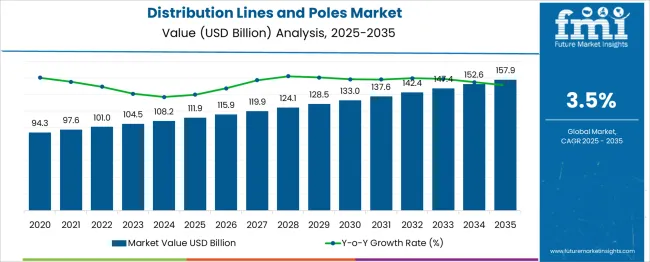

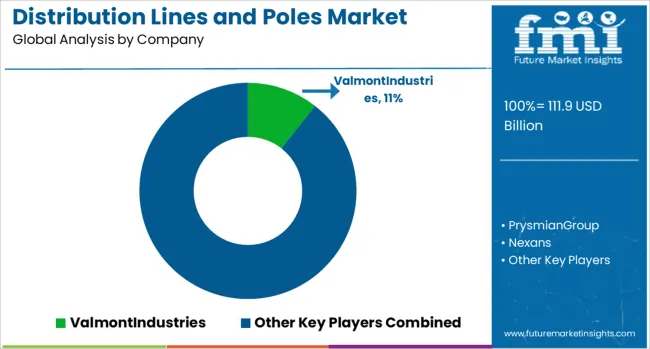

The Distribution Lines And Poles Market is estimated to be valued at USD 111.9 billion in 2025 and is projected to reach USD 157.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. This growth reflects a multiplier of 1.41x, supported by a steady CAGR of 3.5%, driven by increasing investments in power grid modernization, urbanization, and rural electrification. In the first five-year phase (2025–2030), the market is expected to reach USD 133.2 billion, adding USD 21.3 billion, which accounts for 46.3% of the total incremental growth, fueled by the global push for upgrading electrical infrastructure. The second phase (2030–2035) contributes USD 24.7 billion, representing 53.7% of incremental growth, driven by continued demand for resilient and sustainable power distribution solutions, particularly in renewable energy integration and smart grid systems.

Annual increments will rise from USD 4 billion in the early years to USD 5.5 billion by 2035, reflecting strong momentum in infrastructure investments and technological upgrades. Manufacturers focusing on eco-friendly materials, high-capacity poles, and next-gen smart grid solutions will capture the largest share of this USD 46 billion opportunity.

| Metric | Value |

|---|---|

| Distribution Lines And Poles Market Estimated Value in (2025 E) | USD 111.9 billion |

| Distribution Lines And Poles Market Forecast Value in (2035 F) | USD 157.9 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The distribution lines and poles market is experiencing accelerated growth as global utilities and infrastructure developers address the dual challenge of modernizing aging grids while supporting rising energy demand. With the integration of renewable energy sources and electrification of sectors such as transportation and industry, robust and adaptable distribution systems have become critical.

Investment surges across both developed and developing regions are being fueled by public and private sector initiatives focused on expanding last-mile connectivity, improving outage response, and ensuring grid resilience. Urban sprawl and rural electrification efforts are further amplifying demand for durable pole systems and high-capacity line configurations.

Technological advancements such as smart fault detection, automated load balancing, and digital twin simulations are being increasingly incorporated into new installations, further elevating the role of the distribution network as an intelligent, responsive backbone of energy delivery. In the coming years, sustainability mandates and extreme weather resilience planning are expected to solidify the market’s trajectory toward high-performance materials and next-generation voltage systems.

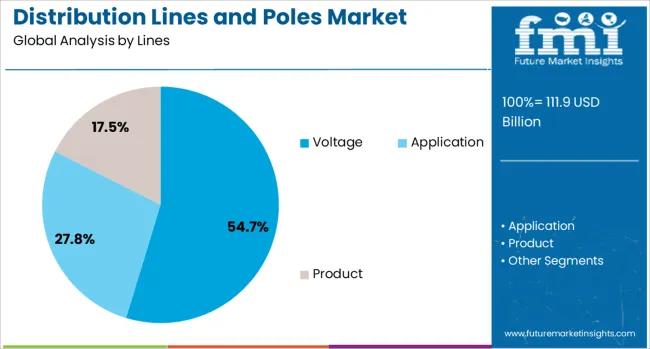

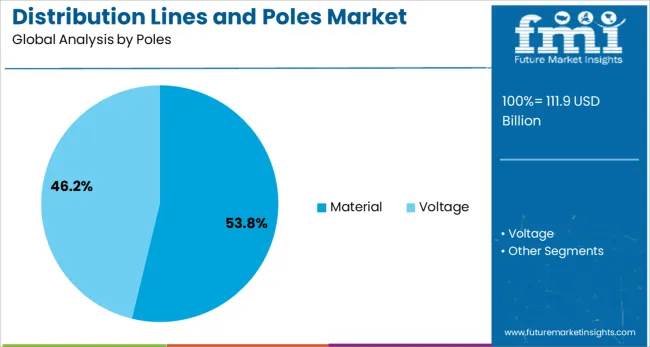

The distribution lines and poles market is segmented by lines, poles, and geographic regions. By lines of the distribution lines and poles, the market is divided into Voltage and Application Product. In terms of poles of the distribution lines, and poles market is classified into Material Voltage. Regionally, the distribution lines and poles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The voltage subsegment is anticipated to account for 54.7% of the total revenue share within the lines segment of the distribution lines and poles market in 2025. This dominant position is being driven by increasing demand for medium and high-voltage distribution infrastructure in rapidly urbanizing and industrializing regions. The need for efficient transmission of power over extended distances without significant energy loss has led to the widespread deployment of voltage-optimized line systems.

Advancements in insulation materials and conductor technologies have enabled more compact and high-capacity configurations, supporting both grid stability and integration of decentralized energy resources. Additionally, regulatory mandates for power quality and transmission efficiency have accelerated upgrades in voltage management across utilities.

The transition toward smart grids has further reinforced the relevance of voltage-sensitive distribution lines, especially those capable of dynamic response to load fluctuations. As renewable energy penetration continues to grow, voltage-based line configurations are expected to remain central to grid adaptability and expansion efforts.

The material subsegment within the poles category is projected to hold 53.8% of the total revenue share in 2025, underscoring its pivotal role in infrastructure reliability and safety. Material selection has gained increased attention as utilities seek to balance mechanical strength, environmental durability, and lifecycle cost efficiency. Rising adoption of composite, fiberglass, and advanced treated wood poles has been influenced by their resistance to corrosion, insects, and fire-all of which are critical considerations amid rising climate volatility.

Improved manufacturing techniques and the development of lightweight, high-strength materials have further supported cost-effective logistics and quicker field installation. In addition, materials that support integration with smart sensors, line reclosers, and real-time monitoring devices are being preferred for future-ready pole systems.

The increasing frequency of extreme weather events and growing grid resilience requirements have led to a shift away from traditional pole materials toward those offering longer service life and minimal maintenance. As energy distribution networks evolve, material performance will continue to define reliability and total cost of ownership across regions.

The distribution lines and poles market is experiencing growth, driven by the increasing demand for reliable and efficient power distribution infrastructure. Growth drivers include the need for modernization of aging electrical grids and expansion of renewable energy sources. Opportunities lie in rural electrification projects and increasing government investments in infrastructure. Emerging trends show a shift toward smart grid technology. However, market restraints include high capital investment costs and challenges in regulatory approvals, which can delay infrastructure projects.

A major growth driver in the distribution lines and poles market is the need for the modernization of aging electrical grids. In 2024, many regions began upgrading their infrastructure to improve reliability and accommodate new power generation technologies, including renewables. This trend is expected to continue into 2025, as countries focus on boosting grid efficiency, reducing downtime, and improving service quality. These factors contribute significantly to the expansion of the distribution lines and poles market.

Opportunities in the distribution lines and poles market are emerging through rural electrification initiatives. Governments and utility companies are investing in extending power lines to underserved areas. In 2024, several developing countries launched projects aimed at connecting rural populations to the grid, which is expected to continue in 2025. These efforts are opening new avenues for market players to expand their reach and supply infrastructure to remote locations, driving demand for distribution lines and poles.

Emerging trends in the distribution lines and poles market are focused on the integration of smart grid technology. In 2024, advancements in automation, digitalization, and communication technologies began to play a more prominent role in modernizing distribution networks. Smart grid systems enable real-time monitoring, better fault detection, and improved energy management. This trend is expected to increase further by 2025, as utilities increasingly prioritize efficiency and sustainability in their power distribution networks.

Market restraints in the distribution lines and poles sector include high capital investment requirements and regulatory approval delays. In 2024, utility companies and governments faced challenges related to the substantial upfront costs required for the installation of distribution infrastructure. Additionally, the time-consuming process of securing permits and approvals for new projects also slowed market growth. These barriers are expected to persist in 2025, hindering the pace at which new distribution lines and poles are implemented globally.

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

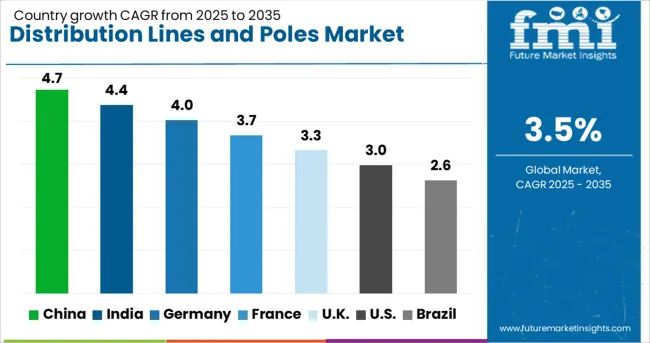

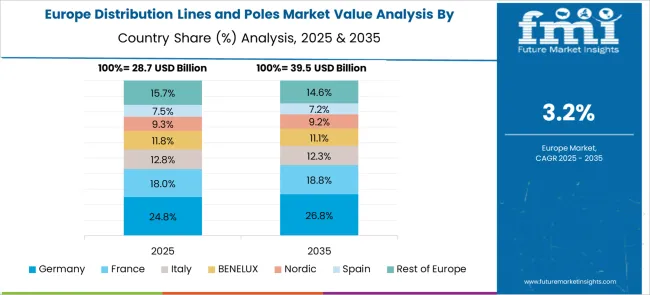

The global distribution lines and poles market is projected to grow at a CAGR of 3.5% from 2025 to 2035. China leads with a growth rate of 4.7%, followed by India at 4.4%, and France at 3.7%. The United Kingdom records a growth rate of 3.3%, while the United States shows the slowest growth at 3.0%. These variations in growth rates are driven by regional infrastructure development, energy distribution demands, and government policies. Emerging markets like China and India are seeing higher growth due to significant investments in rural electrification and infrastructure expansion, while more mature markets like the USA and the UK exhibit slower growth due to established distribution networks.

The distribution lines and poles market in China is growing at a strong pace, with a projected CAGR of 4.7%. The country’s rapid urbanization, industrialization, and ongoing infrastructure development are key drivers of this market. China’s growing energy demand, coupled with the government’s push for rural electrification and the expansion of smart grid technologies, is significantly contributing to the demand for distribution lines and poles. Additionally, investments in renewable energy projects and the need for modernized electrical distribution networks further fuel the growth of the market.

The distribution lines and poles market in India is projected to grow at a CAGR of 4.4%. India’s ongoing push for rural electrification, urban infrastructure development, and smart grid adoption is driving the demand for distribution lines and poles. The government’s focus on expanding the electricity grid to underserved areas and the increased demand for reliable electricity in urban regions contribute to the growth of the market. Additionally, India's ambitious renewable energy goals further drive the need for modern and efficient distribution infrastructure to handle distributed energy generation.

The distribution lines and poles market in France is expected to grow at a CAGR of 3.7%. The country’s focus on renewable energy integration, smart grid deployment, and modernization of electrical infrastructure is contributing to steady demand for distribution lines and poles. France’s commitment to reducing carbon emissions and expanding its renewable energy capacity is pushing for better energy distribution solutions. The market growth is also supported by investments in rural and remote areas to ensure reliable energy access. While growth is slower compared to emerging markets, continued infrastructure upgrades drive steady demand.

The distribution lines and poles market in the United Kingdom is projected to grow at a CAGR of 3.3%. The UK’s steady market growth is primarily driven by its efforts to modernize the electricity grid and expand the use of renewable energy sources. The adoption of smart grid technologies, alongside the government’s goals to decarbonize energy systems, is creating a growing demand for updated distribution infrastructure. Despite market maturity, the push for more resilient and sustainable electrical distribution systems ensures consistent demand for distribution lines and poles.

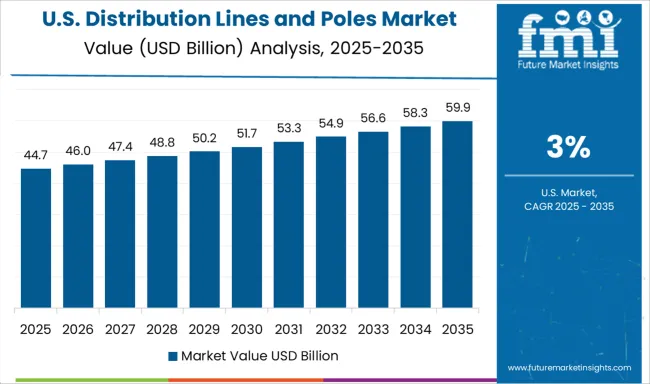

The distribution lines and poles market in the United States is expected to grow at a CAGR of 3.0%. Although the USA market is more mature, ongoing infrastructure investments and the need to upgrade outdated distribution systems drive steady demand for distribution lines and poles. The push towards renewable energy integration and smart grid technologies also fuels the demand for updated distribution infrastructure. In addition, the need to enhance energy reliability and mitigate the effects of extreme weather events further supports the market's steady expansion.

Competition in the distribution lines and poles market is being shaped by global infrastructure providers, pole manufacturers, and regional EPC contractors who use scale, product diversity, and localized supply to strengthen their advantage. Demand is being driven by electricity consumption growth, grid reinforcement programs, and national electrification projects that require both overhead and underground distribution expansion. Global players such as ABB, Siemens, Eaton, GE, and Schneider Electric secure competitive positions by offering end-to-end distribution packages that combine pole systems, lines, installation services, and lifecycle support. Their focus is on modernization and smart grid integration, where long-term service agreements ensure recurring revenue. Valmont Industries differentiates itself with engineered steel and concrete poles designed for heavy-duty and urban installations, while Stella-Jones and Koppers maintain leadership in treated wood poles, producing more than 4 million units annually and using automated treatment lines to deliver consistent quality. Cable specialists such as Nexans and Prysmian use their manufacturing scale to supply pole-mounted conductors and accessories that complement distribution networks across diverse geographies.

Regional EPC contractors such as Skipper Limited and KEC International add competitive pressure by supplying poles and executing turnkey electrification projects in India, Africa, and Southeast Asia. Their business model integrates design, manufacturing, and installation, ensuring speed of deployment in high-growth regions. The competitive landscape is defined by strategies that emphasize multi-material portfolios spanning wood, steel, concrete, and composite, along with modular platforms for faster deployment. Scalability is pursued through local production sites, service integration, and technology upgrades, ensuring resilience and compatibility with smart grids while meeting rising electrification targets worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 111.9 Billion |

| Lines | Voltage, Application, and Product |

| Poles | Material and Voltage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ValmontIndustries, PrysmianGroup, Nexans, APARIndustries, ElsewedyElectric, GeneralCable, KoppersUtility&IndustrialProducts, BellLumber&PoleCompany, KEIIndustries, Stella-Jones, SWCCSHOWAHOLDINGCo., StressCrete,Group., UtilityStructuresInc, BridgeWellResources, T.R.MillerMillCo.,Inc., DynamicCables, LAMIFIL, ZTT, KreativeConcreteIndustries, and PelcoStructural |

| Additional Attributes | Dollar sales by line and pole type and application, demand dynamics across utility, telecommunications, and construction sectors, regional trends in distribution line and pole adoption, innovation in smart grid integration and material technologies, impact of regulatory standards on safety and environmental concerns, and emerging use cases in renewable energy integration and urban infrastructure development. |

The global distribution lines and poles market is estimated to be valued at USD 111.9 billion in 2025.

The market size for the distribution lines and poles market is projected to reach USD 157.9 billion by 2035.

The distribution lines and poles market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in distribution lines and poles market are voltage, _11 kv - 33 kv, _≤ 11 kv, _> 33 kv, application, _primary, _secondary, product, _abc and _open wire.

In terms of poles, material segment to command 53.8% share in the distribution lines and poles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Franchising and Distribution Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Subsea Umbilicals Risers And Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Transformers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Distribution Logistics Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA