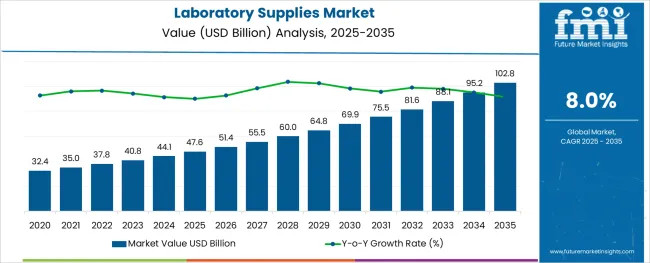

The Laboratory Supplies Market is estimated to be valued at USD 47.6 billion in 2025 and is projected to reach USD 102.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The laboratory supplies market is expanding steadily due to increased investments in research and development, growing demand for high precision testing, and expanding applications across pharmaceutical, biotechnology, and academic sectors. As innovation accelerates in fields such as life sciences, diagnostics, and material sciences, laboratories are placing greater emphasis on upgrading their infrastructure and enhancing analytical accuracy.

Demand has also been reinforced by rising global healthcare needs, regulatory quality control requirements, and advancements in laboratory automation. Institutions are prioritizing reliable, durable, and customizable lab setups that can support complex workflows while meeting safety and compliance standards.

The market outlook remains positive as research institutions, CROs, and manufacturing units continue to focus on operational excellence and quality assurance, making laboratory supplies a critical enabler in scientific progress.

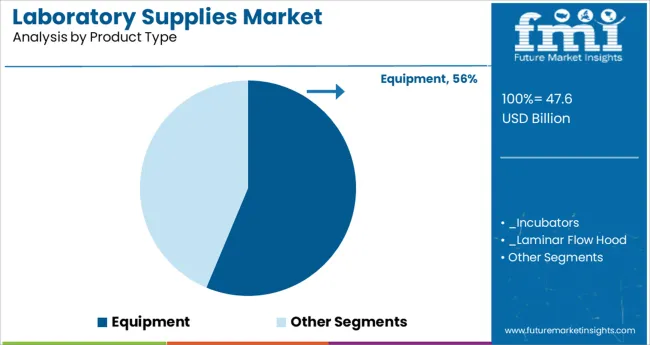

The market is segmented by Product Type and region. By Product Type, the market is divided into Equipment and Disposables. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The equipment segment is expected to account for 56.30% of total market revenue by 2025 within the product type category, establishing it as the leading segment. This dominance is driven by the essential role laboratory equipment plays in supporting a wide range of analytical, diagnostic, and preparatory procedures.

The growing adoption of advanced technologies such as automated analyzers, centrifuges, and spectrophotometers has increased capital spending on durable laboratory assets. Moreover, the demand for precision instrumentation and scalable systems in both research and quality assurance settings has reinforced equipment as a core investment.

Institutions are also upgrading equipment to align with digital lab ecosystems, enhance reproducibility, and reduce manual error. As labs scale their operations and prioritize consistency in output, the equipment segment continues to lead due to its foundational role in ensuring data integrity, compliance, and efficiency across testing environments.

The global demand for Laboratory Supplies is projected to increase at a CAGR of 8% during the forecast period between 2025 and 2035, reaching a total of USD 102.8 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 6%.

Scientific institutions such as laboratories, research centers, and companies need quality laboratory equipment to perform a variety of tests, studies, and experiments. The results of these activities depend upon the quality, strength, and durability of the equipment. They aid to offer accurate results and also improve work efficiency. This is eventually creating demand for the equipment and boost market growth.

Technological advancements in laboratory equipment are also driving its adoption. Modern laboratory instruments have interfaces that make their operation easy for users. BrandTech Scientific, Inc. provides an electronic pipette with touchscreen operation & automatic tip ejection. This has a screen that works like a smartphone, letting users access functions with a simple swipe.

Advancements in Laboratory Testing Approaches paving Way for Robust Supplies

The demand for laboratory products is rising due to technological advancements in the field of chemical and biological research. The increasing volume of clinical laboratory tests and life science research investigations is driving the demand for laboratory disposable products.

The market is also projected to gain continuous demand for a constant supply of key laboratory devices and equipment among procurement managers in the pharmaceutical and healthcare sectors.

Laboratories need a range of equipment & instruments to run tests and research studies. General lab equipment & instruments can be found in educational labs, research labs, quality assurance, diagnostic testing in medical labs, R&D, manufacturing, and others.

The use of laboratory equipment allows faster analyses that add value to the laboratory itself by increasing the capacity of the instruments, thus letting it perform more tests every day. The faster procedures may even allow testing to be combined into fewer instruments which can decrease maintenance, consumables, the need for regulatory documentation, and overall costs.

Technology trends are also improving laboratory capabilities. Innovative technologies and procedures allow laboratory technicians and scientists to work more accurately and efficiently than ever before. Automation, miniaturization, artificial intelligence, and smart technology are becoming real-world, streamlining life in the lab. Concurrently, the pressure to deliver results quickly is also increasing.

Hence, laboratories must be fast and agile. For laboratory managers, a key way to increase efficiency is by improving the purchasing process. The lab suppliers are also trying to make the product selection and ordering processes simpler.

High Manufacturing Costs of Laboratory Supplies Hindering Growth

High costs associated with the manufacturing of laboratory supplies can impede market growth in the near future. The consistent volatility in the prices of raw materials leads to an increase in manufacturing costs. The high costs discourage sales. This factor will restrain the growth of the laboratory supplies market to a considerable extent.

Rising Number of Biopharmaceutical and Pharmaceutical Firms Engaged in R&D Driving Market for Laboratory Supplies

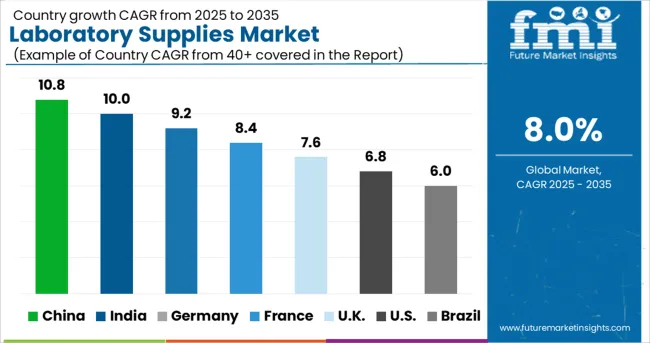

North America accounted for the largest share of more than 37.5% in 2024. This is attributed to the presence of several biopharmaceutical and pharmaceutical firms engaged in R&D. In addition, an increase in the number of grants, such as the National Institute of Health (NIH), to enhance research activities provided by government establishments is anticipated to boost the market growth. The quality and track record of firms that have operated in the region are believed to attract further investments for research during the forecast period.

The biopharmaceutical industry is one of the region’s leading sectors in terms of funding research. Many companies are focusing on the development of new leads and storing an enormous amount of samples, thereby creating demand for these products. Furthermore, a large number of companies are engaged in the development of therapeutics and vaccines due to the outbreak of coronavirus, hence boosting the market growth.

Expansion of the Research and Development (R&D) Expenditure in The USA. Will Drive the Adoption of Laboratory Supplies

The presence of R&D bases of major pharmaceutical and biotech companies and prominent research and academic institutes makes the United States the leader in pharmaceutical-related R&D.

According to a report published in September 2024 by the Pharmaceutical Research and Manufacturers of America (PhRMA), in the last decade, biopharmaceutical companies invested more than a trillion dollars in research and development, including a record-breaking year in 2024 where PhRMA member companies invested about USD 91 Billion in the research and development. Thus, increasing research and development expenditure boosts the market over the forecast period.

Increasing Investments in India is Spurring Demand for Laboratory Supplies

India is projected to exhibit a fast growth rate in the forecast period owing to rising public health concerns, and increased government and private sector investments. As a result of technological advancements, lab supplies manufacturers have been able to develop innovative products.

According to the report of NITI Ayog in 2024, over the last two decades, India has emerged as one of the fastest-growing emerging economies, attracting large FDI in pharmaceutical sector inflows that have increased from USD 32.4 billion in 2000 to 01 to USD 50 Billion in 2020 to 20.

The healthcare sector, in particular, has attracted increased investor interest in recent years, with transaction values rising from USD 94 Million in 2011 to USD 1,275 Million in 2020 a 13.5-fold increase. Thus increasing healthcare investment is driving the market for laboratory supplies.

The equipment segment is expected to grow at a significant rate

The equipment segment accounted for the largest share of over 63.4% in 2024. The segment consists of incubators, centrifuges, laminar hoods, air filtration systems, microscopes, etc., and each product has a very crucial role when carrying out research on cell or tissue culture, which is essential to studying drug toxicology, oncology therapies, and personalized medicine. The equipment segment is the largest owing to the high equipment costs resulting in one-time installments for many years. With the help of the equipment, process controls, experiments, and quality assurance are carried out. It serves for quick capture and orientation in different categories.

Scientific institutions such as laboratories, research centers, and companies need quality laboratory equipment to perform a variety of tests, studies, and experiments. The results of these activities depend upon the quality, strength, and durability of the equipment. They aid to offer accurate results and also improve work efficiency. This is eventually creating demand for the equipment and boosting market growth.

Some of the start-ups in the Laboratory Supplies market include-

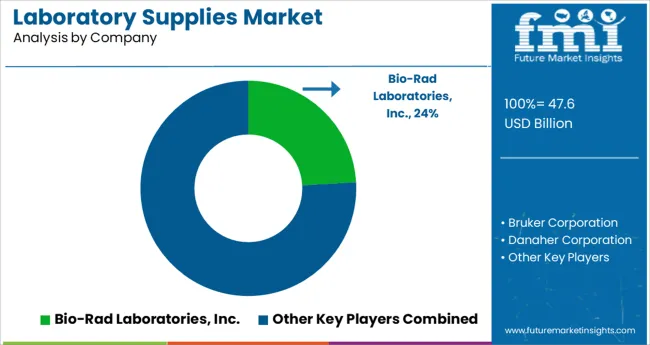

Key players in the Laboratory Supplies market are Bio-Rad Laboratories, Inc.; Bruker Corporation; Danaher Corporation; Fujifilm Holdings Corporation (Irvine Scientific Sales Company, Inc.); Agilent Technologies Inc.; and Others.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 47.6 billion |

| Market Value in 2035 | USD 102.8 billion |

| Growth Rate | CAGR of 8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Product, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Russia, Australia, China, Japan, India, South Korea, GCC Countries, South Africa, Saudi Arabia, UAE, Israel |

| Key Companies Profiled |

Bio-Rad Laboratories, Inc.; Bruker Corporation; Danaher Corporation; Fujifilm Holdings Corporation (Irvine Scientific Sales Company, Inc.).; Agilent Technologies Inc.; PerkinElmer Inc.; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific, Inc.; Waters Corporation |

| Customization | Available Upon Request |

The global laboratory supplies market is estimated to be valued at USD 47.6 billion in 2025.

It is projected to reach USD 102.8 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are equipment, _incubators, _laminar flow hood, _micro manipulation systems, _centrifuges, _lab air filtration system, _scopes, _sonicators and homogenizers, _autoclaves and sterilizers, _spectrophotometer and microarray equipment, _others, disposables, _pipettes, _tips, _tubes, _cuvettes, _dishes, _gloves, _masks, _cell imaging consumables and _cell culture consumables.

segment is expected to dominate with a 0.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laboratory Filtration Equipment Market Growth – Trends & Forecast 2019-2027

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Laboratory Benchtop Automation Market Growth – Trends & Forecast 2025 to 2035

Laboratory Balances and Scales Market Growth - Industry Forecast 2025 to 2035

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

Laboratory Sample Container Market

Laboratory Glassware and Plasticware Market

Laboratory Ovens Market Analysis by Mechanical Convection and Vacuum Ovens Type through 2035

AI in Laboratory Solution Market Size and Share Forecast Outlook 2025 to 2035

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA