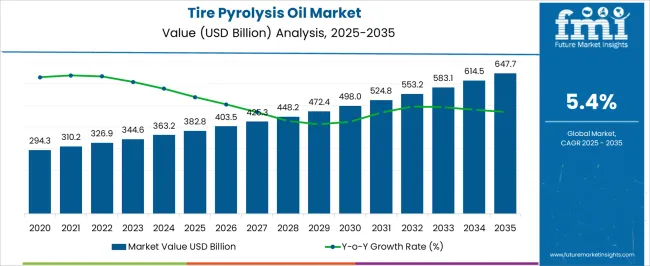

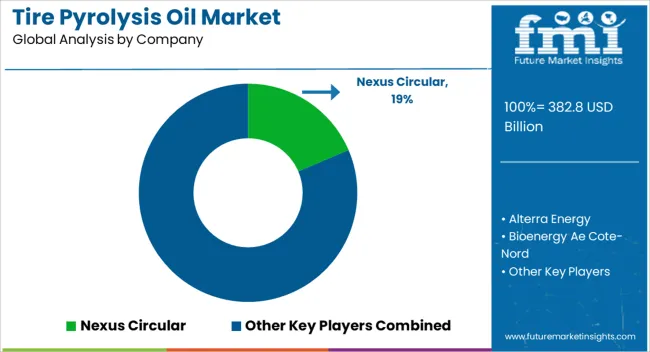

The tire pyrolysis oil market is projected to reach 382.8 USD billion in 2025 and is anticipated to expand to 647.7 USD billion by 2035, representing a CAGR of 5.4%. Market share dynamics are influenced by evolving feedstock availability, regulatory frameworks, and shifting end-use preferences across energy and chemical sectors.

Established pyrolysis oil producers are expected to maintain dominance through large-scale, integrated production facilities and strategic partnerships with tire recycling companies, while smaller regional operators may experience gradual share erosion due to capacity constraints and limited access to advanced processing technologies. Adoption of high-efficiency pyrolysis reactors and enhanced oil recovery techniques is anticipated to provide competitive advantages for leading manufacturers. Over the forecast period, the chemical, fuel, and energy sectors are projected to drive incremental demand, resulting in market share gains for companies with diversified portfolios and global distribution networks. Emerging regions with growing tire waste volumes may witness rapid uptake of pyrolysis solutions, leading to a redistribution of market shares across geographic segments. Technological improvements, policy incentives for waste-to-energy conversion, and increasing focus on circular economy practices are expected to further shape market competitiveness.

The market is forecasted to evolve through a combination of consolidation, expansion of production capacity, and regional diversification, highlighting both opportunities for growth and the potential for share shifts among key players in the tire pyrolysis oil industry.

| Metric | Value |

|---|---|

| Tire Pyrolysis Oil Market Estimated Value in (2025 E) | USD 382.8 billion |

| Tire Pyrolysis Oil Market Forecast Value in (2035 F) | USD 647.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The tire pyrolysis oil market is influenced by five interconnected parent markets, each contributing differently to overall demand and growth. The energy and fuel market holds the largest share at 40%, driven by the use of pyrolysis oil as an alternative fuel in power generation, industrial boilers, and transportation applications. The chemicals and petrochemicals sector contributes 25%, with pyrolysis oil being used as a feedstock for the production of synthetic chemicals, carbon black, and lubricants.

The industrial manufacturing market accounts for 15%, where pyrolysis oil is utilized in process heating, steam generation, and as a substitute for conventional fossil fuels in energy-intensive operations. The waste management and recycling services market holds a 12% share, driven by tire recycling initiatives and the conversion of end-of-life tires into valuable pyrolysis products. The research and pilot project segment represents 8%, supporting technology development, process optimization, and small-scale adoption across emerging regions.

The tire pyrolysis oil market is gaining momentum as industries seek sustainable and economically viable alternatives to conventional fossil fuels. Increasing environmental concerns over waste tire disposal, coupled with tightening emission regulations, are driving adoption across industrial and energy sectors. The market is benefiting from advancements in pyrolysis technologies that enhance yield, improve product purity, and reduce operational costs.

Supportive government policies promoting circular economy practices are encouraging investments in large-scale pyrolysis plants, particularly in regions with abundant waste tire availability. Price volatility in crude oil markets is further positioning pyrolysis oil as a strategic substitute in certain fuel applications.

Integration into blended fuels, industrial heating, and chemical feedstocks is expanding demand potential, with producers focusing on refining processes to meet stringent quality standards. Over the forecast period, market growth is expected to be sustained by ongoing technological innovations, strengthened waste management frameworks, and increasing end-user acceptance, leading to stable revenue generation and broader global penetration.

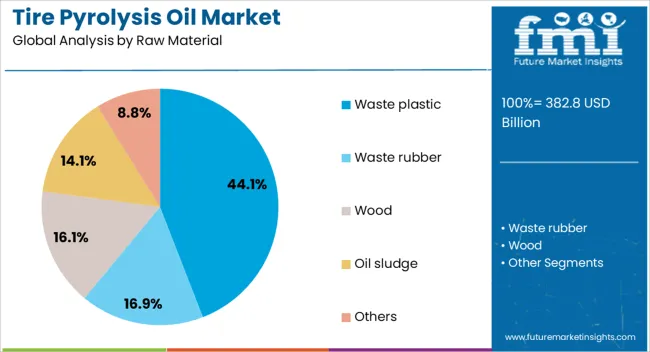

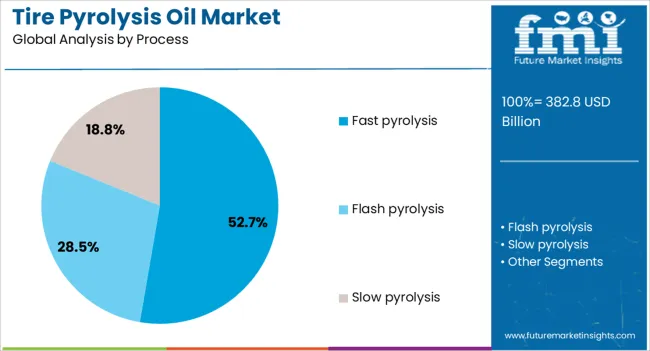

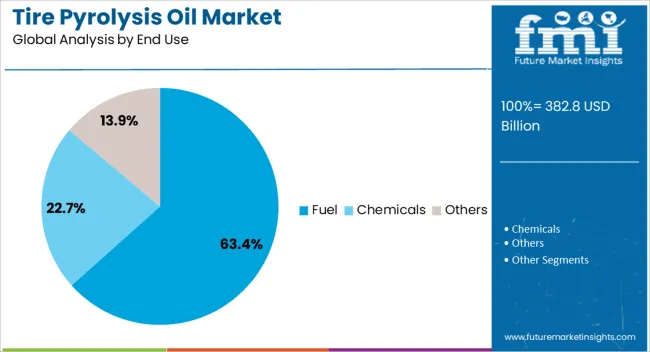

The tire pyrolysis oil market is segmented by raw material, process, end use, and geographic regions. By raw material, tire pyrolysis oil market is divided into Waste plastic, Waste rubber, Wood, Oil sludge, and Others. In terms of process, tire pyrolysis oil market is classified into Fast pyrolysis, Flash pyrolysis, and Slow pyrolysis.

Based on end use, tire pyrolysis oil market is segmented into Fuel, Chemicals, and Others. Regionally, the tire pyrolysis oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The waste plastic sub-segment, holding 44.1% of the raw material category, has emerged as a significant contributor to the tire pyrolysis oil market due to its high calorific value and consistent feedstock availability. Processing waste plastics alongside waste tires has been found to enhance oil yield and improve certain quality parameters, making it a preferred input for many operators.

The segment’s share is reinforced by the scalability of collection and sorting systems in both developed and developing economies. Regulatory measures targeting plastic waste reduction have indirectly boosted pyrolysis adoption by encouraging alternative disposal and recycling methods.

Moreover, the economic benefit of co-processing plastics with tires has been leveraged to optimize plant throughput and reduce unit production costs. Continued advancements in feedstock pre-treatment technologies are expected to improve efficiency further, ensuring the waste plastic segment remains integral to future capacity expansions in the industry.

Fast pyrolysis, representing 52.7% of the process category, dominates due to its ability to produce higher liquid yields with relatively shorter residence times compared to conventional methods. The process is favored for its operational efficiency and scalability, making it suitable for both small and large-scale facilities.

Its adoption is further supported by ongoing R&D efforts aimed at enhancing reactor design, heat transfer rates, and catalyst performance, resulting in improved oil quality and reduced by-product formation. Lower processing time also contributes to better energy efficiency, translating to cost advantages for producers.

Compliance with environmental standards is more achievable with fast pyrolysis, as the process can be integrated with emission control systems to meet regulatory requirements. As global demand for alternative fuels rises, the fast pyrolysis segment is expected to maintain its leading position through technological innovation, improved process economics, and growing acceptance in diverse industrial applications.

The fuel segment, accounting for 63.4% of the end-use category, leads the market owing to its direct applicability as an industrial heating fuel and potential as a blendstock in diesel engines after appropriate refining. Rising fossil fuel prices and the need for low-cost alternatives have supported steady demand from manufacturing, power generation, and marine sectors.

The segment’s growth is underpinned by its ability to provide a competitive energy solution while contributing to waste reduction and sustainability goals. Producers are focusing on refining processes to remove impurities and enhance combustion performance, thereby expanding its acceptance in regulated markets.

Infrastructure compatibility, coupled with minimal modifications required for usage, has further boosted adoption rates. As global energy consumption continues to rise and environmental policies tighten, the fuel segment is expected to retain its dominant share, supported by ongoing technological advancements and broader integration into industrial and transportation energy mixes.

Tire pyrolysis oil growth is driven by industrial fuel demand, chemical applications, and regulatory support. Modular and small-scale solutions further enhance market adoption globally.

The tire pyrolysis oil market is being driven by increasing demand for alternative and renewable fuel sources, especially in industrial and power generation sectors. Pyrolysis oil derived from end-of-life tires provides an efficient and cost-effective substitute for conventional fossil fuels in boilers, furnaces, and electricity generation units. Growing energy requirements in emerging economies, coupled with high oil prices, are encouraging adoption of pyrolysis-based fuels. Industrial operators are focusing on reducing operational costs and diversifying energy sources. Adoption is supported by government policies promoting waste-to-energy solutions and emission reduction targets. The increasing availability of end-of-life tires provides a consistent feedstock, ensuring steady production and contributing to market expansion globally.

Tire pyrolysis oil is gaining traction as a feedstock for chemical and petrochemical industries, influencing market growth. It is used in producing synthetic chemicals, carbon black, resins, and lubricants, enabling manufacturers to reduce dependency on crude oil-derived raw materials. Industrial applications are expanding in chemicals, automotive, and rubber processing sectors. The use of pyrolysis oil in industrial processes provides cost efficiency and supports circular economy initiatives. Market participants are increasingly forming strategic partnerships to optimize supply chains and distribution networks. Regions with high tire waste volumes are witnessing rapid adoption of pyrolysis-based chemical solutions, offering manufacturers new revenue streams. Increasing regulatory emphasis on waste management further supports industrial utilization and market penetration.

Government regulations and policy frameworks are key drivers shaping the tire pyrolysis oil market. Mandates for proper tire disposal, waste-to-energy initiatives, and incentives for renewable fuels encourage the adoption of pyrolysis oil solutions. Policies in North America, Europe, and Asia-Pacific promote tire recycling and conversion of waste into usable fuels or chemical feedstocks. Public-private partnerships and grants are facilitating pilot projects and industrial-scale installations. Compliance with environmental and safety standards ensures market credibility and acceptance. Regulatory measures also help balance the market by preventing unregulated or inefficient pyrolysis operations. Strong government support is fostering investor confidence, enabling market expansion, and ensuring long-term growth across diverse industrial and energy applications globally.

The market for tire pyrolysis oil is increasingly shaped by small-scale and modular production systems that provide flexibility, rapid deployment, and local energy solutions. Distributed pyrolysis plants are being deployed near industrial hubs, urban centers, and remote locations to process end-of-life tires efficiently. Modular systems allow scalability based on feedstock availability and energy demand, reducing operational and logistical challenges. Industrial operators and energy service providers are adopting these solutions to generate on-site fuel, minimize transportation costs, and improve energy security. Strategic collaborations, pilot projects, and demonstration plants are driving awareness and adoption. The focus on operational efficiency, economic viability, and localized production continues to support market growth across both developed and emerging economies.

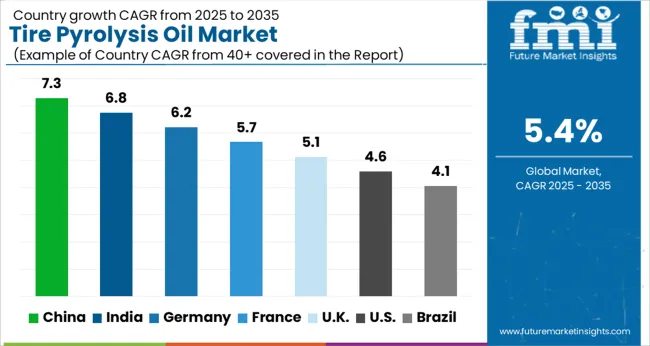

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global tire pyrolysis oil market is projected to grow at a CAGR of 5.4% from 2025 to 2035, led by China at 7.3% and India at 6.8%, both showing rapid adoption due to abundant end-of-life tires and industrial energy demand. Germany, the UK, and the USA, key OECD members, are expanding adoption driven by industrial fuel use, waste-to-energy initiatives, and chemical feedstock applications. Growth is fueled by energy generation, industrial heating, chemical production, and emission reduction mandates. Strategic partnerships, pilot projects, and investments in modular pyrolysis units are enhancing capacity and operational efficiency. Emerging regions are increasingly contributing to demand through small-scale and distributed pyrolysis solutions, while developed markets focus on high-efficiency and regulatory-compliant plants. The analysis includes over 40 countries, with the leading markets shown below.

The tire pyrolysis oil market in China is projected to grow at a CAGR of 7.3% from 2025 to 2035, driven by the rapid generation of end-of-life tires and rising industrial energy demand. Utility and industrial sectors are increasingly adopting pyrolysis oil as an alternative fuel for boilers, furnaces, and power generation units, providing cost-efficient energy solutions. Large-scale pyrolysis plants are being developed in industrial clusters to process tire waste and produce fuel and chemical feedstocks. Government policies promoting waste-to-energy initiatives and emission reduction targets are further supporting market growth. Strategic partnerships between tire recyclers, technology providers, and energy operators are facilitating efficient supply chains and scalable operations. Advances in reactor efficiency, modular plant designs, and predictive monitoring systems are improving production output, quality, and operational reliability. China is emerging as a dominant market for tire pyrolysis oil due to its strong industrial base, tire consumption volume, and supportive regulatory environment.

The tire pyrolysis oil market in India is expected to grow at a CAGR of 6.8% from 2025 to 2035, fueled by increasing industrial energy requirements and a growing focus on alternative fuels. Industrial facilities in sectors like chemicals, manufacturing, and energy generation are adopting pyrolysis oil to reduce dependence on conventional fossil fuels and manage operational costs. Regional players are establishing pyrolysis plants near urban centers with high tire waste volumes to ensure consistent feedstock availability. Policy support from the government, including waste management regulations and renewable energy incentives, is encouraging adoption across both industrial and commercial sectors. Collaborative projects with technology providers and global solution vendors are enabling efficient plant designs and high-quality oil production. The focus on cost-effective energy solutions, circular economy principles, and emission reduction measures is driving market expansion. India’s market is poised for rapid growth, with modular pyrolysis solutions and small-scale plants increasing accessibility in emerging regions.

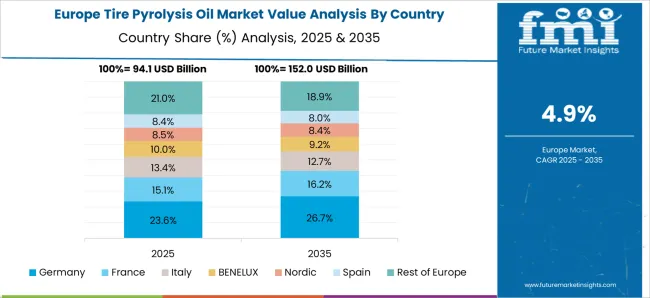

The tire pyrolysis oil market in Germany is projected to grow at a CAGR of 6.2% from 2025 to 2035, driven by strict waste management regulations and increasing industrial adoption. Germany’s focus on circular economy practices and emission reduction has encouraged tire recycling and conversion of end-of-life tires into pyrolysis oil. Industrial sectors such as manufacturing, chemicals, and energy generation are utilizing pyrolysis oil for heat recovery and process energy, lowering operational costs and reducing environmental impact. European Union policies incentivizing waste-to-energy projects and renewable fuel adoption are supporting market penetration. Advanced pyrolysis technologies and modular plant configurations are being implemented to maximize efficiency, ensure high-quality oil production, and meet regulatory compliance. Partnerships with energy operators, chemical companies, and technology providers are strengthening market growth. Germany is expected to maintain a leading position in Europe due to its regulatory environment, industrial base, and emphasis on sustainable energy solutions.

The tire pyrolysis oil market in the UK is expected to grow at a CAGR of 5.1% from 2025 to 2035, supported by industrial energy requirements, emission reduction mandates, and increasing adoption of waste-to-energy solutions. Pyrolysis plants are being deployed in industrial clusters and urban centers to process end-of-life tires efficiently. Industrial facilities in chemicals, power, and manufacturing sectors are utilizing pyrolysis oil to reduce dependence on conventional fossil fuels and optimize energy costs. Government incentives, renewable energy credits, and environmental regulations encourage investments in pyrolysis technology. Modular and small-scale plants are being adopted to provide localized fuel production, reduce transportation costs, and ensure operational flexibility. Strategic partnerships with technology providers and energy operators are enabling high-efficiency installations and reliable supply chains. Overall, the UK market is expanding steadily due to regulatory support, industrial adoption, and growing awareness of sustainable waste-to-energy solutions.

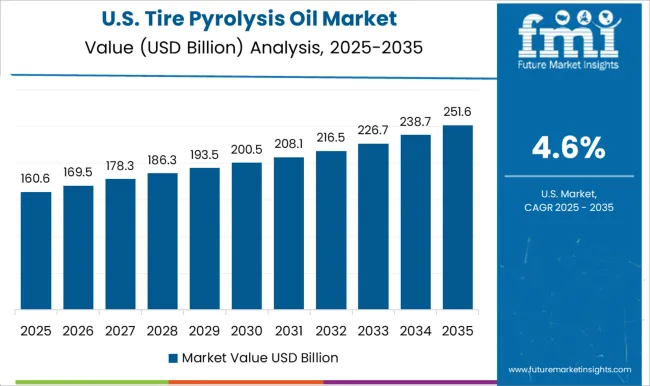

The tire pyrolysis oil market in the USA is projected to grow at a CAGR of 4.6% from 2025 to 2035, driven by industrial demand, waste tire availability, and government initiatives promoting alternative fuels. Large-scale pyrolysis plants are being established in regions with high tire waste, such as western and southern states, to supply fuel and chemical feedstocks. Industrial sectors, including manufacturing, chemicals, and power generation, are adopting pyrolysis oil to lower operational costs and reduce carbon emissions. Public-private partnerships, renewable energy incentives, and circular economy initiatives are supporting market growth. Modular and distributed pyrolysis solutions are being implemented for smaller-scale or off-grid applications, enabling flexible deployment. The focus on process optimization, predictive monitoring, and high-efficiency production ensures reliable oil quality and operational performance. The USA market is gradually shifting toward widespread industrial and commercial adoption, with opportunities for regional expansion and technology-driven efficiency improvements.

Competition in the tire pyrolysis oil market is defined by feedstock management, production efficiency, and fuel quality consistency. Nexus Circular and Alterra Energy lead by offering large-scale pyrolysis solutions with integrated tire collection, high-yield oil recovery, and robust downstream processing capabilities. Bioenergy Ae Cote-Nord, Bridgestone Corporation, and Ensyn differentiate through modular and scalable systems, advanced reactor designs, and applications spanning industrial fuel, chemical feedstocks, and renewable energy generation. Green Fuel Nordic Oy, Mk Aromatics Limited, and New Energy Kft. compete by providing specialized pyrolysis plants optimized for low-temperature and distributed waste tire processing, enabling flexible deployment and localized energy production.

Mid-tier and niche players such as New Hope Energy and Plastic Energy focus on region-specific solutions, including tire recycling programs, last-mile industrial fuel supply, and small-scale pyrolysis units. Strategies emphasize feedstock traceability, consistent oil quality, compliance with emission and environmental regulations, and integration with energy and chemical supply chains. Co-development partnerships with tire manufacturers, industrial operators, and technology providers are leveraged to optimize plant design, enhance operational efficiency, and improve profitability.

| Item | Value |

|---|---|

| Quantitative Units | USD 382.8 Billion |

| Raw Material | Waste plastic, Waste rubber, Wood, Oil sludge, and Others |

| Process | Fast pyrolysis, Flash pyrolysis, and Slow pyrolysis |

| End Use | Fuel, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nexus Circular, Alterra Energy, Bioenergy Ae Cote-Nord, Bridgestone Corporation, Ensyn, Green Fuel Nordic Oy, Mk Aromatics Limited, New Energy Kft., New Hope Energy, and Plastic Energy |

| Additional Attributes | Dollar sales, share, CAGR by region and country, feedstock availability, industrial and energy applications, competitor landscape, technology adoption, regulatory incentives, pricing trends, project pipelines, and market entry opportunities. |

The global tire pyrolysis oil market is estimated to be valued at USD 382.8 billion in 2025.

The market size for the tire pyrolysis oil market is projected to reach USD 647.7 billion by 2035.

The tire pyrolysis oil market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in tire pyrolysis oil market are waste plastic, waste rubber, wood, oil sludge and others.

In terms of process, fast pyrolysis segment to command 52.7% share in the tire pyrolysis oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Cord Market

Tire Carousel Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA