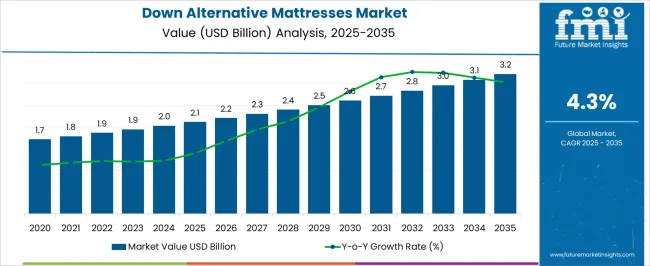

The down alternative mattresses market, estimated at USD 2.1 billion in 2025 and forecasted to reach USD 3.2 billion by 2035 with a CAGR of 4.3%, exhibits pronounced regional growth imbalances driven by differing consumer preferences, lifestyle trends, and economic conditions. Asia-Pacific is poised to experience accelerated adoption due to the rising penetration of organized retail channels, growing awareness of hypoallergenic bedding solutions, and expanding middle-class populations with increasing emphasis on home comfort and wellness.

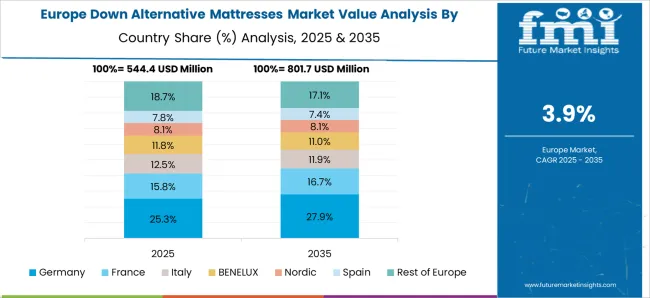

Urban households in major APAC economies are increasingly seeking alternatives to traditional down products, which is fueling gradual but consistent market growth in the region. Europe, characterized by mature bedding markets and high consumer standards for quality and environmental compliance, is expected to show steady expansion. Stringent regulations on synthetic materials and eco-friendly product certifications influence market adoption patterns, with growth largely concentrated in Western European countries.

North America, which already demonstrates strong consumer familiarity with down alternative bedding, is projected to maintain moderate growth. Market penetration is supported by established e-commerce platforms, brand recognition, and consumer demand for cruelty-free and allergen-resistant products, although the rate of increase is comparatively lower due to market maturity. The regional disparities indicate that Asia-Pacific will likely contribute a larger incremental share over the forecast period, whereas Europe and North America will sustain stable, mature market bases. Strategic targeting of emerging APAC markets alongside tailored marketing and product positioning remains crucial to capitalize on these regional growth differences.

| Metric | Value |

|---|---|

| Down Alternative Mattresses Market Estimated Value in (2025 E) | USD 2.1 billion |

| Down Alternative Mattresses Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The down alternative mattresses market represents a specialized segment within the global bedding and sleep solutions industry, emphasizing comfort, hypoallergenic materials, and durability. Within the broader mattress and sleep products sector, it accounts for about 5.2%, driven by adoption in residential, hospitality, and premium bedding applications. In the synthetic and fiberfill bedding segment, it holds nearly 4.7%, reflecting demand for non-feather alternatives that provide similar softness and support. Across the luxury and premium mattress market, the share is 4.1%, supporting consumer preference for comfort, easy maintenance, and allergy-free sleep solutions. Within the home furnishings and interior comfort category, it represents 3.8%, highlighting integration with bedroom aesthetics and lifestyle trends.

In the health-focused sleep and ergonomics sector, it secures 3.5%, emphasizing pressure relief, temperature regulation, and sleep quality improvement. Recent developments in this market have focused on material innovation, durability, and consumer customization. Innovations include advanced microfiber fillings, gel-infused fibers for temperature regulation, and eco-friendly synthetic alternatives that replicate natural down properties. Key players are collaborating with textile manufacturers, sleep research institutions, and mattress brands to improve comfort, longevity, and allergen resistance.

Adoption of adjustable firmness options, hybrid constructions, and washable covers is gaining traction to enhance convenience and user satisfaction. The eCommerce platforms, direct-to-consumer models, and subscription-based mattress offerings are being deployed to expand reach and accessibility.

The current market scenario reflects increasing awareness of health and environmental concerns associated with traditional down feathers.

Enhanced comfort, affordability, and easy maintenance are further contributing to the rising adoption of down alternative products across both developed and emerging regions. The market outlook is shaped by innovations in synthetic materials that mimic the softness and insulation properties of natural down while addressing allergy and ethical concerns.

Growing investments in home improvement and bedding product upgrades are also driving demand. As consumers seek sustainable and cost-effective sleep solutions, the down alternative mattresses market is expected to expand steadily, supported by increasing distribution channels and rising online sales.

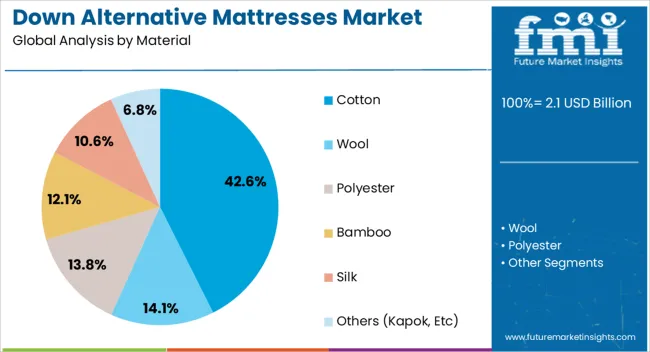

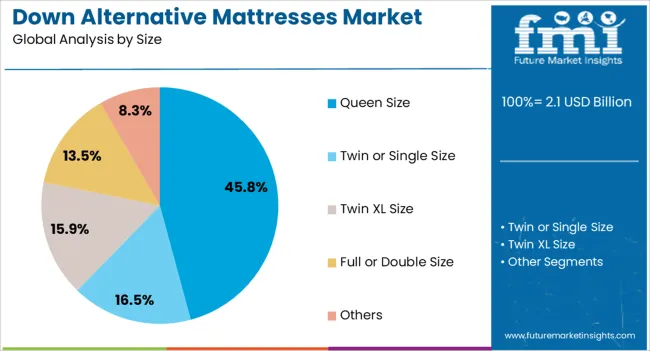

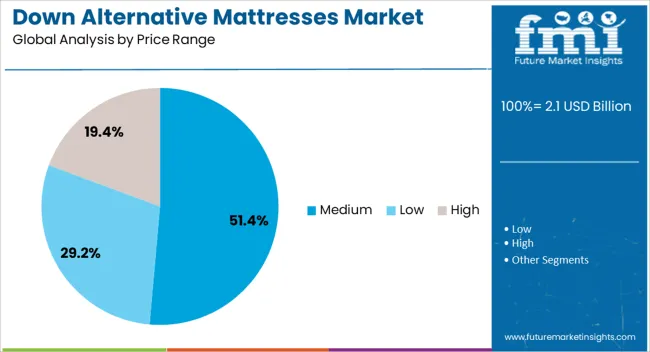

The down alternative mattresses market is segmented by material, size, price range, firmness level, end-use, distribution channel, and geographic regions. By material, down alternative mattresses market is divided into Cotton, Wool, Polyester, Bamboo, Silk, and Others (Kapok, Etc). In terms of size, down alternative mattresses market is classified into Queen Size, Twin or Single Size, Twin XL Size, Full or Double Size, and Others.

Based on price range, down alternative mattresses market is segmented into Medium, Low, and High. By firmness level, down alternative mattresses market is segmented into Medium, Soft, and Firm. By end-use, down alternative mattresses market is segmented into Residential, Commercial, Hotel, Hospital, and Others (Educational Institutions, etc.). By distribution channel, down alternative mattresses market is segmented into Online, E-Commerce Website, Company Owned Website, Offline, Hypermarket/Supermarket, Specialized Stores, and Other Retail Stores. Regionally, the down alternative mattresses industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cotton is estimated to hold 42.6% of the material segment revenue share in 2025, positioning it as the leading material in the down alternative mattresses market. This dominance is being driven by cotton’s natural breathability, moisture-wicking properties, and environmental friendliness compared to synthetic fabrics.

Cotton’s hypoallergenic characteristics contribute to its preference among health-conscious consumers and those with sensitive skin. The availability of organic and sustainably sourced cotton options further reinforces its market position.

Its durability and ease of care have supported widespread adoption in premium and mid-range mattresses. The material’s compatibility with various filling types allows manufacturers to meet diverse consumer preferences, sustaining cotton’s strong revenue share.

The Queen Size mattress segment is anticipated to hold 45.8% of the size-based revenue share in 2025, making it the most prominent size category in the down alternative mattresses market. This preference is being influenced by the balance between space efficiency and sleeping comfort that queen-size mattresses provide, catering well to couples and individual users alike.

The segment benefits from broad compatibility with bedroom dimensions in urban and suburban homes. Its popularity is sustained by consumer trends favoring multifunctional living spaces where moderate mattress sizes are preferred.

Retailers and manufacturers prioritize queen-size offerings, resulting in wide availability and competitive pricing that further supports demand.

The Medium price range segment is expected to account for 51.4% of the market revenue share in 2025, reflecting consumer demand for mattresses that balance quality and affordability. This segment’s growth is being enabled by the increasing availability of down alternative mattresses that offer enhanced features such as cooling technology, durability, and comfort at accessible price points.

Consumers seeking value-driven purchases without compromising on key performance attributes have driven the expansion of this price category. The segment attracts a broad demographic, including first-time buyers and those upgrading from lower-tier products.

Enhanced marketing efforts and promotions in the medium price range have further facilitated adoption, maintaining its leading revenue share within the market.

The market has experienced robust growth as consumers increasingly seek comfort, hypoallergenic properties, and sustainability in bedding solutions. Down alternative materials, including polyester fibers, microfiber blends, and recycled synthetics, provide similar softness and insulation as natural down while minimizing allergy risks. Rising awareness of ethical sourcing and animal welfare has contributed to their adoption over traditional feather or goose down mattresses.

eCommerce platforms, home furnishing retailers, and specialty bedding stores have expanded accessibility, while marketing strategies highlight comfort, temperature regulation, and durability. Product innovation, including hybrid designs and eco-friendly fillings, has enhanced consumer appeal.

The adoption of down alternative mattresses has been strongly influenced by consumer preference for hypoallergenic and ethically sourced bedding. Individuals prone to allergies or respiratory issues prefer synthetic fillings over traditional down due to reduced risk of dust mites and allergens. Animal welfare considerations have further reinforced demand, as down alternatives eliminate reliance on feather harvesting. Manufacturers emphasize certifications, such as OEKO-TEX and Responsible Down Standard compliance, to build consumer confidence. Marketing campaigns highlight comfort, sleep quality, and environmental consciousness, attracting health-conscious and ethically minded consumers. These factors have driven residential adoption, hotel industry integration, and boutique hospitality usage, expanding the overall market reach for down alternative mattresses.

Technological advancements in materials, fiber engineering, and mattress construction have significantly improved the performance of down alternative mattresses. High-quality microfibers, gel-infused fillings, and adaptive layers enhance temperature regulation, softness, and support. Quilting techniques, zoned support designs, and compression resilience increase durability and maintain consistent comfort over extended use. Hybrid models combine memory foam, latex, or pocket springs with synthetic down layers to address varied sleep preferences. Production automation, advanced filling processes, and moisture-wicking treatments enhance consistency and hygiene. Continuous innovation in these areas has elevated consumer perception of down alternative mattresses, making them competitive alternatives to traditional down bedding in both price and performance.

Retail expansion and online sales channels have been key drivers for the down alternative mattress market. Home furnishing chains, specialty bedding stores, and direct-to-consumer brands provide extensive product variety and accessibility. E-commerce platforms offer convenience, competitive pricing, and customer reviews, influencing purchasing decisions. Subscription-based delivery models and trial periods have reduced entry barriers for consumers. International shipping and global distribution networks have enabled market penetration into emerging regions with growing middle-class populations. Retail marketing strategies, including bundled sleep solutions and seasonal promotions, further stimulate demand. The combination of offline and online presence ensures widespread consumer reach and sustained growth for down alternative mattress products.

The market faces challenges due to fluctuating raw material costs, competition from natural down products, and market fragmentation. Synthetic fibers such as polyester and microfiber are subject to price volatility, impacting production costs. Brand proliferation and inconsistent product quality create consumer confusion and affect trust. Additionally, niche preferences for natural down or organic bedding may limit conversion in certain segments. Logistics, storage, and handling of bulky products also contribute to operational complexities. To address these challenges, manufacturers are focusing on innovative fiber blends, standardized quality certifications, and cost-efficient production methods, ensuring consistent product performance while maintaining competitive pricing across diverse markets.

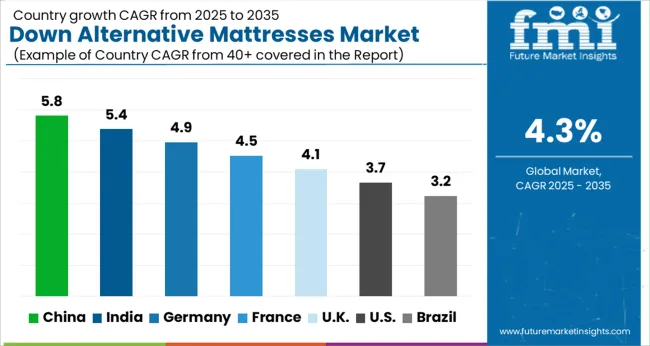

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The market is anticipated to expand at a CAGR of 4.3% from 2025 to 2035, fueled by increasing consumer preference for hypoallergenic and sustainable bedding solutions. Germany registered 4.9, reflecting steady adoption in urban households and premium hotel segments, while India reached 5.4, driven by growing middle-class demand and modern retail expansion. China led with 5.8, supported by large-scale manufacturing and rising domestic consumption. The United Kingdom recorded 4.1, benefiting from lifestyle trends and online retail growth, and the United States reached 3.7, sustained by innovations in comfort and eco-friendly materials. These markets depict a varied landscape of production, adoption, and technological integration. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 5.8%, driven by increasing awareness of hypoallergenic bedding, urban housing developments, and demand for affordable luxury sleep products. Adoption has been reinforced by growing e commerce channels and a preference for synthetic fiber fillings that mimic down. Domestic manufacturers focus on high quality, durable, and comfortable mattress offerings targeting residential consumers. Market growth is further supported by rising household consumption, online retail expansion, and partnerships with bedding and furniture brands. The outlook remains positive as Chinese consumers increasingly invest in enhanced sleep comfort solutions.

India is expected to record a CAGR of 5.4%, supported by growing middle class households, increasing e commerce adoption, and awareness of hypoallergenic bedding solutions. Adoption has been reinforced by domestic manufacturers providing affordable, comfortable, and durable mattresses using synthetic down alternatives. Market expansion is further influenced by collaborations with furniture retailers, online marketplaces, and direct to consumer sales channels. Demand is expected to grow steadily as consumers increasingly prioritize sleep quality and invest in bedroom comfort solutions across urban and semi urban areas in India.

Germany is projected to expand at a CAGR of 4.9%, driven by demand for ecofriendly, hypoallergenic, and premium bedding solutions. Adoption has been reinforced by consumer preference for sustainable synthetic fibers, health oriented bedding, and durable mattress designs. German manufacturers focus on high quality craftsmanship, certifications for safety and health standards, and innovative sleep technologies. Market growth is further supported by partnerships with home furnishing retailers and increasing awareness of sleep quality.

The United Kingdom market is expected to grow at a CAGR of 4.1%, supported by demand for comfort bedding, allergy friendly products, and synthetic fiber mattresses. Adoption has been reinforced by retailers providing premium and mid-range options with enhanced durability, breathability, and comfort. Market expansion is influenced by growing e commerce channels, collaborations with home decor brands, and consumer awareness campaigns focused on sleep wellness. The outlook remains steady as U K consumers continue to invest in mattresses that provide comfort, support, and hypoallergenic benefits.

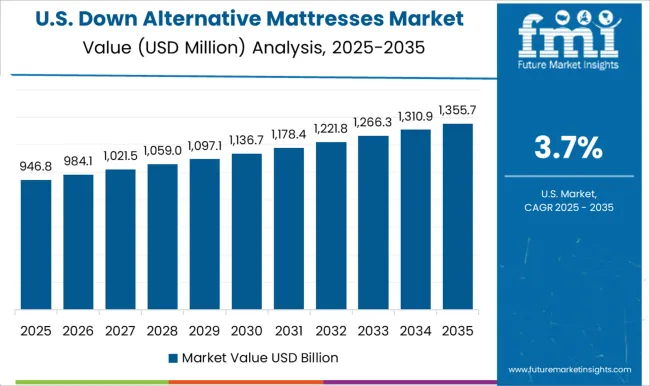

The United States market is projected to expand at a CAGR of 3.7%, driven by consumer preference for allergy friendly bedding, affordable luxury, and synthetic fiber filled mattresses. Adoption has been reinforced by both retail and online channels offering premium, mid-range, and budget options with enhanced comfort. Leading manufacturers focus on ergonomic designs, long term durability, and certified hypoallergenic materials. Market growth remains moderate but consistent as consumers increasingly prioritize sleep wellness and invest in synthetic bedding solutions.

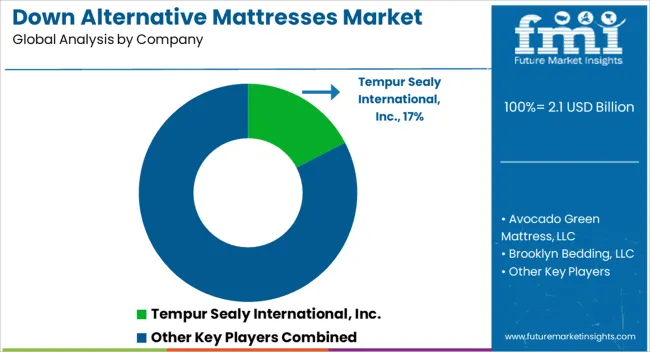

The market is characterized by the presence of established global mattress manufacturers and specialized sleep solution providers, competing on product innovation, comfort technology, and sustainability features. Key players such as Tempur Sealy International, Inc., Serta Simmons Bedding, LLC, Sleep Number Corporation, and Purple Innovation, Inc. maintain strong market positions through brand recognition, wide distribution networks, and advanced sleep technologies. Emerging and niche-focused companies including Avocado Green Mattress, LLC, Casper Sleep Inc., Helix Sleep, Inc., Layla Sleep, Brooklyn Bedding, LLC, and Saatva Inc. differentiate themselves through eco-friendly materials, customizable comfort layers, and direct-to-consumer sales models.

Companies like DreamCloud (Resident Home LLC), Puffy Mattress, Signature Sleep, Tuft & Needle, and Nest Bedding, Inc. focus on affordability, hybrid constructions, and premium synthetic fill solutions to attract a diverse customer base. Competitive dynamics are influenced by evolving consumer preferences for hypoallergenic and cruelty-free bedding, innovations in cooling, support, and ergonomic designs, and the expansion of online mattress retail platforms. Market leaders investing in R&D, sustainable materials, and differentiated sleep experiences are strategically positioned to capitalize on growing demand across residential and hospitality sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Material | Cotton, Wool, Polyester, Bamboo, Silk, and Others (Kapok, Etc) |

| Size | Queen Size, Twin or Single Size, Twin XL Size, Full or Double Size, and Others |

| Price Range | Medium, Low, and High |

| Firmness Level | Medium, Soft, and Firm |

| End-Use | Residential, Commercial, Hotel, Hospital, and Others (Educational Institutions, Etc) |

| Distribution Channel | Online, E-Commerce Website, Company Owned Website, Offline, Hypermarket/Supermarket, Specialized Stores, and Other Retail Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tempur Sealy International, Inc., Avocado Green Mattress, LLC, Brooklyn Bedding, LLC, Casper Sleep Inc., DreamCloud (Resident Home LLC), Helix Sleep, Inc., Layla Sleep, Nest Bedding, Inc., Puffy Mattress, Purple Innovation, Inc., Saatva Inc., Serta Simmons Bedding, LLC, Signature Sleep, Sleep Number Corporation, and Tuft & Needle |

| Additional Attributes | Dollar sales by mattress type and fill material, demand dynamics across residential, hospitality, and premium segments, regional trends in hypoallergenic and sustainable bedding adoption, innovation in comfort technologies, durability, and temperature regulation, environmental impact of material sourcing and disposal, and emerging use cases in allergy-friendly sleep solutions, eco-conscious home products, and luxury bedding offerings. |

The global down alternative mattresses market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the down alternative mattresses market is projected to reach USD 3.2 billion by 2035.

The down alternative mattresses market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in down alternative mattresses market are cotton, wool, polyester, bamboo, silk and others (kapok, etc).

In terms of size, queen size segment to command 45.8% share in the down alternative mattresses market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Downhole Tractor Market Size and Share Forecast Outlook 2025 to 2035

Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Down and Feather Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Downhole Tractor Providers

Sit-Down Reach Truck Market Size and Share Forecast Outlook 2025 to 2035

Washdown Scales Market

Car Breakdown Recovery Service Market Size and Share Forecast Outlook 2025 to 2035

Emergency Shutdown System Market Trends - Growth & Forecast 2025 to 2035

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alternative Protein Market Insights - Sustainable Food Trends 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Meat Alternative Market Forecast and Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA