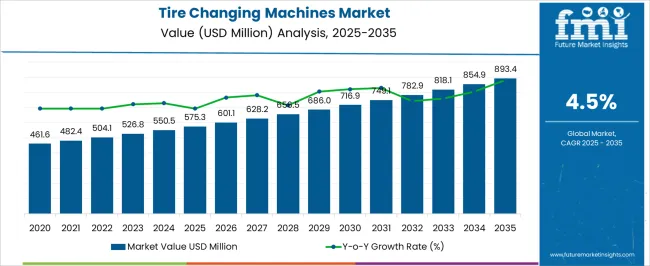

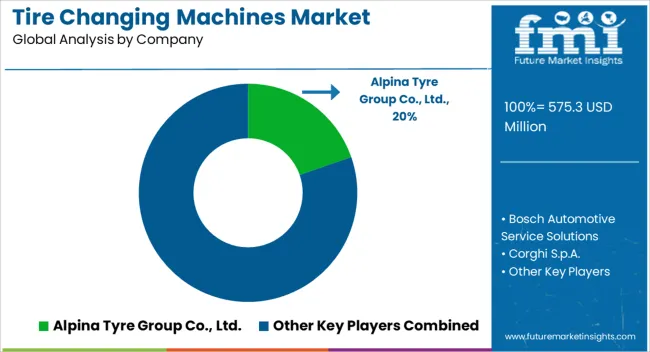

The tire changing machines market is estimated to be valued at USD 575.3 million in 2025 and is projected to reach USD 893.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The tire changing machines market, valued at USD 575.3 million in 2025 and projected to reach USD 893.4 million by 2035 with a CAGR of 4.5%, reflects moderate but steady growth supported by operational efficiency gains across automotive service chains. The cost structure of this market is shaped by raw materials, manufacturing processes, labor intensity, and technology integration. Steel, aluminum, and electronic components constitute the primary raw material expenses, making material price volatility a critical cost factor. Assembly and testing, requiring precision and automation, add to manufacturing expenditures, while distribution and aftersales service further influence the overall cost burden.

Within the value chain, upstream activities involve component suppliers of hydraulic systems, motors, and digital control panels. Midstream players, comprising equipment manufacturers, drive competitiveness through efficiency, reliability, and service support. Downstream, the market heavily depends on automotive workshops, tire retailers, and service stations that adopt machines to reduce labor costs and improve turnaround times. The incremental value from integration of semi-automatic and fully automatic machines enhances efficiency, creating opportunities for technology-driven differentiation. The growth from USD 575.3 million to USD 893.4 million shows that despite moderate CAGR, sustained value creation is expected through standardization, cost optimization, and stronger aftersales networks. By 2035, the market will likely favor manufacturers with robust supply chains and technology-enabled services in the value chain.

| Metric | Value |

|---|---|

| Tire Changing Machines Market Estimated Value in (2025 E) | USD 575.3 million |

| Tire Changing Machines Market Forecast Value in (2035 F) | USD 893.4 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The tire changing machines market represents an important category within automotive workshop and service equipment, highlighting its role in improving efficiency, safety, and precision for tire replacement operations. Within the broader automotive garage equipment sector, it accounts for around 5.9%, supported by expanding vehicle fleets and rising aftermarket demand. In the wheel and tire service equipment market, it secures nearly 6.5%, reflecting continuous adoption by repair shops and dealerships.

Across the global automotive maintenance tools and equipment industry, its share is 4.3%, emphasizing its function in streamlining routine vehicle servicing. Within the heavy-duty vehicle maintenance equipment segment, it contributes about 3.7%, addressing the requirements of commercial and industrial vehicles. In the automated workshop machinery space, the share stands at 3.4%, showing how automation is advancing tire service operations. Recent developments in this market have concentrated on automation, precision engineering, and digital integration.

Semi-automatic and fully automatic tire changers are gaining traction, offering enhanced speed and reduced operator fatigue. Innovations such as touchless tire changers and rim protection technologies are being introduced to handle advanced alloy wheels and run-flat tires. Integration of hydraulic assist arms and ergonomic designs has improved safety and handling in high-volume workshops.

Manufacturers are also investing in IoT-enabled machines that allow remote diagnostics, usage tracking, and predictive maintenance. Furthermore, portable and compact tire changers are being adopted by mobile tire service providers. These advancements demonstrate how safety, efficiency, and digitalization are shaping the future of the market.

The tire changing machines market is expanding steadily, driven by increasing global vehicle ownership, rising demand for efficient maintenance services, and technological advancements in automotive workshop equipment. The growing number of passenger and commercial vehicles on the road has intensified the need for fast, reliable, and user friendly tire servicing solutions.

Regulatory requirements for road safety and periodic vehicle inspections are further stimulating market adoption. Advancements such as ergonomic designs, automation features, and enhanced safety mechanisms are improving operational efficiency for end users.

Emerging economies are witnessing heightened demand due to the expansion of automotive service centers and the growth of aftermarket repair industries. The market outlook remains positive as both developed and developing regions continue to prioritize high performance equipment that reduces downtime and improves service quality.

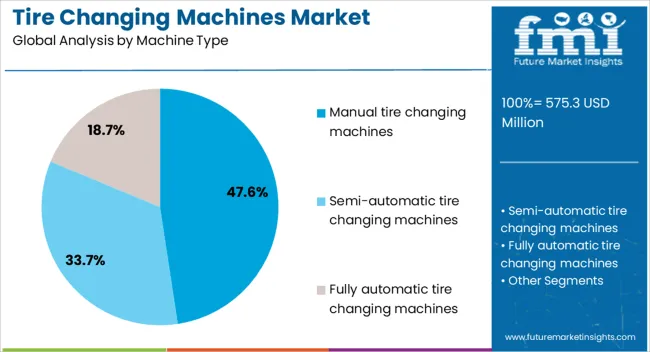

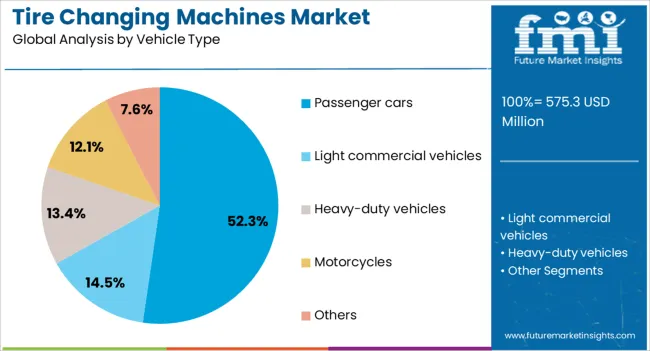

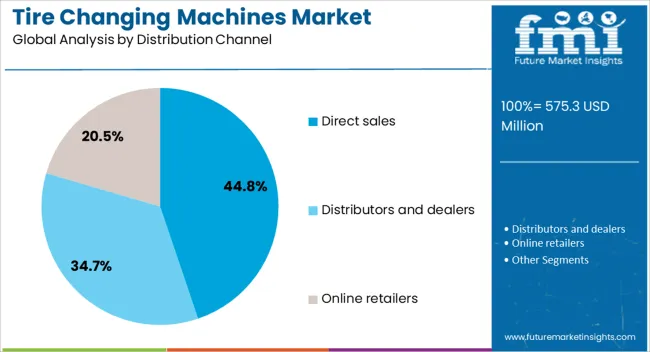

The tire changing machines market is segmented by machine type, vehicle type, distribution channel, end-user, and geographic regions. By machine type, tire changing machines market is divided into manual tire changing machines, semi-automatic tire changing machines, and fully automatic tire changing machines. In terms of vehicle type, tire changing machines market is classified into passenger cars, light commercial vehicles, heavy-duty vehicles, motorcycles, and others. Based on distribution channel, tire changing machines market is segmented into direct sales, distributors and dealers, and online retailers. By end-user, tire changing machines market is segmented into automotive service centers, vehicle dealerships, commercial fleets, and repair shops. Regionally, the tire changing machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual tire changing machines segment is projected to account for 47.6% of the total market revenue by 2025, positioning it as the most prominent machine type. This dominance is supported by its cost effectiveness, durability, and suitability for small to medium scale workshops.

Manual machines require lower initial investment and minimal maintenance, making them ideal for emerging markets and independent garages. Their ease of operation without dependency on complex electrical systems also makes them preferable in locations with limited infrastructure support.

The continued use of manual machines in rural and semi urban areas sustains their market leadership within the machine type category.

The passenger cars segment is expected to hold 52.3% of total market revenue by 2025 within the vehicle type category, making it the leading segment. The dominance of this category is fueled by the rising global passenger car fleet, frequent tire replacements due to varying road conditions, and increased consumer awareness regarding vehicle safety.

The proliferation of car ownership in urban areas, coupled with growth in personal mobility trends, has boosted demand for tire changing services.

Passenger vehicles require regular tire maintenance to ensure optimal performance and compliance with safety standards, thereby sustaining high demand for tire changing machines in this segment.

The direct sales segment is projected to represent 44.8% of total market revenue by 2025 within the distribution channel category, establishing it as the leading segment. Its growth is driven by manufacturers’ preference for direct customer engagement, enabling better pricing control, customized solutions, and strong after sales service relationships.

Direct sales channels allow for faster delivery, tailored product offerings, and enhanced brand loyalty. This approach also enables manufacturers to gather valuable feedback for product development, reinforcing customer satisfaction and repeat business.

The direct sales model continues to dominate as it strengthens trust and efficiency in the procurement process for tire changing machines.

The market has been gaining notable traction due to rising automotive ownership, increasing demand for efficient maintenance services, and technological improvements in workshop equipment. These machines have become essential for automotive service centers, tire shops, and fleet operators to handle different vehicle categories ranging from passenger cars to heavy duty trucks. The market has been influenced by automation trends, expansion of repair networks, and the rising complexity of modern tires. The demand has been supported by the need for precision, safety, and reduced turnaround times in tire replacement services.

The automotive aftermarket has played a pivotal role in increasing the demand for tire changing machines. With vehicle numbers rising across global markets, the need for frequent tire replacement and maintenance has grown significantly. Automotive service centers and independent workshops have invested heavily in advanced equipment to cater to this expanding customer base. Fleet operators have also required efficient tire servicing to minimize downtime and operational losses. The growing number of long distance freight activities and passenger transportation services has added to the frequency of tire wear. Consequently, tire changing machines have been increasingly adopted as essential tools within maintenance infrastructure, ensuring greater productivity and service reliability.

Automation has become a defining factor shaping the tire changing machines market. Automated and semi-automatic machines have been developed to enhance efficiency, reduce physical strain on technicians, and ensure consistent handling of modern tire designs including run flat and low profile variants. Integration of pneumatic and hydraulic systems has enabled smoother bead breaking and tire mounting processes. Advanced machines with touchless technology have been introduced to minimize tire and rim damage, particularly in high value vehicles. Training requirements for operators have been lowered due to user friendly interfaces and safety features. This adoption of technologically advanced systems has strengthened the competitive advantage of modern service centers and has been a catalyst for market growth.

Innovations in tire design and materials have influenced the demand for advanced tire changing machines. Wider, heavier, and more rigid tires have required specialized equipment to ensure proper installation and removal. The popularity of alloy wheels, run flat technology, and ultra-high performance tires has created significant challenges for traditional equipment. As a result, manufacturers have developed machines with enhanced clamping force, precision controls, and adaptable mounting heads. The market has been supported by strong demand from workshops that need to accommodate diverse tire specifications across vehicles ranging from compact cars to commercial fleets. This influence of evolving tire designs has created continuous opportunities for technological advancements within the industry.

High capital investment associated with advanced tire changing machines has acted as a limitation for small and mid-sized service providers. Semi-automatic and fully automatic machines require higher procurement and maintenance costs compared to manual models, creating financial barriers in cost sensitive markets. In addition, frequent calibration and technical expertise have been necessary for effective operations, increasing the burden on service centers with limited skilled manpower. Space requirements for installation have also restricted adoption in smaller workshops. While manufacturers have been introducing cost optimized models, balancing affordability with performance remains an ongoing challenge. Overcoming these barriers is considered crucial for sustained adoption across emerging economies and smaller business operators.

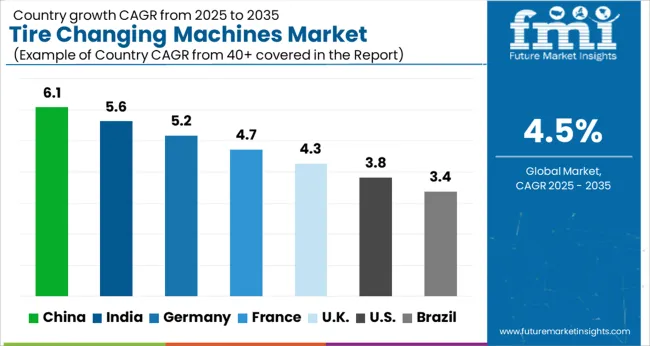

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The market is expected to grow at a CAGR of 4.5% from 2025 to 2035, supported by rising vehicle ownership, aftermarket service expansion, and integration of advanced equipment in workshops. India posted 5.6%, with momentum shaped by an expanding automotive service network and demand from mid-sized repair shops. Germany accounted for 5.2%, influenced by premium vehicle maintenance requirements and advanced garage infrastructure. China remained the leader at 6.1%, benefiting from high vehicle sales and rapid service center growth. The United Kingdom achieved 4.3%, reflecting steady replacement demand and gradual adoption of automated solutions, while the United States recorded 3.8%, with growth supported by large-scale repair chains and technology-driven upgrades. The market trajectory demonstrates how both developed and emerging economies are advancing modernization in tire service equipment. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 6.1%, supported by rising vehicle ownership, continuous expansion of automotive service centers, and modernization of garage equipment. Domestic manufacturers are focusing on producing semi-automatic and fully automatic machines to meet demand from small workshops as well as large service chains. Imports of premium European brands also play a role in catering to high end markets. Growth has been reinforced by an increase in commercial vehicle servicing needs and stronger aftermarket support across urban centers.

India is expected to expand at a CAGR of 5.6%, driven by growing automotive sales, expansion of vehicle servicing outlets, and adoption of modern workshop equipment. Domestic manufacturers supply cost efficient semi-automatic machines, while imports from China and Europe cater to premium demands. Rising investments by tire retail chains in modern garages have played a role in driving adoption. The trend toward multi brand service stations has created additional opportunities for machine suppliers across tier one and tier two cities.

Germany is projected to grow at a CAGR of 5.2%, supported by strong demand from premium automotive workshops, tire dealerships, and aftermarket service providers. Domestic manufacturers emphasize advanced technologies, including leverless and touchless tire changing machines, to reduce manual effort and ensure rim safety. Imports from China supplement mid-range offerings, while German brands dominate the high precision segment. Strict safety standards and a focus on high efficiency service equipment continue to shape product development in the country.

The United Kingdom is expected to record a CAGR of 4.3%, supported by steady demand from tire dealerships, independent garages, and fleet service operators. Imports dominate the market, with European and Chinese suppliers meeting the majority of requirements. Demand is reinforced by the need for compact and automated machines suited for smaller workshops. Growth has also been influenced by rising demand for tire replacement services from electric vehicle owners, creating opportunities for advanced machines compatible with larger and heavier tires.

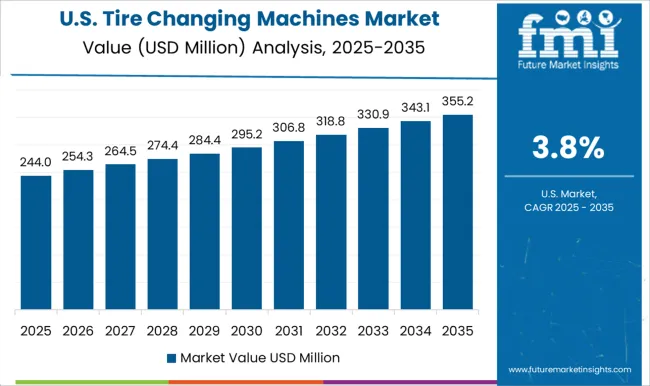

The United States market is forecast to grow at a CAGR of 3.8%, supported by expansion of automotive aftermarket services, dealership investments, and rising replacement demand from fleet operators. Domestic manufacturers focus on high performance machines with advanced features like robotic arms and ergonomic designs, while imports supplement lower priced segments. Growth has been reinforced by rising demand from EV servicing centers, where tire sizes require more specialized handling. The market outlook remains stable as workshop modernization continues nationwide.

The market features a competitive landscape shaped by a mix of global leaders, specialized European manufacturers, and diversified automotive service solution providers. Bosch Automotive Service Solutions and Snap-on Incorporated dominate with strong brand recognition, expansive distribution networks, and integrated garage equipment portfolios that serve workshops worldwide. Hunter Engineering Company strengthens its leadership through advanced automation, ergonomic design, and strong partnerships with automotive OEMs and service chains.

European players such as Corghi S.p.A., Ravaglioli S.p.A., Giuliano Group, Hofmann Megaplan, SICE (SAE), and Twin Busch GmbH are recognized for engineering expertise, innovation in high-performance tire service equipment, and reliability tailored to professional automotive workshops. Alpina Tyre Group Co., Ltd. adds competitive pressure by providing cost-effective machines targeted toward emerging markets and independent service centers. The market is influenced by the growing demand for machines compatible with run-flat and ultra-low-profile tires, as well as integration of automation and touchless technology. Companies that focus on durability, operator safety, and digital diagnostics are expected to hold strategic advantage in both mature and developing automotive aftermarkets.

| Item | Value |

|---|---|

| Quantitative Units | USD 575.3 million |

| Machine Type | Manual tire changing machines, Semi-automatic tire changing machines, and Fully automatic tire changing machines |

| Vehicle Type | Passenger cars, Light commercial vehicles, Heavy-duty vehicles, Motorcycles, and Others |

| Distribution Channel | Direct sales, Distributors and dealers, and Online retailers |

| End-User | Automotive service centers, Vehicle dealerships, Commercial fleets, and Repair shops |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpina Tyre Group Co., Ltd., Bosch Automotive Service Solutions, Corghi S.p.A., Giuliano Group, Hofmann Megaplan, Hunter Engineering Company, Ravaglioli S.p.A., SICE (SAE), Snap-on Incorporated, and Twin Busch GmbH |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across automotive repair shops, service centers, and fleet operations, regional trends in vehicle maintenance equipment adoption, innovation in automation, precision, and safety features, environmental impact of energy use and equipment lifecycle, and emerging use cases in high-performance workshops, mobile tire services, and integrated vehicle service solutions. |

The global tire changing machines market is estimated to be valued at USD 575.3 million in 2025.

The market size for the tire changing machines market is projected to reach USD 893.4 million by 2035.

The tire changing machines market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in tire changing machines market are manual tire changing machines, semi-automatic tire changing machines and fully automatic tire changing machines.

In terms of vehicle type, passenger cars segment to command 52.3% share in the tire changing machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Cord Market

Tire Carousel Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA