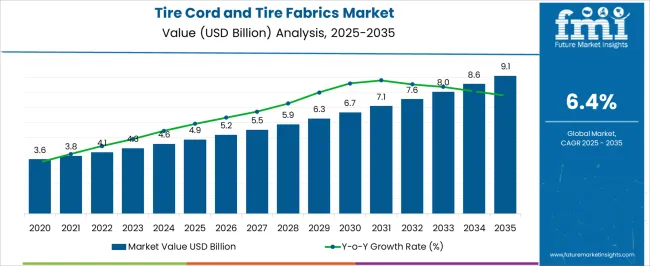

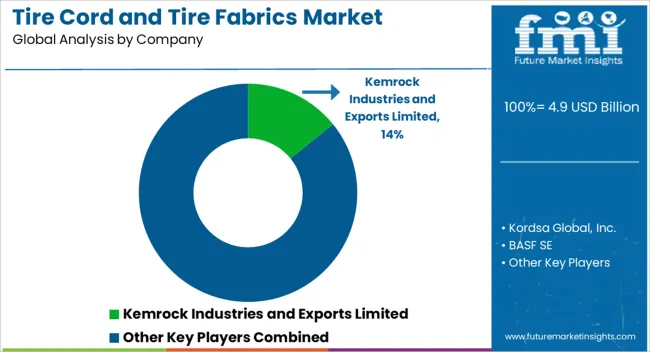

The tire cord and tire fabrics market is anticipated to grow from USD 4.9 billion in 2025 to USD 9.1 billion by 2035, reflecting a CAGR of 6.4%. Analysis of regional growth patterns indicates a pronounced imbalance, with Asia-Pacific emerging as the dominant contributor to market expansion. Extensive automotive manufacturing hubs, high vehicle production volumes, and increasing replacement tire demand largely drive the region’s growth.

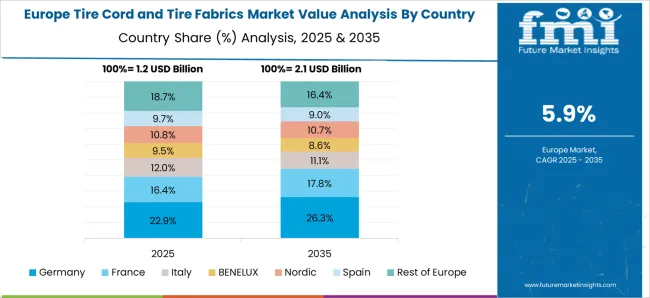

China, India, and Japan serve as critical centers of production and consumption, where investments in modern tire technologies and infrastructure amplify the adoption of advanced tire cord and fabric materials. Europe, while exhibiting steady growth, demonstrates a comparatively moderate trajectory, influenced by mature automotive markets, stringent regulatory frameworks, and technological emphasis on fuel efficiency and performance.

Countries such as Germany, France, and Italy maintain strong tire production and replacement markets, but incremental expansion is constrained relative to the Asia-Pacific. North America shows measured growth, supported by stable automotive demand and a focus on premium and performance tires.

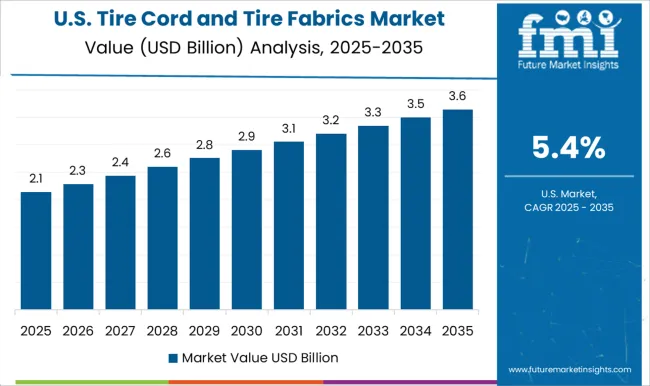

The United States dominates the regional market due to industrial-scale manufacturing and rising consumer preference for advanced tire technologies. However, slower vehicle production growth and market saturation temper expansion relative to Asia-Pacific. The regional disparity underscores Asia-Pacific as the primary growth engine, with Europe and North America contributing smaller, yet significant, portions of market revenue, reflecting a global market where demand and production capabilities are unevenly distributed across key regions.

| Metric | Value |

|---|---|

| Tire Cord and Tire Fabrics Market Estimated Value in (2025 E) | USD 4.9 billion |

| Tire Cord and Tire Fabrics Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The tire cord and tire fabrics market represents a specialized segment within the automotive components and rubber reinforcement materials industry, emphasizing durability, strength, and performance in tire manufacturing. Within the overall tire materials market, it accounts for about 6.5%, driven by demand from passenger cars, commercial vehicles, and off-road applications. In the automotive reinforcement textiles segment, it holds nearly 5.8%, reflecting usage in radial and bias tires. Across the commercial and heavy duty vehicle tire market, the segment captures 4.2%, supporting structural integrity and load bearing. Within the specialty polymer and synthetic fiber category, it represents 3.7%, highlighting adoption of nylon, polyester, and aramid fibers. In the replacement tire and aftermarket sector, it secures 3.3%, emphasizing maintenance, performance optimization, and durability. Recent developments in this market have focused on high strength fibers, hybrid cord designs, and sustainable materials. Innovations include use of aramid and ultra-high molecular weight polyester to enhance tensile strength and heat resistance. Key players are collaborating with tire manufacturers to develop cords optimized for low rolling resistance, fuel efficiency, and high mileage performance. Advanced weaving and coating technologies have improved adhesion with rubber matrices and uniformity in tire construction. Additionally, research into bio-based and recycled fibers is gaining traction to reduce environmental impact. These trends demonstrate how performance optimization, material innovation, and sustainability are shaping the tire cord and tire fabrics market.

The tire cord and tire fabrics market is experiencing stable growth, supported by rising global vehicle production and increasing demand for durable, high-performance tires. Industry updates and manufacturing reports have indicated that the adoption of advanced reinforcement materials has enhanced tire strength, longevity, and fuel efficiency. Tire cords and fabrics are critical in maintaining tire shape under varying loads, improving safety and driving performance.

The market is also benefiting from automotive sector trends toward lightweight yet robust materials, which help meet stringent fuel economy and emission regulations. Growth in electric and hybrid vehicles is further influencing product innovation, with manufacturers focusing on reinforcement materials optimized for torque-heavy and high-load applications.

Expanding infrastructure development and rising disposable incomes in emerging economies are driving higher demand for passenger and commercial vehicles, thereby boosting the consumption of tire cords and fabrics across all categories.

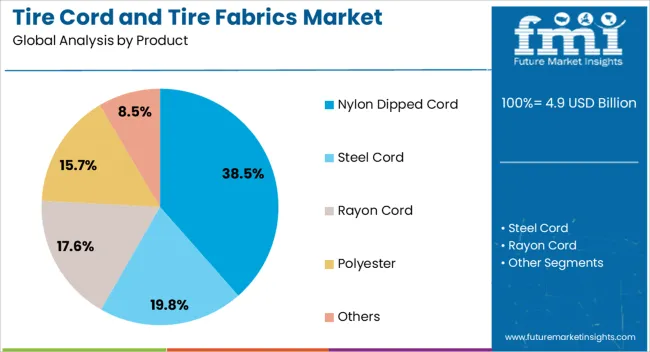

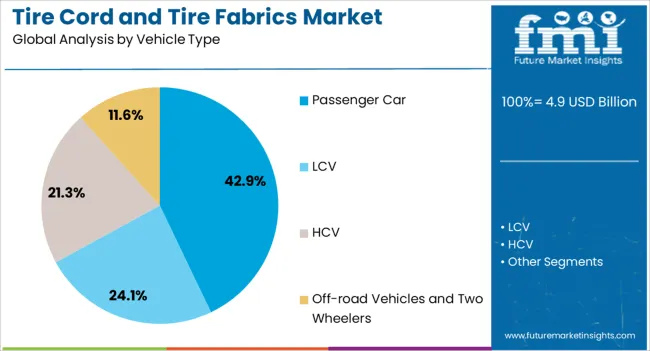

The tire cord and tire fabrics market is segmented by product, vehicle type, and geographic regions. By product, tire cord and tire fabrics market is divided into Nylon Dipped Cord, Steel Cord, Rayon Cord, Polyester, and Others.

In terms of vehicle type, tire cord and tire fabrics market is classified into Passenger Car, LCV, HCV, and Off-road Vehicles and Two Wheelers. Regionally, the tire cord and tire fabrics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Nylon Dipped Cord segment is projected to account for 38.5% of the tire cord and tire fabrics market revenue in 2025, maintaining its lead among product categories. This dominance is linked to nylon’s excellent strength, fatigue resistance, and high adhesion properties when treated with dipping solutions.

The dipping process enhances cord-to-rubber bonding, increasing tire durability and performance under high-stress conditions. Nylon dipped cords are widely utilized in bias and radial tires for motorcycles, passenger cars, and heavy vehicles due to their ability to withstand heavy loads and variable road conditions.

Production advancements have allowed for more consistent quality and improved resistance to moisture and heat, further reinforcing market adoption. As the automotive industry continues to prioritize safety, handling, and long service life, the Nylon Dipped Cord segment is expected to remain a preferred choice for tire reinforcement applications.

The Passenger Car segment is projected to hold 42.9% of the tire cord and tire fabrics market revenue in 2025, retaining its position as the dominant vehicle type. Market growth in this segment is fueled by the high production volumes of passenger vehicles globally, coupled with increasing consumer demand for comfort, fuel efficiency, and extended tire lifespan.

Passenger cars require tire reinforcement materials that ensure consistent performance across a variety of driving conditions, from city roads to highways. Tire cords and fabrics in this category are designed to deliver stability, traction, and resistance to wear, aligning with both safety standards and consumer expectations.

The expansion of automotive manufacturing in emerging economies, along with the rising adoption of premium and performance tires, has bolstered demand for quality reinforcement materials. As OEMs and aftermarket suppliers continue to emphasize tire reliability and efficiency, the Passenger Car segment is expected to sustain its leading market share.

The market has been expanding due to the increasing demand for high-performance tires across passenger vehicles, commercial vehicles, and off-road applications. Tire cords, typically made from polyester, nylon, and aramid fibers, provide tensile strength and stability to tires, while tire fabrics enhance flexibility, durability, and uniform load distribution. Growth in automotive production, rising replacement demand, and the need for fuel-efficient, long-lasting tires have been major factors driving the market. Technological advancements in fiber treatment, weaving patterns, and resin impregnation have improved durability and performance.

The market has been significantly influenced by rising automotive production and replacement tire demand. Passenger cars, light trucks, and heavy commercial vehicles require durable and high-strength cords to support modern tire designs, including radial, bias, and hybrid tires. Increasing vehicle sales in emerging regions, coupled with the need for replacement tires due to road conditions and mileage, has expanded consumption. Manufacturers are investing in lightweight, high-performance fibers to improve fuel efficiency while maintaining tire safety and longevity. The trend toward all-season and performance tires has encouraged development of specialized cords and fabrics with superior abrasion resistance and load-bearing capacity. Replacement tire channels, including aftermarket service centers, also contribute to sustained demand, making automotive production and replacement cycles critical drivers of market growth.

Technological innovations in fiber materials and engineering techniques have strengthened the tire cord and tire fabrics market. Polyester, nylon, aramid, and hybrid fiber constructions are increasingly utilized to achieve enhanced tensile strength, elasticity, and thermal resistance. Advanced weaving, braiding, and resin impregnation methods improve adhesion between fibers and rubber, resulting in higher performance and longer tire life. Nanotechnology and surface treatment methods have been explored to enhance durability, reduce rolling resistance, and improve wet traction. Research on bio-based and lightweight fibers is also underway to meet environmental and fuel-efficiency targets. Such innovations have expanded the applicability of tire cords in high-performance, electric, and specialty tires, ensuring that material science advancements remain a key factor driving competitiveness and technological differentiation in the market.

Commercial vehicles and off-road applications have emerged as significant contributors to tire cord and tire fabrics consumption. Heavy trucks, buses, and mining or construction equipment require reinforced tires capable of handling high loads, rough terrains, and continuous operation. Tire cords with superior tensile strength and heat resistance are preferred to withstand the demanding operating conditions of these vehicles. The growing logistics, construction, and mining sectors have amplified demand for specialized tire fabrics that improve durability, reduce maintenance, and extend tire service life. The off-road tires for agricultural and industrial vehicles incorporate robust cord and fabric designs to optimize traction and structural integrity. The performance demands in these segments ensure that commercial and off-road applications remain major drivers for product development and market expansion.

Sustainability and environmental regulations have influenced the market, compelling manufacturers to adopt eco-friendly materials and production methods. Efforts to reduce carbon footprint and energy consumption in manufacturing processes are shaping material selection and resin usage. Recycling initiatives for end-of-life tires are encouraging the integration of secondary materials, while lightweight and high-strength fibers are promoted to improve fuel efficiency in vehicles. The challenges, such as fluctuating raw material costs, stringent quality requirements, and complex supply chains, continue to impact market growth. Compliance with global and regional safety and environmental standards remains a critical consideration. The interplay between sustainability, innovation, and cost efficiency is expected to shape the strategic development of the tire cord and tire fabrics market in the coming decade.

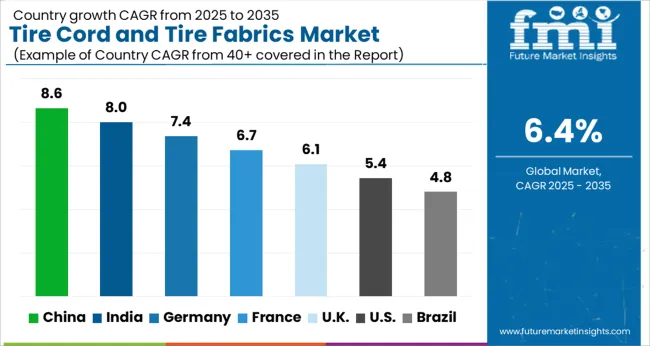

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

China leads the market with a forecast growth rate of 8.6%, supported by high demand in automotive manufacturing and replacement tire industries. India follows at 8.0%, driven by expanding vehicle production and increasing exports. Germany records 7.4%, where integration of high-performance materials in automotive applications sustains steady growth. The United Kingdom reaches 6.1%, fueled by innovation in lightweight and durable tire components. The United States maintains 5.4%, supported by ongoing demand in commercial and passenger vehicle segments. These countries represent the core of manufacturing, technology adoption, and market scaling in the global tire cord and tire fabrics industry. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 8.6%, propelled by increasing automotive production and rising demand for high-performance tires. The market is witnessing expansion due to the adoption of advanced tire reinforcement materials and innovation in tire cord technologies. Increasing passenger car and commercial vehicle sales are contributing to market growth. Government regulations promoting road safety and tire durability are encouraging manufacturers to adopt premium tire fabrics. Investments in R&D for lightweight and eco-friendly materials are enhancing product performance and competitiveness. Strategic partnerships between local tire manufacturers and raw material suppliers are facilitating supply chain efficiency. Growing exports of tires to international markets are further boosting demand, making China a significant contributor to global market growth.

India’s market is projected to expand at a CAGR of 8%, driven by rising vehicle sales and modernization of the tire industry. Increasing production of passenger cars, commercial vehicles, and two-wheelers is creating demand for durable and high-performance tire reinforcements. The market is influenced by technological advancements in textile and polymer-based tire cords that improve strength and longevity. Government initiatives promoting road safety and standards for tire performance are encouraging manufacturers to adopt high-quality materials. Partnerships with international suppliers are enhancing availability of premium fabrics. Growth in the automotive aftermarket and increasing exports of tires are further stimulating market adoption. Sustainability trends, including recyclable and eco-friendly tire fabrics, are gradually gaining traction.

Germany is anticipated to grow at a CAGR of 7.4%, fueled by stringent safety regulations and the adoption of high-performance tires. Automotive manufacturers are increasingly focusing on lightweight and durable tire reinforcements to improve fuel efficiency and tire longevity. Technological innovations in polyester and steel cords are enhancing tire reliability. Growth in premium passenger cars and commercial vehicles is driving the market. Collaborations between local tire makers and global fabric suppliers are supporting product innovation and supply chain optimization. Sustainability initiatives, such as recyclable tire components, are gradually influencing material selection. The German market benefits from a strong automotive sector and export-oriented tire production, supporting steady adoption of advanced tire fabrics.

The United Kingdom’s market is projected to expand at a CAGR of 6.1%, driven by increasing vehicle production and demand for high-quality tires. Adoption of advanced materials in tire cords and fabrics is improving tire performance and durability. Government regulations on road safety and tire standards are promoting use of reinforced fabrics. UK manufacturers are investing in research for lightweight and eco-friendly tire materials to meet environmental targets. Collaborations with European and global suppliers are ensuring consistent quality and availability. Market demand is supported by growth in the commercial vehicle segment and aftermarket tire replacement. Increasing emphasis on sustainability and reduced carbon footprint is shaping future development strategies.

The United States market is expected to grow at a CAGR of 5.4%, fueled by rising automotive production and increasing demand for advanced tire reinforcements. Manufacturers are focusing on high-strength polyester and steel cords to enhance tire durability and performance. Technological advancements in tire cord fabrics are enabling improved safety and longer lifespan. Growth in passenger cars, commercial trucks, and off-road vehicles is contributing to market expansion. Strategic partnerships between domestic tire manufacturers and raw material suppliers are optimizing production efficiency. The US market is also witnessing gradual adoption of eco-friendly and recyclable materials in line with sustainability trends. Rising aftermarket demand for tire replacement is reinforcing steady growth potential.

The market is dominated by manufacturers specializing in high-strength reinforcement materials essential for modern tire performance and safety. Kemrock Industries and Exports Limited and Kordsa Global, Inc. focus on producing advanced tire cords with superior tensile strength, durability, and resistance to heat and fatigue, catering to both passenger and commercial vehicle tires. BASF SE and Arkema S.A leverage chemical innovations to develop synthetic fibers that improve tire longevity and rolling efficiency, supporting fuel economy and performance requirements.

SGL Carbon SE and Solvay S.A supply carbon-based and high-modulus fibers that enhance structural integrity and dimensional stability of tires. Kolon Industries, Inc., Mitsubishi Rayon Co. Ltd, and Hyosung Corporation emphasize polyester and nylon-based tire fabrics with optimized flexibility and adhesion properties for various tire applications. Toray Industries Inc. integrates cutting-edge polymer technologies to produce tire cords with uniform strength and resistance to environmental stresses, reinforcing tires against mechanical wear. These providers drive market growth by offering durable, lightweight, and high-performance reinforcement materials that meet evolving automotive safety, efficiency, and regulatory standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Product | Nylon Dipped Cord, Steel Cord, Rayon Cord, Polyester, and Others |

| Vehicle Type | Passenger Car, LCV, HCV, and Off-road Vehicles and Two Wheelers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kemrock Industries and Exports Limited, Kordsa Global, Inc., BASF SE, Arkema S.A, SGL Carbon SE, Solvay S.A., Kolon Industries, Inc., Mitsubishi Rayon Co. Ltd, Hyosung Corporation, and Toray Industries Inc. |

| Additional Attributes | Dollar sales by cord and fabric type and application, demand dynamics across passenger, commercial, and off-road tires, regional trends in tire manufacturing adoption, innovation in strength, durability, and lightweight materials, environmental impact of production and disposal, and emerging use cases in high-performance, eco-friendly, and smart tire solutions. |

The global tire cord and tire fabrics market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the tire cord and tire fabrics market is projected to reach USD 9.1 billion by 2035.

The tire cord and tire fabrics market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in tire cord and tire fabrics market are nylon dipped cord, steel cord, rayon cord, polyester and others.

In terms of vehicle type, passenger car segment to command 42.9% share in the tire cord and tire fabrics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Carousel Market

Tire Inflating Machine Market

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA