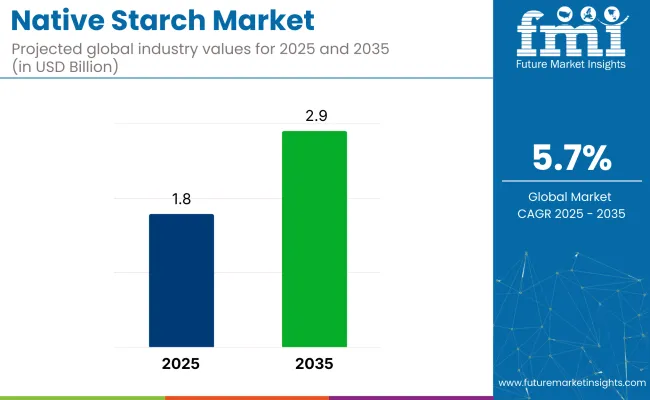

The global native starch market is valued at USD 1.8 billion in 2025 and is expected to reach USD 2.9 billion by 2035, reflecting a CAGR of 5.7%. This growth is driven by increasing demand for clean-label and minimally processed ingredients, especially in food and beverage applications.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 1.8 billion |

| Projected Size (2035) | USD 2.9 billion |

| CAGR (2025 to 2035) | 5.7% |

Native starches, which are derived from natural sources like corn, wheat, potato, and tapioca, are gaining popularity due to their role in thickening, stabilizing, and texturizing. Enhanced consumer awareness around health and wellness, combined with the rising trend of vegan and allergen-free diets, is expected to further support demand across both developed and emerging markets.

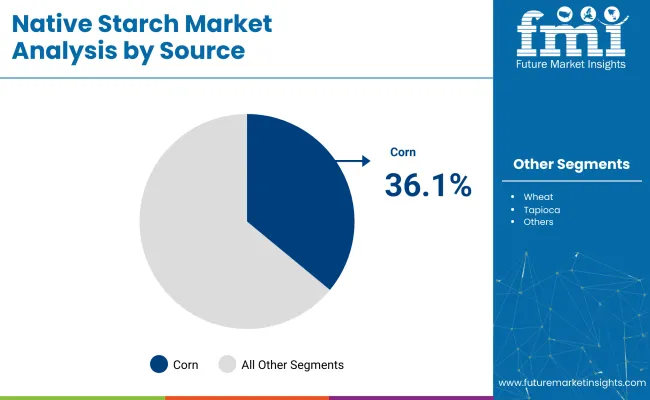

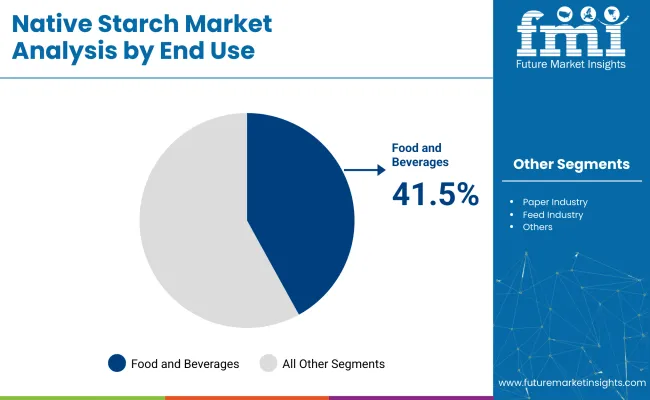

North America is expected to dominate the global native starch market by 2025, owing to strong demand for gluten-free, vegan, and allergen-friendly food products, especially with the USA growing at a CAGR of 5.1%. In contrast, Japan and the UK closely follow this growth with prominent CAGRs of 5.5% and 4.6% respectively. With around 36.1% market share, corn starch will continue to be the leading source segment. The food and beverages industry will remain the top application area with a projected 41.5% share.

The native starch market holds a significant but niche share within its broader parent categories. It accounts for approximately 18-22% of the overall starch and derivatives market, given its use across food, pharma, and industrial sectors. Within the functional food ingredients market, native starch represents around 8-10%, primarily driven by its role in clean-label and allergen-free products.

In the clean label ingredients market, native starch contributes about 12-15% owing to its unmodified, natural profile. Though smaller in share within the plant-based and specialty ingredients markets (roughly 5-7%), it remains a fast-growing segment due to rising health and transparency trends.

The global native starch market is segmented by source, form, end-use and region. By source, it includes corn, wheat, potatoes, tapioca, and others (rice, cassava, arrowroot). By form, it is segmented into powder and liquid.

By end use, it includes food and beverages (dairy, bakery, soups/sauces/dressings, infant formula, convenience foods, snacks and confectionery, drinks, others), the paper industry, the feed industry and others (pharmaceuticals, cosmetics, textiles).

By region, it covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Pacific, the Middle East and Africa.

Corn is projected to remain the most lucrative source segment, accounting for approximately 36.1% of the market share in 2025. Its widespread use in processed and convenience foods is attributed to superior thickening, stabilizing, and moisture-retention capabilities.

Compared to wheat and potato starch, corn starch offers better compatibility with dry mix formulations and high-volume industrial processes, making it the preferred choice in bakery mixes, soups, and snack production. Additionally, it is cost-effective and readily available in key production regions such as the USA, China, and Brazil.

Powdered native starch is expected to dominate the form segment, accounting for approximately 87.2% of the market share in 2025. This dominance is driven by its superior shelf-stability, easy solubility, and high compatibility with diverse food systems. The powdered form simplifies transportation and storage while offering consistent functional performance across multiple applications.

It is widely used in dry mixes, seasoning blends, bakery premixes, and powdered sauces. Furthermore, its seamless integration with automated production lines makes it an essential component in industrial food processing.

The food and beverages industry is poised to dominate end-use applications, holding 41.5% of the global market share in 2025. This is driven by growing demand for clean-label, non-GMO, and allergen-free ingredients. Within this segment, dairy, bakery, and convenience foods use native starch for texturizing, moisture retention, and improving mouthfeel. The clean label movement, coupled with plant-based diet trends, continues to accelerate starch replacement of synthetic thickeners across packaged foods.

Recent Trends in the Native Starch Market

Challenges in the Native Starch Market

Among the five leading countries in the native starch market, Japan is forecasted to grow the fastest with a CAGR of 5.5%, followed by the United States at 5.1% from 2025 to 2035. The United Kingdom and Germany are projected to grow at 4.6% and 4.1%, respectively, supported by rising clean-label adoption and regulatory changes.

France will see more modest expansion at 3.9% CAGR, driven by traditional food applications and growing interest in additive-free formulations. Overall, Asia and North America lead in pace, while Western Europe continues to grow steadily, focusing on reformulation and transparency.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The native starch market in the USA is projected to grow at a CAGR of 5.1% from 2025 to 2035. This growth is primarily attributed to rising consumer demand for clean-label and allergen-free ingredients, especially in the bakery, dairy, and snack segments.

The USA food processing industry continues to innovate with formulations that prioritize natural and non-GMO components, further driving starch applications.

The revenue from native starch in the UK is expected to register a CAGR of 4.6% from 2025 to 2035. Growth is supported by increasing regulatory pressure to replace chemically modified ingredients with natural alternatives.

British consumers show a strong preference for clean-label and organic food products, elevating the demand for native starch in sauces, soups, and ready meals.

The native starch demand in Germany is anticipated to grow at a CAGR of 4.1% between 2025 and 2035. The country’s strong starch processing infrastructure and export-oriented manufacturing base play a central role in Europe’s starch supply chain.

Demand is driven by clean-label trends in bakery and infant nutrition, as well as innovations in pharmaceutical binders. Despite limited domestic crop availability, German producers focus on high-quality, precision-engineered starches tailored for advanced applications, including biodegradable materials and cosmetics.

The native starch market in France is projected to expand at a CAGR of 3.9% during 2025 to 2035. France’s growth is moderate but consistent, fueled by demand for additive-free foods and traditional culinary formats.

French consumers are highly responsive to ingredient transparency, which has encouraged manufacturers to incorporate native starches into clean-label desserts, dressings, and sauces. Despite high regulatory standards and competition from modified starches, native starch adoption is rising in foodservice and gourmet retail channels.

The native starch industry in Japan is forecasted to grow at a CAGR of 5.5% from 2025 to 2035. High demand stems from Japan’s precision-oriented food culture, where native starch is used extensively in traditional items like mochi and soups, as well as in modern processed foods.

The country emphasizes quality and texture, favoring native starches for their purity and performance. Additionally, Japan’s biotech and pharma sectors are utilizing native starch as a binder and excipient, expanding its role beyond food applications.

The market is moderately consolidated, with a few global leaders-such as Ingredion Inc., Cargill Inc., Tate & Lyle PLC, Archer Daniels Midland Company (ADM), and Roquette Frères S.A., commanding a significant share of global revenues. These Tier 1 companies compete through innovation in clean-label formulations, expansion into plant-based and specialty starches, and strategic acquisitions to diversify their portfolios.

Ingredion has expanded its clean-label offerings with the launch of NOVATION® Indulge 2940, a functional native corn starch designed for dairy and alternative dairy applications. Tate & Lyle's acquisition of CP Kelco in November 2024 for USD 1.8 billion aims to strengthen its position in the specialty ingredients sector.

Roquette has introduced new tapioca-based cook-up starches, enhancing its texturizing solutions range. Meanwhile, ADM faces challenges due to accounting irregularities and profit outlook cuts, prompting a focus on cost controls and operational resilience.

Recent Native Starch Industry News

In February 2024, Ingredion launched NOVATION® Indulge 2940, a non-GMO functional native corn starch for clean-label and health-focused food applications in North America, expanding globally soon after.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 2.9 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Source | Corn, Wheat, Potatoes, Tapioca, Others (Rice, Cassava, Arrowroot) |

| By Form | Powder, Liquid |

| By End Use | Food and Beverages (Dairy, Bakery, Soups & Sauces, Infant Formula, Snacks, Convenience Foods, Beverages, Others), Paper Industry, Feed Industry, Others (Pharma, Cosmetics, Textiles) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia , Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Ingredion, Inc., Cargill, Inc., E. I. du Pont de Nemours, Tate & Lyle PLC, Archer Daniels Midland Company, Roquette Frères S.A., Euroduna Food Ingredients GmbH, BENEO GmbH, Kent Corporation, MGP Ingredients, Inc., AGRANA - Beteiligungs AG |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per product type, the target market has been categorized into Corn, Wheat, Potatoes, Tapioca and Others

As per the application, the target market is sub-segmented into Food and Beverages (Dairy Products, Bakery, Soups, Sauces, and Dressings, Infant Formula, Convenience Foods, Snacks and Confectionery, Beverages Others) Paper Industry and Feed Industry

Powder and Liquid are key two forms

Industry analysis has been carried out in key countries of the regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 1.8 billion in 2025.

The market is forecasted to reach USD 2.9 billion by 2035, reflecting a CAGR of 5.7%.

Corn starch is expected to lead the market with a 36.1% share in 2025.

Food and beverages are expected to hold a 41.5% share of the market in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 5.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Native Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Native Whey Protein Market

Native Advertising Market Analysis - Trends & Forecast 2025 to 2035

Native Collagen Market Trends - Health & Beauty Applications 2024 to 2034

Native Micellar Casein Market – Growth, Demand & Industry Innovations

Native Whey Protein Ingredients Market

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alternative Protein Market Insights - Sustainable Food Trends 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Cloud-Native Network Function Market – Next-Gen Telecom Solutions

Meat Alternative Market Forecast and Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA