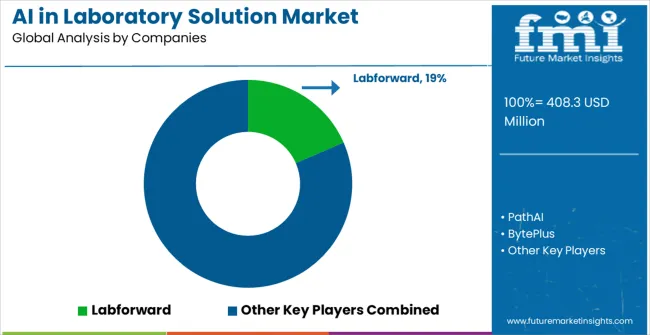

The global AI in Laboratory Solution Market is expected to reach USD 408.3 million in 2025 and scale up to USD 1,245.6 million by 2035, reflecting a steady compound annual growth rate (CAGR) of 11.8%. This expansion highlights the accelerating adoption of artificial intelligence tools in laboratories worldwide, supporting advancements in diagnostics, workflow optimization, and predictive analytics. Increasing demand for automation, coupled with rising R&D investments, is fueling this transformation. From drug discovery to genetic analysis, AI-driven laboratory solutions are bridging gaps between data complexity and actionable insights. The market’s trajectory indicates a future where efficiency, accuracy, and cost-effectiveness drive widespread implementation, ultimately reshaping how laboratories operate across healthcare, biotech, and academic sectors.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 408.3 million |

| Forecast Value in (2035F) | USD 1,245.6 million |

| Forecast CAGR (2025 to 2035) | 11.8% |

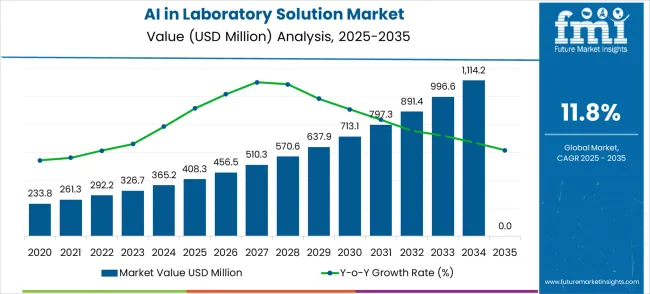

A key driver of this market is the growing reliance on automation and data-driven decision-making in laboratories. AI-enabled platforms reduce manual errors, streamline processes, and enhance the reproducibility of experiments. The year-on-year (YoY) growth trend shows a consistent upward movement, with market values climbing from USD 233.8 million in 2023 to USD 408.3 million in 2025, and continuing a sharp rise in subsequent years. This momentum is driven by the urgent need for faster diagnostic solutions, real-time monitoring tools, and robust data interpretation in clinical settings. Additionally, collaborations between AI technology providers and laboratory service companies are boosting adoption rates. Government initiatives supporting digital healthcare ecosystems further strengthen the market outlook, ensuring AI becomes integral to lab workflows.

Looking ahead, the AI in Laboratory Solution Market is projected to maintain its strong growth curve, with YoY increases ranging between 7% and 12% over the forecast period. By 2030, the market is forecasted to surpass USD 713.1 million, and by 2035, exceed USD 1.24 billion, underscoring the long-term viability of this sector. The CAGR of 11.8% reflects not just consistent expansion but also the widening applications of AI in diverse laboratory operations. As precision medicine, genomics, and advanced imaging demand smarter analytics, AI solutions will play a pivotal role. The continuous integration of machine learning, cloud computing, and big data tools positions laboratories to transition from reactive approaches to proactive, predictive science, fueling sustained market acceleration.

Market expansion is being supported by the increasing global demand for laboratory automation and the corresponding shift toward intelligent research technologies that can provide superior analytical capabilities while meeting industry requirements for accelerated research timelines and improved accuracy. Modern research laboratories and pharmaceutical companies are increasingly focused on incorporating AI solutions to enhance research efficiency while satisfying demands for data-driven insights and automated analysis processes. AI laboratory solutions' proven ability to deliver superior pattern recognition, predictive analytics, and automated decision-making makes them essential tools for modern research operations and drug discovery applications.

The growing emphasis on precision medicine and personalized healthcare is driving demand for high-quality AI laboratory solution products that can support distinctive analytical capabilities and premium research positioning across life sciences, pharmaceutical development, and diagnostic categories. Research institutions' preference for technologies that combine analytical excellence with automation capabilities is creating opportunities for innovative AI laboratory implementations in both traditional research and emerging precision medicine applications. The rising influence of big data analytics and computational biology is also contributing to increased adoption of premium AI laboratory solution products that can provide authentic high-performance research acceleration characteristics.

The market is segmented by solution type, application, and region. By solution type, the market is divided into hardware equipment and software and systems. Based on application, the market is categorized into life sciences, chemicals and pharmaceuticals, semiconductors and electronics, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The hardware equipment segment is projected to account for 35.6% of the AI in laboratory solution market in 2025, reaffirming its position as the leading solution type category. Research laboratories and pharmaceutical companies increasingly utilize AI-enabled hardware equipment for their superior processing capabilities, integrated functionality, and reliable performance across diverse laboratory applications. Hardware equipment technology's specialized computing architecture and dedicated processing systems directly address the research requirements for high-performance AI computation and efficient data processing in laboratory research operations.

This solution type segment forms the foundation of modern AI laboratory applications, as it represents the technology with the greatest computational power and established reliability across multiple research methodologies.

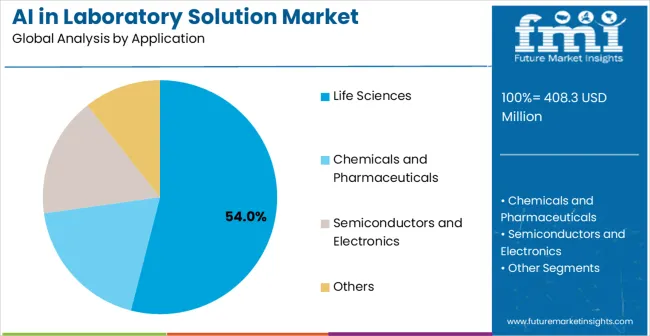

Life sciences applications are projected to represent the 54% share of AI in laboratory solution demand in 2025, underscoring their critical role as the primary application for artificial intelligence technologies in biological research and biomedical discovery operations. Research scientists prefer AI solutions for their exceptional pattern recognition capabilities, data analysis efficiency, and ability to accelerate discovery processes while supporting complex biological data interpretation requirements during research activities. Positioned as essential tools for high-performance life sciences research, AI laboratory solutions offer both analytical advancement and research acceleration advantages.

The segment is supported by continuous growth in biomedical research activities and the growing availability of specialized AI algorithms that enable enhanced discovery capabilities and research optimization at the laboratory level.

The AI in laboratory solution market is advancing rapidly due to increasing research digitization investments and growing demand for intelligent automation that emphasizes superior analytical capabilities across life sciences and pharmaceutical research applications. However, the market faces challenges, including high implementation costs for AI systems, data privacy and security concerns in research environments, and technical complexity in AI algorithm customization. Innovation in cost reduction technologies and user-friendly AI platforms continues to influence market development and expansion patterns.

The growing adoption of AI in drug discovery and precision medicine applications is enabling technology companies to develop solutions that provide distinctive research capabilities while commanding premium positioning and enhanced discovery acceleration. Advanced applications provide superior analytical insights while allowing more sophisticated research development across various pharmaceutical categories and therapeutic segments. Companies are increasingly recognizing the competitive advantages of AI-powered research positioning for premium technology development and pharmaceutical innovation market penetration.

Modern AI laboratory solution suppliers are incorporating cloud-based platforms, advanced machine learning algorithms, and automated data processing systems to enhance analytical capabilities, improve research scalability, and meet laboratory demands for flexible and powerful AI-driven research solutions. These programs improve research performance while enabling new applications, including remote laboratory access and collaborative research platforms. Advanced technology integration also allows suppliers to support premium market positioning and innovation leadership beyond traditional laboratory equipment.

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| Brazil | 12.4% |

| U.S. | 11.2% |

| U.K. | 10.0% |

| Japan | 8.9% |

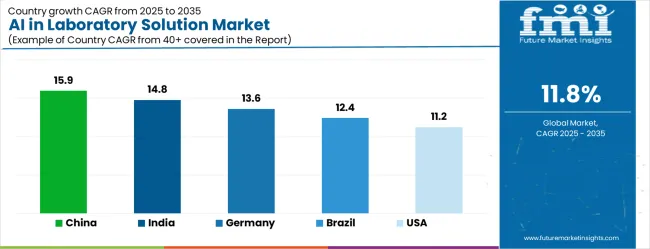

The AI in laboratory solution market is experiencing exceptional growth globally, with China leading at a 15.9% CAGR through 2035, driven by the rapidly expanding biotechnology sector, massive investments in artificial intelligence development, and increasing adoption of laboratory automation technologies. India follows at 14.8%, supported by growing pharmaceutical research, rising AI investments, and expanding biotechnology capabilities. Germany shows growth at 13.6%, emphasizing advanced research technology and premium laboratory automation solutions. Brazil records 12.4%, focusing on emerging research applications and biotechnology development. The U.S. demonstrates 11.2% growth, prioritizing AI innovation and research technology advancement. The U.K. exhibits 10.0% growth, supported by research excellence and advanced laboratory capabilities. Japan shows 8.9% growth, emphasizing precision research excellence and high-quality laboratory technology production.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China’s AI-driven laboratory solutions market is expected to witness remarkable expansion, growing at a CAGR of 15.9% through 2035, driven by the rapidly expanding biotechnology sector and massive government investments in artificial intelligence development across major research hubs. The country's growing research infrastructure and increasing adoption of laboratory automation technologies are creating substantial demand for intelligent laboratory solutions in both established and emerging research applications. Major AI technology companies and laboratory equipment manufacturers are establishing comprehensive research and development capabilities to serve both domestic research needs and export markets.

The AI-based laboratory solutions market in India is projected to grow at a CAGR of 14.8%, supported by growing pharmaceutical research, increasing AI investments, and expanding biotechnology applications. The country's developing research ecosystem and expanding technology capabilities are driving demand for advanced laboratory solutions across both pharmaceutical development and academic research applications. International AI companies and domestic technology manufacturers are establishing comprehensive distribution and development capabilities to address growing market demand for intelligent laboratory automation solutions.

AI in laboratory solutions in Germany is projected to grow at a CAGR of 13.6% through 2035, driven by the country's advanced research technology sector, premium laboratory automation capabilities, and leadership in scientific innovation solutions. Germany's sophisticated research culture and willingness to invest in cutting-edge AI technologies are creating substantial demand for both standard and specialized AI laboratory solution varieties. Leading technology companies and research institutions are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

AI in laboratory solutions in Brazil is projected to grow at a CAGR of 12.4% through 2035, supported by the country's expanding research infrastructure, growing biotechnology applications, and increasing adoption of AI technologies requiring advanced laboratory solutions. Brazilian researchers and international companies consistently seek intelligent laboratory systems that enhance research capabilities for both domestic applications and global collaboration. The country's position as a regional research hub continues to drive innovation in AI laboratory applications and research standards.

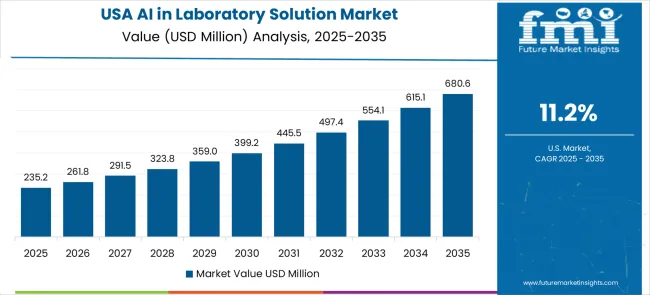

AI in laboratory solutions in the United States is projected to grow at a CAGR of 11.2% through 2035, supported by the country's advanced AI research sector, laboratory technology innovation capabilities, and established leadership in scientific research solutions. American research institutions and pharmaceutical companies prioritize innovation, efficiency, and discovery acceleration, making AI laboratory solutions essential tools for both academic research and commercial drug development. The country's comprehensive research capabilities and technical expertise support continued market development.

AI in laboratory solutions in the United Kingdom is projected to grow at a CAGR of 10.0% through 2035, supported by the country's research excellence sector, advanced laboratory capabilities, and established expertise in scientific innovation solutions. British researchers' focus on innovation, quality, and research impact creates steady demand for intelligent AI laboratory systems. The country's attention to research quality and discovery optimization drives consistent adoption across both traditional academic research and emerging biotechnology applications.

AI in laboratory solutions in Japan is projected to grow at a CAGR of 8.9% through 2035, supported by the country's precision research technology excellence, advanced AI expertise, and established reputation for producing superior laboratory systems while working to enhance analytical precision capabilities and develop next-generation research technologies. Japan's laboratory technology industry continues to benefit from its reputation for delivering high-quality research equipment while focusing on innovation and precision engineering.

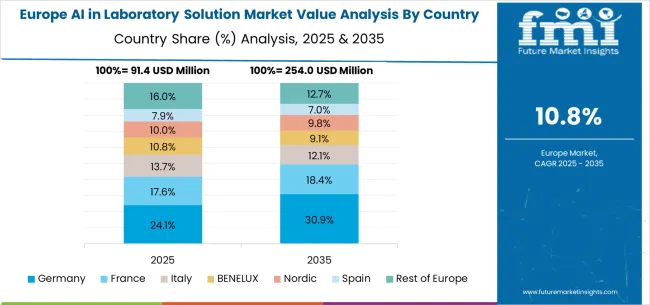

The AI in laboratory solution market in Europe is projected to grow from USD 106.3 million in 2025 to USD 303.4 million by 2035, registering a CAGR of 11.1% over the forecast period. Germany is expected to maintain its leadership position with a 27.8% market share in 2025, remaining stable at 27.6% by 2035, supported by its advanced research technology sector, precision laboratory automation industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 20.4% share in 2025, projected to reach 20.6% by 2035, driven by research excellence programs, advanced laboratory capabilities, and a growing focus on AI-powered research solutions for premium applications. France holds a 17.9% share in 2025, expected to maintain 17.7% by 2035, supported by research infrastructure demand and advanced AI applications, but facing challenges from market competition and research funding considerations. Italy commands a 14.3% share in 2025, projected to reach 14.5% by 2035, while Spain accounts for 10.7% in 2025, expected to reach 10.9% by 2035. The Netherlands maintains a 5.8% share in 2025, growing to 5.9% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 16.7% in 2025, declining slightly to 16.4% by 2035, attributed to mixed growth patterns with strong expansion in some advanced research markets balanced by moderate growth in smaller countries implementing AI laboratory development programs.

The AI in laboratory solution market is characterized by competition among established technology companies, specialized AI developers, and integrated laboratory solution suppliers. Companies are investing in advanced machine learning technologies, cloud computing platforms, application-specific solution development, and comprehensive technical support capabilities to deliver consistent, high-performance, and intelligent laboratory AI products. Innovation in algorithm optimization, user interface enhancement, and customized research solutions is central to strengthening market position and customer satisfaction.

Labforward leads the market with a strong focus on laboratory digitization and comprehensive AI-powered laboratory solutions, offering sophisticated artificial intelligence products with emphasis on research automation and analytical excellence. PathAI provides specialized AI pathology capabilities with a focus on diagnostic applications and medical research networks. BytePlus delivers advanced AI technology with a focus on innovation and scalable solution development. Siemens Healthineers specializes in healthcare technology with an emphasis on technical expertise and laboratory automation optimization. Allied Vision focuses on imaging and AI technologies with advanced machine learning capabilities. Aiforia emphasizes AI-powered image analysis expertise with a focus on research applications and analytical precision.

AI in laboratory solutions represents the convergence of artificial intelligence technologies with scientific research infrastructure, enabling automated data analysis, pattern recognition, and predictive modeling that accelerate discovery processes across life sciences, pharmaceuticals, and advanced research applications. With the market projected to grow from USD 408.3 million in 2025 to USD 1,245.6 million by 2035 at an exceptional 11.8% CAGR, these intelligent systems transform traditional laboratory workflows through machine learning algorithms, computer vision, and automated decision-making capabilities.

The dominance of hardware equipment solutions (35.6% market share) and life sciences applications reflects the computational intensity and specialized processing requirements of laboratory AI implementations. However, market expansion faces significant challenges, including high implementation costs, data privacy and security concerns, algorithm validation complexities, and the need for specialized technical expertise. Maximizing growth potential requires coordinated efforts across AI technology developers and algorithm specialists, research institutions and laboratory operators, data management and cybersecurity experts, regulatory agencies and validation organizations, and technology integration and support service providers.

Domain-Specific AI Development: Create specialized artificial intelligence algorithms tailored for laboratory applications, including computer vision for microscopy analysis, natural language processing for literature mining, and machine learning models for drug discovery and biomarker identification. Develop AI systems that understand scientific contexts and can interpret complex experimental data with domain expertise.

Edge Computing and Hardware Integration: Design AI-optimized hardware solutions, including specialized processors, accelerated computing platforms, and embedded AI systems that provide real-time analysis capabilities directly within laboratory instruments. Develop edge computing solutions that minimize data transfer requirements while maximizing computational performance.

Explainable AI and Scientific Validation: Implement transparent AI systems that provide clear explanations for their decisions and recommendations, essential for scientific validation and regulatory compliance. Create AI models that not only deliver results but also explain their reasoning process in scientifically interpretable terms.

Automated Workflow Integration: Develop AI systems that seamlessly integrate with existing laboratory information management systems (LIMS), electronic lab notebooks, and research workflows. Create intelligent automation that can adapt to different laboratory protocols and experimental designs while maintaining data integrity.

Continuous Learning and Model Adaptation: Build AI systems that continuously improve through exposure to new data and research outcomes, enabling them to adapt to evolving scientific knowledge and laboratory practices while maintaining validation and compliance standards.

Strategic AI Adoption Planning: Develop comprehensive strategies for AI integration that identify high-impact use cases, assess technological requirements, and create phased implementation plans that maximize return on investment while minimizing disruption to ongoing research activities.

Data Infrastructure Development: Establish robust data management systems that can support AI applications, including data standardization, quality control, and governance frameworks. Implement comprehensive data strategies that ensure AI systems have access to high-quality, well-annotated datasets for training and validation.

Interdisciplinary Collaboration: Foster collaboration between research scientists, data scientists, and AI specialists to ensure AI solutions address real scientific challenges and integrate effectively with research workflows. Create cross-functional teams that combine domain expertise with technical AI knowledge.

Research Validation and Quality Control: Establish rigorous validation protocols for AI-generated results, including comparison with traditional methods, statistical validation, and peer review processes. Implement quality control systems that ensure AI recommendations meet scientific standards and regulatory requirements.

Talent Development and Training: Invest in training programs that help research staff understand AI capabilities and limitations while developing skills needed to utilize AI tools in their research effectively. Create educational programs that bridge the gap between scientific research and AI technology.

Laboratory Data Security: Develop comprehensive cybersecurity frameworks specifically for AI-enabled laboratory environments, including secure data transmission, encrypted storage, and access control systems that protect sensitive research data while enabling AI analysis capabilities.

Privacy-Preserving AI Technologies: Implement advanced privacy protection techniques, including federated learning, differential privacy, and homomorphic encryption, that enable AI analysis while protecting proprietary research data and patient information in clinical research applications.

Data Governance and Compliance: Establish data governance frameworks that ensure AI systems comply with research ethics requirements, intellectual property protections, and regulatory standards such as GDPR, HIPAA, and FDA guidelines for research data management.

AI Model Security and Validation: Create security protocols that protect AI models from adversarial attacks, data poisoning, and intellectual property theft while ensuring model integrity and reliability in critical research applications.

Audit and Monitoring Systems: Implement comprehensive monitoring and audit systems that track AI system performance, detect anomalies, and maintain detailed logs of AI decision-making processes for regulatory compliance and scientific validation.

AI Validation Standards: Develop comprehensive validation frameworks for laboratory AI systems, including performance metrics, testing protocols, and acceptance criteria that ensure AI tools meet scientific and regulatory standards for accuracy, reliability, and reproducibility.

Regulatory Guidance Development: Create clear regulatory pathways for AI-enabled laboratory solutions, including approval processes for diagnostic AI, clinical decision support systems, and research tools that incorporate artificial intelligence capabilities.

International Harmonization: Foster international cooperation on AI laboratory solution standards, including data sharing protocols, validation requirements, and cross-border research collaboration frameworks that accelerate global AI adoption while maintaining safety and quality standards.

Ethics and Governance Frameworks: Establish ethical guidelines for AI use in laboratory research, including bias prevention, algorithmic transparency, and responsible AI development practices that protect research integrity and participant rights.

Continuous Monitoring and Assessment: Implement post-market surveillance systems that monitor AI laboratory solution performance in real-world applications, identify emerging risks, and ensure continued compliance with evolving regulatory requirements.

End-to-End Implementation Services: Provide comprehensive AI integration services, including needs assessment, system design, implementation planning, and change management, that help laboratories successfully adopt AI technologies while minimizing operational disruption.

Technical Support and Maintenance: Establish specialized technical support capabilities, including AI system monitoring, performance optimization, troubleshooting services, and regular system updates that ensure continued AI performance and reliability.

Training and Education Services: Develop comprehensive training programs covering AI system operation, data interpretation, quality control procedures, and troubleshooting techniques specifically tailored for laboratory personnel and research scientists.

Custom AI Solution Development: Offer specialized development services that create custom AI solutions for unique research applications, including algorithm customization, workflow integration, and performance optimization for specific laboratory environments and research requirements.

Market Development and Expansion: Support AI laboratory solution adoption in high-growth markets like China (15.9% CAGR) and India (14.8% CAGR) through technology transfer programs, local partnership development, and region-specific implementation support that addresses local research needs and regulatory requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 408.3 million |

| Solution Type | Hardware Equipment, Software and System |

| Application | Life Sciences, Chemicals and Pharmaceuticals, Semiconductors and Electronics, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Labforward, PathAI, BytePlus, Siemens Healthineers, Allied Vision, Aiforia, Labflow, Prudential AI Lab, GE HealthCare, Clinisys, HKAI LAB, Artificial, Lenovo, and AI21 Labs |

| Additional Attributes | Dollar sales by solution type and application, regional demand trends, competitive landscape, technological advancements in artificial intelligence, research automation development initiatives, machine learning optimization programs, and laboratory integration strategies |

The global AI in laboratory solution market is estimated at USD 408.3 million in 2025.

The market is projected to reach USD 1,245.6 million by 2035.

It is expected to grow at a 11.8% CAGR between 2025 and 2035.

Hardware equipment leads with a 35.6% share.

Life sciences holds the lead with a 54% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Sample Container Market

AI-based Clinical Trials Solution Provider Market Trends – Growth & Forecast 2024-2034

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Market Analysis - Size, Share & Forecast 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Vending Massage Chair Payment Solution Market Size and Share Forecast Outlook 2025 to 2035

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Containers & Fluid Transfer Solutions Market – Trends & Forecast 2025 to 2035

Western Europe On-Shelf Availability Solution Market Growth – Trends & Forecast 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA