The ethernet connector and transformer market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Between 2020 and 2024, the market grew from USD 0.8 billion to 1.0 billion, marking the early adoption phase. During this period, growth was steady and primarily driven by specialized applications in networking, data centers, and industrial automation. Early adopters, including niche manufacturers and regional distributors, tested product performance and reliability, establishing initial market credibility. Incremental adoption allowed stakeholders to refine sourcing, production, and distribution practices. This foundational stage prepared the market for broader acceptance and set the stage for expansion in the coming years. From 2025 to 2030, the market enters the scaling phase, growing from USD 1.0 billion to approximately 1.3 billion.

Adoption expands as demand rises across enterprise networks and industrial installations, supported by more established supply chains. By 2030, with the market surpassing USD 1.3 billion, the industry begins transitioning toward consolidation. From 2030 to 2035, growth continues steadily to USD 1.8 billion, as leading manufacturers consolidate market share, optimize production, and stabilize operations. This phase reflects a mature market with predictable demand and steady expansion across key segments.

| Metric | Value |

|---|---|

| Ethernet Connector and Transformer Market Estimated Value in (2025 E) | USD 1.0 billion |

| Ethernet Connector and Transformer Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The market is experiencing steady expansion driven by the increasing demand for high-speed, reliable data transmission across communication, industrial automation, and enterprise networking sectors. This growth is being supported by the ongoing rollout of gigabit and multi-gigabit Ethernet infrastructure and the rising penetration of connected devices across industrial and commercial settings.

The growing importance of seamless data flow in smart factories, data centers, and enterprise networks is prompting a shift toward advanced connectivity components that offer performance, durability, and electromagnetic interference mitigation. Demand has also been influenced by the transition to Industry 4.0 standards and the increasing need for compact and high-density connectivity solutions.

With the continuous expansion of network architecture and the growing requirement for efficient signal integrity in harsh environments, the market is positioned for long-term growth Future opportunities are expected to emerge from innovation in high-frequency magnetics, miniaturized designs, and energy-efficient Ethernet components tailored for low-latency applications.

The ethernet connector and transformer market is segmented by type, application type, and geographic regions. By type, the market is divided into RJ45 connector, M12 connector, M8 connector, and iX connector. In terms of application type, the market is classified into network switches, routers, network interface cards, hubs, and servers. Regionally, the ethernet connector and transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The RJ45 connector type is projected to account for 41.7% of the market revenue in 2025, making it the leading segment by type. This prominence is being attributed to the RJ45 connector’s wide compatibility with Ethernet cabling standards, its standardized pin configuration, and ease of integration into existing network environments. Its broad use across commercial networking, industrial control, and residential broadband has made it the default interface for Ethernet ports globally.

Growth in this segment has been influenced by the rapid scaling of gigabit and multi-gigabit applications, where RJ45 connectors provide a reliable and cost-effective means for physical connectivity. Demand is also being sustained by the growing number of Ethernet ports embedded in consumer electronics, networking equipment, and industrial hardware.

The connector’s simplicity in termination and field-installability further support its continued preference among installers and manufacturers As digital infrastructure expands and devices increasingly rely on wired connectivity for secure and stable data exchange, the RJ45 connector is expected to retain its dominant market position.

The network switches application segment is expected to capture 36.2% of the total market revenue in 2025, establishing it as the most prominent application area. This leading share is being supported by the rising demand for data traffic management in data centers, enterprise networks, and telecommunication infrastructures. Ethernet connectors and transformers play a critical role in ensuring signal integrity, isolation, and EMI protection in high-port-density switch environments.

Growth in this segment has been driven by the proliferation of cloud computing, IoT devices, and edge data processing which require resilient and scalable switch systems. Network operators and businesses are increasingly adopting high-speed switching equipment that relies on compact and high-performance connectors and integrated magnetics.

The segment has also benefited from the shift toward Power over Ethernet systems, which require enhanced electrical characteristics provided by specialized transformers and connectors As networking complexity continues to rise, the demand for high-efficiency components in switch hardware is anticipated to support the segment’s leadership in the market.

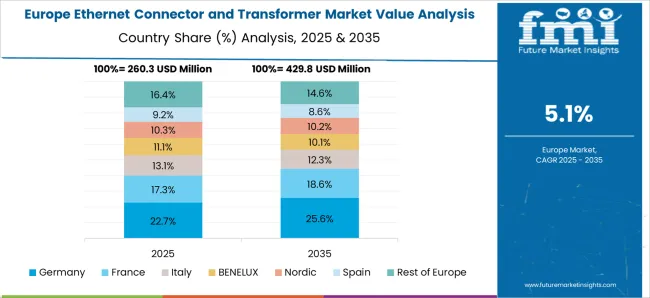

The ethernet connector and transformer market is experiencing steady growth, driven by increasing demand for high-speed data transmission, networking infrastructure, and telecom applications. These components are critical for LAN, data centers, industrial automation, and consumer electronics. North America and Europe dominate due to advanced IT infrastructure and industrial adoption, while Asia-Pacific shows strong growth fueled by expanding data centers, smart manufacturing, and IoT deployments. Market expansion is supported by innovations in miniaturization, high-performance materials, and enhanced signal integrity. Companies focus on reliability, multi-port solutions, and compliance with emerging Ethernet standards to differentiate products across networking and industrial segments.

Consistent performance and quality of ethernet connectors and transformers remain key challenges. Variations in manufacturing processes, material quality, and precision can affect signal integrity, crosstalk, and data transmission efficiency. Manufacturers supplying enterprise, telecom, and industrial clients require compliance with strict standards such as IEEE Ethernet specifications, RoHS, and UL certifications. Lack of standardized testing protocols across suppliers can lead to performance variability, impacting system reliability. Until industry-wide harmonized quality metrics are widely adopted, maintaining consistent performance and gaining customer trust remain critical challenges for market participants.

Technological advancements are reshaping the ethernet connector and transformer market. Innovations include high-speed connectors supporting 10G/25G/40G Ethernet, compact designs for space-constrained devices, and integrated transformers with enhanced signal integrity and EMI suppression. Emerging technologies like PoE (Power over Ethernet) enable simultaneous power and data transmission, expanding industrial and consumer applications. Advanced materials and automated assembly processes improve durability and thermal performance. Companies collaborating with R&D institutions validate high-speed performance and reliability, creating competitive differentiation. These innovations are driving adoption in data centers, industrial automation, and next-generation networking applications.

Ethernet connectors and transformers are subject to regulatory and industry compliance standards. Manufacturers must adhere to UL, IEC, RoHS, REACH, and IEEE guidelines to ensure safety, environmental compliance, and interoperability. Telecom and industrial applications require certifications for electromagnetic compatibility (EMC) and reliability under operational stress. Non-compliance can limit market access, especially in North America and Europe, where regulatory scrutiny is high. Suppliers aligning products with recognized certifications and standards gain market credibility and smoother adoption across sectors. Until global regulatory harmonization improves, companies must navigate complex regional compliance landscapes.

The market is moderately competitive, with global and regional players offering diverse connector and transformer solutions. Raw material availability, precision manufacturing, and electronics-grade components impact production scalability and costs. Supply chain disruptions, component shortages, and fluctuating demand in data centers or industrial sectors affect delivery timelines. Companies investing in vertical integration, diversified sourcing, and automated manufacturing processes gain reliability and cost advantages. Competitive differentiation is increasingly achieved through high-performance specifications, miniaturization, PoE capabilities, and compliance certifications. Until supply chain stability improves, competition and sourcing challenges will continue to influence market growth and adoption.

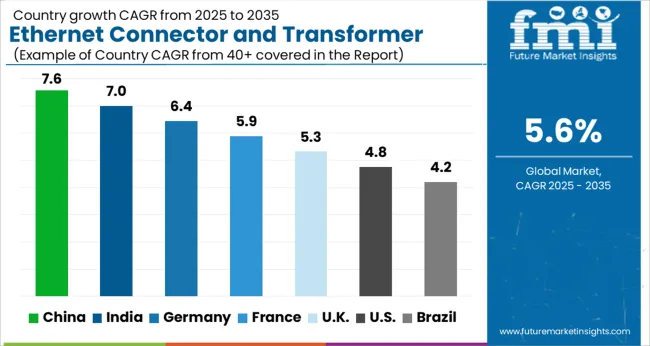

The global market is projected to grow at a CAGR of 5.6% through 2035, supported by increasing demand across networking infrastructure, data centers, and telecommunication systems. Among BRICS nations, China has been recorded with 7.6% growth, driven by large-scale production and deployment in commercial and industrial networks, while India has been observed at 7.0%, supported by expanding adoption in enterprise and telecommunications sectors. In the OECD region, Germany has been measured at 6.4%, where manufacturing for high-performance networking components has been steadily maintained. The United Kingdom has been noted at 5.3%, reflecting consistent uptake in IT infrastructure projects, while the USA has been recorded at 4.8%, with production and adoption in enterprise and commercial systems being consistently increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The ethernet connector and transformer market in China is growing at a CAGR of 7.6%, driven by rapid digitalization and expansion of data centers, telecommunication infrastructure, and industrial networking. Ethernet connectors and transformers are essential components in high-speed data transmission systems, ensuring reliable connectivity and signal integrity. The adoption of IoT devices, 5G networks, and cloud computing further boosts the demand for robust Ethernet solutions. Chinese manufacturers are focusing on advanced designs and miniaturized components to meet the growing bandwidth and energy efficiency requirements. Government initiatives promoting smart cities, industrial automation, and high-speed internet connectivity are also supporting market growth. With increasing investments in networking infrastructure and continuous technological upgrades, the Ethernet connector and transformer market in China is poised for steady expansion over the forecast period.

The ethernet connector and transformer market in India is expanding at a CAGR of 7.0%, fueled by the growing IT and telecommunications sectors. Rapid deployment of high-speed internet, data centers, and cloud-based services drives the adoption of Ethernet connectivity solutions. Increasing digitalization in manufacturing, smart cities projects, and industrial automation further support market growth. Manufacturers in India are introducing high-performance connectors and transformers that meet international quality standards while optimizing energy efficiency. The government’s focus on the Digital India initiative and enhanced broadband penetration accelerates market adoption. As India continues to expand its industrial, enterprise, and networking infrastructure, the demand for reliable Ethernet connectors and transformers is expected to rise steadily in the forecast period.

The ethernet connector and transformer market in Germany is growing at a CAGR of 6.4%, supported by the industrial, automotive, and telecommunication sectors. Germany’s emphasis on Industry 4.0 and smart manufacturing drives demand for reliable Ethernet solutions. Connectors and transformers are critical in ensuring efficient high-speed data transfer, signal integrity, and network reliability. Manufacturers prioritize advanced, energy-efficient components to comply with stringent European quality and environmental standards. Industrial networking, automation, and increasing adoption of IoT devices in manufacturing plants further bolster market growth. With continuous innovation, regulatory compliance, and technological upgrades, the Ethernet connector and transformer market in Germany is expected to expand steadily during the forecast period.

The ethernet connector and transformer market in the United Kingdom is expanding at a CAGR of 5.3%, driven by growth in IT infrastructure, data centers, and industrial networking. Connectors and transformers ensure reliable high-speed connectivity in enterprise networks, telecommunications, and smart manufacturing systems. Growing adoption of IoT devices, cloud computing, and industrial automation increases the need for robust Ethernet solutions. Manufacturers are emphasizing energy-efficient, high-performance components that meet international standards. The UK government’s support for digital infrastructure development and smart city initiatives further encourages market expansion. With continuous technological advancements and increasing networking requirements, the Ethernet connector and transformer market in the United Kingdom is expected to maintain steady growth throughout the forecast period.

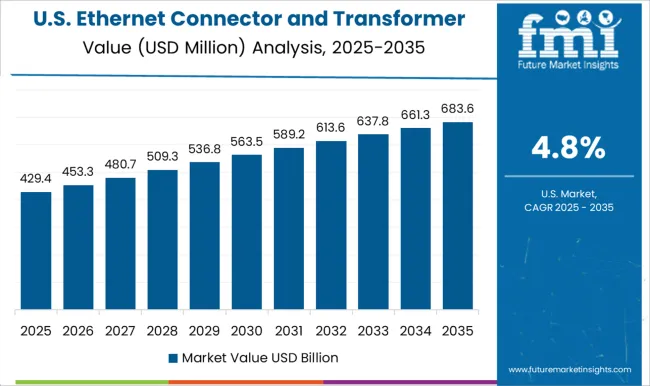

The ethernet connector and transformer market in the United States is growing at a CAGR of 4.8%, supported by the increasing deployment of data centers, enterprise networks, and industrial automation systems. Ethernet connectors and transformers play a critical role in ensuring signal integrity, high-speed data transmission, and network reliability. Adoption of IoT devices, smart manufacturing, and cloud computing services further fuels market demand. Manufacturers in the USA focus on developing high-quality, energy-efficient, and compact components to meet industrial and enterprise requirements. With continuous upgrades in networking infrastructure and strong demand from IT and telecommunication sectors, the Ethernet connector and transformer market in the United States is projected to witness consistent growth during the forecast period.

The ethernet connector and transformer market is a critical segment of the global networking and telecommunications industry, supporting high-speed data transfer, signal integrity, and reliable connectivity across commercial, industrial, and consumer applications. Demand is fueled by the proliferation of data centers, cloud computing, 5G networks, and increasing digitalization across industries, which require robust, high-performance networking components. Amphenol Corporation is a leading supplier of ethernet connectors and transformers, offering advanced connectivity solutions for industrial, automotive, and telecommunications applications. HALO Electronics specializes in magnetic components and ethernet transformers, emphasizing high-quality performance and compliance with stringent industry standards. Belden Inc provides a broad portfolio of networking infrastructure products, including ethernet connectors and transformers designed for high-speed data transmission and reliability. Schneider Electric focuses on industrial and building automation solutions, integrating ethernet connectivity components into energy management and control systems.

Rockwell Automation offers industrial ethernet solutions optimized for factory automation and smart manufacturing environments. Pulse Electronics supplies high-performance magnetic components and connectors, while Eaton Corporation integrates ethernet connectivity into power management and industrial automation systems. Other notable manufacturers include TE Connectivity, Weidmüller Holding, LINK-PP, Mentech Technology, Bourns, TT Electronics, WAY Technology, Bel Fuse, Würth Elektronik, and Abracon, all of which provide specialized products for data transmission, signal integrity, and network reliability. These companies continue to innovate through research and development, focusing on miniaturization, higher bandwidth capabilities, energy efficiency, and compliance with evolving industry standards. With the ongoing growth of high-speed networking and digital infrastructure globally, these leading suppliers and manufacturers are poised to play a pivotal role in advancing the ethernet connector and transformer market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Type | RJ45 Connector, M12 Connector, M8 Connector, and iX Connector |

| Application Type | Network Switches, Routers, Network Interface Cards, Hubs, and Servers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amphenol Corporation, HALO Electronics, Belden Inc, Schneider Electric, Rockwell Automation, Pulse Electronics, Eaton Corporation, Taimag Corporation, TE Connectivity, Weidmüller Holding AG & Co. KG, LINK-PP, Mentech Technology, Bourns, Inc, TT Electronics, way Technology Co., Ltd., Bel Fuse Inc, Würth Elektronik GmbH & Co. KG, and Abracon |

| Additional Attributes | Dollar sales by type including RJ45 connectors, magnetics, and integrated modules, application across data centers, enterprise networking, industrial automation, and telecommunications, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for high-speed data transmission, expansion of networking infrastructure, and increasing adoption of IoT and connected devices. |

The global ethernet connector and transformer market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the ethernet connector and transformer market is projected to reach USD 1.8 billion by 2035.

The ethernet connector and transformer market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in ethernet connector and transformer market are rj45 connector, m12 connector, m8 connector and ix connector.

In terms of application type, network switches segment to command 36.2% share in the ethernet connector and transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Backhaul Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Access Device Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Switch Market

TSN Ethernet Chips Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Ethernet Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

PoE Solutions Market - Growth, Demand & Forecast 2025 to 2035

In-Vehicle Ethernet System Market Growth – Trends & Forecast 2025 to 2035

SP Routing And Ethernet Switching Market Size and Share Forecast Outlook 2025 to 2035

Connector Market Size and Share Forecast Outlook 2025 to 2035

Connector Adapter Kits Market

Connector Kits Market

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

SMP Connectors Market Size and Share Forecast Outlook 2025 to 2035

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

Gas Connectors and Gas Hoses Market - Safety, Demand & Market Outlook 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA