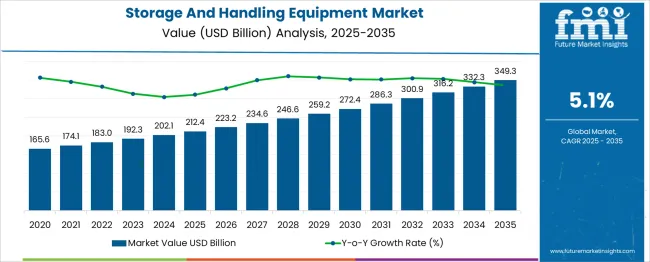

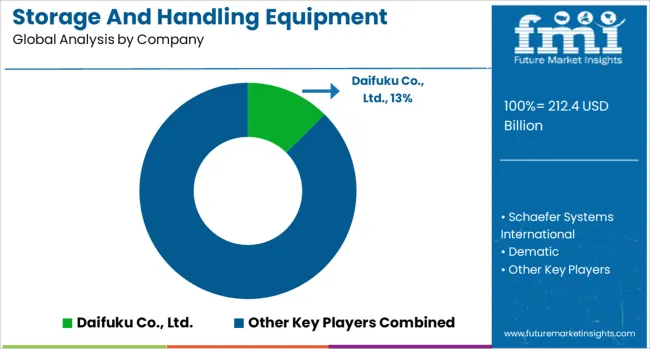

The Storage And Handling Equipment Market is estimated to be valued at USD 212.4 billion in 2025 and is projected to reach USD 349.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. Analysis of rolling CAGR over shorter intervals reveals steady growth throughout the decade. Between 2025 and 2030, the market expands from USD 212.4 billion to approximately USD 259.2 billion, reflecting a CAGR of 4.2%.

This period is driven by consistent demand across industries such as warehousing, manufacturing, and logistics, where efficient storage solutions and handling equipment are essential to maintaining operational flow. Upgrading existing equipment and expanding facilities contribute to the steady increase in market value. From 2030 to 2035, growth accelerates slightly as the market climbs from USD 259.2 billion to USD 349.3 billion, with a CAGR of about 6.0%.

This uptick is supported by broader adoption of enhanced storage and handling solutions to accommodate rising inventory volumes and improve supply chain efficiency. Replacement cycles for equipment purchased in the earlier part of the decade also add to the growth momentum. Overall, the rolling CAGR analysis highlights a consistent upward trend, with the latter half of the decade showing a stronger pace, reflecting ongoing investments and expanding operational needs across multiple sectors.

| Metric | Value |

|---|---|

| Storage And Handling Equipment Market Estimated Value in (2025 E) | USD 212.4 billion |

| Storage And Handling Equipment Market Forecast Value in (2035 F) | USD 349.3 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The Storage and Handling Equipment market is experiencing sustained growth, primarily driven by the increasing need for organized warehousing, material flow efficiency, and inventory optimization across industries. Rising global trade volumes, e-commerce expansion, and the emphasis on lean manufacturing practices are shaping the market. Organizations are investing in scalable storage systems to accommodate growing product diversity and fluctuating demand, particularly in logistics and manufacturing sectors.

Push for workplace safety and space optimization is encouraging the adoption of modern equipment that ensures efficient material handling while reducing manual effort. Technological integration and modular equipment designs are also contributing to flexibility and lifecycle cost reductions.

As global supply chains become increasingly complex, investments in advanced storage and handling solutions are expected to intensify, positioning the market for continued expansion. Future growth will be underpinned by industrial automation trends and smart warehouse infrastructure development across both developed and emerging economies..

The storage and handling equipment market is segmented by equipment type, automation, application, distribution channel, and geographic regions. By equipment type, the storage and handling equipment market is divided into Storage equipment and handling equipment. In terms of automation, the storage and handling equipment market is classified into Manual, semi-automated, and fully automated.

Based on the application, the storage and handling equipment market is segmented into Manufacturing, Automotive, Electronics, Food and beverage, Pharmaceuticals, Chemicals, Textiles, Distribution and logistics, Retail, E-commerce, and others.

The distribution channel of the storage and handling equipment market is segmented into direct and indirect. Regionally, the storage and handling equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

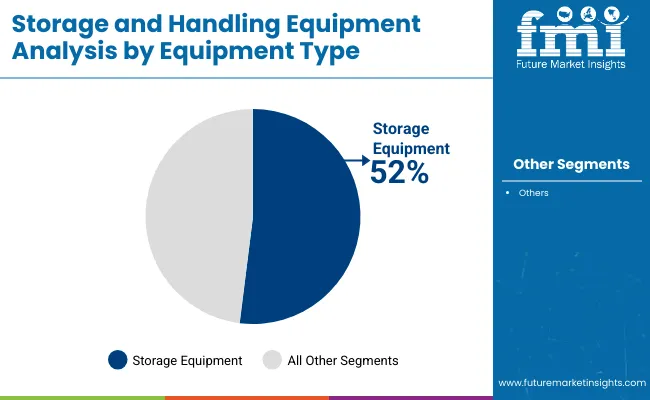

The storage equipment segment is projected to hold 52% of the Storage and Handling Equipment market revenue share in 2025, positioning it as the leading equipment type. This dominance has been driven by the need for efficient inventory management and the growing volume of goods processed across warehousing, logistics, and manufacturing facilities.

Storage systems such as shelving units, racking structures, and vertical lift modules have been adopted for their ability to improve space utilization and facilitate quick access to stored materials. The increasing demand for organized storage solutions in high-density environments has further contributed to the segment’s growth.

In addition, the modularity and scalability of storage equipment allow businesses to adapt systems to evolving operational needs without significant capital reinvestment. As supply chains evolve and just-in-time inventory models become more prevalent, investments in reliable and durable storage infrastructure are expected to remain a key priority, ensuring this segment’s continued leadership in the overall market.

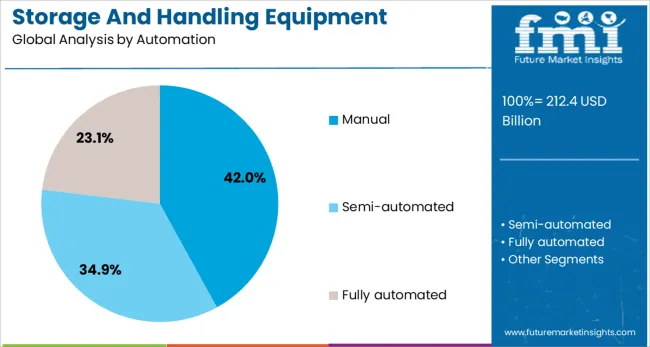

The manual segment is expected to account for 42% of the Storage and Handling Equipment market revenue share in 2025, emerging as a leading automation type. This growth has been attributed to the lower initial capital investment and flexibility associated with manually operated equipment. Small and medium enterprises, in particular, have continued to prefer manual systems due to their ease of deployment, minimal maintenance, and adaptability across varying operational settings.

Additionally, the lack of complex software and control systems has made manual solutions more accessible in regions with limited technical infrastructure. While automation is advancing across industries, manual equipment remains relevant where human intervention is still required for precision, safety checks, or customization of handling operations.

The ability to combine manual processes with semi-automated tools has further strengthened the appeal of this segment. Continued demand in industries prioritizing workforce adaptability and budget-conscious operations is expected to support the growth of manual systems in the market landscape..

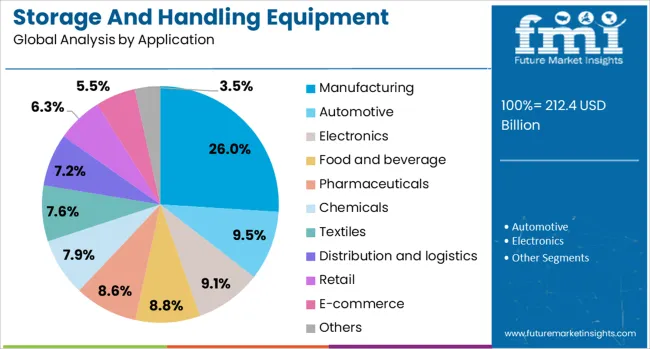

The manufacturing segment is projected to hold 26% of the Storage and Handling Equipment market revenue share in 2025, making it the leading application area. This leadership position has been supported by the increasing focus on operational efficiency, safety, and material flow optimization within production environments. Manufacturers across automotive, electronics, and heavy industries have been investing in storage and handling systems that support lean manufacturing, reduce downtime, and improve productivity.

Equipment tailored for manufacturing use cases often integrates with production lines, facilitating seamless material staging and retrieval, which reduces bottlenecks and enhances throughput. The rising need for safe handling of components, work-in-progress materials, and finished goods has further increased adoption in this segment.

Moreover, the push for automation and data-driven operations in factories has resulted in growing interest in smart storage solutions that can be scaled or reconfigured with minimal disruption. These factors collectively are reinforcing the dominance of manufacturing as the primary application area in the market..

The storage and handling equipment market is growing steadily, driven by expanding warehousing, manufacturing, and logistics activities worldwide. Equipment such as forklifts, conveyors, pallets, and automated storage systems improve operational efficiency and space utilization. Rising e-commerce and supply chain complexities increase demand for flexible and scalable solutions. Challenges include high maintenance costs and safety concerns. Technological advancements like automation and robotics, coupled with the need for optimized inventory management, offer significant growth opportunities. Regional infrastructure development and modernization initiatives further fuel market expansion.

Rapid growth in warehousing and logistics sectors is a primary driver for storage and handling equipment. The surge in e-commerce and omnichannel retail has intensified the need for efficient material movement and storage solutions. Businesses are investing in modern equipment to enhance throughput, reduce manual labor, and optimize space utilization. Manufacturing industries also require robust handling systems for raw materials and finished goods management. The rise of just-in-time inventory practices and cold chain logistics further support demand. As supply chains become more complex and customer expectations grow, storage and handling equipment is vital to ensure smooth operations and timely deliveries.

Storage and handling equipment requires regular maintenance to ensure safety and operational reliability. High maintenance costs and downtime due to repairs can disrupt warehouse workflows and increase operational expenses. Additionally, improper use of handling equipment poses safety risks to workers, resulting in workplace injuries and compliance issues. Training skilled operators is essential but often challenging, particularly in emerging markets with labor shortages. Equipment downtime and safety incidents can affect productivity and reputation. Manufacturers and warehouse operators must focus on robust safety features, preventive maintenance programs, and operator training to mitigate risks. These factors influence equipment lifecycle costs and impact buyer decisions.

The adoption of automation and smart technologies in storage and handling equipment is transforming warehouse operations. Automated guided vehicles, robotic arms, and conveyor systems improve speed and accuracy while reducing labor dependency. Integration with warehouse management systems and IoT devices enables real-time inventory tracking, predictive maintenance, and optimized workflows. These innovations support scalability and flexibility, essential for handling fluctuating order volumes in e-commerce and retail. Growing interest in sustainable operations also promotes energy-efficient equipment. Companies investing in intelligent, connected solutions can offer differentiated products and gain a competitive edge. As automation costs decline and technology matures, market adoption is expected to rise significantly.

Emerging economies in Asia Pacific, Latin America, and the Middle East are witnessing increased industrial activity and infrastructure projects, boosting demand for storage and handling equipment. Investments in logistics parks, distribution centers, and manufacturing hubs require advanced material handling systems. Developed regions focus on upgrading existing warehouses with automated and ergonomic equipment to improve efficiency. Government initiatives promoting trade facilitation, industrial growth, and smart city developments further encourage market growth. Regional supply chain improvements and expanding dealer networks enhance equipment accessibility. Manufacturers customizing products to meet regional operational conditions and regulatory requirements can capitalize on these growth opportunities.

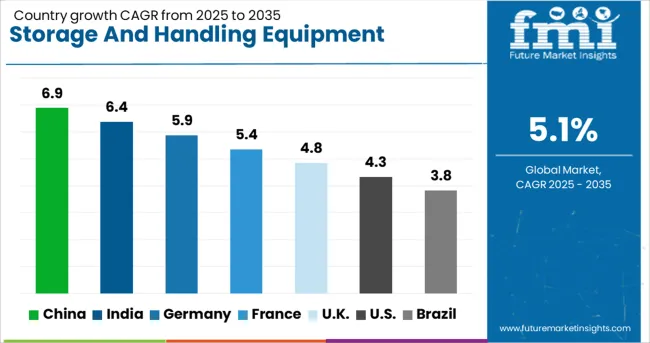

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global storage and handling equipment market is advancing at a 5.1% CAGR, propelled by growth across key regions. Among BRICS countries, China leads with 6.9% growth, driven by rapid industrialization and expanding logistics infrastructure. India follows at 6.4%, supported by increasing warehouse automation and supply chain modernization. Within the OECD group, Germany registers 5.9% growth, reflecting adoption of advanced technologies and stringent safety regulations. The United Kingdom records steady growth at 4.8%, fueled by investments in efficient material handling solutions. The United States, representing a mature market, experiences 4.3% growth, shaped by high standards for equipment reliability and smart system integration. These countries collectively influence market trends through innovations in automation, durability, and energy efficiency. This report includes insights on 40+ countries; the top countries are shown here for reference.

Storage and handling equipment market in China is growing rapidly at a 6.9% CAGR. The expansion is fueled by increasing industrialization and a boom in manufacturing and logistics sectors. Growing e-commerce and retail industries demand advanced warehouse solutions and automated handling systems to improve efficiency. Domestic manufacturers are investing in smart storage technologies, including automated guided vehicles (AGVs) and intelligent shelving systems. Government initiatives to upgrade infrastructure and promote smart logistics support market growth. Additionally, increasing demand for cold storage and specialized handling equipment is observed in the food and pharmaceutical sectors. The rise of third-party logistics providers is also boosting equipment purchases for warehousing and distribution centers.

Storage and handling equipment market in India is growing at a 6.4% CAGR, propelled by rapid growth in warehousing, retail, and manufacturing sectors. Government initiatives such as the Logistics Efficiency Enhancement Program and Make in India campaign are encouraging investments in modern storage infrastructure. The rise of e-commerce and organized retail has increased demand for advanced material handling equipment like forklifts, conveyors, and pallet racking systems. Indian manufacturers and international players are collaborating to introduce cost-effective, technology-enabled products. Cold chain logistics is a key area of focus, with increased demand for temperature-controlled storage solutions. The growth of third-party logistics and contract warehousing providers further supports market expansion.

Germany’s market for storage and handling equipment is expanding at a 5.9% CAGR, driven by industrial automation and modernization of logistics operations. The country’s strong manufacturing base requires efficient storage solutions that integrate seamlessly with automated warehouse management systems. There is high adoption of robotics, AGVs, and smart shelving to optimize space utilization and handling speed. Environmental regulations encourage energy-efficient and sustainable equipment choices. Rental and leasing models are popular among logistics companies seeking flexible capacity management. Germany’s mature market features a strong presence of both domestic manufacturers and global suppliers competing on innovation and quality. The food and automotive sectors are significant end-users of specialized storage equipment.

The United Kingdom storage and handling equipment market is growing at a 4.8% CAGR, supported by rising logistics and retail sector demands. Increased focus on e-commerce fulfillment centers and last-mile delivery infrastructure is boosting investment in material handling and storage technologies. UK companies favor modular and scalable equipment that can adapt to fluctuating storage needs. The market sees growing use of automated systems and digital warehouse management tools to improve accuracy and efficiency. Sustainability concerns drive interest in energy-efficient machinery and eco-friendly materials. Rental services remain popular for managing seasonal and peak demand in storage capacity.

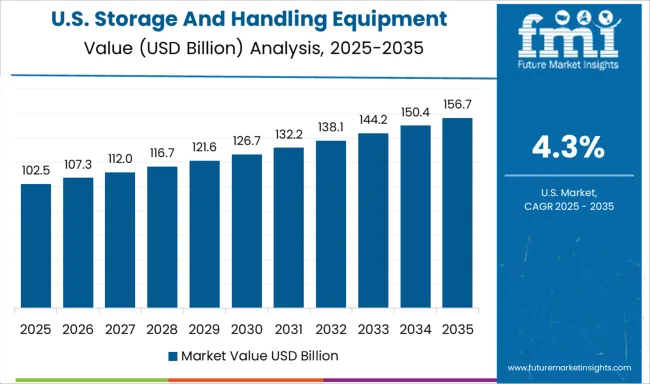

The United States storage and handling equipment market is growing at a 4.3% CAGR. Steady growth is fueled by continued expansion in retail, manufacturing, and third-party logistics sectors. Demand for automated storage and retrieval systems (ASRS), conveyor belts, and forklifts is increasing as companies strive to optimize warehouse operations. Technological advances such as IoT integration, robotics, and AI-driven inventory management are gaining traction. The market features strong competition among manufacturers offering a range of equipment from basic to highly automated solutions. Environmental regulations and a focus on sustainability influence product development. The rise of omni-channel retailing also creates demand for flexible storage and handling equipment capable of supporting complex distribution networks.

The storage and handling equipment market has traditionally been dominated by mechanical solutions provided by Tier-1 OEMs such as Daifuku Co., Ltd., Schaefer Systems International, Dematic, Honeywell Intelligrated, and Toyota Industries Corporation. Between 2020 and 2024, these established players focused heavily on robust, reliable mechanical equipment, including conveyors, automated storage and retrieval systems (AS/RS), and forklifts, which formed the backbone of warehouse and logistics operations worldwide.

Their expertise in durable hardware and extensive service networks helped them maintain a stronghold over the market, catering primarily to large-scale industrial and commercial clients. However, the market landscape is undergoing a notable shift driven by the rise of software-led disruptors and innovative startups introducing steer-by-wire and autonomous technologies.

These emerging players emphasize intelligent, software-driven solutions that enable real-time data integration, enhanced automation, and flexible system configurations. Unlike traditional mechanical dominance, the future market is increasingly shaped by digital transformation, where advanced control systems, cloud connectivity, and AI-driven analytics optimize storage efficiency and reduce operational costs. This transition challenges incumbents to rethink their product offerings, moving from purely hardware-centric solutions to integrated hardware-software ecosystems.

Companies like Honeywell Intelligrated and Dematic are investing heavily in developing smart warehouses with IoT-enabled equipment, predictive maintenance, and robotics integration to retain competitive advantage. Meanwhile, startups leveraging steer-by-wire technology provide more precise and adaptable handling equipment, appealing to markets requiring high agility and customization. The competitive dynamics of the Storage and Handling Equipment Market reveal a clear trend from mechanical dominance to software-driven innovation, where success depends on the ability to blend hardware reliability with cutting-edge digital capabilities.

As mentioned in official press releases from Crown Equipment Corporation (May 1, 2025), the company celebrated its 80th anniversary with the launch of the SP 1500 Series high-level order picker featuring a mid-platform window and fast lift speeds. Additionally, their LiDAR-based ProximityAssist System enhances operator safety by detecting obstacles and reinforcing best practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.4 Billion |

| Equipment Type | Storage equipment and Handling equipment |

| Automation | Manual, Semi-automated, and Fully automated |

| Application | Manufacturing, Automotive, Electronics, Food and beverage, Pharmaceuticals, Chemicals, Textiles, Distribution and logistics, Retail, E-commerce, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daifuku Co., Ltd., Schaefer Systems International, Dematic, Honeywell Intelligrated, and Toyota Industries Corporation |

| Additional Attributes | Dollar sales vary by equipment type, including racks, shelving, bins, and mezzanines; by automation level, from manual through semi-automated to fully automated systems; and by region, led by Asia-Pacific, North America, and Europe. Growth is driven by e-commerce expansion, warehouse densification, and smart intralogistics adoption. |

The global storage and handling equipment market is estimated to be valued at USD 212.4 billion in 2025.

The market size for the storage and handling equipment market is projected to reach USD 349.3 billion by 2035.

The storage and handling equipment market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in storage and handling equipment market are storage equipment, _pallet racking systems, __selective racking, __double deep racking, __drive-in/drive-through racking, __push back racking, __others, _shelving systems, __static shelving, __mobile shelving, __others, _specialty storage, __cantilever racks, __multi-tier racking, __mezzanine flooring, __modular storage systems, __others, handling equipment, _transport equipment, __forklifts, __pallet jacks, __hand trucks, __conveyor systems, __others, _lifting equipment, __cranes, __hoists, __lift tables, __scissor lifts, __others, _continuous handling equipment, __belt conveyors, __roller conveyors, __chain conveyors and __pneumatic systems.

In terms of automation, manual segment to command 42.0% share in the storage and handling equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Manure Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Marine Waste Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Handling Equipment Market

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Material Handling Equipment Market

Air Handling Unit Market Size and Share Forecast Outlook 2025 to 2035

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Handling Robot Market Trends & Forecast 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA