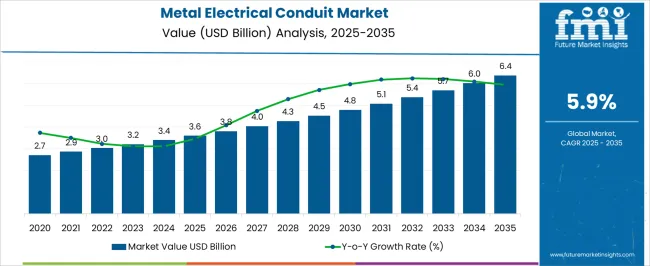

The global metal electrical conduit market is projected to reach USD 3.6 billion in 2025 and grow to USD 6.4 billion by 2035, advancing at a CAGR of 5.9% during this period. Year-on-year progression shows a steady but firm expansion, as the values rise from USD 2.7 billion in the earlier stages of the cycle to USD 6.4 billion at the end of the projection period.

Growth patterns indicate that incremental increases begin modestly in the early years, with USD 2.9 billion in the next year and USD 3.0 billion soon after, but later shifts into larger additions, moving toward USD 4.3 billion by mid-phase and USD 5.4 billion as the decade matures. This trajectory suggests a market environment where adoption is being driven by consistent investment in industrial infrastructure and reinforced by safety regulations that mandate reliable electrical protection systems. The steady growth also highlights how contractors, utilities, and facility managers are prioritizing conduits to meet construction codes and long-term safety needs. Rising emphasis on fire-resistance, corrosion protection, and high-strength installation will further accelerate adoption.

By the time the market reaches USD 6.4 billion in 2035, the compounded effect of regulatory pressure, increasing commercial building activities, and replacement demand in aging infrastructure will have transformed the market into a more specialized but expansive field. The year-on-year growth curve, therefore, points not only to steady expansion but also to a stronger long-term role for metal conduits in energy distribution, industrial projects, and commercial applications.

| Metric | Value |

|---|---|

| Metal Electrical Conduit Market Estimated Value in (2025 E) | USD 3.6 billion |

| Metal Electrical Conduit Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The metal electrical conduit market is shaped by several larger parent markets that define its expansion, material demand, and sector-specific applications. The construction industry holds the largest share at about 42% as metal conduits are a core component in residential, commercial, and industrial building projects where safety codes and electrical standards require strong protective casing for wiring. The utilities and power distribution sector contributes close to 27%, driven by rising investment in grid expansion, underground cabling, and substations where metal conduits ensure durability against environmental and mechanical stress. The industrial manufacturing sector accounts for nearly 15%, as production facilities, warehouses, and processing plants utilize metal conduits for heavy-duty applications that demand fire resistance and mechanical strength.

The oil, gas, and petrochemical sector provides around 10%, given the need for high-performance conduits in hazardous environments that require compliance with stringent safety regulations. The remaining 6% comes from transport infrastructure, defense facilities, and niche applications where electrical safety and resilience against corrosion are prioritized. This layered breakdown indicates that the market has matured beyond conventional building usage into a diversified industry supported by utilities, heavy industries, and energy sectors. Companies that focus on innovations in corrosion-resistant alloys, cost-efficient installation methods, and regional compliance standards are more likely to strengthen their positioning within these parent markets, ensuring steady long-term growth.

The metal electrical conduit market is experiencing consistent growth, driven by rising investments in power infrastructure, commercial construction, and industrial facilities. Demand is being fueled by the increasing emphasis on safety, durability, and compliance with stringent electrical codes and standards. Metal conduits are widely recognized for their ability to protect electrical wiring from mechanical damage, moisture, and corrosion, making them suitable for both indoor and outdoor applications.

Growth is further supported by rapid urbanization, expansion of smart city projects, and modernization of aging electrical grids in multiple regions. Manufacturers are focusing on enhancing product designs, coatings, and installation efficiency to meet the evolving needs of contractors and project developers.

The adoption of metal conduits in renewable energy projects and large-scale infrastructure developments is also strengthening market prospects. As construction activity accelerates and safety regulations become more stringent, the market is expected to maintain a strong upward trajectory, with continued innovation and regional expansion shaping future opportunities.

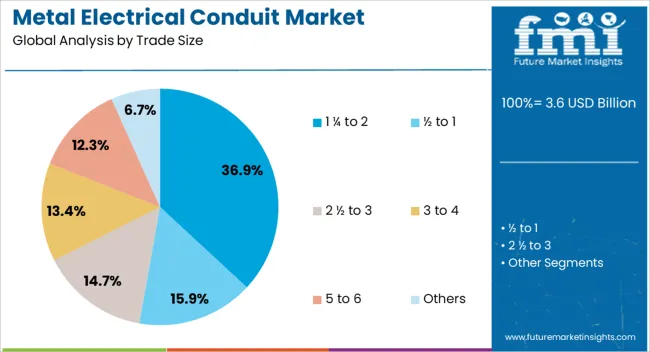

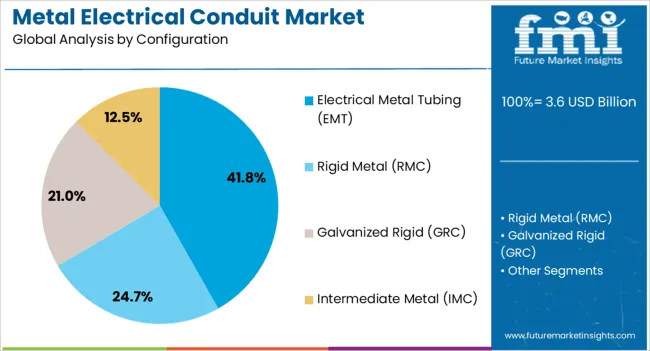

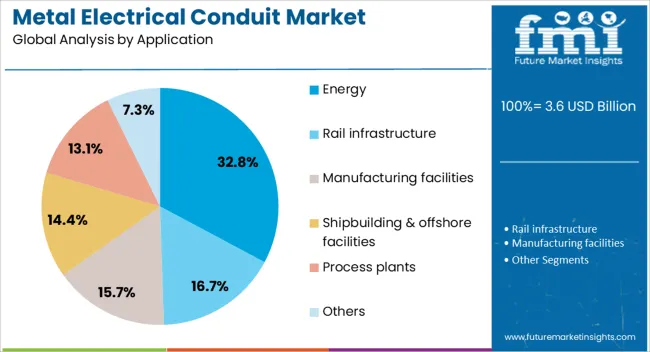

The metal electrical conduit market is segmented by trade size, configuration, application, end use, and geographic regions. By trade size, metal electrical conduit market is divided into 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of configuration, metal electrical conduit market is classified into Electrical Metal Tubing (EMT), Rigid Metal (RMC), Galvanized Rigid (GRC), and Intermediate Metal (IMC).

Based on application, metal electrical conduit market is segmented into Energy, Rail infrastructure, Manufacturing facilities, Shipbuilding & offshore facilities, Process plants, and Others. By end use, metal electrical conduit market is segmented into Commercial, Residential, Industrial, and Utility. Regionally, the metal electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1 ¼ to 2 trade size segment is projected to hold 36.9% of the metal electrical conduit market revenue share in 2025, making it the leading trade size category. This dominance is supported by its suitability for a wide range of medium-capacity electrical installations, balancing optimal wiring space with manageable installation requirements. Contractors prefer this size range for its versatility across commercial, industrial, and infrastructure projects, where both capacity and ease of handling are critical.

Its ability to accommodate multiple conductors without overcrowding ensures compliance with safety codes while maintaining efficient electrical performance. The segment’s growth is reinforced by increasing use in retrofit projects, where upgrades to larger conduit sizes improve system capacity without significant structural modifications.

Durability, cost efficiency, and compatibility with standard fittings and accessories are further strengthening its market position As electrical systems evolve to handle higher loads and more complex wiring requirements, the demand for 1 ¼ to 2 trade size conduits is expected to remain strong across diverse applications.

The electrical metal tubing configuration segment is expected to account for 41.8% of the metal electrical conduit market revenue share in 2025, establishing itself as the leading configuration. This position is supported by the segment’s lightweight structure, cost efficiency, and ease of installation compared to other metal conduit types. Electrical metal tubing offers a high level of mechanical protection while allowing for quick bending and cutting on-site, reducing labor time and costs.

Its corrosion-resistant coatings and compatibility with compression or set-screw fittings make it a preferred choice for both indoor and outdoor environments. The configuration is widely adopted in commercial buildings, manufacturing facilities, and institutional projects, where safety and code compliance are essential.

Its adaptability to various wiring layouts and compatibility with modern installation techniques further contribute to its growth. As the construction sector expands and efficiency requirements intensify, the electrical metal tubing configuration is expected to maintain its leadership through performance reliability and installation flexibility.

The energy application segment is anticipated to capture 32.8% of the metal electrical conduit market revenue share in 2025, making it the leading application area. Its dominance is driven by the rising demand for reliable wiring protection in power generation, transmission, and distribution projects. Metal conduits in energy applications provide superior shielding against environmental stress, mechanical impact, and electromagnetic interference, ensuring consistent operational performance.

The segment is benefiting from the expansion of renewable energy installations, where robust and code-compliant wiring protection is critical to system longevity. Large-scale infrastructure projects, such as power plants and substations, rely on metal conduits to meet safety and durability standards in high-load conditions.

Increasing investment in upgrading and expanding energy infrastructure, coupled with the global shift toward cleaner energy systems, is further fueling demand. As energy networks become more complex and capacity requirements grow, the segment’s importance in ensuring operational safety and efficiency is expected to solidify its leadership in the market.

Metal electrical conduits are propelled by construction, utilities, industrial adoption, and regulatory mandates. These interconnected forces highlight the critical role of safety and durability in driving the market forward.

Metal electrical conduits are seeing consistent traction from construction projects across residential, commercial, and industrial sectors. Building codes emphasize the use of conduits for wiring safety, which strengthens reliance on metal-based options due to their mechanical durability and fire resistance. Contractors prefer steel and aluminum conduits for high-rise projects, factories, and hospitals, where long-term performance outweighs cost considerations. Demand is further supported by retrofitting and renovation activity, where older wiring systems are being replaced with metal conduits that meet modern safety norms. This steady consumption pattern illustrates how construction remains the backbone of conduit usage, ensuring continued expansion in both mature and emerging regions.

The growth of utilities and power distribution networks has been a major contributor to the adoption of metal conduits. Expansion of underground cabling, substations, and renewable power installations requires safe and reliable wiring protection. Metal conduits provide the strength and corrosion resistance needed for challenging environments, making them favored by utilities and contractors. Government-driven energy investments and electrification projects will add consistent opportunities for suppliers. Utilities prefer conduit systems that meet regional compliance standards while offering ease of installation in large-scale projects. This reliance positions power distribution as a vital segment influencing demand for conduit products across multiple geographies.

Industrial and manufacturing facilities rely on metal conduits for wiring safety in heavy-duty environments. Warehouses, production plants, and processing industries require electrical systems that can withstand heat, vibration, and chemical exposure. Metal conduits offer that reliability and are often chosen to ensure uninterrupted operations. Their use extends to food processing, automotive production, and chemical plants where compliance with fire safety and operational standards is mandatory. Industries adopting automation and large-scale electrification prefer conduits for protecting cables that operate equipment continuously. This emphasis on industrial-grade safety ensures that conduits remain a critical component in maintaining efficiency and avoiding operational downtime.

Stringent safety regulations and standards across multiple regions are shaping the conduit market. Codes such as the NEC in the US and equivalent standards in Europe mandate the use of metal conduits in hazardous and high-risk environments. Regulatory enforcement ensures that contractors and facility managers must adhere to safe wiring practices, favoring metal conduits for compliance. Regulatory landscape acts as a shield against substitution by lower-cost alternatives, as codes leave limited room for compromise on safety. For manufacturers, compliance certifications and region-specific testing create differentiation in the market, offering a competitive advantage for suppliers who prioritize safety standards.

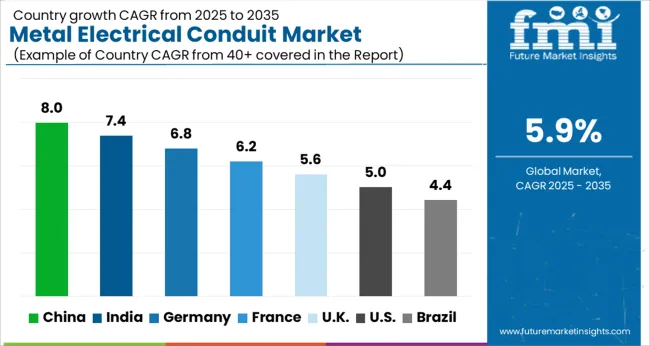

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

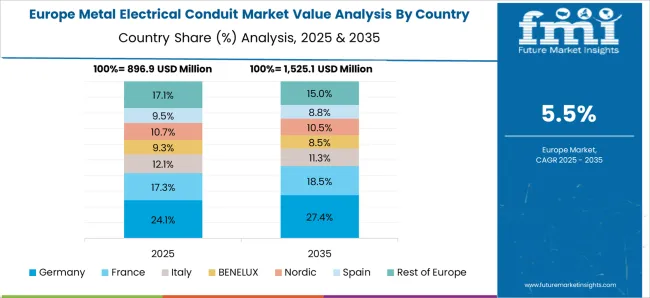

The global metal electrical conduit market is anticipated to grow at a CAGR of 5.9% between 2025 and 2035. China leads growth at 8.0%, followed by India at 7.4%, Germany at 6.8%, France at 6.2%, the United Kingdom at 5.6%, and the United States at 5.0%. Expansion is being supported by increased demand for construction, industrial safety compliance, and utility infrastructure upgrades. China and India dominate with their large-scale construction activities, industrial expansion, and manufacturing capacity. Germany shows consistent growth due to its regulatory standards, industrial base, and structured engineering practices. France emphasizes modern building projects and energy systems, while the United Kingdom advances through retrofitting programs and urban construction. The United States progresses at a slower rate due to a mature infrastructure base but continues to see steady demand from industrial retrofits and energy-related investments. The analysis spans more than 40+ countries, with the leading markets detailed below.

The metal electrical conduit market in China is projected to grow at a CAGR of 8.0% from 2025 to 2035, supported by massive construction activities, rapid industrialization, and stringent building safety codes. Conduit usage is expanding in residential, commercial, and industrial structures where fire resistance and long-term wiring safety are critical. China’s power infrastructure expansion, including grid modernization and underground cabling, provides consistent opportunities. Domestic manufacturers are scaling production and offering cost-competitive conduits for both local and export markets, further strengthening China’s global role. China will remain the most dominant market, as its large-scale infrastructure projects and competitive manufacturing base make it a cornerstone for global conduit demand.

The metal electrical conduit market in India is expected to grow at a CAGR of 7.4% from 2025 to 2035, driven by nationwide infrastructure development, urban housing expansion, and industrial growth. Rising electricity consumption and new power distribution projects are fueling conduit adoption across utilities. Manufacturing plants, commercial buildings, and large housing projects require durable conduit solutions that meet safety regulations. Indian suppliers are increasing output capacity and forming partnerships with global players to address growing demand. India presents a promising growth environment where agriculture-driven electrification programs and industrial expansion sustain strong conduit usage, positioning the country as a fast-emerging hub in this segment.

The metal electrical conduit market in Germany is anticipated to grow at a CAGR of 6.8% from 2025 to 2035, driven by strict compliance with European safety standards and large-scale industrial requirements. German industries, particularly automotive and manufacturing plants, rely heavily on metal conduits to ensure wiring safety and operational resilience. Commercial and residential retrofitting projects also add to steady demand. The country’s structured engineering practices and preference for durable, high-quality products ensure consistent growth. Germany’s role is reinforced by its commitment to high engineering standards and its adoption of advanced materials, keeping the conduit market competitive and highly regulated.

The metal electrical conduit market in the United Kingdom is projected to grow at a CAGR of 5.6% from 2025 to 2035, supported by building renovations, housing retrofits, and industrial applications. Electrical safety codes enforce conduit usage, particularly in older infrastructure being upgraded for modern standards. Industrial facilities and commercial complexes rely on metal conduits to ensure fire resistance and long-term durability. Import reliance shapes part of the supply chain, though domestic distributors continue to meet regional needs. The UK conduit market grows steadily but moderately, influenced by retrofitting programs and modernization efforts in both public and private infrastructure.

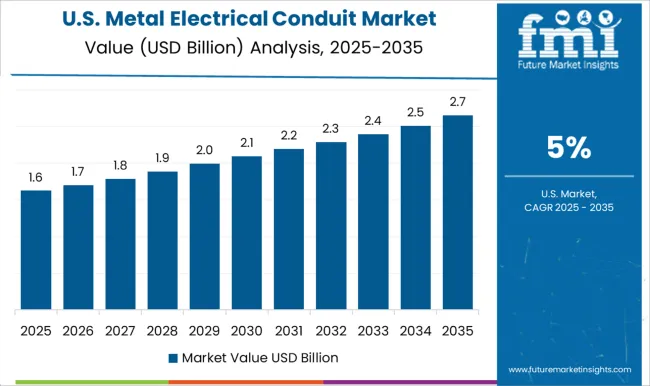

The metal electrical conduit market in the United States is expected to grow at a CAGR of 5.0% from 2025 to 2035, driven by industrial retrofits, power system upgrades, and commercial building projects. The market is relatively mature, with growth primarily supported by replacement demand in aging infrastructure. Energy-related investments and industrial safety standards continue to secure adoption across multiple sectors. The country’s established construction sector maintains consistent but moderate growth for conduit usage. While the US market expands more slowly than emerging economies, its focus on quality, safety compliance, and infrastructure upgrades keeps it an important player globally.

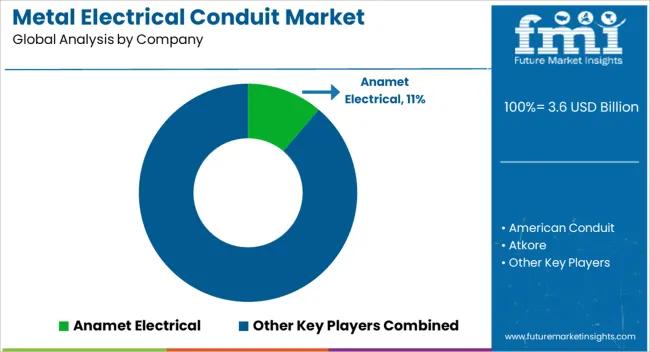

The metal electrical conduit market is highly competitive, led by global and regional manufacturers supplying galvanized steel, aluminum, and stainless-steel conduit solutions. Key players such as Allied Tube & Conduit, Atkore International, Thomas & Betts (a subsidiary of ABB), and Legrand dominate through extensive production capabilities, wide distribution networks, and compliance with electrical safety standards. Competition is largely driven by the ability to offer durable, corrosion-resistant, and easy-to-install conduit solutions suitable for residential, commercial, and industrial applications. Differentiation is achieved through product range diversity, including rigid, flexible, EMT (electrical metallic tubing), and threaded conduit options, as well as value-added services such as custom cutting, pre-assembled fittings, and logistics support.

Regional players focus on cost-effective production and localized distribution to meet specific market requirements, adding depth to market dynamics. Strategic partnerships with construction companies, OEMs, and electrical contractors enhance market positioning, while adherence to safety codes, building regulations, and certifications remains critical.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Trade Size | 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | Electrical Metal Tubing (EMT), Rigid Metal (RMC), Galvanized Rigid (GRC), and Intermediate Metal (IMC) |

| Application | Energy, Rail infrastructure, Manufacturing facilities, Shipbuilding & offshore facilities, Process plants, and Others |

| End Use | Commercial, Residential, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Anamet Electrical, American Conduit, Atkore, Flexa, Gibson Stainless & Specialty, HellermannTyton, Legrand, Nucor Tubular Products, Schneider Electric, Techno Flex, United Pipe & Steel, Weifang East Steel Pipe, Western Tube, Wheatland Tube, and Zekelman Industries |

| Additional Attributes | Dollar sales, share, regional growth, competitive positioning, product mix, regulatory drivers, demand from construction, utilities, industrial projects, raw material pricing, and distribution trends. |

The global metal electrical conduit market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the metal electrical conduit market is projected to reach USD 6.4 billion by 2035.

The metal electrical conduit market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in metal electrical conduit market are 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, electrical metal tubing (emt) segment to command 41.8% share in the metal electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA