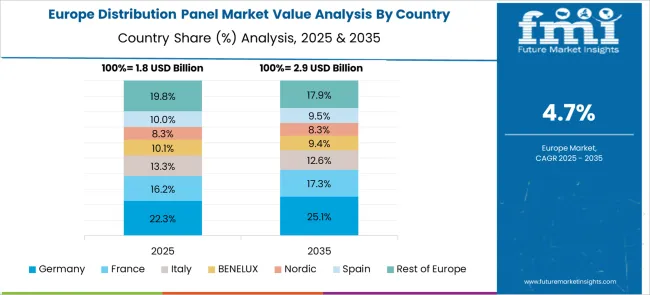

Germany is registering a 6.0% CAGR in the distribution panel market, driven by strong industrial demand, energy transition goals, and building automation systems. The country is investing heavily in renewable power generation and decentralized energy grids, requiring sophisticated panel systems with high connectivity and grid interoperability. Industrial automation is boosting the use of intelligent panels with programmable logic controllers and real-time diagnostics. German engineering standards prioritize safety, energy efficiency, and space optimization, influencing panel design and production. Building retrofit projects and energy upgrades across commercial and residential sectors are contributing to market growth. Local manufacturers are leveraging Industry 4.0 technologies to enhance panel performance and monitoring capabilities.

The United Kingdom is experiencing a 4.9% CAGR in the distribution panel market, with demand driven by building renovations, infrastructure modernization, and sustainability regulations. Government initiatives focused on net-zero emissions and electrification of public buildings are fueling the need for efficient and low-loss distribution panels. Upgrades in transport networks, including rail and EV charging stations, are contributing to market expansion. British manufacturers are focusing on compact, customizable panels that meet space-constrained environments. Integration with energy monitoring software and digital control systems is becoming standard. The commercial construction sector is particularly active in panel installations as part of energy performance compliance. Imports of specialized components supplement domestic production.

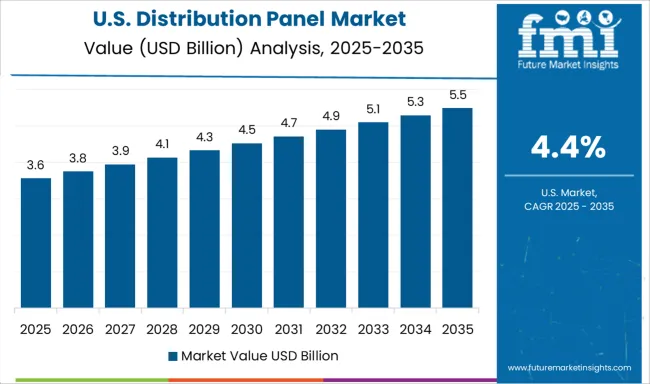

The United States is seeing a 4.4% CAGR in the distribution panel market, supported by residential upgrades, data center expansion, and grid modernization. Aging electrical infrastructure is being replaced with advanced distribution systems capable of handling higher loads and digital controls. The rise of smart homes and intelligent buildings is encouraging adoption of panels with integrated monitoring and safety features. Data centers require high-reliability panels with modular redundancy and real-time fault tracking. Energy efficiency programs and federal funding for infrastructure are driving new installations across public and private sectors. Local manufacturers are offering UL-certified products with customizable configurations for different building types. Utilities and commercial property developers are key end-users in this steadily growing market.

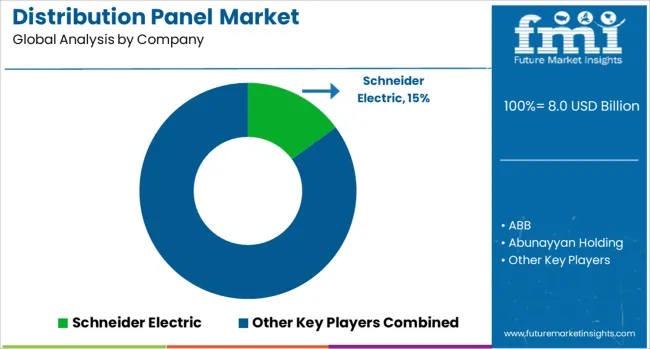

The distribution panel market is witnessing steady growth, propelled by ongoing developments in commercial buildings, industrial automation, and grid modernization. Distribution panels serve as essential components for managing and distributing electricity within facilities, making them integral to efficient and safe power systems. Their use spans across residential, commercial, and industrial installations, with a particular focus on safety, modularity, and compatibility with evolving electrical codes. Global leaders such as Schneider Electric, ABB, Siemens, Eaton, and General Electric dominate the market through comprehensive product portfolios and strong integration across power management systems. These companies offer advanced features like arc flash protection, intelligent monitoring, and scalable panelboard solutions.

Their ability to cater to both low-voltage and medium-voltage needs allows them to service a broad range of end-users, from urban infrastructure to energy-intensive industries. Alongside the global players, regional and specialized manufacturers such as Larsen & Toubro, alfanar Group, Abunayyan Holding, Norelco, and EAMFCO contribute significantly to localized supply, especially in the Middle East and Asia-Pacific markets. These firms often tailor their offerings to meet regional electrical standards and project specifications. Meanwhile, companies like Legrand, Hager Group, and Meba Electric strengthen the mid-tier segment with strong presence in commercial and light industrial applications. Overall, the competitive landscape is shaped by reliability, regulatory compliance, and the ability to meet increasing electrification demands across sectors.

As mentioned in L‑com’s official February 2024 press release, the company launched a new line of IEC connectors, power entry modules, and PDUs for industrial and IT power distribution. The products meet IEC/EN 60320, UL, CSA, and VDE standards and are available in over 100 configurations for immediate shipment.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.0 Billion |

| Voltage | Low voltage and Medium voltage |

| Mounting | Surface mounting and Flush mounting |

| End Use | Commercial, Industrial, Utility, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Abunayyan Holding, AGS, alfanar Group, EAMFCO, Eaton, ESL POWER SYSTEMS, General Electric, Hager Group, INDUSTRIAL ELECTRIC MFG, Larsen & Toubro, Legrand, Meba Electric, NHP, Norelco, and Siemens |

| Additional Attributes | Dollar sales vary by panel type and application, with low-voltage units dominating, while smart and modular panels grow fastest. Asia-Pacific leads in volume, while North America and Europe generate higher value. Pricing fluctuates with raw materials and smart-tech costs. Growth accelerates via IoT integration, renewable grid compatibility, and urban infrastructure expansion under efficiency mandates. |

The global distribution panel market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the distribution panel market is projected to reach USD 13.3 billion by 2035.

The distribution panel market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in distribution panel market are low voltage and medium voltage.

In terms of mounting, surface mounting segment to command 55.0% share in the distribution panel market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA