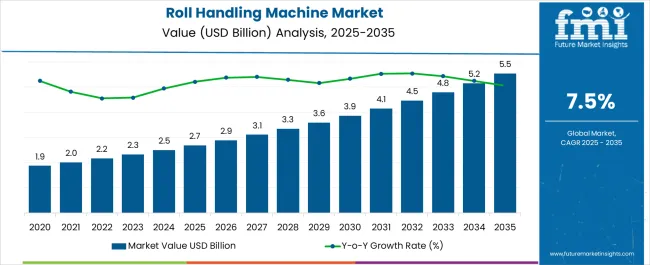

The Roll Handling Machine Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Roll Handling Machine Market Estimated Value in (2025 E) | USD 2.7 billion |

| Roll Handling Machine Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Roll Handling Machine market is experiencing steady growth, driven by the increasing demand for efficient material handling solutions across the paper and packaging industries. Rising production volumes and the need for automation in manufacturing processes are fueling the adoption of advanced roll handling systems. Continuous advancements in machine technology, including automatic control, real-time monitoring, and integration with industrial automation systems, are improving operational efficiency, reducing labor dependency, and enhancing workplace safety.

Growing focus on minimizing downtime, optimizing throughput, and maintaining product quality is further supporting market expansion. The demand for energy-efficient and ergonomically designed machines is also increasing, driven by sustainability initiatives and occupational health considerations.

Manufacturers are investing in research and development to improve machine flexibility, load capacity, and adaptability to various roll sizes and weights As paper and packaging industries continue to modernize and adopt smart factory concepts, the market for roll handling machines is expected to witness sustained growth, with automated, high-performance solutions serving as key enablers for efficiency and cost-effectiveness.

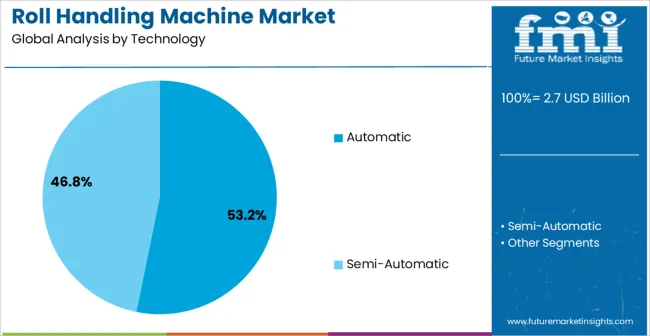

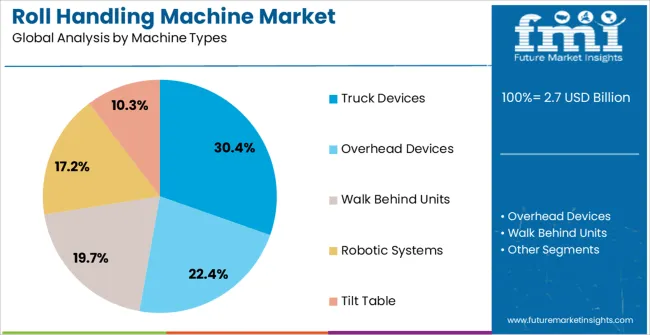

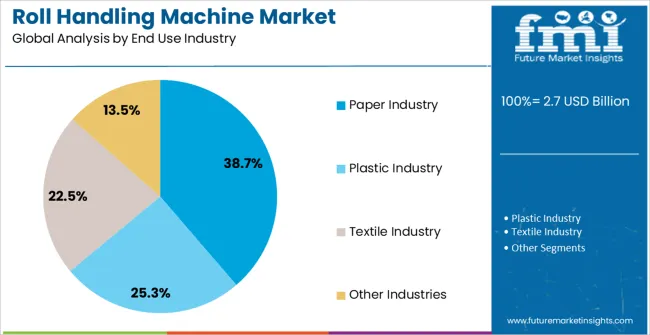

The roll handling machine market is segmented by technology, machine types, end use industry, and geographic regions. By technology, roll handling machine market is divided into Automatic and Semi-Automatic. In terms of machine types, roll handling machine market is classified into Truck Devices, Overhead Devices, Walk Behind Units, Robotic Systems, and Tilt Table. Based on end use industry, roll handling machine market is segmented into Paper Industry, Plastic Industry, Textile Industry, and Other Industries. Regionally, the roll handling machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic technology segment is projected to hold 53.2% of the market revenue in 2025, establishing it as the leading technology category. Growth in this segment is being driven by the increasing preference for automation to improve efficiency, reduce labor costs, and minimize human error in material handling operations.

Automatic roll handling machines are equipped with features such as programmable controls, real-time load monitoring, and integration with industrial production systems, which allow for smoother, faster, and safer handling of heavy rolls. The capability to handle high production volumes with minimal operator intervention enhances productivity and reduces operational risk.

In addition, automatic systems provide precise movement, alignment, and placement of rolls, which is essential for maintaining product quality and minimizing damage As industries increasingly adopt Industry 4.0 concepts and smart manufacturing practices, automatic roll handling technology is expected to maintain its leadership, driven by technological innovations that improve efficiency, reliability, and adaptability in complex production environments.

The truck devices machine type segment is expected to account for 30.4% of the market revenue in 2025, making it the leading machine type. Its growth is being driven by the need for flexible and mobile solutions that can transport heavy rolls efficiently across production floors and warehouses. Truck devices offer maneuverability and adaptability, allowing for easy integration into existing workflows without requiring significant infrastructure modifications.

These machines enhance safety by reducing manual handling and minimizing the risk of workplace injuries while improving operational speed. The ability to transport rolls of various sizes and weights reliably supports high-volume production environments.

As paper and packaging industries continue to adopt lean manufacturing practices and emphasize safety and productivity, truck devices are expected to remain a preferred machine type Their versatility, combined with ease of operation and integration into automated systems, ensures sustained demand and reinforces their leading position in the market.

The paper industry segment is projected to hold 38.7% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is driven by the increasing need for efficient roll handling in paper manufacturing, processing, and packaging operations. The sector requires high-capacity machines capable of transporting heavy and bulky rolls while maintaining product integrity and minimizing downtime.

Automation and integration with production lines enhance operational efficiency, reduce labor dependency, and improve workplace safety. Rising global demand for paper products, coupled with the adoption of smart factory concepts, is supporting investment in advanced roll handling solutions.

Additionally, the focus on energy efficiency, sustainability, and compliance with safety standards is driving the modernization of material handling equipment in paper plants As production volumes continue to increase and operational efficiency becomes more critical, the paper industry segment is expected to remain the primary revenue contributor, supported by ongoing technological innovations and automation trends in roll handling systems.

Rolls of various materials are manufactured such as foil, paper, film, textiles, and nonwovens on cores of surfaces such as metal, cardboard or plastic. Handling of these rolls is important in order to transport them for further processing. In roll handling, rolls are manufactured and then wounded on core for web processing and then transported to other convertors for processing.

With roll handling machine, firstly rolls are handled and are transferred to convertors for further processing and packaging purposes. It provides faster way of handling rolls. Carrying out manual roll handling and packaging may cause back injuries to employees which costs industries millions of dollars in the form of compensation. Roll handling machine prevent lots of problems caused by manual work.

Also manual work may cause damage to rolls, which result in wastage of material. There are various devices available for roll handling such as truck devices, overhead roll handling devices, walk behind roll handling devices, automatic and semi-automatic robotic systems and other such devices. The truck devices are further divided into various types. The global roll handling machine market is anticipated to witness high preference among manufacturers across the globe due to various advantages.

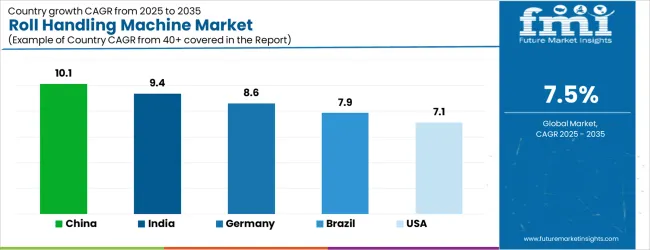

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

The Roll Handling Machine Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Roll Handling Machine Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Roll Handling Machine Market is estimated to be valued at USD 1.0 billion in 2025 and is anticipated to reach a valuation of USD 1.0 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 123.2 million and USD 84.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Technology | Automatic and Semi-Automatic |

| Machine Types | Truck Devices, Overhead Devices, Walk Behind Units, Robotic Systems, and Tilt Table |

| End Use Industry | Paper Industry, Plastic Industry, Textile Industry, and Other Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumpf, R&D ERGO, Packline, Tilt-Lock, ASE Systems, Torros, AZTECH Converting System, Easy Lift Equipment, Hofpartner AB, Dotec B.V., and Factory Supply Inc. |

The global roll handling machine market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the roll handling machine market is projected to reach USD 5.5 billion by 2035.

The roll handling machine market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in roll handling machine market are automatic and semi-automatic.

In terms of machine types, truck devices segment to command 30.4% share in the roll handling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roller Gear Cam Unit Market Size and Share Forecast Outlook 2025 to 2035

Roller Press Gear Units Market Size and Share Forecast Outlook 2025 to 2035

Roll Type Thermal Paper Market Forecast and Outlook 2025 to 2035

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Roller Sports Product Market Size and Share Forecast Outlook 2025 to 2035

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Roll-up Laminate Tubes Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Roll Containers Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Roll-Your-Own Tobacco Products Market Trends - Growth & Forecast 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Market Share Breakdown of Roll Containers Manufacturers

Rolle Market

Roll-on Bottles Market

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Roll Forming Machines

Roll Forming Machine Market by Type from 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA