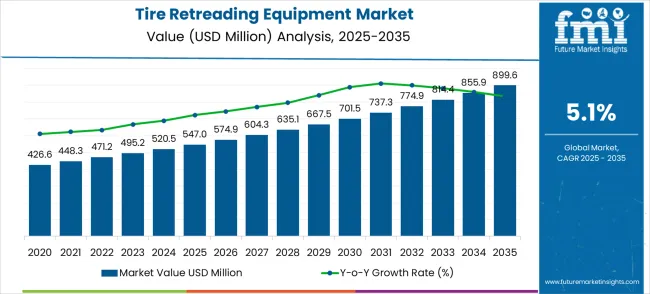

The tire retreading equipment market begins its growth decade from a USD 547.0 million foundation in 2025, establishing a solid platform for consistent expansion across global tire recycling and operations. The initial development phase demonstrates steady momentum building, with market value climbing from USD 574.9 million in 2026 to USD 737.3 million by 2030. This foundational period reflects increasing awareness and expanding tire retreading capacity requirements across emerging and developed automotive markets.

The acceleration phase witnesses enhanced growth dynamics, propelling the market from USD 774.9 million in 2031 to reach USD 899.6 million by 2035. Dollar increments during 2030-2035 maintain consistent progression, with annual value additions averaging USD 32.5 million compared to USD 38.1 million in the foundational phase. This progression represents a 64.4% total value increase over the forecast decade.

Market expansion drivers include growing environmental initiatives, rising tire disposal costs, and commercial fleet optimization requirements. The 5.1% compound annual growth rate positions market participants to capitalize on USD 352.6 million in additional value creation opportunities. This trajectory signals robust prospects for equipment manufacturers, technology providers, and tire retreading service facility developers across the global automotive aftermarket landscape.

Market expansion unfolds through two distinct growth phases, characterized by varying characteristics and development patterns. The 2025-2030 establishment period is expected to deliver USD 190.3 million in value additions, representing a 34.8% growth from the baseline position. Market dynamics during this phase center on technology adoption, environmental compliance initiatives, and operational efficiency improvement across tire retreading and automotive aftermarket facilities worldwide.

The 2030-2035 maturation period generates USD 162.3 million in incremental value, representing a 22.0% increase from the 2030 position. This phase exhibits mature market characteristics, characterized by enhanced competition, technological differentiation strategies, and circular economy-focused expansion initiatives. Value contributions shift from foundational capacity development to operational optimization and advanced automation integration in next-generation tire retreading facilities.

The competitive landscape evolves from emerging adoption to established market leadership positioning. The initial period emphasizes technology standardization and environmental compliance establishment within traditional tire retreading applications. The subsequent period witnesses intensified competition for advanced technology segments and commercial fleet service solution markets. Market maturation factors include standardized equipment specifications, automated operation integration capabilities, and cross-application development across passenger car tire retreading, commercial vehicle tire processing, and specialty tire renovation sectors.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 547.0 million |

| Market Forecast (2035) ↑ | USD 899.6 million |

| Growth Rate ★ | 5.1% CAGR |

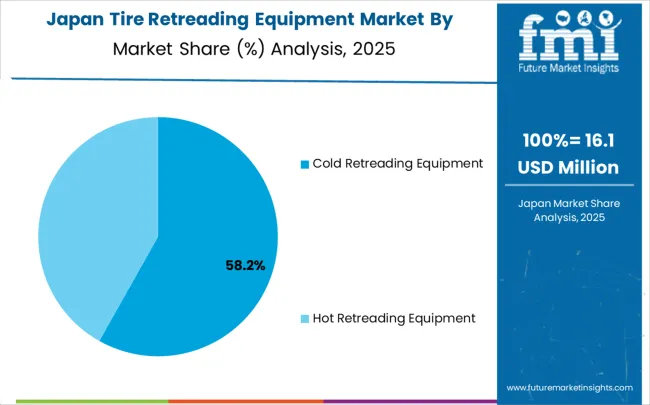

| Leading Segment → | Cold Retreading Equipment |

| Primary Application → | Commercial vehicle tires |

Market expansion rests on four fundamental shifts driving tire demand acceleration:

The growth faces challenges from high capital investment requirements and limitations in technical expertise. Quality consistency concerns create adoption barriers for smaller retreading facilities without specialized quality control systems. Technical complexity increases operational expenses through specialized maintenance requirements and skilled operator training programs.

Primary Classification: Equipment Type Distribution

Secondary Breakdown: Application Categories

Geographic Segmentation: Regional Market Distribution

Market Position: Cold retreading equipment establishes clear market leadership through superior quality consistency and operational flexibility benefits. Cold process systems eliminate heat-related limitations in demanding commercial tire retreading applications. Consistent processing capabilities enable precise material application where hot retreading alternatives cannot achieve required quality specifications.

Value Drivers: Advanced adhesive technology improvements enhance bonding strength uniformity and reduce processing time requirements. Digital control integration provides real-time temperature monitoring and curing optimization capabilities. Specialized processing capabilities accommodate multiple tire sizes within single operational configurations for enhanced productivity and operational flexibility.

Competitive Advantages: Cold retreading systems offer enhanced quality consistency compared to hot alternatives requiring complex temperature control procedures. Superior process control increases retreading success rates through precise material application in high-volume operations. Cost-effectiveness justification occurs through total operational cost advantages and quality improvement benefits in tire retreading facilities.

Market Challenges: Extended curing processes may increase cycle time requirements compared to hot retreading configurations. Quality control demands sophisticated monitoring equipment and technical expertise not available in all retreading facilities. Operational constraints create limitations for high-volume applications requiring rapid throughput and specialized processing procedures.

Strategic Market Importance: Commercial vehicle tire retreading represents the primary demand driver for advanced retreading equipment across global fleet management operations. Transportation fleet operations, logistics companies, and commercial vehicle manufacturers require precise tire retreading for cost optimization and operational efficiency. Quality control standards mandate consistent retreading performance for fleet efficiency and operational cost maintenance.

Market Dynamics Q&A:

Business Logic: Large-scale fleet operations prioritize operational cost efficiency and tire performance, making advanced tire retreading equipment essential for meeting fleet management targets. Cost justification occurs through improved tire lifecycle extension and reduced replacement costs. Quality assurance requirements demand consistent retreading properties for optimal fleet performance and safety standards.

Forward-looking Implications: Electric commercial vehicle adoption creates new requirements for specialized tire retreading systems with enhanced precision capabilities. Advanced fleet management demands improved retreading quality control for specialized applications. Global transportation growth equipment demand across expanding fleet regions with developing logistics infrastructure.

The tire retreading equipment market is primarily driven by increasing global environmental awareness, which requires superior performance and cost-effective tire lifecycle management. Applications in commercial fleet operations, logistics management, and transportation require equipment that maintains consistent retreading performance under demanding operational conditions, making advanced tire retreading equipment a crucial solution. The integration of automation and digital control systems into tire retreading operations underscores the importance of precise material application and process optimization, thereby ensuring consistent product quality. Stringent environmental regulations across global transportation sectors encourage the use of advanced retreading equipment that meets international standards and reduces environmental impact. Tire retreading equipment compliance with environmental and safety standards also makes it a preferred choice for critical fleet management applications, where documented operational performance is essential for regulatory compliance and environmental protection assurance, creating a stable demand pipeline globally.

Despite its advantages, the tire retreading equipment market faces several growth inhibitors. Capital investment costs are significantly higher than conventional tire replacement approaches, discouraging adoption in cost-sensitive fleet operations and smaller transportation companies. The installation and operational processes are complex, requiring specialized technical expertise, comprehensive quality protocols, and sophisticated auxiliary systems, which are not universally available. Limited availability of skilled technicians and retreading specialists further constrains operational capacity expansion. The technical complexity involved in operating and maintaining tire retreading equipment necessitates continuous training programs and specialized parts inventory, adding to operational overheads. Quality consistency concerns collectively slow market penetration, particularly in emerging transportation regions or quality-sensitive sectors, restraining market growth despite rising cost management demands.

The tire retreading equipment market is evolving rapidly, driven by technological innovations and advancements. Industry 4.0 integration allows precise control over retreading parameters, enhancing operational efficiency for specialized applications such as electric commercial vehicles, high-performance fleet tires, and advanced transportation management. Automation in retreading operations is another trend, reducing labor costs, improving process consistency, and minimizing operational risks. Circular economy initiatives are gaining traction, prompting the development of energy-efficient retreading methods that reduce environmental impact and operational costs. There is an increasing demand for modular equipment designs tailored to specific fleet requirements, offering operational flexibility while maintaining performance standards. These trends collectively indicate a market that is technologically advancing while responding to regulatory, environmental, and application-specific needs, ensuring growth and innovation.

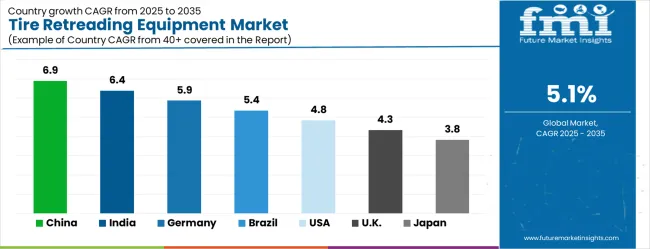

Global market dynamics reveal distinct performance tiers reflecting regional tire retreading capabilities and automotive aftermarket development levels. Growth Leaders, including China (6.9% CAGR) and India (6.4% CAGR), demonstrate expanding commercial vehicle ecosystems with advanced tire retreading technology adoption, while Germany (5.9% CAGR) represents European sustainability excellence in tire lifecycle management applications. Steady Performers such as Brazil (5.4% CAGR) and the United States (4.8% CAGR) show consistent demand growth aligned with fleet management modernization and retreading capacity requirements. Mature Markets, including the United Kingdom (4.3% CAGR) and Japan (3.8% CAGR) display moderate growth rates reflecting established market penetration and technology advancement focus.

Regional synthesis indicates Asia Pacific dominance through commercial vehicle production concentration and fleet management requirements. European markets emphasize sustainability excellence and environmental compliance in tire management applications. North American demand reflects fleet optimization adoption and sustainable tire management development initiatives.

| Country | CAGR (%) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

China establishes market leadership through commercial vehicle sector dominance across integrated logistics operations, fleet management facilities, and transportation infrastructure installations. A 6.9% CAGR value reflects extensive commercial vehicle capacity and export-oriented transportation requirements driving consistent demand for high-performance tire retreading equipment. Growth metrics demonstrate comprehensive transportation industry modernization supported by government infrastructure development initiatives and stringent environmental improvement mandates across logistics sectors.

Market dynamics center on sustainable transportation expansion creating new high-efficiency tire retreading requirements for enhanced cost efficiency and substantial environmental reduction targets. State-owned logistics enterprise modernization programs drive widespread adoption of advanced retreading equipment for operational cost improvement and international competitiveness. Export market demands necessitate strict international quality standard adherence through extensively documented performance specifications and certification processes.

Manufacturing concentration in major logistics regions creates significant demand density for high-performance tire retreading equipment and specialized applications. Industrial development policies specifically include advanced sustainability equipment requirements for comprehensive environmental upgrading initiatives. Foreign technology transfer partnerships bring international transportation standards requiring advanced tire retreading applications and technical expertise development.

Strategic Market Indicators:

India demonstrates robust growth potential through rapidly expanding commercial transportation capabilities and comprehensive government promotion of domestic logistics development initiatives under various infrastructure advancement programs. A 6.4% CAGR reflects increasing transportation sophistication and widespread sustainability standard adoption across fleet management sectors. Transportation industry growth under government initiatives creates consistent demand for advanced tire retreading equipment across both integrated logistics complexes and specialty fleet management facilities.

E-commerce logistics sector expansion drives significant secondary demand through stringent cost requirements for commercial transportation and delivery applications. Government transportation certification mandates actively promote advanced retreading equipment adoption for enhanced cost compliance and international standard adherence. Major infrastructure development projects substantially increase commercial vehicle volumes requiring comprehensive tire retreading applications and specialized cost management systems.

Market activity centers on comprehensive technology transfer agreements bringing international fleet management standards and best practices to domestic transportation facilities. Foreign direct investment in logistics operations introduces advanced tire retreading requirements for improved operational cost efficiency and competitive advantage. Skill development initiatives include extensive training programs for advanced retreading equipment operation techniques and quality control procedures.

Market Intelligence Brief:

Germany maintains market leadership through exceptional environmental sustainability excellence and established tire lifecycle management traditions across diverse transportation sectors. A 5.9% CAGR demonstrates sustained market demand supported by an advanced environmental industrial base with sophisticated tire retreading capabilities and premium sustainability management expertise. Transportation sector strength creates consistent demand for high-performance tire retreading equipment across precision fleet management and advanced environmental compliance applications requiring superior processing properties.

Logistics equipment manufacturing sector requires extensively certified equipment specifications for strict export compliance and adherence to international environmental quality standards. Environmental services sector utilizes premium retreading equipment for advanced sustainability development and comprehensive lifecycle assessment applications requiring precise environmental characteristics. Quality standard development significantly influences global transportation practices requiring advanced equipment adoption and environmental innovation.

Advanced sustainability research initiatives continuously develop innovative applications for tire retreading equipment across emerging environmental sectors. Export market leadership necessitates comprehensive environmental documentation supporting international transportation sales and regulatory compliance requirements.

Performance Metrics:

Brazil represents a significant emerging transportation market with substantial growth potential, achieving a 5.4% CAGR through comprehensive infrastructure development initiatives and commercial vehicle expansion across domestic and regional markets. The market reflects increasing transportation sophistication and widespread sustainability standard adoption driven by government policies promoting domestic fleet management capabilities. Transportation industry modernization creates consistent demand for advanced tire retreading equipment across integrated logistics facilities and specialty fleet management installations.

Commercial transportation growth drives primary market demand through domestic logistics expansion and regional export requirements for Latin American transportation markets. Fleet management sector expansion creates substantial opportunities for precision retreading applications and advanced cost management solutions. Infrastructure sector development significantly increases commercial vehicle volumes requiring quality fleet management capabilities and advanced retreading systems.

Market development faces challenges including economic volatility affecting transportation investment decisions and currency fluctuation impacting imported high-performance equipment costs. Infrastructure development projects support transportation sector growth requiring precision fleet management capabilities and advanced tire retreading applications.

Strategic Market Considerations:

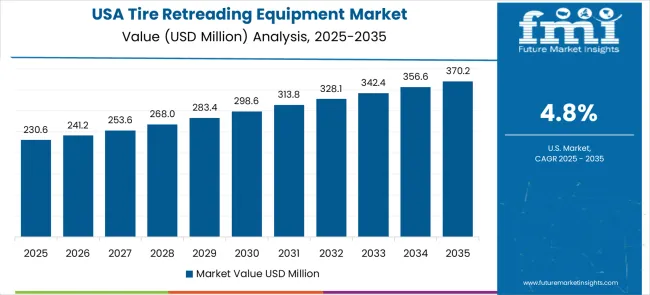

The United States market demonstrates steady and sustained growth with a 4.8% CAGR through comprehensive fleet management sector leadership and strategic transportation optimization initiatives driving advanced logistics development. The market reflects an established transportation industrial base with significant sustainability adoption trends and advanced tire retreading capabilities. Fleet management sector leadership creates substantial demand for advanced tire retreading equipment and comprehensive cost optimization systems meeting stringent transportation regulatory requirements.

Logistics industry leadership requires precision retreading applications for critical fleet management and specialized high-performance transportation procedures. Transportation sector maintains a consistent demand for quality-certified retreading procedures and advanced equipment specifications supporting innovative fleet optimization. Sustainability automation adoption creates sophisticated requirements for retreading equipment integration with advanced fleet management execution systems.

Transportation competitiveness initiatives encourage substantial investment in advanced retreading equipment and comprehensive sustainability technologies supporting fleet optimization advancement. Environmental compliance requires extensively documented retreading procedures supporting regulatory approval processes and international market access requirements across global logistics distribution networks.

Market Dynamics:

The United Kingdom demonstrates strong market stability through comprehensive transportation innovation and strategic fleet management advancement initiatives across key logistics sectors. A 4.3% CAGR market value reflects an established transportation base with strong emphasis on sustainability excellence and precision fleet development applications. Fleet management sector strength creates substantial demand for precision tire retreading applications in critical logistics operations and advanced transportation procedures.

Commercial vehicle sector requires precision retreading equipment for fleet management and regulatory compliance operations meeting stringent environmental quality and sustainability standards. Logistics organizations maintain strict quality standard requirements for international transportation markets and global competitiveness supporting advanced fleet development. Transportation research initiatives continuously develop innovative applications for precision retreading equipment and comprehensive sustainability systems.

Post-Brexit transportation considerations create significant opportunities for domestic fleet management growth requiring precision sustainability capabilities and advanced retreading solutions supporting transportation independence. Government logistics strategy initiatives actively support advanced retreading technology adoption and comprehensive innovation development across fleet management sectors.

Current Market Observations:

Japan maintains technological leadership through exceptional precision fleet management excellence and comprehensive quality standard development across diverse transportation sectors. A 3.8% CAGR market value reflects a mature transportation market with established precision tire retreading equipment adoption across industries and advanced fleet management capabilities. Transportation sector leadership creates consistent demand for advanced retreading technologies and comprehensive tire lifecycle management equipment meeting strict logistics quality requirements.

Commercial vehicle manufacturing sector requires precision retreading equipment for fleet development and comprehensive sustainability applications ensuring reliable transportation performance across global markets. Logistics technology industry utilizes specialized retreading applications for precision fleet management and comprehensive quality procedures supporting advanced transportation delivery systems. Quality management system development significantly influences global transportation practices and retreading technology adoption standards.

Transportation technology exports include precision retreading equipment requirements for international fleet facilities and comprehensive technology transfer programs supporting global logistics advancement. Research and development initiatives continuously advance retreading methodologies and comprehensive sustainability technologies supporting transportation innovation across emerging fleet applications.

Market Status Indicators:

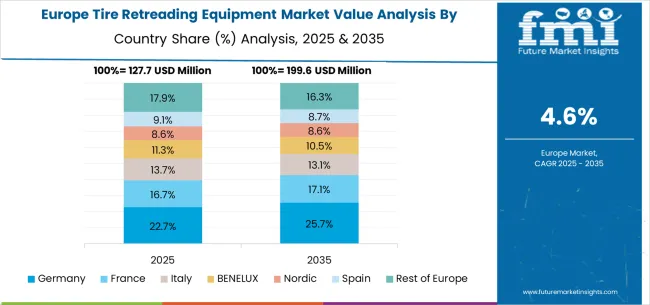

The tire retreading equipment market in Europe is projected to grow steadily, supported by strong environmental regulations and advanced fleet management demand for sustainable tire solutions. The market value in Europe is estimated at USD 121.4 million in 2025, with Germany leading the region with a 41.2% share, driven by its robust environmental standards and advanced commercial vehicle fleet management capabilities. The United Kingdom follows with a 19.4% market share, benefiting from fleet optimization initiatives and stringent sustainability standards in transportation requiring precision tire retreading. France holds 15.1% of the market, supported by expansions in logistics infrastructure and environmental compliance investments requiring comprehensive retreading systems. Italy and Spain collectively represent 16.7% of European demand, spurred by commercial transportation development and growing adoption of sustainable tire management technologies. The Rest of Europe, including Nordic countries, BENELUX region, and Eastern European nations, accounts for 7.6% of the market, backed by specialized fleet applications and expanding commercial transportation operations. This diverse regional distribution highlights Europe's significance as a key market for tire retreading equipment, driven by evolving environmental regulations, sustainability advancement requirements, and stringent quality standards across multiple sectors including logistics, commercial transportation, fleet management, and environmental compliance applications.

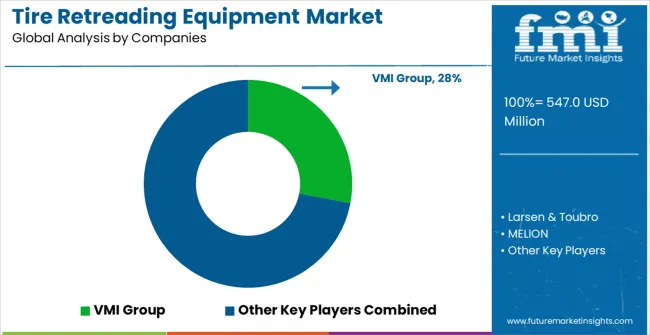

The Tire Retreading Equipment market is defined by competition among specialized manufacturing equipment producers, sustainable technology companies, and comprehensive fleet solution providers. Companies are investing in advanced retreading methodology development, automation integration optimization, environmental compliance improvements, and comprehensive service capabilities to deliver reliable, sustainable, and cost-effective tire lifecycle management solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

VMI Group offers comprehensive tire retreading equipment solutions with established engineering expertise and industry-leading sustainability capabilities for large-scale fleet operations. Larsen & Toubro provides specialized retreading technology with a focus on operational efficiency and advanced automation integration. MELION delivers advanced retreading equipment solutions with emphasis on environmental compliance and processing optimization. TRM srl specializes in professional retreading systems with advanced automation design integration and comprehensive project delivery capabilities.

Akarmak offers precision retreading equipment with comprehensive regional fleet support capabilities. ELGI Rubber Company delivers established tire retreading solutions with advanced processing technologies and cost-effective implementations. Marangoni SpA provides specialized retreading services with a focus on quality assurance optimization. Mesnac, Guilin Rubber Machinery, and other regional players offer specialized engineering expertise, equipment reliability, and comprehensive sustainability development across global and regional market segments.

The tire retreading equipment market is central to transportation excellence, fleet cost management, environmental compliance advancement, and circular economy initiatives. With increasing demands for operational efficiency, environmental compliance, and cost optimization, the sector faces pressure to balance capital investment costs, technology complexity, and service accessibility measures. Coordinated action from governments, industry bodies, equipment manufacturers, fleet operators, and investors is essential to transition toward environmentally friendly, technologically advanced, and economically viable tire retreading systems.

How Governments Could Spur Local Infrastructure and Adoption?

How Industry Bodies Could Support Market Development?

How Equipment Manufacturers and Technology Players Could Strengthen the Ecosystem?

How Fleet Operators Could Navigate the Sustainability Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 547.0 million |

| Equipment Type | Cold Retreading Equipment, Hot Retreading Equipment |

| Application | Commercial Vehicle Tires, Passenger Car Tires, Engineering Vehicle Tires, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | VMI Group, Larsen & Toubro, MELION, TRM srl, Akarmak, ELGI Rubber Company, Marangoni SpA, Mesnac, Guilin Rubber Machinery |

| Additional Attributes | Dollar sales by equipment categories, regional demand trends across Asia Pacific, Europe, and North America, competitive landscape with service provider descriptions, adoption patterns across commercial transportation and fleet management industries, integration with sustainability initiatives, innovations in retreading technology and automation control, and development of specialized applications with enhanced environmental performance |

The global tire retreading equipment market is estimated to be valued at USD 547.0 million in 2025.

The market size for the tire retreading equipment market is projected to reach USD 899.6 million by 2035.

The tire retreading equipment market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in tire retreading equipment market are cold retreading equipment and hot retreading equipment.

In terms of application, commercial vehicle tires segment to command 71.8% share in the tire retreading equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Cord Market

Tire Carousel Market

Tire Inflating Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA