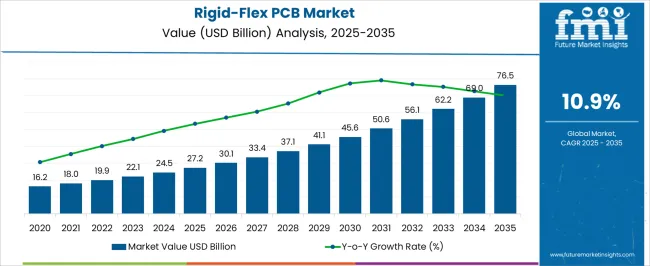

The rigid-flex PCB market is poised for strong growth, reaching USD 27.2 billion in 2025 and projected to expand to USD 76.5 billion by 2035, at a CAGR of 10.9%. This growth is fueled by the rising demand for compact, lightweight, and high-performance electronic components across industries such as consumer electronics, automotive, aerospace, defense, and healthcare.

Rigid-flex PCBs are increasingly adopted in smartphones, wearables, and medical devices due to their durability, space-saving design, and ability to handle complex circuit architectures. In the automotive sector, the transition toward electric vehicles and advanced driver-assistance systems (ADAS) is boosting demand for reliable PCB designs that can withstand harsh environments. Aerospace and defense applications are also contributing significantly, where reliability and performance under extreme conditions are critical.

Technological advancements in flexible materials, miniaturization, and multilayer PCB integration are further accelerating adoption. With expanding applications and ongoing innovation, the rigid-flex PCB market is set to maintain its momentum through the forecast period.

| Metric | Value |

|---|---|

| Rigid-Flex PCB Market Estimated Value in (2025 E) | USD 27.2 billion |

| Rigid-Flex PCB Market Forecast Value in (2035 F) | USD 76.5 billion |

| Forecast CAGR (2025 to 2035) | 10.9% |

The rigid-flex PCB market is experiencing accelerated growth, supported by the increasing demand for compact, lightweight, and high-reliability circuit board solutions in modern electronics. These boards combine the structural stability of rigid PCBs with the design adaptability of flexible circuits, enabling superior performance in complex and space-constrained applications.

Rising adoption in industries such as aerospace, defense, automotive, medical devices, and consumer electronics is being fueled by the need for durable interconnect solutions capable of withstanding vibration, bending, and thermal stress. Technological advancements in manufacturing processes, including precision laser drilling and high-density interconnect technologies, are enabling more complex designs while maintaining mechanical integrity.

The ability to reduce component count, improve signal integrity, and enhance overall product reliability is making rigid-flex solutions a preferred choice for next-generation devices. As miniaturization trends continue and electronics become more integrated, the market is expected to witness sustained expansion, with manufacturers investing in advanced materials and fabrication capabilities to meet diverse and evolving application requirements.

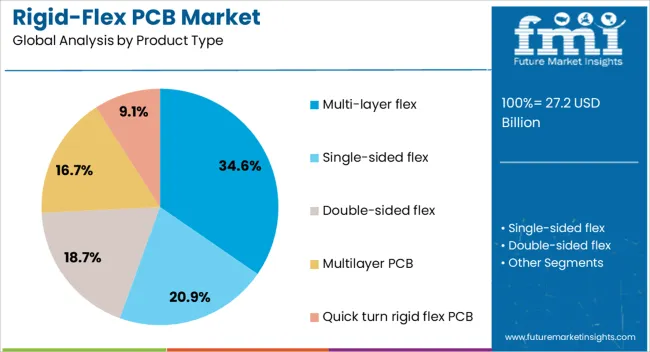

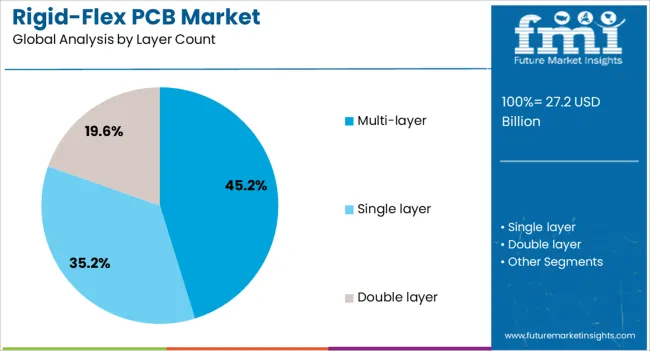

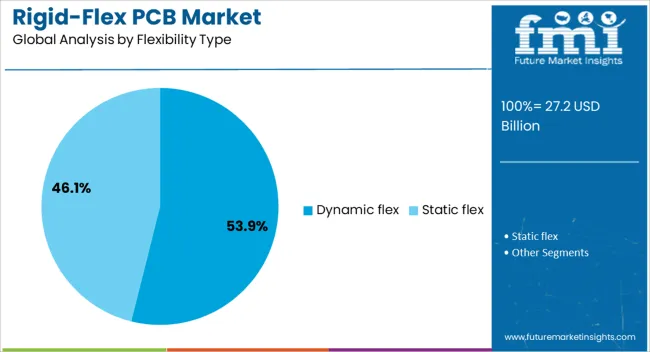

The rigid-flex PCB market is segmented by product type, layer count, flexibility type, materials, end-use industry, and geographic regions. By product type, rigid-flex PCB market is divided into Multi-layer flex, Single-sided flex, Double-sided flex, Multilayer PCB, and Quick turn rigid flex PCB. In terms of layer count, rigid-flex PCB market is classified into Multi-layer, Single layer, and Double layer. Based on flexibility type, rigid-flex PCB market is segmented into Dynamic flex and Static flex. By materials, rigid-flex PCB market is segmented into FR4, Kapton, Rogers, and Others. By end-use industry, rigid-flex PCB market is segmented into Consumer electronics, Aerospace and defense, Automotive, Industrial, IT and telecommunications, Healthcare, and Others (e.g., Energy, Transportation). Regionally, the rigid-flex PCB industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi-layer flex segment is projected to hold 34.6% of the rigid-flex PCB market revenue share in 2025, positioning it as the leading product type. This dominance is being driven by the segment’s ability to accommodate complex circuit designs while providing enhanced mechanical flexibility and high signal transmission performance. Multi-layer flex configurations allow for increased routing density, which supports the integration of more functionality within compact device architectures.

The segment benefits from its suitability in applications requiring both durability and adaptability, particularly in mission-critical environments where mechanical reliability and long operational life are essential. Advancements in material science, including the use of high-performance polyimide films, are improving thermal stability and resistance to environmental stresses.

Additionally, the capability to reduce assembly steps and eliminate connectors between layers lowers overall weight and improves product reliability. As industries demand more compact, multifunctional, and robust electronics, multi-layer flex PCBs are expected to maintain their leadership position in the market, supported by continuous innovation and broader adoption across high-performance applications.

The multi-layer segment in terms of layer count is anticipated to account for 45.2% of the rigid-flex PCB market revenue share in 2025, making it the dominant configuration. This leadership is being reinforced by the need for higher circuit density, improved electrical performance, and enhanced design flexibility in advanced electronic systems. Multi-layer rigid-flex PCBs enable the integration of multiple functionalities into a single board, reducing the need for additional connectors and interconnects, which in turn enhances reliability and reduces potential points of failure.

Their ability to support high-speed data transmission and complex signal routing is making them indispensable in sectors such as aerospace, medical imaging equipment, and advanced communication systems. Continuous improvements in lamination processes and via technologies are enabling the creation of more compact yet powerful designs.

The segment’s growth is also supported by its compatibility with both rigid and flexible sections, making it ideal for intricate device architectures. As electronic devices evolve toward greater complexity and miniaturization, multi-layer configurations are expected to remain the preferred choice for high-performance applications.

The dynamic flex segment is expected to capture 53.9% of the rigid-flex PCB market revenue share in 2025, securing its position as the leading flexibility type. This dominance is being attributed to its superior ability to withstand repeated flexing and bending without mechanical degradation, making it ideal for applications involving continuous motion or frequent repositioning. The segment is benefiting from growing demand in sectors such as robotics, aerospace, medical devices, and consumer electronics, where long-term durability under mechanical stress is critical.

Advances in flexible substrate materials and adhesive technologies are enhancing the mechanical strength and fatigue resistance of dynamic flex PCBs, ensuring consistent performance over extended lifecycles. Their capacity to maintain electrical integrity under extreme operating conditions is further driving adoption in mission-critical applications.

As industries increasingly integrate electronics into moving components and wearable devices, the demand for dynamic flex solutions is expected to rise. The combination of high reliability, adaptability, and mechanical resilience is reinforcing the segment’s leading position in the global market.

Complex electronics demand, miniaturization trends, and rising reliability expectations are redefining the adoption of rigid-flex PCBs across industries. While innovations in multilayer integration enhance performance and space efficiency, challenges persist around high manufacturing costs, supply chain complexity, and yield consistency in production.

Market expansion is being shaped by ongoing improvements in multilayer stack-ups and hybrid rigid-flex configurations that allow for greater circuit density in smaller footprints. This innovation is enabling higher reliability in harsh environments, reduced connector requirements, and enhanced durability under flexing conditions. The evolution of rigid-flex PCB technology is anticipated to create new performance benchmarks, particularly for applications in aerospace, defense, medical devices, and electric vehicles. As demand for lightweight, compact, and high-performance solutions rises, these innovations are expected to anchor credibility and strengthen adoption across premium electronics segments.

Consumer and industrial electronics dominated by advanced functions such as wearables, IoT devices, and autonomous mobility are influencing market direction. Rigid-flex PCBs are increasingly aligned with next-generation applications that require superior signal integrity, mechanical flexibility, and space optimization. This convergence is projected to extend relevance beyond traditional electronics into emerging markets like healthcare monitoring and smart automotive systems. The repositioning of rigid-flex PCBs as enablers of complex, multifunctional devices is likely to foster strong synergies with semiconductor, healthcare, and mobility platforms, ensuring sustained engagement across diverse end-use industries.

| Countries | CAGR |

|---|---|

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| France | 11.4% |

| UK | 10.4% |

| USA | 9.3% |

| Brazil | 8.2% |

China leads with 14.7% growth, driven by large-scale electronics production and expanding 5G, automotive, and consumer device industries. India follows at 13.6%, supported by growing domestic electronics manufacturing and government initiatives to strengthen semiconductor and PCB supply chains. In the OECD region, Germany reports 12.5% growth, backed by advanced automotive electronics and high-end industrial applications. France, growing at 11.4%, has maintained steady demand through aerospace and defense projects. The United Kingdom, at 10.4%, reflects consistent adoption in healthcare devices, automotive systems, and telecommunication infrastructure. The United States, at 9.3%, shows strong demand from defense, aerospace, and data center sectors, while Brazil, at 8.2%, is influenced by consumer electronics expansion and regional automotive assembly. This report includes insights on 40+ countries, with the top markets highlighted below.

The rigid-flex PCB market in China is projected to expand at a CAGR of 14.7%, driven by large-scale consumer electronics manufacturing and government-backed semiconductor programs. Local suppliers have increased capabilities in multilayer designs and high-density interconnects, meeting requirements for smartphones, wearables, and electric vehicles. Exports have also surged as China serves as a global hub for electronics assembly. Aerospace and telecom applications are adding to momentum.

Strong push from 5G and EV manufacturing

Expansion in multilayer and high-density PCB production

Government support for electronics supply chain growth

India’s market is growing at a CAGR of 13.6%, driven by Make in India policies, electronics manufacturing services (EMS) expansion, and rising consumer demand. Domestic producers are adopting advanced rigid-flex designs for smartphones, medical devices, and automotive electronics. Local manufacturing incentives and PLI schemes are accelerating capacity building.

Government incentives under Make in India and PLI

Expanding EMS sector supporting local PCB adoption

Growth in automotive and healthcare device applications

Germany records a CAGR of 12.5%, supported by high-end automotive electronics, Industry 4.0 integration, and stringent quality requirements. PCB suppliers cater to advanced driver-assistance systems (ADAS), electric mobility platforms, and industrial automation equipment.

Strong demand from automotive OEMs and Tier-1 suppliers

Emphasis on precision, reliability, and durability

Integration with advanced industrial automation systems

France is expanding at a CAGR of 11.4%, driven by aerospace, satellite, and defense industries that require advanced PCB designs. Local firms benefit from partnerships with defense contractors and aerospace integrators.

High adoption in aerospace and defense projects

Demand for miniaturized and durable PCBs

Strong ecosystem in R&D-driven applications

The UK market is growing at a CAGR of 10.4%, fueled by healthcare technology, automotive systems, and telecom infrastructure upgrades. British firms emphasize customization and high-value solutions.

Expansion in healthcare device applications

Growing use in EVs and automotive systems

Steady demand from telecom and data infrastructure

The rigid-flex PCB market is highly competitive, shaped by a mix of global leaders and strong regional specialists. Major companies such as Zhen Ding Technology Holding Limited, Nippon Mektron, Ltd., Sumitomo Electric Industries, Ltd., and Unimicron Technology Corporation dominate with scale, advanced multilayer capabilities, and extensive supply partnerships with consumer electronics and automotive OEMs. Their focus on innovation in high-density interconnects and flexible circuit integration ensures leadership in premium applications, such as smartphones, wearables, and 5G devices.

Players such as Interflex Co., Ltd., Young Poong Electronics Co., Ltd., and Meiko Electronics Co., Ltd. strengthen their positions through specialization in automotive, industrial, and aerospace segments, offering PCBs designed for reliability under harsh operating conditions. Companies like TTM Technologies, Inc., Jabil Circuit, Inc., and Samsung Electro-Mechanics leverage global manufacturing footprints and diverse client portfolios, excelling in both volume production and tailored solutions.

Niche firms such as Sierra Circuits, Inc., Eltek Ltd., and FlexPCB (Printed Circuits LLC) compete on agility, offering customized, small-batch, and quick-turn solutions, often serving medical and defense customers. European suppliers such as AT&S Austria Technologie & Systemtechnik AG and Würth Elektronik GmbH & Co. KG differentiate through engineering depth and strong compliance with stringent quality standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.2 Billion |

| Product Type | Multi-layer flex, Single-sided flex, Double-sided flex, Multilayer PCB, and Quick turn rigid flex PCB |

| Layer Count | Multi-layer, Single layer, and Double layer |

| Flexibility Type | Dynamic flex and Static flex |

| Materials | FR4, Kapton, Rogers, and Others |

| End-Use Industry | Consumer electronics, Aerospace and defense, Automotive, Industrial, IT and telecommunications, Healthcare, and Others (e.g., Energy, Transportation) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ZhenDingTechnologyHoldingLimited, NipponMektron,Ltd., SumitomoElectricIndustries,Ltd., UnimicronTechnologyCorporation, InterflexCo.,Ltd., YoungPoongElectronicsCo.,Ltd., TTMTechnologies,Inc., Multek(aFlexCompany), ShengyiTechnologyCo.,Ltd., AT&SAustriaTechnologie&SystemtechnikAG, MeikoElectronicsCo.,Ltd., KinwongElectronicCo.,Ltd., SierraCircuits,Inc., EltekLtd., JabilCircuit,Inc., SamsungElectro-Mechanics, WürthElektronikGmbH&Co.KG, ShenzhenKinwongElectronicCo.,Ltd., and FlexPCB(PrintedCircuitsLLC) |

| Additional Attributes | Dollar sales vary by board type, including single-sided, double-sided, and multi-layer rigid-flex PCBs; by application, such as consumer electronics, automotive, aerospace & defense, medical devices, and telecommunications; by end-use industry, spanning electronics, automotive, healthcare, and industrial; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by miniaturization, rising demand for lightweight durable electronics, and high-density interconnect solutions. |

The global rigid-flex PCB market is estimated to be valued at USD 27.2 billion in 2025.

The market size for the rigid-flex PCB market is projected to reach USD 76.5 billion by 2035.

The rigid-flex PCB market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in rigid-flex PCB market are multi-layer flex, single-sided flex, double-sided flex, multilayer PCB and quick turn rigid flex pcb.

In terms of layer count, multi-layer segment to command 45.2% share in the rigid-flex PCB market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Substrate-like PCB Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA