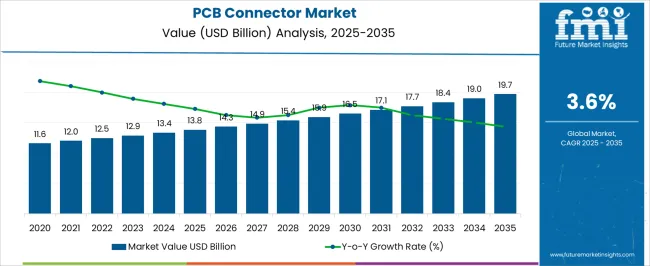

The PCB connector market is projected to grow from USD 13.8 billion in 2025 to USD 19.7 billion in 2035, reflecting a CAGR of 3.6%. This represents an absolute dollar opportunity of USD 5.9 billion over the decade. The market is expected to expand steadily, reaching USD 14.3 billion in 2026, USD 15.4 billion in 2029, USD 16.5 billion in 2031, and USD 19.0 billion in 2034. The consistent growth trajectory highlights increasing demand for PCB connectors across electronics and industrial applications, providing manufacturers and investors with opportunities to capture incremental revenue and strengthen their market position over the forecast period.

From an absolute dollar perspective, annual incremental growth starts at approximately USD 0.4–0.5 billion in the early years and rises to around USD 0.7 billion in the later stages, culminating in USD 5.9 billion by 2035. Intermediate benchmarks, such as USD 13.4 billion in 2025, USD 15.9 billion in 2030, and USD 18.4 billion in 2033, illustrate predictable growth phases. This enables stakeholders to plan production, distribution, and capacity expansion efficiently.

| Metric | Value |

|---|---|

| PCB Connector Market Estimated Value in (2025 E) | USD 13.8 billion |

| PCB Connector Market Forecast Value in (2035 F) | USD 19.7 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

Between 2025 and 2027, the market rises from USD 13.8 billion to USD 14.3 billion, marking the early growth phase where moderate adoption and steady demand drive incremental revenue. Another critical breakpoint occurs around 2029–2031, as the market grows from USD 15.4 billion to USD 16.5 billion, reflecting a period of stronger expansion and higher absolute dollar gains. These stages are essential for manufacturers and investors to optimize production, align supply chains, and capture revenue during periods of accelerating market demand.

The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 18.4 billion to USD 19.7 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 15.9 billion to USD 17.7 billion, acting as bridging periods that maintain growth momentum.

Future outlook is shaped by the increasing demand for miniaturized and high-performance electronic products across industries such as telecommunications, automotive, consumer electronics, and industrial automation.

Advancements in connector technologies are supporting faster data transmission, improved durability, and better signal integrity, which are essential for next-generation applications like 5G networks and IoT devices. Growing investments in telecom infrastructure and the rising adoption of smart devices continue to fuel the demand for advanced PCB connectors.

Additionally, the push for automation and electrification across industries is expected to further propel market growth by driving the need for reliable and efficient interconnect solutions The market is positioned for steady expansion as technological innovations and increasing electronic device penetration create sustained demand.

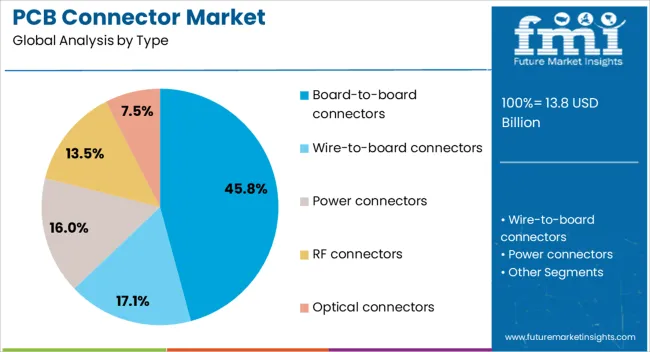

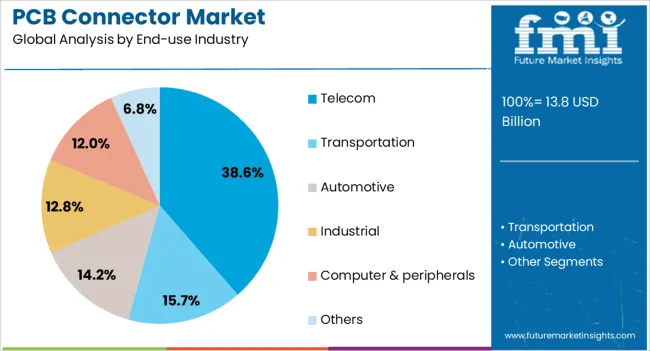

The PCB connector market is segmented by type, end-use industry, and geographic regions. By type, the PCB connector market is divided into Board-to-board connectors, Wire-to-board connectors, Power connectors, RF connectors, and Optical connectors. In terms of end-use industry, the PCB connector market is classified into Telecom, Transportation, Automotive, Industrial, Computer & peripherals, and Others. Regionally, the PCB connector industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The board-to-board connectors type segment is projected to hold 45.8% of the PCB Connector market revenue share in 2025, making it the dominant connector type. This leadership is attributed to the segment’s ability to provide compact, high-density interconnections essential for modern electronic assemblies.

The growth of this segment has been driven by the demand for efficient signal transmission between multiple printed circuit boards within compact spaces, particularly in telecom equipment, computing devices, and industrial applications. The versatility and reliability of board-to-board connectors in supporting high-speed data and power transmission have accelerated their adoption.

Furthermore, their role in enabling modular designs and facilitating ease of assembly and maintenance has reinforced the preference for this connector type. As electronic products continue to evolve with more complex architectures, the need for advanced board-to-board connections is expected to sustain the segment’s market dominance.

The telecom end-use industry segment is expected to account for 38.6% of the PCB Connector market revenue share in 2025, representing the largest end-use sector. This prominence is due to the rapid expansion of telecommunications infrastructure globally, driven by the deployment of 5G networks and the increasing demand for high-speed data connectivity.

The growth of telecom applications has necessitated the use of advanced connectors that can support high-frequency signals and ensure reliable performance in demanding environments. Additionally, the shift toward network densification and the proliferation of small cells and base stations have contributed to rising demand for compact and high-performance PCB connectors within telecom equipment.

The continual upgrade cycles and expansion of telecom networks worldwide have reinforced the sector’s substantial share in the market. As the telecom industry advances, the need for innovative connector solutions to support next-generation technologies is expected to drive further growth in this segment.

The PCB connector market is expanding as electronics manufacturers demand reliable interconnection solutions for printed circuit boards in consumer electronics, automotive, industrial, and telecommunications applications. PCB connectors facilitate signal, power, and data transfer between circuit boards, modules, and devices, supporting miniaturization, high-speed performance, and durability.

Rising adoption of high-density PCBs, IoT devices, automotive electronics, and 5G-enabled systems drives growth. Manufacturers offering connectors with compact form factors, high-current capacity, robust mechanical strength, and superior signal integrity gain a competitive edge. Trends toward automation, high-frequency communication, and flexible PCBs further accelerate adoption. Integration of surface-mount technology, advanced plating, and corrosion-resistant materials enhances reliability, making PCB connectors an essential component in modern electronic systems across multiple industries.

Market growth is restrained by cost pressures and increasing design complexity of PCB connectors. Advanced connectors with high pin counts, specialized plating, and precise tolerances increase manufacturing expenses. Integrating connectors into compact or multi-layer PCBs requires careful design to maintain signal integrity, reduce crosstalk, and manage thermal performance. Inconsistent quality or misalignment can lead to device failure, recalls, or warranty claims. Additionally, varying connector standards across regions and industries complicate design and procurement for manufacturers. Smaller electronics producers may face high adoption costs and technical barriers when integrating high-performance connectors. Until cost-effective, standardized, and reliable solutions become more widely available, adoption may remain concentrated in high-volume electronics and industrial applications.

Technological advancements are shaping trends in the PCB connector market. Innovations in high-speed connectors, low-profile designs, flexible PCB interfaces, and enhanced contact materials improve signal integrity, current capacity, and durability. Integration with automated assembly and testing systems reduces production errors and enhances efficiency. Connectors optimized for high-frequency, high-density, or ruggedized applications are increasingly required in 5G, aerospace, automotive, and industrial electronics. Advanced plating techniques, corrosion resistance, and hybrid connector designs enhance longevity and reliability. These innovations enable manufacturers to meet growing demands for miniaturized, high-performance, and high-reliability interconnect solutions across diverse electronic systems.

Opportunities in the PCB connector market are driven by increasing electronics production, IoT device proliferation, and automotive electronics growth. Rising consumer demand for smartphones, wearables, smart home devices, and connected industrial equipment expands the need for robust connectors. Electric vehicles, autonomous driving systems, and advanced driver-assistance systems require high-reliability PCB interconnects. Emerging markets investing in electronics manufacturing and telecom infrastructure offer significant growth potential. Manufacturers providing modular, compact, and high-speed connectors, along with strong after-sales support, can capture market share. The trend toward IoT-enabled devices and 5G networks further accelerates demand for connectors that ensure fast data transfer, energy efficiency, and long-term reliability.

Market growth is restrained by intense competition, lack of standardization, and supply chain vulnerabilities. Multiple global and regional players compete on performance, pricing, and technological features, creating margin pressures. Variability in connector standards, interface protocols, and regional compliance requirements complicates design and procurement.

Dependence on high-purity metals, specialty plastics, and precision manufacturing exposes manufacturers to supply chain disruptions and cost volatility. Quality control is critical, as faulty connectors can cause device failure or recalls. Until manufacturers achieve standardization, supply chain resilience, and cost-effective high-performance solutions, adoption may remain concentrated among large electronics OEMs, industrial users, and high-reliability applications.

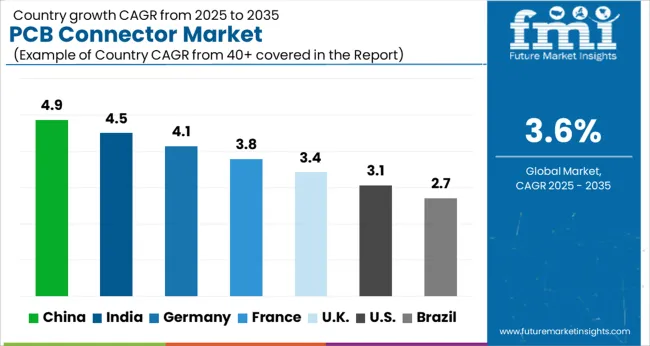

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

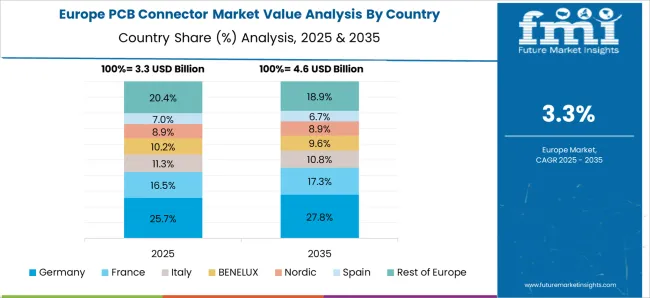

The global PCB connector market was projected to grow at a 3.6% CAGR through 2035, driven by demand in electronics, telecommunications, and industrial automation applications. Among BRICS nations, China recorded 4.9% growth as large-scale production and assembly facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 4.5% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 4.1% maintained substantial output under strict industrial and quality regulations, while the United Kingdom at 3.4% relied on moderate-scale operations for electronic and industrial applications. The USA, expanding at 3.1%, remained a mature market with steady demand across electronics, telecommunication, and industrial automation segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The PCB connector market in China is growing at a CAGR of 4.9% due to increasing demand for electronic devices, industrial automation, and automotive electronics. Manufacturers are adopting PCB connectors to ensure reliable electrical connections, high signal integrity, and compact assembly in printed circuit boards. Growth is supported by rising electronics production, expansion of consumer and industrial applications, and investment in high-tech manufacturing. Suppliers provide a wide range of connectors including board-to-board, wire-to-board, and high-speed signal connectors to meet diverse industrial requirements. Distribution through electronic component distributors, system integrators, and online platforms ensures availability across production hubs. Adoption is further driven by manufacturers seeking reliable, durable, and cost effective solutions for high volume production. China remains a leading market due to large-scale electronics manufacturing, technological adoption, and demand for high quality interconnect solutions.

India is witnessing growth at a CAGR of 4.5% in the PCB connector market due to rising electronics manufacturing, automotive electronics, and industrial automation adoption. Companies are using connectors to ensure secure electrical connections, high signal integrity, and efficient PCB assembly. Growth is supported by increasing demand for consumer electronics, automotive components, and industrial equipment. Suppliers provide board-to-board, wire-to-board, and high-speed signal connectors with high durability and quality standards. Distribution through component distributors, integrators, and online platforms ensures product availability across industrial regions. Adoption is further driven by manufacturers seeking reliable, compact, and cost effective interconnect solutions. India’s expanding electronics and automotive sectors make it an important market for PCB connector adoption, supported by industrial modernization and growing domestic production capabilities.

Germany is growing at a CAGR of 4.1% in the PCB connector market due to demand from automotive electronics, industrial machinery, and consumer electronics sectors. Manufacturers use PCB connectors to ensure reliable electrical performance, signal integrity, and compact design in assemblies. Suppliers provide a variety of connectors, including high-speed, board-to-board, and wire-to-board types, tailored for industrial and commercial applications. Growth is supported by industrial automation, electronics innovation, and high quality manufacturing standards. Distribution through electronic component suppliers, integrators, and service providers ensures availability for both domestic and export applications. Adoption is further influenced by manufacturers seeking durable, reliable, and cost effective interconnect solutions. Germany’s focus on precision, quality, and high technology adoption makes it a key European market for PCB connectors.

The United Kingdom market is expanding at a CAGR of 3.4% due to rising electronics manufacturing, industrial automation, and automotive electronics adoption. PCB connectors are used to ensure secure connections, signal integrity, and efficient assembly in electronic products. Suppliers provide board-to-board, wire-to-board, and high-speed connectors suitable for industrial, automotive, and consumer applications. Growth is supported by industrial modernization, adoption of automated production, and rising electronics production. Distribution through component distributors, integrators, and online platforms ensures accessibility across regions. Adoption is further driven by manufacturers seeking reliable, cost effective, and durable interconnect solutions. The United Kingdom continues to see steady growth as electronics and industrial manufacturing sectors increase demand for high quality PCB connectors.

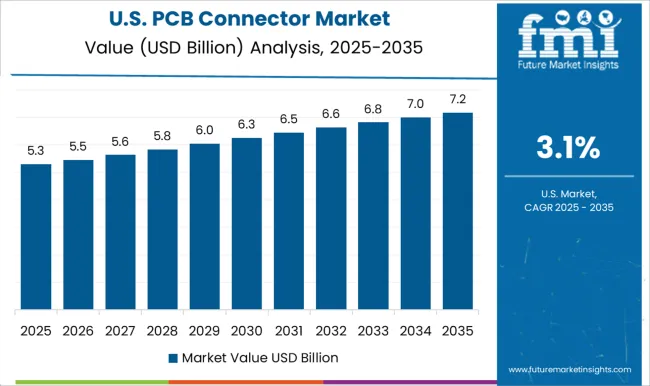

The United States market is growing at a CAGR of 3.1% due to increasing adoption of PCB connectors in electronics manufacturing, automotive systems, and industrial automation. Connectors are used for secure electrical connections, high signal integrity, and efficient PCB assembly. Suppliers provide board-to-board, wire-to-board, and high-speed connectors suitable for consumer electronics, automotive, and industrial applications. Growth is supported by expansion of electronics manufacturing, automation adoption, and rising industrial production. Distribution through component distributors, system integrators, and online platforms ensures availability across major production regions. Adoption is further driven by manufacturers seeking durable, high quality, and cost effective interconnect solutions. The United States remains an important market for PCB connectors due to its strong electronics, automotive, and industrial manufacturing ecosystem.

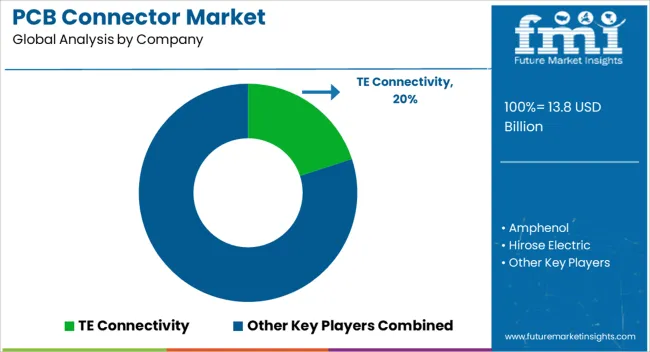

The PCB connector market is primarily served by TE Connectivity, Amphenol, Hirose Electric, JST Manufacturing, Molex, Samtec, and Würth Elektronik. Product brochures emphasize high-density configurations, signal integrity, durability, and modular designs. Visuals highlight board-to-board, wire-to-board, and mezzanine connectors, with detailed specifications covering current rating, voltage tolerance, mating cycles, and material composition. Thermal resistance, corrosion protection, and space-saving designs are frequently presented to suit industrial, automotive, and consumer electronics applications. Competition is driven by precision engineering, global distribution networks, and compliance with industry standards.

TE Connectivity and Amphenol focus on ruggedized connectors for harsh environments and high-speed data transmission. Molex and Hirose Electric emphasize miniaturized solutions with high pin counts, while JST Manufacturing highlights reliable low-profile and cost-effective connectors. Samtec is observed to target high-speed signal and optical interconnects (observed industry pattern), and Würth Elektronik prioritizes flexible solutions for prototyping and rapid deployment. Partnerships with OEMs, electronics assemblers, and system integrators influence market positioning. Market strategies revolve around innovation, standardization, and vertical integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.8 Billion |

| Type | Board-to-board connectors, Wire-to-board connectors, Power connectors, RF connectors, and Optical connectors |

| End-use Industry | Telecom, Transportation, Automotive, Industrial, Computer & peripherals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Amphenol, Hirose Electric, JST Manufacturing, Molex, Samtec, and Würth Elektronik |

| Additional Attributes | Dollar sales vary by connector type, including board-to-board, wire-to-board, and coaxial connectors; by application, such as consumer electronics, automotive, industrial equipment, and telecommunications; by end-use industry, spanning electronics manufacturing, automotive, and industrial automation; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising electronics production, miniaturization, and demand for reliable interconnect solutions. |

The global pcb connector market is estimated to be valued at USD 13.8 billion in 2025.

The market size for the pcb connector market is projected to reach USD 19.7 billion by 2035.

The pcb connector market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in pcb connector market are board-to-board connectors, wire-to-board connectors, power connectors, rf connectors and optical connectors.

In terms of end-use industry, telecom segment to command 38.6% share in the pcb connector market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCB Design Software Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Substrate-like PCB Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Connector Market Size and Share Forecast Outlook 2025 to 2035

Connector Adapter Kits Market

Connector Kits Market

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

SMP Connectors Market Size and Share Forecast Outlook 2025 to 2035

Gas Connectors and Gas Hoses Market - Safety, Demand & Market Outlook 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Aviation Connector Market

Global Luer Lock Connector Market Analysis – Size, Share & Forecast 2024-2034

Automotive Connectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA