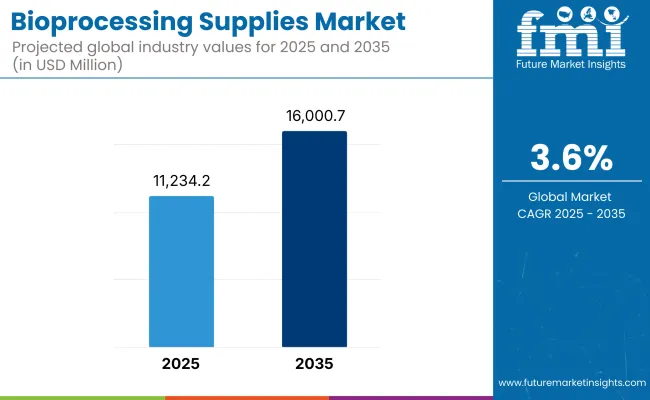

The global Bioprocessing Supplies Market is projected to reach a valuation of USD 11,234.2 million by 2025 and USD 16,000.7 million by 2035. This reflects a decade-long increase of USD 4,766.5 million between 2025 and 2035. The market is anticipated to grow at a compound annual growth rate (CAGR) of 3.6%, representing a 1.42X expansion over the ten-year forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025 E) | USD 11,234.2 million |

| Forecast Value in (2035 F) | USD 16,000.7 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

During the first five-year period from 2025 to 2030, the global bioprocessing supplies market is projected to expand from USD 11,234.2 million to USD 13,407.3 million, generating an incremental revenue opportunity of USD 2,173.1 million, which accounts for 45.6% of the total decade growth.

Single-use bioprocess containers will remain the dominant segment, holding around 22.5% share by 2030, supported by their critical role in upstream processing workflows, faster batch changeovers, and compliance with evolving regulatory standards. Chromatography components and filtration devices will also see steady uptake, driven by their necessity in downstream purification steps, but neither is expected to surpass the container segment in share during this phase.

From 2030 to 2035, the market is forecast to add USD 2,593.4 million, representing 54.4% of the total growth, as revenues increase from USD 13,407.3 million to USD 16,000.7 million. Growth in this phase will be powered by the large-scale adoption of advanced single-use systems in both mature and emerging biomanufacturing hubs, alongside heightened demand for filling and freezing supplies in cell and gene therapy production.

The single-use bioprocess containers segment is anticipated to maintain its leadership at approximately 22.2% share by 2035, supported by ongoing CDMO expansions, global vaccine manufacturing capacity build-outs, and cost efficiencies achieved through modular, disposable-based facilities.

From 2020 to 2024, the Bioprocessing Supplies Market expanded from USD 10,135.9 million to USD 11,043.2 million. Leading manufacturers such as Cytiva, Sartorius AG, and Merck KGaA together contribute approximately mid-40s% of global revenue, led by Cytiva through breadth in single-use bioprocess containers, filtration, and chromatography.

Key strategies have centered on multi-region capacity additions (bags, resins, membranes), early alignment to USP <665>/<1665> extractables requirements, and CDMO partnerships to co-engineer qualified assemblies. Bioprocess sensors (disposable) showed minimal traction during the historic years, remaining a niche as advanced PAT adoption lagged routine upstream/downstream consumables.

In 2025, the market is expected to reach USD 11,234.2 million. Growth reflects a transition from component-level buys to end-to-end single-use workflows spanning media prep to fill-finish, alongside broader uptake in filling and freezing supplies as CGT and vaccine programs scale. Traditional players will focus on reliability and validation support to defend installed bases.

Major players will push integrated platforms pre-packed columns, automated mixing, and qualified BPCs to lock in lifetime consumables. Emergent entrants, especially in Asia, will target value tiers with localized assemblies and faster lead-times, gradually expanding from tubing/transfer sets into higher-spec fluid-management kits.

The market is segmented by Product, Application, End-User, and Region. Product includes Single-use Bioprocess Containers, Filtration Devices, Tubing & Assemblies, Chromatography Components, Storage & Sampling Accessories, Bioprocess Sensors, Transfer Systems, Mixing and Agitation Supplies, and Filling and Freezing Supplies, highlighting the core elements driving adoption.

Application classification covers Upstream Processing, Downstream Processing, and Fill-Finish. Based on End User, the segmentation includes Biopharma and Biotech Companies, CDMOs, Academic & Government Research Institutes, Cell and Gene Therapy Companies, Vaccine Manufacturers, and Others. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

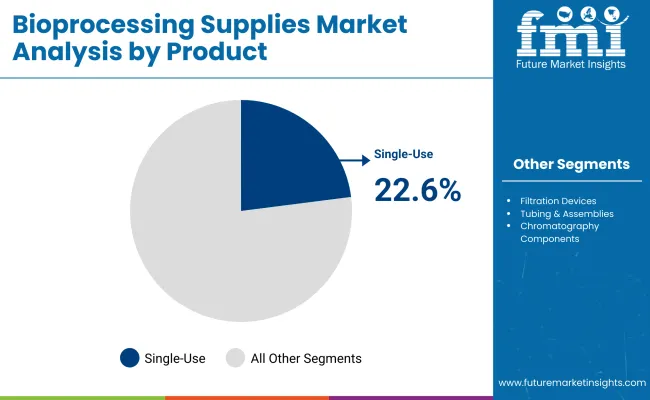

Single-use bioprocess containers are expected to retain a dominant position, contributing 22.6% of the market in 2025, owing to their critical role in upstream and downstream workflows for biologics, vaccines, and cell and gene therapies. Their adoption has been propelled by the global shift toward single-use technologies that minimize cross-contamination risks, reduce turnaround times, and improve operational flexibility.

These containers are particularly favored in CDMOs and biopharma manufacturing sites for their scalability across volumes and compatibility with modular, disposable-based production facilities. Regulatory drivers such as USP <665>/<1665> compliance have further incentivized facilities to transition from stainless-steel to single-use storage and transfer systems, ensuring validated material integrity and traceability.

Additionally, rising investments in biologics manufacturing capacity across the USA, Europe, and APAC have amplified demand, as these containers enable faster facility start-up and simplified changeovers. Collectively, these factors have sustained the strong demand trajectory for single-use bioprocess containers over traditional multi-use storage solutions.

| By Product | Market Share (%) |

|---|---|

| Single-use Bioprocess Containers | 22.6% |

| Filtration Devices | 15.0% |

| Tubing & Assemblies | 12.1% |

| Chromatography Components | 14.3% |

| Storage & Sampling Accessories | 8.6% |

| Bioprocess Sensors (Disposable) | 5.4% |

| Transfer Systems | 6.5% |

| Mixing and Agitation Supplies | 7.9% |

| Filling and Freezing Supplies | 7.5% |

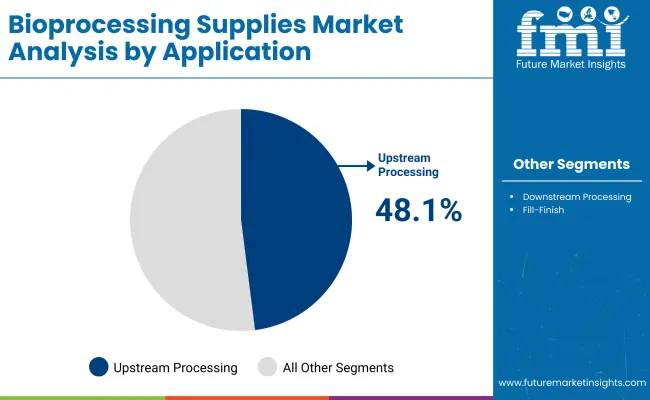

Upstream processing has emerged as the leading application area in the bioprocessing supplies market and is projected to hold around 48.1% share in 2025, driven by the expansion of biologics, vaccines, and cell therapy pipelines. This stage involves cell culture, fermentation, and initial product formation, requiring a high volume of single-use bioprocess containers, filtration devices, tubing, and mixing systems.

Demand is further strengthened by the industry’s shift toward perfusion and intensified processing, which increases consumable usage per production cycle. Regulatory expectations for contamination control and material traceability have also pushed facilities to adopt validated single-use systems for upstream operations.

Moreover, ongoing capacity expansions by CDMOs and biopharma companies, particularly in Asia-Pacific and North America, are boosting procurement of upstream-specific supplies to enable rapid facility start-up and flexible multi-product manufacturing. These factors collectively position upstream processing as the dominant revenue contributor through the forecast period.

| Application | Market Share (%) |

|---|---|

| Upstream Processing | 48.1% |

| Downstream Processing | 35.5% |

| Fill-Finish | 16.3% |

Biopharma and biotech companies are expected to remain the largest end-user segment, contributing around 41.2% of the market in 2025, driven by their extensive in-house manufacturing operations for biologics, biosimilars, and advanced therapies. These organizations rely heavily on single-use bioprocess containers, chromatography components, and filtration devices to support high-volume upstream and downstream production. The demand is reinforced by the rapid expansion of biologics pipelines, particularly monoclonal antibodies and recombinant proteins, which require large-scale, validated processing infrastructure.

Continuous investments in facility upgrades and process intensification strategies are prompting biopharma players to standardize on flexible, disposable-based systems that enable faster product changeovers and reduced cleaning requirements.

Additionally, regulatory expectations for material traceability and contamination control have encouraged adoption of fully integrated single-use platforms. With increasing global demand for biologics, biopharma and biotech companies are expected to sustain their position as the dominant revenue contributor through the forecast period.

| By End User | Market Share (%) |

|---|---|

| Biopharma/Biotech Companies | 41.2% |

| CDMOs | 28.5% |

| Academic & Government Research Institutes | 6.2% |

| Cell and Gene Therapy Companies | 9.5% |

| Vaccine Manufacturers | 11.5% |

| Others | 3.1% |

The Bioprocessing Supplies Market is experiencing steady growth as biopharmaceutical manufacturers face rising pressure to accelerate biologics, vaccine, and cell and gene therapy production while maintaining stringent regulatory compliance. Key drivers include the expansion of global biomanufacturing capacity, stricter material standards under USP <665>/<1665>, and the shift toward fully integrated single-use technologies to reduce cross-contamination risk and turnaround times.

High-volume adoption of single-use bioprocess containers, filtration devices, and chromatography components is being fueled by CDMO investments and modular facility designs that favor disposables for flexibility and cost efficiency. Increasing therapeutic complexity, particularly in personalized medicines, is amplifying demand for specialized filling and freezing supplies to preserve product integrity.

In fast-growing markets such as South Korea, China, and India, government-backed biotech hubs and facility upgrades are driving procurement at scale, while in mature regions, replacement cycles and process intensification initiatives are boosting recurring consumable sales for established suppliers.

Regulatory Enforcement of Material Compliance and Contamination Control

One of the most significant drivers accelerating demand in the Bioprocessing Supplies Market is the tightening of global standards governing material safety and contamination control in biologics manufacturing. Regulatory frameworks such as USP <665> and <1665>, EMA guidelines, and ISO standards require rigorous extractables/leachables testing, risk-based qualification, and validated single-use systems for upstream and downstream applications.

Biopharma manufacturers, CDMOs, and vaccine producers are integrating single-use bioprocess containers, filtration devices, and chromatography components into standard operating procedures to meet these compliance benchmarks. This regulatory momentum is reinforced by contract manufacturing bids that mandate pre-qualified consumables for faster tech transfer and product release, driving systematic adoption across both mature and emerging biomanufacturing hubs.

High Conversion Costs from Stainless-Steel to Single-Use Systems

Despite the operational benefits, the migration from established stainless-steel infrastructure to fully disposable systems pose a significant cost and operational barrier. Facilities incur capital expenses for cleanroom redesign, process requalification, operator retraining, and supply chain validation, which can delay or limit adoption.

This challenge is particularly acute in cost-sensitive markets or among mid-tier manufacturers, where the ROI horizon for switching can be stretched by budget constraints and lower production volumes.

Additionally, long-term supplier lock-in for consumables raises concerns about procurement flexibility and pricing. Some operators mitigate these costs by adopting hybrid models, where critical steps are transitioned to single-use while non-critical processes remain stainless steel, but this often limits the full efficiency gains and contamination control advantages.

Integration of Single-Use Supplies into Modular Biomanufacturing Facilities

A transformative trend shaping the market is the integration of bioprocessing consumables into pre-fabricated modular and POD-based manufacturing facilities. Leading equipment suppliers and consumable manufacturers are collaborating to develop customized, facility-specific kits combining single-use bags, tubing, connectors, and sensors designed for rapid installation and validated for specific process workflows.

This approach aligns with the biopharma industry’s push toward multi-product flexibility, shorter time-to-market, and leaner facility footprints. Modular facilities allow production scaling without the long construction timelines of traditional plants, and pre-configured consumable kits ensure seamless integration from day one.

As adoption accelerates in regions like North America, Western Europe, South Korea, and China, procurement strategies are shifting from one-off component purchases to long-term, bundled supply contracts that guarantee consistent quality, regulatory compliance, and just-in-time availability. This system-level integration is strengthening vendor-client partnerships, creating higher switching costs, and securing predictable revenue streams for market leaders.

| Country | CAGR |

|---|---|

| USA | 3.6% |

| Brazil | 4.2% |

| China | 4.9% |

| India | 5.4% |

| Europe | 2.3% |

| Germany | 1.9% |

| France | 2.6% |

| UK | 2.3% |

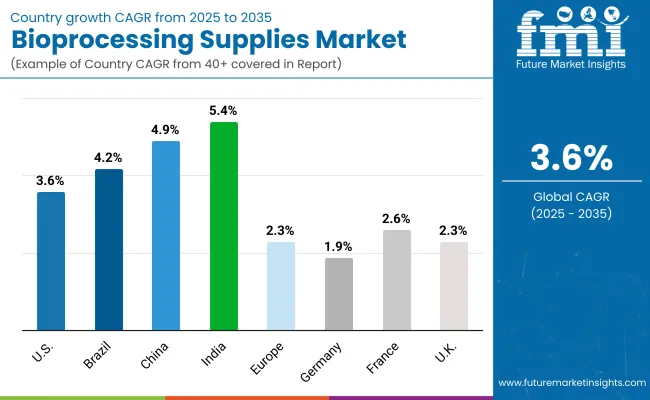

Asia Pacific is emerging as the fastest-growing region in the Bioprocessing Supplies Market, projected to grow well above the global average at 4.9% CAGR between 2025 and 2035. Within the region, India is forecast to expand at 5.4% CAGR, driven by aggressive investments in biologics and vaccine manufacturing parks, government-backed biotech hubs, and the rapid build-out of CDMO capacity.

China is expected to post a 4.9% CAGR, supported by large-scale public and private investments in biomanufacturing infrastructure, expansion of state-owned vaccine facilities, and growing adoption of single-use technologies in new GMP-compliant plants. This momentum is reinforced by regulatory modernization in both countries, encouraging risk-based qualification of process-contact materials and E&L compliance under globally harmonized guidelines.

Europe will grow steadily at 2.3% CAGR through 2035, with Germany (1.9% CAGR) benefiting from automation in upstream and downstream process lines, France (2.6% CAGR) seeing demand from public biomanufacturing projects under industrial modernization programs, and the UK (2.3% CAGR) leveraging investments in advanced therapy manufacturing facilities.

The region’s market is underpinned by harmonized EMA guidelines, strong academic-industry collaborations, and replacement of legacy stainless-steel systems with hybrid or fully single-use solutions.

North America remains a mature but innovation-led market, with the USA projected to grow at 3.6% CAGR between 2025 to 2035. Growth is driven by replacement of older consumable portfolios with integrated single-use platforms, alignment with USP <665>/<1665> compliance, and expansion of modular and POD-based manufacturing units. Federal and state incentives for domestic biomanufacturing capacity, combined with the rise in cell and gene therapy pipelines, are further accelerating demand for high-quality, validated bioprocessing supplies.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 3500.0 |

| 2026 | 3578.5 |

| 2027 | 3659.5 |

| 2028 | 3743.7 |

| 2029 | 3830.3 |

| 2030 | 3919.4 |

| 2031 | 4010.2 |

| 2032 | 4104.2 |

| 2033 | 4201.6 |

| 2034 | 4301.5 |

| 2035 | 4402.2 |

The USA bioprocessing supplies market is projected to grow at a 3.6% CAGR between 2025 and 2035, driven by sustained investment in biologics, biosimilars, and cell and gene therapy manufacturing capacity. Regulatory alignment with USP <665>/<1665> standards is accelerating the transition toward validated single-use bioprocess containers, filtration devices, and chromatography components. Large biopharma players and CDMOs are replacing legacy stainless-steel systems with modular, disposable-based workflows to enhance flexibility and reduce cleaning validation cycles.

The UK bioprocessing supplies market is forecast to expand at a 2.3% CAGR through 2035, supported by investments in advanced therapy manufacturing hubs under the UK Life Sciences Vision program. NHS-backed initiatives and Innovate UK funding are promoting the modernization of biologics production facilities, with an emphasis on upstream and downstream process intensification.

Germany’s bioprocessing supplies market is projected to grow at a 1.9% CAGR to 2035, anchored by the country’s strong biologics manufacturing base and precision-engineered process equipment sector. Federal programs supporting biomanufacturing resilience are driving gradual replacement of stainless-steel infrastructure with hybrid systems.

| Europe Country | 2025 |

|---|---|

| Germany | 25.2% |

| UK | 18.2% |

| France | 14.9% |

| Italy | 11.3% |

| Spain | 9.6% |

| BENELUX | 7.2% |

| Nordic Countries | 5.6% |

| Rest of Western Europe | 8.1% |

| Europe Country | 2035 |

|---|---|

| Germany | 24.7% |

| UK | 17.8% |

| France | 14.6% |

| Italy | 11.1% |

| Spain | 9.4% |

| BENELUX | 7.1% |

| Nordic Countries | 5.5% |

| Rest of Western Europe | 9.9% |

The bioprocessing supplies market in India is projected to grow at a robust 5.4% CAGR, making it one of the fastest-expanding markets in the global landscape. This growth is underpinned by massive investments in vaccine and biologics manufacturing hubs, the creation of government-backed biotech parks, and aggressive capacity expansion by both domestic and multinational CDMOs.

The government’s Make in India initiative, coupled with the Production Linked Incentive (PLI) scheme, is fostering localized manufacturing of key consumables such as single-use bioprocess containers, filtration devices, and chromatography components, reducing dependency on imports and strengthening domestic supply chains.

India’s biologics pipeline is expanding rapidly, with R&D clusters in Tier 1 cities like Hyderabad, Bengaluru, and Pune, as well as Tier 2 cities, driving adoption of modular, disposable-based systems to comply with GMP standards and global regulatory norms. Increasing collaborations between academic institutions and private biomanufacturers are promoting pilot-scale manufacturing using localized consumables, making innovation more cost-effective.

The bioprocessing supplies market in China is forecast to grow at a 4.9% CAGR through 2035, supported by the Healthy China 2030 policy, which prioritizes healthcare self-sufficiency and advanced manufacturing capabilities. Significant capital investments in state-of-the-art biomanufacturing facilities by both state-owned enterprises and private sector players are fueling demand for compliant, single-use solutions.

Regulatory harmonization with global E&L (extractables and leachables) and GMP standards is compelling facilities to transition to validated disposable systems for critical upstream and downstream workflows.

China’s major urban biomanufacturing hubs, such as Beijing, Shanghai, and Guangzhou, are transitioning to fully disposable fluid management workflows, while regional plants are adopting hybrid stainless steel-single-use models to balance capital costs with operational efficiency. Domestic suppliers are rapidly scaling production and are increasingly focusing on integrating consumables with automation and process control skids to match the offerings of global vendors.

Japan’s bioprocessing supplies market is projected to reach USD 438.1 million in 2025, with single-use bioprocess containers holding 22.6% of demand. Growth is anchored in Japan’s long-standing focus on process precision, operational safety, and strict compliance with PMDA and Japanese Pharmacopoeia GMP guidelines. The market is also influenced by aging workforce dynamics, prompting increased automation in upstream and downstream production to reduce manual intervention and improve reproducibility.

Japan’s life sciences sector is being strengthened by government programs promoting advanced therapy manufacturing, with particular emphasis on cell and gene therapy as well as small-batch, high-value biologics. CDMOs are embracing standardized disposable assemblies to streamline process changeovers and minimize contamination risk. Meanwhile, local manufacturers are enhancing domestic production of high-grade films, connectors, and tubing to reduce reliance on imports and secure the supply chain against global disruptions.

The South Korean bioprocessing supplies market is expected to reach USD 314.6 million in 2025, with the fastest regional growth rate of 4.7% CAGR through 2035. This rapid growth is fueled by the government’s Bioeconomy 2025 strategy, which aims to position South Korea as a global leader in biologics exports, particularly in monoclonal antibodies and biosimilars.

The market is characterized by accelerated deployment of single-use technologies in upstream production, alongside growing adoption of high-performance filtration and chromatography systems in downstream workflows.

The country’s biopharmaceutical manufacturing hubs, including Incheon, Osong, and Songdo, are investing heavily in modular biomanufacturing facilities that use pre-validated consumable kits for faster commissioning and scalability. South Korean firms are also expanding strategic partnerships with global OEMs to co-develop localized, GMP-compliant single-use solutions tailored for both export and domestic markets.

The Bioprocessing Supplies Market is moderately consolidated, with global leaders, established mid-sized firms, and specialized players competing across upstream, downstream, and fill-finish applications. Cytiva holds a leading market position, leveraging its broad portfolio of single-use bioprocess containers, filtration systems, chromatography solutions, and process automation platforms.

The company’s growth strategy focuses on multi-continent capacity expansions, end-to-end process integration, and early alignment with USP <665>/<1665> compliance, positioning it as a preferred supplier for both large-scale biopharma manufacturers and CDMOs.

Established players such as Sartorius AG, Thermo Fisher Scientific, Merck KGaA, Lonza Group AG, and Eppendorf AG cater to diverse market tiers by offering modular, single-use process solutions, high-performance filtration devices, and chromatography components. These companies are differentiating through automation integration, supply chain resilience, and hybrid process offerings, making them key partners for facilities undergoing large-scale process intensification or technology transfers.

Specialized and niche-focused companies like Repligen, Asahi Kasei Medical, Solesis Medical, BoehringerIngelheim, Corning, and Fujifilm Healthcare target high-growth segments such as advanced therapy manufacturing, perfusion systems, and custom filtration media. Their strengths lie in product innovation, rapid customization for specific process requirements, and collaborative development with OEMs to create pre-validated single-use kits for modular biomanufacturing facilities.

As the market evolves, competitive differentiation is shifting from standalone consumables toward bundled, facility-integrated solutions that combine validated single-use assemblies, IoT-enabled process monitoring, and seamless compatibility with upstream and downstream automation platforms. This transition is redefining vendor selection criteria, favoring suppliers capable of delivering system-level reliability, regulatory compliance, and scalable innovation.

Key Developments:

| Item | Value |

|---|---|

| Quantitative Units | USD 11 , 234.2 million |

| Product | Single-use Bioprocess Containers, Filtration Devices, Tubing & Assemblies, Chromatography Components, Storage & Sampling Accessories, Bioprocess Sensors (Disposable), Transfer Systems, Mixing and Agitation Supplies, and Filling and Freezing Supplies. |

| Application | Upstream Processing, Downstream Processing, and Fill-Finish |

| End User | Biopharma/Biotech Companies, CDMOs, Academic & Government Research Institutes, Cell and Gene Therapy Companies, Vaccine Manufacturers, and Others. |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, Europe, France, UK etc. |

| Key Companies Profiled | Cytiva , Satorius AG, Eppendorf AG, Corning, Merck KgaA , Thermofischer Scientific, Lonza Group AG, Boehringer Ingelheim , Solesis Medical, Repligen , Asahi Kasei Medical, Fujifilm Healthcare. |

| Additional Attributes | Dollar sales by application and regions, adoption trends of single-use bioprocessing systems, rising demand in biotech & research aseptic use, growing demand across CDMOs and biopharmaceutical manufacturing. |

The global Bioprocessing Supplies Market is estimated to be valued at USD 11,234.2 million in 2025.

The market size for Bioprocessing Supplies is projected to reach USD 16,000.7 million by 2035.

The Bioprocessing Supplies Market is expected to grow at a CAGR of 3.6% during this period.

Key segments include Single-use Bioprocess Containers, Filtration Devices, Tubing & Assemblies, Chromatography Components, Storage & Sampling Accessories, Bioprocess Sensors (Disposable), Transfer Systems, Mixing and Agitation Supplies, and Filling and Freezing Supplies.

The Upstream Processing segment is projected to command the largest share at 48.1% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Portable Bioprocessing Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Upstream Bioprocessing Equipment Market - Growth, Trends & Forecast 2025 to 2035

Single-use Bioprocessing Probes and Sensors Market - Growth & Trends 2024 to 2034

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Moving Supplies Market Analysis - Growth & Demand 2025 to 2035

Key Players & Market Share in the Dental Supplies Industry

Medical Supplies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brewing Supplies Market Analysis by Product Type, Application, Category, and Region Forecast Through 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Pet Bathing Supplies Market Growth - Trends & Forecast to 2035

Microbrewery Supplies Market Size and Share Forecast Outlook 2025 to 2035

Horse Stable Supplies Market Size and Share Forecast Outlook 2025 to 2035

Commercial Bar Supplies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA