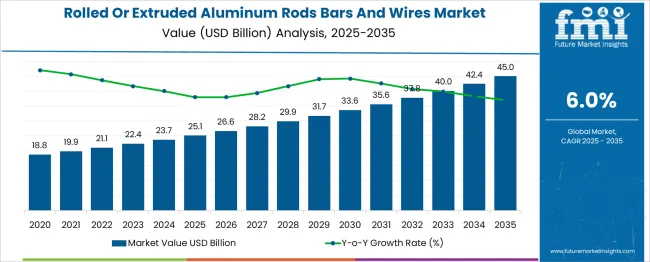

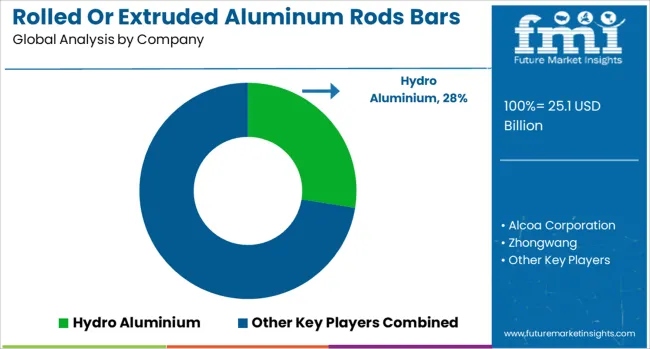

The Rolled Or Extruded Aluminum Rods Bars And Wires Market is estimated to be valued at USD 25.1 billion in 2025 and is projected to reach USD 45.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Rolled Or Extruded Aluminum Rods Bars And Wires Market Estimated Value in (2025 E) | USD 25.1 billion |

| Rolled Or Extruded Aluminum Rods Bars And Wires Market Forecast Value in (2035 F) | USD 45.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The rolled or extruded aluminum rods bars and wires market is progressing steadily, supported by demand from automotive aerospace construction and electrical industries. The lightweight strength and corrosion resistance of aluminum alloys have made them a preferred choice for manufacturing components in these sectors. Increasing focus on fuel efficiency and emission reduction has driven the automotive industry toward using aluminum extensively.

Technological improvements in extrusion and rolling processes have enhanced product quality and customization options. Growing infrastructure projects and electrical transmission upgrades have further fueled market expansion. Environmental regulations encouraging lightweight and recyclable materials have strengthened aluminum’s position.

Going forward the market is expected to grow with rising industrialization and innovations in alloy formulations and processing technologies. Segment growth is forecast to be led by extruded aluminum rods in type 6xxx series alloys favored for their strength and versatility and hot extrusion as the key processing method.

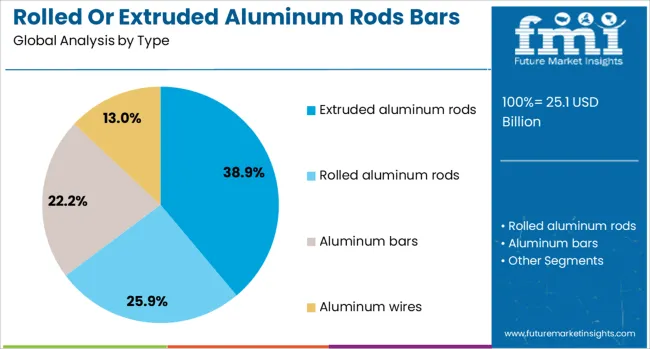

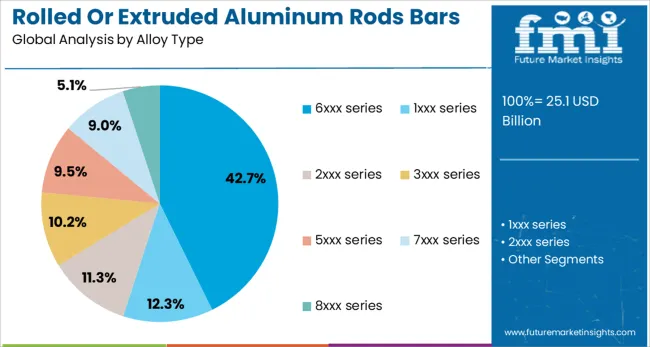

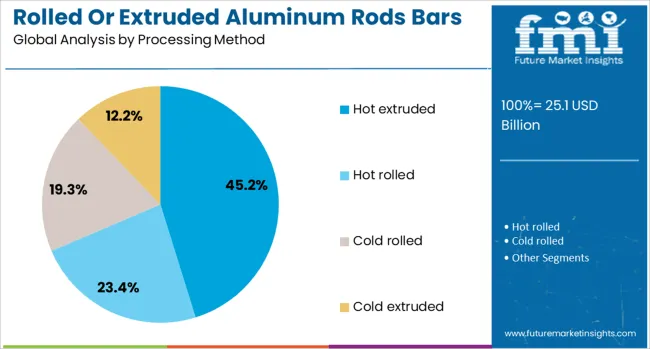

The rolled or extruded aluminum rods bars and wires market is segmented by type, alloy type, processing method, and application and geographic regions. By type of the rolled or extruded aluminum rods bars and wires market is divided into Extruded aluminum rods, Rolled aluminum rods, Aluminum bars, and Aluminum wires. In terms of alloy type of the rolled or extruded aluminum rods bars and wires market is classified into 6xxx series, 1xxx series, 2xxx series, 3xxx series, 5xxx series, 7xxx series, and 8xxx series. Based on processing method of the rolled or extruded aluminum rods bars and wires market is segmented into Hot extruded, Hot rolled, Cold rolled, and Cold extruded. By application of the rolled or extruded aluminum rods bars and wires market is segmented into Automotive, Aerospace, Construction, Electrical & electronics, Machinery, and Others. Regionally, the rolled or extruded aluminum rods bars and wires industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The extruded aluminum rods segment is projected to account for 38.9% of the market revenue in 2025 due to its adaptability and wide range of industrial applications. This segment has been favored for producing complex cross-sections with tight tolerances and excellent mechanical properties. Manufacturers prefer extruded rods for their dimensional consistency and surface finish which are critical for automotive and aerospace components.

The ability to produce lightweight yet strong parts has boosted adoption in sectors emphasizing performance and sustainability. Additionally extruded rods offer design flexibility that supports customization and innovation in product development.

These factors have contributed to the continued leadership of extruded aluminum rods within the market.

The 6xxx series alloy segment is expected to hold 42.7% of the market revenue in 2025 driven by its excellent combination of strength corrosion resistance and machinability. These alloys contain magnesium and silicon which provide good mechanical properties and formability suited for structural and architectural applications.

The 6xxx series is widely used in automotive parts electrical enclosures and building facades where durability and weight savings are important. Increased demand for versatile alloys that meet stringent quality and performance requirements has elevated the popularity of the 6xxx series.

Ongoing alloy development to enhance corrosion resistance and strength further supports the segment’s growth prospects.

The hot extruded segment is projected to contribute 45.2% of the market revenue in 2025 reflecting its prominence as a preferred processing technique. Hot extrusion allows for shaping aluminum rods bars and wires at elevated temperatures which improves material flow and reduces defects.

This process produces products with superior mechanical properties and surface finish essential for demanding industrial applications. The ability to form complex shapes with high dimensional accuracy has increased the adoption of hot extrusion in automotive aerospace and construction industries.

Additionally hot extrusion supports large-scale production and customization meeting varied customer specifications. The efficiency and product quality advantages of hot extrusion have solidified its leading position in the market.

Demand for rolled and extruded aluminum rods, bars and wires is increasing across infrastructure, automotive and renewable energy sectors. Sales of high-strength alloys, conductive wire materials and lightweight structural profiles are expanding rapidly. Growth is strongest in Asia Pacific and North America, where industrial modernization and electrification projects drive robust consumption.

Demand for rolled and extruded aluminum profiles surged by 27% in 2024, propelled by lightweight structural adoption across automotive, aerospace and construction industries. Aluminum rods and bars are increasingly used in EV frames, facade supports, power transmission fittings and architectural sections. Aerospace manufacturers reported 21% lower assembly weight when replacing steel components, enabling energy efficiency improvements. In the automotive sector, extruded lightweight connectors and reinforcement rails reduced vehicle mass by 18%, supporting range and payload improvements. Industrial support structures and modular building frameworks also boosted demand for rolled and extruded profiles, particularly alloy grades like 6000 series.

Sales of aluminum wires, especially high-purity or high-strength alloy variants, rose 30% year-over-year in 2025. These materials are widely used in overhead transmission lines, EV charging infrastructure and large-format conductor cables. Aluminum wires enabled 15% lower line energy losses compared to copper alternatives while cutting material weight by up to 40%. Demand is especially high in renewable energy zones installing solar farms and grid upgrades, as well as EV charging corridor rollouts requiring lightweight conductive cables. High-strength wire formats, such as those alloyed with scandium or zirconium, are increasingly specified for demanding structural applications where mechanical performance matters.

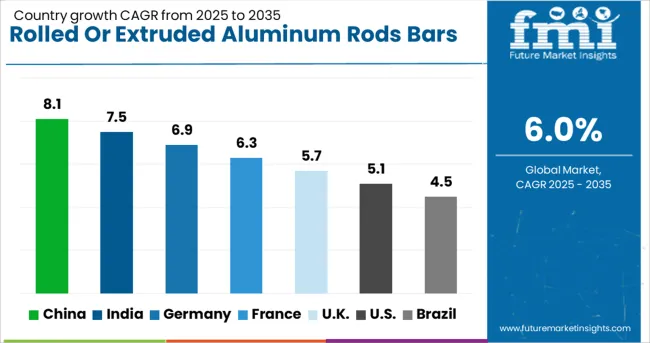

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global market for rolled or extruded aluminum rods, bars and wires is set to expand at a CAGR of 6.0% between 2025 and 2035, fueled by growth in electric vehicles, renewable infrastructure and lightweight manufacturing. China leads with an 8.1% CAGR, driven by aggressive capacity expansion, export-led production and demand from power transmission and EV sectors. India follows with 7.5% CAGR, supported by infrastructure modernization, aluminum-intensive transport networks and local sourcing of green aluminum. Germany, growing at 6.9%, benefits from advanced extrusion technologies, demand from wind and automotive industries and a robust circular economy. The UK sees 5.7% CAGR, influenced by sustainable construction and aerospace retooling. The US, at 5.1%, is propelled by power grid upgrades, rising EV sales and recovery in non-residential construction. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China leads with an 8.1% CAGR, driven by aggressive capacity expansion, export-led production and demand from power transmission and EV sectors. India follows with 7.5% CAGR, supported by infrastructure modernization, aluminum-intensive transport networks and local sourcing of green aluminum. Germany, growing at 6.9%, benefits from advanced extrusion technologies, demand from wind and automotive industries and a robust circular economy. The UK sees 5.7% CAGR, influenced by sustainable construction and aerospace retooling. The US, at 5.1%, is propelled by power grid upgrades, rising EV sales and recovery in non-residential construction.

India is projected to grow at a 7.5% CAGR, supported by infrastructure modernization and growing aluminum use in transport and power sectors. Government initiatives promoting renewable energy and transmission grid expansion are driving significant demand for aluminum conductors. Rail modernization and metro projects favor lightweight aluminum solutions for overhead wiring and structural applications. Domestic producers are investing in energy-efficient extrusion facilities to align with increasing automotive and EV requirements. Rising local sourcing of low-carbon aluminum further boosts competitiveness for manufacturers in global markets. Export potential remains high for industrial-grade and high-strength aluminum products.

Germany is forecast to expand at a 6.9% CAGR, driven by advanced extrusion technologies and demand from automotive, wind energy, and electrical sectors. Aluminum rods and bars are integral to lightweight vehicle designs and e-mobility applications. Industrial demand is supported by offshore wind projects requiring high-performance conductors. German firms focus on circular economy principles, enhancing recycling and closed-loop systems for aluminum production. Innovation in high-strength, corrosion-resistant alloys is improving product adoption in aerospace and industrial machinery. Strategic collaborations between material scientists and OEMs accelerate development of next-generation extruded aluminum profiles for critical applications.

The United Kingdom is expected to post a 5.7% CAGR, supported by demand from aerospace retooling, advanced construction systems, and electric grid upgrades. Adoption of aluminum solutions in structural frameworks and cable systems enhances efficiency in transport and building projects. Aerospace manufacturers are increasing reliance on high-performance extruded aluminum components to optimize weight without compromising strength. The rise of EV infrastructure and charging stations adds to conductor demand. Domestic producers are leveraging alloy innovation and precision extrusion techniques to cater to specialized applications in renewable energy and industrial sectors.

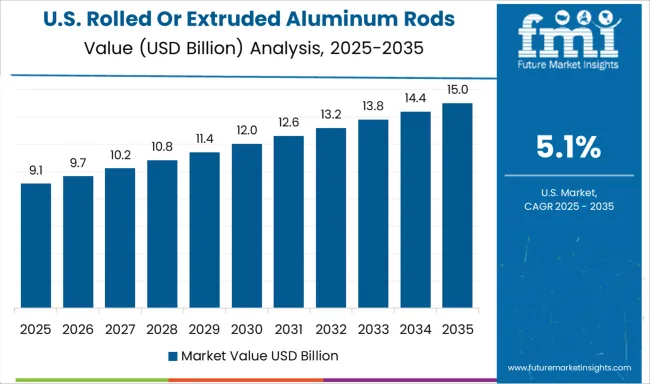

The United States is projected to grow at a 5.1% CAGR, influenced by power grid modernization, recovery in non-residential construction, and the accelerating EV market. Aluminum rods and wires are key in transmission line upgrades and renewable energy integration. The automotive sector is driving demand for extruded aluminum components, particularly for structural parts and battery enclosures. Investment in aerospace manufacturing and defense programs adds further traction for high-performance aluminum alloys. Domestic producers are enhancing production efficiency through automation and adopting advanced alloying techniques to meet stringent performance requirements.

Hydro Aluminium holds the top spot with a significant market share, driven by strong production capacity and consistent demand from construction, automotive and electrical sectors. Alcoa Corporation continues to serve North American and global buyers with its well-integrated supply chain and focus on low-carbon aluminum. Zhongwang and Chalco lead in China, benefiting from large-scale infrastructure and export volumes. Rusal remains a major player in Europe and Asia, with robust capabilities in high-strength alloy products. The market is being shaped by rising investment in renewable energy, lightweight vehicles and electrical grid upgrades, all of which require aluminum rods, bars and wires.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.1 Billion |

| Type | Extruded aluminum rods, Rolled aluminum rods, Aluminum bars, and Aluminum wires |

| Alloy Type | 6xxx series, 1xxx series, 2xxx series, 3xxx series, 5xxx series, 7xxx series, and 8xxx series |

| Processing Method | Hot extruded, Hot rolled, Cold rolled, and Cold extruded |

| Application | Automotive, Aerospace, Construction, Electrical & electronics, Machinery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hydro Aluminium, Alcoa Corporation, Zhongwang, Rusal (UC Rusal), and Chalco (Aluminum Corporation of China) |

| Additional Attributes | Dollar sales by product form (rolled rods, extruded bars, drawn wires) and alloy grade (1xxx, 3xxx, 5xxx, 6xxx series), demand dynamics across electrical, automotive, construction and aerospace segments, regional leadership in Asia‑Pacific and North America, innovation in precision extrusion and recycling techniques, and environmental impact via energy-efficient production and material reuse. |

The global rolled or extruded aluminum rods bars and wires market is estimated to be valued at USD 25.1 billion in 2025.

The market size for the rolled or extruded aluminum rods bars and wires market is projected to reach USD 45.0 billion by 2035.

The rolled or extruded aluminum rods bars and wires market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in rolled or extruded aluminum rods bars and wires market are extruded aluminum rods, rolled aluminum rods, aluminum bars and aluminum wires.

In terms of alloy type, 6xxx series segment to command 42.7% share in the rolled or extruded aluminum rods bars and wires market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Controlled Intelligent Packaging Market

Controlled & Slow Release Fertilizers Market 2025-2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient-Controlled Injectors Market

Voltage Controlled Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast and Outlook 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

Temperature Controlled Packaging Boxes Market

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA