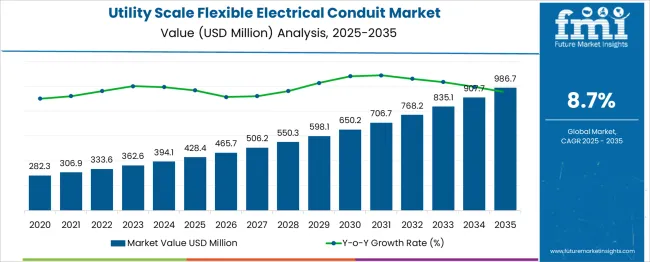

The utility-scale flexible electrical conduit market is estimated to be valued at USD 428.4 million in 2025 and is projected to reach USD 986.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. This growth is supported by a robust CAGR of 8.7%, driven by the increasing demand for flexible conduit solutions in large-scale infrastructure projects, renewable energy installations, and power distribution systems.

In the first five-year phase (2025–2030), the market is expected to expand from USD 428.4 million to USD 629.8 million, adding USD 201.4 million, which accounts for 36.1% of the total incremental growth, driven by rising utility-scale projects and renewable energy deployments. The second phase (2030–2035) will contribute USD 356.9 million, representing 63.9% of incremental growth, reflecting strong demand as infrastructure and renewable energy investments continue to rise globally. Annual increments will increase from USD 40.3 million in early years to USD 74.3 million by 2035, driven by the expanding use of flexible conduits in energy-efficient systems and smart grid technologies. Manufacturers focusing on durable, cost-efficient, and sustainable conduit solutions will capture the largest share of this USD 558.3 million opportunity.

Electrical contractors evaluate flexible conduit specifications based on crush resistance ratings, chemical compatibility characteristics, and pulling tension limits when planning cable installations for utility-scale solar arrays, offshore wind connections, and transmission line undergrounding projects requiring reliable cable protection. Product selection involves analyzing bend radius capabilities, joint sealing effectiveness, and UV degradation resistance while considering installation equipment compatibility, splice vault integration, and long-term durability requirements necessary for critical infrastructure applications. Procurement decisions weigh material costs against installation efficiency gains, considering labor reduction potential, equipment compatibility benefits, and maintenance accessibility improvements that justify premium conduit investment through project lifecycle cost analysis.

Manufacturing operations require specialized extrusion processes, corrugation forming techniques, and quality validation systems that achieve precise geometric tolerances while maintaining material properties throughout high-volume production sequences designed for utility infrastructure applications. Production coordination involves managing polymer resin sourcing, additive blending, and dimensional control while addressing environmental compliance, workplace safety, and testing protocol requirements specific to electrical conduit manufacturing. Quality assurance encompasses mechanical testing, environmental stress evaluation, and electrical performance validation that ensure specification compliance while supporting utility company approval processes and project certification requirements.

Project integration involves utility engineers, installation contractors, and conduit specialists collaborating to optimize cable protection systems that balance installation efficiency with long-term reliability while addressing specific site conditions and regulatory compliance requirements. Installation planning encompasses routing optimization, splice location coordination, and vault integration while managing excavation scheduling, environmental permitting, and utility coordination throughout complex infrastructure projects. Technical support includes installation guidance, troubleshooting assistance, and performance monitoring that ensure successful project completion while maintaining system integrity and operational reliability.

| Metric | Value |

|---|---|

| Utility-Scale Flexible Electrical Conduit Market Estimated Value in (2025 E) | USD 428.4 million |

| Utility-Scale Flexible Electrical Conduit Market Forecast Value in (2035 F) | USD 986.7 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

The Utility Scale Flexible Electrical Conduit market is undergoing a steady transformation as modern electrical infrastructure demands increased safety, adaptability, and regulatory compliance. This market is being driven by the surge in utility-scale construction projects, coupled with rising investments in renewable energy facilities and grid modernization programs. The emphasis on cost-efficient and labor-saving installation methods is further strengthening the adoption of flexible conduit systems in electrical installations.

Manufacturers are being prompted to innovate through product material advancements and enhanced performance attributes, particularly focusing on high-flexibility and crush resistance. In response to evolving building codes and safety standards, flexible conduit systems are gaining preference across energy, transportation, and industrial applications.

The ability to route conduit through complex structures and confined spaces without compromising durability is helping increase market penetration. As electrification and digital control systems become standard in large-scale projects, the demand for reliable and scalable flexible conduit systems is expected to remain strong, ensuring a sustained growth trajectory for the market..

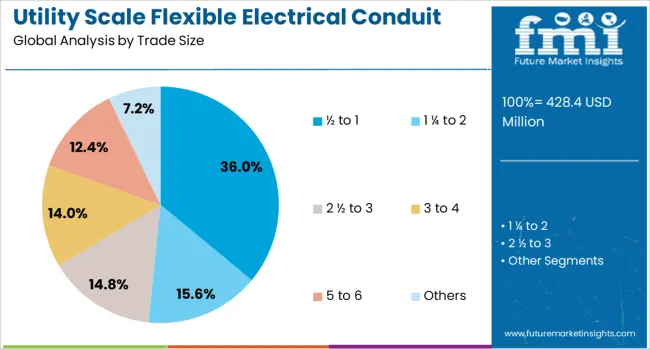

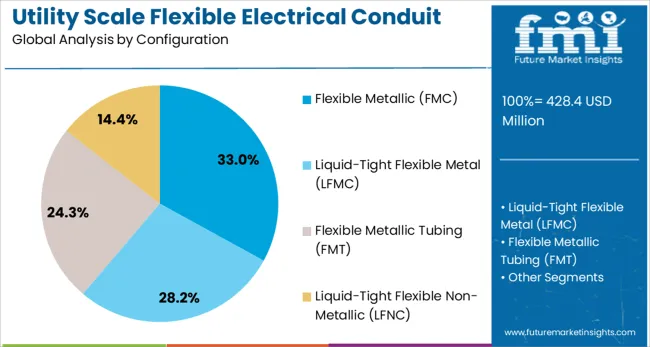

The utility-scale flexible electrical conduit market is segmented by trade size, configuration, and geographic regions. By trade size, the utility-scale flexible electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and others. In terms of configuration, the utility-scale flexible electrical conduit market is classified into Flexible Metallic (FMC), Liquid-Tight Flexible Metal (LFMC), Flexible Metallic Tubing (FMT), and Liquid-Tight Flexible Non-Metallic (LFNC). Regionally, the utility-scale flexible electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is expected to account for 36% of the Utility Scale Flexible Electrical Conduit market revenue share in 2025, emerging as the leading size category. This dominance has been primarily driven by its widespread use in medium-load utility projects where a balance between capacity and flexibility is essential.

These sizes are being adopted for a variety of power and control cable routing applications due to their ease of handling and compatibility with standard fittings. Utility-scale operators have been favoring this segment because it provides adequate wire fill capacity without sacrificing bendability, making it well-suited for both retrofit and new construction scenarios.

The ½ to 1 range has also been noted for reducing material and labor costs, which further supports its integration into high-volume projects. As infrastructure projects continue to scale in complexity and demand faster deployment, the reliability and cost-effectiveness of these conduit sizes have positioned them as the preferred choice across multiple sectors..

The flexible metallic configuration segment is projected to hold 33% of the Utility Scale Flexible Electrical Conduit market revenue share in 2025, establishing itself as the leading configuration type. This segment has experienced growing adoption due to its superior mechanical protection, grounding capabilities, and thermal resistance. Utility operators have increasingly chosen flexible metallic conduit for installations in demanding environments where physical impact, vibration, or heat exposure is a concern.

Its ease of installation and reconfiguration has enabled flexible routing through complex structural layouts, supporting diverse applications ranging from power distribution to control systems. The metallic construction allows it to comply with stringent utility safety standards while providing long service life, reducing maintenance needs in large-scale facilities.

Continued growth of the segment has also been influenced by its compatibility with automation systems and emerging smart grid technologies. As utility-scale projects pursue durable and future-ready infrastructure components, the demand for flexible metallic conduit has remained consistently high across regional and international markets..

The utility scale flexible electrical conduit market is driven by the increasing demand for reliable, durable electrical systems in infrastructure and renewable energy projects. Opportunities in expanding energy infrastructure are fueling growth, while trends toward corrosion-resistant materials are shaping the market. However, challenges such as high material costs and supply chain disruptions may hinder progress. By 2025, overcoming these barriers through improved sourcing and manufacturing strategies will be essential for sustaining growth in the market.

The utility scale flexible electrical conduit market is growing due to the rising demand for reliable and flexible electrical systems in power plants, commercial buildings, and industrial applications. Flexible conduits are used to protect and route electrical wiring, offering advantages such as ease of installation and durability. With increasing infrastructure development, especially in renewable energy projects, the demand for these conduits is expected to rise. By 2025, the market will continue to benefit from the need for flexible, high-performance electrical solutions.

Opportunities in the utility scale flexible electrical conduit market are increasing with the expansion of infrastructure and renewable energy projects. As power generation shifts toward solar, wind, and other renewable sources, the need for efficient and reliable electrical conduit solutions grows. Additionally, expanding industrial and commercial sectors require enhanced electrical wiring protection systems. By 2025, the increasing investment in energy infrastructure and renewable energy will create significant growth opportunities for flexible conduit manufacturers.

Emerging trends in the market include the growing demand for corrosion-resistant and high-durability flexible electrical conduits. With the increasing complexity of electrical systems in harsh environments, such as offshore platforms and chemical plants, the demand for specialized conduits that offer enhanced protection against corrosion and environmental stress is rising. By 2025, these trends will dominate, as industries seek longer-lasting, durable solutions for electrical installations in demanding conditions.

Despite growth, challenges related to high material costs and supply chain disruptions continue to affect the utility scale flexible electrical conduit market. The rising prices of raw materials like metals and plastics, which are crucial for manufacturing conduits, can increase production costs. Additionally, supply chain inefficiencies, particularly in global markets, can cause delays and impact product availability. By 2025, addressing these issues through strategic sourcing and production efficiency will be crucial for maintaining market growth.

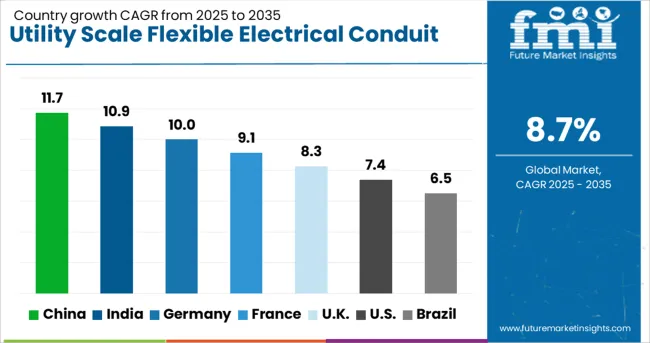

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

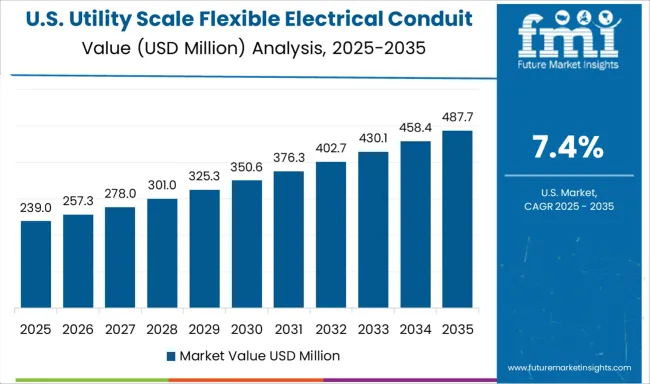

| USA | 7.4% |

| Brazil | 6.5% |

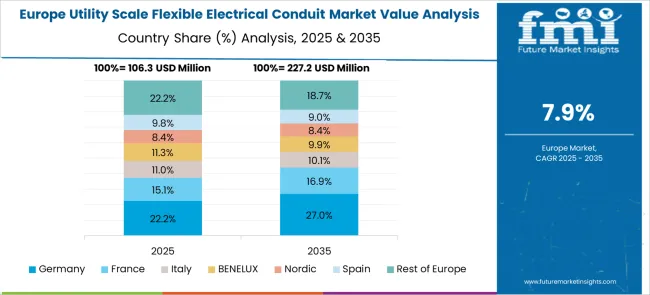

The global utility scale flexible electrical conduit market is projected to grow at an 8.7% CAGR from 2025 to 2035. China leads with a growth rate of 11.7%, followed by India at 10.9%, and France at 9.1%. The United Kingdom records a growth rate of 8.3%, while the United States shows the slowest growth at 7.4%. These varying growth rates are driven by factors such as increasing demand for efficient, durable, and safe electrical conduit solutions in utility-scale projects, rapid industrialization, and infrastructure development. Emerging markets like China and India are experiencing higher growth due to expansive industrialization, urbanization, and investments in energy infrastructure, while more mature markets like the USA and the UK show steady growth driven by the need to upgrade aging infrastructure and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The utility scale flexible electrical conduit market in China is growing at a remarkable rate, with a projected CAGR of 11.7%. China’s rapid industrialization, urbanization, and increasing demand for energy infrastructure are key factors driving the market. The country’s large-scale investments in utility projects, particularly in power generation, distribution, and renewable energy, are significantly boosting the demand for flexible electrical conduits. Additionally, China’s focus on improving electrical safety and compliance with global standards, combined with growing infrastructure needs in both urban and rural areas, further accelerates the market growth.

The utility scale flexible electrical conduit market in India is projected to grow at a CAGR of 10.9%. India’s expanding industrial sector, along with its focus on energy infrastructure development, is driving the demand for flexible electrical conduits. The country’s growing energy needs, particularly in power generation and distribution, require efficient and reliable electrical conduit solutions. Additionally, India’s focus on renewable energy projects and infrastructure upgrades in both urban and rural areas is boosting the adoption of flexible electrical conduits for utility-scale projects. The government’s initiatives to improve energy distribution networks further support market growth.

The utility scale flexible electrical conduit market in France is projected to grow at a CAGR of 9.1%. France’s established demand for energy-efficient electrical systems in both residential and industrial applications is contributing to steady market growth. The country’s increasing focus on sustainable energy infrastructure, particularly in renewable energy projects such as wind and solar farms, is accelerating the need for durable and flexible conduit solutions. Additionally, France’s regulatory environment, which mandates the use of safe and reliable materials in energy infrastructure, is further driving the demand for flexible electrical conduits in utility-scale projects.

The utility scale flexible electrical conduit market in the United Kingdom is projected to grow at a CAGR of 8.3%. The UK continues to experience steady demand for flexible electrical conduit solutions, particularly in energy infrastructure, renewable energy projects, and the construction industry. The country’s commitment to reducing carbon emissions, improving energy efficiency, and transitioning to renewable energy sources drives the adoption of flexible electrical conduits. Additionally, the UK’s focus on upgrading aging electrical infrastructure, combined with investments in smart grid technologies and sustainable energy projects, contributes to continued market growth.

The utility scale flexible electrical conduit market in the United States is expected to grow at a CAGR of 7.4%. The USA market is driven by the increasing need for reliable and durable electrical conduit solutions in power generation, transmission, and distribution networks. The growing demand for renewable energy sources, particularly wind and solar power, is contributing to the adoption of flexible electrical conduits for utility-scale projects. Additionally, the USA government’s focus on improving energy infrastructure and supporting green energy projects further drives the demand for these systems, despite slower growth compared to emerging markets.

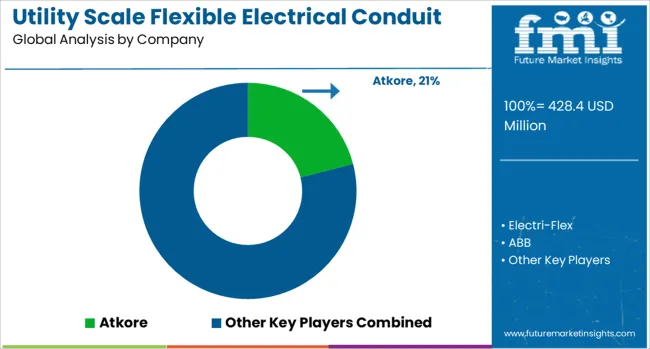

The utility-scale flexible electrical conduit market is growing steadily, driven by increasing investments in renewable energy infrastructure, grid modernization, and large-scale industrial electrification. Atkore Inc. and Electri-Flex Company lead the market with a wide range of high-performance flexible conduit systems designed to protect power cables in demanding outdoor and high-voltage environments. Their products emphasize durability, corrosion resistance, and compliance with stringent safety and electrical standards critical for utility-scale operations.

ABB Ltd. plays a key role through its extensive electrical infrastructure portfolio, offering conduit and cable management solutions that integrate seamlessly with power distribution and control systems. ABB’s global reach and engineering expertise position it as a preferred partner for large-scale grid and substation projects. Southwire Company LLC strengthens the market with flexible conduit solutions optimized for high-current transmission and renewable installations, particularly in solar and wind energy applications.

Calbrite contributes through its stainless steel flexible conduit systems, known for their superior corrosion resistance and suitability for harsh or exposed environments, including coastal and utility installations. Overall, the market is propelled by expanding renewable power capacity, stringent safety regulations, and the growing need for robust electrical protection systems in utility-scale energy and industrial infrastructures.

| Item | Value |

|---|---|

| Quantitative Units | USD 428.4 Million |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | Flexible Metallic (FMC), Liquid-Tight Flexible Metal (LFMC), Flexible Metallic Tubing (FMT), and Liquid-Tight Flexible Non-Metallic (LFNC) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Atkore Inc., Electri-Flex Company, ABB Ltd., Southwire Company LLC, Calbrite |

| Additional Attributes | Dollar sales by conduit type and application, demand dynamics across power transmission, construction, and industrial sectors, regional trends in utility-scale flexible electrical conduit adoption, innovation in corrosion-resistant and high-temperature materials, impact of regulatory standards on safety and performance, and emerging use cases in renewable energy infrastructure and smart grid systems. |

The global utility-scale flexible electrical conduit market is estimated to be valued at USD 428.4 million in 2025.

The market size for the utility-scale flexible electrical conduit market is projected to reach USD 986.7 million by 2035.

The utility-scale flexible electrical conduit market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in utility-scale flexible electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, flexible metallic (fmc) segment to command 33.0% share in the utility-scale flexible electrical conduit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA