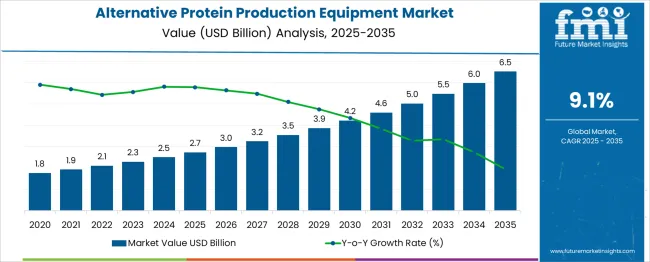

The alternative protein production equipment market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period. This reflects a growth multiplier of 2.41x over the decade, backed by a strong CAGR of 9.1%. The growth curve indicates early scaling during 2025–2030, where the market rises from USD 2.7 billion to USD 4.2 billion, contributing USD 1.5 billion, or 39% of the total incremental gain, with a 5-year multiplier of 1.55x.

Investments in extrusion systems, bioreactors, and cultured meat processing lines support this phase. The second phase, from 2030 to 2035, delivers a larger share, adding USD 2.3 billion, representing 61% of incremental growth, as commercialization accelerates for plant-based meat alternatives, fermentation-derived proteins, and lab-grown meat solutions. Annual increments grow from USD 0.3 billion in early years to USD 0.5 billion by the final years, reflecting capital intensification in precision fermentation and hybrid protein systems.

Producers adopting modular equipment designs, automated processing, and regional manufacturing hubs will capture significant value in this USD 3.8 billion growth opportunity, as demand for scalable, cost-efficient production platforms becomes critical in the alternative protein ecosystem.

| Metric | Value |

|---|---|

| Alternative Protein Production Equipment Market Estimated Value in (2025 E) | USD 2.7 billion |

| Alternative Protein Production Equipment Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The alternative protein production equipment market holds a growing share within multiple food manufacturing and processing segments. In the food processing equipment market, its share is approximately 4–5%, as conventional meat, dairy, and bakery processing still dominate. Within the plant-based food processing market, its contribution is higher at around 15–18%, since extrusion, blending, and drying equipment are essential for producing plant-based protein products.

In the meat and dairy alternatives processing equipment market, alternative protein systems account for nearly 20–22%, driven by the increasing adoption of plant-based meats and dairy substitutes. For the biotechnology and fermentation equipment market, the share is about 6–7%, as precision fermentation and cell-cultured proteins rely on advanced bioreactors and controlled systems. In the nutritional and functional food manufacturing equipment market, its share stands at approximately 8–10%, reflecting the integration of alternative proteins into protein bars, shakes, and fortified foods.

Growth in this segment is supported by rising consumer demand for sustainable and high-protein foods, coupled with technological advancements in extrusion, fermentation, and drying systems. Manufacturers are focusing on automation, energy efficiency, and modular designs to meet production scalability. As alternative protein consumption expands globally, this equipment market is expected to capture a significantly larger share within these parent categories.

Rising demand for plant-based, cultured, and fermented proteins has intensified the need for specialized equipment capable of delivering scalable, efficient, and high-quality production.

Manufacturers are increasingly prioritizing energy-efficient and hygienic machinery designs to comply with stringent food safety regulations and to meet the operational requirements of high-throughput production. Future growth is expected to be supported by continued innovation in processing technologies, growing investment in alternative protein startups, and collaborative efforts between equipment manufacturers and producers to develop tailored solutions.

Increasing awareness about the environmental impact of animal agriculture and shifting dietary patterns are creating long-term opportunities, paving the way for wider adoption of advanced production systems.

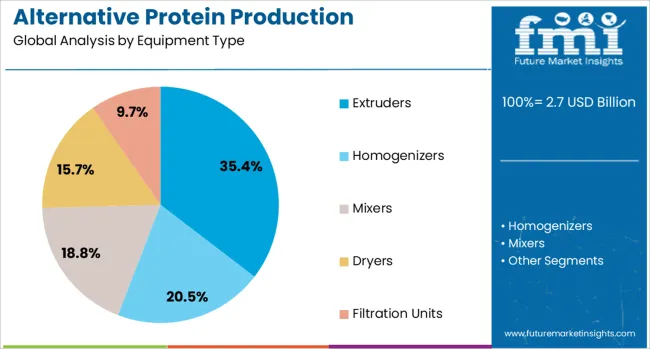

The alternative protein production equipment market is segmented by equipment type, mode of operation, application, end use, processing technology and geographic regions. The alternative protein production equipment market is divided by equipment type into Extruders, Homogenizers, Mixers, Dryers, and Filtration Units.

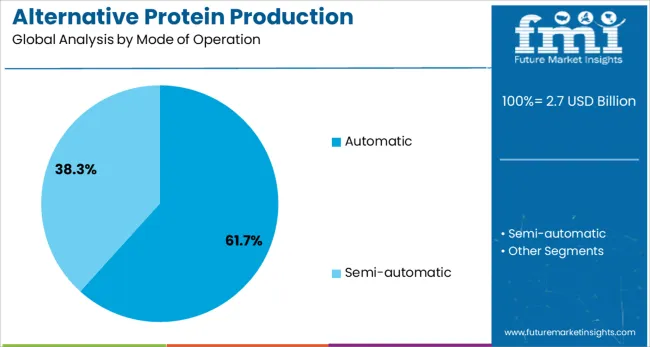

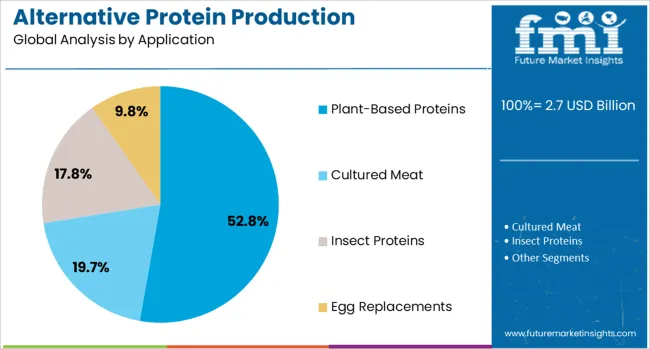

In terms of mode of operation, the alternative protein production equipment market is classified into Automatic and Semi-automatic. Based on the application of the alternative protein production equipment, the market is segmented into Plant-Based Proteins, Cultured Meat, Insect Proteins, and Egg Replacements. The alternative protein production equipment market is segmented by end use into Food Industry, Animal Feed, Nutraceuticals, and Others.

The processing technology of the alternative protein production equipment market is segmented into Texturization, Fermentation, Emulsification, and Spray Drying. Regionally, the alternative protein production equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment type, the extruders segment is expected to account for 35.4% of the market revenue in 2025, making it the leading equipment type. This leadership is being driven by the critical role extruders play in texturizing plant-based proteins and creating meat-like structures with desirable taste and mouthfeel.

High versatility, precision in moisture and temperature control, and the ability to handle diverse raw materials have positioned extruders as indispensable in large-scale production of alternative proteins. Operational efficiency has also been enhanced through innovations in screw and barrel designs, allowing consistent output with lower energy consumption.

These performance advantages and their integration into continuous processing lines have reinforced the dominance of extruders as the preferred equipment choice for manufacturers aiming to deliver high-quality products at scale.

Segmented by mode of operation, the automatic segment is projected to hold 61.7% of the market revenue in 2025, establishing itself as the leading operational mode. This dominance is being attributed to the growing emphasis on operational efficiency, consistency, and hygiene in food production environments.

Automatic systems have enabled manufacturers to reduce manual intervention, minimize human error, and maintain stringent quality standards, all while increasing throughput. Technological advancements in sensors, control systems, and real-time monitoring have allowed automatic equipment to deliver precise process control and optimized resource utilization.

Rising labor costs and the need for scalable, repeatable processes have further accelerated the shift toward automation, ensuring that this segment remains at the forefront of the market.

When segmented by application, the plant-based proteins segment is forecast to capture 52.8% of the market revenue in 2025, securing its position as the leading application area. This leadership is being reinforced by surging consumer demand for plant-derived protein alternatives and the established infrastructure supporting their production.

Equipment designed for plant-based applications has benefited from decades of development in extrusion, drying, and forming technologies, making it highly efficient and cost-effective. The segment’s growth has also been propelled by the broader availability of raw materials, streamlined regulatory pathways, and increasing product variety demanded by consumers seeking healthier and more sustainable diets.

The ability to achieve desirable textures, flavors, and nutritional profiles has positioned plant-based proteins as the dominant category, sustaining high demand for equipment tailored to their production.

The alternative protein production equipment market is expanding as manufacturers invest in advanced processing systems to meet rising demand for plant-based, fermentation-derived, and cultivated proteins. Growth opportunities exist in precision fermentation and bioreactor-based cell culture systems for scalable production.

Key trends include the adoption of modular equipment, high-capacity extrusion technology, and integrated digital monitoring systems. However, the market faces restraints such as high capital expenditure, complex process validation, and regulatory uncertainties for novel protein types. Suppliers focusing on automation, cost optimization, and compliance with food-grade safety standards are positioned for a competitive advantage in this rapidly evolving industry.

The market growth is being driven by a surge in demand for extrusion systems capable of producing texturized plant proteins at commercial scale. In 2024, large-scale food manufacturers installed twin-screw extruders to deliver improved texture and flavor consistency in meat alternatives. Precision fermentation facilities also expanded their bioprocessing infrastructure to support alternative dairy protein development. Equipment upgrades to achieve higher throughput and energy efficiency are widely considered essential by protein manufacturers seeking to reduce production costs. It is strongly believed that capacity expansion for extrusion and bioreactor systems will remain the primary driver of equipment procurement through 2025.

Significant opportunities exist in advanced bioreactor platforms designed for cultivated meat and precision fermentation protein production. In 2025, large bioprocessing firms introduced stainless steel and single-use bioreactors with enhanced control systems for temperature, pH, and oxygen transfer. These developments are creating strong interest from alternative protein startups and contract manufacturers aiming to accelerate commercial viability. It is considered that companies offering modular, automated bioreactor systems with integrated quality assurance will capture growing investment from food-tech ventures and institutional food producers focusing on next-generation protein supply for diverse product portfolios.

Emerging trends indicate strong movement toward modular systems that allow scalability and flexibility in production lines. In 2024, manufacturers implemented plug-and-play solutions for extrusion and fermentation units to streamline commissioning and reduce downtime. Integration of automation technologies for continuous monitoring and predictive maintenance has been widely adopted to enhance operational efficiency. Equipment designed with IoT-enabled sensors for real-time control is becoming standard in large-scale processing plants. It is widely believed that companies prioritizing modularity and connectivity will strengthen their competitive edge as alternative protein markets diversify across global regions.

One of the primary restraints in this market is the significant capital investment required for setting up extrusion lines, fermentation tanks, and bioreactor systems. In 2024, several startups reported funding challenges for scaling pilot facilities due to the high cost of specialized stainless steel equipment. Regulatory approval processes for cultivated proteins add further delays, requiring rigorous validation and compliance testing. It is considered that these financial and regulatory barriers limit entry for smaller players and hinder commercialization, despite strong interest from investors and food manufacturers seeking novel protein solutions.

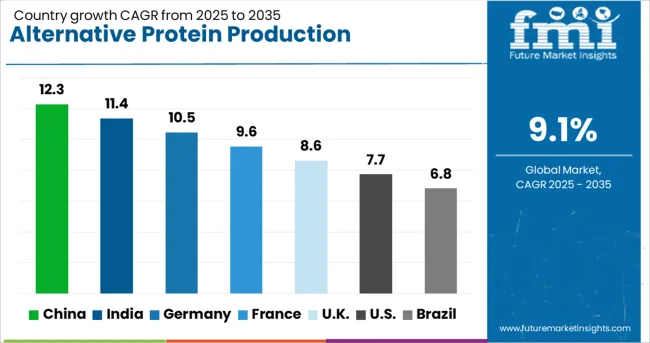

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global alternative protein production equipment market is projected to grow at a CAGR of 9.1% from 2025 to 2035. China leads with 12.3%, followed by India at 11.4% and Germany at 10.5%. France records 9.6%, while the United Kingdom posts 8.6%. Growth is fueled by rising demand for plant-based and cell-cultured proteins, increasing investment in food tech infrastructure, and advancements in processing automation. China and India dominate due to strong domestic demand and processing capacity expansion, while Germany focuses on precision fermentation systems. France and the UK emphasize modular equipment and energy-efficient production technologies for sustainable protein manufacturing.

The alternative protein production equipment market in China is expected to grow at 12.3%, driven by significant investments in plant-based and cultivated meat processing plants. Extrusion systems dominate adoption for texturized protein production. Manufacturers integrate automation and IoT features to enhance efficiency and reduce downtime. Strategic alliances with global food tech startups strengthen the country’s leadership in alternative protein processing.

The alternative protein production equipment market in India is projected to grow at 11.4%, supported by growing adoption of plant-based diets and government-backed food innovation initiatives. Wet extrusion and spray drying systems dominate functional protein ingredient processing. Manufacturers prioritize cost-effective solutions with high scalability for SMEs. Expanding quick-service restaurant chains and health-focused food brands drive demand for advanced processing lines.

The alternative protein production equipment market in Germany is expected to grow at 10.5%, driven by strong demand for precision fermentation and cultivated meat processing systems. Bioreactors dominate deployment in cellular agriculture facilities. Manufacturers develop modular fermentation units with integrated control systems. EU-backed green protein initiatives support investments in next-generation food processing technologies.

The alternative protein production equipment market in France is forecast to grow at 9.6%, supported by innovation in hybrid and clean-label protein formats. Twin-screw extruders dominate production of textured plant-based meat alternatives. Manufacturers integrate energy-efficient heating systems to reduce operational costs. Partnerships with premium food brands enhance equipment adoption in gourmet plant-based food manufacturing.

The alternative protein production equipment market in the UK is projected to grow at 8.6%, driven by a surge in plant-based food innovation and increasing adoption of cultured protein technologies. Freeze-drying systems dominate in high-value nutritional applications. Manufacturers invest in AI-based predictive maintenance solutions to improve operational uptime. Retailer-driven sustainability goals further accelerate market growth.

The alternative protein production equipment market is moderately consolidated, with Bühler AG recognized as a leading player due to its advanced extrusion systems, innovative processing technologies, and strong partnerships with alternative protein manufacturers worldwide. The company’s expertise in plant-based protein texturization and integration of digital automation has established its dominance in this segment.

Key players include Alfa Laval AB, ANDRITZ AG, BAK Food Equipment, Bepex International LLC, FAM STUMABO, GEA Group Aktiengesellschaft, JBT Marel Corporation, Middleby Corporation, MULTIVAC Sepp Haggenmüller SE & Co. KG, Paul Mueller Company, Robert Reiser & Co., Inc., Rockwell Automation, Scansteel Foodtech A/S, and SPX FLOW. These companies provide a wide range of equipment, including extruders, separators, heat exchangers, mixers, and packaging systems tailored for plant-based, fermentation-derived, and cultivated protein production.

Market growth is driven by the rapid expansion of plant-based and cell-based protein industries, consumer demand for sustainable and high-protein alternatives, and increasing investments in food innovation facilities. Leading suppliers are focusing on automation, energy-efficient designs, and hygienic processing systems to meet regulatory and safety standards. Trends such as modular production lines, smart sensors for quality monitoring, and advanced drying technologies are shaping the competitive landscape.

North America and Europe lead in adoption due to strong alternative protein startups and infrastructure, while Asia-Pacific shows the fastest growth due to rising consumption of plant-based products and large-scale capacity expansions.

In May 2025, GEA inaugurated its Future Food Innovation Center in Janesville, Wisconsin, with a USD 20 million investment. The hub focuses on scaling plant-based, cultured, and microbial protein production, advancing equipment research and development, and providing technical support for manufacturers across the expanding USA alternative protein market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Equipment Type | Extruders, Homogenizers, Mixers, Dryers, and Filtration Units |

| Mode of Operation | Automatic and Semi-automatic |

| Application | Plant-Based Proteins, Cultured Meat, Insect Proteins, and Egg Replacements |

| End Use | Food Industry, Animal Feed, Nutraceuticals, and Others |

| Processing Technology | Texturization, Fermentation, Emulsification, and Spray Drying |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bühler AG, Alfa Laval AB, ANDRITZ AG, BAK Food Equipment, Bepex International LLC, FAM STUMABO, GEA Group Aktiengesellschaft, JBT Marel Corporation, Middleby Corporation, MULTIVAC Sepp Haggenmüller SE & Co. KG, Paul Mueller Company, Robert Reiser & Co., Inc., Rockwell Automation, Scansteel Foodtech A/S., and SPX FLOW |

| Additional Attributes | Dollar sales segmented by equipment type (extruders, dryers, mixers, filtration, homogenizers), production scale (small/medium vs large-scale), and application (plant-based, cultured, insect proteins). Regional demand shows APAC as fastest-growing. Buyers favor automation, hygienic scalability, and integration with functional food systems. Innovations include wide-band extruders, AI-enabled process control, and clean-label processing technologies. |

The global alternative protein production equipment market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the alternative protein production equipment market is projected to reach USD 6.5 billion by 2035.

The alternative protein production equipment market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in alternative protein production equipment market are extruders, homogenizers, mixers, dryers and filtration units.

In terms of mode of operation, automatic segment to command 61.7% share in the alternative protein production equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alternative Protein Market Insights - Sustainable Food Trends 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA