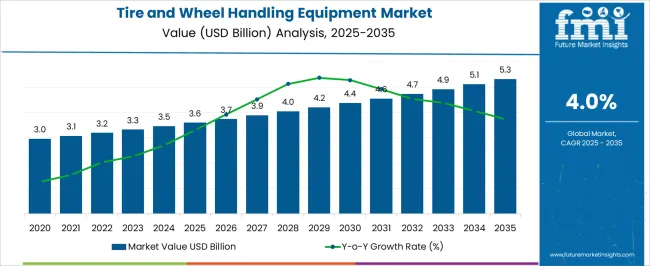

The tire and wheel handling equipment market is projected to reach 3.6 billion dollars in 2025 to USD 5.3 billion, growing at a CAGR of 4.0%. During the early adoption phase from 2020 to 2024, demand was primarily driven by automotive repair shops, tire service centers, and fleet maintenance operators testing equipment efficiency and safety features. Entering the scaling phase in 2025, adoption broadens across commercial garages, large-scale fleet operators, and tire manufacturing units.

Manufacturers increase production capacity, expand dealer networks, and provide training programs. Rising vehicle fleets and replacement cycles contribute to steady revenue growth, supporting wider market acceptance. From 2030 to 2035, the market is expected to reach 5.3 billion dollars, maintaining a CAGR of 4.0%. In the consolidation phase, leading suppliers strengthen market positions through partnerships, expanded service coverage, and bulk contracts with automotive chains. Smaller players either focus on niche applications or exit.

Adoption stabilizes as most service providers are equipped with standardized handling solutions. Companies emphasize operational efficiency, equipment reliability, and customer support. By 2035, the market exhibits mature competitive dynamics, predictable growth, and established service and quality standards, forming a stable and well-structured industry environment.

| Metric | Value |

|---|---|

| Tire and Wheel Handling Equipment Market Estimated Value in (2025 E) | USD 3.6 billion |

| Tire and Wheel Handling Equipment Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The tire and wheel handling equipment market is influenced by multiple end-use segments. Automotive Repair and Service Centers lead the demand, accounting for approximately 35% of the market, driven by the need for efficient tire replacement and wheel maintenance. Commercial Fleet Operators contribute 20%, including logistics, delivery, and transportation companies maintaining large fleets with frequent tire rotation and replacement requirements.

Tire Manufacturing Units hold around 15%, using handling equipment for assembly lines and quality checks. Automotive Dealerships represent 10%, integrating equipment for service bays and maintenance operations. Warehouse and Distribution Centers account for 7%, handling bulk tire storage and movement. Construction and Off-Highway Vehicle Operators contribute 5%, where specialized equipment supports heavy-duty tire handling. Public Transport Operators, like buses and rail maintenance depots, make up 4%, requiring reliable handling solutions for large wheels. Smaller segments, including Motorsports and Specialty Garages, represent 4%, focusing on performance and precision equipment.

Market revenue distribution reflects these segments, growing from 3.0 billion dollars in 2020 to 3.6 billion in 2025, and projected to reach 5.3 billion by 2035, at a CAGR of 4.0%. Automotive repair centers and commercial fleets remain primary drivers, while manufacturing units and dealerships steadily increase their share as tire volumes and vehicle fleets expand globally.

The tire and wheel handling equipment market is experiencing steady growth driven by the rising volume of automotive maintenance activities, increased vehicle ownership, and the demand for precision in tire servicing. Advancements in wheel balancing, alignment, and handling technologies are enabling improved safety, ride quality, and operational efficiency.

The shift toward automated and semi-automated equipment in workshops is further enhancing productivity while reducing human error. Additionally, the expansion of electric and premium vehicle segments is creating new opportunities for specialized equipment that caters to advanced wheel and tire specifications.

Regulatory emphasis on vehicle safety and regular maintenance schedules is also stimulating demand across developed and emerging economies. With workshops focusing on speed, accuracy, and customer satisfaction, the adoption of advanced handling systems is set to expand in the coming years.

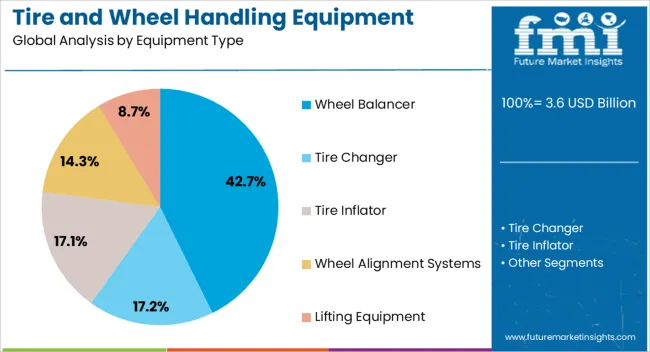

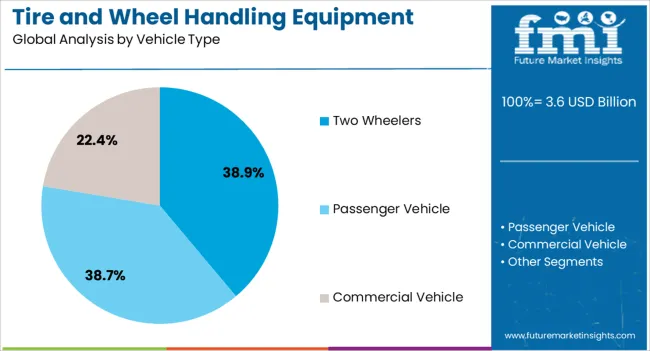

The tire and wheel handling equipment market is segmented by equipment type, vehicle type, end user, and geographic regions. By equipment type, tire and wheel handling equipment market is divided into Wheel Balancer, Tire Changer, Tire Inflator, Wheel Alignment Systems, and Lifting Equipment. In terms of vehicle type, tire and wheel handling equipment market is classified into Two Wheelers, Passenger Vehicle, and Commercial Vehicle.

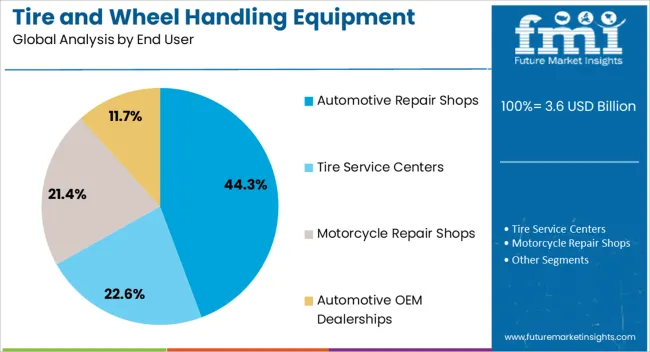

Based on end user, tire and wheel handling equipment market is segmented into Automotive Repair Shops, Tire Service Centers, Motorcycle Repair Shops, and Automotive OEM Dealerships. Regionally, the tire and wheel handling equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wheel balancer segment is projected to hold 42.70% of total market revenue by 2025, making it the leading equipment type. This dominance is supported by its critical role in ensuring vehicle stability, reducing tire wear, and improving fuel efficiency.

The rising complexity of wheel assemblies, especially in modern passenger and performance vehicles, has increased the necessity for precise balancing solutions. Technological enhancements, such as digital measurement systems and automated calibration, have improved operational accuracy, making wheel balancers indispensable in both small and large workshops.

As customer expectations for smooth driving experiences continue to grow, wheel balancers remain a vital investment for service providers.

The two wheelers segment is expected to account for 38.90% of market revenue by 2025, leading the vehicle type category. This is primarily driven by the high volume of two wheeler ownership in emerging economies and the frequent maintenance cycles required for these vehicles.

The need for efficient tire and wheel servicing in motorcycles and scooters is reinforced by rising urban mobility trends and growing recreational motorbike use. The adoption of specialized handling equipment for smaller, lighter wheels has allowed workshops to improve turnaround times and service quality.

This focus on quick, precise maintenance continues to support the leadership of the two wheelers segment.

The automotive repair shops segment is projected to capture 44.30% of market revenue by 2025, making it the most prominent end user category. This dominance is linked to the wide network of independent and franchise repair centers providing tire and wheel services to diverse vehicle owners.

Increased consumer preference for third party service centers over dealerships, due to cost-effectiveness and accessibility, has fueled demand for advanced handling equipment in this segment. Investments in modernizing facilities with high-capacity, accurate, and user-friendly machines have further enhanced service capabilities.

As competition intensifies, repair shops are increasingly prioritizing equipment that ensures efficiency, precision, and customer satisfaction, securing their leading position in the market.

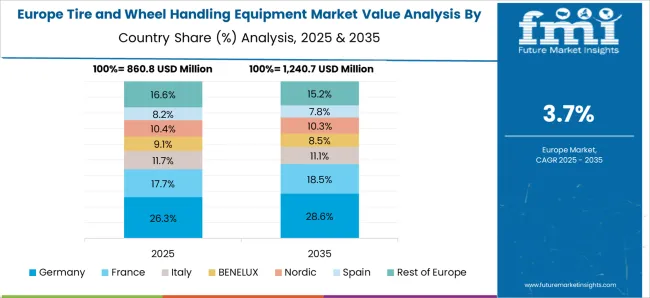

The tire and wheel handling equipment market is expanding due to increasing automotive production, commercial fleet maintenance, and demand for workshop automation. North America and Europe lead with advanced, ergonomic, and automated lifting and mounting solutions, while Asia-Pacific shows rapid growth driven by growing vehicle fleets, tire replacement services, and industrial applications. Manufacturers differentiate through safety features, load capacity, and compact designs. Regional variations in automotive infrastructure, workforce skill, and equipment standards strongly influence adoption, operational efficiency, and competitive positioning globally.

Adoption of tire and wheel handling equipment is strongly influenced by the need for efficient, safe, and automated workshop operations. North America and Europe prioritize advanced lifting systems, automated tire changers, and balancing machines to enhance technician productivity and reduce workplace injuries. Asia-Pacific markets focus on affordable, semi-automated equipment to manage increasing vehicle service volumes and fleet maintenance requirements. Differences in automation adoption, workforce skill, and operational scale affect equipment selection, throughput, and service quality. Leading suppliers offer integrated systems with ergonomic design and high throughput, while regional manufacturers provide reliable, cost-effective alternatives. Automation and productivity contrasts shape adoption, operational efficiency, and competitiveness in the global tire and wheel handling equipment market.

Safety and ergonomic design are critical drivers in the tire and wheel handling equipment market. North America and Europe emphasize equipment with anti-slip features, load limiters, and operator-friendly interfaces to minimize accidents and fatigue. Asia-Pacific markets adopt robust, functional designs suitable for high-volume workshops where operator safety is important but cost is also a key factor. Differences in safety standards, ergonomic requirements, and user training influence purchase decisions, productivity, and adoption rates. Leading suppliers provide certified, safety-focused equipment with ergonomic enhancements, while regional players focus on practical, durable, and cost-effective designs. Safety and ergonomics contrasts shape adoption, workplace efficiency, and market competitiveness globally.

Maintenance, reliability, and durability of tire and wheel handling equipment significantly influence adoption. North America and Europe prioritize systems with long service intervals, low wear components, and easy maintenance features to reduce downtime and operational costs. Asia-Pacific markets focus on affordable, robust equipment capable of handling high usage cycles in workshops and industrial fleets. Differences in equipment durability, maintenance complexity, and service support affect operational continuity, cost efficiency, and user satisfaction. Leading suppliers invest in high-quality materials, modular components, and preventive maintenance solutions, while regional manufacturers emphasize practical, low-maintenance designs. Maintenance and durability contrasts shape adoption, operational reliability, and competitive positioning globally.

Compliance with industrial safety standards, equipment certification, and operational regulations impacts market adoption. North America and Europe enforce OSHA, CE, and ISO standards for tire handling equipment to ensure safe operations in workshops and industrial facilities. Asia-Pacific regulations vary; advanced economies adhere to international norms, while emerging markets implement locally recognized standards balancing safety and affordability. Differences in regulatory requirements, certification processes, and enforcement affect procurement, deployment timelines, and end-user confidence. Suppliers offering certified, standard-compliant solutions gain premium adoption, while regional manufacturers provide practical, regulation-aligned, and cost-efficient alternatives. Regulatory and standard contrasts shape adoption, market credibility, and competitiveness globally.

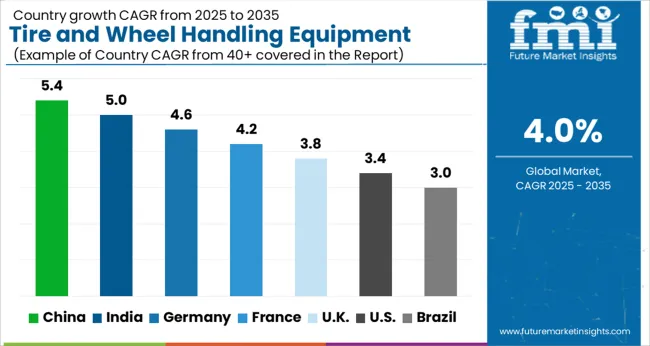

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global tire and wheel handling equipment market is projected to grow at a 4.0% CAGR through 2035, driven by demand in automotive manufacturing, maintenance, and logistics operations. Among BRICS nations, China led with 5.4% growth as production and deployment facilities were established and compliance with industrial standards was ensured, while India at 5.0% growth expanded manufacturing and service capacity to support growing automotive and commercial operations. In the OECD region, Germany at 4.6% maintained steady output under stringent regulatory frameworks, while the United Kingdom at 3.8% operated mid-scale units servicing automotive and logistics sectors. The USA, growing at 3.4%, supported consistent demand across maintenance and manufacturing operations, adhering to federal and state-level safety and quality regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The tire and wheel handling equipment market in China is projected to grow at a CAGR of 5.4% due to increasing automotive production and the need for efficient maintenance operations. Adoption is being driven by equipment that improves safety, reduces labor intensity, and increases workshop productivity. Manufacturers are being encouraged to supply high quality, durable, and ergonomically designed equipment. Distribution through automotive service providers, repair shops, and industrial suppliers is being strengthened. Research into automation, load handling capacity, and efficiency improvements is being conducted. Expansion of the automotive sector, growing vehicle ownership, and demand for workshop efficiency are considered key factors supporting the tire and wheel handling equipment market in China.

The tire and wheel handling equipment market in India is expected to grow at a CAGR of 5.0%, fueled by increasing automotive workshops and rising demand for vehicle maintenance solutions. Adoption is being strengthened by equipment that ensures safe lifting, accurate positioning, and faster handling of tires and wheels. Manufacturers are being encouraged to provide cost effective, high performance, and reliable equipment. Distribution through service centers, dealerships, and industrial suppliers is being expanded. Training programs and technical demonstrations are being conducted to promote proper usage and maintenance. Expansion of vehicle servicing centers, rising vehicle ownership, and modernization of workshops are recognized as primary drivers of the tire and wheel handling equipment market in India.

Germany is experiencing growth in the tire and wheel handling equipment market at a CAGR of 4.6%, supported by adoption in automotive service centers and industrial vehicle maintenance facilities. Adoption is being strengthened by equipment that enhances safety, improves workflow, and reduces manual effort. Manufacturers are being encouraged to supply technologically advanced, durable, and efficient equipment. Distribution through automotive workshops, service providers, and industrial suppliers is being maintained. Research in automation, ergonomic design, and load handling capacity is being conducted. Expansion of automotive maintenance services, emphasis on worker safety, and increased demand for efficiency are considered key growth drivers for the tire and wheel handling equipment market in Germany.

The tire and wheel handling equipment market in the United Kingdom is expected to grow at a CAGR of 3.8% due to rising automotive servicing activities and workshop modernization. Adoption is being emphasized for equipment that ensures safe handling, improves operational efficiency, and reduces manual labor. Manufacturers are being encouraged to provide reliable, high quality, and cost effective solutions. Distribution through service centers, automotive workshops, and authorized dealers is being strengthened. Awareness campaigns and demonstrations are being conducted to educate operators on safe and proper usage. Growth in vehicle ownership, expansion of service centers, and increasing workshop efficiency are recognized as key contributors to the tire and wheel handling equipment market in the United Kingdom.

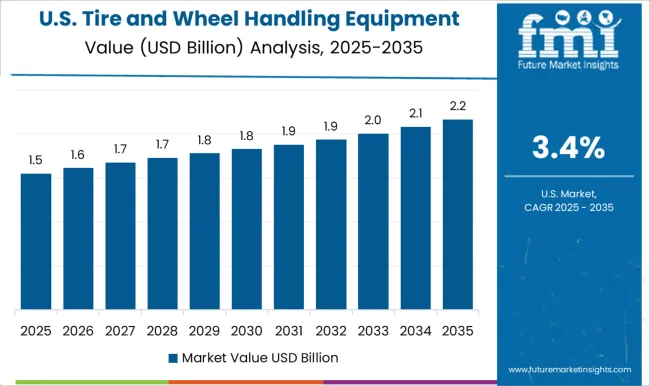

The tire and wheel handling equipment market in the United States is projected to grow at a CAGR of 3.4%, driven by rising vehicle maintenance demand and workshop automation. Adoption is being supported by equipment that enhances safety, reduces labor requirements, and increases productivity. Manufacturers are being encouraged to provide durable, reliable, and high performance solutions. Distribution through automotive service providers, industrial suppliers, and repair workshops is being maintained. Research in automation, ergonomic design, and operational efficiency is being conducted. Expansion of vehicle maintenance networks, increased automotive service centers, and focus on efficiency are considered key factors driving growth of the tire and wheel handling equipment market in the United States.

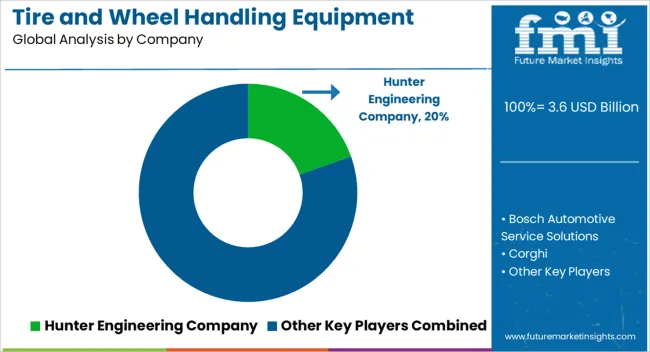

The tire and wheel handling equipment market is shaped by global equipment manufacturers, regional distributors, and specialized service solution providers catering to automotive, commercial vehicle, and industrial sectors. Leading players such as Hunter Engineering Company, Snap-on Incorporated, John Bean Technologies, and Hofmann Megaplan maintain strong positions by offering a diversified portfolio of tire changers, wheel balancers, alignment systems, and automated handling solutions. Competitive differentiation is largely driven by equipment precision, durability, automation capabilities, ergonomic design, and after-sales support. Regional manufacturers, especially in Asia-Pacific and Europe, compete by offering cost-effective solutions and tailored products for local automotive service centers and fleet operators.

Strategic collaborations with OEMs, automotive service chains, and logistics providers enhance market reach and customer engagement. Innovation in robotic-assisted handling systems, digital monitoring, and IoT-enabled diagnostic tools strengthens competitive positioning. Companies prioritizing technological advancement, compliance with safety standards, and efficient supply chains are well-positioned to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Equipment Type | Wheel Balancer, Tire Changer, Tire Inflator, Wheel Alignment Systems, and Lifting Equipment |

| Vehicle Type | Two Wheelers, Passenger Vehicle, and Commercial Vehicle |

| End User | Automotive Repair Shops, Tire Service Centers, Motorcycle Repair Shops, and Automotive OEM Dealerships |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hunter Engineering Company, Bosch Automotive Service Solutions, Corghi, Ravaglioli, Rotary Lift, Hofmann, Coats (a Fortive Corporation Brand), and Mahle Service Solutions |

| Additional Attributes | Dollar sales vary by equipment type, including tire changers, wheel balancers, lifts, and alignment systems; by application, such as automotive service centers, commercial fleets, and tire manufacturing units; by end-use, spanning repair shops, OEMs, and logistics operators; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising vehicle production, fleet maintenance demand, and automation in tire service operations. |

The global tire and wheel handling equipment market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the tire and wheel handling equipment market is projected to reach USD 5.3 billion by 2035.

The tire and wheel handling equipment market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in tire and wheel handling equipment market are wheel balancer, tire changer, tire inflator, wheel alignment systems and lifting equipment.

In terms of vehicle type, two wheelers segment to command 38.9% share in the tire and wheel handling equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Cord Market

Tire Carousel Market

Tire Inflating Machine Market

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA