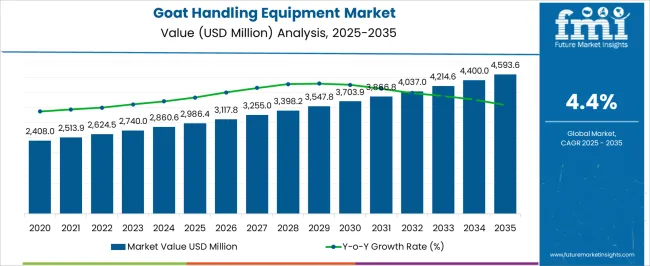

The Goat Handling Equipment Market is estimated to be valued at USD 2986.4 million in 2025 and is projected to reach USD 4593.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Goat Handling Equipment Market Estimated Value in (2025 E) | USD 2986.4 million |

| Goat Handling Equipment Market Forecast Value in (2035 F) | USD 4593.6 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The goat handling equipment market is expanding due to rising demand for efficient livestock management, improved animal welfare standards, and the growing adoption of mechanized farming practices. Increasing herd sizes and the commercial importance of goat-derived products such as milk, meat, and fiber have accelerated the need for durable and efficient equipment solutions.

Farmers are increasingly investing in modern tools that reduce manual labor, enhance productivity, and minimize animal stress during handling. Advancements in material strength, automation technologies, and ergonomic designs are supporting long-term adoption across both developed and emerging economies.

Government-backed initiatives promoting livestock productivity and welfare are further reinforcing equipment usage. The outlook remains positive as technology integration, durability, and operational efficiency continue to define purchasing decisions, positioning modern goat handling equipment as an indispensable component in sustainable livestock management.

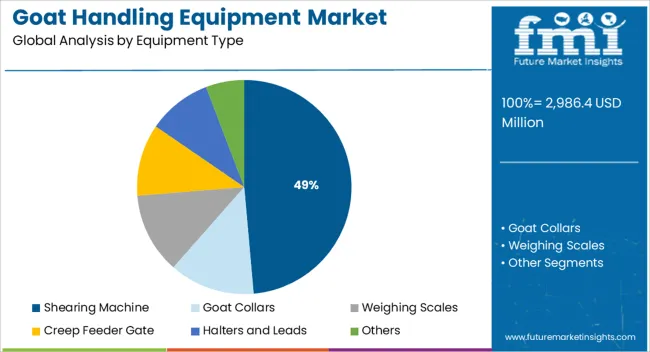

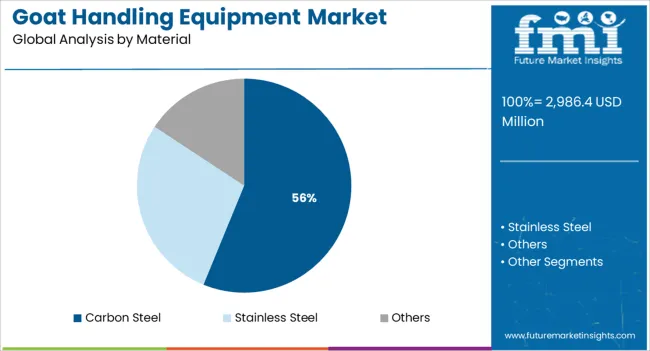

The market is segmented by Equipment Type, Material, and Operation and region. By Equipment Type, the market is divided into Shearing Machine, Goat Collars, Weighing Scales, Creep Feeder Gate, Halters and Leads, and Others. In terms of Material, the market is classified into Carbon Steel, Stainless Steel, and Others. Based on Operation, the market is segmented into Automatic, Manual, and Semi-Automatic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shearing machine segment is projected to hold 48.60% of the total market revenue by 2025 within the equipment type category, making it the leading segment. Its dominance is driven by the increasing demand for efficient wool and fiber collection processes, reduced handling time, and improved animal comfort during shearing.

Mechanized shearing solutions provide consistency, safety, and reduced labor intensity, which are critical factors in commercial goat farming. Adoption is further supported by the need for faster processing during peak shearing seasons and the ability of modern machines to ensure high-quality fiber yield.

These advantages have solidified the segment’s position as the primary contributor within equipment type.

The carbon steel segment is expected to contribute 56.20% of total market revenue by 2025 within the material category, positioning it as the dominant segment. Carbon steel is widely preferred for its strength, durability, and resistance to wear and tear, making it ideal for equipment subjected to frequent and heavy use.

The material’s cost-effectiveness compared to high-grade alloys has further supported its widespread adoption among small and large-scale farmers. Equipment manufactured from carbon steel ensures long service life, reduced maintenance, and reliability in demanding farm environments.

These attributes have enabled carbon steel to maintain its leadership position in the material category.

Automation and Robotics

The adoption of automation and robotics is on the rise in the goat-handling equipment industry. Manufacturers are developing automated feeders, milking machines, and other devices that can improve efficiency and reduce labor costs.

IoT (Internet of Things) Technology

IoT technology is being used by several manufacturers to monitor and track the health and well-being of goats and to gather data on their behavior and preferences. This technology can help farmers improve the productivity and quality of their goat herd.

Materials and Design

Innovation in materials and design is also playing a role in the production of goat-handling equipment. Equipment made from lightweight yet durable materials, easy to clean and sanitize, and designed with animal welfare in mind is in high demand.

With advances in technology, there is a potential for the development of new and innovative equipment that can improve efficiency, reduce labor costs, and increase productivity. This new equipment could be a great opportunity for manufacturers, who will be able to sell them for a good profit margin.

In addition, due to a growing population in developing countries and an increasing demand for goat products, there is an opportunity to expand into new markets such as Asia and Africa. These markets have large growth potential and could be a significant source of revenue for manufacturers.

As the demand for goat products increases, there is also a growing demand for value-added products such as cheese, yogurt, and skin care products. These products can offer higher profit margins than traditional meat and milk products and could be an area of growth for manufacturers and investors.

| Report Attributes | Details |

|---|---|

| Goat Handling Equipment Market Value (2025) | USD 2986.4 million |

| Goat Handling Equipment Market CAGR (2025 to 2035) | 4.4% |

| Anticipated Goat Handling Equipment Market Value (2035) | USD 4593.6 million |

According to Future Market Insights, the goat-handling equipment industry rose at a CAGR of 3.9% from USD 2,247.02 million in 2020 to USD 2,618.6 million in 2025.

The rising demand for meat and dairy products globally has led farmers to adopt goat-handling equipment to reduce labor and increase the productivity of their animals. Proper and timely feed delivery using these machines is also anticipated to create opportunities for manufacturers. As they improve efficiency and reduce costs in animal husbandry processes, the demand for goat-handling equipment is likely to rise during the forecast period.

| Attribute | Valuation |

|---|---|

| 2025 | USD 2,986.42 million |

| 2035 | USD 3,398.23 million |

| 2035 | USD 4,036.97 million |

The market is anticipated to garner a CAGR of 4.4% during the forecast period, surpassing USD 4,215 million by 2035. The use of highly automated and sophisticated technology used to satisfy the need of livestock producers is the major driving force behind this growth.

Short Term (2025 to 2025): The rise in demand for compound feed and feed additives has given machinery manufacturers the opportunities to fulfill demand by supplying a variety of equipment and cutting-edge technology. The market is expected to grow during this period due to the expansion of feed-based industries.

Medium Term (2025 to 2035): The increasing demand for automated production line operations among manufacturers in various industries is likely to boost sales of goat-handling equipment and, in turn, drive market growth.

Long Term (2035 to 2035): The use of advanced technologies in the manufacturing of goat-handling equipment is likely to support market growth. As the goat population is expected to increase, manual herd management will become more difficult, leading to a growing demand for goat-handling equipment to assist with routine feeding and herd management.

With a share of 25%, the shearing machine segment is anticipated to dominate the market by 2035. This shearing machine segment is expected to be in high demand as it is a crucial process for grooming and wool production in goat farms. This creates an opportunity for manufacturers to focus on creating advanced and efficient shearing machines to meet this demand. Companies looking to enter the market can focus on research and development to offer innovative equipment targeting this segment.

The stainless-steel segment dominated the market with a share of 40% in 2025. However, during the forecast period, market trends indicate that the carbon steel segment is anticipated to be in high demand due to its exceptional properties such as strength, durability, and resistance to corrosion.

The adoption of carbon steel in the production of goat-handling equipment is the latest trend in the market anticipated to catch the attention of key players. In addition, the cost-effectiveness and longevity of carbon steel as a preferred material presents a lucrative opportunity for companies looking to enter the market.

The automatic segment is expected to lead the goat-handling equipment industry with a CAGR of 6% during the forecast period. This is due to the growing demand for automation in the agricultural sector, which enables farmers to achieve increased precision, control, and efficiency in their livestock operations. Automated systems can help to cut labor expenses and boost productivity, leading to cost savings and improved performance. Furthermore, this segment is appealing to the farmers due to the added benefit of increased safety and reduced animal discomfort provided by the automated systems.

| Country | United States |

|---|---|

| Market Share (2025 to 2035) | 29.6% |

| Market Value by 2035 (in USD million) | 4593.6 |

| Country | Germany |

|---|---|

| Market Share (2025 to 2035) | 17.5% |

| Market Value by 2035 (in USD million) | 459.2 |

| Country | United Kingdom |

|---|---|

| Market Share (2025 to 2035) | 8.7% |

| Market Value by 2035 (in USD million) | 361.0 |

| Country | Japan |

|---|---|

| Market Share (2025 to 2035) | 5.3% |

| Market Value by 2035 (in USD million) | 139.4 |

| Country | China |

|---|---|

| Market Share (2025 to 2035) | 8.6% |

| Market Value by 2035 (in USD million) | 318.1 |

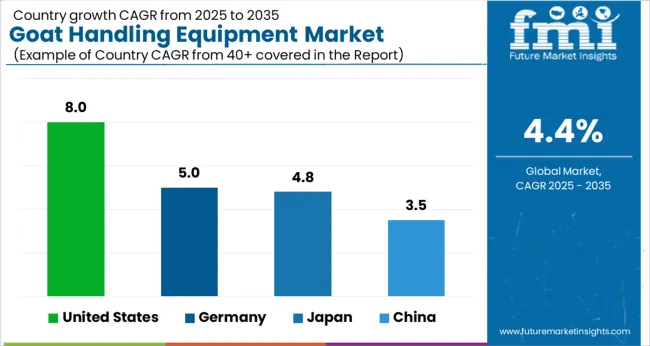

The United States goat handling equipment market is anticipated to surpass USD 4593.6 million by 2035, rising at a CAGR of 8% during the forecast period.

Factors driving the growth of the goat handling equipment market in the United States include increasing consumer demand for goat meat and dairy products, as well as rising interest in small-scale and hobby farming. In addition, the United States is home to a large and diverse goat population, making it a prominent goat-handling equipment industry.

The United States Department of Agriculture (USDA) data show that the number of goats in the United States has been consistently increasing over the years and is expected to witness significant growth during the forecast period. This increase in the number of goats leads to an increased demand for goat-handling equipment, which is likely to drive the growth of the market.

The market in the United States is expected to be further driven by advancements in technology and the introduction of new and innovative products. Many goat-handling equipment manufacturers are currently focusing on developing automated feeding systems, portable housing solutions, and other specialized tools to meet the specific needs of farmers and ranchers.

Germany is likely to hold a 17.5% share of the global goat-handling equipment industry. The German goat-handling equipment industry is anticipated to be worth USD 459.2 million by 2035, recording a CAGR of 5% during the forecast period.

Germany is known for its efficient and advanced agricultural sector, and the country has a considerable number of farmers producing goat's milk and meat. The increasing demand for organic and specialty goat products is driving the growth of the market in Germany. Also, the increasing trend of small-scale and hobby farming is expected to further boost the market for goat-handling equipment in Germany.

The German government is also supporting the farmers by providing them with subsidies and other incentives which in turn, is expected to drive the growth of the market in the country. This support is expected to encourage farmers to invest more in goat-handling equipment, which is likely to increase productivity and efficiency in the goat-farming sector.

According to FMI, the United Kingdom's goat-handling equipment industry is estimated to be worth USD 361 million by 2035, with a projected CAGR of 4.7% during the forecast period. This suggests that the demand for goat-handling equipment in the United Kingdom is likely to increase at a moderate pace.

Japan's goat-handling equipment industry is to reach USD 139.4 million by 2035, expanding at a moderate CAGR of 4.8% over the projected period. Due to urbanization and increased demand for goat milk and meat, the region's sales of goat-handling equipment are increasing. The rising cost of raw materials for animal usage is driving up demand for goat handling equipment. The healthy expansion of the processed meat sector also contributes to market growth.

China accounts for 8.6% of the goat-handling equipment industry, with a 3.5% CAGR during the projection period. Due to the region's high consumption of goat meat, China's goat handling equipment sector is expected to exceed USD 318.1 million by 2035. The market is primarily driven by rising government incentives for automation as a result of population growth, technological advancements, and the consolidation of goat-handling equipment manufacturers. The expansion of China's goat-handling equipment industry benefits both the development of the country's livestock industry and the expansion of export opportunities for other nations.

Significant players in the market are focusing on developing innovative products to satisfy diversifying needs of the farmers. One leading trend in the market is the use of automatic feeding systems for goats. These systems use sensors to monitor the feed level in the trough and automatically dispense feed as needed.

Another innovation in the goat-handling equipment industry is the use of portable, modular housing solutions for goats. These housing solutions can be quickly and easily assembled on-site and can be customized to meet the specific needs of different operations. They are particularly useful for farmers and ranchers who need to frequently move their goats to new pastures.

In addition, several companies are now producing equipment that can be used for milking and breeding goats, which can ease the process of milking and breeding goats. The equipment automates the process and makes it more efficient.

Goat-handling equipment manufacturers are focusing on developing health management equipment. These include equipment such as weighing scales and feed analysis systems that help farmers and ranchers monitor the health and nutritional status of their goats.

Leading Manufacturers in the Goat Handling Equipment Industry:

Recent Developments in the Goat Handling Equipment Industry:

The global goat handling equipment market is estimated to be valued at USD 2,986.4 million in 2025.

The market size for the goat handling equipment market is projected to reach USD 4,593.6 million by 2035.

The goat handling equipment market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in goat handling equipment market are shearing machine, goat collars, weighing scales, creep feeder gate, halters and leads and others.

In terms of material, carbon steel segment to command 56.2% share in the goat handling equipment market in 2025.

The global goat handling equipment market is estimated to be valued at USD 2,986.4 million in 2025.

The market size for the goat handling equipment market is projected to reach USD 4,593.6 million by 2035.

The goat handling equipment market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in goat handling equipment market are shearing machine, goat collars, weighing scales, creep feeder gate, halters and leads and others.

In terms of material, carbon steel segment to command 56.2% share in the goat handling equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Goat Milk Products Market Size and Share Forecast Outlook 2025 to 2035

Goat Creep Feeder Market Analysis by Material, Operation, Application and Region: A Forecast for 2025 and 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Sheep and Goat Equipment Market Size and Share Forecast Outlook 2025 to 2035

Air Handling Unit Market Size and Share Forecast Outlook 2025 to 2035

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Glass Handling Robot Market Trends & Forecast 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Manure Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Monorails Market

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA