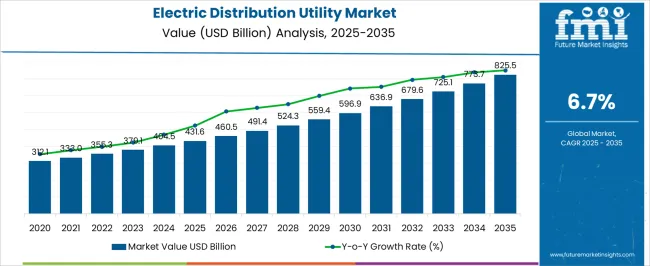

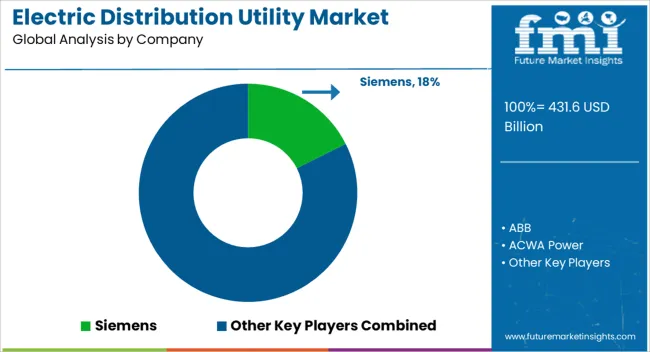

The electric distribution utility market is expected to grow from USD 431.6 billion in 2025 to USD 825.5 billion by 2035, with a CAGR of 6.7%. A Peak-to-Trough Analysis highlights key phases of acceleration and deceleration in market growth. Between 2025 and 2030, the market increases from USD 431.6 billion to USD 596.9 billion, adding USD 165.3 billion in growth, which represents a CAGR of 7.1%. This period reflects strong growth driven by investments in smart grid technologies, renewable energy integration, and modernization of electrical infrastructure to meet growing energy demands. The first peak occurs at USD 596.9 billion in 2030, followed by a slowdown between 2030 and 2032, with growth from USD 596.9 billion to USD 636.9 billion, showing a more modest CAGR of 3.3%. This deceleration reflects market maturation as major infrastructure upgrades and renewable energy projects reach their completion stages. From 2032 to 2035, the market rebounds sharply, moving from USD 636.9 billion to USD 825.5 billion, adding USD 188.6 billion in growth with a CAGR of 9.1%. This rebound is driven by the increasing electrification of industries, growing demand for sustainable energy solutions, and the continued development of grid technologies. The Peak-to-Trough Analysis demonstrates strong early growth, followed by a temporary slowdown and a sharp acceleration as the market reaches new peaks.

| Metric | Value |

|---|---|

| Electric Distribution Utility Market Estimated Value in (2025 E) | USD 431.6 billion |

| Electric Distribution Utility Market Forecast Value in (2035 F) | USD 825.5 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The electric distribution utility market is undergoing structural modernization, supported by rising urbanization, grid reliability mandates, and the integration of decentralized energy resources. Growing electricity demand across emerging economies, coupled with aging infrastructure in developed regions, is driving large-scale upgrades in distribution networks.

Regulatory pressure to reduce transmission losses and improve outage response times has accelerated adoption of intelligent monitoring systems, advanced metering, and distributed automation technologies. Utilities are increasingly focusing on grid resilience, cost efficiency, and the integration of renewables, which is influencing capital investment strategies and procurement policies.

Digitalization trends, along with increased electrification of residential and mobility sectors, are expected to continue driving transformation across medium- and low-voltage infrastructure. Future growth will also be shaped by supportive funding programs, evolving rate structures, and increased stakeholder collaboration on grid modernization frameworks.

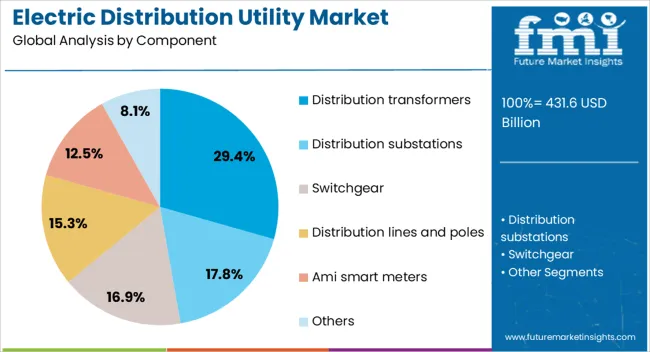

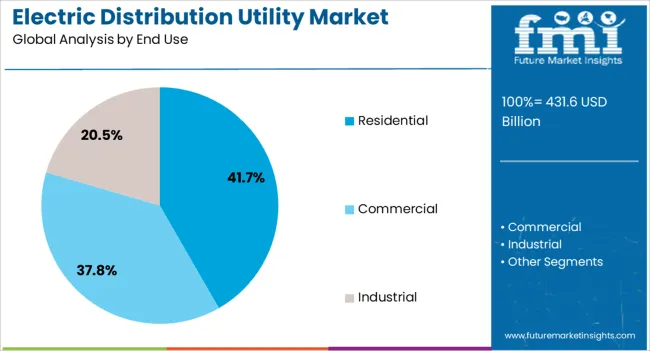

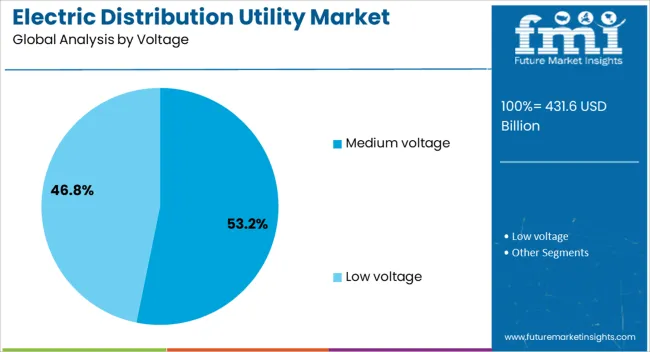

The electric distribution utility market is segmented by component, end use, voltage, and region. By component, the market is divided into distribution transformers, distribution substations, switchgear, distribution lines and poles, AMI smart meters, and others. In terms of end use, it is classified into residential, commercial, and industrial. Based on voltage, the market is segmented into medium voltage and low voltage. Regionally, the electric distribution utility industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Distribution transformers are expected to account for 29.40% of the total market revenue in 2025, positioning them as the leading component segment. This segment’s growth is being driven by widespread deployment across last-mile grid applications, where voltage is stepped down for end-user accessibility.

Increased investments in rural electrification, grid reliability improvements, and urban infrastructure projects are supporting demand for high-efficiency distribution transformers. The segment is also benefiting from the push toward reduced technical losses and compliance with energy efficiency standards.

With the growing adoption of renewable energy at the distribution level, transformers are being upgraded to handle bidirectional power flow and fluctuating loads, further reinforcing their strategic role in grid operations.

The residential segment is projected to lead the market in 2025 with a 41.70% revenue share. This dominance is being shaped by rapid housing development, increased appliance usage, and electrification of domestic heating and cooling systems.

Expanding urban populations and rising living standards are contributing to higher peak demand, necessitating robust and reliable residential distribution infrastructure. The growth of electric vehicles and home-based renewable installations such as rooftop solar is also intensifying the need for residential-level energy management and load balancing.

Utilities are responding by enhancing low-voltage networks, deploying smart meters, and enabling real-time consumption tracking all of which reinforce the residential segment’s prominence within the distribution utility market.

Medium voltage infrastructure is expected to hold 53.20% of the market share in 2025, establishing it as the dominant voltage level in the distribution utility landscape. This segment’s leadership is driven by its central role in bridging high-voltage transmission lines and localized low-voltage distribution.

Industrial zones, commercial centers, and densely populated residential clusters rely heavily on medium voltage systems for reliable and efficient electricity delivery. Technological upgrades such as smart switchgear, automated substations, and condition-based monitoring are increasingly being deployed within this range to enhance fault detection and reduce downtime.

Furthermore, medium voltage grids are playing a critical role in integrating distributed energy resources and microgrids, especially in urban and semi-urban regions, sustaining long-term demand for modernized, scalable solutions in this segment.

The electric distribution utility market is witnessing growth driven by the increasing demand for reliable and efficient power distribution systems. As urbanization accelerates and industrialization expands, the need for modernized infrastructure to support electricity supply in residential, commercial, and industrial sectors is rising. The adoption of smart grid technologies, coupled with regulatory pressure to reduce downtime and improve service reliability, is boosting market growth. Despite challenges such as aging infrastructure and high operational costs, there are significant opportunities for growth in the transition to advanced, digitalized energy distribution networks.

The increasing demand for reliable and efficient power distribution systems is a major driver for the growth of the electric distribution utility market. As urbanization and industrial activities intensify, electricity consumption is surging, creating the need for modernized infrastructure capable of handling higher loads. The adoption of smart grid technologies has significantly contributed to improving power reliability, efficiency, and real-time monitoring of the distribution network. Furthermore, government regulations emphasizing reduced downtime, improved service reliability, and the integration of renewable energy sources into the grid are fueling the adoption of advanced electric distribution systems. This demand for enhanced distribution solutions is leading to the modernization of electrical infrastructure and boosting the market.

Aging infrastructure remains a significant challenge in the electric distribution utility market. Many existing power grids and distribution systems require extensive maintenance or replacement to meet current demand and regulatory standards. The high capital investment needed for infrastructure upgrades, along with the complexities of modernizing older systems, can be a deterrent for utility companies. Additionally, the operational costs associated with maintaining and upgrading these systems are substantial, placing financial pressure on electric distribution utilities. The integration of renewable energy sources and the growing complexity of power networks further increase the operational costs. Addressing these challenges requires strategic investments in technology and long-term planning to ensure grid reliability and efficiency.

The electric distribution utility sector offers significant opportunities through the integration of smart grid technologies. These advanced systems enable real-time monitoring, predictive maintenance, and improved energy management, which enhance the reliability and efficiency of power distribution networks. Smart grids also allow for better integration of renewable energy sources into the existing grid, optimizing energy flow and reducing losses. The digitalization of the power grid, including the use of IoT, AI, and big data analytics, is transforming the way utilities manage their infrastructure. These innovations are creating opportunities for utilities to improve grid stability, reduce downtime, and lower operational costs, opening new growth avenues in the sector.

One of the key trends in the electric distribution utility market is the increased adoption of advanced metering infrastructure (AMI) and remote monitoring systems. These technologies enable utilities to gather detailed data on energy consumption, identify faults in the distribution network, and optimize power delivery. Remote monitoring allows utilities to respond to issues more quickly, reducing service interruptions and improving operational efficiency. The shift towards digitalization in energy management is making utilities more agile and responsive to changes in demand and supply. Furthermore, AMI systems help consumers track and manage their energy usage, contributing to better demand-side management and reducing energy waste. These trends are reshaping the way electric distribution utilities operate, enhancing both efficiency and customer satisfaction.

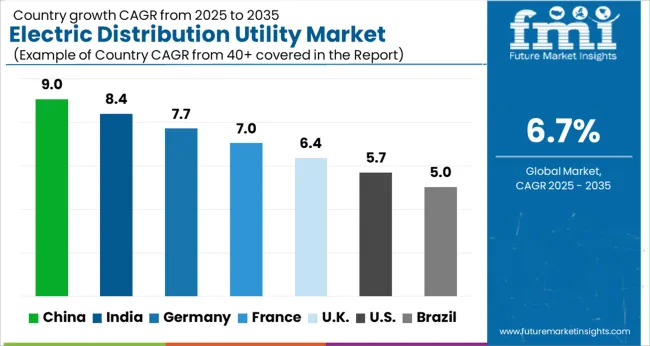

The electric distribution utility market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads at 9.0%, followed by India at 8.4%, and Germany at 7.7%. The United Kingdom records 6.4%, while the United States stands at 5.7%. The market growth is driven by increasing energy demand, the ongoing development of smart grid infrastructure, and the adoption of renewable energy sources. China and India show strong growth due to their expanding industrial sectors, infrastructure development, and government initiatives to improve the power distribution networks. In contrast, Germany, the UK, and the USA continue to see steady growth, focusing on enhancing grid efficiency and reliability while transitioning to cleaner energy solutions. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 9.0% through 2035, with the country’s robust industrial and infrastructure development driving the demand for efficient and reliable power distribution systems. China’s focus on transitioning to cleaner energy solutions, combined with its massive urbanization and industrialization, is creating significant demand for upgraded electrical distribution networks. The Chinese government’s continued investment in smart grid technologies, energy storage systems, and renewable energy infrastructure boosts the market for electric distribution utilities. China’s commitment to improving grid reliability and integrating renewable energy sources into its distribution system will continue to drive market growth.

India is projected to grow at a CAGR of 8.4% through 2035, driven by increasing electricity demand, the government’s push for energy infrastructure development, and the shift toward renewable energy. India’s focus on modernizing its electrical distribution networks to address power shortages and improve efficiency is driving the adoption of smart grid technologies and energy storage systems.The increasing industrialization, urbanization, and infrastructure projects are creating higher demand for reliable electricity distribution. The government’s emphasis on electrification in rural areas and boosting renewable energy production further accelerates the market for electric distribution utilities in the country.

Germany is projected to grow at a CAGR of 7.7% through 2035, supported by the country's leadership in renewable energy adoption and energy distribution efficiency. Germany’s focus on modernizing its electrical grid infrastructure and transitioning to smart grids is driving market growth. The rise in renewable energy sources, particularly solar and wind power, necessitates the need for advanced distribution systems to integrate these resources. Germany’s commitment to reducing carbon emissions and enhancing energy efficiency contributes to the growing adoption of sustainable energy distribution solutions. The country’s innovative approach to power distribution will continue to support market expansion.

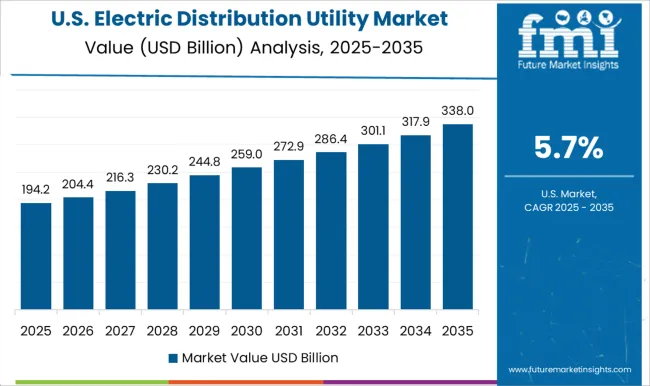

The United States is projected to grow at a CAGR of 5.7% through 2035, driven by technological advancements in energy distribution, grid modernization, and the push for renewable energy integration. The USA continues to modernize its power grid, adopting smart technologies to enhance efficiency, reliability, and security. The increasing electricity demand, paired with government initiatives to invest in clean energy, accelerates the adoption of advanced distribution systems. The growing focus on energy storage and decentralized power solutions contributes to the expansion of the market. As the USA embraces clean energy solutions, the electric distribution utility market will experience steady growth.

The United Kingdom is projected to grow at a CAGR of 6.4% through 2035, with the market driven by the growing need for efficient, reliable power distribution systems in both urban and rural areas. The UK continues to modernize its electrical grid, focusing on integrating renewable energy sources and enhancing grid resilience. Government initiatives, including the transition to clean energy and smart grid investments, are driving the demand for innovative electrical distribution technologies. The rise in energy storage systems and decentralization of power generation further contributes to the growth of the electric distribution utility market in the UK

The electric distribution utility market is driven by leading global players offering advanced solutions for electricity distribution, grid management, and energy infrastructure. Siemens, ABB, and Schneider Electric are dominant players, providing smart grid solutions, automation, and control technologies that improve the efficiency, reliability, and safety of electrical distribution systems. Eaton and Mitsubishi Electric Corporation offer high-performance electrical equipment for utilities, focusing on digital grid solutions, monitoring, and optimization. GE Vernova and Hitachi Energy bring strong expertise in energy management and renewable integration, enabling utilities to modernize their infrastructure and meet the growing demand for green energy solutions.

Duke Energy, China Yangtze Power, and Kansai Electric Power lead in the traditional electricity distribution and grid operation sectors, emphasizing grid expansion, reliability, and performance. Engie and National Grid provide smart grid technologies and integrated solutions, promoting the transition to sustainable energy systems and optimizing energy consumption. Anchor Electric and Coil Innovation offer specialized components for distribution networks, while Lucy Group, Orecco Electric, and Southern Company provide equipment and systems that enhance grid capacity, performance, and customer service.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Component | Distribution transformers, Distribution substations, Switchgear, Distribution lines and poles, Ami smart meters, and Others |

| End Use | Residential, Commercial, and Industrial |

| Voltage | Medium voltage and Low voltage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, ACWA Power, Anchor Electric, China Yangtze Power, Coil Innovation, Duke Energy, Eaton, Enel, Engie, Fuji Electric, GE Vernova, Hitachi Energy, Iberdrola, Kansai Electric Power, Lucy Group, Mitsubishi Electric Corporation, National Grid, Orecco Electric, Schneider Electric, SGC, and Southern Company |

| Additional Attributes | Dollar sales by product type (transformers, circuit breakers, switchgear, automation systems) and end-use segments (residential, commercial, industrial utilities). Demand is driven by grid modernization, renewable energy adoption, and smart grid integration. Regional growth is strong in North America and Europe, with Asia-Pacific expanding due to urbanization. Innovation focuses on digitalization, energy storage, and renewable integration. |

The global electric distribution utility market is estimated to be valued at USD 431.6 billion in 2025.

The market size for the electric distribution utility market is projected to reach USD 825.5 billion by 2035.

The electric distribution utility market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in electric distribution utility market are distribution transformers, distribution substations, switchgear, distribution lines and poles, ami smart meters and others.

In terms of end use, residential segment to command 41.7% share in the electric distribution utility market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electric Utility Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA