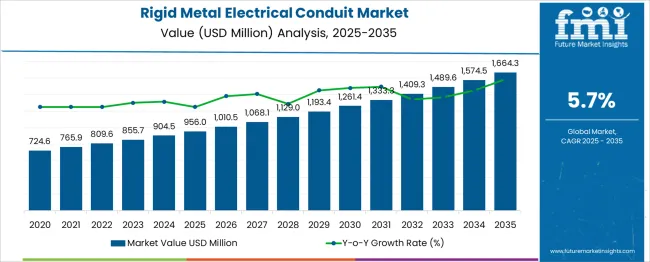

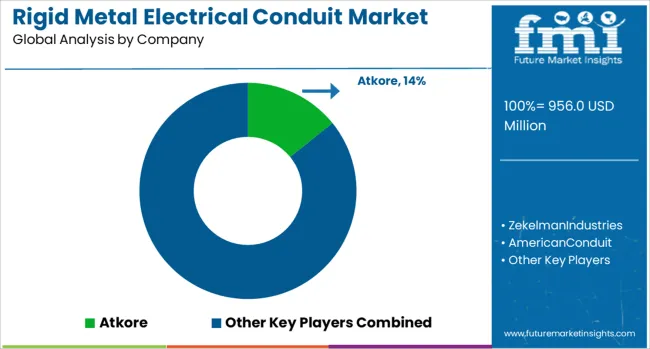

The Rigid Metal Electrical Conduit Market is estimated to be valued at USD 956.0 million in 2025 and is projected to reach USD 1664.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The growth curve is strongly progressive, with steady YoY increases averaging USD 60–80 million in the early years and exceeding USD 90 million annually post-2030, signaling accelerating infrastructure investment cycles and retrofit activity. From 2025 to 2030, the market rises from USD 724.6 million to USD 1,010.5 million an increase of USD 285.9 million, supported by mandates for grounded metal enclosures in commercial and industrial facilities per NEC and UL 6 standards. Key sectors driving this surge include urban utilities, smart grid infrastructure, and heavy industrial complexes requiring EMI shielding and high mechanical protection. From 2030 to 2035, market momentum intensifies with an additional USD 653.8 million in value. According to data trends published in IEEE Transactions on Industry Applications, the uptake of RMEC is also increasing due to stricter fire codes, insurance-driven compliance, and durability advantages over PVC alternatives. This decade-long growth reflects both system reliability demand and evolving safety regulation enforcement worldwide.

| Metric | Value |

|---|---|

| Rigid Metal Electrical Conduit Market Estimated Value in (2025 E) | USD 956.0 million |

| Rigid Metal Electrical Conduit Market Forecast Value in (2035 F) | USD 1664.3 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The Rigid Metal Electrical Conduit Market is primarily driven by the industrial sector, which accounts for approximately 50% of total demand. This includes applications in manufacturing facilities, process plants, energy operations, and infrastructure projects where durability, mechanical strength, and protection from physical damage are essential. The construction sector contributes around 35%, covering commercial, institutional, and residential buildings. Rigid metal conduits are preferred here for fire resistance, grounding capability, and adherence to electrical safety codes. The energy and power industry represents about 30% of the market, particularly in power generation and distribution facilities where long-term reliability and environmental protection are crucial. The IT and telecommunications sector holds around 20 to 25%, where these conduits help protect fiber-optic and communication lines in data centers and underground installations. The residential segment accounts for roughly 15%, driven by urban expansion and retrofitting of older electrical systems. Rail infrastructure, marine, and other specialized segments collectively make up about 10 to 12%, as they require robust conduit systems that can withstand vibration, moisture, and corrosive environments. The market distribution highlights that rigid metal conduits are widely adopted in sectors prioritizing safety, structural integrity, and high-performance electrical infrastructure across diverse environments.

The rigid metal electrical conduit market is witnessing robust growth, driven by the increasing focus on resilient and secure electrical infrastructure across a range of sectors. The preference for rigid conduit systems has been significantly influenced by their mechanical protection capabilities, fire resistance, and long-term durability, making them a staple in commercial and industrial construction. This growth is further supported by updated electrical safety standards and construction codes mandating the use of metallic conduit in high-risk environments.

In addition, ongoing urbanization, industrial automation, and expansion of utility-scale infrastructure projects have amplified the need for reliable conduit systems. Energy-intensive operations and heavy machinery installations across manufacturing and processing industries continue to demand rigid metallic protection for electrical wiring, reinforcing the market’s upward trajectory.

Advancements in corrosion-resistant coatings and standardized trade sizes are also making installation and inspection more efficient, aligning with project scalability needs. Over the forecast period, the market is expected to benefit from rising investments in renewable energy, transportation, and industrial expansion initiatives across both mature and emerging economies.

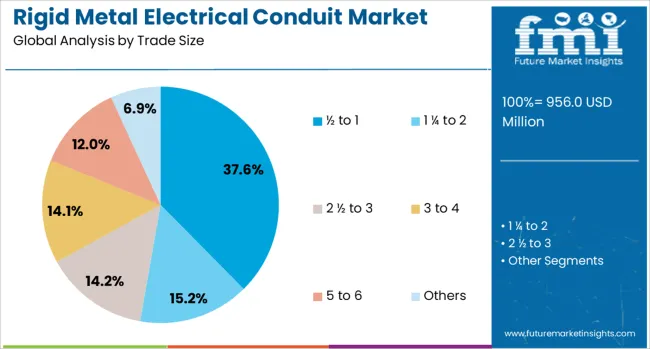

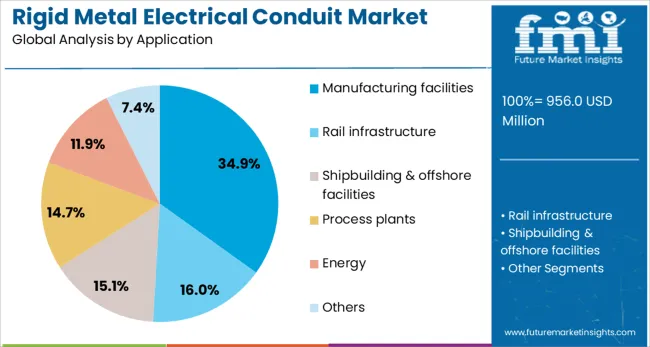

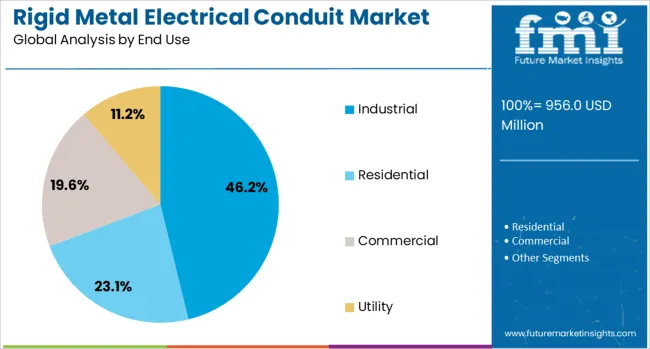

The rigid metal electrical conduit market is segmented by trade size, application, end use, and geographic regions. By trade, the size of the rigid metal electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. The rigid metal electrical conduit market is classified into Manufacturing facilities, Rail infrastructure, Shipbuilding & offshore facilities, Process plants, Energy, and Others. Based on end use of the rigid metal electrical conduit market is segmented into Industrial, Residential, Commercial, and Utility. Regionally, the rigid metal electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size category is expected to account for 37.6% of the rigid metal electrical conduit market revenue in 2025, positioning it as the dominant trade size segment. The segment's leadership is attributed to its versatility and widespread suitability for a broad range of electrical wiring installations, particularly in low to medium voltage circuits. The size range is preferred for its balance between structural rigidity and installation flexibility, making it ideal for routine construction activities and industrial retrofits.

Cost efficiency, easier handling, and compliance with standard conduit fittings have further contributed to its large-scale adoption. Additionally, demand from small to mid-scale commercial and industrial facilities has remained consistently strong, where conduit routing needs to be both space-efficient and secure.

The segment’s popularity has also been reinforced by its compatibility with automated conduit bending equipment and fast installation timelines, making it highly effective in time-sensitive projects. As infrastructure modernization accelerates, especially in manufacturing and logistics, this trade size is expected to retain its prominence in the global conduit market.

Manufacturing facilities are projected to hold 34.9% of the total market revenue in the rigid metal electrical conduit market in 2025, emerging as the largest application segment. The segment's growth is being supported by the increasing electrification and automation of factory environments, where protection of power and data cabling is critical for operational continuity. Rigid metal conduits are extensively used to safeguard wiring in harsh conditions involving high temperatures, vibration, and exposure to chemicals, all of which are common in manufacturing plants.

Their use aligns with safety standards that require enhanced protection for workers and equipment, particularly in sectors such as automotive, heavy machinery, and electronics. The demand for retrofitting older production units with modern wiring protection has also contributed to segment growth.

In addition, the push toward energy efficiency and digitization within smart manufacturing environments has increased reliance on high-integrity conduit systems. This trend is expected to continue as manufacturers expand capacity and implement Industry 4.0 solutions requiring secure and scalable electrical infrastructure.

The industrial end-use segment is expected to contribute 46.2% to the total market revenue in the rigid metal electrical conduit market by 2025, making it the leading end-use sector. The segment’s dominance is influenced by large-scale usage of rigid conduits in high-demand environments such as factories, warehouses, power plants, and chemical processing facilities. These settings require enhanced physical protection for wiring systems due to exposure to moisture, heat, and mechanical impact, which rigid metal conduits are uniquely equipped to handle.

Regulatory enforcement of electrical safety standards in industrial construction has further strengthened adoption. Moreover, the growth of sectors such as oil and gas, renewable energy, and heavy engineering has increased the need for robust conduit infrastructure that supports continuous operations.

Installation of complex control systems, motor-driven equipment, and power distribution networks in industrial zones also requires conduit systems that provide long-term durability and minimal maintenance. As industrial expansion continues in response to global supply chain realignment and infrastructure investments, the segment is expected to remain the largest consumer of rigid metal electrical conduit solutions.

Demand for durable and safe conduit solutions is rising due to stringent electrical safety codes and infrastructure expansion. Electrical contractors and facility managers require robust wiring protections for industrial, commercial, and residential installations.

Rigid metal conduit is being specified in new construction and retrofitting projects to meet electrical code requirements related to mechanical protection, fire resistance, and grounding integrity. Installers in manufacturing plants, hospitals, office towers, and data centers depend on steel or aluminum conduit to protect wiring from impact, chemical exposure, and environmental hazards. Conduits are frequently used in seismic zones or heavy-duty industrial environments where flexibility alone would pose risk. The durability and steel strength make rigid conduit preferred for permanence and longevity. Growth is occurring as regulatory bodies update building codes and inspectors enforce tougher compliance, which supports market activity in regulated sectors globally.

Market growth is being unlocked through factory-fabricated conduit assemblies and prebuilt bending kits that reduce field labor and increase installation accuracy. Suppliers that collaborate with electrical wholesalers and panel manufacturers to bundle conduit supply with connectors, junction boxes, and installation tools are being embraced. Regional stocking programs near construction hubs ensure fast order fulfillment. Subscription-style access to conduit assemblies for repeat-building developers simplifies project procurement. Training programs offered by manufacturers for electricians help promote best practices and reduce error rates. These integrated service models make rigid conduit solutions more practical for general contractors and electrical teams managing large or recurring installation cycles.

RMC producers confront rising costs and price volatility in key metals such as steel and zinc. Steel coil prices surged in 2024 due to trade restrictions and pandemic-related supply constraints. Continued price fluctuation makes stable pricing models difficult to maintain. Fluctuations in raw material cost create unpredictable finished-product pricing, which complicates long-term contracts with electrical contractors and distributors. Fabricators relying on bonded conduit systems may face margin erosion if they cannot pass through cost increases. Additionally, scrap metal import restrictions in key markets like the EU and India limit access to higher quality feedstock, increasing reliance on domestic supply at higher cost. Without better hedging or strategic sourcing contracts, manufacturers may struggle to remain price-competitive in both industrial and residential sectors.

Between 2025 and 2030, accelerated programs to upgrade aging electrical infrastructure in urban centers will significantly boost demand for rigid metal conduits. Cities in North America, Europe, and emerging markets are replacing aging non-metallic or exposed wiring systems in public buildings, transit hubs, and hospitals. Compared to 2025, spending on conduit-based electrical upgrades is forecast to grow by over 15 percent by 2030. RMC is favored for its robust grounding, pull strength for heavy cabling, and fire-resistant enclosure features. Retrofit applications such as Class A buildings, railway electrification modules, and sub-station rewiring increasingly specify rigid metal conduit for compliance with updated electrical and fire codes. Suppliers able to deliver pre-cut, threaded conduit and matching accessories will gain traction among electrical contractors focused on safety and installation speed.

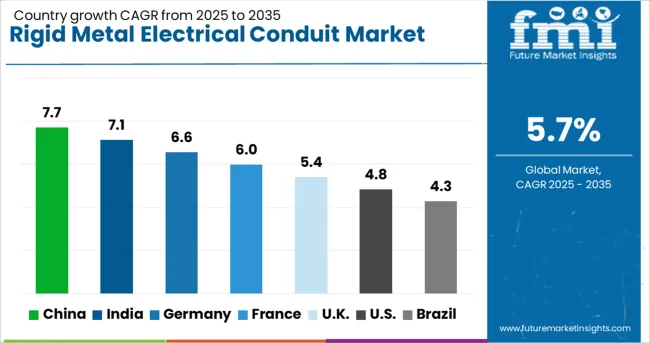

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

Among BRICS countries, China leads with a projected CAGR of 7.7% from 2025 to 2035, driven by rapid urban infrastructure expansion, increasing industrial construction, and a 28% rise in commercial real estate development requiring high-durability wiring systems. India follows at 7.1%, supported by Smart Cities initiatives, demand from data center construction, and government-led electrification projects using galvanized steel conduit. In the OECD group, Germany is expected to grow at 6.6%, fueled by high safety standards in industrial wiring and adoption of corrosion-resistant conduit in renewable energy installations. France shows a 6.0% CAGR, with demand supported by strict fire codes and modernization of rail and airport infrastructure. The United Kingdom, growing at 5.4%, benefits from refurbishment of public buildings and increased adoption in EV charging station installations. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is advancing its rigid metal electrical conduit sector with a CAGR of 7.7%, supported by strong urban development, nationwide industrial electrification, and rising safety regulations. Demand is accelerating in large-scale infrastructure projects, including metro systems, airports, and high-rise commercial spaces. The government is promoting durable construction standards that prioritize fire resistance and longevity. As green building certifications gain traction, builders are adopting metal conduit systems for better sustainability compliance. Domestic companies are scaling up with automation and smart manufacturing to meet rising domestic and export demand. The integration of smart grids and the expansion of high-speed rail projects are further supporting the use of robust electrical containment systems.

India is recording a CAGR of 7.1% in the rigid metal electrical conduit market, driven by rapid urbanization, industrial growth, and heightened emphasis on electrical safety. Commercial real estate projects, infrastructure modernization, and expansion in data centers are contributing significantly to rising demand. As builders shift away from PVC and plastic alternatives, rigid metal conduits are becoming the preferred choice for durability and fire resistance. The government’s Smart Cities Mission and Industrial Corridor initiatives are creating a favorable policy environment for higher-quality construction materials. Additionally, manufacturers are investing in advanced fabrication techniques and forming technology collaborations with international partners to enhance product offerings. The focus on compliance with updated safety codes has increased adoption across both private and public sector projects.

In Germany, rigid metal electrical conduit market is expanding at a CAGR of 6.6%, supported by the country’s advanced industrial base and stringent building regulations. Increased investments in green buildings, energy-efficient infrastructure, and automated manufacturing facilities are supporting the shift toward fire-resistant and corrosion-proof conduit materials. Metal conduits are widely preferred in public utility projects and high-end commercial constructions. Innovations in conduit bending and joining technology are improving installation efficiency and safety standards. As Germany pursues ambitious energy transition goals, the integration of renewable energy facilities requires durable and safe electrical conduit systems that meet strict codes.

France is witnessing a CAGR of 6.0% in the rigid metal electrical conduit segment, fueled by growth in infrastructure renewal and a preference for eco-friendly construction materials. Metal conduits are seeing strong adoption in government-backed housing programs and transport upgrades. Developers are increasingly specifying rigid metal conduits in tender requirements to meet environmental and safety standards. The rise of smart cities and energy-efficient residential projects is further encouraging the use of high-durability materials. In addition, growth in EV charging infrastructure is also contributing to demand for protected and long-lasting conduit pathways. Domestic manufacturers are focusing on lightweight and recyclable metal options to support sustainability goals.

The United Kingdom is growing at a CAGR of 5.4% in the rigid metal electrical conduit market, largely due to modernization in housing and commercial infrastructure. Safety-focused construction policies and insurance incentives are steering developers toward metal over plastic conduits. Demand is particularly strong in healthcare, education, and public housing sectors, where long-term durability is essential. Refurbishment of aging infrastructure, such as schools and railway stations, also supports market growth. UK-based contractors are adopting pre-fabricated conduit assemblies to streamline installations and reduce onsite labor. Ongoing developments in modular construction are creating new use cases for rigid conduit systems across both temporary and permanent structures.

The rigid metal electrical conduit (RMEC) market is structured around Tier 1, Tier 2, and Tier 3 suppliers, each serving specific segments based on scale, specialization, and value-added capabilities. Tier 1 suppliers are major manufacturers with vertically integrated operations, advanced galvanizing or coating technologies, and expansive distribution networks. These companies, such as Atkore, Zekelman Industries, and American Conduit, deliver a comprehensive range of rigid steel, aluminum, and stainless steel conduit products designed to meet stringent USA NEC (National Electrical Code) and international standards.

Their offerings are tailored for large-scale infrastructure projects, commercial buildings, data centers, and industrial plants where conduit integrity, mechanical protection, and long-term corrosion resistance are critical. Tier 1 suppliers also invest significantly in automation, in-house testing labs, and sustainability practices, often supplying low-embodied carbon steel or recyclable conduit to meet green building requirements. Tier 2 players, including Nucor Tubular Products and Schneider Electric, bring a systems-based approach to the market.

They integrate RMEC with a suite of complementary electrical infrastructure solutions such as raceways, cable trays, and power distribution units. This bundling strategy offers logistical efficiency, reduces installation complexity, and appeals to EPC contractors and OEMs seeking consolidated procurement. Tier 2 firms often provide value through engineering support, kitting services, and modular configurations for design flexibility across industrial automation, utilities, and transportation sectors.

Tier 3 suppliers like Pittsburgh Pipe, Gibson Stainless & Specialty Inc., and Weifang East Steel Pipe serve specialized regional markets or harsh application environments. Their product lines typically include custom-fabricated or niche-grade conduits, such as Schedule 80, 316 stainless steel, or fusion-bonded epoxy-coated conduits for corrosive or hazardous settings like wastewater treatment plants, oil refineries, and marine installations. These firms often emphasize fast lead times, application-specific customization, and strong technical support, filling the gap where large manufacturers may not offer tailored solutions or small-batch flexibility.

On January 22, 2025, Rep Materials Company (RMC), based in Oxnard, CA, officially launched RMC Stainless, a stainless steel electrical raceway product line, and simultaneously unveiled its dedicated website (rmcstainless.com). The launch included stainless rigid conduit, fittings, and accessories, with stocking locations in Oxnard and Houston fully operational

| Item | Value |

|---|---|

| Quantitative Units | USD 956.0 Million |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Application | Manufacturing facilities, Rail infrastructure, Shipbuilding & offshore facilities, Process plants, Energy, and Others |

| End Use | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore, ZekelmanIndustries, AmericanConduit, NucorTubularProducts, SchneiderElectric, Legrand, HellermannTyton, PittsburghPipe, SMCElectric, AnametElectricalInc., GibsonStainless&SpecialtyInc., TechnoFlex, WeifangEastSteelPipe, FlexaGmbH, and YaleElectricalSupply |

| Additional Attributes | Dollar sales by conduit type including rigid, intermediate, electrical metallic tubing and flexible metal conduits, trade size, and industry usage such as industrial, commercial, utility and residential sectors; demand driven by grid expansion, building electrification and infrastructure development; innovation in corrosion resistance, modular pre‑assembled kits and smart conduit sensors; cost influenced by steel price volatility and installation complexity; and emerging use in smart city and renewable energy systems. |

The global rigid metal electrical conduit market is estimated to be valued at USD 956.0 million in 2025.

The market size for the rigid metal electrical conduit market is projected to reach USD 1,664.3 million by 2035.

The rigid metal electrical conduit market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in rigid metal electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of application, manufacturing facilities segment to command 34.9% share in the rigid metal electrical conduit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Galvanized Rigid Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA