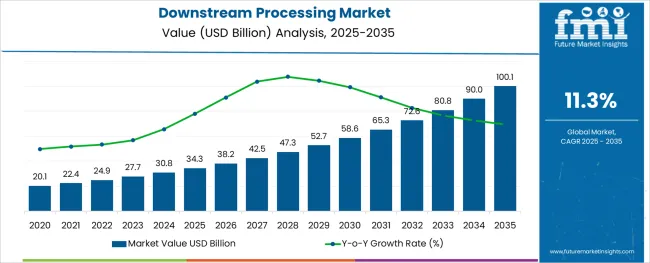

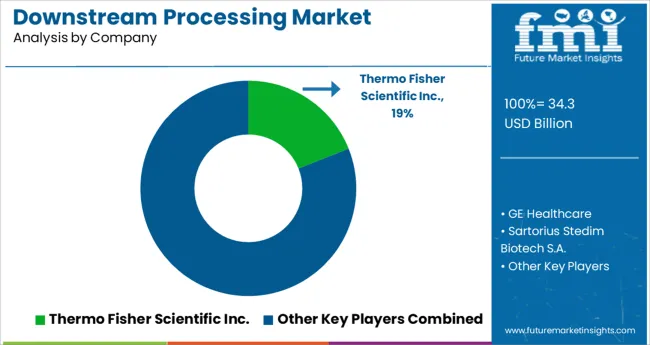

The Downstream Processing Market is estimated to be valued at USD 34.3 billion in 2025 and is projected to reach USD 100.1 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

The webbing cutting machine market is witnessing notable growth as industries including automotive, apparel, military, and packaging increasingly depend on precision fabric cutting technologies to improve productivity and reduce material waste. Automation has become central to the evolution of these machines, as manufacturers seek to enhance output consistency, minimize human error, and meet diverse order specifications with minimal downtime.

The demand for faster changeovers, smart control systems, and digitally calibrated feed mechanisms is accelerating, particularly in high-mix production environments. Additionally, integration with vision systems and programmable logic controls is enabling manufacturers to achieve tighter tolerances across various textile and synthetic materials.

Emerging application areas such as wearable technology and smart textiles are also encouraging investment in highly adaptable cutting equipment. As global supply chains become more reliant on efficiency and precision, future growth will be shaped by machines that offer high throughput, minimal material degradation, and compatibility with sustainable production practices.

The market is segmented by Product, Technique, Application, and End User and region. By Product, the market is divided into Chromatography Columns and Resins, Membrane Adsorbers, Single-use Products, and Consumables and Accessories. In terms of Technique, the market is classified into Purification, Separation, and Concentration. Based on Application, the market is segmented into Monoclonal Antibody Production, Vaccine Production, Insulin Production, Immunoglobulin Production, Erythropoietin Production, and Other Application. By End User, the market is divided into Biopharmaceutical Companies, CDMO/Contract Research Organization, and Research/Academic Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is projected to command 63.50% of the total market revenue in 2025, establishing it as the dominant category within the automation segment. This leadership is driven by increasing demand for machines that offer continuous operation with minimal manual intervention.

Automatic webbing cutting machines are equipped with features such as digital length setting, heat sealing, and tension control, which enhance cutting accuracy and reduce edge fraying. These machines are particularly valued for their role in streamlining operations in mass production environments, where high repeatability and reduced setup time are critical.

With rising labor costs and the need for lean manufacturing, adoption of automatic systems has accelerated across both established and emerging economies. Furthermore, their ability to integrate into larger production lines and support smart factory initiatives has reinforced their position as the preferred automation type in the webbing cutting machine market.

The 50 to 100 meter per minute capacity range is anticipated to hold 42.70% of market revenue in 2025, making it the leading segment by capacity. This range has emerged as the optimal balance between operational speed and control, particularly in industries requiring mid-volume production with high dimensional accuracy.

Machines in this capacity bracket are favored for their versatility, enabling manufacturers to process a wide variety of webbings such as nylon, polyester, and cotton with consistent quality. Their compatibility with both manual and automated feeding systems has further expanded their utility across small and medium-sized enterprises.

Additionally, lower energy consumption and compact machine footprints make them suitable for space-constrained production floors. These characteristics have led to widespread adoption, particularly in textile and accessories manufacturing, positioning this capacity range as the most commercially viable in the segment.

In the application segment, tapes are expected to account for 24.60% of total market revenue in 2025, making it the leading application area for webbing cutting machines. This growth is being propelled by the expanding use of woven and non-woven tapes in sectors such as automotive interiors, safety equipment, apparel reinforcement, and packaging. Precision and clean-edge cutting are critical in tape production, especially when dealing with specialty adhesives, heat-sensitive fabrics, and reflective materials.

Webbing cutting machines designed for tape applications often feature hot knife or ultrasonic options to meet these requirements. The increasing demand for customized widths, batch production flexibility, and high-speed order fulfillment has driven adoption in this segment.

Moreover, advancements in coating and lamination techniques have created new performance expectations, which these machines are being designed to meet. As tape usage diversifies across industries, its status as a core application for webbing cutters is expected to remain strong.

The global sales of downstream processing products are projected to grow at 11.3% CAGR between 2025 and 2035, in comparison to the 5.8% CAGR registered during the historical period from 2012 to 2024.

Rising usage of downstream processing techniques for manufacturing various biopharmaceutical products and increasing investments in research and development by pharmaceutical and biopharmaceutical companies are some of the key factors driving the global downstream processing market

Similarly, Rising government funding for basic and clinical research to address real clinical needs, burgeoning demand for biopharmaceuticals, and growing adoption of automation across the pharmaceutical industry is expected to boost the sales of some of the key downstream processing products during the forecast period.

In recent years, biopharmaceutical companies and contract research organizations have ramped up their production of proteins, vaccines, antibodies, and other biopharmaceutical products by employing upstream processes and downstream processing techniques.

The retrieval and purification of biosynthetic products from natural sources, such as plant or animal tissue, is referred to as downstream processing. For example, a crucial step in the production of antibiotics like penicillin is downstream processing.

The method includes separating and purifying antibiotics from a variety of media. Due to the rising need for biologics, downstream technology is increasingly being used in industrial-scale and laboratory applications. This trend is expected to boost downstream processing market growth over the coming years.

Also, the essential force that drives the downstream processing industry is the cumulative demand for biosynthetic products for use in pharmaceutics. Due to their lower risk of side effects, drugs made from naturally occurring sources are currently witnessing increasing demand.

A steady increase in the demand for high-quality pharmaceuticals or recombinant products is expected to drive the downstream processing market at a prolific pace during the forecast period.

Similarly, the rising prevalence of diseases like diabetes, pneumonia, and influenza along with increased awareness of biologics and large molecules is also anticipated to boost demand for downstream techniques during the upcoming years.

Advancements in Downstream Processing to Foster Growth Over the Forthcoming Years

Recently, chromatography adapted to the pharmaceutical industry upon seeing tremendous success in the textile industry, assisting with operations including material preparation and molecular characterization. The downstream processing chromatography industry is experiencing significant advancements with the rise of new therapeutic modalities including monoclonal antibody (mAbs)-based therapeutics.

Pharmaceutical and biopharmaceutical firms are embracing continuous processing, and regulatory bodies support real-time monitoring via process analytical technology (PAT) to control the downstream process. The growth of chromatography systems will also be impacted by the transition from larger, single-product facilities to smaller, multiproduct facilities.

Biopharmaceutical manufacturers are highly focused on effective process control in automation in manufacturing. The pinnacle of intelligence-in-manufacturing, addressed by industry-focused R & D initiatives, is continuously developing through centralized/distributed hardware/software automation systems.

Additionally, the concept of a digital twin for enabling control is shown for a small-scale end-to-end monoclonal antibody production platform. Automation in the manufacturing sector would offer significant opportunities to overcome many constraints to commercial success.

Developers of biotherapeutics must consider large-scale production from the commencement of process development and should incorporate automation techniques. Thus, such advancement will create lucrative opportunities in the downstream processing market.

The cost of separation and purification often makes up more than half of the overall process cost. In order to build a cost-effective bioprocess, the downstream process is carefully examined.

Numerous separation and purification procedures have been combined to achieve the requisite degree of purity, which has increased the cost of the downstream process. Even though the efficiency of each stage is satisfactory, the system's extensive steps result in an increase in equipment costs as well as a reduction in the process' overall separation efficiency.

The monitoring and control of bioprocesses, such as downstream processing, have become more complex as a result of production process advancements, particularly in the biopharmaceutical and nutraceutical industries, and the limitations of some modern and some classical control system techniques are now becoming evident.

The above-mentioned factors pose a restrictive impact on the downstream processing industry and call for prompt attention toward optimization techniques for a smooth process flow.

Increasing Demand for Biopharmaceuticals Fuelling the Sales in the USA

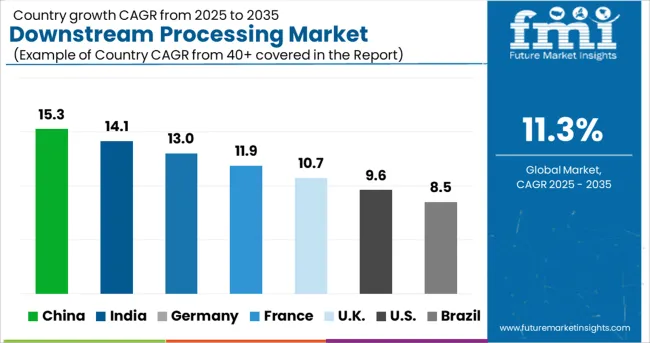

In 2024, the USA held a maximum share of about 90.4% in the North American downstream processing market and it is projected to display a growth rate of 10.5% CAGR during the forecast period (2025 to 2035).

Growth in the USA downstream processing market is driven by rising production and consumption of biopharmaceuticals, favourable government support, the surge in chronic and infectious diseases, and the strong presence of leading end-use industries.

The manufacturers based in the USA are focused on expanding their manufacturing facility to broaden their product portfolio and proposed new avenues for research, and would thus propel the growth of the overall downstream processing industry in this region throughout the forecast period.

For instance, in January 2024, Pall Corporation made significant investments in its global production capacity to meet industry demands driven by six existing manufacturing facilities as well as a new manufacturing facility in the USA

Rising Healthcare Spending Generating Demand in Germany's Downstream Processing Market

Germany held approximately 28.1% market share in the global downstream processing market in 2024 and it is projected to expand at a CAGR of 10.9% during the forecast period.

Rising healthcare spending, government funding for developing bioprocess technology, and rapidly expanding healthcare infrastructure are some of the key factors driving demand for downstream processing products in Germany’s market.

Additionally, the nation has seen significant strategic partnerships with pharmaceutical companies that are heavily investing in the research and development of vaccines and biopharmaceuticals. This will further accelerate the growth of the downstream processing market in Germany during the assessment period.

The surge in the Number of Pharmaceutical Companies in India Driving Growth

India accounted for a market value share of around 52.9% in the South Asia downstream processing market in 2024 and it is poised to exhibit strong growth during the next ten years.

Growth in the Indian downstream processing market is driven by rising production and export of biopharmaceuticals, the large presence of pharmaceutical companies, and increasing healthcare spending due to a surge in chronic and infectious diseases.

Improved product portfolio with process development and modeling of flow during bioprocess, through acquisition and merger activities, has deemed the production of bulk compounds as time-efficient, cost-effective, and with improved quality, even with large quantization of cultures. This has proposed new avenues for research, and would thus propel the growth of the overall bioprocess technology industry throughout the forecast period.

Demand Remains High for Chromatography Columns and Resins

Based on product, the chromatography columns and resins segment dominated the global downstream processing market with a share of around 37.9% in 2024 and it is likely to grow at a robust pace during the forecast period. This can be attributed to the increasing usage of chromatography columns and resins during downstream processing.

Chromatography columns are being increasingly used for the separation of chemical compounds or pharmaceutical compounds while chromatography resins are used to capture and polish mAbs, vaccines, antibody fragments, and other biomolecules.

The constant technological advancement in chromatography, which is considered a dynamic invention in the field of biopharmaceuticals, is predicted to experience positive progress during the forecast timeframe. This in turn will result in the high adoption of products like chromatography columns and resins.

However, the single-use products segment is anticipated to increase at the fastest rate during the coming years.

Purification Remains the Most Widely Used Downstream Processing Technique

The purification segment held a revenue share of around 43.5% in the global downstream processing market in 2024 and it is expected to experience an impressive growth rate of 13.5% during the forecast period. This can be attributed to the rising adoption of purification techniques for getting pure and quality products.

Purification is a key stage technique in downstream processing as it plays a significant role in enhancing the quality of the product and maintaining the purity of the product.

However, the separation segment is anticipated to grow at the fastest rate during the coming years due to the rising adoption of separating various pharmaceutical compounds across various end-use sectors.

Vaccine Production Will Remain the Most Lucrative Application

The vaccine production segment held the highest market share of 30.1% in 2024 and it is expected to grow at a CAGR of 14.5% during the projected period. The growth of this segment is attributed to the development of low-cost and high-quality products like vaccines using downstream purification technologies.

Similarly, the rising incidence of various chronic and infectious diseases and the growing need for improving the immune system of people will indirectly favour the growth of the vaccine production segment during the next ten years.

Most of the Sales to Remain Concentrate on Biopharmaceutical Companies

As per FMI, the biopharmaceutical companies segment held a market share of around 44.0% in 2024 and it is expected to grow at a CAGR of 8.6% during the forecast period. This can be attributed to the rising usage of downstream processing products like chromatography columns & resins, membrane adsorbers, consumables, and single-use products across biopharmaceutical companies.

Biopharmaceutical companies have gained significant traction with expansive strategies to enhance offerings associated with therapeutic and biological use. They are constantly making efforts to improve their productivity by using novel techniques like downstream processing.

Leading players in the downstream processing market are focusing on the development and launch of next-generation downstream processing products. Apart from that, they are concentrating on the expansion of their manufacturing capabilities with high flexibility and rapid operations.

A few of these strategies undertaken by the market players in the downstream processing market are:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 34.3 billion |

| Projected Market Size (2035) | USD 100.1 billion |

| Anticipated Growth Rate (2025 to 2035) | 11.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, UK, Germany, Italy, Russia, Spain, France, BENELUX, Nordic Countries, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, Israel, GCC Countries, North Africa, and South Africa |

| Key Market Segments Covered | Product, Technique, Application, End User, and Region |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; GE Healthcare; Sartorius Stedim Biotech S.A.; Merck Millipore; Danaher Corporation; 3M Company; Boehringer Ingelheim; Lonza Group AG; Eppendorf AG; Finesse Solutions, Inc.; Bio-Rad Laboratories; Agilent technologies; Solida Biotech GmBH; Waters Corporation; Applikon BioTechnique/Getinge AB |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global downstream processing market is estimated to be valued at USD 34.3 billion in 2025.

It is projected to reach USD 100.1 billion by 2035.

The market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types are chromatography columns and resins, membrane adsorbers, single-use products and consumables and accessories.

purification segment is expected to dominate with a 47.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rice Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Equipment Market - Size, Share, and Forecast Outlook 2025 to 2035

Food Processing Seals Market Growth & Demand, 2025 to 2035

Fish Processing Market Analysis by Source, Application, Processing Type, Equipment, and Region through 2035

Wafer Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Media Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA