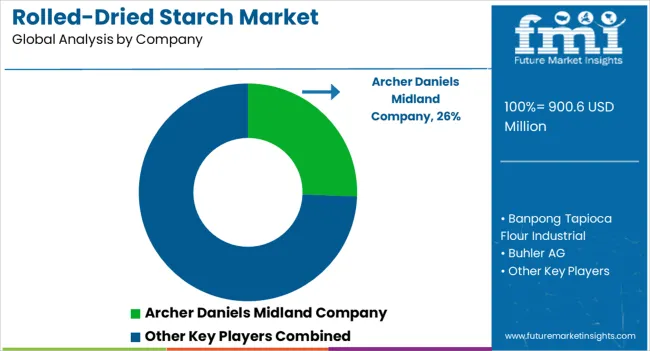

The Rolled-Dried Starch Market is estimated to be valued at USD 900.6 million in 2025 and is projected to reach USD 1495.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Analysis of the market maturity curve indicates that the industry is currently transitioning from early growth into a more established expansion phase. Initial adoption was driven by demand from food, pharmaceutical, and industrial applications, where the product’s functional properties, such as thickening, stabilizing, and texturizing, were recognized by key end users. The early adopters, primarily large-scale food and beverage manufacturers, facilitated the validation of product performance, which in turn encouraged wider industry uptake.

Over the forecast period, the adoption lifecycle is projected to move through the early majority and toward the late majority phase. Incremental improvements in production efficiency, standardization of product specifications, and expansion into new industrial applications are likely to accelerate market penetration. Regional markets, especially in the Asia-Pacific, are expected to drive adoption, leveraging cost advantages and increasing industrial utilization.

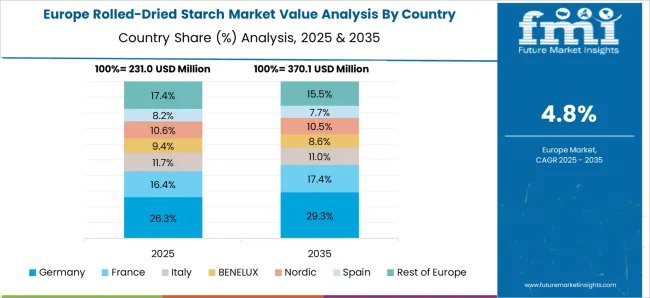

North America and Europe continue to represent mature markets with steady but slower adoption rates, where focus shifts toward premium quality and specialty starch variants. By 2035, the market is expected to enter a plateau stage in mature regions, while emerging economies will continue to see significant adoption growth. Strategic collaborations, technological enhancements in processing, and regulatory compliance will be key factors influencing the lifecycle, supporting sustained but moderated expansion across global regions.

| Metric | Value |

|---|---|

| Rolled-Dried Starch Market Estimated Value in (2025 E) | USD 900.6 million |

| Rolled-Dried Starch Market Forecast Value in (2035 F) | USD 1495.2 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

The rolled dried starch market is expanding steadily due to increasing demand for clean label ingredients, versatile texturizing agents, and plant based functional additives. Changing consumer preferences toward minimally processed and allergen-free food formulations are encouraging manufacturers to adopt starches that offer high stability and natural thickening properties.

Rolled drying techniques are gaining popularity due to their ability to retain functional properties while extending shelf life. Technological advancements in processing and extraction are also enhancing product purity and performance, especially in heat and shear-sensitive applications.

Regulatory support for starch as a natural and safe food additive further boosts its use across a wide range of end uses. The market is anticipated to maintain an upward trajectory as demand for plant-derived thickeners and stabilizers rises across the food, pharmaceutical, and personal care sectors.

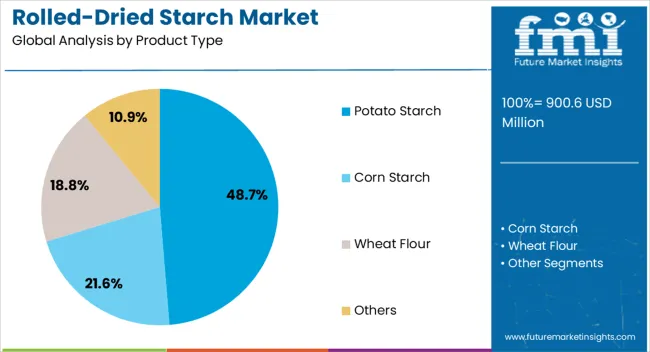

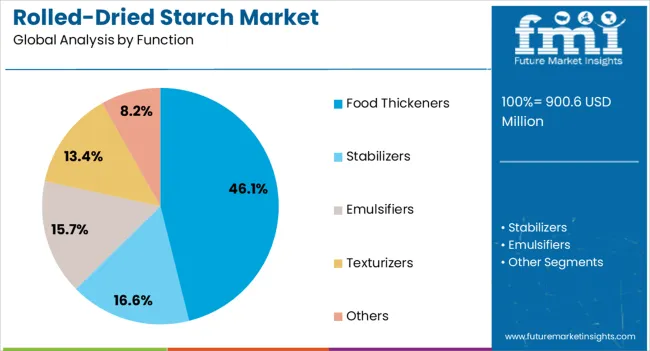

The rolled-dried starch market is segmented by product type, function, end-use industry, and geographic regions. By product type, the rolled-dried starch market is divided into Potato Starch, Corn Starch, Wheat Flour, and Others. In terms of function, the rolled-dried starch market is classified into Food Thickeners, Stabilizers, Emulsifiers, Texturizers, and Others.

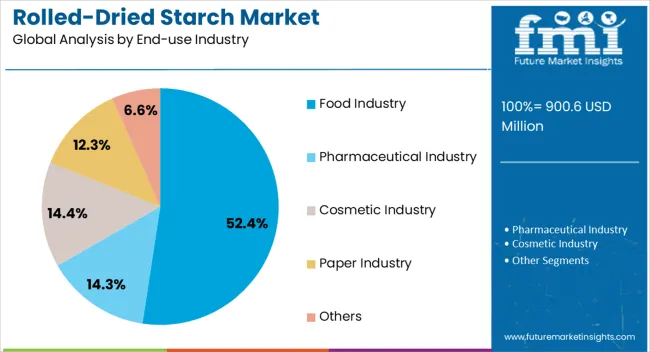

Based on end-use industry, the rolled-dried starch market is segmented into the Food Industry, Pharmaceutical Industry, Cosmetic Industry, Paper Industry, and Others. Regionally, the rolled-dried starch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Potato starch is projected to hold 48.70% of the total market revenue by 2025 within the product type category, establishing it as the leading segment. This is primarily due to its high viscosity, neutral taste, and excellent water-binding properties, which make it highly suitable for food and industrial applications.

It exhibits superior thickening and gelling behavior under low temperatures, which enhances its suitability in heat-sensitive formulations. Additionally, potato starch offers clean label appeal, aligning with consumer demand for natural and allergen-free ingredients.

The processing efficiency and wide availability of raw material also support its cost-effectiveness and scalability. These combined attributes have reinforced the segment’s leadership in the roll-dried starch market.

Food thickeners are expected to contribute 46.10% of total market revenue within the function category by 2025, making it the most prominent functional application. This growth is being driven by the rising demand for texture-optimized and stable food products, particularly in sauces, soups, dressings, and dairy alternatives.

RolLED dried starch is increasingly utilized as a natural thickener due to its compatibility with clean label formulations and superior freeze-thaw stability. Its ability to maintain consistency, improve mouthfeel, and withstand processing stresses makes it a preferred choice among food technologists.

With ongoing innovation in formulation science and consumer preference for indulgent yet functional food products, the food thickeners segment continues to lead in functional applications.

The food industry segment is projected to account for 52.40% of total market revenue by 2025 under the end-use category, positioning it as the dominant segment. This dominance stems from the widespread use of rolled dried starch in a variety of food processing applications, including ready-to-eat meals, bakery products, meat processing, and snack formulations.

The ingredient’s multifunctionality in providing structure, viscosity, and stability has made it essential in delivering consistent product quality. Furthermore, increased consumer demand for processed foods that are both convenient and nutritionally balanced is accelerating starch incorporation across formulations.

The food industry’s focus on innovation and clean label transparency continues to drive the adoption of rolLED dried starch, maintaining its position as the leading end-use sector.

The market has been expanding due to rising demand in food processing, bakery, confectionery, and industrial applications. This starch form, produced by cooking, drying, and rolling processes, has been valued for its stability, viscosity control, and easy dispersibility in liquids. Manufacturers have focused on improving functional properties, consistency, and batch uniformity to meet diverse industrial needs. Market growth has been influenced by increasing processed food consumption, industrial utilization of starch derivatives, and the need for efficient thickening, gelling, and stabilizing agents across multiple sectors globally.

The market has been largely driven by its widespread adoption in the food and beverage industry. Its thickening, stabilizing, and gelling properties have been applied in bakery products, confectionery, soups, sauces, and dairy items. Consistent quality and rapid dispersion have allowed manufacturers to maintain uniform product textures, reduce processing time, and optimize ingredient usage. Ready-to-use applications in instant noodles, sauces, and puddings have reinforced demand, particularly in regions with high processed food consumption. Functional properties such as freeze-thaw stability, clarity, and viscosity control have enabled product differentiation. Additionally, convenience-focused products, including instant meals and powdered beverages, have required starches with predictable behavior. As food and beverage manufacturers seek to improve shelf life, texture, and sensory experience, rolled-dried starch has been increasingly incorporated, reinforcing its position as a critical ingredient in processed food formulations globally.

Technological advancements have played a significant role in expanding the market. Innovations in drying, rolling, and modification techniques have improved starch solubility, viscosity consistency, and functional versatility. Cross-linked, pre-gelatinized, and enzymatically modified starches have allowed wider application in high-temperature and industrial processes. Automation and process control have ensured uniform particle size distribution, reduced moisture content, and minimized variability between batches. Packaging innovations have enhanced product stability during storage and transportation. Research in functional starch blends has enabled multi-property solutions, supporting clean-label formulations and enhanced processing efficiency. Continuous improvements in process energy efficiency and yield optimization have reduced production costs while maintaining quality standards. These technological developments have strengthened adoption across food, industrial, and pharmaceutical sectors, positioning rolled-dried starch as a reliable, multifunctional ingredient in modern manufacturing applications.

The market has been influenced by its utilization in industrial and pharmaceutical applications. In pharmaceuticals, starch has been used as a binder, disintegrant, and filler in tablets and capsules, ensuring controlled release and product stability. In paper, textile, and adhesive industries, rolled-dried starch has provided thickening, coating, and sizing properties, enhancing product strength and surface finish. Its predictable rheology and ease of handling have allowed seamless integration into continuous industrial processes. Cosmetic formulations have also leveraged starch for absorbency, texture, and consistency. Supply chain optimization, including bulk packaging and standardized particle size, has further facilitated adoption. By diversifying applications beyond food, rolled-dried starch has strengthened market resilience, enabling manufacturers to address multiple industry demands while maintaining consistent quality, functionality, and process efficiency.

The market has been influenced by regulatory standards and sustainability initiatives. Food safety and quality regulations have guided production processes, labeling, and purity criteria, ensuring consumer safety and compliance. Industrial standards have ensured consistency in functional properties, moisture content, and particle size, supporting process reliability. Sustainability measures, including sourcing starch from non-GMO crops and implementing energy-efficient production processes, have reinforced responsible manufacturing practices. Waste minimization and water recycling have further enhanced environmental performance. Growing consumer awareness regarding clean-label and responsibly sourced ingredients has encouraged manufacturers to adopt traceability and certification measures. These regulatory and sustainability considerations have strengthened market credibility, supporting widespread adoption across food, pharmaceutical, and industrial sectors while addressing environmental and consumer expectations globally.

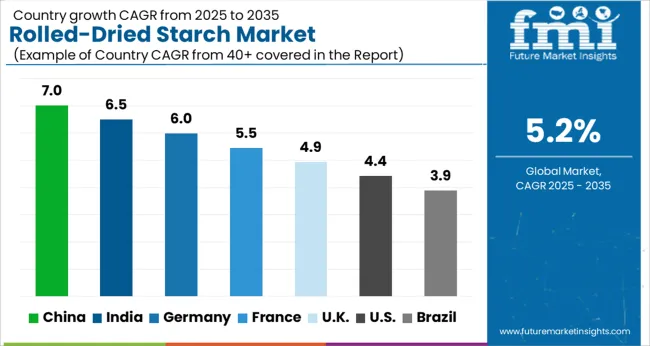

The market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by rising demand in food processing, pharmaceutical formulations, and industrial applications. China leads with a 7.0% CAGR, propelled by large-scale production and adoption in the processed food and packaging industries. India follows at 6.5%, supported by expanding manufacturing capacities and growing utilization in bakery and convenience foods.

Germany, at 6.0%, benefits from advanced food technology and high-quality industrial starch applications. The UK, with a growth rate of 4.9%, focuses on functional food and specialty starch products, whereas the USA, at 4.4%, experiences steady growth driven by pharmaceutical and processed food consumption. This report includes insights on 40+ countries, with the top markets highlighted here for reference.

The market in China is projected to grow at a CAGR of 7.0%, supported by the expanding food processing and industrial starch applications. Manufacturers are focusing on high-quality, consistent starch products for bakery, confectionery, and snack production. The growth is further fueled by increasing investments in starch processing facilities and the adoption of advanced drying and rolling technologies. Demand for convenience foods and processed products is also rising. Strategic collaborations with end-use industries are enabling product customization and enhanced distribution networks. Innovations in modified starch and specialty formulations are enhancing market opportunities.

India is anticipated to expand at a CAGR of 6.5% due to rising food processing activities and growing industrial applications. Manufacturers are introducing starch varieties with improved viscosity and texture for the bakery, confectionery, and snack industries. Government support for processing industries and the modernization of manufacturing units is driving adoption. Increasing demand for processed and convenience foods is contributing to steady growth. Strategic partnerships between starch producers and food manufacturers are enhancing distribution and market penetration. Research and development efforts to produce specialty starches are also influencing growth prospects.

The market in Germany is forecasted to grow at a CAGR of 6.0%, driven by industrial applications in food, pharmaceuticals, and paper industries. Manufacturers are investing in automation, quality control, and sustainable production techniques. The demand for clean-label starches and specialty formulations is increasing among food producers. Technological advancements in drying and rolling processes are improving product consistency and efficiency. Strategic collaborations with end-use industries are supporting market expansion. Consumer preference for processed and ready-to-use food products is further contributing to demand growth.

The United Kingdom market for Rolled-Dried Starch is projected to expand at a CAGR of 4.9%, supported by growing processed food demand and industrial starch applications. Manufacturers are focusing on specialty starches with improved functionality for bakery, snacks, and convenience foods. Rising consumer preference for high-quality processed food is fueling sales. Strategic collaborations with food and beverage companies are facilitating distribution and product innovation. Continuous investment in processing technologies and product differentiation is enhancing market competitiveness. Increasing demand for starch-based industrial applications is also contributing to growth opportunities.

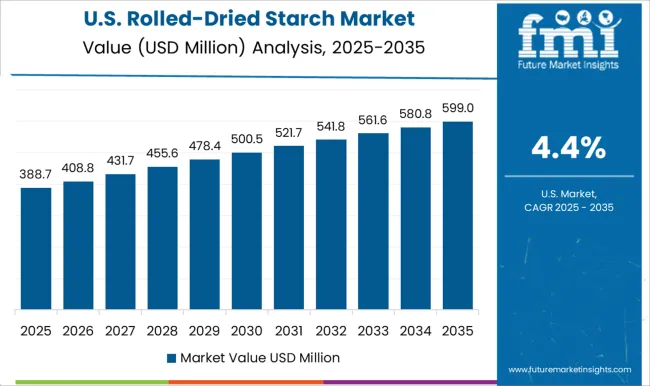

The United States market is expected to grow at a CAGR of 4.4%, driven by industrial applications in food processing, pharmaceuticals, and paper production. Manufacturers are introducing specialty starches with enhanced texture and functional properties. Rising processed food consumption and demand for convenience foods are supporting market growth. Strategic alliances with food manufacturers and industrial users are expanding market reach. Adoption of advanced drying and rolling technologies is improving product quality and consistency. Innovations in modified starch and clean-label formulations are enhancing competitive advantage.

Major global and regional suppliers, including Archer Daniels Midland Company, Cargill Incorporated, and Roquette Frères, dominate the market. Archer Daniels Midland offers a broad range of high-quality starches tailored for food, beverage, and industrial applications, emphasizing consistent performance and scalability. Cargill Incorporated provides specialty starches with enhanced functional properties for diverse sectors such as bakery, confectionery, and pharmaceutical processing.

Roquette Frères focuses on plant-based starch solutions, combining sustainability initiatives with technological innovation to meet growing consumer and industrial demand. Other influential players such as Buhler AG, Grain Processing Corporation, and Tate & Lyle contribute advanced processing capabilities, enabling the production of starch with precise viscosity, texture, and stability profiles. Companies like Banpong Tapioca Flour Industrial, Galam, Karandikars Cashell, Mesa Foods LLC., S A Pharmachem Pvt Ltd, and Visco Starch supply niche and regional markets, ensuring localized support and tailored product solutions. The market is shaped by increasing demand for clean-label ingredients, functional food development, and industrial applications requiring consistent thickening, gelling, and stabilizing properties, positioning these providers at the forefront of innovation and quality assurance.

| Item | Value |

|---|---|

| Quantitative Units | USD 900.6 Million |

| Product Type | Potato Starch, Corn Starch, Wheat Flour, and Others |

| Function | Food Thickeners, Stabilizers, Emulsifiers, Texturizers, and Others |

| End-use Industry | Food Industry, Pharmaceutical Industry, Cosmetic Industry, Paper Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company, Banpong Tapioca Flour Industrial, Buhler AG, Cargill Incorporated, Galam, Grain Processing Corporation, Karandikars Cashell, Mesa Foods LLC., Roquette Frères, S A Pharmachem Pvt Ltd, Tate & Lyle, and Visco Starch |

| Additional Attributes | Dollar sales by starch type and application, demand dynamics across food, beverage, and industrial sectors, regional trends in production and consumption, innovation in processing and functional properties, environmental impact of sourcing and processing, and emerging use cases in clean-label and specialty products. |

The global rolled-dried starch market is estimated to be valued at USD 900.6 million in 2025.

The market size for the rolled-dried starch market is projected to reach USD 1,495.2 million by 2035.

The rolled-dried starch market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in rolled-dried starch market are potato starch, corn starch, wheat flour and others.

In terms of function, food thickeners segment to command 46.1% share in the rolled-dried starch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Food Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Starch Derivatives Market Trends – Growth, Demand & Forecast 2025-2035

Native Starch Market Analysis - Size, Growth, and Forecast 2025 to 2035

Europe Starch Derivatives Market Insights – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA