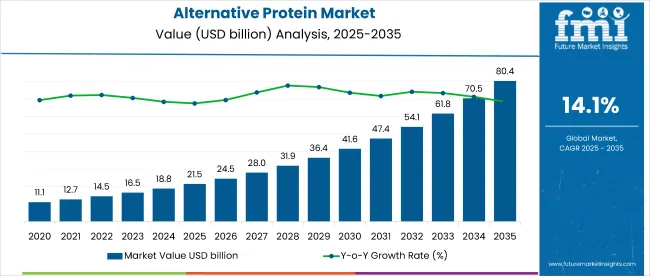

The global alternative protein market is estimated at USD 21.5 billion in 2025 and is projected to reach USD 80.4 billion by 2035, growing at a CAGR of 14.1% over the forecast period. In 2025, the total global protein market, including animal, dairy, and plant sources is valued at USD 430 billion, positioning alternative proteins at a 5% share.

| Metric | Value |

|---|---|

| Market Size 2025 | USD 21.5 billion |

| Market Size 2035 | USD 80.4 billion |

| CAGR 2025 to 2035 | 14.1% |

This rising share underscores accelerating structural shifts toward non-animal proteins amid investment in fermentation, cellular agriculture, and sustainable food technologies. Production cost disparity and regulatory asymmetry continue to restrain full commercial rollout. Lab-grown proteins face approval bottlenecks and high per-kilo production costs, estimated at 5-10x conventional meat in 2024. Moreover, adoption in foodservice channels remains patchy due to variable consumer acceptance and sensory mismatch across geographies.

Nevertheless, tech-forward players investing in AI-optimized blends, precision fermentation, and CRISPR-driven strain improvements are expected to reduce cost per unit by 40% by 2035. These firms will capture early-mover advantage as demand for climate-resilient proteins rises. Conversely, legacy players tied to conventional soy isolates or bulk protein formats may underperform.

The market is segmented into Insect-based; Microbial-based; Plant-based Alternative Protein; Other Sources; Food & Beverage; Cattle; Aquaculture; Animal Feed; Pet Food; Equine; Other Applications; North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East & Africa.

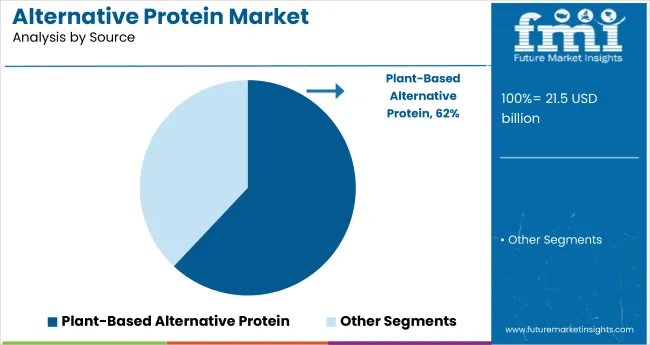

Plant-based alternative protein dominates the market in 2025 with a 62% share, supported by scale advantages, consumer familiarity, and broad application across food and beverage formats. Its edge stems from high global availability of soy, pea, lentil, and duckweed protein sources and low entry barriers for manufacturers.

Two core drivers underpin segment growth

A key disruptor is the adoption of AI-assisted protein blending, which improves mouthfeel, bioavailability, and cost efficiency-expected to cut formulation time by 25%. This enables mid-sized brands to compete with incumbents across both developed and emerging regions.

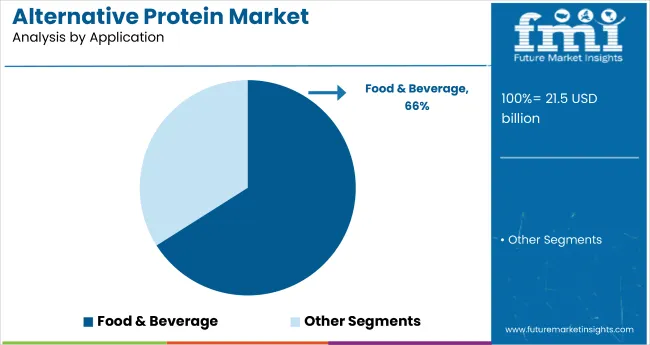

The Food & Beverage segment holds the largest share of the alternative protein market in 2025 at 66%, owing to its central role in consumer-facing adoption across plant-based meat, dairy-free products, and fortified beverages. The segment benefits from established distribution networks and evolving consumer demand for ethical, high-protein, and allergen-friendly foods.

Growth is supported by widespread uptake of plant-based alternatives across mainstream food categories such as dairy, snacks, and ready meals, alongside rising investment in formulation technologies that improve texture, solubility, and flavor fidelity without synthetic enhancers. Constraints persist in sensory optimization and ingredient sourcing consistency, particularly across emerging markets.

A major disruptor is the integration of AI-based formulation tools-expected to reduce time-to-market by 30% for new products. This is enabling firms to rapidly iterate protein blends that meet regional taste, nutrition, and regulatory criteria, accelerating adoption across supermarkets, QSRs, and e-commerce platforms.

From retail-led growth in the US and UK to policy-backed expansion in Japan and South Korea, alternative protein adoption is being shaped by local infrastructure, dietary baselines, and government intervention.

Markets such as Germany and France are scaling fast due to R&D incentives and regulatory clarity, while high-growth economies like China, India, and Brazil are fueling volume gains through affordability and food security priorities. Across all 40+ covered countries, uptake will reflect a mix of taste normalization, cost parity, and investment in domestic production capacity.

The USA alternative protein market is valued at USD 6.4 billion in 2025 and projected to reach USD 28.9 billion by 2035, expanding at a CAGR of 16.3%. Growth is fueled by the rise of flexitarian diets and national-scale distribution of plant-based and cultivated protein products.

Margin expansion is supported by economies of scale in extrusion and fermentation, reducing cost-per-unit by 22% since 2022. However, cultivated protein firms still face FDA-USDA dual approval hurdles, slowing mass rollout

In 2023, the USA Department of Agriculture approved two lab-grown chicken products; this regulatory breakthrough, combined with mainstream retail and QSR partnerships, is accelerating market reach.

Sales of alternative protein in the United Kingdom is valued at USD 1.4 billion in 2025, expected to reach USD 6.2 billion by 2035, growing at a CAGR of 16%. Market gains stem from strong government alignment with net-zero food production and widespread supermarket access to plant- and fermentation-based proteins.

Margins benefit from R&D tax relief and retail consolidation, though higher inflation in protein inputs compressed margins by 8% YoY in 2024. Regulatory consistency through the FSA enables smoother launches compared to EU peers.

UK-based start-ups in cultivated seafood and fungi-based proteins received over USD 350 million in public and private investment between 2022 and 2024. This, combined with retail commitments, has accelerated category maturity.

France’s market is estimated at USD 1.2 billion in 2025, forecast to reach USD 5 billion by 2035, at aCAGR of 15.5%. The country benefits from institutional funding for sustainable agriculture and food innovation, especially fermentation-derived proteins.

Margins improved by 13% from 2023 to 2025 due to supply chain localization, but legal ambiguity around meat-labeling for non-animal products limits visibility in retail channels.

French biotech firms have advanced in algae-based protein and single-cell fermentation, gaining EU research grants totaling EUR 100 million between 2021 and 2024. Still, uptake remains slower outside urban zones.

Germany’s alternative protein market stands at USD 1.6 billion in 2025, projected to hit USD 6.6 billion by 2035, advancing at a CAGR of 15.1%. Berlin and Hamburg anchor a growing foodtech ecosystem with strong cross-linkages to cultivated meat research.

Profitability has improved with scaling of pea- and lupin-based protein manufacturing; production costs declined by 19% since 2022. However, consumer trust issues over ultra-processing remain a barrier to broader uptake.

Germany leads EU in retail shelf space for plant-based proteins, capturing 23% of regional product launches in 2024. New precision fermentation startups are testing AI-optimized protein blends across multiple product lines.

Japan’s alternative protein market is valued at USD 1.1 billion in 2025 and expected to reach USD 4.9 billion by 2035, growing at a CAGR of 16.1%. Demand is driven by food self-sufficiency concerns and aging population nutritional needs.

High-cost imports and a complex regulatory path slowed early adoption. Academic partnerships have improved protein bioavailability in elderly-specific formulations. National chains began testing precision-fermented milk in 2024, driving mainstream visibility.A survey conducted by the APAC Society for Cellular Agriculture (APAC-SCA) in May 2023, found that 42% of Japanese consumers were willing to try cultivated meat or seafood products, provided they were proven safe.

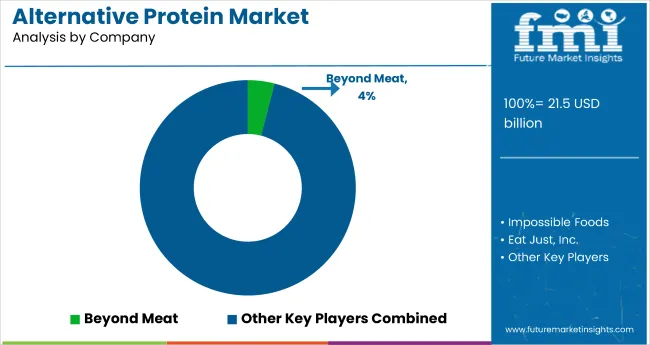

The players in the alternative protein market are focusing on precision fermentation, hybrid protein formulation, and regulatory fast-tracking to reduce production costs and improve consumer acceptance. Companies such as Beyond Meat, Impossible Foods, and Eat Just have expanded aggressively across retail and foodservice, leveraging partnerships with major QSR chains and grocery platforms to maintain scale.

This strategic shift is driven by clear signals: microbial fermentation is now used by over 65% of alt-protein innovators, while AI-optimized formulation tools are shortening R&D cycles by up to 30%. Meanwhile, regulatory momentum-such as cultivated meat approvals in the USA, Singapore, and Israel-is prompting global players to secure early positioning in high-barrier markets.

Over the next five years, market leadership will hinge on cost efficiency and infrastructure scale-up. Eat Just, for instance, secured production rights in Asia via joint ventures to lower overheads by 35%. At the same time, new entrants like Aleph Farms and Meati Foods are scaling vertically, moving from lab to pilot plants within two years-compressing time-to-commercialization.

Players embracing AI-enhanced ingredient systems, low-emission manufacturing, and cross-border licensing will outpace legacy brands tied to commodity plant inputs or single-source strategies. Those failing to diversify beyond soy or pea are likely to lose margin share as next-gen proteins enter mass market.

Alternative Protein Industry News

| Attribute | Details |

|---|---|

| Market Size 2025 | USD 21.5 billion |

| Market Size 2035 | USD 80.4 billion |

| CAGR 2025 to 2035 | 14.1% |

| Base Year | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Units | Revenue in USD Billion |

| Segments Covered | By Source, By Application, By Region |

| Source Segments | Insect-based, Microbial-based, Plant-based, Other Sources |

| Application Segments | Food & Beverage, Cattle, Aquaculture, Animal Feed, Pet Food, Equine, Others |

| Regional Coverage | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Country Coverage | USA, Canada, Germany, UK, France, China, India, Japan, South Korea, Australia, GCC, Brazil, Mexico, and 30+ others |

| Key Players Profiled | Beyond Meat, Impossible Foods, Eat Just, Nature’s Fynd, Perfect Day, Meati Foods, Mosa Meat, Aleph Farms, Geltor, Rebellyous Foods |

The alternative protein market is valued at USD 21.5 billion in 2025.

It is projected to reach USD 80.4 billion by 2035.

Plant-based proteins hold the leading share at 62% in 2025.

Food & Beverage is the top application, accounting for 66% of demand.

The United States is the most lucrative market, growing at a CAGR of 16.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Australia Animal Feed Alternative Protein Market Report – Size, Share & Innovations 2025-2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Pea Protein Demand in Dairy Alternatives Analysis - Size Share and Forecast outlook 2025 to 2035

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Meat Alternative Market Forecast and Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA