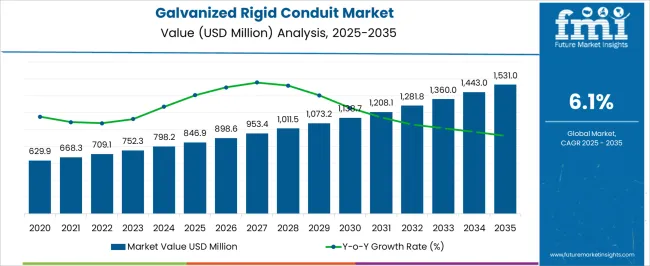

The galvanized rigid conduit market is projected to grow from USD 846.9 million in 2025 to USD 1,531.0 million by 2035, representing an absolute dollar opportunity of USD 684.1 million over the forecast period. Between 2025 and 2030, the market grows from USD 846.9 million to USD 1,138.7 million, contributing USD 291.8 million in growth. This period represents a CAGR of 6.2%, driven by increasing demand for durable and safe electrical conduit solutions in industries such as construction, industrial automation, and infrastructure development. The rise in urbanization and infrastructure projects globally contributes to the steady demand for galvanized rigid conduits, particularly in the commercial and residential sectors. From 2030 to 2035, the market expands from USD 1,138.7 million to USD 1,531.0 million, contributing USD 392.3 million in growth, with a slightly lower CAGR of 5.9%. This phase shows a deceleration in growth as the market matures, though continued demand for reliable, corrosion-resistant conduit solutions in industrial, commercial, and renewable energy sectors ensures steady market expansion. The USD 684.1 million absolute dollar opportunity underscores strong market potential, driven by both the ongoing need for infrastructure and the growing emphasis on safety and efficiency in electrical systems. The market’s overall trajectory highlights consistent growth with increasing adoption and applications across various sectors.

| Metric | Value |

|---|---|

| Galvanized Rigid Conduit Market Estimated Value in (2025 E) | USD 846.9 million |

| Galvanized Rigid Conduit Market Forecast Value in (2035 F) | USD 1531.0 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The galvanized rigid conduit (GRC) market is witnessing steady growth, driven by rising demand for durable, non-combustible electrical infrastructure across high-risk and industrial environments. Regulatory compliance with national and international electrical safety codes has reinforced the preference for GRC in commercial and industrial sectors.

Galvanized coating provides corrosion resistance, enabling longer lifecycle performance in harsh environments, including outdoor and underground installations. Ongoing infrastructure modernization, coupled with a renewed focus on resilient grid and factory systems, is prompting electrical contractors and utilities to favor GRC for its mechanical strength and fireproofing properties.

In emerging economies, increased industrialization and foreign direct investments in manufacturing zones are creating new opportunities for conduit deployment. As sustainability pressures mount, the recyclability and extended service life of galvanized steel are enhancing its viability in long-term asset strategies.

The galvanized rigid conduit market is segmented by trade size, application, end use, and geographic region.

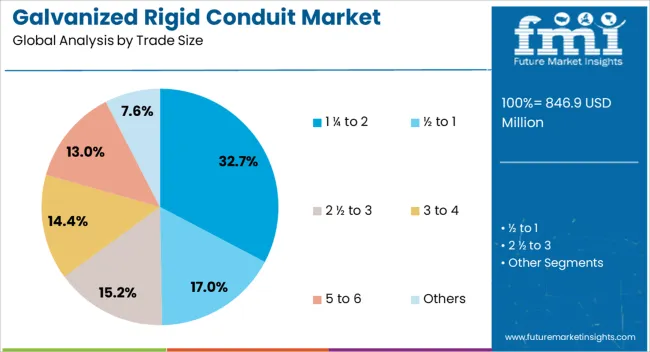

By trade size, the market is divided into ½ to 1, 1¼ to 2, 2½ to 3, 3 to 4, 5 to 6, and others.

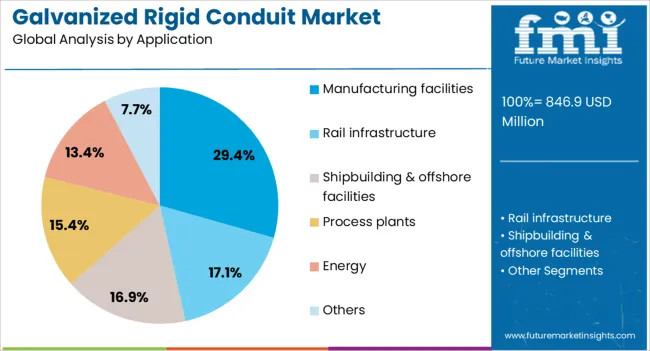

By application, it is classified into manufacturing facilities, rail infrastructure, shipbuilding and offshore facilities, process plants, energy, and others.

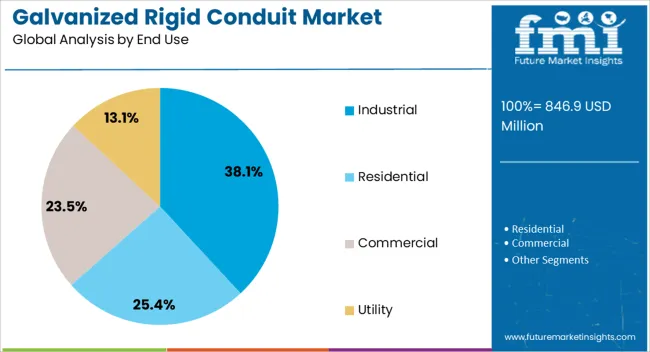

By end use, the market is segmented into industrial, residential, commercial, and utility.

By region, the galvanized rigid conduit industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1 ¼ to 2 trade size segment is projected to account for 32.70% of the overall market revenue in 2025, positioning it as the leading trade size category. This segment’s growth is being influenced by its compatibility with mid- to large-scale conduit installations commonly found in industrial and utility environments.

Its dimensional versatility allows for secure wiring capacity while maintaining ease of handling during installation. The size range is well-suited for applications requiring both durability and protection against environmental damage, making it a standard choice for backbone systems in commercial construction and process industries.

Demand is further supported by strict adherence to NEC standards and structural requirements in large electrical circuits, where conduit fill efficiency and mechanical strength must be balanced.

Manufacturing facilities are expected to represent 29.40% of the GRC market revenue in 2025, emerging as the leading application segment. This prominence is driven by the intensive wiring and high-power transmission needs within factory environments, where conduit performance under thermal and mechanical stress is critical.

The use of galvanized rigid conduit ensures compliance with workplace safety regulations while providing robust protection against physical impacts and corrosive agents. Energy-intensive sectors such as automotive, electronics, and heavy machinery are increasingly investing in upgraded conduit systems to support automation, power redundancy, and equipment safety.

Continued expansion of industrial corridors and smart manufacturing clusters is expected to reinforce this segment’s dominance in both developed and developing regions.

The industrial sector is projected to contribute 38.10% of the market revenue in 2025, making it the leading end-use category in the galvanized rigid conduit market. This leadership is being driven by the sector’s inherent demand for high-integrity electrical infrastructure that supports heavy loads, uninterrupted operation, and resilience to environmental hazards.

GRC is preferred in settings such as oil refineries, chemical plants, power generation stations, and water treatment facilities due to its ability to withstand corrosive exposure and physical damage. The long-term cost efficiency of GRC, along with its alignment with industrial safety mandates, has made it a default specification in both retrofit and new-build projects.

Moreover, ongoing upgrades to aging industrial electrical networks and increased global manufacturing output are expected to sustain segmental momentum.

The galvanized rigid conduit market is expanding due to rising demand for durable and corrosion-resistant solutions in electrical installations across industries like construction, telecommunications, and manufacturing. Galvanized rigid conduits provide high strength, protection against mechanical damage, and resistance to rust and corrosion, making them ideal for harsh environments. The growing infrastructure development, especially in emerging economies, is fueling the demand for these conduits. Despite challenges like high production costs, opportunities are arising through innovations in manufacturing processes, the adoption of environmentally friendly coatings, and the expansion of industrial and commercial construction projects.

The demand for galvanized rigid conduit systems is driven by rapid infrastructure development across the globe, particularly in the commercial and industrial construction sectors. As urbanization increases, the need for durable electrical systems that can withstand harsh environmental conditions and provide long-term protection is growing. Galvanized rigid conduits are essential in these environments, offering robust protection against mechanical damage and corrosion, which is crucial for maintaining the safety and functionality of electrical installations. The stricter safety regulations and building codes are pushing for the use of fire-resistant and durable materials, driving the adoption of galvanized rigid conduits in both new construction and retrofitting projects.

A key challenge in the galvanized rigid conduit market is the high production cost associated with manufacturing these conduits. The galvanization process requires significant resources, such as zinc coatings, which increase the overall cost of production compared to non-galvanized alternatives. These added costs can deter manufacturers from choosing galvanized conduits, particularly in price-sensitive markets. Moreover, the environmental impact of zinc mining and galvanization processes is coming under scrutiny as industries face growing pressure to adopt greener manufacturing practices. Balancing cost-efficiency with the demand for more sustainable solutions presents a challenge for manufacturers in this market, requiring innovation to reduce production costs and improve sustainability.

There are significant opportunities in the galvanized rigid conduit market due to the expanding construction and infrastructure development in emerging economies. As industrialization and urbanization continue to grow in regions like Asia-Pacific, Latin America, and Africa, the demand for reliable and safe electrical conduit systems is increasing. Additionally, advancements in technology are enabling manufacturers to innovate and produce more cost-effective and environmentally friendly galvanized conduits. The development of alternative, eco-friendly coatings, such as polymer-based options, is reducing the environmental impact of galvanization processes. These innovations, combined with the increasing demand for long-lasting and corrosion-resistant electrical systems, are driving opportunities for market growth in both developing and developed regions.

A prominent trend in the galvanized rigid conduit market is the adoption of environmentally friendly coatings and automation in manufacturing processes. With growing environmental concerns, manufacturers are exploring new materials and coatings that provide similar protection and durability to galvanized coatings but with less environmental impact. Additionally, automation in the production of galvanized rigid conduits is enhancing manufacturing efficiency, reducing costs, and improving product consistency. These technological advancements not only help manufacturers meet environmental standards but also drive cost reduction and increase the overall competitiveness of galvanized conduit products in the marketplace. The integration of smart manufacturing technologies and enhanced material science is paving the way for more sustainable, efficient, and cost-effective conduit systems.

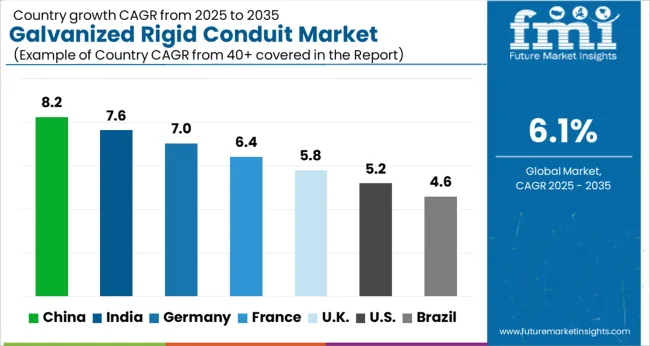

The galvanized rigid conduit market is projected to grow at a global CAGR of 6.1% from 2025 to 2035. China leads with a CAGR of 8.2%, followed by India at 7.6%, and Germany at 7.0%. The United Kingdom shows 5.8%, while the United States stands at 5.2%. China and India experience strong growth due to rapid industrialization, urbanization, and infrastructure development. On the other hand, Germany, the UK, and the USA, as part of the OECD, show steady growth, supported by infrastructure modernization, especially in the construction and electrical sectors. The analysis spans over 40+ countries, with the leading markets shown below.

India is projected to grow at a CAGR of 7.6% through 2035, driven by rapid industrialization, urbanization, and the growing demand for efficient electrical infrastructure. As the country embarks on large-scale infrastructure projects, including smart cities, transportation hubs, and industrial zones, the demand for galvanized rigid conduits for electrical wiring and protection is expected to rise. Government initiatives like “Make in India” and “Smart Cities Mission” further drive the construction and infrastructure sectors, which in turn boost the demand for reliable and durable conduit solutions. India’s growing industrial base and expanding residential sectors are contributing to this trend.

IChina is projected to grow at a CAGR of 8.2% through 2035, with strong demand for galvanized rigid conduit driven by the country's rapid industrialization and infrastructure development. The ongoing focus on modernizing the electrical grid and the rise of smart cities in China further drive the need for durable electrical conduits. The country’s expansion in the manufacturing sector, coupled with government-led infrastructure projects, continues to increase the demand for reliable and corrosion-resistant conduit systems. China’s growing urban centers and the rise in residential and commercial construction further contribute to the market’s expansion.

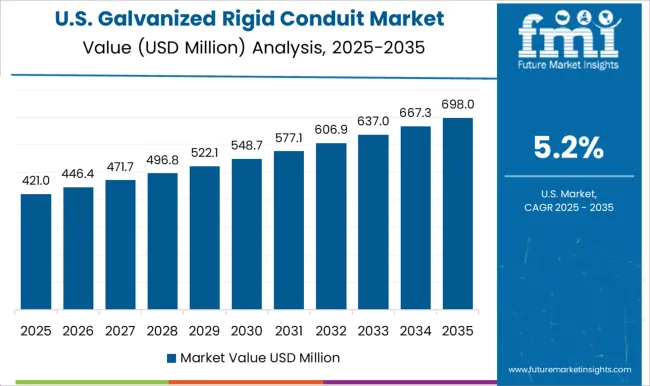

The United States is projected to grow at a CAGR of 5.2% through 2035, with steady demand for galvanized rigid conduit driven by the growing construction and electrical sectors. In the USA, stringent electrical safety standards and the demand for durable, long-lasting infrastructure solutions continue to support the adoption of galvanized rigid conduits. The ongoing expansion in both commercial and residential sectors, particularly in the renewable energy and construction industries, further accelerates demand. With a focus on modernizing aging infrastructure and improving electrical wiring systems, galvanized rigid conduits are increasingly being incorporated in large-scale electrical projects.

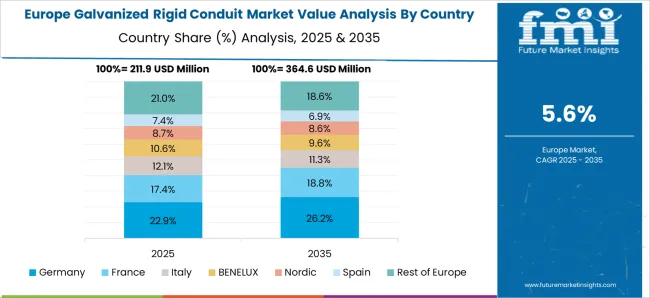

Germany is projected to grow at a CAGR of 7.0% through 2035, driven by the increasing demand for reliable electrical infrastructure and robust construction materials. As Europe’s leading economy, Germany’s industrial sector continues to grow, along with its focus on modernizing infrastructure to meet environmental and safety standards. The German market for galvanized rigid conduits is primarily supported by the construction, automotive, and energy sectors, as well as the need for high-performance electrical systems in residential and commercial buildings. Germany’s focus on green energy and modernizing its electrical grid will continue to boost the market for these conduits.

The United Kingdom is projected to grow at a CAGR of 5.8% through 2035, with the increasing adoption of galvanized rigid conduits driven by the demand for energy-efficient construction materials and electrical infrastructure. As the UK transitions to greener energy solutions and modernizes its electrical grids, the need for high-quality conduit systems grows. The expansion of smart buildings and growing demand for efficient electrical systems in both residential and commercial sectors further contributes to the market’s growth. Additionally, ongoing construction projects and the government’s push for safer, more sustainable electrical systems accelerate the demand for galvanized rigid conduits.

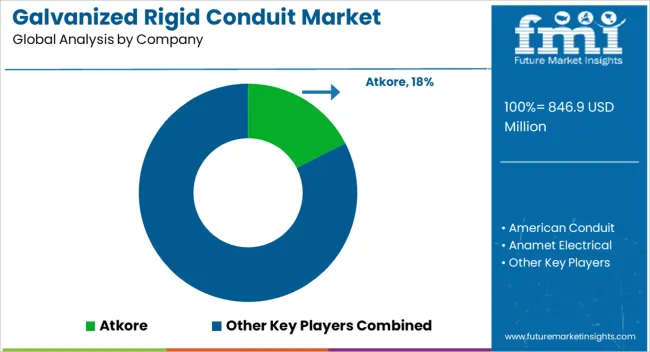

The galvanized rigid conduit (GRC) market is driven by major manufacturers specializing in high-quality conduit solutions for electrical installations and protection in industrial, commercial, and residential applications. Atkore and American Conduit are prominent players, offering durable and reliable galvanized rigid conduits used for safeguarding electrical wiring in various industries, including construction, telecommunications, and utilities. Anamet Electrical and B.E.C. Conduits provide GRC products designed for high-performance environments, emphasizing corrosion resistance and structural integrity. Gibson Stainless & Specialty and Goodluck India are known for producing GRC systems with advanced features such as enhanced mechanical strength, flexibility, and ease of installation. HellermannTyton and Legrand focus on providing electrical conduit solutions with an emphasis on safety, efficiency, and compliance with industry standards, catering to a wide range of applications.

Lowe's and McMaster-Carr serve as significant distributors, ensuring a broad market reach for GRC products, while Nucor Tubular Products and Pittsburgh Pipe contribute to the market with high-quality manufacturing and competitive pricing. Schneider Electric offer specialized electrical conduit systems, integrating GRC solutions into comprehensive electrical protection packages. SMC Electric, Techno Flex, and Weifang East Steel Pipe offer custom GRC solutions for specific applications, focusing on innovation in corrosion protection and customization. Yale Electrical Supply and Zekelman Industries also play key roles, offering reliable conduit solutions designed to meet evolving industry requirements. Competitive differentiation is driven by product quality, durability, corrosion resistance, compliance with industry standards, and the ability to offer tailored solutions for specific markets. Barriers to entry include high manufacturing costs, regulatory compliance, and maintaining relationships with distributors. Strategic priorities include improving product performance, expanding distribution networks, and offering sustainable and cost-effective solutions for various industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Trade Size | 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Application | Manufacturing facilities, Rail infrastructure, Shipbuilding & offshore facilities, Process plants, Energy, and Others |

| End Use | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore, American Conduit, Anamet Electrical, B.E.C. Conduits, Gibson Stainless & Specialty, Goodluck India, HellermannTyton, Legrand, Lowe's, McMaster-Carr, Nucor Tubular Products, Pittsburgh Pipe, Schneider Electric, SMC Electric, Techno Flex, Weifang East Steel Pipe, Yale Electrical Supply, and Zekelman Industries |

| Additional Attributes | Dollar sales by conduit type (galvanized rigid conduit, flexible conduit, liquid-tight conduit) and end-use segments (industrial, commercial, residential, utilities). Demand dynamics are driven by increasing infrastructure development, the growing demand for electrical protection in construction projects, and the rise of smart building technologies. Regional trends indicate strong growth in North America and Europe, driven by construction and industrial activity, while Asia-Pacific is seeing rapid adoption due to urbanization and industrialization. |

The global galvanized rigid conduit market is estimated to be valued at USD 846.9 million in 2025.

The market size for the galvanized rigid conduit market is projected to reach USD 1,531.0 million by 2035.

The galvanized rigid conduit market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in galvanized rigid conduit market are 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of application, manufacturing facilities segment to command 29.4% share in the galvanized rigid conduit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Foam Market Forecast Outlook 2025 to 2035

Rigid Box Market Forecast and Outlook 2025 to 2035

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Rigid Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Galvanized and Coated Iron and Steel Sheets Market Size and Share Forecast Outlook 2025 to 2035

Rigid Food Packaging Market Size, Share & Forecast 2025 to 2035

Rigid Industrial Packaging Market Size, Share & Forecast 2025 to 2035

Competitive Overview of Rigid IBC Market Share

Breaking Down Market Share in Rigid Food Containers

Rigid Tray Market from 2024 to 2034

Rigid Packaging Containers Market Insights – Growth & Forecast 2024-2034

Rigid Colored PU Foam Market

FFS Rigid Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of FFS Rigid Film Manufacturers

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Luxury Rigid Box Manufacturers

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA