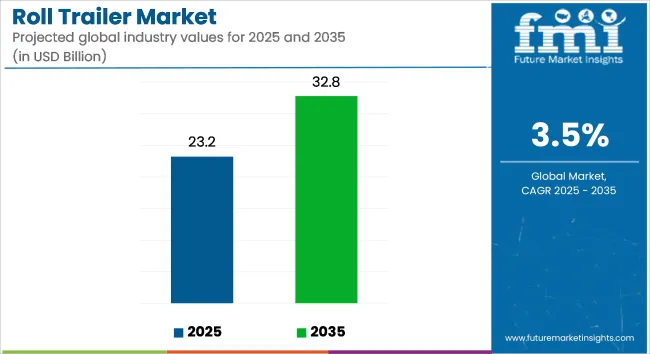

The global roll trailer market is estimated at USD 23.2 billion in 2025 and projected to reach USD 32.8 billion by 2035, exhibiting a CAGR of 3.5% over the forecast period. Market expansion is being supported by continued growth in logistics, construction, and industrial shipping sectors, where intermodal cargo handling has relied on robust and modular trailer platforms.

In late 2024, America Made Dumpsters introduced a roll-off trailer designed for roofing contractors. The product was engineered for use with standard 10- to 15-yard dumpsters and developed to improve maneuverability in residential and commercial job sites, reducing reliance on large dump trucks.

Joloda Hydraroll launched its Modular Rollerbed System with Powered Cargo Rollers in 2024. The system was designed to retrofit existing trailers with low-profile pneumatic rollers capable of lifting air cargo pallets and ULDs. As stated by the company, installation can be completed in under a day without modifying the trailer frame, offering operational flexibility in air and road freight logistics.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 23.2 billion |

| Projected Market Size in 2035 | USD 32.8 billion |

| CAGR (2025 to 2035) | 3.5% |

Roll trailer configurations have increasingly included tilt-bed, flatbed, and roller-deck variants, engineered to reduce material handling time and damage during transfers. Structural advancements such as reinforced steel chassis, integrated tie-down points, and hydraulic assist mechanisms have been adopted to support demanding applications in heavy-haul and project cargo transport.

Industrial usage has expanded to include mining equipment mobility and temporary manufacturing modules. Roll trailers equipped with pneumatic deck systems have been deployed at coastal and rail terminals for container repositioning and multimodal cargo integration.

Maintenance practices have evolved, with powder-coated surfaces and sealed components used to reduce corrosion risks in outdoor environments. Retrofit kits for hydraulic and flooring systems have been developed to extend the service life of aging fleets.

With infrastructure investments and supply chain modernization initiatives projected to continue through 2035, demand for high-durability, modular roll trailers is expected to remain strong. Manufacturers are anticipated to prioritize improvements in system integration, structural resilience, and safety technologies to meet evolving freight handling requirements.

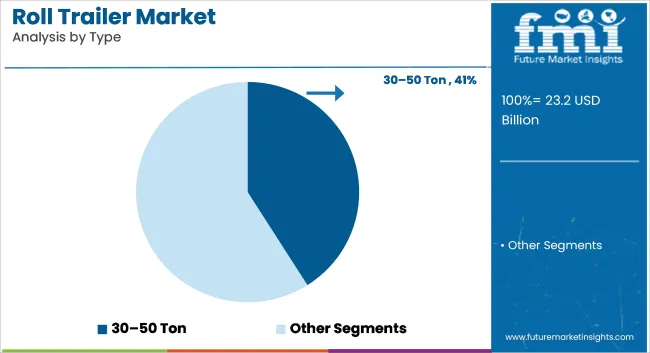

In 2025, 30-50 ton lifting systems hold an estimated 41% share of the global market and are projected to grow at a CAGR of 3.6% through 2035. Their adoption is supported by high versatility, operational efficiency, and cost-effectiveness in handling medium-load applications.

These systems are widely used in dockside cargo handling, mid-rise construction sites, prefabricated structure assembly, and heavy equipment transportation. In 2025, construction contractors and port operators continue to favor this capacity range for its balance between maneuverability and payload.

Manufacturers focus on enhancing hydraulic precision, safety locking mechanisms, and frame durability to meet regulatory standards and operator requirements. Deployment remains strong in Asia-Pacific and the Middle East where infrastructure development and industrial logistics expansion support consistent demand.

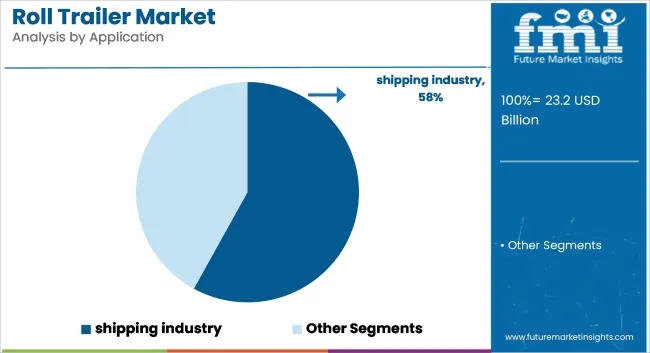

The shipping industry holds approximately 58% of the global lifting systems market by application in 2025 and is projected to grow at a CAGR of 3.7% through 2035. This dominance is supported by ongoing global trade expansion, container traffic growth, and increasing vessel sizes requiring specialized lifting solutions for cargo transfer, maintenance, and portside operations.

Lifting systems are deployed extensively at seaports, shipyards, and onboard vessels to manage shipping containers, heavy machinery, and modular storage units. Equipment specifications prioritize corrosion-resistant materials, compact structure design, and load stability under dynamic conditions.

Demand is concentrated in maritime hubs such as Singapore, Rotterdam, Shanghai, and Los Angeles, where efficient cargo handling is critical to operational throughput. Manufacturers focus on integrating telematics, load monitoring, and automation to meet safety and performance expectations of port authorities and marine logistics operators.

High Capital Investment and Maintenance Costs

Roll trailers are heavy-duty, specialized equipment requiring significant capital investment. Additionally, their maintenance, especially in corrosive environments like ports, incurs high ongoing expenses. Manufacturers are working on solutions to extend equipment lifespan, yet cost remains a major barrier for small and medium-sized logistics firms, especially in emerging economies.

Volatility in Global Trade Volumes

The roll trailer market is heavily dependent on international trade. Fluctuations in trade volumes, impacted by geopolitical tensions or economic downturns, directly affect market demand and growth potential. Uncertain tariff policies, political instability, and evolving international agreements further complicate the landscape, making strategic planning challenging for industry stakeholders.

Expansion of Global Port Infrastructure

With global trade expansion and the growth of mega-ports in regions like Asia-Pacific and the Middle East, demand for efficient cargo handling solutions including roll trailers is steadily increasing. Major investments in smart ports, enhanced customs facilities, and the development of free trade zones are also reinforcing the need for advanced trailer fleets.

Rising Demand for Intermodal Transportation

The growing focus on seamless cargo transfer between ships, trucks, and trains is boosting demand for durable, customizable roll trailers, especially in logistics hubs aiming to minimize handling time. Increased investment in intermodal freight corridors and government support for multimodal logistics infrastructure further propel market expansion opportunities.

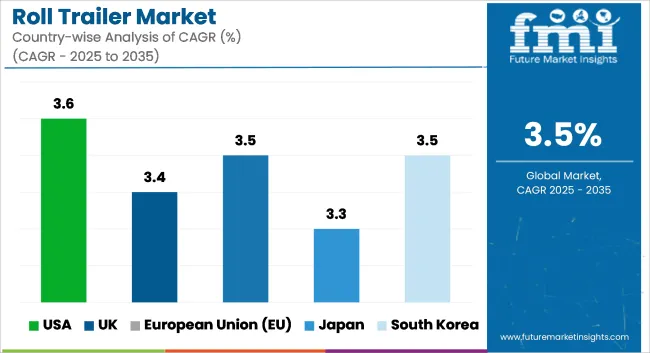

The United States roll trailer market is experiencing steady growth, primarily fueled by rising activities in port logistics, heavy machinery transportation, and intermodal freight movements. Increased investments in port infrastructure modernization, coupled with the growth of industrial and construction sectors, are pushing demand for durable and high-capacity roll trailers.

The market is also seeing innovations focused on enhancing trailer strength and corrosion resistance. Moreover, companies are increasingly focusing on energy-efficient trailer designs to meet environmental regulations, which is expected to further bolster the adoption of advanced roll trailers across the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

The United Kingdom’s roll trailer market is developing steadily, supported by expanded trade activities, and particularly containerized shipping. The emphasis on efficient cargo handling, shorter turnaround times at ports, and a growing focus on automation in logistics operations are boosting demand for technologically advanced roll trailers.

Additionally, sustainability initiatives are encouraging the use of eco-friendly materials in trailer manufacturing. Enhanced collaborations between port authorities and private logistics players are further driving the demand for innovative trailer solutions tailored to the specific needs of the UK's diverse shipping industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

In the European Union, the roll trailer market is propelled by the expansion of intra-European trade, stringent logistics safety regulations, and the rise in RoRo (Roll-on/Roll-off) shipping services. Countries such as Germany, Netherlands, and Belgium are leading in port-based logistics activities, driving demand for specialized roll trailers capable of handling varied cargo types efficiently.

Manufacturers are focusing on lightweight yet robust designs to improve operational efficiency. Furthermore, EU-wide initiatives promoting sustainable freight transport and port digitalization projects are amplifying opportunities for roll trailer manufacturers over the next decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

Japan’s roll trailer market remains strong due to its sophisticated port operations, automotive exports, and the shipping of heavy industrial equipment. Continuous advancements in material science and the integration of telematics for fleet management are key trends influencing the market.

Additionally, Japan’s focus on enhancing the efficiency of its global supply chain networks supports sustained demand for high-quality roll trailers. Increasing adoption of smart logistics solutions and government programs supporting port automation are expected to drive further innovations in the Japanese roll trailer segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

In South Korea, the roll trailer market is growing, driven by thriving shipbuilding, steel export industries, and increasing containerized cargo movement. Significant investments in smart port technologies and automation are fueling demand for innovative roll trailers with higher payload capacities and enhanced durability.

The market is also benefitting from the government’s initiatives to strengthen the country’s maritime logistics competitiveness. Moreover, South Korea’s aggressive adoption of green logistics practices is pushing manufacturers to develop eco-friendly and lightweight roll trailers designed for next-generation port operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

The roll trailer market is witnessing stable expansion, driven by the rise of global trade volumes, advancements in port infrastructure, and an increasing demand for efficient cargo handling. Roll trailers are crucial in transporting heavy and oversized cargo in port terminals and industrial sectors, providing a reliable and flexible solution for Ro-Ro (Roll-on/Roll-off) operations. Innovation in material technologies, such as lightweight high-strength steels and corrosion-resistant coatings, is further enhancing trailer durability and performance.

Emerging markets are particularly contributing to growth, fueled by massive investments in port modernization projects. With a projected CAGR of 3.5% from 2025 to 2035, the roll trailer market is expected to maintain a steady upward trajectory, supported by technological upgrades, expanding maritime trade, and a growing need for logistical efficiency.

Other Key Players

The overall market size for roll trailer market was USD 23.2 billion in 2025.

The roll trailer market expected to reach USD 32.8 billion in 2035.

Growth in international trade, rising port infrastructure development, increasing demand for efficient cargo handling, and advancements in trailer design will drive roll trailer market demand.

The top 5 countries which drives the development of cargo bike tire market are USA, UK, Europe Union, Japan and South Korea.

Shipping industry segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Roller Sports Product Market Size and Share Forecast Outlook 2025 to 2035

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Roll-up Laminate Tubes Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Roll Containers Market Size and Share Forecast Outlook 2025 to 2035

Roll-Your-Own Tobacco Products Market Trends - Growth & Forecast 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Industry Share & Competitive Positioning in Roll Forming Machines

Market Share Breakdown of Roll Containers Manufacturers

Roll Forming Machine Market by Type from 2024 to 2034

Rolling Stock Management Market Growth – Trends & Forecast 2024-2034

Rolle Market

Roll Slitting Machine Market

Roll-to-Roll Type UV Imprinting Machines Market

Roll-on Bottles Market

Trolley Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA