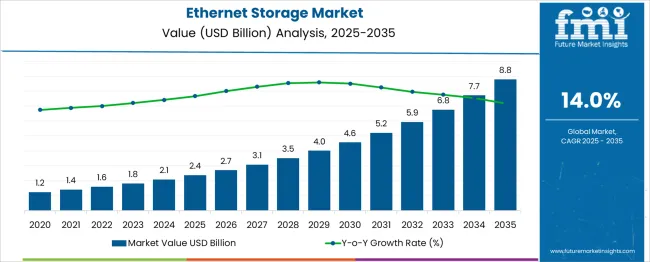

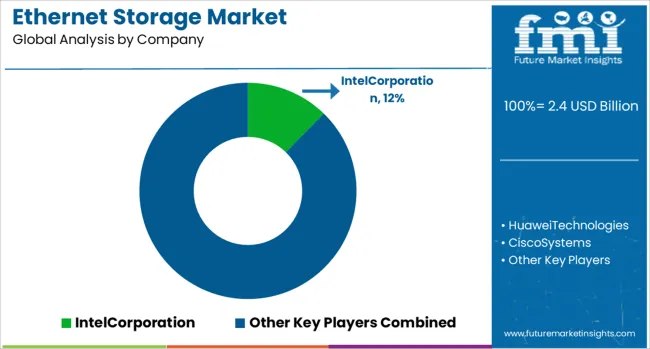

The Ethernet Storage Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period. A Rolling CAGR Analysis examines shorter multi-year intervals to detect shifts in growth intensity over the forecast period. From 2025 to 2028, the market grows from USD 2.4 billion to USD 3.5 billion, delivering a three-year rolling CAGR of approximately 13.4%. This early stage reflects healthy but not yet peak acceleration, likely tied to initial adoption in high-performance computing and enterprise data centers. Between 2028 and 2031, growth strengthens with values rising from USD 3.5 billion to USD 5.2 billion, translating to a rolling CAGR of about 13.9%. This period shows stability in the expansion rate, underpinned by broader integration in cloud storage infrastructure and increasing bandwidth requirements.

From 2031 to 2034, the market advances from USD 5.2 billion to USD 7.7 billion, marking a rolling CAGR of 14.4%, the highest in the dataset. This surge may stem from advancements in Ethernet speeds, cost reductions, and the scalability advantage over legacy storage solutions. The consistent yet slightly rising rolling CAGR indicates a robust and sustainable growth trajectory, with acceleration in later years reflecting technological maturation and deeper market penetration.

| Metric | Value |

|---|---|

| Ethernet Storage Market Estimated Value in (2025 E) | USD 2.4 billion |

| Ethernet Storage Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The Ethernet storage market is experiencing a steady rise in demand, primarily driven by the expanding data volumes generated from cloud workloads, AI training models, and real-time analytics. Enterprises are increasingly transitioning from legacy storage solutions to Ethernet-based architectures due to their scalability, reduced cabling complexity, and compatibility with modern data center environments.

The widespread adoption of virtualization and software-defined infrastructures has enhanced the appeal of Ethernet storage, which supports high-throughput access and centralized storage management. The growing preference for NVMe over Fabrics (NVMe-oF) and RDMA-enabled Ethernet technologies is significantly reducing latency and boosting data transfer rates.

Additionally, increased investments in 5G, edge computing, and digital transformation across industries are fostering a higher dependency on Ethernet-based storage systems. The market outlook remains positive, with continual enhancements in protocol standards, integration of AI-based monitoring tools, and the rising need for secure and cost-efficient storage frameworks contributing to the future growth trajectory.

The Ethernet storage market is segmented by component, storage architecture, storage medium, protocol, enterprise size, end-use industry, and geographic regions. The Ethernet storage market is divided into Hardware, Software, and Services. In terms of storage architecture, the Ethernet storage market is classified into File Storage, Object Storage, and Block Storage. Based on the storage medium, the Ethernet storage market is segmented into Solid-State Drive (SSD) and Hard Disk Drive (HDD). The Ethernet storage market is segmented into iSCSI, Fibre Channel over Ethernet (FCoE), NFS (Network File System), and CIFS/SMB (Common Internet File System / Server Message Block). The enterprise size of the Ethernet storage market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The end-use industry of the Ethernet storage market is segmented into IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Government, Media & Entertainment, Education, Manufacturing, and others. Regionally, the Ethernet storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

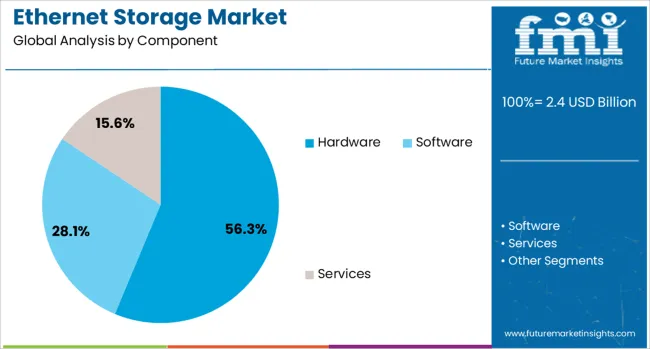

The hardware segment is projected to account for 56.3% of the Ethernet storage market revenue in 2025, establishing itself as the dominant component. This growth is attributed to the rising deployment of high-capacity storage arrays, switches, network interface cards, and other physical infrastructure that enable high-performance connectivity across enterprise networks. Hardware advancements have played a critical role in reducing latency and increasing throughput, especially in environments utilizing NVMe-oF and 25G or higher Ethernet backbones.

Storage appliances integrated with advanced cooling systems and redundant failover mechanisms are being adopted widely in hyperscale data centers and disaster recovery environments. The segment has also benefited from demand for compact, rack-optimized units that offer modular expansion and dense compute integration.

Continued innovations in chipsets, controller architecture, and port scalability have strengthened the long-term reliability of hardware systems. As the demand for secure, efficient, and low-maintenance storage solutions rises, hardware infrastructure is expected to remain the backbone of Ethernet storage deployments across both private and public sector workloads.

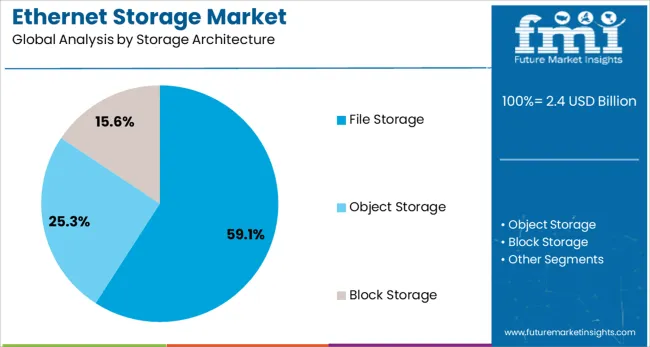

The file storage segment is anticipated to hold 59.1% of the revenue share in the Ethernet storage market in 2025, making it the leading architecture type. Its dominance is being supported by the growing need for scalable, shared access storage in content-heavy applications such as media processing, software development, and enterprise collaboration platforms. File storage systems are increasingly being optimized for Ethernet environments due to their ability to support multi-user access with consistency and data integrity.

Protocols such as NFS and SMB have undergone enhancements to improve performance over Ethernet fabrics, facilitating adoption in both on-premise and hybrid cloud architectures. The ease of management, familiarity among IT teams, and cost-effective scalability have further propelled the use of file-based storage systems in business-critical applications.

Additionally, file storage offers streamlined integration with containerized workloads and AI-driven pipelines, which require fast, shared access to unstructured data. As enterprises prioritize flexible and high-availability storage frameworks, file storage continues to emerge as the preferred choice in Ethernet-connected ecosystems.

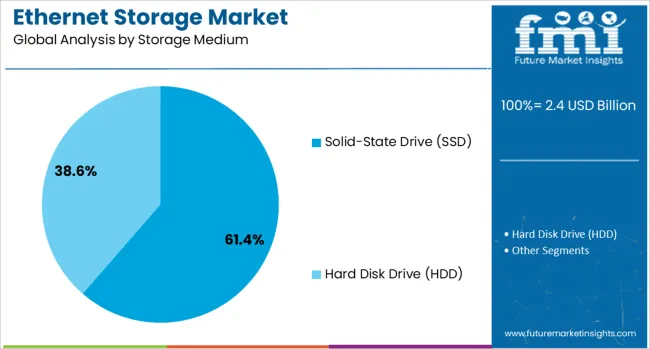

The solid-state drive (SSD) segment is forecast to capture 61.4% of the Ethernet storage market revenue in 2025, highlighting its significant lead in storage medium preference. This growth has been driven by the increasing demand for high-speed data retrieval, minimal latency, and superior endurance in performance-sensitive environments. SSDs are widely adopted in enterprise and hyperscale data centers that require fast input/output operations for virtualization, databases, and machine learning applications.

The evolution of NVMe interfaces and support for end-to-end flash architectures over Ethernet networks has made SSDs essential for meeting the growing bandwidth and responsiveness demands of modern workloads. Compared to traditional HDDs, SSDs offer enhanced reliability, energy efficiency, and space optimization, which are critical in dense storage environments.

Furthermore, the falling cost per gigabyte and extended lifespan of enterprise-grade SSDs have expanded their deployment across small and large-scale Ethernet storage infrastructures. As workloads become increasingly data-intensive and real-time processing becomes critical, SSDs are positioned to maintain their dominant role in the market.

The market has been experiencing consistent expansion, supported by the increasing need for high-speed data transfer, scalability, and flexible storage infrastructure in enterprise and cloud computing environments. Ethernet-based storage solutions have been widely adopted for their ability to integrate seamlessly with existing network infrastructures while providing low latency and high bandwidth performance. The growing volume of unstructured data from IoT devices, streaming services, and enterprise applications has been driving demand for efficient storage networking systems. Organizations have been seeking Ethernet storage to optimize data center efficiency, facilitate virtualization, and support disaster recovery solutions.

Exponential growth in data generation from AI-driven analytics, video surveillance, industrial automation, and cloud-based services has been a significant driver for the Ethernet storage market. Enterprises have been under pressure to deploy scalable and cost-effective storage architectures capable of managing petabyte-scale workloads without compromising on speed or reliability. Ethernet-based storage networks have been offering a flexible solution that supports both block and file-level data transfer, enabling compatibility with various application environments. The ability to scale horizontally with minimal downtime has been a key advantage in meeting fluctuating storage demands. Service providers have also been leveraging Ethernet storage to improve data replication, backup, and business continuity processes. This adaptability has positioned Ethernet storage as a core infrastructure component for organizations seeking to future-proof their storage strategies amid rapidly changing data requirements.

Technological developments in Ethernet protocols have been instrumental in boosting the efficiency and reliability of storage networking solutions. The transition from 10GbE to 25GbE, 40GbE, and even 100GbE connections has been significantly improving throughput and reducing latency in high-demand environments such as cloud data centers, financial trading systems, and scientific research institutions. Enhanced congestion management, low-overhead packet processing, and improved error correction have been incorporated to ensure consistent performance under heavy workloads. Storage protocols such as iSCSI and NVMe over Fabrics have been optimized for Ethernet, enabling faster access to data stored in both on-premises and cloud-based environments. Vendors have been integrating Ethernet storage capabilities with intelligent network management tools to ensure optimal bandwidth allocation and system resilience. These advancements are reinforcing Ethernet storage’s position as a performance-focused solution for mission-critical applications.

The increasing complexity of IT infrastructure has been encouraging the deployment of Ethernet storage solutions across cloud, edge, and hybrid environments. Cloud service providers have been adopting Ethernet-based storage to support multi-tenant architectures and ensure high-speed connectivity between compute and storage nodes. At the edge, Ethernet storage has been enabling faster data processing for latency-sensitive applications in sectors such as telecommunications, autonomous vehicles, and smart manufacturing. Hybrid IT environments have been benefiting from Ethernet storage’s interoperability with diverse storage systems, allowing seamless data movement between private and public cloud platforms. This versatility has been particularly valuable for enterprises pursuing digital transformation initiatives, where workload mobility and real-time access to data are essential. As IT ecosystems become increasingly distributed, Ethernet storage is expected to remain a key enabler of efficient data management.

Ethernet storage has been increasingly deployed to support AI-driven computing, big data analytics, and machine learning workloads that require rapid access to large datasets. The low-latency and high-throughput capabilities of Ethernet networks have been instrumental in enabling real-time data processing and model training across distributed computing environments. In big data clusters, Ethernet storage has been allowing faster ingestion, transformation, and retrieval of structured and unstructured data. Enterprises involved in predictive analytics, genomic research, and real-time fraud detection have been utilizing Ethernet storage to meet the performance demands of complex analytical models. Integration with software-defined storage solutions has further enhanced resource utilization and storage optimization. With AI and analytics becoming integral to decision-making processes across industries, Ethernet storage is expected to remain a strategic technology for high-performance data ecosystems.

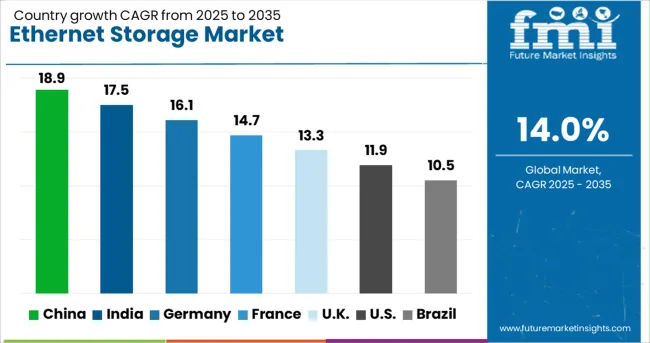

| Country | CAGR |

|---|---|

| China | 18.9% |

| India | 17.5% |

| Germany | 16.1% |

| France | 14.7% |

| UK | 13.3% |

| USA | 11.9% |

| Brazil | 10.5% |

The market is projected to grow at a CAGR of 14.0% from 2025 to 2035, fueled by the rising adoption of high-speed data networks, demand for scalable storage architectures, and expansion of enterprise data centers. China is expected to lead with an 18.9% CAGR, supported by rapid IT infrastructure growth and widespread deployment of high-capacity storage solutions. India follows at 17.5%, driven by the expansion of cloud services and digital transformation initiatives. Germany, at 16.1%, benefits from industrial automation and advanced enterprise storage requirements. The UK, with a 13.3% CAGR, sees growth from increasing investment in network modernization. The USA, at 11.9%, experiences demand from large-scale enterprises and hyperscale data center projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 18.9% from 2025 to 2035, supported by rapid adoption of high-speed networking solutions in data centers and enterprise environments. Investment in 5G infrastructure, AI-driven analytics, and edge computing is driving storage requirements that demand low latency and scalable architecture. Domestic technology providers are enhancing product lines with NVMe over Fabrics and high-capacity Ethernet switches to meet growing demand. Government-backed initiatives for cloud adoption in manufacturing, financial services, and education sectors are further strengthening industry growth.

India is forecast to grow at a CAGR of 17.5%, driven by rapid digitalization across BFSI, healthcare, and retail industries. Increasing adoption of virtualization and containerized workloads is generating demand for scalable, cost-efficient storage networks. Local and global vendors are establishing partnerships to deploy advanced Ethernet solutions, including high-bandwidth switches and storage arrays. Government programs encouraging cloud migration for public institutions and smart city projects are also fueling market expansion.

Germany’s market is expected to register a CAGR of 16.1%, supported by strong adoption in automotive design, industrial automation, and research institutions. The need for high-throughput, low-latency storage networking is pushing investment in advanced Ethernet technologies. Vendors are focusing on integrating automation and AI-based traffic management to optimize storage performance. Compliance with stringent data protection regulations is also influencing network architecture choices, particularly for critical data applications.

The United Kingdom is forecast to see a CAGR of 13.3% in the Ethernet Storage market, driven by modernization of IT infrastructure across public and private sectors. Cloud-first strategies, adoption of hybrid cloud models, and increasing AI workload processing are key factors elevating demand. Vendors are targeting sectors such as financial services and media production that require high bandwidth and secure storage connectivity. Regulatory compliance with data handling laws is further encouraging investment in reliable Ethernet-based solutions.

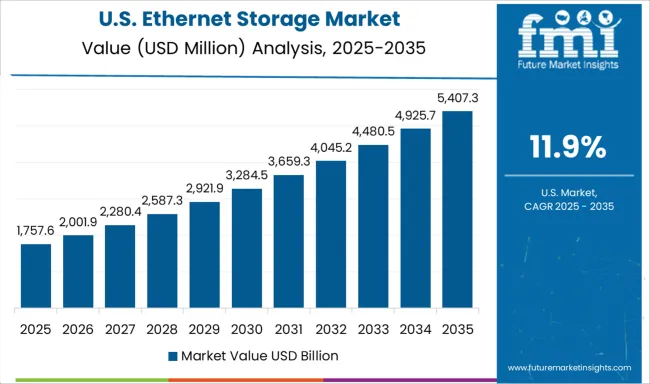

The United States market is projected to grow at a CAGR of 11.9%, propelled by the increasing need to manage massive datasets for AI, ML, and analytics workloads. Major cloud service providers and hyperscale data centers are upgrading to Ethernet-based storage for better scalability and efficiency. The focus is on low-latency data transfer, improved energy efficiency, and seamless integration with multi-cloud environments. Strategic investments in edge computing are also expanding Ethernet storage deployment in remote locations.

The Ethernet Storage Market is shaped by a diverse mix of global technology giants and specialist vendors, each pursuing unique strategies to capture growing demand from enterprises, hyperscale data centers, and cloud providers. Cisco Systems, Huawei Technologies, Arista Networks, Juniper Networks, Hewlett Packard Enterprise, Dell Technologies, Intel, and Lenovo dominate the competitive field by leveraging broad portfolios of networking hardware, including high-speed Ethernet switches, controllers, and adapters, while investing heavily in 100 GbE and beyond to serve bandwidth-intensive and latency-sensitive workloads. These companies strengthen their position through alliances, large-scale deployments, and integrated software-driven services that generate recurring revenue streams while ensuring seamless scalability for customers. Nvidia, through Mellanox, and Arista have taken a performance-centric approach, tailoring their solutions for AI-driven workloads and high-performance computing environments by optimizing Ethernet fabrics as viable alternatives to InfiniBand.

Enterprise-focused providers such as Fujitsu, Fortinet, and Allied Telesis differentiate through security and reliability features, catering to telecom operators and mid-tier enterprises requiring robust and cost-effective Ethernet storage frameworks. On the storage vendor side, NetApp has advanced NVMe-over-Ethernet solutions, enhancing ultra-fast data transfer while delivering agile infrastructure for cloud and hybrid IT ecosystems. Smaller innovators like Coraid, with their AoE (ATA over Ethernet) technology, remain relevant in specialized SAN applications, demonstrating that niche approaches still hold importance in this evolving market. Strategically, large integrators rely on platform consistency, unified infrastructure, and global reach to dominate, while AI-centric firms emphasize low-latency performance to win workloads tied to emerging technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Component | Hardware, Software, and Services |

| Storage Architecture | File Storage, Object Storage, and Block Storage |

| Storage Medium | Solid-State Drive (SSD) and Hard Disk Drive (HDD) |

| Protocol | iSCSI, Fibre Channel over Ethernet (FCoE), NFS (Network File System), and CIFS/SMB (Common Internet File System / Server Message Block) |

| Enterprise Size | Large Enterprises and Small & Medium Enterprises (SMEs) |

| End-Use Industry | IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Government, Media & Entertainment, Education, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IntelCorporation, HuaweiTechnologies, CiscoSystems, DellTechnologies, HewlettPackardEnterprise, JuniperNetworks, AristaNetworks, MellanoxTechnologies, LenovoGroup, Fortinet, Fujitsu, D-Link,Vicinity, and MicrosemiCorporation |

| Additional Attributes | Dollar sales by storage protocol and deployment model, demand dynamics across enterprise data centers, cloud storage, and industrial automation, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in high-speed Ethernet standards and low-latency storage solutions, environmental impact of large-scale storage infrastructure and energy consumption, and emerging use cases in AI-driven analytics, IoT device data management, and 5G-enabled edge computing environments. |

The global ethernet storage market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the ethernet storage market is projected to reach USD 8.8 billion by 2035.

The ethernet storage market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in ethernet storage market are hardware, software and services.

In terms of storage architecture, file storage segment to command 59.1% share in the ethernet storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Backhaul Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Access Device Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Ethernet Switch Market

TSN Ethernet Chips Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Storage Container Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA