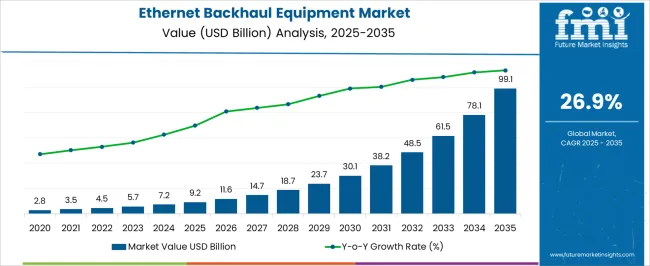

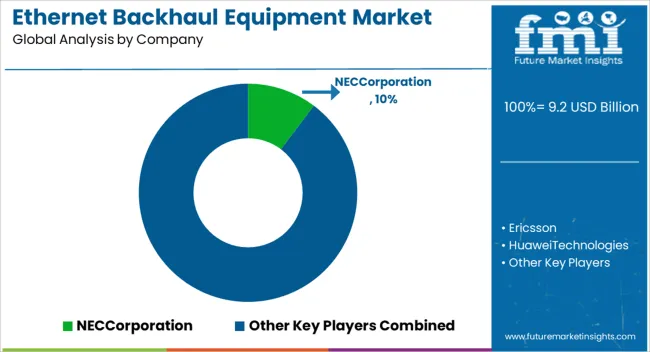

The Ethernet Backhaul Equipment Market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 99.1 billion by 2035, registering a compound annual growth rate (CAGR) of 26.9% over the forecast period.

| Metric | Value |

|---|---|

| Ethernet Backhaul Equipment Market Estimated Value in (2025E) | USD 9.2 billion |

| Ethernet Backhaul Equipment Market Forecast Value in (2035F) | USD 99.1 billion |

| Forecast CAGR (2025 to 2035) | 26.9% |

The Ethernet backhaul equipment market is experiencing sustained growth driven by expanding mobile data traffic, the rollout of 5G networks, and the need for low-latency communication infrastructure. Telecom operators and internet service providers are increasingly investing in Ethernet-based transport solutions to ensure seamless backhaul from radio access networks to core networks.

The demand for scalable bandwidth and network virtualization is encouraging adoption of packet-based backhaul technologies that support real-time services and efficient traffic aggregation. Enterprises and carriers are focusing on enhancing quality of service through improved service level agreements, latency reduction, and dynamic routing capabilities.

Continued infrastructure modernization efforts in emerging economies and the integration of software-defined networking are further supporting market evolution. Future opportunities are expected in hybrid network architectures that combine fiber and wireless links, enabling operators to scale backhaul capacity in line with edge computing and cloud access requirements.

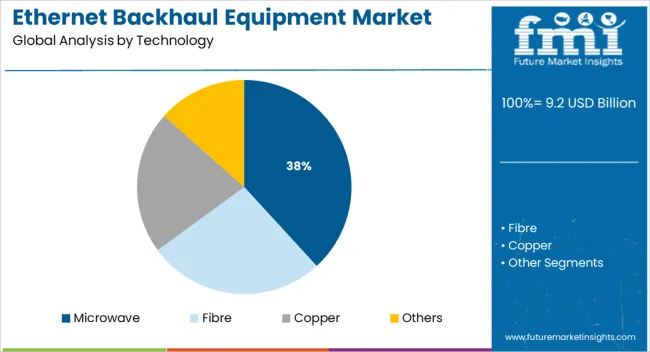

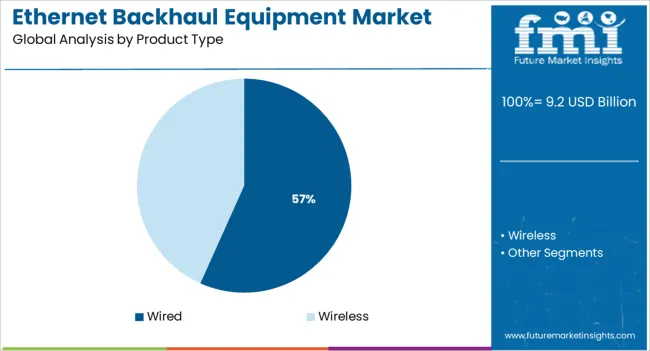

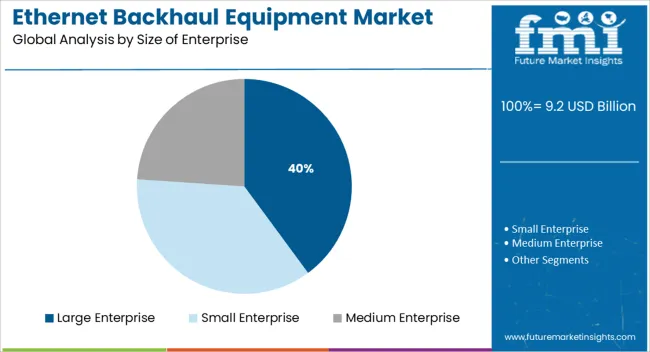

The market is segmented by Technology, Product Type, Size of Enterprise, and Application and region. By Technology, the market is divided into Microwave, Fibre, Copper, and Others. In terms of Product Type, the market is classified into Wired and Wireless. Based on Size of Enterprise, the market is segmented into Large Enterprise, Small Enterprise, and Medium Enterprise. By Application, the market is divided into Civil Communication, Defence Communication, Military Communication, and Among Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microwave segment is expected to account for 38.2% of the revenue share in 2025 within the technology category, making it a leading backhaul solution. Its dominance is being driven by its ability to offer rapid deployment in areas where fiber is either unavailable or economically unfeasible.

Microwave backhaul supports high capacity transmission over long distances without requiring extensive physical infrastructure, making it particularly effective in suburban and rural deployments. The ability to upgrade microwave systems with enhanced spectrum efficiency and advanced modulation schemes has strengthened their relevance in modern backhaul architecture.

Moreover, flexibility in licensing and the availability of millimeter wave spectrum have contributed to its growing use in 5G rollouts and small cell connectivity. As operators seek cost-effective and agile solutions for expanding coverage, the microwave segment is expected to remain integral to the backhaul strategy.

The wired segment is projected to lead the product type category with a 56.7% share of the total market revenue in 2025. This leadership is supported by the reliability, low latency, and bandwidth scalability that wired connections provide, particularly in high-density urban environments.

Fiber-based Ethernet backhaul has become the backbone for data-intensive services and enterprise applications requiring consistent performance and security. The increased penetration of fiber-optic networks and government incentives for broadband expansion have further accelerated the deployment of wired backhaul solutions.

Additionally, the integration of wired infrastructure with software-defined networking tools allows for greater operational control and automation. Wired systems are also favored in regulated industries where data security and service continuity are critical, reinforcing their share in the Ethernet backhaul equipment market.

Large enterprises are forecast to hold 39.9% of total market revenue in 2025 within the size of enterprise category, making them the leading end user segment. This is attributed to their need for robust and scalable connectivity to support high volumes of data transmission across geographically dispersed sites.

Ethernet backhaul solutions are being adopted by large enterprises to facilitate unified communications, remote collaboration, cloud application access, and real-time analytics. These organizations often demand dedicated bandwidth, low jitter, and strong quality of service controls, which Ethernet-based infrastructure is well positioned to deliver.

Investments in private 5G networks, edge data centers, and hybrid cloud platforms by large corporations have further fueled demand for reliable backhaul systems. As digital transformation accelerates and enterprise workloads become more distributed, large enterprises will continue to drive adoption of high-capacity Ethernet backhaul solutions.

The demand for ethernet backhaul equipment is projected to grow thanks to the development of 3G and 4G services, which is likely to fuel the market growth during the projected period. Furthermore, the requirement for bulk voice and data transfers between locations has grown due to network technology advancements and modern communications. These factors are primary drivers boosting the ethernet backhaul equipment market share during the forecast period.

The rising need for constant connectivity and the rapid adoption of 3G and 4G (Long-Term Evolution) networks have accelerated the demand for ethernet backhaul equipment. Mobile data traffic has expanded along with computer and smartphone usage, stimulating the demand for quick and dependable connectivity. Small cells and other technological developments are required to meet the increased bandwidth demands, which further propels the sales of ethernet backhaul equipment.

High data traffic growth due to high adoption by enterprises and an increase in application in government sectors and educational institutions are enabling the growth in revenue of the global ethernet backhaul equipment market.

The demand for ethernet backhaul equipment is anticipated to have improved revenue growth as customers are becoming additionally conscious of connected gadgets and the need to keep in contact even in remote areas.

The expansion and revenue of the global Ethernet backhaul equipment market are being expedited by the high data traffic growth brought on by high enterprise adoption, growth in application in government and educational institutions, and high adoption by enterprises.

The launch of 5G provides a significant opportunity for the ethernet backhaul market players. Data traffic is driven by the rising popularity of data-intensive services like video on demand, internet streaming, and video connection. By installing tiny cells, network operators utilize Wi-Fi to offload traffic onto the unlicensed spectrum, which relieves congestion on the licensed spectrum and macro-cells.

The global economic expansion and digitization trend have produced many opportunities for ethernet backhaul configuration. In addition, it is anticipated that ethernet backhaul equipment will become a widely used method for data transfer, increasing demand for this market throughout the forecast period.

North America now rules the global ethernet backhaul equipment market, and this dominance is anticipated to last during the forecast period. North America holds a sizable portion of the market and obtains about 30.4% market share. The demand for ethernet backhaul equipment is growing primarily as a result of the spread of small cells, a sharp rise in data traffic, a rising telecommunication industry, and an upsurge in the use of point-to-point microwave transmission technology.

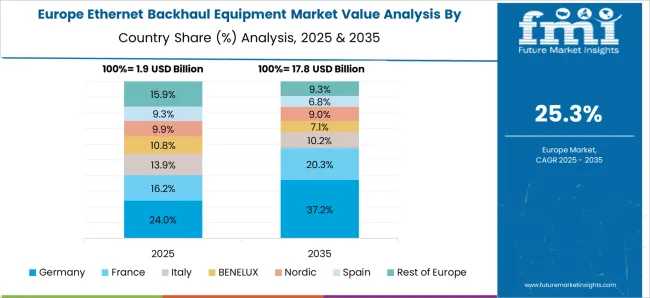

Owing to Europe’s substantial share in the global ethernet backhaul equipment market, which is close to 24.5%, it is anticipated to outpace the North American market in terms of revenue. Additionally, during the forecast period, this region is anticipated to exhibit the greatest opportunity.

Business models evolve, sometimes due to changes in the market and other times due to technological developments, giving rise to exciting new trends. These market trends for ethernet backhaul equipment are the consequence of several new start-ups that have just entered the industry. Several big corporations also aid start-ups with new developments.

For instance, a US-based start-up called Altran that sells ethernet backhaul equipment is supported by Capgemini. It offers fiber optic transmission systems, microwave and millimeter wave radio systems, and wireless backhaul solutions. With new and market-disruptive complete ODU and high capacity IDU microwave backhaul technology enabling Carrier Ethernet MEF2.0 Services, the start-up hoped to gain a sizable market share quickly.

Players involved in the ethernet backhaul equipment market sector are increasingly engaged with strategies like targeted marketing, CSR initiatives, etc., to increase global prominence. The fact that these businesses are now aiming to handle a specific business-related activity in a country that offers advantageous legislation is a clearly discernible trend that is being noted across the board. By doing this, it enables the aforementioned enterprises to save expenses while retaining industry experts for each crucial stage of their respective organizations. Several organizations are putting their best effort into developing and improving ethernet backhaul equipment configuration.

Example:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 26.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Technology, Product Type, Size of Enterprise, Application, Region |

| Regions Covered | North America; Latin America; The Asia Pacific; Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | NEC Corporation; Ericsson; Huawei Technologies; Alcatel-Lucent; Ceragon Networks; Cisco Systems Inc.; Actelis Networks; Adtran Adva Optical Networking; Alvarion; Aviat Networks; BridgeWave Communications; Cambridge Broadband Networks; Canoga Perkins; DRS Technologies; General dynamics; L-3 communications; MicroStrategy Nippon Avionics; OMRON; Raytheon company; Sofradir; TestoAG; Texas Instrument; Vigo systems; Celtro |

| Customization | Available Upon Request |

The global ethernet backhaul equipment market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the ethernet backhaul equipment market is projected to reach USD 99.1 billion by 2035.

The ethernet backhaul equipment market is expected to grow at a 26.9% CAGR between 2025 and 2035.

The key product types in ethernet backhaul equipment market are microwave, fibre, copper and others.

In terms of product type, wired segment to command 56.7% share in the ethernet backhaul equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Access Device Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Switch Market

TSN Ethernet Chips Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Ethernet Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

PoE Solutions Market - Growth, Demand & Forecast 2025 to 2035

In-Vehicle Ethernet System Market Growth – Trends & Forecast 2025 to 2035

SP Routing And Ethernet Switching Market Size and Share Forecast Outlook 2025 to 2035

Microwave Backhaul System Market Size and Share Forecast Outlook 2025 to 2035

Wireless and Mobile Backhaul Equipment Market Analysis by Equipment, Service, and Region Through 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA