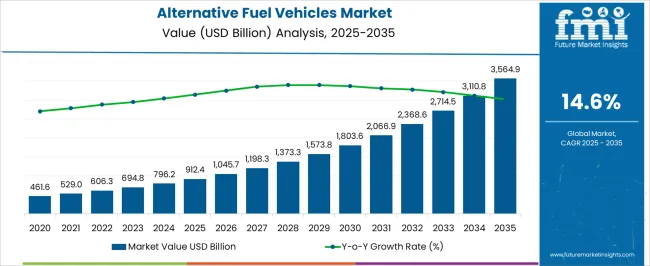

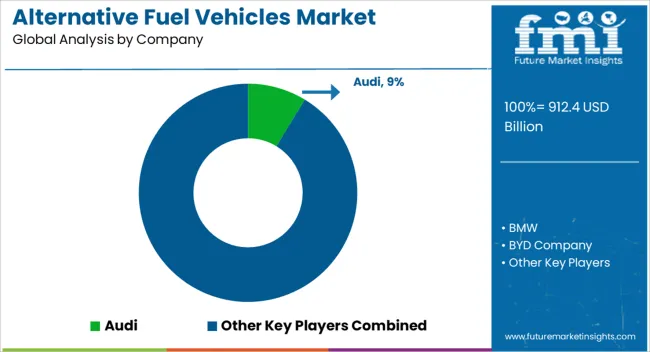

The alternative fuel vehicles market is estimated to be valued at USD 912.4 billion in 2025 and is projected to reach USD 3564.9 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period. Emission control mandates, fuel efficiency standards, and incentives for low- and zero-emission vehicles constitute key regulatory drivers that shape market dynamics. Across major regions, stringent emission regulations targeting internal combustion engine vehicles have accelerated the adoption of electric, hydrogen, and hybrid propulsion technologies, directly contributing to the growth trajectory from USD 912.4 billion in 2025 to USD 1,373.3 billion by 2028 and further to USD 3,564.9 billion by 2035.

Policy instruments, including tax credits, rebates, and subsidies for battery-electric vehicles and hydrogen fuel cell vehicles, have reduced adoption barriers, thereby expanding consumer access and corporate fleet penetration. The government-imposed penalties for high-emission vehicles and regulatory support for charging and fueling infrastructure have reinforced market uptake. Standards for safety, battery performance, and vehicle interoperability further ensure technology compliance and consumer confidence, directly impacting purchasing behavior and manufacturer investments.

The cumulative regulatory impact underscores a market environment where compliance requirements, incentives, and supportive infrastructure collectively guide the growth pattern. The projected expansion indicates that regulatory influence is not only a compliance necessity but a strategic lever driving innovation, technology diversification, and accelerated market adoption, positioning AFVs to achieve the forecasted USD 3,564.9 billion valuation by 2035.

| Metric | Value |

|---|---|

| Alternative Fuel Vehicles Market Estimated Value in (2025 E) | USD 912.4 billion |

| Alternative Fuel Vehicles Market Forecast Value in (2035 F) | USD 3564.9 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

The alternative fuel vehicles market represents a significant segment within the global automotive and sustainable mobility industry, emphasizing energy diversification, emission reduction, and technological innovation. Within the broader passenger and commercial vehicle sector, it accounts for about 8.5%, driven by demand for electric, hydrogen, biofuel, and hybrid-powered vehicles. In the electric vehicle and hybrid segment, its share is approximately 6.9%, reflecting adoption of battery-electric drivetrains, regenerative systems, and fuel-efficient technologies.

Across the commercial fleet and public transport industry, it contributes around 5.4%, supporting low-emission solutions for urban and long-haul transportation. Within the government and fleet adoption category, it represents 4.8%, highlighting incentives, regulatory compliance, and emission reduction goals. In the overall automotive and clean mobility ecosystem, the market contributes about 7.2%, emphasizing performance, sustainability, and innovation-driven adoption of non-conventional propulsion systems. Recent developments in the alternative fuel vehicles market have focused on electrification, fuel diversification, and smart integration. Groundbreaking trends include battery-electric vehicles with extended range, hydrogen fuel cell integration, plug-in hybrid adoption, and biofuel compatibility.

Key players are collaborating with charging infrastructure providers, energy companies, and software developers to enable connected vehicle platforms and energy management solutions. Adoption of lightweight materials, advanced batteries, and modular drivetrains is gaining traction to enhance efficiency and cost-effectiveness. The government incentives, low-emission zones, and fleet modernization programs are accelerating market penetration.

The alternative fuel vehicles market is witnessing accelerated growth, driven by rising environmental regulations, technological advancements, and increasing investments in sustainable transportation infrastructure. Government incentives, stricter emission norms, and heightened consumer awareness about carbon footprint reduction have collectively enhanced market adoption. Electrification remains the most prominent trend, supported by declining battery costs and expanded charging networks, while other alternative fuels continue to gain traction in niche applications.

The market is benefitting from robust demand in both passenger and commercial sectors, with urbanization and smart mobility initiatives further stimulating uptake. Economic viability is improving as the total cost of ownership for alternative fuel vehicles narrows compared to conventional counterparts, creating favorable conditions for fleet operators and private consumers.

With continuous innovations in powertrain efficiency, integration of autonomous features, and stronger OEM commitments to sustainability targets, the market outlook remains highly positive. Over the forecast period, policy alignment with renewable energy strategies is expected to consolidate the position of alternative fuel vehicles as a mainstream transportation choice.

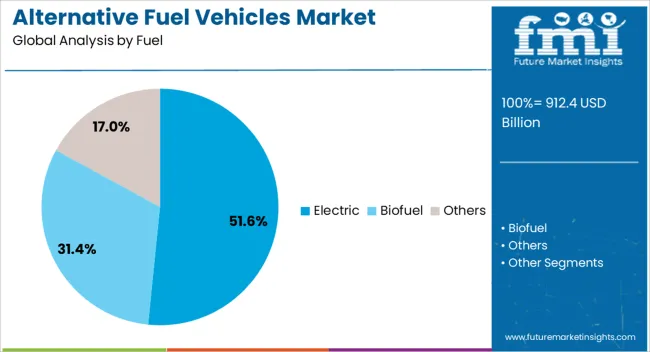

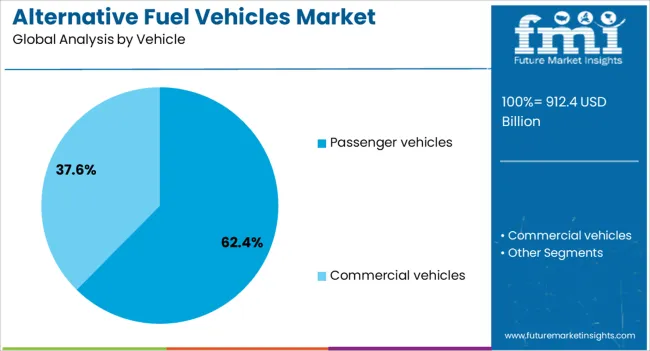

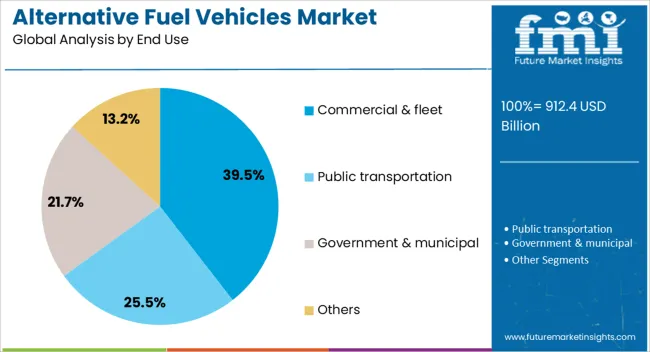

The alternative fuel vehicles market is segmented by fuel, vehicle, end use, and geographic regions. By fuel, alternative fuel vehicles market is divided into Electric, Biofuel, and Others. In terms of vehicle, alternative fuel vehicles market is classified into Passenger vehicles and Commercial vehicles. Based on end use, alternative fuel vehicles market is segmented into Commercial & fleet, Public transportation, Government & municipal, and Others. Regionally, the alternative fuel vehicles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric segment leads the fuel category in the alternative fuel vehicles market, accounting for approximately 51.6% of the overall share. This leadership is supported by rapid advancements in battery technology, offering higher energy density, faster charging, and longer driving ranges. Government-backed incentives, subsidies, and tax benefits have significantly lowered acquisition costs, accelerating adoption across urban and suburban markets.

Expansion of public and private charging infrastructure has enhanced convenience, addressing one of the key barriers to adoption. The segment’s dominance is also attributed to its alignment with zero-emission targets and corporate sustainability commitments by automotive manufacturers.

Increasing integration of smart connectivity and over-the-air software updates has further elevated user experience, attracting a tech-savvy consumer base. With supportive policy frameworks and continued cost reductions in lithium-ion and solid-state batteries, the electric segment is projected to maintain its leading position, driving the market’s transition towards cleaner mobility solutions over the coming decade.

The passenger vehicles segment dominates the vehicle category, holding around 62.4% of the alternative fuel vehicles market share. Growth in this segment is driven by rising consumer demand for eco-friendly personal transportation options and the proliferation of electric and hybrid models across multiple price points. Automakers have intensified their focus on expanding product portfolios with enhanced safety features, improved range, and better performance, making alternative fuel passenger vehicles more competitive against traditional internal combustion engine models.

Financial incentives, reduced registration fees, and urban access benefits have contributed to strong sales momentum, particularly in densely populated metropolitan areas. The segment’s strength is further reinforced by heightened interest among younger, environmentally conscious consumers seeking sustainable lifestyle choices.

Continuous expansion of financing options and subscription-based ownership models has also broadened accessibility. With urban mobility trends favoring low-emission personal transport, the passenger vehicles segment is expected to sustain its dominance throughout the forecast horizon.

The commercial & fleet segment leads the end use category, capturing approximately 39.5% of the alternative fuel vehicles market. This dominance is primarily attributed to cost savings achieved through reduced fuel expenses and lower maintenance requirements, which have strong appeal for fleet operators. The segment benefits from regulatory pressure on logistics and transport companies to meet emission reduction targets, encouraging large-scale adoption of electric, hybrid, and other alternative fuel-powered fleets.

Advances in telematics, route optimization, and vehicle performance analytics have improved operational efficiency, further strengthening the business case for investment. Infrastructure development tailored to fleet operations, including depot-based charging and fueling stations, has accelerated the transition.

Additionally, corporate sustainability goals and brand positioning strategies have led major logistics, delivery, and public transportation companies to prioritize alternative fuel fleets. With economies of scale and favorable lifecycle cost economics, the commercial & fleet segment is expected to remain a critical driver of market penetration in the years ahead.

The market has been gaining momentum due to the rising focus on environmental protection, energy diversification, and reduction of fossil fuel dependency. Vehicles powered by electricity, hydrogen, natural gas, biofuels, and hybrid systems are increasingly being adopted across passenger, commercial, and industrial segments. Supportive government policies, emission regulations, and incentives for clean energy adoption have accelerated market growth. Technological advancements in batteries, fuel cells, and hybrid powertrains have enhanced vehicle efficiency, performance, and range. Consumer awareness regarding air quality, fuel economy, and long-term operating costs has also contributed to adoption.

The growth of battery-electric vehicles (BEVs) has been a major driver for the alternative fuel vehicles market. Advances in lithium-ion and solid-state battery technologies have improved energy density, charging speed, and overall vehicle range. Battery management systems, regenerative braking, and lightweight materials have enhanced vehicle efficiency and performance. OEMs are offering a variety of BEV models, from compact city cars to heavy-duty trucks, to meet consumer and commercial demand. Charging infrastructure expansion, including fast-charging stations and home charging solutions, has further enabled market penetration. Urban fleets, public transportation, and ride-hailing services are increasingly deploying BEVs to reduce operational costs and emissions. Combined with supportive government policies and incentives, electrification has accelerated adoption and is shaping future mobility trends globally.

Hydrogen fuel cell vehicles and vehicles using compressed natural gas, liquefied petroleum gas, or biofuels are gaining traction as alternative fuel options. Hydrogen vehicles offer long driving ranges, short refueling times, and zero tailpipe emissions, making them suitable for heavy-duty transport and commercial fleets. Biofuel-powered vehicles utilize renewable feedstocks, contributing to reduced carbon intensity and enhanced energy security. Regulatory support, fleet electrification mandates, and incentives for clean energy adoption have boosted investment in hydrogen refueling infrastructure and biofuel production. Market expansion is supported by pilot projects, collaboration between energy providers and vehicle manufacturers, and technological innovations in fuel storage, delivery, and utilization. These efforts have broadened the adoption base beyond light-duty BEVs and enabled multi-fuel mobility solutions.

Government policies and regulatory frameworks have significantly influenced the adoption of alternative fuel vehicles. Emission standards, fuel efficiency mandates, and clean energy targets have compelled manufacturers to expand alternative fuel vehicle offerings. Tax credits, subsidies, and reduced registration fees incentivize consumer purchases, while corporate fleet mandates encourage commercial adoption. Investments in refueling infrastructure, such as EV charging networks and hydrogen stations, have addressed accessibility challenges. Regional strategies targeting urban air quality, noise reduction, and sustainable transportation have increased the emphasis on zero-emission mobility solutions. Compliance with international standards for safety, emissions, and performance further ensures global market acceptance. Collectively, policy support and regulatory frameworks have provided a structured pathway for accelerated adoption of alternative fuel vehicles worldwide.

Consumer awareness regarding environmental impact, fuel savings, and advanced vehicle features has fueled alternative fuel vehicle demand. Preferences are shifting toward low-emission and energy-efficient transportation solutions. Technological trends such as connected vehicles, autonomous features, and smart energy management systems enhance user experience and market appeal. Automotive manufacturers are responding with innovative vehicle designs, modular platforms, and diversified powertrain options to meet evolving consumer needs. Marketing campaigns, green certifications, and corporate social responsibility initiatives have reinforced the perception of alternative fuel vehicles as sustainable and forward-looking choices. The combination of consumer demand, innovation, and environmental awareness continues to expand market penetration across personal, commercial, and industrial segments worldwide.

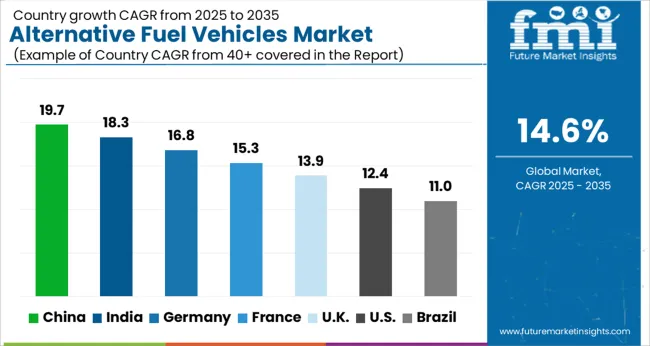

| Country | CAGR |

|---|---|

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| France | 15.3% |

| UK | 13.9% |

| USA | 12.4% |

| Brazil | 11.0% |

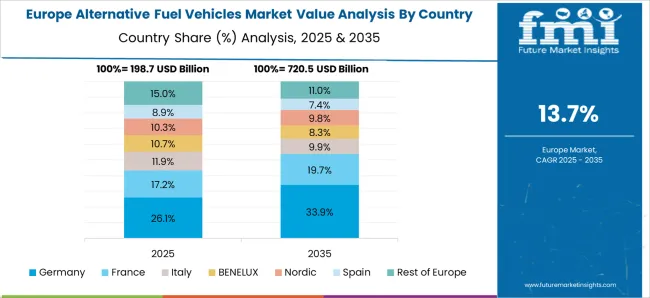

The market is expected to grow at a CAGR of 14.6% from 2025 to 2035, reflecting the global shift toward low-emission and energy-efficient transportation. China leads with 19.7%, driven by strong government incentives, expanding electric vehicle infrastructure, and domestic EV production. India follows at 18.3%, supported by policy initiatives and growing consumer adoption of electric and hybrid vehicles. Germany records 16.8%, reflecting advancements in automotive technology and emission reduction targets. The UK holds 13.9%, influenced by regulatory measures and rising EV sales. The USA registers 12.4%, driven by increasing investment in clean mobility and charging infrastructure. Market expansion is propelled by innovation, regulatory compliance, and changing consumer preferences for sustainable transport. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a remarkable 19.7% CAGR, driven by government incentives, expansion of electric vehicle charging infrastructure, and strong adoption of battery electric and hydrogen fuel cell vehicles. Domestic and international automakers invested heavily in research and development, production facilities, and battery technology to meet growing urban and commercial demand. Public transportation fleets and shared mobility services increasingly adopted electric and hybrid solutions to reduce operational costs and emissions. Competitive strategies emphasized fast charging network expansion, local supply chain integration, and vehicle affordability. Collaboration between automakers, battery manufacturers, and energy providers supported large scale deployment. Innovation in battery efficiency, range extension, and vehicle connectivity further reinforced market growth.

India demonstrated an 18.3% CAGR, supported by policy measures, electric vehicle manufacturing hubs, and rising consumer awareness. Automakers invested in electric and hybrid vehicle production lines, battery manufacturing, and vehicle connectivity systems. Urban adoption was highest among two wheelers, three wheelers, and passenger cars due to fuel cost savings and environmental benefits. Incentives such as tax reductions and state level subsidies accelerated market penetration. Competitive strategies included partnerships with battery and charging infrastructure providers, and development of localized supply chains. Automotive startups focused on high efficiency EV models for urban commuting, while established brands introduced hybrid and plug in models to capture diversified segments.

Germany progressed at a 16.8% CAGR, shaped by growing adoption of electric, plug in hybrid, and hydrogen fuel cell vehicles. OEMs invested in battery technology, production automation, and high performance vehicle segments. Urban fleets, corporate mobility programs, and government vehicle initiatives increased uptake. Charging infrastructure expansion and hydrogen refueling stations supported widespread adoption. Competitive advantage was gained through technological innovation, vehicle performance, and integration of connected mobility solutions. Export potential to neighboring European countries influenced production and design decisions. Manufacturers emphasized compliance with EU emission standards, sustainability, and high range efficiency. Strategic collaborations with energy providers ensured uninterrupted operation and enhanced customer confidence.

The United Kingdom advanced at a 13.9% CAGR, driven by government policies, rising consumer awareness, and expansion of EV infrastructure. Electric, hybrid, and hydrogen vehicles were increasingly adopted by corporate fleets, public transport, and private consumers. Manufacturers invested in battery development, vehicle connectivity, and low emission mobility solutions. Competitive strategies emphasized affordability, range enhancement, and localized service networks. Public and private partnerships supported rapid deployment of charging networks and pilot projects. Fleet operators adopted alternative fuel vehicles for operational cost efficiency and compliance with emission regulations. Promotional campaigns, tax benefits, and vehicle leasing schemes further stimulated adoption among early adopters and environmentally conscious buyers.

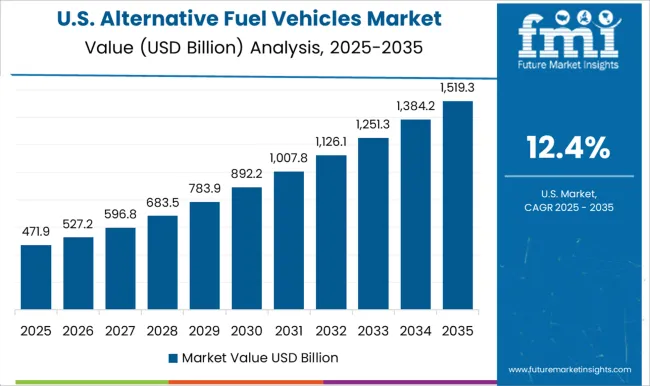

The United States expanded at a 12.4% CAGR, influenced by rising adoption of electric, hybrid, and hydrogen fuel cell vehicles. Incentives at federal and state levels, including tax credits and grants, supported consumer uptake. Automakers invested in large scale EV production, battery research, and charging network expansion. Urban commuters, corporate fleets, and commercial delivery services increasingly adopted alternative fuel vehicles to reduce operational costs. Technological innovation, vehicle range improvement, and integration with connected mobility systems provided competitive differentiation. Strategic partnerships with energy providers facilitated rapid deployment of charging infrastructure. Manufacturers emphasized sustainability, compliance with emission standards, and regional service networks to capture diverse market segments across the country.

The market has been shaped by established automotive leaders and emerging electric mobility pioneers. Audi, BMW, Mercedes-Benz, and Toyota have focused on premium electrified vehicles, combining performance, efficiency, and advanced battery management systems. Their strategies emphasize reducing carbon footprint, integrating hybrid and plug-in technologies, and leveraging global distribution networks. BYD Company and Hyundai Motor have targeted mass market adoption, emphasizing affordability, range efficiency, and rapid charging infrastructure compatibility.

Ford Motor, General Motors, Honda Motors, and Fiat Chrysler Automobiles have differentiated through modular vehicle platforms and multi-fuel adaptability. Product brochures highlight battery electric, plug-in hybrid, and hydrogen fuel cell options, focusing on long driving range, low maintenance, and safety standards. Audi and BMW showcase performance-oriented electric drivetrains, while Toyota emphasizes hybrid reliability and fuel efficiency. Ford and GM present fleet solutions and regional adaptations, highlighting versatility and scalability.

| Item | Value |

|---|---|

| Quantitative Units | USD 912.4 Billion |

| Fuel | Electric, Biofuel, and Others |

| Vehicle | Passenger vehicles and Commercial vehicles |

| End Use | Commercial & fleet, Public transportation, Government & municipal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Audi, BMW, BYD Company, Mercedes-Benz, Fiat Chrysler Automobiles, Ford Motor, General Motors, Honda Motors, Hyundai Motor, and Toyota |

| Additional Attributes | Dollar sales by vehicle type and fuel category, demand dynamics across passenger, commercial, and fleet segments, regional trends in alternative fuel adoption, innovation in battery, hydrogen, and biofuel technologies, environmental impact of reduced emissions and lifecycle energy use, and emerging use cases in urban mobility, long-haul transportation, and shared fleet solutions. |

The global alternative fuel vehicles market is estimated to be valued at USD 912.4 billion in 2025.

The market size for the alternative fuel vehicles market is projected to reach USD 3,564.9 billion by 2035.

The alternative fuel vehicles market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in alternative fuel vehicles market are electric, _battery electric vehicles (bevs), _hybrid electric vehicles (hevs), _plug-in hybrid electric vehicles (phevs), _fuel cell electric vehicle (fcev), biofuel and others.

In terms of vehicle, passenger vehicles segment to command 62.4% share in the alternative fuel vehicles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alternative Protein Market Insights - Sustainable Food Trends 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Meat Alternative Market Forecast and Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA